Meet the New 3Commas AI Assistant

Nov 24, 2025

Automatize suas estratégias de negociação SOL para capitalizar nas velocidades de transação subsegundo da Solana e taxas de fração de centavo. Execute negociações de alta frequência, capture oportunidades de arbitragem através de plataformas DeFi e responda instantaneamente a oscilações de volatilidade diária de 5-15% que negociação manual simplesmente não pode igualar. Seus fundos permanecem seguros em sua conta da exchange.

Um bot de trading Solana é um software automatizado que executa suas estratégias de negociação SOL 24 horas por dia. Ele reage instantaneamente a mudanças de mercado com base em suas configurações, o que é crucial dada a volatilidade de preço da Solana. O bot aproveita as velocidades rápidas de transação e taxas mínimas do SOL para negociar eficientemente. Com o 3Commas, seus fundos permanecem em sua conta da exchange. Conectamos através de chaves API sem permissões de saque, então você mantém controle total de seus ativos.

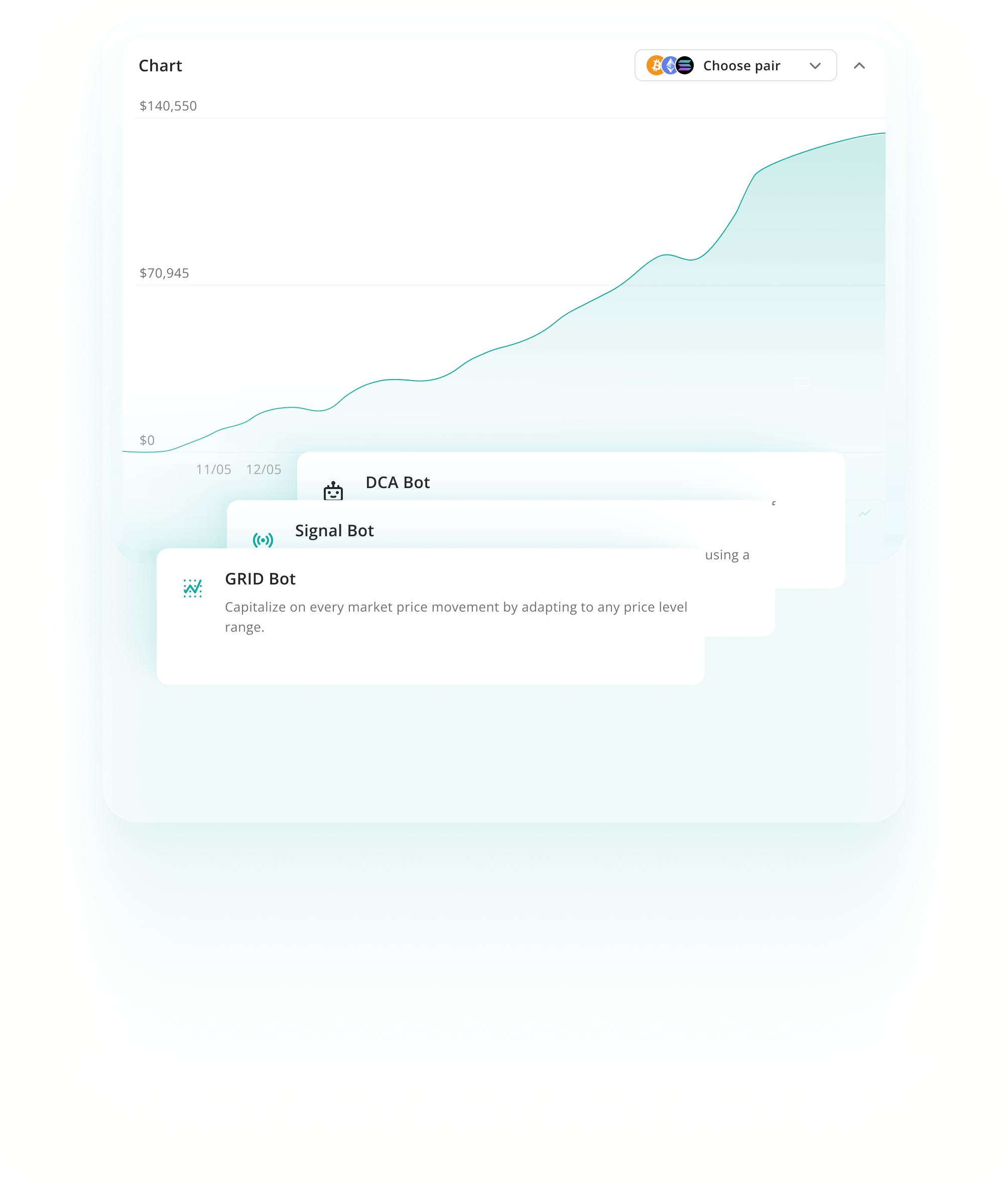

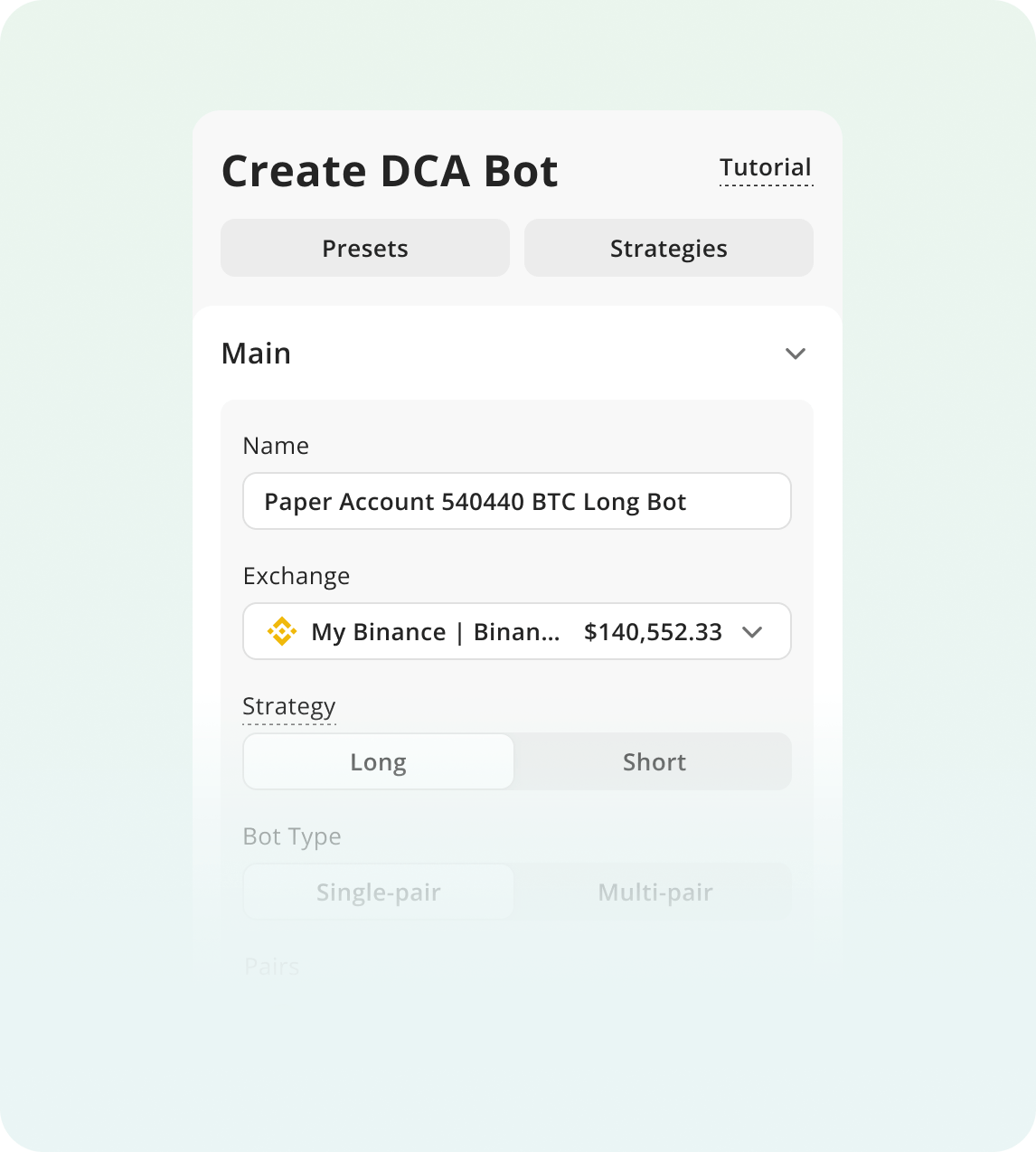

Bots Dollar Cost Averaging executam compras sistemáticas em intervalos regulares ou quedas de preço acionadas, distribuindo sua entrada através de múltiplas transações em vez de uma quantia única. Esta abordagem suaviza o preço médio de compra durante períodos voláteis. A estratégia funciona particularmente bem com a tendência da Solana de experimentar quedas acentuadas de 20-30% seguidas por recuperações rápidas, permitindo acumulação durante fraqueza temporária.

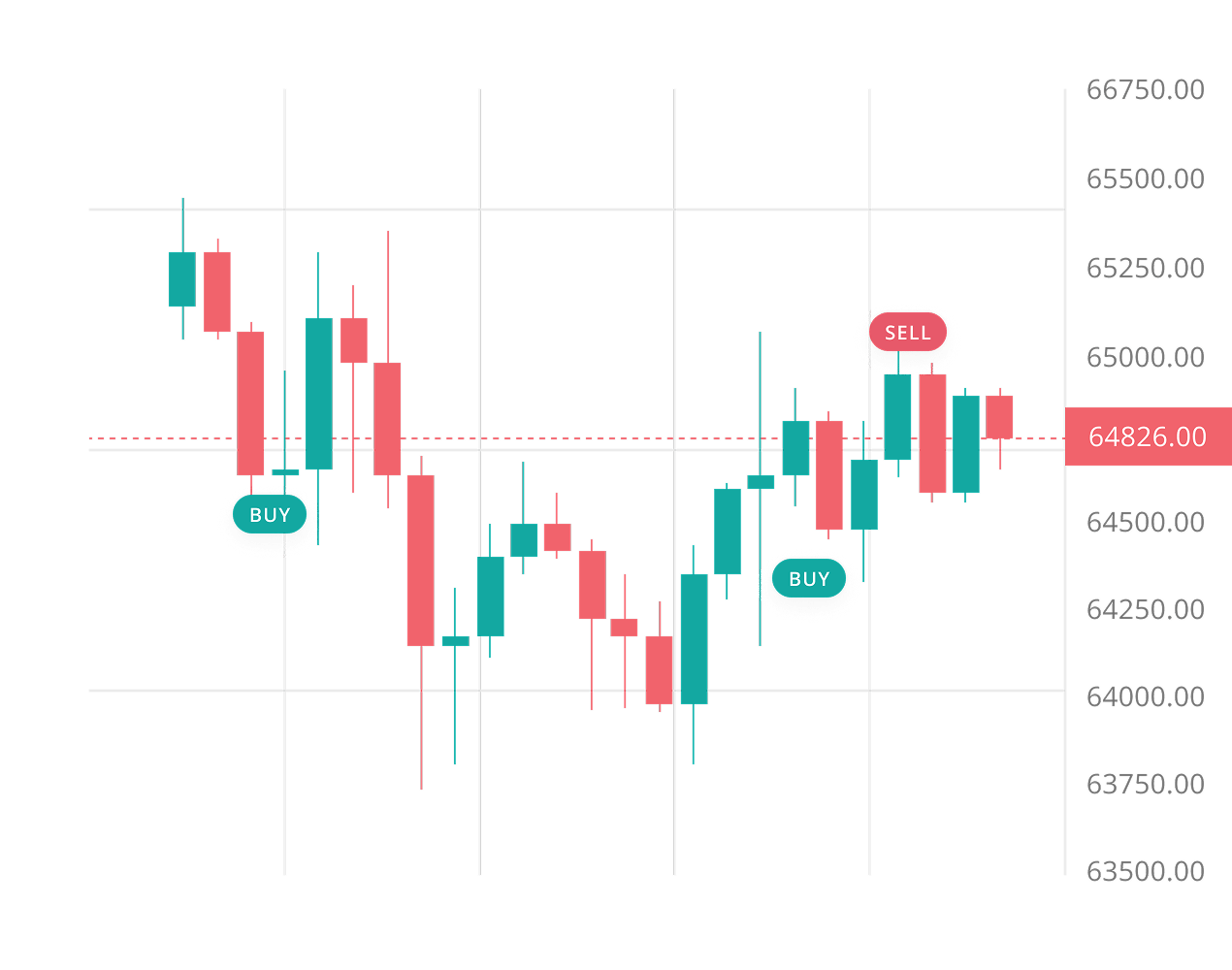

Saiba maisEsta abordagem automatizada coloca múltiplas ordens de compra e venda em intervalos de preço predeterminados dentro de uma faixa definida. Ela captura lucro de cada pequeno movimento de preço conforme Solana oscila para cima e para baixo. Mais adequado para fases de consolidação do SOL onde o preço negocia lateralmente em canais de 15-25% de largura que podem persistir por semanas ou meses após movimentos direcionais significativos.

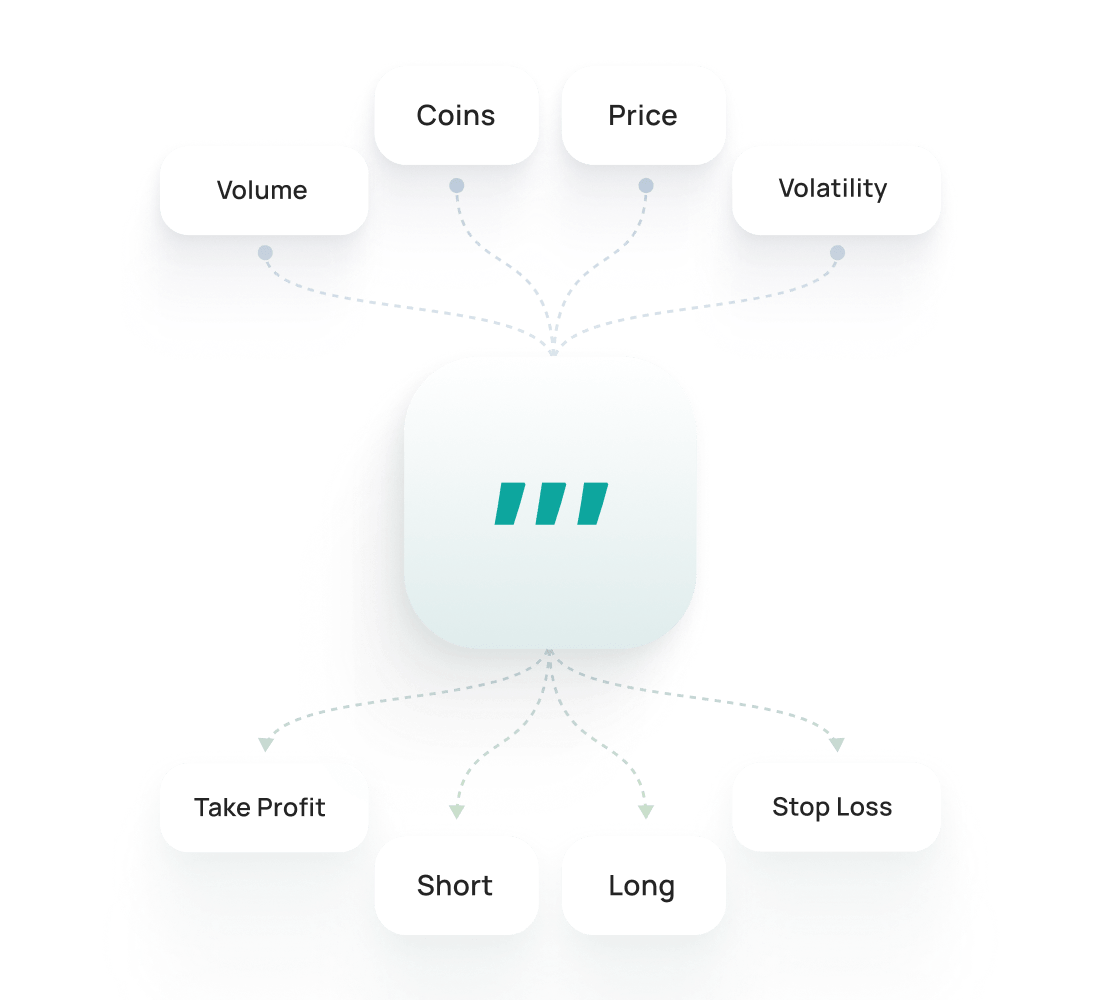

Saiba maisEsses bots executam negociações automaticamente quando condições técnicas específicas do TradingView ou indicadores personalizados são acionadas. Sinais comuns incluem cruzamentos de médias móveis, divergências RSI ou confirmações MACD. Esta estratégia se destaca com SOL porque o token demonstra forte responsividade a padrões de análise técnica, especialmente durante tendências de momentum estabelecidas onde timing de entrada e saída se torna crítico para capturar movimentos direcionais.

Saiba maisO Backtesting de Solana permite testar estratégias com dados históricos para ver como elas poderiam ter se saído. Ajuda a ajustar configurações, avaliar riscos e construir confiança antes de operar ao vivo.

Saiba maisO Solana SmartTrade oferece opções avançadas de negociação manual como take-profit, stop-loss, trailing e saídas em múltiplos alvos. O Solana Public Presets são estratégias prontas de outros traders que você pode usar instantaneamente ou personalizar conforme sua necessidade.

Para começar a negociar com bots:

Cadastre-se na 3Commas e escolha seu plano

Conecte uma Exchange e escolha a estratégia do seu bot.

Configure os parâmetros do seu bot e coloque para rodar!

SOL se move rápido. Uma queda de 30% pode acontecer da noite para o dia enquanto você dorme, como o crash de abril de 2024 de $175 para $122. Negociação manual significa que você perde oportunidades e toma decisões emocionais durante volatilidade. Nosso bot monitora mercados 24/7, remove vendas de pânico e compras FOMO, e protege suas posições com stop losses automáticos e ordens take profit. Você define a estratégia uma vez. O bot a executa sem hesitação, mesmo durante oscilações selvagens de preço.

O agregador DEX Jupiter encontra automaticamente os melhores preços para você verificando liquidez através de dezenas de pools de negociação Solana simultaneamente.

Taxas de transação custam frações de centavo, o que significa que você pode executar estratégias lucrativas de arbitragem e scalping sem taxas consumindo seus ganhos.

O próximo cliente validador Firedancer remove riscos de ponto único de falha e empurra capacidade de rede além de um milhão de transações por segundo.

Defina stop losses mais amplos que o usual para contabilizar a volatilidade do SOL. Oscilações diárias de 5-15% são normais, então colocar stops muito apertados fará você ser parado durante ação de preço regular antes que qualquer tendência real se desenvolva.

Mantenha tamanhos de posição pequenos porque Solana carrega riscos técnicos únicos. A rede experimentou interrupções completas onde seu bot não pode executar negociações ou ajustar posições, deixando você exposto durante movimentos críticos de mercado.

Monitore cronogramas de liquidação do espólio FTX e anúncios regulatórios da SEC de perto. Esses eventos externos criam pressão de venda previsível e incerteza legal que podem desencadear quedas repentinas de preço independentemente de sinais técnicos.

Bots principais para trading Spot em 1 exchange

$20/ mês

Assistente de IA

Apenas Spot

1

Chaves API Ativas

5

Bots de DCA em Funcionamento

2

Active Signal Bots

2

Active Grid Bots

20

Negociações ativas de DCA

10

Negociações ativas de Signal

10

SmartTrades Ativas

100

Backtests de DCA

Período de 1 ano

100

Backtests de GRID

Período de 4 months

API para desenvolvedores

Somente leitura

Execução de Pine Script®

Suporte via chat ao vivo

Trading Spot e Futuros com múltiplas contas

$50/ mês

Assistente de IA

Spot e Futuros

3

Chaves API Ativas

20

Bots de DCA em Funcionamento

20

Bots de Signal em Funcionamento

10

Bots de Grid em Funcionamento

100

Negociações ativas de DCA

100

Negociações ativas de Signal

50

SmartTrades Ativas

500

Backtests de DCA

Período de 2 years

500

Backtests de GRID

Período de 4 months

API para desenvolvedores

Somente leitura

Execução de Pine Script®

Suporte via chat ao vivo

Limites excepcionais e trading via API

$140/ mês

Assistente de IA

Spot e Futuros

15

Chaves API Ativas

1K

Bots de DCA em Funcionamento

1K

Bots de Signal em Funcionamento

1K

Bots de Grid em Funcionamento

5K

Negociações ativas de DCA

5K

Negociações ativas de Signal

5K

SmartTrades Ativas

5K

Backtests de DCA

Histórico completo

5K

Backtests de GRID

Período de 4 months

API para desenvolvedores

Leitura e escrita

Execução de Pine Script®

Suporte prioritário via chat ao vivo

Execute sua estratégia Solana na Binance, Coinbase Advanced, Kraken e mais de 12 outras exchanges suportadas via 3Commas. Conecte via API segura, defina entradas, saídas e riscos uma única vez e deixe a automação rodar 24/7. Um só workspace para todos os ativos significa registros mais limpos, iteração mais rápida e menos oportunidades perdidas nos seus pares de SOL.

O Backtesting na 3Commas facilita muito a vida. Posso testar ideias, ver o que funciona e evitar erros bobos — tudo sem perder dinheiro. Eu comprei o plano Expert para realizar mais testes.

Por muito tempo usei uma estratégia que considerava lucrativa, mas ao longo do tempo estava perdendo dinheiro devagar. Com o recurso de backtest da 3Commas percebi que só precisava de pequenos ajustes na estratégia para me tornar lucrativo.

Uso a 3Commas há alguns anos e os bots da plataforma, depois que você aprende como funcionam, oferecem retornos interessantes com pouco risco (se você sabe o que está fazendo, é possível conseguir 15–30% ao ano com pouco risco e sem alavancagem). Dá para ganhar dinheiro enquanto dorme e aprender cada vez mais.

O time está sempre disponível, focado nas necessidades do cliente, melhorando o app e o site, e se adaptando às novidades. Trabalho excelente!

Já usei outros bots de negociação, mas esse é bem melhor: consigo controlar perdas e maximizar ganhos com mais facilidade. Vou continuar usando cada vez mais.

Sou novo no mercado cripto e consegui usar o 3Commas facilmente. Aprendi muito com a negociação em modo simulação e me sinto seguro usando a plataforma.

2,0M

Traders cadastrados

Avaliado como Ótimo em

1.479 avaliações

Avaliações Google

4.0

Depende de seus objetivos e condições de mercado. Bots não garantem lucros—eles automatizam estratégias de negociação que capturam volatilidade de curto prazo. As frequentes oscilações diárias de 5-15% da Solana criam oportunidades que HODLar perde, mas elas também amplificam perdas se mercados se moverem contra você. A vantagem real é eficiência: bots executam sua estratégia 24/7 sem decisões emocionais. Sucesso requer gerenciamento de risco adequado, expectativas realistas e entendimento de que nenhuma estratégia funciona em todas as condições. Pense nisso como negociação ativa sem o tempo constante de tela.

Configuração inicial leva 15-30 minutos: conecte sua exchange via API, escolha um template de estratégia e defina seus parâmetros de risco. Iniciantes frequentemente se sentem sobrecarregados por configurações de grid e faixas de preço—comece com presets conservadores em vez de otimizar tudo imediatamente. Uma vez em execução, verifique seu bot a cada poucos dias para ajustar para mudanças maiores de mercado. A volatilidade do SOL significa que você vai querer monitorar estabilidade de rede durante períodos de interrupção conhecidos. Não é renda passiva, mas é muito menos exigente que negociação manual enquanto captura oportunidades que você perderia de outra forma.

O 3Commas é não-custodial—nunca detemos seus fundos. Sua cripto permanece em sua conta da exchange o tempo todo. Chaves API apenas concedem permissões de negociação, não acesso de saque, o que você explicitamente desabilita durante configuração. Pior cenário possível com configuração adequada: um bot faz negociações que você não queria, mas seus fundos permanecem seguros na exchange. Não podemos sacar, transferir ou acessar seus ativos. Pense em chaves API como chaves de valet—elas nos deixam dirigir mas não possuir seu carro. Sempre verifique se permissões de saque estão desabilitadas.

O 3Commas suporta múltiplas estratégias otimizadas para características do SOL. Grid bots colocam ordens de compra e venda em intervalos definidos, lucrando com volatilidade. Bots DCA fazem média em posições durante quedas. Estratégias adjacentes a HODL como take-profit trailing capturam vantagem enquanto protegem ganhos. As baixas taxas de transação do SOL tornam negociação grid de alta frequência viável, diferente de chains caras. Você pode executar arbitragem entre DEXs Solana e exchanges centralizadas, ou implantar sinais personalizados de indicadores técnicos. Cada estratégia se adequa a diferentes condições de mercado—mercados de faixa favorecem grids, enquanto mercados de tendência funcionam melhor com ordens trailing.

Obtenha o teste com acesso total a todas as ferramentas de negociação SOL.