- All

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Tools

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Starter Pack: Terra

The diversity of blockchain ecosystems, as well as the sheer scale of the DeFi space, is continuing to proliferate as time goes on. Users are offered thousands of platforms and protocols to choose from, each one providing different interfaces, capabilities and implementations across various networks. It isn’t easy to cover all the possibilities here, and in order to start using alternative networks, one must first spend a significant amount of time studying the solutions in order to utilize own capital efficiently.

In today’s article, we are going to take some time to talk about the Terra blockchain and the ecosystem that is currently developing around it. To tackle this, we’ve put together a list of useful services and platforms that you can use to start taking advantage of the Terra universe today.

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Terra in a nutshell

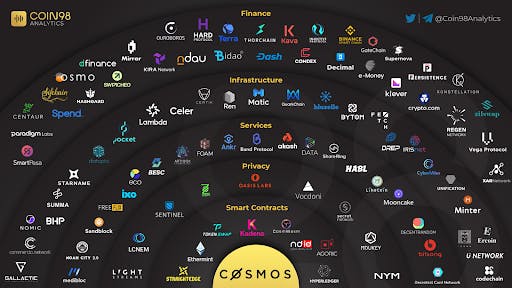

Terra is a PoS-based blockchain platform that offers algorithmic stablecoins payment solutions. The development of Terra was supported by Terra Alliance, which includes large Asian e-commerce companies. Terra is a full-stack ecosystem with infrastructure protocols and oracles integrated with dozens of networks and platforms through the Cosmos SDK.

Terra’s LUNA native token is used to manage the protocol, place bids and maintain stablecoins’ target price level. The price of stablecoins is equated to the price of the underlying asset. For example, TerraSDR (SDT) tracks the price of the IMF SDR. In total, there are more than 15 stablecoins available on the network, such as TerraUSD (UST), TerraKRW (KRT), and more.

The essence of algorithmic stablecoins is that the supply of coins either increases or decreases depending on the market conditions in order to maintain the target price level. For example, if the price of 1 SDT is less than the price of 1 USD (UST token’s underlying asset), then users can send SDT tokens to a smart contract and receive 1 LUNA in return. If the price of 1 SDT rises above the base asset, then users can receive 1 SDT in exchange for their LUNA. By exchanging tokens, users are able to keep stablecoins functioning, while at the same time profiting from arbitrage opportunities.

Where to start?

CoinHall‘s dashboard provides real-time information on trading pairs, price charts and trades in-progress on the Terra blockchain. You can use the Terra Finder browser to obtain information on addresses, blocks and transactions.

The ApeBoard Portfolio Manager supports more than ten different networks, including Terra, and provides dashboards for displaying various asset status data. The platform also provides staking, pooling and airdrop data from various platforms in the Terra ecosystem, such as Anchor, Mirror, and more.

Wallets

Terra has a convenient Terra Station dashboard and wallet for storing Terra assets and stablecoins. The Station enables users to exchange LUNA and UST tokens for other ecosystem assets, as well as take advantage of voting and protocol management features and dashboards, complete with charts and statistics to track blockchain and asset status, staking, and pool information.

Thanks to integrating the two networks and creating the so-called “Terra Zone”, Terra assets can also be used in the Cosmos ecosystem. The Keplr cryptocurrency wallet allows Terra assets to be stored in the created zone and to gain access to Cosmos’ crosschain capabilities.

Bridges

In addition to accessing the Cosmos crosschain space, links have been established between Terra and Ethereum, BSC and Harmony networks via Terra Bridge, with more than 15 tokens from the Terra ecosystem being available for transfer between networks.

The Colombus-5 update, which enabled Terra’s blockchain to interact with other networks more effectively, allowed the network to join the existing Wormhole bridge between Ethereum, Solana and BSC.

Protocols and Platforms

The Terra ecosystem ranks 4th in TVL size, and offers innovative solutions that are both highly popular and highly useful. We will review some of the ecosystem’s platforms below. A complete list of protocols in the Terra network is available on the official website.

The TerraSwap AMM protocol allows users to create liquidity pools and exchange ecosystem tokens. The amount of funds locked in the protocol is about $1.4 billion.

The Mirror platform provides synthetic asset creation capabilities — mAssets. Synthetic assets are available for trading on the platform, linked to the price of Big Tech stocks, crypto assets, ETFs and more. Mirror users can earn MIR tokens, providing liquidity to mAssets and staking LUNA. The platform also provides trading, lending and management functions, which are made readily available.

The Anchor protocol, developed with Cosmos and Polkadot, offers lending, collateral and liquidity options, providing a marketplace for lenders and borrowers of stablecoins. Users can also deposit Ethereum-based stablecoins on the platform, such as USDT, USDC, DAI, and more. The yield on USTs is 20.5%, with the rest of the stablecoins yielding around 16.5%.

Nexus Protocol is a vault for Anchor loans which maximizes returns mitigating liquidation risks. Vaults, liquidity pools, token exchanges, voting and platform management are all available on the platform. Nexus offers two types of tokens:

- nAssets are funds held in Nexus’ vault. Their holders are entitled to receive revenue from the vaults.

- Psi token is used for protocol management and betting, and is a means of revenue distribution.

The Pylon protocol offers decentralized savings and payment solutions based on Anchor and a crowdfunding and token launching platform in the Terra Pylon Gateway ecosystem. The payments solution allows recurring payments for services (such as subscriptions, for instance), in which users can deposit Terra stablecoins as a base asset. At the end of the subscription term, the base asset can be withdrawn. This is achieved through customizable deposit contracts and revenue channeling.

Outlook

Terra is one of the most popular networks, with millions of people using its features every day. The ChaiFinance payment app, for example, offers low fees for everyday payments by using the KRT stablecoin tied to the Korean Won, and is actively used in South Korea.

The Terra ecosystem consists of innovative solutions offering various options for generating additional income. As cryptocurrencies continue to become more and more popular, the number of retailers and vendors wishing to use Terra’s blockchain capabilities also increases. There are only about 10 major platforms on the Terra network, four of which have more than $1 billion locked by the users. It is the availability of real-world applications of the technology that has truly determined the ecosystem’s successful development.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.