- All

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Tools

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

GTI trading bots

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Dear Friends,

A LITTLE BIT ABOUT ME

Cryptocurrency traders know me as Mikhail Hyipov.

I have been actively trading for over a decade. During this time, I have had many victories and defeats. No matter how bloody the failure, I never stopped trading. Instead, I doubled down on my study and developed the art of trading.

I began my career trading Forex, then went to promotions and chests of drawers. I managed to get to know cryptocurrency intimately when Bitcoin was $200, and everyone was sitting on BTC-e.

During this time, I plunged deeply into the study of such technical analysis tools as:

- Analysis Tools and Trading Strategies by Thomas DeMark

- Square 9, the method of Pythagoras and the real eclipse

- Harmonic patterns, fractal and cyclic analysis

- Graphical and trend analysis

- Panoramic review and SK-FX

- Analysis of candles, tic-tac-toe, Range, Kagi, Renko, Linear breakthrough

- Cluster analysis and volume analysis

- Wave analysis

- Various trend indicators and oscillators

- Also, I paid great attention to the study of market psychology, fundamental analysis, and the study of risk management systems.

- I share all my accumulated knowledge and experience with my favorite readers for free.

- You can find my educational and analytical articles and forecasts on the Internet at various sources, the main of which is here

MY STRATEGY

Active volatility and manipulativeness are the main characteristics of the cryptocurrency market. Therefore, trading based on smaller timeframes (minute charts) confuses things with market noise and false signals. Trading in such short periods without automation psychologically exhausts any trader and causes mistakes.

Leave this frustration behind and use 3commas robots!

Using my decade of knowledge and experience, I developed a strategy that works effectively in any market condition on many timeframes.

Not a single trader with a working strategy will disclose all his secrets; however, thanks to 3commas, you have the opportunity to participate in trading with me online.

GTI MH’s trading strategy is inspired by the work of a well-known trader and technical analysis expert, Thomas DeMark.

I developed a unique script that indicates abnormal oversold values of an asset according to the DeMark indicators at a particular point in time — once reached, a necessary pullback not far behind.

Taking into account the general trend the asset is in, the strategy is to analyze the pattern and turn it into successful trades during price pullback.

Studies show that the minimum rollback after the received signal is 3%.

To minimize potential errors from being made, the strategy focuses on a profit margin of 0.5% per trade. The signal, according to this strategy, is not delayed, but often gives a leading sign.

The strategy provides for cost averaging with micro-increases of your position and reduction of the spread helping create more profit and less risk. Averaging allows you to maintain the level of necessary growth for closing a Take-Profit transaction at a distance of less than 3%, even taking into account a 6% drawdown of the entry point.

All signals will be given based on data from the BINANCE exchange and exclusively on liquid trading instruments.

For options that will hopefully help everyone, I divided the strategy 3 signal channels:

- GTI MH BTCUSD – works exclusively on the BTCUSDT pair (simple bot, minimum deposit size is 240 USD) – FREE

- GTI MH ALTBTC – works exclusively on Altcoin / BTC pairs (composite bot, minimum deposit size is 0.12 BTC) – only $8.76 per month

- GTI MH ALTUSD – works exclusively on Altcoin / USDT pairs (composite bot, minimum deposit size is 1200 USDT) – only $8.76 per month

EXAMPLE OF THE WORK OF A TRADE CHANNEL

Suppose you are connected to the ALTBTC channel. The bot settings for all channels are identical. Therefore this example will be relevant for other channels of the GTI family as well.

Following the trading strategy, we received two buy signals with a small interval from each other. Since this channel allows you to open up to 5 trades simultaneously, and one pair up to 3 orders, both signals were processed.

As you can see, the last signal took profit in less than 30 minutes, because immediately after the signal there was a micro-rollback, which was enough to fix income.

As for the first signal, the situation with it is much more enjoyable. The red arrow marks the original entry point. Immediately after it, six safety orders line up below, which come with compaction and growth in size. When each of the six orders is executed, a new one opens even lower. Such a margin allows you to catch the squeeze of the candle (a long shadow of the candle to take out the stops) and instantly close the position with a good profit.

However, in our example, this is not the case, instead of panic sales, a systematic decline continued.

The green frame indicates the executed insurance orders – only 8 out of 16. Below is another 6 in line – highlighted with a blue frame. And even lower, I highlighted with a red frame, the place where the last two safety orders will appear, in case the situation continues to worsen.

Look at the example. Upon execution of all orders, we see that the deviation from the level of profit-taking is not more than 2.55%.

As seen in the table above, the deviation essentially stops increasing at the tenth insurance order. It ceases growing to maintain a high probability of moving to a profitable position, even in a dump of 6% from entry. It is extremely rare to see a drawdown depth more significant than this.

The chart above shows that the compaction of insurance orders is associated with reliable trading channels and support levels that are quite capable of providing at least a short-term bullish pullback, in the wake of which we will fix the profit.

As you can see, very soon, the price crossed the breakeven level – marked with an orange arrow and is very close to the level of profit-taking. But let’s imagine the worst-case scenario and no rollback ever happened.

In this case, you have two options:

- Fix losses that do not exceed 1% of your deposit. To do this, fix with a deviation of 4-5% from the breakeven level or about 10% from the moment of entry. Since the entrance is carried out at a local bearish impulse, from the beginning of the fall, it will already be a depth of 15-20%. Traders who have been in crypto for a long time know that such powerful collapses, without counter rollbacks, are extremely rare and are usually associated with some force majeure. But again, even in this case, the loss will not exceed 1% of the deposit, which corresponds to the standard rules for risk management.

- If you are more conservative and do not want to accept even a 1% loss, there is an opportunity to get out of the water and make a profit. There is a magic function to reverse the transaction.

After you activate it, the bot will cancel your open orders, and a new bot will strategize for your already purchased crypto. The new strategy will play in the fall. Its peculiarity is that it works on a decline, but without any leverage.

It acts on the same principle as the classic bot, only in the opposite direction. It sells the base order at the current position and redeems lower by a specified percentage. If the crypto unfolds and goes up, then we record growth in insurance orders. In any case, it will be beneficial for us since, with the growth of the viola, we will get more of our underlying asset (compensate for our losses).

With this method, you need to be very careful. It will not protect you from losses in the event of a bearish collapse and the continuation of the trend. It is instead a way to average a position, without increasing it, near current values in the case when there are expectations of a reverse rollback.

Therefore, I can recommend this method even for experienced traders. And on my reputation, I can say that it works and works well!

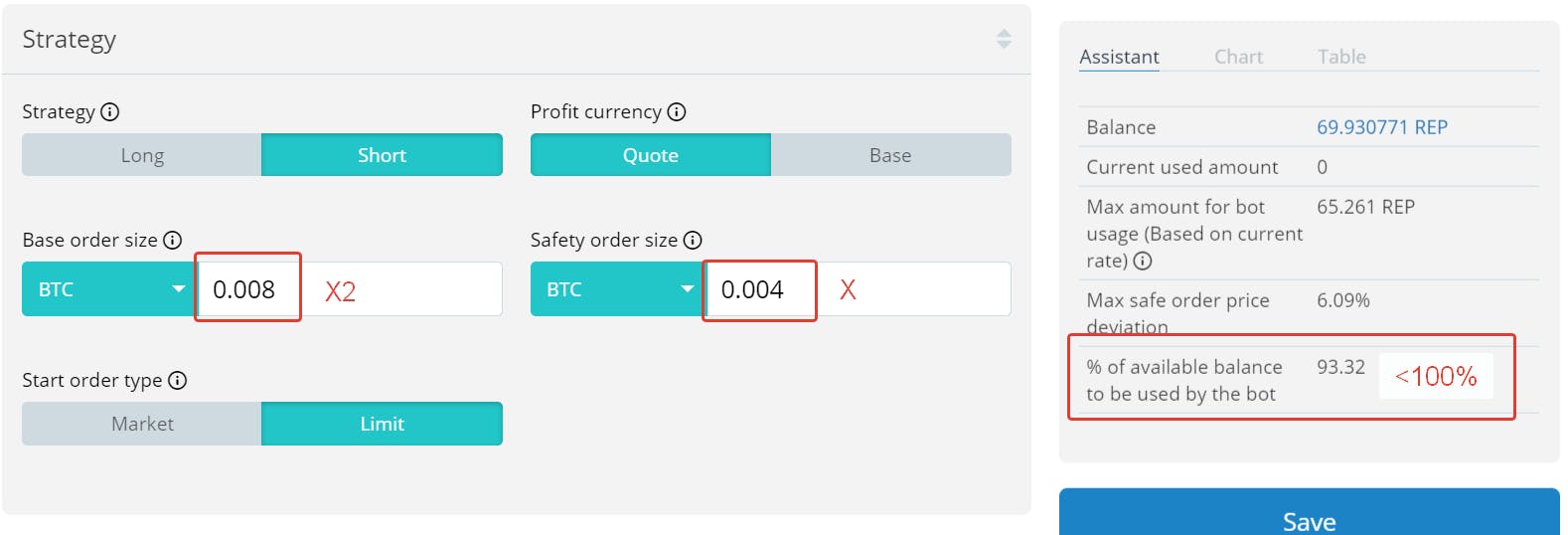

If you suddenly decide to go this way, do not forget to check the settings.

- Be sure to place the base and insurance orders in a ratio of 2 to 1

- Make sure that the balance used is not more than 100%

3. The opening of the transaction should occur as soon as possible

4. Profit level at 0.5%

5. The interest rate should be formed depending on the volume

6. The maximum number of safety orders – 16

7. The number of simultaneously active safety orders – 6

8. Price deviation for placing a safety order – 0.84

9. The factor of the volume of safety orders – 1.04

10.Step multiplier of safety orders – 0.88

Channel results:

- For the GTI MH BTCUSD channel, the bot results are here

- For the GTI MH ALTBTC channel, the bot results are here

- For the GTI MH ALTUSD channel, the bot results are here

To summarize results in brief, there are practically no losses on the channels, with the exception of the very beginning, when settings were tested on real accounts. Now, these signals are extremely profitable and bring a steady income!

RECOMMENDATIONS FOR USING THE SIGNAL CHANNEL

- Use a separate account on the exchange to work with GTI signals. This will help to avoid a shortage of funds for placing insurance orders due to cross-transactions from other channels or during manual trading.

- Control the minimum level of funds in the management of the bot. In the absence of open positions, the maximum amount of funds used by the bot should be less than or equal to the free balance. If this is not the case, you need to either reduce the size of the bot position or replenish the balance for management.

- Do not change the bot settings. The bot’s settings are in such a way as to offer the most optimal risk-reward ratio for our trading strategy specifically. Any unauthorized changes may lead to reduced profitability or increased risks!

You can find the most current settings for bots at the links below:

- For the GTI MH BTCUSD channel, the bot settings are here

- For the GTI MH ALTBTC channel, the bot settings are here

- For the GTI MH ALTUSD channel, the bot settings are here

4. Join our community in telegrams https://t.me/GoodTradingIdea /GTI SIGNALS. Thanks to this channel, you will quickly receive a notification on the latest changes in the settings of bots, trading strategies, and all other news related to trading channels. Also, in case of questions, you can always contact our open chat GTI CHAT. We will help you!

Good luck and good profit!

Regards,

Mikhail @Hyipov

DISCLAIMER: Signals Provider does not publish advice about using cryptocurrency or trading cryptocurrency. While the website contains information on an algorithmic indicator created by Signals Provider, it is not giving its reader any financial advice. We are not liable for any data the indicator publishes as they are for informational purposes only. We will not be responsible, whether in contract, tort (including negligence) or otherwise, in respect of any damage, expense or other loss you may suffer arising out of such information or any reliance you may place upon such information.

Our content is intended to be used and must be used for informational purposes only. It is crucial to do your analysis before making any investment based on your circumstances.. Past performances by the algorithmic indicator is not a guide to the future. For the avoidance of any doubt, Signals Provider and any associated companies, or employees, do not hold themselves out as Commodity Trading Advisors (“CTAs”) Or Authorized Financial Advisors (“AFAs”). Given this representation, all information, data and material provided by Signals Provider and any associated companies, or employees, is for educational purposes only and should not be considered specific investment advice.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.