Las recesiones del mercado son una gran oportunidad para hacer grandes movimientos

Los mercados a la baja no tienen por qué resultar en ganancias a la baja. ¡Establezca su estrategia y deje que sus bots trabajen en los gráficos!

3Commas ayuda a los comerciantes a ganar operaciones independientemente de las condiciones del mercado

Para cada condición del mercado, existe una estrategia comercial que puede beneficiarse de ella. Los bots de 3Commas son realmente buenos para reducir los costos promedio de adquisición, lo que incrementa directamente los márgenes de ganancias de cada operación.

Mercados a la baja

Use los bots cortos de DCA para pedir prestados y vender tokens al precio actual y volver a comprarlos a un precio más bajo

Mercado de valores en alza

Use bots largos de DCA para comprar las caídas naturales y vender los picos a medida que el precio sube con el tiempo, logrando un mejor precio de entrada promedio para sus posiciones

Mercados laterales

Use los bots de Grid para recoger tokens más baratos cuando lleguen a los niveles de soporte y véndalos cuando estén cerca de los niveles de resistencia.

Esta es solamente una pequeña muestra de los diferentes caminos que puede tomar para obtener ganancias aprovechando el poder de la plataforma de operaciones 3Commas

El mundo del cripto es complicado, pero 3Commas lo hace más sencillo

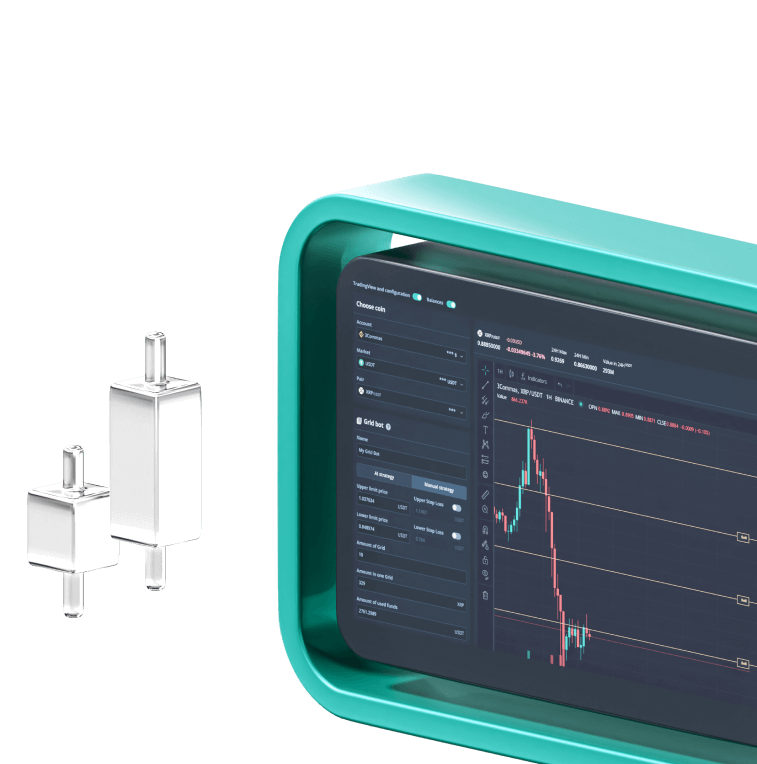

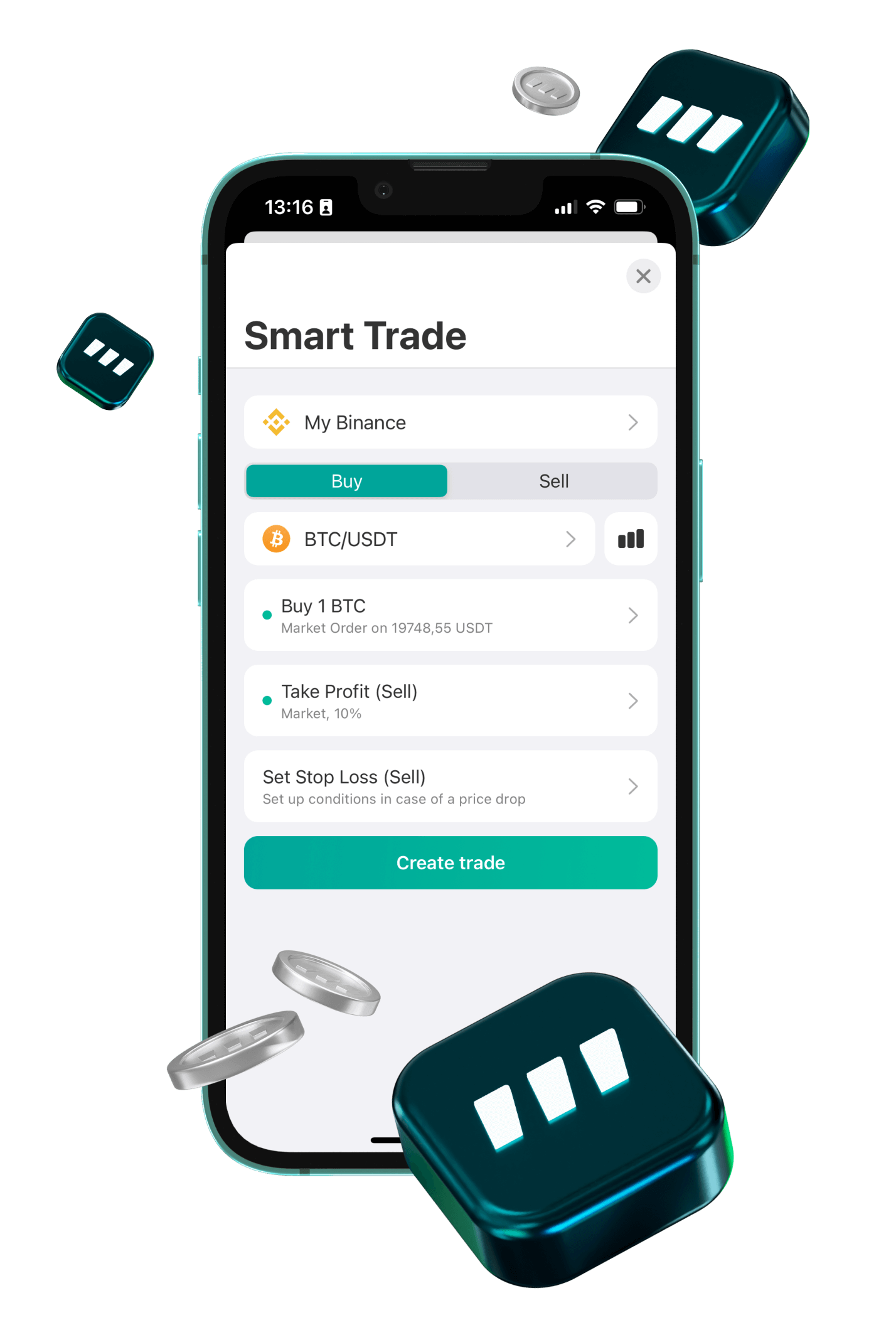

Terminales comerciales inteligentes con el último conjunto de características

SmartTrade y Terminal permiten configurar sus operaciones de manera avanzada en función de los activadores que especifique. Establezca el intercambio y olvídese del tema... 3Commas se encargará de todo.

Track your cryptocurrency

Keep your investments in one place, not all over the place.

Collect all your assets in one portfolio: connect exchanges and wallets, as well as create your own accounts for your favorite tokens and coins.

+31.41%PROFIT LAST MONTH

Ajustes preestablecidos de bot

¿No sabe por dónde empezar? Copie los ajustes preestablecidos de otros traders experimentados y omita la curva de aprendizaje.

Señales

Integre señales en su bot y copie de forma automática las operaciones de los comerciantes profesionales.

Las herramientas adecuadas para cada tipo de mercado

Seguridad

3Commas solamente interactúa con los intercambios mediante claves API. Sus fondos están seguros porque no tenemos sus credenciales y no podemos iniciar retiros

Automatización de intercambio

Nuestros bots DCA, Grid, Opciones y Futuros tienen un desempeño comprobado que ejecutan su estrategia comercial a escala. El mercado nunca duerme, y nuestros bots tampoco

Análisis

Los paneles de 3Commas le muestran exactamente el rendimiento de sus operaciones en tiempo real, para que sepa cuándo optimizar y cuándo dejar que se ejecuten.

Suba de nivel su juego de trading con herramientas comerciales avanzadas que funcionan en 14 de los intercambios más grandes

El objetivo es ganar operaciones, y 3Commas es la herramienta más completa para poder conseguirlo. Al integrarse con la mayoría de los intercambios, 3Commas le brinda las funciones que desea tener, sin ningún riesgo o necesidad de mover sus activos.

3Commas - administre su intercambio cruzado de criptomonedas

Las herramientas automatizadas de trading son compatibles con los 14 principales exchanges de cripto moneda

La automatización comercial abre nuevas formas de obtener ganancias

A diferencia de los mercados de valores tradicionales, los mercados de criptomonedas operan las 24 horas del día, los 7 días de la semana. Este es un punto que da miedo a los comerciantes manuales, pero no a los usuarios de 3Commas. Sus bots no están limitados al horario comercial habitual de lunes a viernes para abrir tratos. Puede configurar bots para operar en prácticamente cualquier contingencia, ya sea un colapso repentino o el mercado disparado hasta la luna. Duerma tranquilo por la noche y deje que los bots hagan el trabajo.

¿Por qué los traders eligen 3Commas?

Funciones adicionales de 3Commas

Rebalancear

Cree carteras con cualquier asignación de monedas y rebalancee su cuenta con un clic.

Dashboard

Agregue varias cuentas para rastrear su cartera y verificar su PnL diario.

Paper trading

Opere sin dinero. Pruebe estrategias de forma segura y sin ningún riesgo.

Smart Cover

Acumule beneficios adicionales con movimientos inesperados del mercado. Venda y compre monedas.

Bots de Opciones

Un conjunto simple de estrategias automatizadas para negociar opciones en una plataforma de intercambio.

Señales

Suscríbase a las señales proporcionadas por otros traders para copiar estrategias.

Administre sus posiciones en un solo toque con la aplicación móvil 3Commas

Descargue la aplicación móvil, realice un seguimiento de las estadísticas de estrategia, inicie bots y cierre pedidos. Ya sea que esté en casa o en la carretera, administre sus posiciones en cualquier lugar.

Noticias y anuncios

La hora de operar ha llegado

En colaboración con Binance

Recomendamos utilizar solo serviciosde trading probados. Trabajamos con Binance desde 2017 y en octubre de 2019 nos convertimos en socios oficiales

3Commas - administre su intercambio cruzado de criptomonedas

3Commas Becomes First Binance Broker Partner

bitcoinist.com

What is automated crypto trading and how does it work?

cointelegraph.com

Jump Crypto Lead $37M Funding for 3Commas Automated Crypto Trading Platform

coindesk.com

Largest Crypto Trading Bot and Investment Platform 3Commas Raises $37M

bloomberg.com

3Commas scores $37m for automated crypto trading bot platform

fintech.global

3Commas Review: Bitcoin & Cryptocurrency Trading Bot Platform

blockonomi.com

Preguntas Frecuentes

Los bots de trading pueden ser muy rentables cuando se configuran con la estrategia adecuada a las condiciones del mercado. El uso de un bot de trading automatizado requiere una comprensión básica de las tendencias actuales del mercado y para poder configurar la mejor estrategia posible. 3Commas ofrece una variedad de plantillas contrastadas creadas por usuarios profesionales que pueden ayudar a los nuevos traders a generar bots con altas rentabilidades.

Sí, se pueden utilizar bots para operar criptomonedas. Selecciona una plataforma de trading y luego conecta un exchange compatible. Luego elige qué tipo de bots quieres usar. Los bots de trading automatizado más comunes son los bots DCA, los bots Grid, los bots de futuros, los bots de opciones, los bots de arbitraje y los bots HODL.

Los bots de trading de criptomonedas son la mejor manera de operar con criptomonedas si tu intenticón va más allá de comprar o y holdear tokens. Por ejemplo, un bot de bitcoin, te permite automatizar la compra en caídas y la venta en subidas cuando el mercado es dinámico. El uso de bots para te permite tener tus activos trabajando para obtener beneficios en lugar de tenerlos acumulados.

Esto depende de varios factores, como las comisiones cobradas por la plataforma exchange utilizada. El uso de un bot para operar altcoins en una plataforma generalmente requerirá una tarifa de suscripción mensual de entre $ 14 y $ 50, según la cantidad y el tipo de bots disponibles. Las comisiones se cobran generalmente con cada operación, lo que puede hacer que algunas estrategias no sean rentables en exchanges con altas comisiones.

Automatizar el trading de criptomonedas pueden generar ganancias considerables operando con Bitcoin o altcoins. Un trader competente mide el éxito por el porcentaje de ganancias obtenido de sus operaciones, en lugar de beneficios totales brutos. No es raro que los traders experimentados promedien entre un 15 y un 25% de beneficio a base de pequeñas operaciones.

Ya se ha demostrado que el trading automatizado funciona. La clave es elegir una plataforma de confianza que cuente con bots con antecedentes comprobados de éxito y datos transparentes. El trading automatizado funciona bien cuando los usuarios combinan un bot de trading de bitcoin o un bot de trading de altcoins con una buena estrategia y señales de terceros en un Exchange con comisiones razonables.

Para configurar un bot de trading de criptomonedas, un trader debe tomar algunas decisiones. Primero, ¿qué tipo de bot quieren utilizar? Luego, deben elegir qué Exchange utilizar. A continuación, deben decidir qué reglas comerciales quieren usar para configurar el bot, incluida la estrategia que determina cómo opera el bot y las señales que determinan cuándo abre o cierra cada operación. Además, pueden elegir una plantilla preestablecida que ya tenga definidas todas estas reglas, lo que simplifica enormemente la configuración del bot para el usuario.

Para comprar un bot de criptomonedas, debe crear una cuenta o comprar una suscripción a una plataforma admitida en el Exchange. Algunos Exchanges ofrecen acceso a un bot gratuito, pero esto limita sus opciones como trader de bots. Algunos Exchanges ofrecen opciones limitadas de bots, pero no son tan buenas como las muchas opciones de bots disponibles en una buena plataforma de trading de bots. Por lo general, puedes registrarte en plataformas de pago con una tarjeta de crédito, tarjeta de débito e incluso pagar con Bitcoin, Ethereum o alguna otra cripto.