- All

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Tools

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Passive crypto income ideas

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Recently, yield farming has started gaining popularity. This type of income attracts inexperienced investors as it does not require much involvement, provides high profitability, and is by far less risky. However, it is difficult to classify farming as a truly passive income. In this article, we will look at different ways of passively increasing cryptocurrency positions.

Methods of passive income with cryptocurrencies

- Lending;

- Stacking;

- Yield farming.

It is important to remember that the higher the risks, the higher the reward. If you choose to loan stablecoins and have a stable APY, your income will be less than that of farmers who pledge tokens subject to volatility.

APY stands for Annual Percentage Yield. This parameter shows how many tokens you will earn per annum. Often the value of this parameter is indicated approximately.

Lending

Lending is when you loan your money to the platform, which distributes these loans to users against their cryptocurrencies. It is often necessary to leave collateral that exceeds the amount of funds borrowed (the so-called “over collateral”). You can also lend funds to margin traders through centralized exchanges, where a clearer liquidation mechanism protects your funds.

Profitability

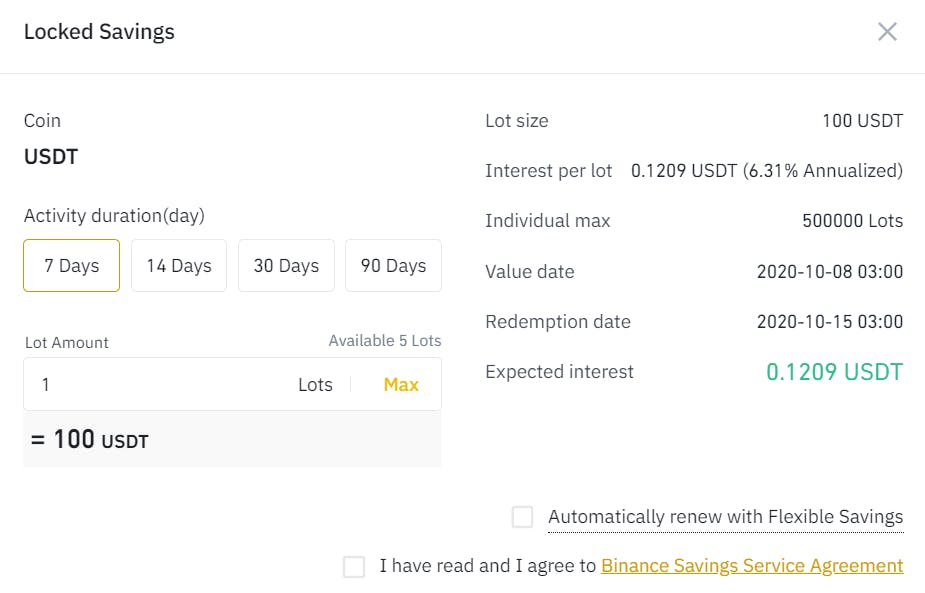

Lending can be classified as the safest type of passive income. Let’s look at an example of lending on the Binance exchange.

Stablecoin yields fluctuate anywhere between 6.31% (when you open a seven-day deposit) and 7% (when you open a 90-day deposit) per annum. It should be noted that the second column is an annual percentage, i.e., by investing $100 for seven days, you will receive 100 * 7 * 0.0631/365 = $0.121.

However, at 7% per annum reinvested every 90 days during the year, you get $7 income for every $100 invested.

Obviously, this type of passive income is suitable for large deposits, when most of the time, crypto is simply held on the wallet.

Similar to centralized lending platforms, there are also decentralized ones.

For example, DDEX is a platform that combines spot and margin markets, as well as loans and lending. This happens in a decentralized way; that is, you do not need to transfer money to anyone, smart contracts take care of all the bureaucracy.

There is also a difference in annual return, it is difficult to predict it accurately, so it is often assumed.

The chart above shows that the DDEX interest rate is fluctuating and, at some points, may reach as high as 82% per annum in USDC. It is important to note that all creditors are in equal conditions. It does not matter when you deposited funds: at the peak of 82% interest rate or a couple of days earlier, in any case, the annual yield you receive stays almost the same.

So how do you earn with decentralized platforms?

Let’s look at an example of lending USDT on DDEX.

- Go to ddex.io and press Earn Interest;

- Connect your wallet by clicking on “Connect wallet” in the upper right corner;

- In the table “Lending,” choose the currency which we want to utilize;

- In the next window, enter the number of coins we wish to credit. You can see the expected annual yield immediately;

- Click “Lend”, allow the contract to interact with USDT, confirm the transaction in your wallet. Please note that the permissions and confirmations are chargeable because this requires interaction with the Ethereum network. For example, with the standard gas price of 99 gwei, the total cost of interacting with DDEX exceeds $20. Therefore, it is better to use centralized platforms to issue loans below $10,000, as they do not require additional investment from lenders.

The examples above demonstrate lending in stablecoins, as these assets are not volatile, hence, less risky, but you can also borrow in various coins and tokens.

Alternative platforms

To save time searching for alternative platforms, we suggest using aggregator websites, which collect information about all available platforms, available currencies, and profitability.

Aggregators:

Staking

Staking is getting passive income from cryptocurrencies based on the PoS algorithm and its variations.

Profitability

Staking yield is generated through new coins issuance. While in PoW-like algorithms, the miners receive a reward for the mined block and transaction fees included in that block depending on their computing power, in PoS-like algorithms, validators, and stakers receive a reward for the mined blocks and fees depending on the number of coins they keep in their wallet or on an exchange. Revenue depends on the coin you stake and the provider’s commissions. Let’s look at two examples: USDN and XTZ.

USDN

USDN is a stablecoin on the Waves blockchain, fully backed by the eponymous cryptocurrency WAVES. WAVES staking has an APY of about 6.5%. It is the source of USDN stacking income: the entire deposit in WAVES is placed for stacking and generates a reward, but it is divided only among those holders of USDN, who have invested their coins in staking. Since only about 42% of all USDN are being staked, the real Neutrino USD rate of return is much higher than the nominal profit from staking WAVES.

As you can see from the table above, with decentralized staking, we will earn 10.74% per annum, and with a centralized one (i.e., we will give it back to the USDN provider), we will get 0.93% less because the providers charge commissions for storing your cryptocurrency.

Staking USDN provides a higher yield than lending USDT on Binance. Although the exchange rate of both of these coins is tied to the dollar, USDN is younger, and the crypto community is not as confident in the project.

Tezos

Staking non-stablecoins is associated with volatility risks; however, in case of price increase, the staker receives an additional reward (when staked coins are converted to fiat or stablecoins).

Let’s have a look at the example of staking XTZ:

The estimated annual return is up to 6%. On the screenshot above, you can see that Binance offers a 6.02% reward, but when you switch to Binance Staking, you can see that the reward is only 5.49%.

Stacking providers take their percentage for services. For comparison, if you don’t want to delegate, you will have to pay for the server and require a certain level of expertise to configure the whole process. However, this will allow you to earn an extra 0.063% per annum.

A bit more about the risks and rewards of staking volatile assets:

Let’s consider an example of PCX stacking. To simplify the calculation, we will start our calculation at the price of $3.14 per coin on October 14, 2019.

1000 PCX was worth $3140, staking with reinvestments, provided a 96% profit per annum, i.e., now the break-even point is at around $1.6 per token.

The red line shows the break-even point. Now the price of PCX is $2.67 per token, which is lower than a year ago, but within a year, our assets have almost doubled to 1960 PCX or $5233, which is 1.66 times more than we originally invested.

We will talk about yield farming in the second part of this series.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.