Meet the New 3Commas AI Assistant

24 nov 2025

Automatiza tus estrategias de trading de MANA para capturar oscilaciones intradiarias frecuentes del 3-6% y volatilidad impulsada por metaverso sin monitoreo constante. Nuestro bot ejecuta tus reglas predefinidas 24/7, especialmente durante horas fuera de horario cuando ocurre el 67% de movimientos de precio importantes. Conéctate solo vía API, no se requiere transferencia de fondos.

Un bot de trading de Decentraland es un software que automáticamente compra y vende MANA basándose en reglas que estableces. Funciona 24/7, capturando oscilaciones de precio durante ciclos de hype de metaverso o volatilidad de madrugada cuando estás desconectado. 3Commas se conecta vía claves API sin derechos de retiro, por lo que tus fondos permanecen en tu exchange. El bot puede operar por ti, pero nunca puede mover dinero fuera. Mantienes control completo.

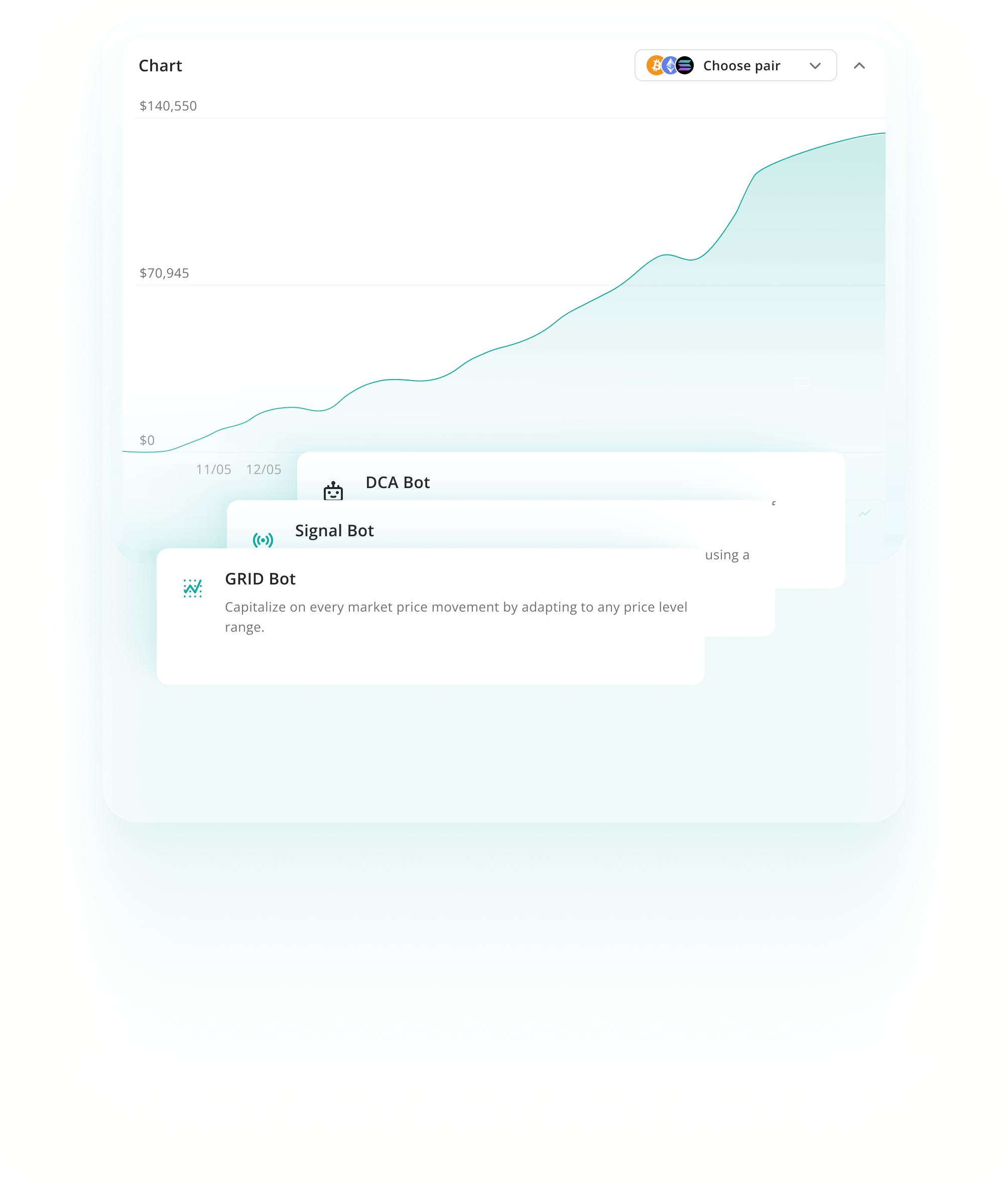

Los Bots DCA distribuyen tus compras de MANA a lo largo del tiempo en lugar de comprar todo de una vez. Este enfoque reduce riesgo de timing durante las oscilaciones diarias frecuentes del 8 al 15% de Decentraland y correcciones mensuales del 20 al 30%. Ideal cuando quieres exposición pero esperas volatilidad continua.

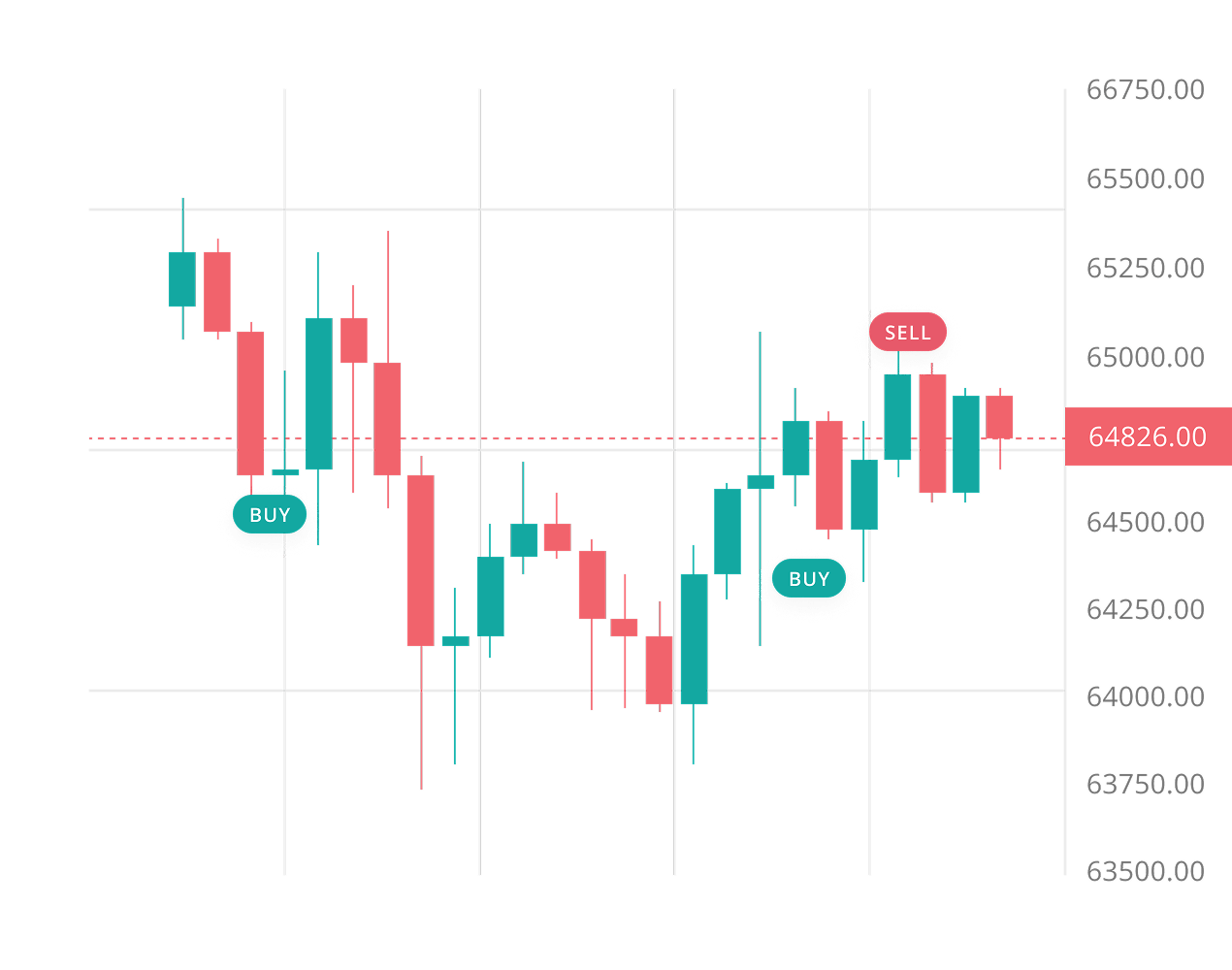

Ver másLos Bots Grid colocan órdenes de compra y venta a través de un rango de precio, capturando ganancias mientras MANA rebota entre niveles. Esto funciona bien porque Decentraland opera lateralmente alrededor del 60% del tiempo, con oscilaciones intradiarias frecuentes del 3 al 6%. Mejor para mercados en rango con zonas de soporte y resistencia predecibles.

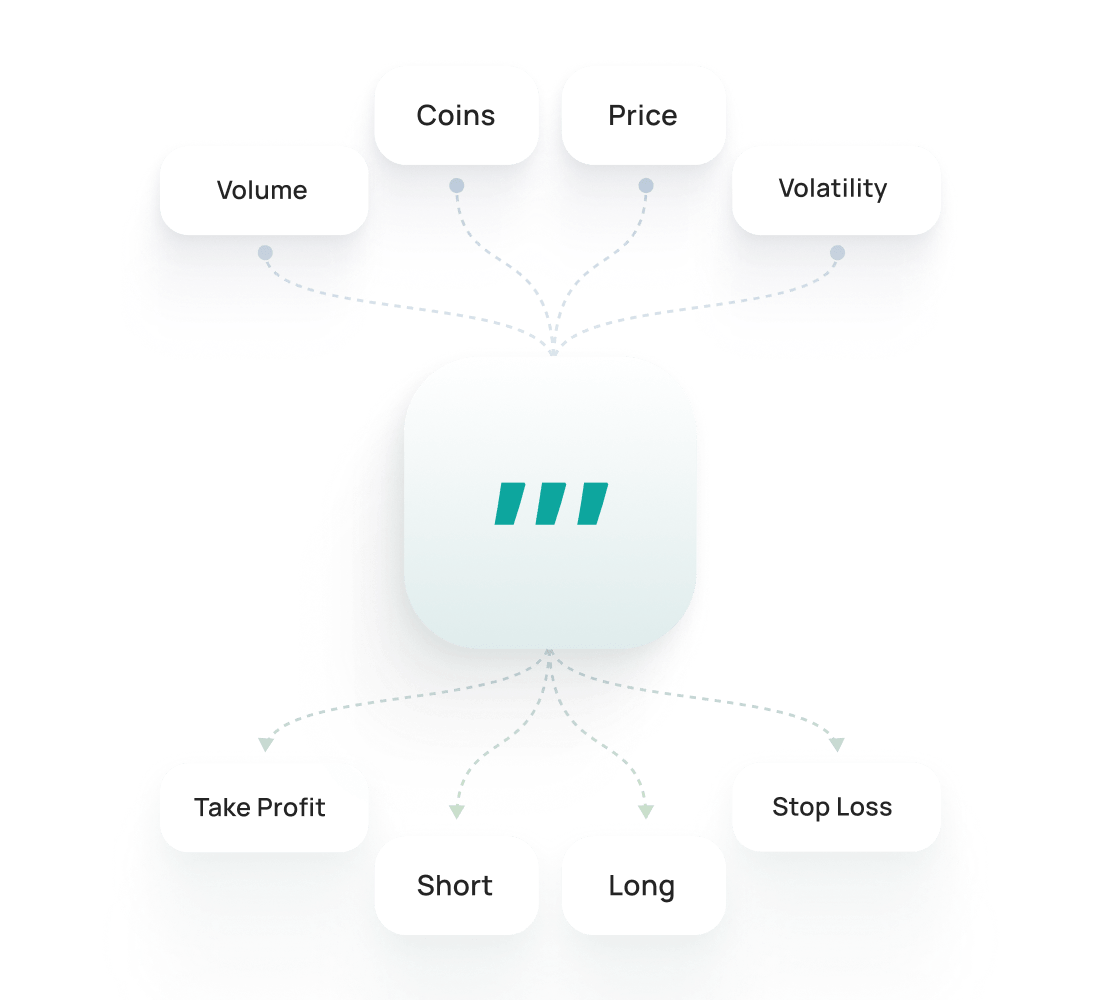

Ver másLos Bots Signal ejecutan operaciones automáticamente cuando indicadores técnicos como RSI o MACD activan señales de entrada. Esto elimina emoción del trading de la acción de precio volátil de MANA. Funciona bien si confías en indicadores pero luchas por actuar sobre señales consistentemente o pierdes configuraciones mientras estás ausente.

Ver másEl backtesting de Decentraland te permite probar estrategias con datos históricos para ver cómo podrían haber funcionado. Te ayuda a ajustar configuraciones, evaluar riesgos y ganar confianza antes de operar en vivo.

Ver másEl SmartTrade de Decentraland te ofrece opciones avanzadas de trading manual, como take-profit, stoploss, trailing y salidas con múltiples objetivos. Los Presets Públicos de Decentraland son estrategias listas de otros traders que puedes lanzar al instante o personalizar según tus necesidades.

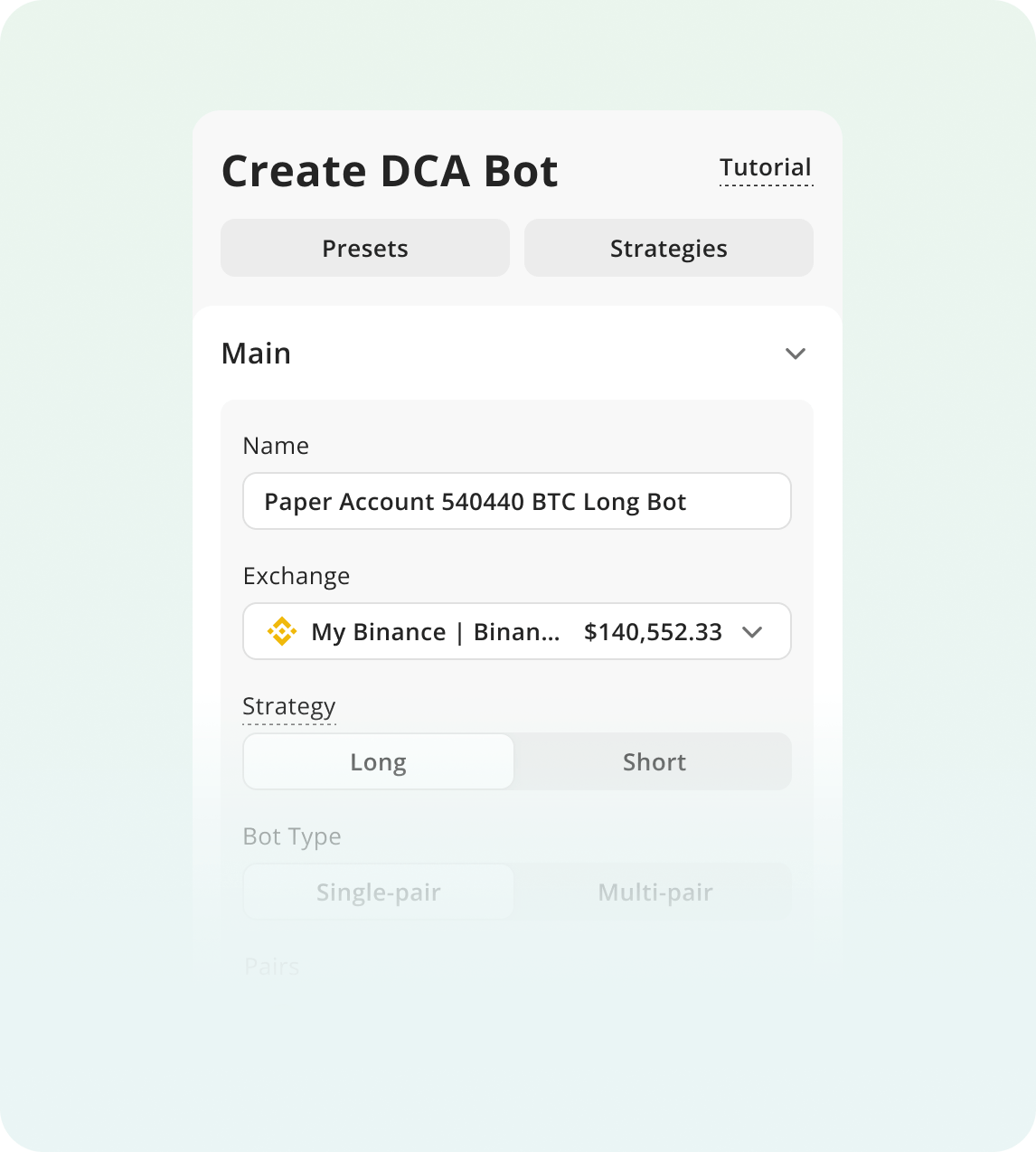

Para empezar a operar con bots:

Regístrate en 3Commas y elige tu plan

Conecta un Exchange y elige la estrategia de tu bot.

Configura los parámetros de tu bot y ¡ponlo a funcionar!

MANA se mueve más fuerte cuando no estás observando. El 67% de oscilaciones de precio importantes ocurren entre 10 PM y 8 AM EST, y los fines de semana ven volatilidad 2.3x más alta que días de semana. Los traders manuales pierden estas ventanas o toman decisiones emocionales durante rallies repentinos. En febrero de 2024, MANA subió 34% en 48 horas, luego cayó 28% en tres días mientras compradores FOMO vendieron en pánico con pérdida. Un bot monitorea 24/7 sin emoción, ejecutando tu estrategia mientras duermes. Los stops de seguimiento aseguran ganancias durante reversiones bruscas, protegiendo beneficios cuando cambia el momentum.

Marcas importantes como Samsung y JP Morgan mantienen espacios virtuales activos, creando demanda institucional continua por tokens MANA.

La integración de Polygon habilita miles de transacciones diarias a menos de $0.01 cada una, soportando actividad on-chain y liquidez consistentes.

Listado en más de 100 exchanges con más de $100M de volumen diario, MANA ofrece spreads ajustados y liquidez profunda para ejecución confiable de operaciones.

Establece stop losses a 8-12% para tener en cuenta la volatilidad típica de MANA sin ser detenido por oscilaciones de precio diarias normales.

Rastrea anuncios de asociaciones de Decentraland, eventos de metaverso y condiciones de red Ethereum ya que estos impactan directamente movimientos de precio de MANA y pueden desencadenar picos de volatilidad repentinos.

Limita tu posición de Decentraland a no más del 5-10% de tu portafolio cripto total para evitar sobreexposición a riesgos de tokens de metaverso.

Bots principales para trading spot en 1 exchange

$20/ mes

AI Assistant

Solo Spot

1

Claves API Activas

5

Bots DCA activos

2

Signal Bots activos

2

Grid Bots activos

20

Operaciones DCA activas

10

Active Signal Trades

10

SmartTrades activos

100

DCA Backtests

Período de 1 año

100

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Trading de spot y futures con múltiples cuentas

$50/ mes

AI Assistant

Spot y Futuros

3

Claves API Activas

20

Bots DCA activos

20

Signal Bots activos

10

Grid Bots activos

100

Operaciones DCA activas

100

Active Signal Trades

50

SmartTrades activos

500

DCA Backtests

Período de 2 años

500

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Límites excepcionales y trading mediante API

$140/ mes

AI Assistant

Spot y Futuros

15

Claves API Activas

1K

Bots DCA activos

1K

Signal Bots activos

1K

Grid Bots activos

5K

Operaciones DCA activas

5K

Active Signal Trades

5K

SmartTrades activos

5K

DCA Backtests

historial complet

5K

GRID Backtests

Período de 4 meses

API para desarrolladores

Lectura y escritura

Ejecución de Pine Script®

Soporte prioritario por chat en vivo

Ejecuta tu estrategia Decentraland en Binance, Coinbase Advanced, Kraken y más de 12 exchanges compatibles a través de 3Commas. Conecta mediante una API segura, define entradas, salidas y el riesgo una sola vez, y deja que la automatización opere 24/7. Un solo espacio de trabajo para todas las plataformas significa registros más claros, iteraciones más rápidas y menos movimientos perdidos en tus pares de MANA.

El backtesting en 3Commas hace la vida mucho más fácil. Puedo probar ideas, ver qué funciona y evitar errores tontos, todo sin perder dinero. Compré el plan Expert para hacer más backtests.

Durante mucho tiempo utilicé una estrategia que consideraba rentable, pero a largo plazo iba perdiendo poco a poco. Con la ayuda de la función de backtesting de 3Commas, me di cuenta de que solo necesitaba hacer pequeños cambios en la estrategia para volverme un trader rentable.

He estado con 3Commas durante un par de años y sus bots potentes, una vez que entiendes su mecánica, pueden generar buenos rendimientos con mínimo riesgo (si sabes lo que haces, puedes sacar un 15–30% anual con poco riesgo y sin apalancamiento). Puedes ganar dinero mientras duermes y seguir aprendiendo mientras avanzas.

El equipo siempre está disponible, centrado en las necesidades del cliente, mejorando la app y el sitio web, y adaptándose a todos los cambios. ¡Un trabajo realmente excelente!

He usado otros bots de trading, pero este es mucho mejor, y puedo controlar mis pérdidas y maximizar las ganancias mucho mejor. Seguiré utilizándolo cada vez más.

Soy nuevo en el trading de criptomonedas y he podido usar 3Commas fácilmente. Aprendí mucho con paper trading y me siento seguro usando el sitio.

2,0 M

Traders registrados

Valorado como Excelente en

1,479 reseñas

Reseñas de Google

4.0

No, los bots de trading no garantizan ganancias. El precio de MANA está influenciado por tendencias de adopción de metaverso, ventas de tierra virtual y condiciones más amplias del mercado cripto que ningún bot puede predecir con certeza. Los bots automatizan la ejecución y ayudan a gestionar riesgo a través de funciones como stop-losses y objetivos de toma de ganancias, pero requieren configuración sensata de estrategia y monitoreo periódico. La volatilidad del mercado afecta todos los resultados. Piensa en los bots como herramientas de eficiencia que ejecutan tu plan de trading 24/7, no como hacedores automáticos de dinero.

No se requiere conocimiento de codificación. 3Commas proporciona estrategias preestablecidas diseñadas para tokens como Decentraland que puedes activar con pocos clics. Conectarás tu exchange vía API, seleccionarás una estrategia y configurarás parámetros básicos como monto de inversión y configuraciones de riesgo. Hay una curva de aprendizaje para entender cómo funcionan diferentes estrategias, pero la plataforma te guía a través de la configuración. También puedes probar configuraciones con paper trading antes de arriesgar fondos reales.

Sí, cuando está configurado correctamente. 3Commas es no custodial, lo que significa que tus fondos siempre permanecen en tu exchange conectado—nunca con 3Commas. Las claves API que creas otorgan solo permisos de trading, no derechos de retiro. Configura tu API del exchange para deshabilitar explícitamente retiros. El bot solo puede ejecutar órdenes de compra y venta en tu nombre. Incluso si 3Commas experimentara un problema de seguridad, tus fondos no podrían ser retirados porque la plataforma nunca los mantiene ni controla.

Los bots automatizan la ejecución de operaciones 24/7 basada en tu estrategia elegida. Pueden ejecutar múltiples enfoques simultáneamente—como DCA para acumulación durante caídas y trading GRID para mercados en rango cuando MANA se consolida. Los bots automáticamente colocan órdenes, toman ganancias en niveles objetivo, cortan pérdidas con stop-losses, y responden a movimientos de precio sin requerir que observes gráficos constantemente. Tú defines las reglas y parámetros de riesgo; el bot maneja ejecución consistente a través de todas las horas del mercado.

Obtén una prueba con acceso completo a todas las herramientas para operar MANA.