Meet the New 3Commas AI Assistant

2025年11月24日

Automate your ETH trading on the world's leading smart contract platform. Navigate Ethereum's high volatility and 24/7 market with precision execution. Our bot monitors opportunities around the clock, removing emotion from your trades while capitalizing on ETH's liquidity and technical patterns you'd otherwise miss.

An Ethereum trading bot is automated software that executes ETH trades for you based on pre-set rules and strategies. It operates 24/7, monitoring the market and capturing opportunities you'd miss while sleeping or working. The bot follows your strategy with precision, removing emotional decisions from trading. 3Commas connects to exchanges through API keys with trading permissions only—withdrawal rights are explicitly disabled, meaning your funds never leave the exchange. Your crypto stays secure in your exchange account.

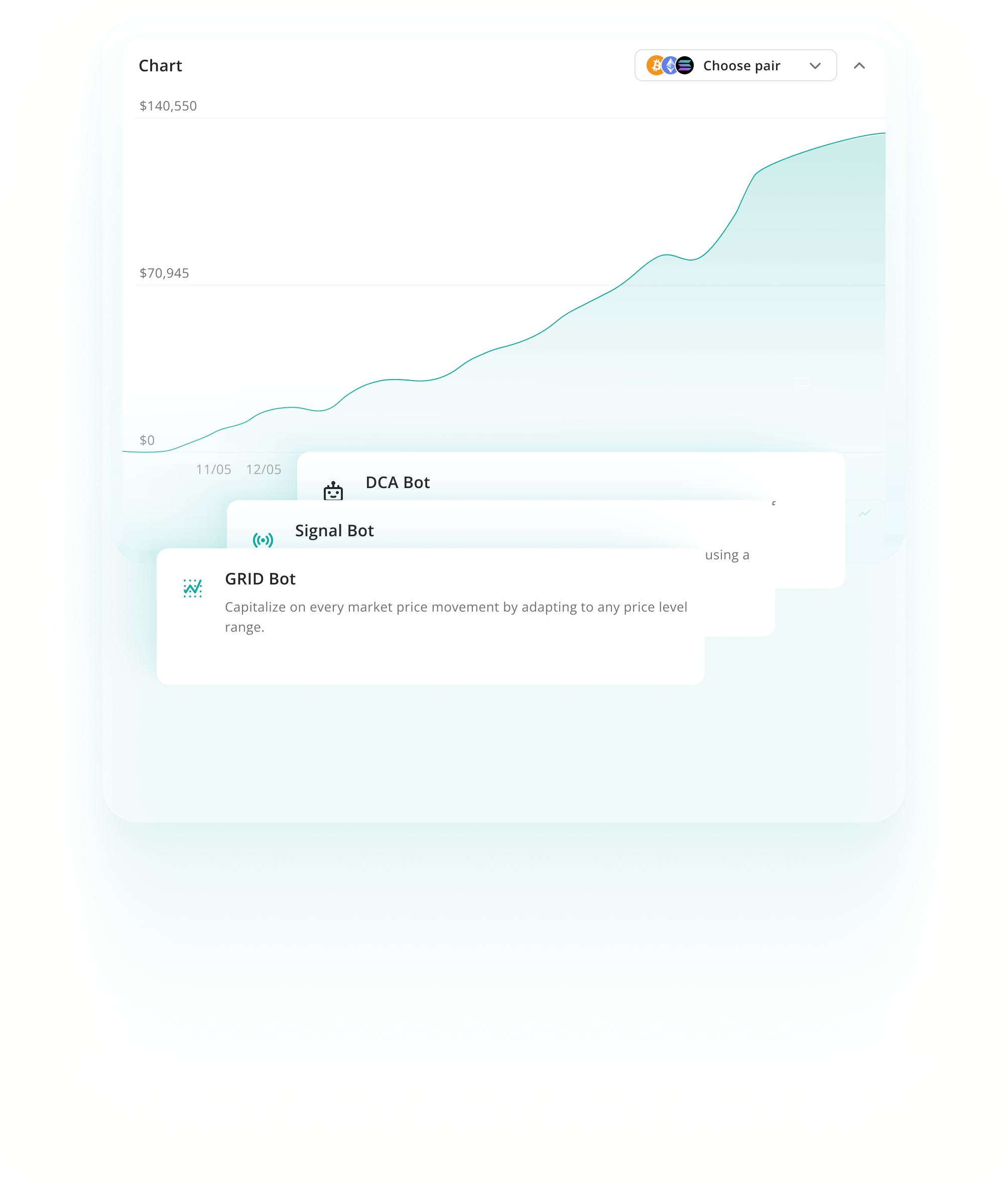

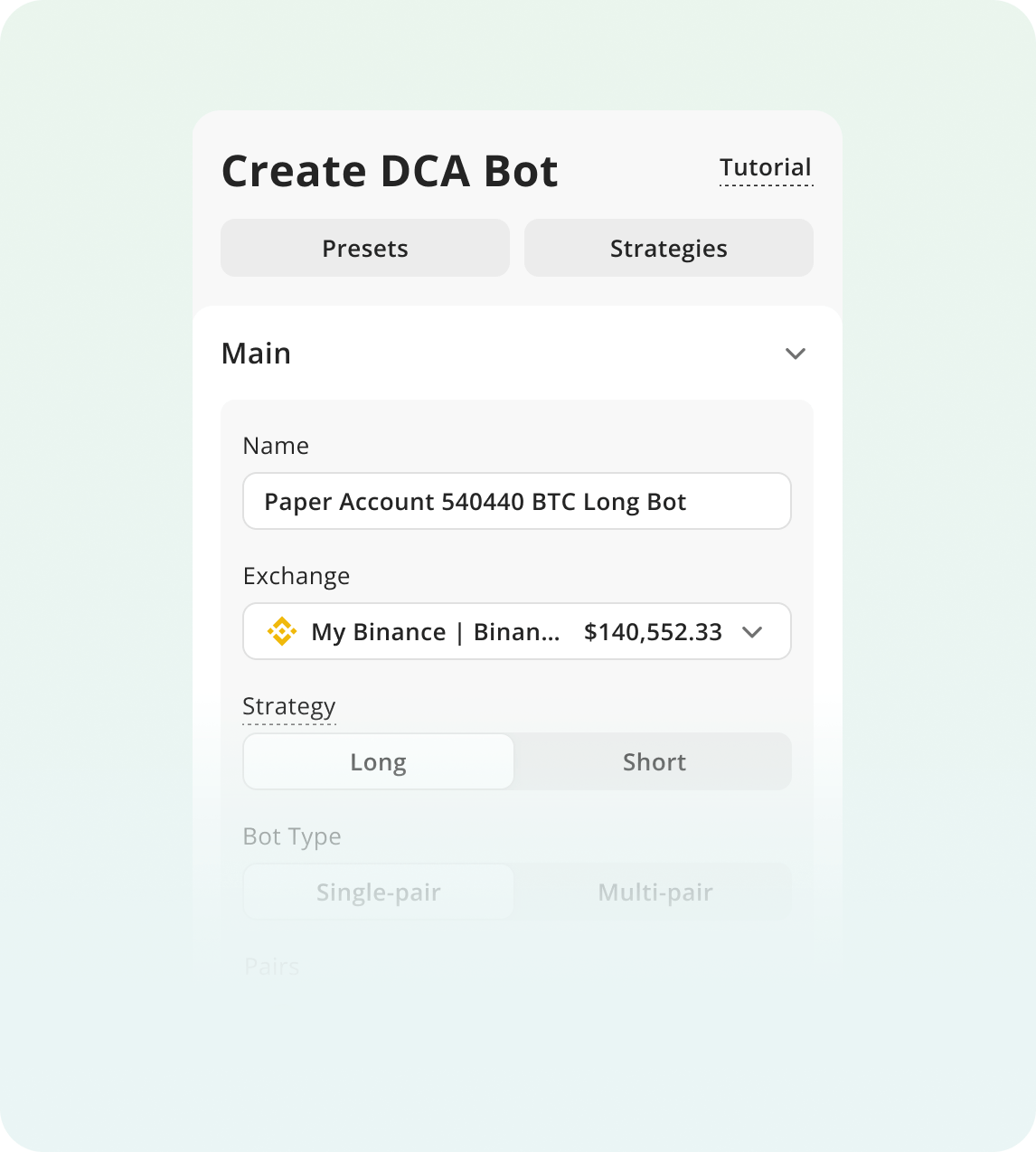

Dollar-cost averaging bots spread ETH purchases over time, reducing the impact of volatility on your entry price. This approach removes timing pressure during Ethereum's sharp sentiment-driven swings. It's particularly effective for long-term accumulation, smoothing out daily fluctuations while capitalizing on broader uptrends.

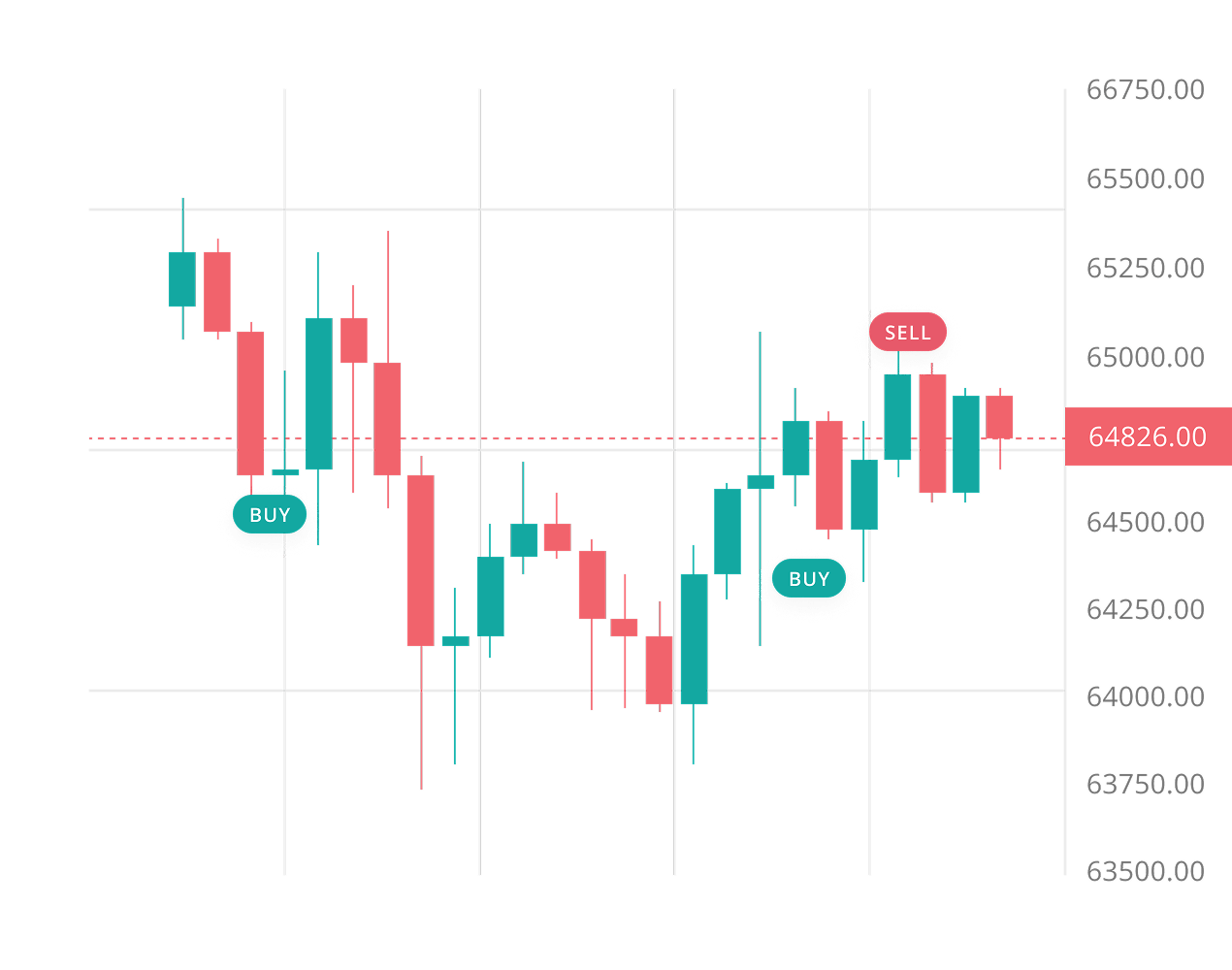

了解更多Grid bots place multiple buy and sell orders across ETH's price range, profiting from repetitive bounces. They excel in sideways markets like Ethereum's 2025 consolidation between $4,200-$5,500. The strategy systematically captures small gains from predictable price swings while managing downside through defined ranges.

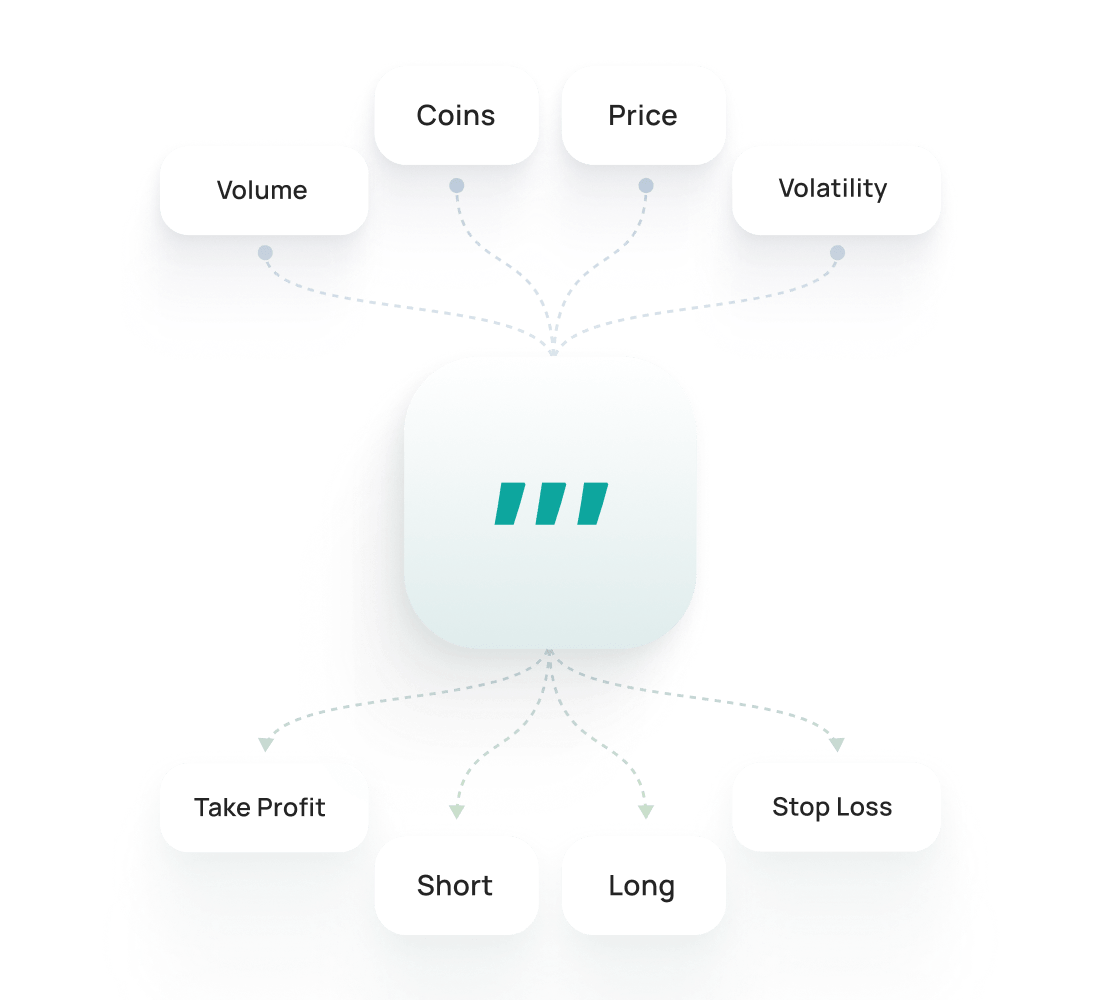

了解更多Signal bots execute trades automatically when technical indicators trigger. ETH responds well to momentum signals like RSI oversold conditions, EMA crossovers, and MACD divergences. This strategy capitalizes on Ethereum's technical responsiveness while maintaining disciplined entries and exits based on predefined conditions rather than emotions.

了解更多Ethereum 回测功能允许你在历史数据上测试策略,了解它们可能的表现。它能帮助优化参数,评估风险,并在实盘交易前建立信心。

了解更多Ethereum SmartTrade为你提供更高级的手动交易选项,例如止盈、stoploss、跟踪止损和多目标出场。Ethereum 公开预设为你带来来自交易员的现成策略,可以一键启动或根据自身需求自定义。

开始使用机器人交易:

注册 3Commas并选择你的套餐

连接交易所并选择你的机器人策略。

配置你的机器人参数并运行机器人!

Manual ETH trading exposes you to costly emotional decisions—buying peaks during FOMO or panic-selling dips. Ethereum moves 24/7, and you can't watch charts constantly. Flash crashes happen while you sleep. A 3Commas bot monitors markets around the clock, executing trades without emotion. Built-in Trailing Stop Loss and Take Profit features protect your capital automatically, locking in gains before reversals hit. You get consistent, disciplined trading—without the stress.

ETH's deep liquidity across exchanges lets you execute large trades with minimal slippage—often under 0.1% on million-dollar orders.

Post-Merge fee burning creates deflationary pressure during high network usage, reducing ETH supply while demand from DeFi and NFTs stays constant.

Native staking yields 3-5% APY, giving you baseline returns while holding and creating opportunity cost that supports price stability.

Set stop-losses wider than 6-8% to avoid being stopped out by ETH's normal volatility, and increase to 12-15% during network upgrades or major regulatory announcements.

Monitor Ethereum-specific catalysts like protocol upgrades, major DeFi exploits, ETF developments, and staking issues, as these events can trigger 10-15% price swings within hours.

Never risk more than 2-3% of your total portfolio on a single ETH trade, and diversify across multiple assets to protect against Ethereum-specific risks.

单一交易所的现货核心机器人

$20/ 月度

AI Assistant

仅限现货

1

活跃的 API 密钥

5

DCA 机器人运行中

2

信号机器人运行中

2

网格机器人运行中

20

活跃的 DCA 交易

10

Active Signal Trades

10

活跃的 SmartTrade

100

DCA 回测

1 年 周期

100

网格回测

4 个月 周期

开发者 API

只读

Pine Script® 执行

在线聊天支持

多账户现货与合约交易

$50/ 月度

AI Assistant

合约 合约

3

活跃的 API 密钥

20

DCA 机器人运行中

20

信号机器人运行中

10

网格机器人运行中

100

活跃的 DCA 交易

100

Active Signal Trades

50

活跃的 SmartTrade

500

DCA 回测

2 年 周期

500

网格回测

4 个月 周期

开发者 API

只读

Pine Script® 执行

在线聊天支持

卓越限制与 API 交易

$140/ 月度

AI Assistant

合约 合约

15

活跃的 API 密钥

1K

DCA 机器人运行中

1K

信号机器人运行中

1K

网格机器人运行中

5K

活跃的 DCA 交易

5K

Active Signal Trades

5K

活跃的 SmartTrade

5K

DCA 回测

完整历史记录

5K

网格回测

4 个月 周期

开发者 API

读写

Pine Script® 执行

优先实时聊天支持

通过 3Commas,把你的Ethereum策略运用于 Binance、Coinbase Advanced、Kraken 及其他 12 家以上支持的交易所。用安全的 API 连接,定义一次进出场和风险,剩下交给自动化全天候执行。多个交易市场统一工作台,意味着更清晰的日志、更快的迭代,以及更少错过你ETH对的交易机会。

3Commas 的回测功能让一切变得更简单。我可以尝试想法,验证有效性,避免愚蠢错误——而且不必冒任何资金风险。我购买了 Expert 套餐,能做更多回测。

很长一段时间我一直使用一套我认为盈利的策略,但长期下来却在慢慢亏损。借助 3Commas 回测功能,我意识到只需要对策略做小调整,就能成为赚钱的交易员。

我使用 3Commas 已有几年。只要掌握了这些强力机器人的运行机制,它们就能在风险极低(我知道我在做什么的情况下,年化收益在 15-30%,不用杠杆)的前提下带来不错的回报。你可以睡觉也赚钱,边用边学习不断成长。

团队一直在线,专注客户需求,持续改进应用和网站,并紧跟市场发展步伐。做得非常棒!

我用过其他的交易机器人,但这个真的更好,能让我有效控制亏损、最大化收益。我会一直用下去。

我刚接触加密货币交易,使用 3Commas 很轻松。通过模拟交易学到很多,对这个网站使用也很放心。

200 万

已注册交易员

被评为优秀于

1,479 条评价

Google 评价

4.0

No, Ethereum bots don't guarantee profit. They're automation tools, not money-printing machines. Bots execute strategies faster and more consistently than manual trading, which helps capitalize on ETH's 3-6% daily volatility and $15-30B trading volume. But success depends entirely on your strategy, current market conditions, and active monitoring. Even the best bot can lose money in unfavorable conditions. Think of bots as tools that remove emotion and execute your plan precisely, not as guaranteed winners.

Technical setup takes minutes—connect your exchange API, choose a bot type, and you're running. The real challenge is strategic setup. Many beginners fail because they don't understand parameters like take profit levels, safety orders, or grid ranges. Start small and treat your first bot as a learning experience. Most platforms offer template strategies you can copy and adjust. The technical part is easy. Learning what settings work for ETH's volatility patterns takes practice and patience.

3Commas is non-custodial, meaning they never hold your funds. Your ETH stays on your exchange account—Binance, Kraken, Coinbase, wherever you trade. 3Commas only uses API keys to execute trades on your behalf. For maximum security, always disable withdrawal permissions when creating your API key. This means even if your API was compromised, nobody could withdraw your funds. The bot can only trade. You maintain full custody at all times through your exchange account.

Yes, you can run multiple bots simultaneously with different strategies. ETH's characteristics make it ideal for various approaches: Grid bots profit from sideways consolidation, DCA bots accumulate during dips for long-term holding, and Signal bots react to technical indicators or ecosystem news. You might run a Grid bot during ranging markets while a DCA bot builds your position. Each bot operates independently, so you can diversify your approach based on market conditions and your goals.

体验试用,全面解锁所有ETH交易工具。