自2017年以来精英交易者的选择

网格机器人用户

创建的网格机器人

完成的交易

交易量

3Commas网格机器人概述

网格机器人的策略类型

通过正确的设置,适应您的交易风格

- PRO TRADING

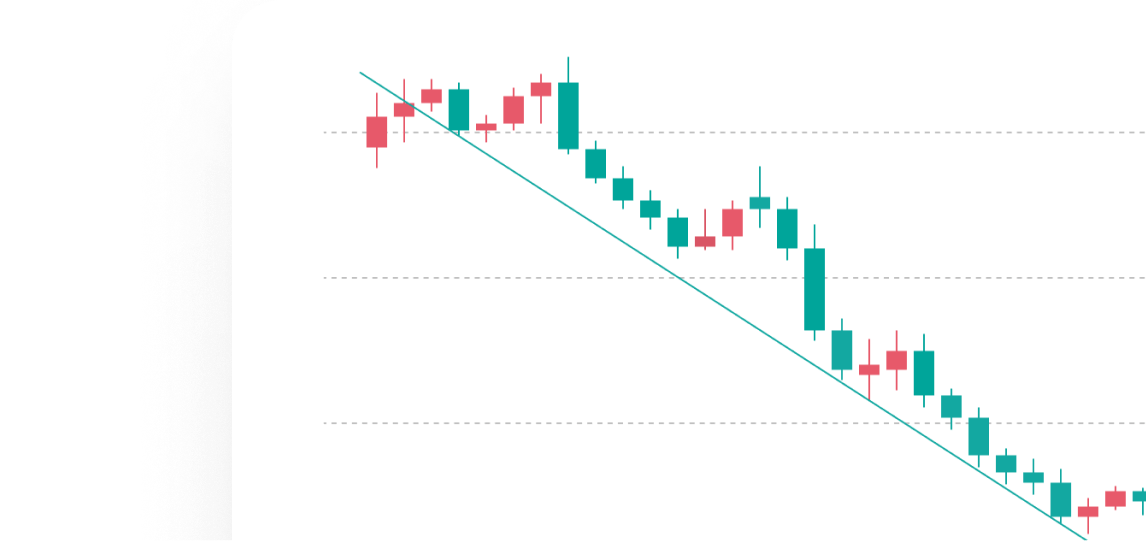

趋势跟踪

让机器人通过动态调整上限和下限(向上/向下追踪)来跟随趋势,或设置单向网格(仅买入或仅卖出)。

- PRO TRADING

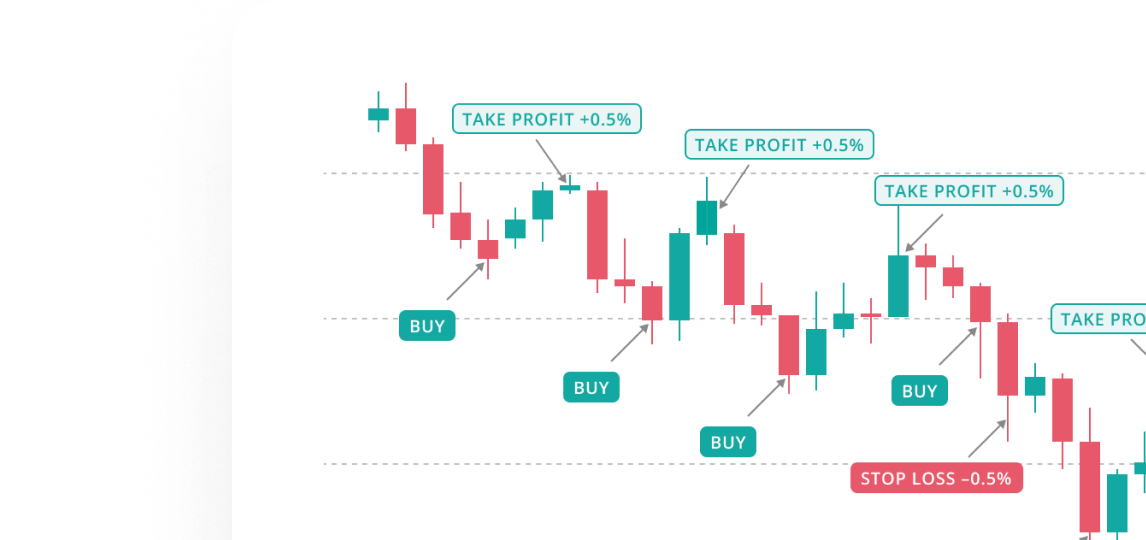

剥头皮

使用较窄的价格区间和很小的网格步长,在短时间内执行多次小额交易。

网格机器人——示例

启动网格机器人的3个简单步骤

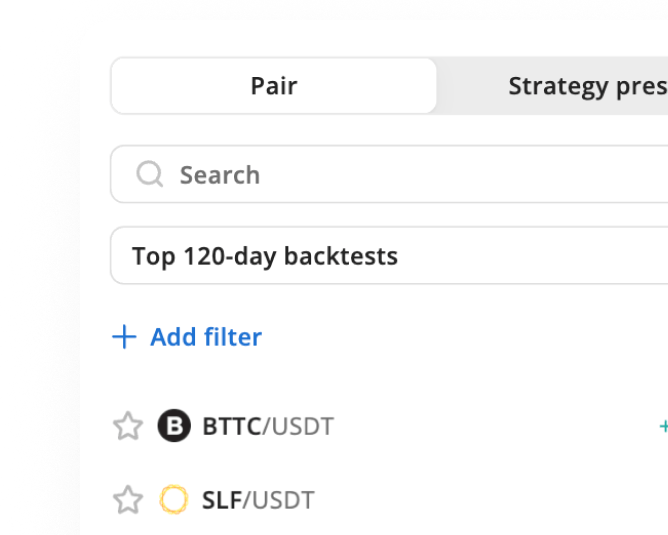

选择合适的币种

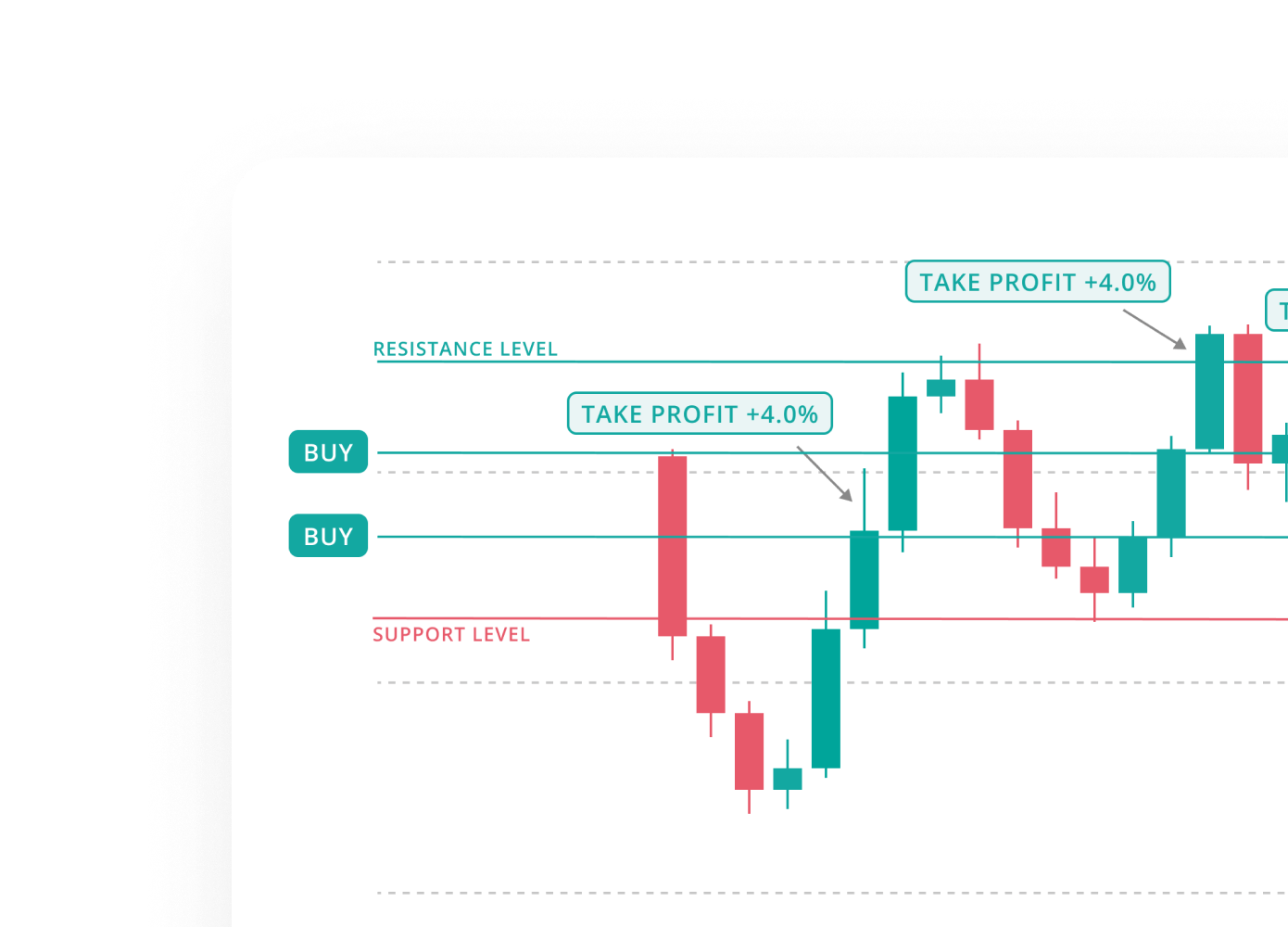

选择具有明确支撑和阻力位的交易对,价格倾向于在此反弹。

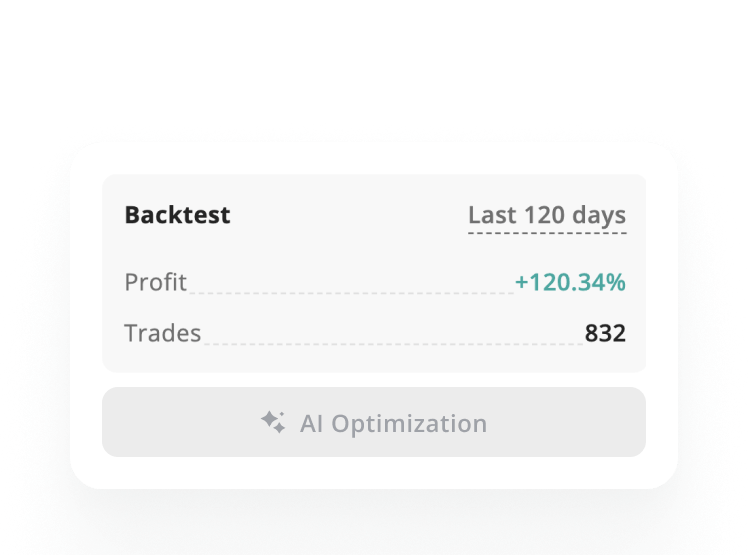

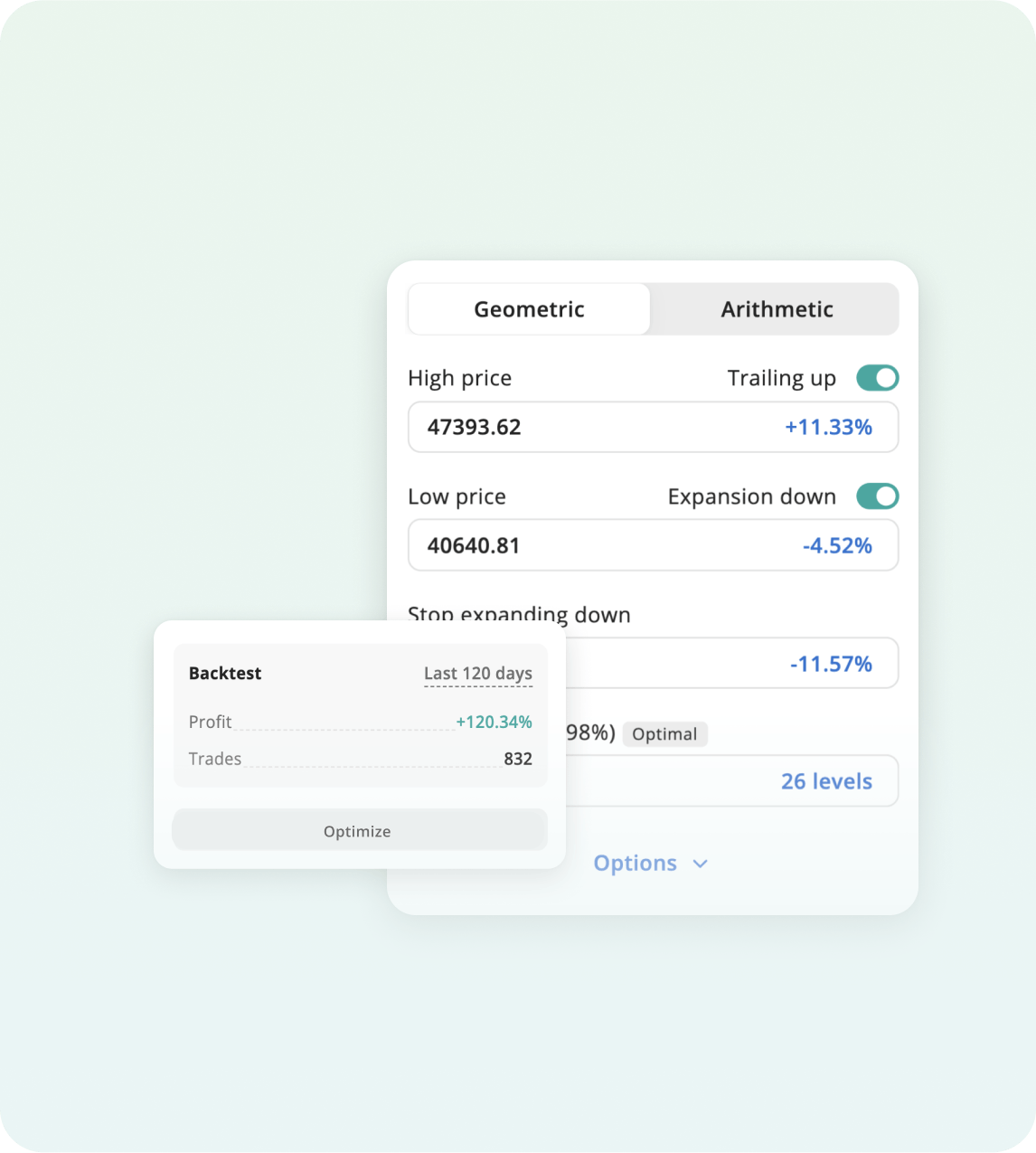

优化您的网格

使用回测和AI建议来找到最佳的步长设置。

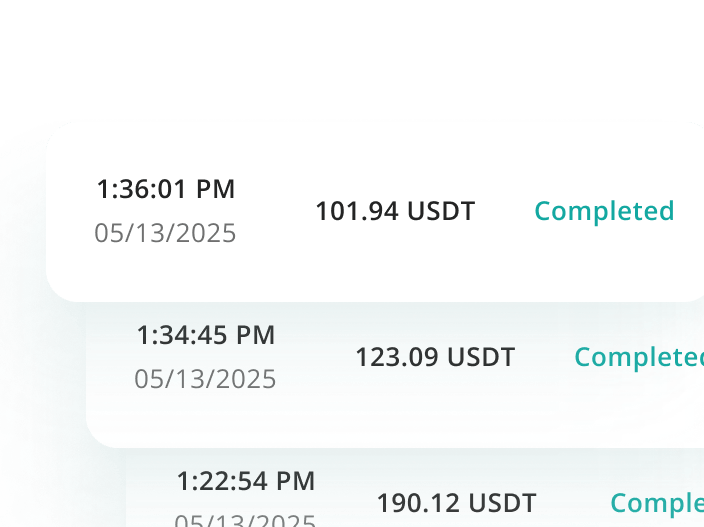

启动并监控

启动机器人并跟踪长期表现。根据需要调整或让它自动运行。

高级功能

让您的机器人在市场超出原始区间时跟随市场。适用于趋势行情——获取更多收益而不是被困住。

在实盘交易前,使用历史数据测试您的网格设置。查看您的策略在不同市场阶段的表现。

让系统分析市场数据并生成可立即使用的网格设置。节省时间,从针对当前市场条件定制的策略开始。

为每个机器人添加止盈、止损和追踪止损逻辑。保持盈利并减少回撤——无需手动干预。

通过追踪止损和最大订单设置来限制风险、锁定收益并控制订单量。

何时使用网格机器人

网格机器人不是用来预测未来的——而是从当前市场走势中获利

横盘市场

适用于没有明确方向的震荡市场。机器人在设定范围内低买高卖,从每次反弹中获取利润。

高波动市场

频繁的价格波动 = 更多网格成交。波动性强的交易对产生更多交易活动,为您的机器人提供更多盈利机会——只需设置智能风控。

市场暴跌

使用网格机器人在大跌后慢慢重新入市。设置纯买入网格,在价格回升时积累资产。

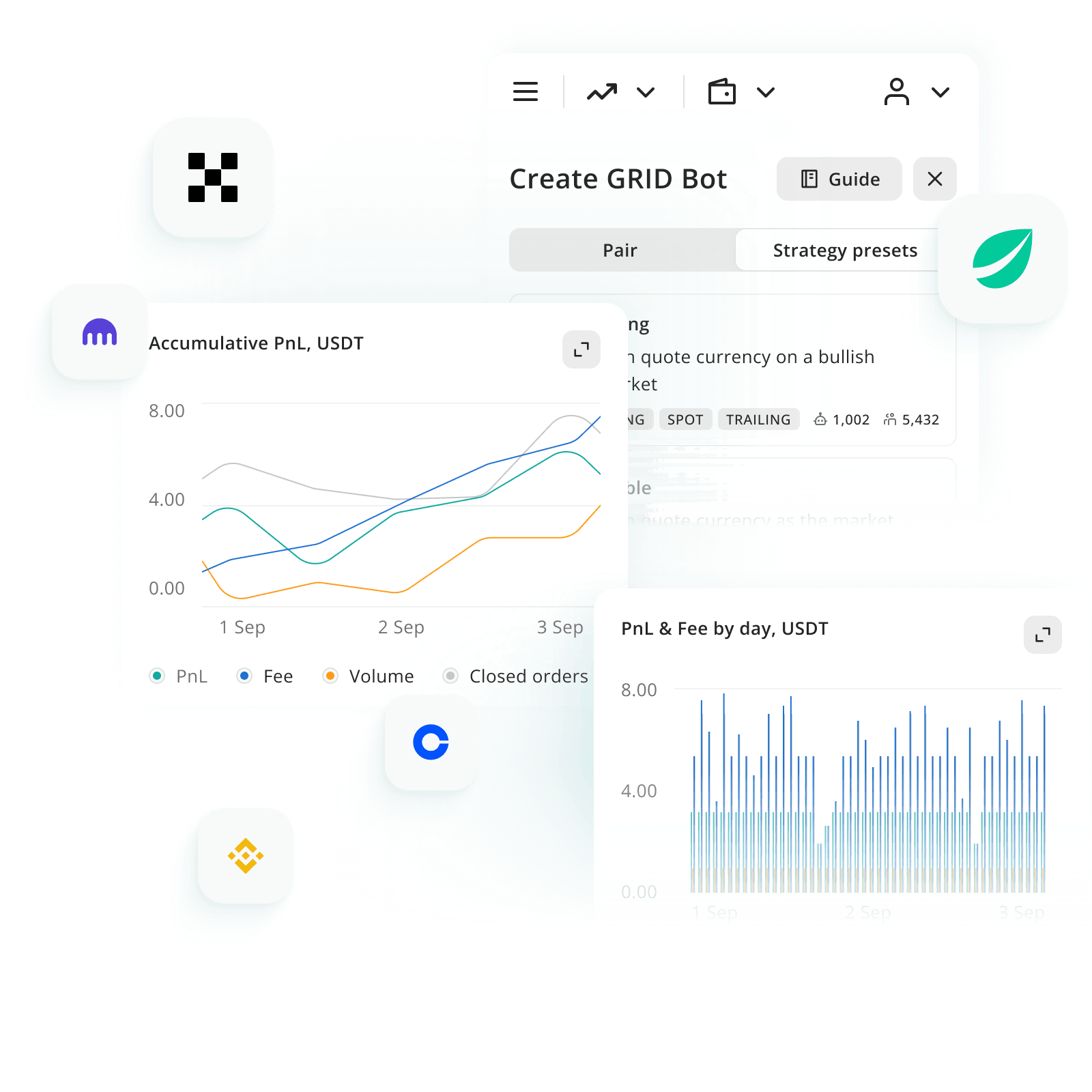

网格机器人深度分析

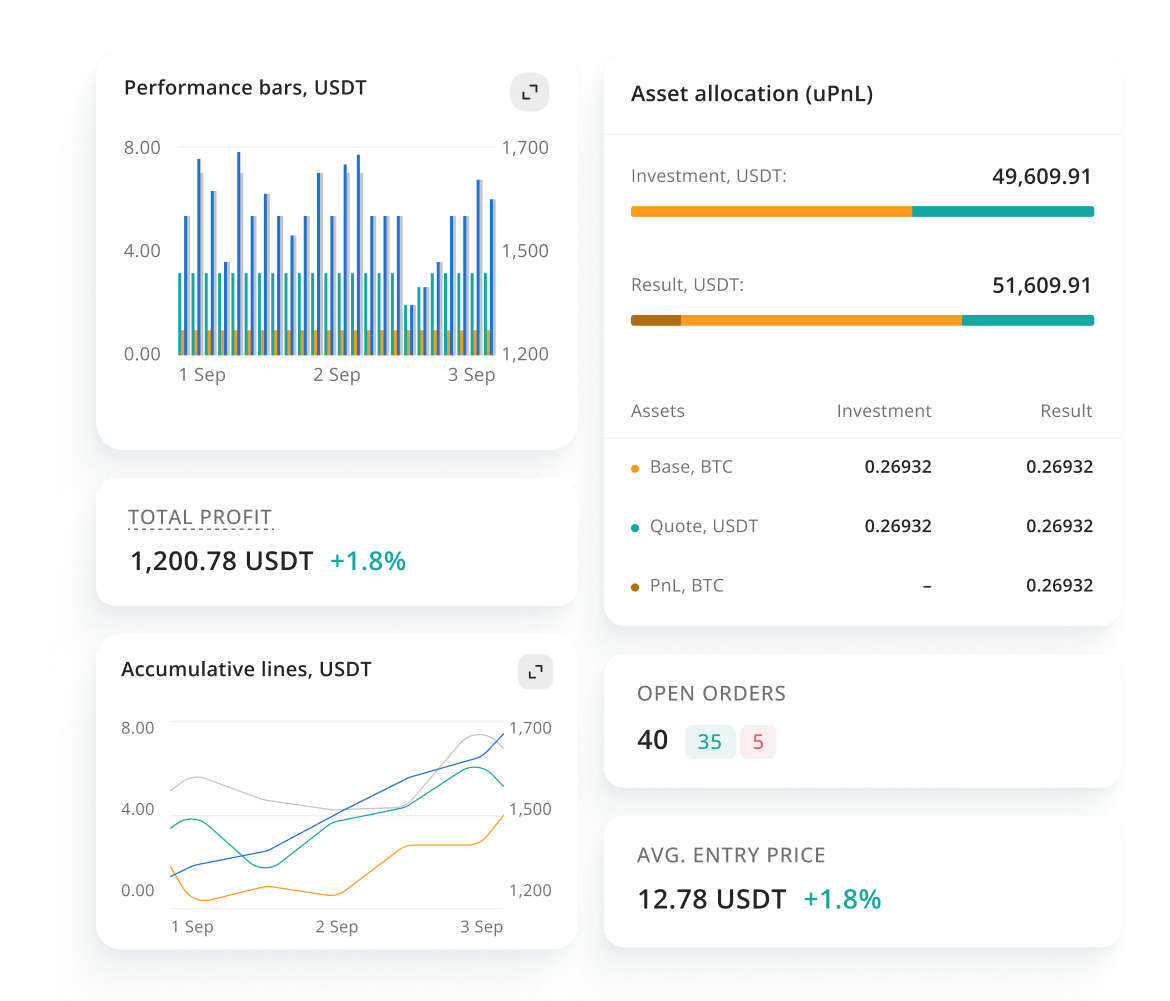

实时跟踪每个机器人的表现:开放订单、利润、手续费和胜率。

查看每个网格的详细分析,发现有效策略,用数据支持的决策改进您的策略。

启动前回测。实时比较机器人。随时优化。

支持主流交易所

几秒钟内连接您喜爱的交易所——通过快速连接或手动添加API密钥。

为什么精英交易者选择3Commas?

评级

优秀

来自

1,754条评价

Salim Dirani

我使用3Commas大约5个月了,效果很棒。我依靠它使用信号机器人和SmartTrade执行和管理自定义交易。他们还提供DCA和网格机器人,我短暂使用过——表现非常好。

Danibankz

我发现3Commas在自动化我的交易策略和有效管理投资组合方面非常有效。该平台的DCA和网格机器人可靠地执行交易,并以最少的手动干预帮助优化利润。

Engin Erdebil

3Commas已成为我交易生活的重要组成部分——在一个平台上实现自动化、精准和安心。

为什么您还没有开始交易?

让我们的技术处理繁琐的任务,您专注于创新新策略

常见问题

什么是网格交易机器人?

网格交易机器人在您定义的价格区间内自动低买高卖。它在预设间隔("网格")处设置多个买单和卖单,并在价格上下波动时赚取小额利润。它非常适合横盘或波动市场,价格在这些市场中会出现波动。

启动网格机器人需要多少资金?

没有固定金额,但您投入的资金越多,可以设置的网格就越多——这会增加交易频率和潜在利润。大多数用户从交易所最低要求开始(通常约$50–100),但建议$300–500+以获得更好的表现。

如果价格突破我的网格区间会发生什么?

机器人会暂停交易,直到价格重新进入您的网格。除非您启用追踪上涨(跟随价格上涨)等功能或结合DCA Bot管理下跌,否则不会在区间外设置订单。

美国居民使用网格交易合法吗?

是的,但这取决于交易所。美国居民可以在美国法律允许访问的交易所上使用网格机器人。3Commas本身不提供交易服务——它通过安全API连接到您的交易所账户。

交易手续费和3Commas费用如何计算?

交易手续费由您的交易所对每个成交订单收取。除了您的订阅计划外,3Commas不会对每笔交易收取任何额外费用。

我可以同时运行多个网格机器人吗?

可以。您可以在Pro计划中运行最多10个网格机器人,在Expert计划中运行最多50个。如果您需要更多,请随时联系我们,了解具有更高限制的定制计划,以满足您的需求。

网格机器人在高波动市场中有效吗?

是的,波动性实际上可以提升表现——更多价格波动意味着更多成交订单。然而,更高的波动性也会增加风险,因此重要的是使用止损、拉高出货保护和Trailing Stop等功能来管理风险。