Meet the New 3Commas AI Assistant

24 nov 2025

Aprovecha la estabilidad de DAI alrededor de su paridad de $1 con bots de trading automatizados. Puedes capturar oscilaciones de precio consistentes y oportunidades de arbitraje en esta stablecoin descentralizada sin monitoreo constante. Tus claves API nunca otorgan derechos de retiro, por lo que mantienes control completo de tus fondos mientras los bots ejecutan operaciones basadas en tu estrategia.

Un bot de trading de Dai es un software que automáticamente compra y vende DAI, una stablecoin vinculada a $1 USD. Porque Dai se mantiene cerca de un dólar, el bot obtiene ganancias de fluctuaciones de precio diminutas por encima y por debajo de esta paridad. Funciona las 24 horas para capturar oportunidades que probablemente perderías. Con 3Commas, tus fondos permanecen seguros en tu exchange. Nos conectamos a través de claves API que no pueden retirar dinero, por lo que permaneces en control completo.

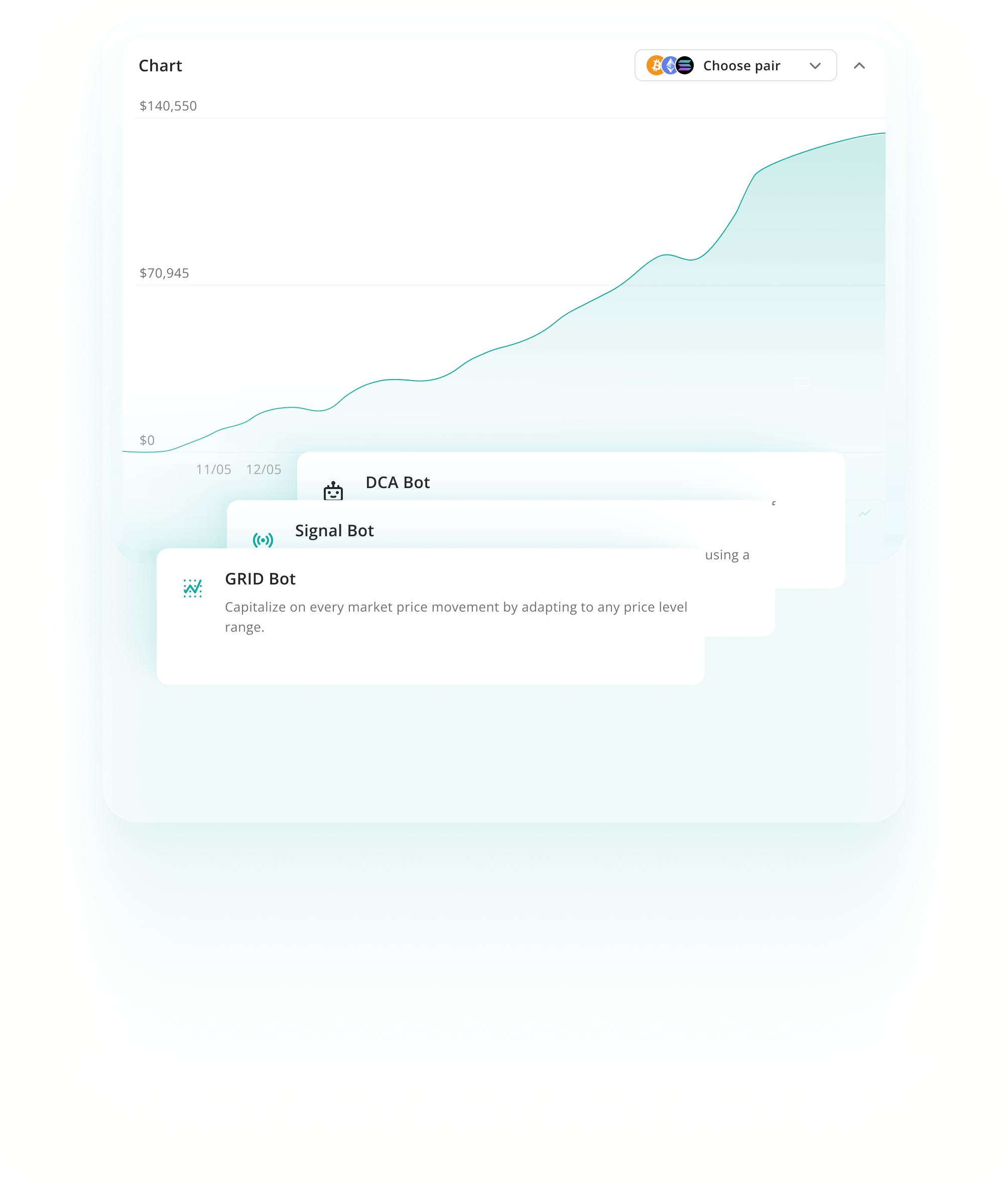

Los Bots DCA funcionan mejor al hacer transición desde activos volátiles hacia Dai, no para apreciación de DAI en sí. Esta estrategia promedia tus precios de salida durante turbulencia del mercado, reduciendo riesgo de timing al moverse a posiciones estables. Es particularmente útil para acumulación sistemática de Dai como moneda base antes de desplegar en oportunidades de rendimiento DeFi.

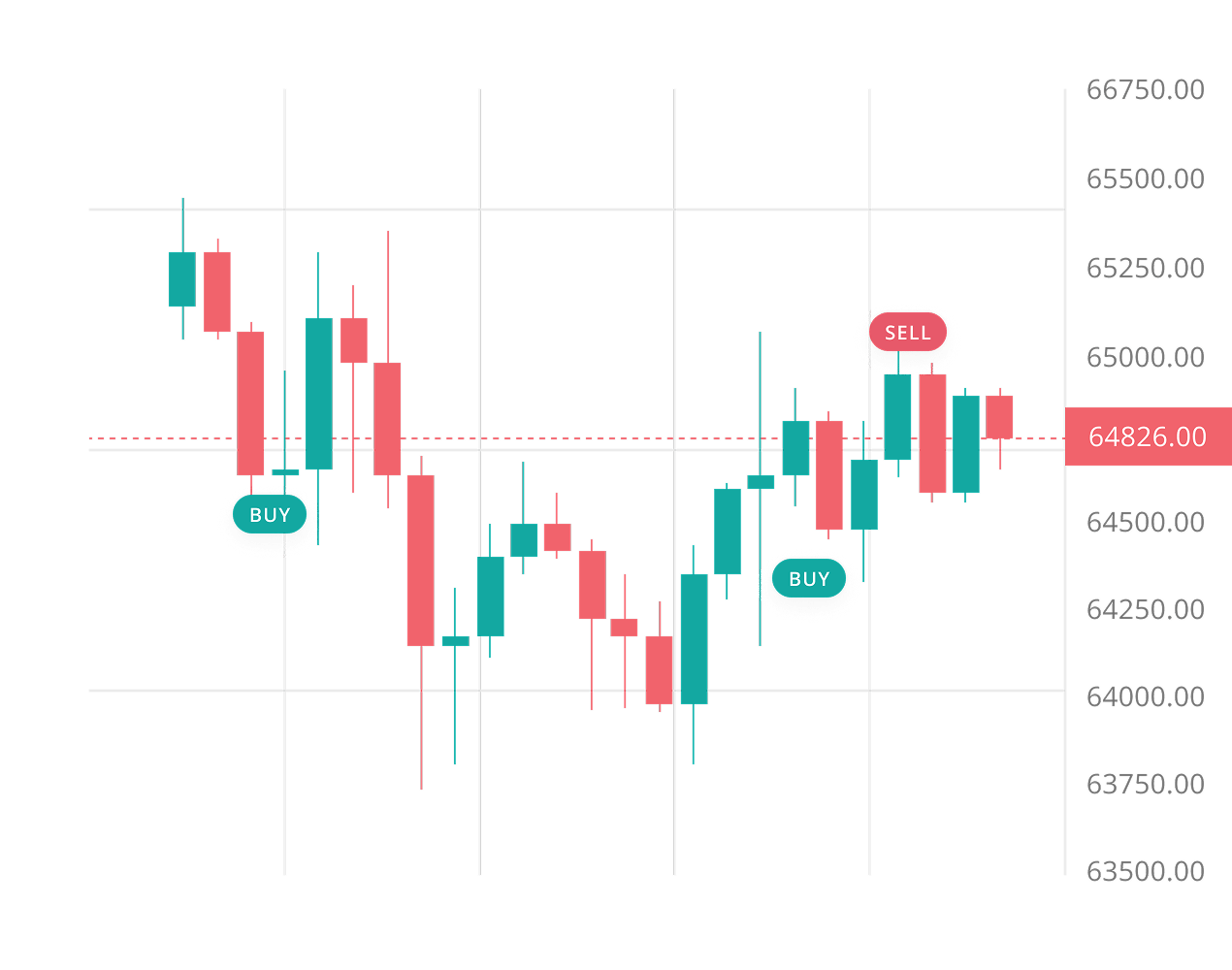

Ver másLos Bots Grid sobresalen con el rango de precio predecible de DAI alrededor de $1. El bot coloca órdenes de compra por debajo de la paridad y órdenes de venta por encima de ella, capturando ganancias de oscilaciones pequeñas constantes. Esta estrategia coincide perfectamente con el comportamiento de canal ajustado de Dai, generando retornos de micro-movimientos repetitivos mientras la stablecoin naturalmente regresa a su paridad del dólar.

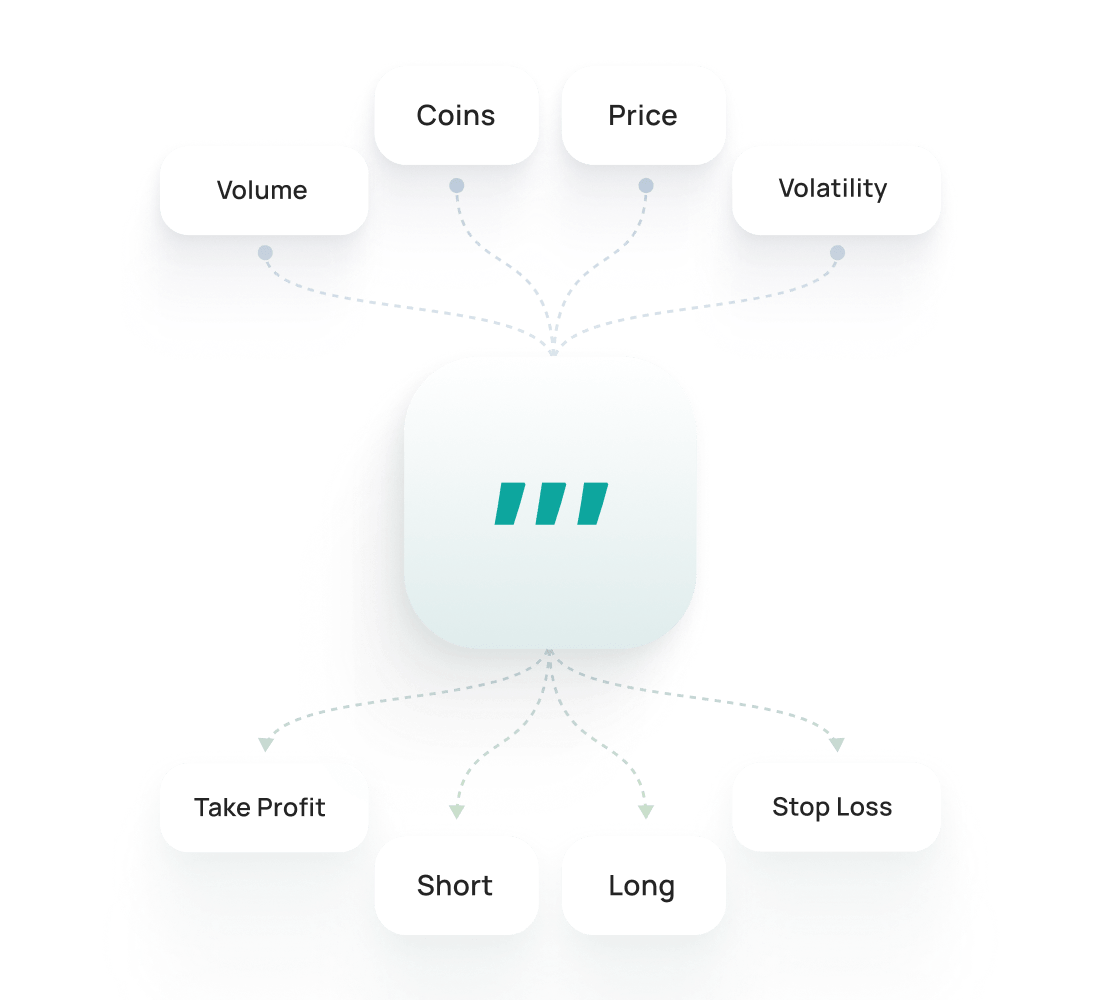

Ver másLos Bots Signal automatizan operaciones de DAI basadas en señales de mercado más amplias en lugar de acción de precio estable de Dai. Los indicadores técnicos tradicionales no aplican aquí. En su lugar, estos bots responden al sentimiento macro del mercado, ejecutando transiciones entre activos volátiles y DAI. También son efectivos para capturar oportunidades de arbitraje durante eventos raros de des-vinculación temporal.

Ver másEl backtesting de Dai te permite probar estrategias con datos históricos para ver cómo podrían haber funcionado. Te ayuda a ajustar configuraciones, evaluar riesgos y ganar confianza antes de operar en vivo.

Ver másEl SmartTrade de Dai te ofrece opciones avanzadas de trading manual, como take-profit, stoploss, trailing y salidas con múltiples objetivos. Los Presets Públicos de Dai son estrategias listas de otros traders que puedes lanzar al instante o personalizar según tus necesidades.

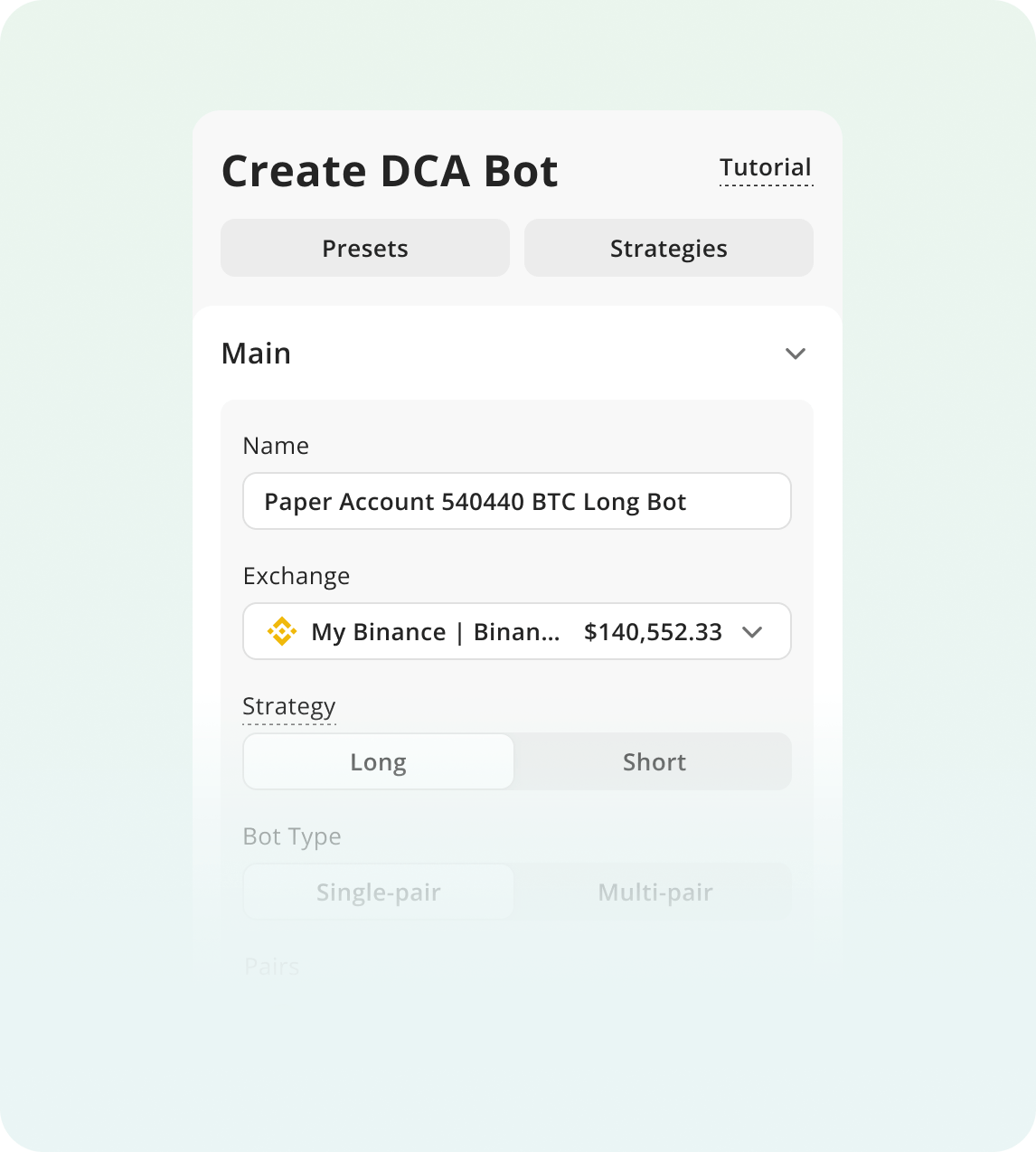

Para empezar a operar con bots:

Regístrate en 3Commas y elige tu plan

Conecta un Exchange y elige la estrategia de tu bot.

Configura los parámetros de tu bot y ¡ponlo a funcionar!

El trading manual de DAI se desmorona durante eventos de des-vinculación. Cuando Dai cae a $0.985, la mayoría de los traders entran en pánico y venden con pérdida antes de que la paridad naturalmente se restaure a $1.00. Un bot elimina esta respuesta emocional. Monitorea DAI las 24 horas, capturando oscilaciones de precio nocturnas del 3-5% durante estrés del mercado que de otra forma perderías. Órdenes automáticas de trailing stop loss y toma de ganancias gestionan reversiones bruscas durante ciclos de des-vinculación más rápido de lo que cualquier trader manual puede reaccionar.

Dai mantiene estabilidad a través de colateral descentralizado, ofreciendo resistencia a censura que las stablecoins centralizadas no pueden igualar.

Fluctuaciones de precio menores alrededor de la paridad de $1 crean oportunidades de arbitraje consistentes y de bajo riesgo para traders atentos.

Integración profunda a través de protocolos DeFi habilita generación de rendimiento automatizada mientras se mantiene la estabilidad de una paridad del dólar.

Establece stop losses 0.3% a 0.5% por debajo de tu punto de entrada para proteger contra eventos de des-vinculación sin ser detenido por ruido de precio normal alrededor de la paridad de $1.

Monitorea votos de gobernanza de MakerDAO y cambios de ratio de colateral semanalmente, ya que decisiones importantes de protocolo pueden desencadenar volatilidad a corto plazo o afectar los mecanismos de estabilidad de DAI.

Nunca asignes más del 5% al 10% de tu capital de trading a cualquier stablecoin única, incluyendo Dai, para reducir exposición a fallas de contratos inteligentes o riesgos de concentración de colateral.

Bots principales para trading spot en 1 exchange

$20/ mes

AI Assistant

Solo Spot

1

Claves API Activas

5

Bots DCA activos

2

Signal Bots activos

2

Grid Bots activos

20

Operaciones DCA activas

10

Active Signal Trades

10

SmartTrades activos

100

DCA Backtests

Período de 1 año

100

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Trading de spot y futures con múltiples cuentas

$50/ mes

AI Assistant

Spot y Futuros

3

Claves API Activas

20

Bots DCA activos

20

Signal Bots activos

10

Grid Bots activos

100

Operaciones DCA activas

100

Active Signal Trades

50

SmartTrades activos

500

DCA Backtests

Período de 2 años

500

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Límites excepcionales y trading mediante API

$140/ mes

AI Assistant

Spot y Futuros

15

Claves API Activas

1K

Bots DCA activos

1K

Signal Bots activos

1K

Grid Bots activos

5K

Operaciones DCA activas

5K

Active Signal Trades

5K

SmartTrades activos

5K

DCA Backtests

historial complet

5K

GRID Backtests

Período de 4 meses

API para desarrolladores

Lectura y escritura

Ejecución de Pine Script®

Soporte prioritario por chat en vivo

Ejecuta tu estrategia Dai en Binance, Coinbase Advanced, Kraken y más de 12 exchanges compatibles a través de 3Commas. Conecta mediante una API segura, define entradas, salidas y el riesgo una sola vez, y deja que la automatización opere 24/7. Un solo espacio de trabajo para todas las plataformas significa registros más claros, iteraciones más rápidas y menos movimientos perdidos en tus pares de DAI.

El backtesting en 3Commas hace la vida mucho más fácil. Puedo probar ideas, ver qué funciona y evitar errores tontos, todo sin perder dinero. Compré el plan Expert para hacer más backtests.

Durante mucho tiempo utilicé una estrategia que consideraba rentable, pero a largo plazo iba perdiendo poco a poco. Con la ayuda de la función de backtesting de 3Commas, me di cuenta de que solo necesitaba hacer pequeños cambios en la estrategia para volverme un trader rentable.

He estado con 3Commas durante un par de años y sus bots potentes, una vez que entiendes su mecánica, pueden generar buenos rendimientos con mínimo riesgo (si sabes lo que haces, puedes sacar un 15–30% anual con poco riesgo y sin apalancamiento). Puedes ganar dinero mientras duermes y seguir aprendiendo mientras avanzas.

El equipo siempre está disponible, centrado en las necesidades del cliente, mejorando la app y el sitio web, y adaptándose a todos los cambios. ¡Un trabajo realmente excelente!

He usado otros bots de trading, pero este es mucho mejor, y puedo controlar mis pérdidas y maximizar las ganancias mucho mejor. Seguiré utilizándolo cada vez más.

Soy nuevo en el trading de criptomonedas y he podido usar 3Commas fácilmente. Aprendí mucho con paper trading y me siento seguro usando el sitio.

2,0 M

Traders registrados

Valorado como Excelente en

1,479 reseñas

Reseñas de Google

4.0

Ningún bot garantiza ganancias, pero la estabilidad de DAI alrededor de $1 lo hace menos riesgoso que criptomonedas volátiles. Los bots Grid funcionan bien con Dai porque obtienen ganancias de movimientos de precio pequeños y predecibles dentro del rango de paridad. Tus retornos dependen de condiciones del mercado, configuraciones de estrategia y tarifas de trading. Los bots automatizan la ejecución y eliminan emoción, pero no pueden eliminar riesgo completamente. Siempre comienza pequeño y entiende tu estrategia.

Configurar un bot de DAI en 3Commas toma minutos y requiere cero habilidades de codificación. Conectas tu exchange vía claves API, seleccionas una estrategia pre-construida como bot Grid, y configuras parámetros básicos. La plataforma te guía a través de cada paso con instrucciones claras. La mayoría de los usuarios comienzan con estrategias Grid simples para Dai ya que su comportamiento de precio estable hace la configuración directa. Puedes lanzar tu primer bot en menos de 10 minutos.

Sí. 3Commas es no custodial, lo que significa que tus fondos nunca salen de tu cuenta del exchange. Nos conectamos vía claves API que solo permiten trading—no retiros. Mantienes control completo de tu DAI y otros activos en todo momento. El bot ejecuta operaciones en tu nombre, pero no puede transferir fondos fuera. Incluso si alguien accediera a tu cuenta de 3Commas, no podrían robar tu cripto. Tu exchange mantiene tus fondos seguramente.

Sí. Puedes ejecutar múltiples bots simultáneamente con diferentes estrategias y pares de trading. Por ejemplo, un bot podría ejecutar una estrategia Grid en el par DAI/USDT mientras otro ejecuta DCA en un par diferente. Cada bot opera independientemente con sus propios fondos asignados y parámetros. Esto te permite diversificar enfoques, probar estrategias y maximizar oportunidades a través de tu portafolio sin intervención manual.

Obtén una prueba con acceso completo a todas las herramientas para operar DAI.