GRID Bot: Automatize Lucros em Mercados Laterais e Voláteis

O grid bot avançado da 3Commas é seu assistente de trading automático que compra na baixa e vende na alta, repetidamente, 24/7.

A escolha de traders de elite desde 2017

Usuários do Grid bot

Grid bots criados

Trades executados

Volume negociado

Visão Geral do Grid Bot da 3Commas

Tipos de Estratégias para Grid Bot

Com a configuração certa, ele se adapta ao seu estilo

- PRO TRADING

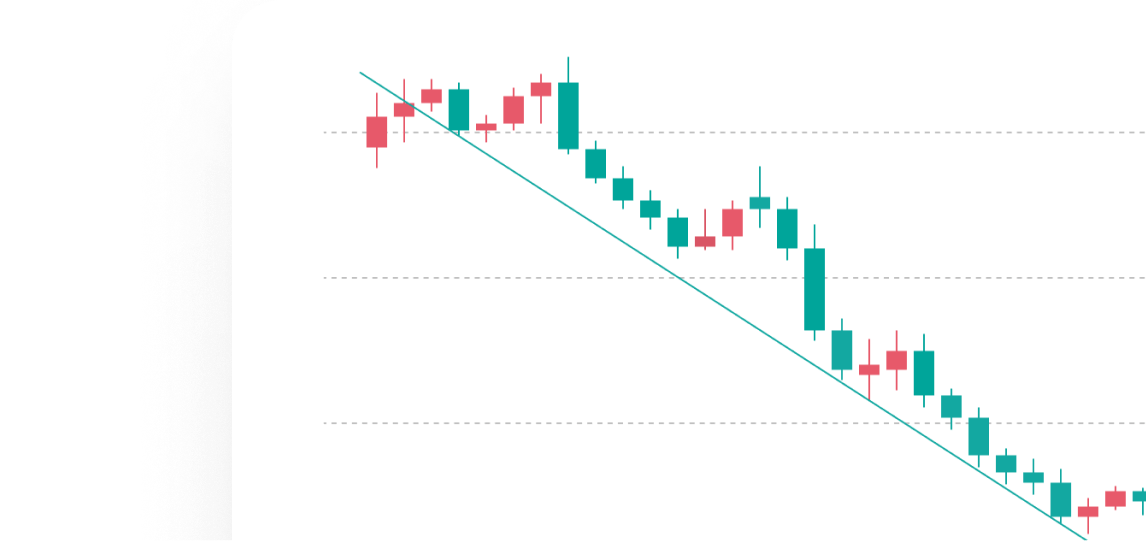

Trend Following

Deixe o bot acompanhar uma tendência ajustando os limites superior e inferior dinamicamente (trailing up/down), ou configurando grids unidirecionais (apenas compra ou apenas venda).

- PRO TRADING

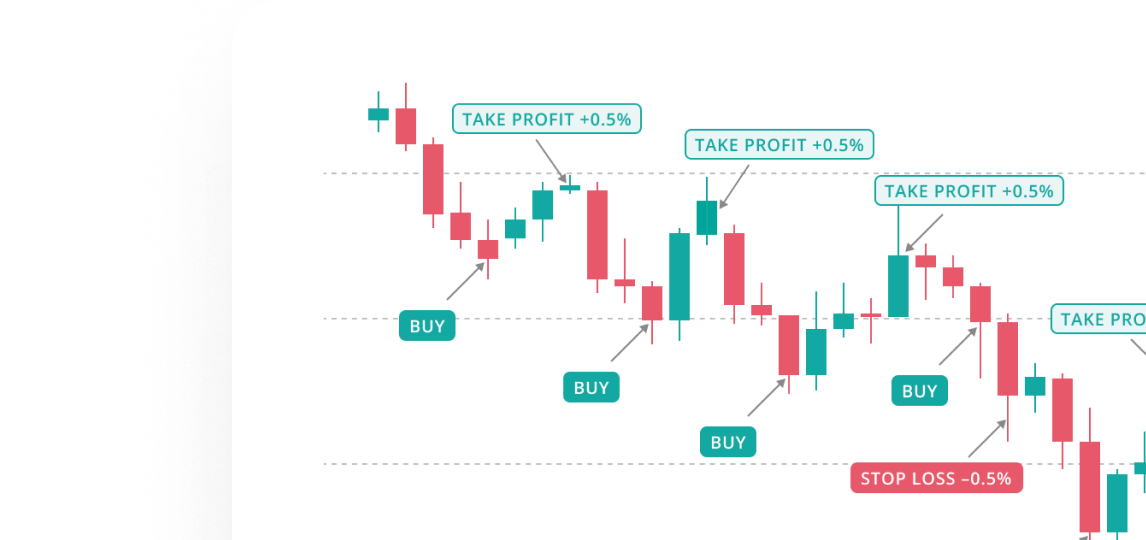

Scalping

Use um range de preço estreito com intervalos de grid muito pequenos para executar muitas operações pequenas em pouco tempo.

Grid Bot – Exemplo

3 Passos Simples para Lançar seu Grid Bot

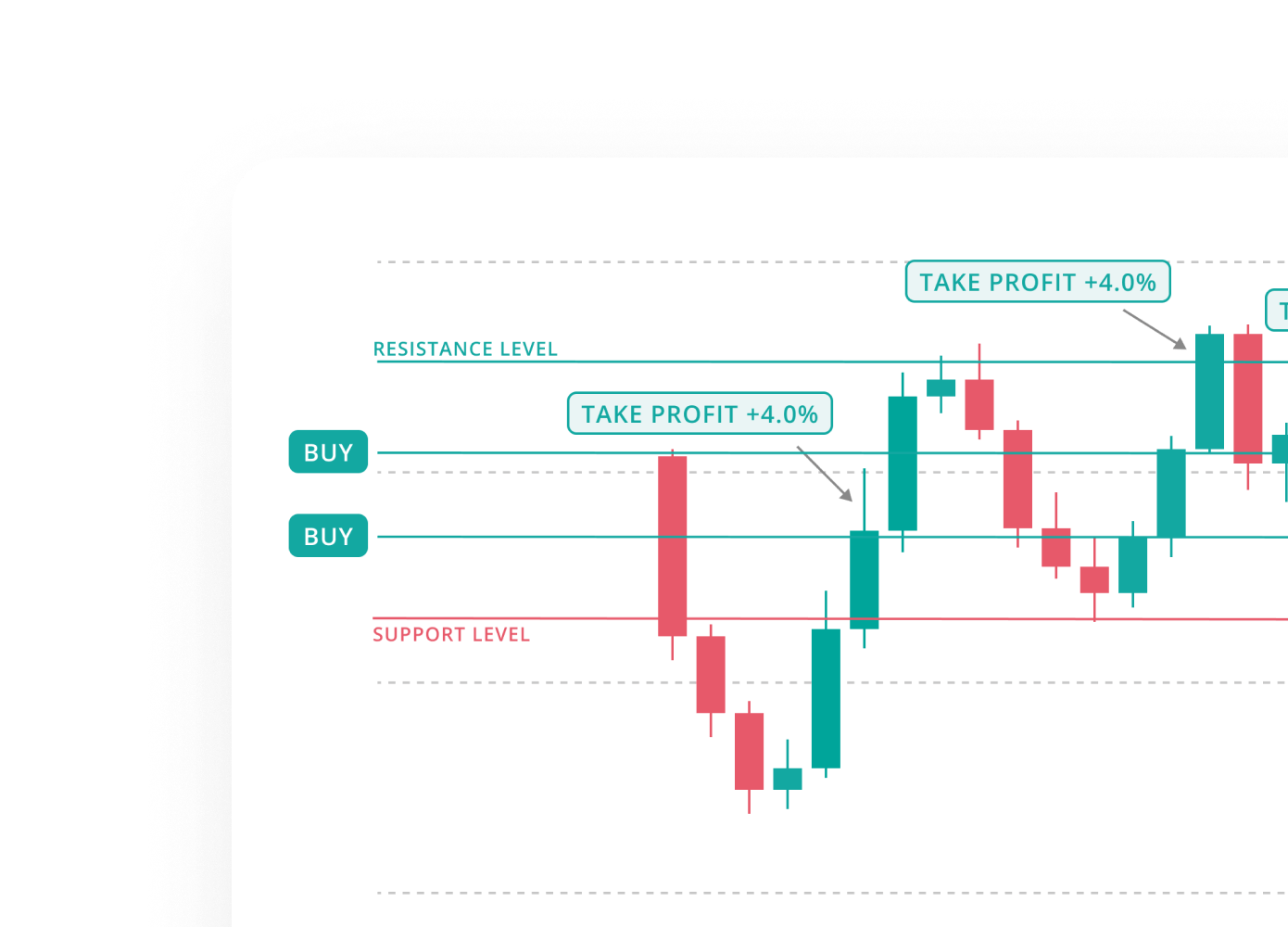

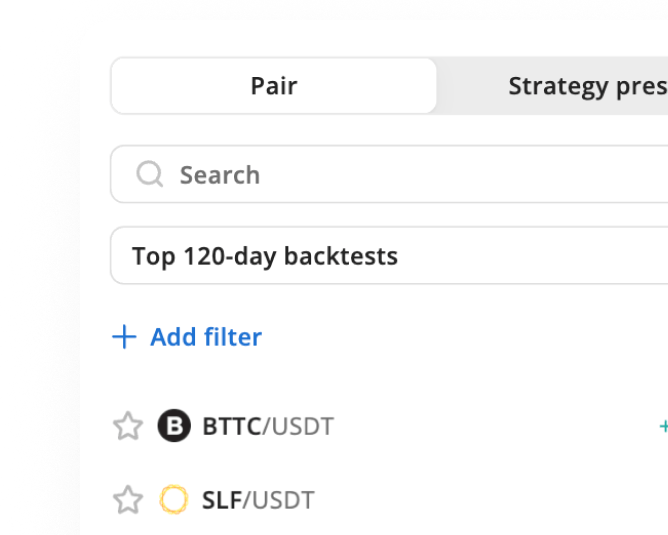

Escolha a Moeda Certa

Escolha um par com níveis claros de suporte e resistência onde o preço tende a saltar.

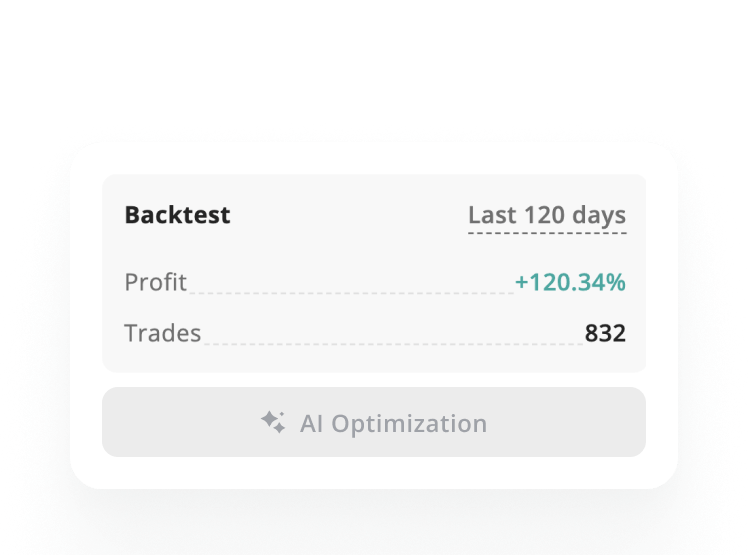

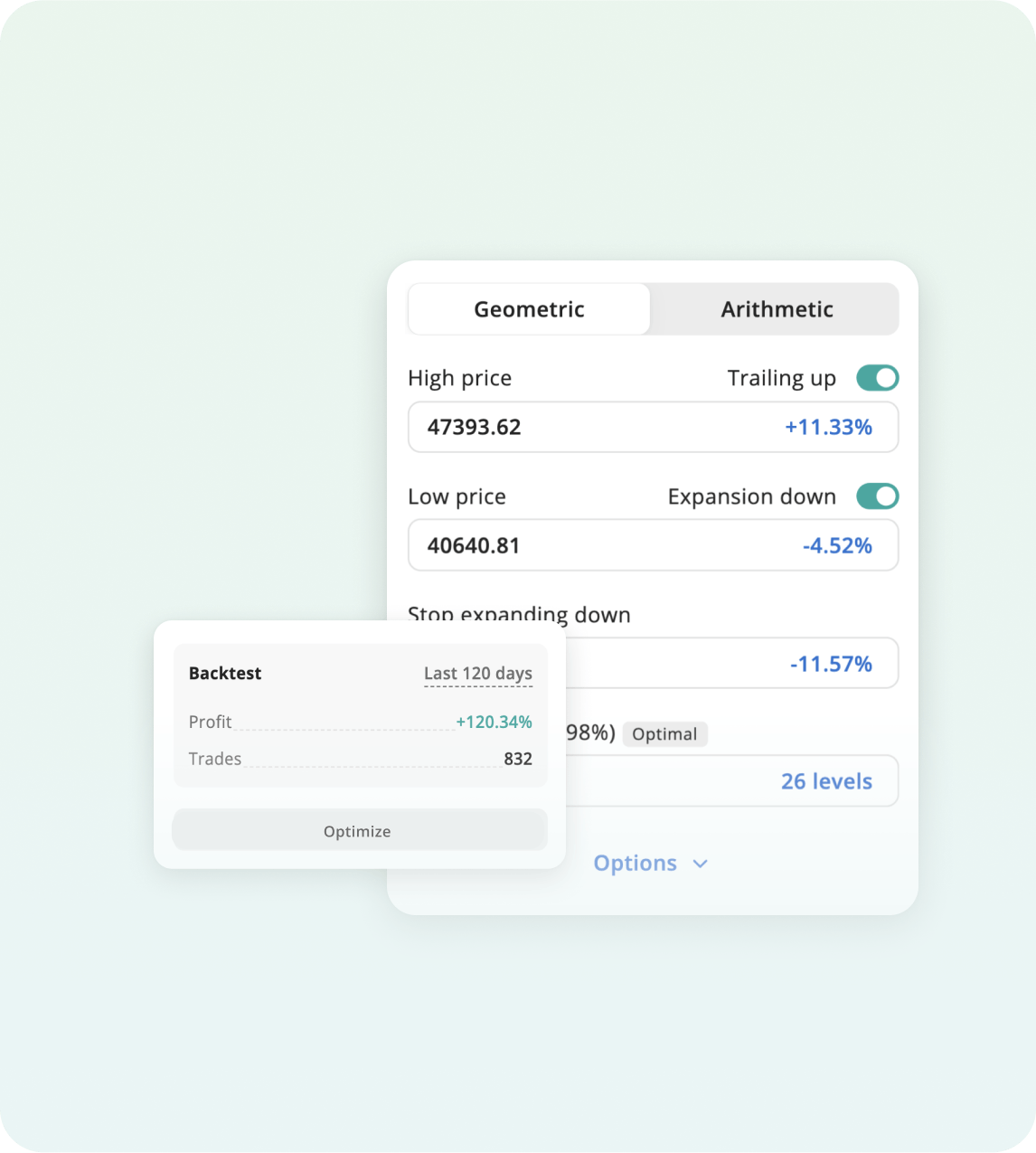

Otimize seu Grid

Use backtesting e sugestões de IA para encontrar o melhor tamanho de intervalo.

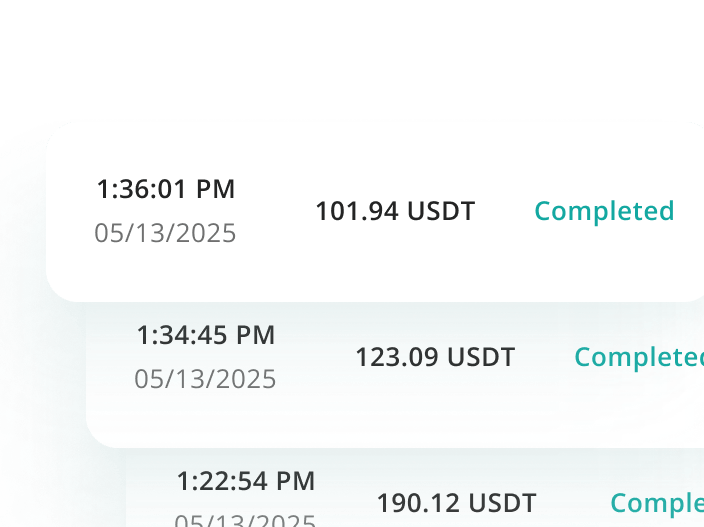

Lance e Monitore

Inicie o bot e acompanhe a performance ao longo do tempo. Ajuste se necessário ou deixe funcionando.

Recursos avançados

Deixe seu bot acompanhar o mercado quando ele se move além do seu range original. Ideal para condições de tendência — capture mais ganhos ao invés de ficar preso.

Teste sua configuração de GRID em dados históricos antes de entrar ao vivo. Veja como sua estratégia teria performado em diferentes fases do mercado.

Deixe o sistema analisar dados de mercado e gerar uma configuração de GRID pronta para usar. Economize tempo e comece com uma estratégia adequada às condições atuais.

Adicione lógica de Take Profit, Stop Loss e Trailing Stop a cada bot. Mantenha-se no lucro e reduza drawdowns — tudo sem intervenção manual.

Limite o risco, trave ganhos e controle o volume de ordens com trailing stops e configurações de ordem máxima.

Quando Usar o GRID Bot

O GRID Bot não se trata de prever o futuro — trata-se de lucrar com a forma como o mercado se move agora

Mercado Lateral

Perfeito para mercados instáveis sem direção clara. O bot compra na baixa e vende na alta dentro de uma faixa definida, capturando lucro de cada oscilação.

Mercado de Alta Volatilidade

Oscilações frequentes de preço = mais grids preenchidos. Pares voláteis geram mais atividade de trading, dando ao seu bot mais chances de ganhar — apenas defina controles de risco inteligentes.

Quedas do Mercado

Use o GRID Bot para reentrar lentamente no mercado após uma grande queda. Configure grids somente de compra para acumular ativos conforme o preço se recupera.

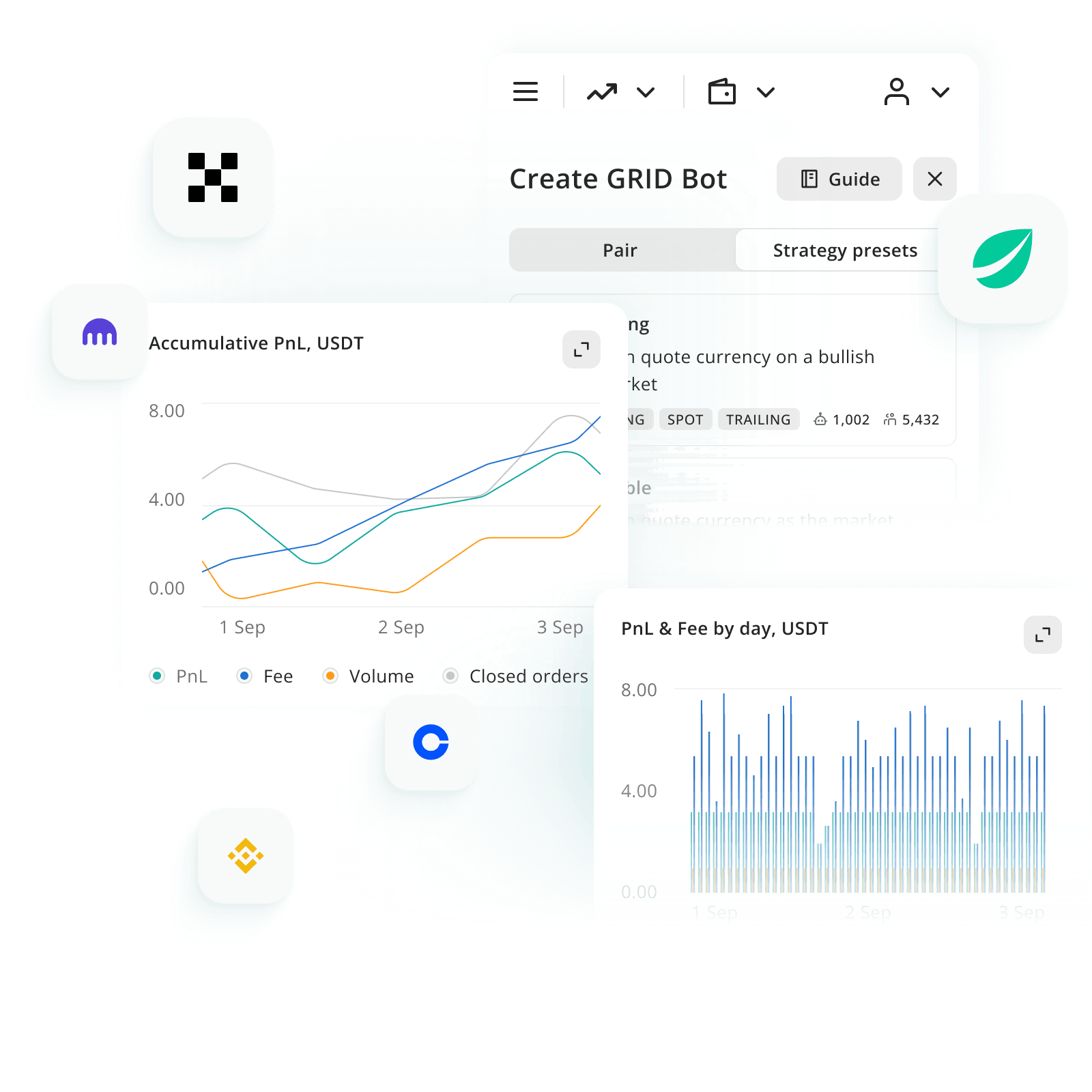

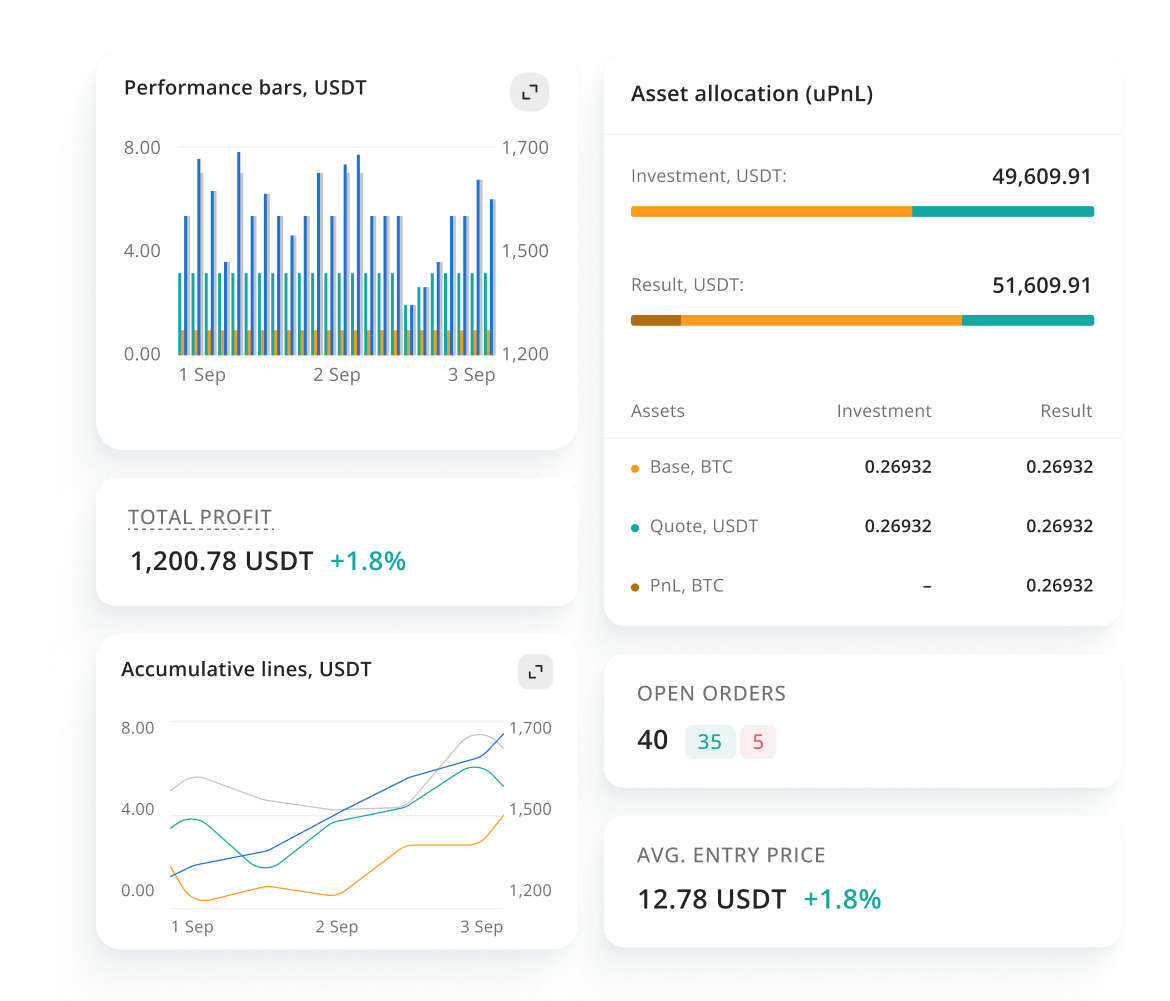

Análises Profundas do Grid Bot

Acompanhe a performance de cada bot em tempo real: ordens abertas, lucros, taxas e taxa de vitória.

Veja detalhamentos detalhados por grid, identifique o que está funcionando e melhore sua estratégia com decisões baseadas em dados.

Faça backtesting antes do lançamento. Compare bots ao vivo. Otimize conforme avança.

Funciona com as Principais Exchanges

Conecte sua exchange favorita em segundos — seja através do Fast Connect ou adicionando chaves API manualmente.

Por que traders de elite escolhem 3Commas?

Avaliado

Excelente

no

1.754 avaliações

Salim Dirani

Estou usando 3Commas há cerca de 5 meses agora, e funciona muito bem. Dependo dele para executar e gerenciar trades personalizados usando bots de sinais e SmartTrade. Eles também oferecem bots DCA e Grid, que usei brevemente — e tiveram um desempenho excelente.

Danibankz

Descobri que 3Commas é altamente eficaz para automatizar minhas estratégias de trading e gerenciar meu portfólio de forma eficiente. Os bots DCA e Grid da plataforma executaram trades de forma confiável e ajudaram a otimizar lucros com intervenção manual mínima.

Engin Erdebil

3Commas se tornou uma parte essencial da minha vida de trading — automação, precisão e tranquilidade em uma plataforma.

Por que você ainda não está fazendo trading?

Deixe nossa tecnologia cuidar das tarefas tediosas enquanto você se concentra em inovar novas estratégias

FAQ

O que é um Bot de Trading GRID?

Um Bot de Trading GRID automatiza compras na baixa e vendas na alta dentro de uma faixa de preço que você define. Ele coloca múltiplas ordens de compra e venda em intervalos predefinidos ("grids") e obtém pequenos lucros conforme o preço sobe e desce. É ideal para mercados laterais ou voláteis onde os preços flutuam.

Quanto capital preciso para iniciar um Grid Bot?

Não há valor fixo, mas quanto mais capital você alocar, mais grids pode colocar — o que aumenta a frequência de trades e lucros potenciais. A maioria dos usuários começa com o mínimo da exchange (geralmente cerca de $50–100), mas $300–500+ é recomendado para melhor performance.

O que acontece se o preço sair da minha faixa do grid?

O bot pausa o trading até o preço voltar ao seu grid. Nenhuma ordem é colocada fora da faixa, a menos que você ative recursos como Trailing Up (para seguir o preço para cima) ou combine com um bot DCA para gerenciar quedas.

Grid Trading é legal para residentes dos EUA?

Sim, mas depende da exchange. Residentes dos EUA podem usar Bots GRID em exchanges que são legalmente acessíveis nos EUA. 3Commas não fornece serviços de trading — ele se conecta à sua conta da exchange via API segura.

Como são calculadas as taxas de trading e as taxas da 3Commas?

Taxas de trading são cobradas pela sua exchange para cada ordem executada. 3Commas não cobra taxas adicionais por trade além do seu plano de assinatura.

Posso executar múltiplos Grid Bots ao mesmo tempo?

Sim. Você pode executar até 10 Bots GRID no plano Pro e até 50 no plano Expert. Se precisar de mais, sinta-se à vontade para nos contatar sobre um plano personalizado com limites maiores para atender às suas necessidades.

Grid Bot funciona em mercados altamente voláteis?

Sim, e a volatilidade pode realmente impulsionar a performance — mais oscilações de preço significam mais ordens executadas. No entanto, maior volatilidade também aumenta o risco, então é importante usar recursos como Stop Loss, Proteção contra Pump & Dump, e Trailing Stop para gerenciá-lo.