Meet the New 3Commas AI Assistant

24 nov 2025

Automatiza tu trading de UNUS SED LEO con los bots de 3Commas. LEO es el token de utilidad del ecosistema iFinex, ofreciendo descuentos reales en tarifas en Bitfinex. Su comportamiento de precio acotado en rango se adapta a estrategias de cuadrícula durante consolidación. Elimina decisiones emocionales y opera LEO sistemáticamente a través de automatización conectada por API mientras gestionas riesgos específicos de plataforma.

Un bot de trading de UNUS SED LEO es un software automatizado que compra y vende tokens LEO basándose en reglas que defines. Funciona como control de crucero para trading: estableces tu estrategia, y ejecuta operaciones 24/7 sin que las emociones se interpongan. Los patrones de precio de LEO lo hacen especialmente adecuado para estrategias de cuadrícula automatizadas. 3Commas se conecta a tu exchange a través de claves API solo con permisos de trading, nunca acceso de retiro. Tus fondos siempre permanecen en tu exchange, dándote control completo y seguridad.

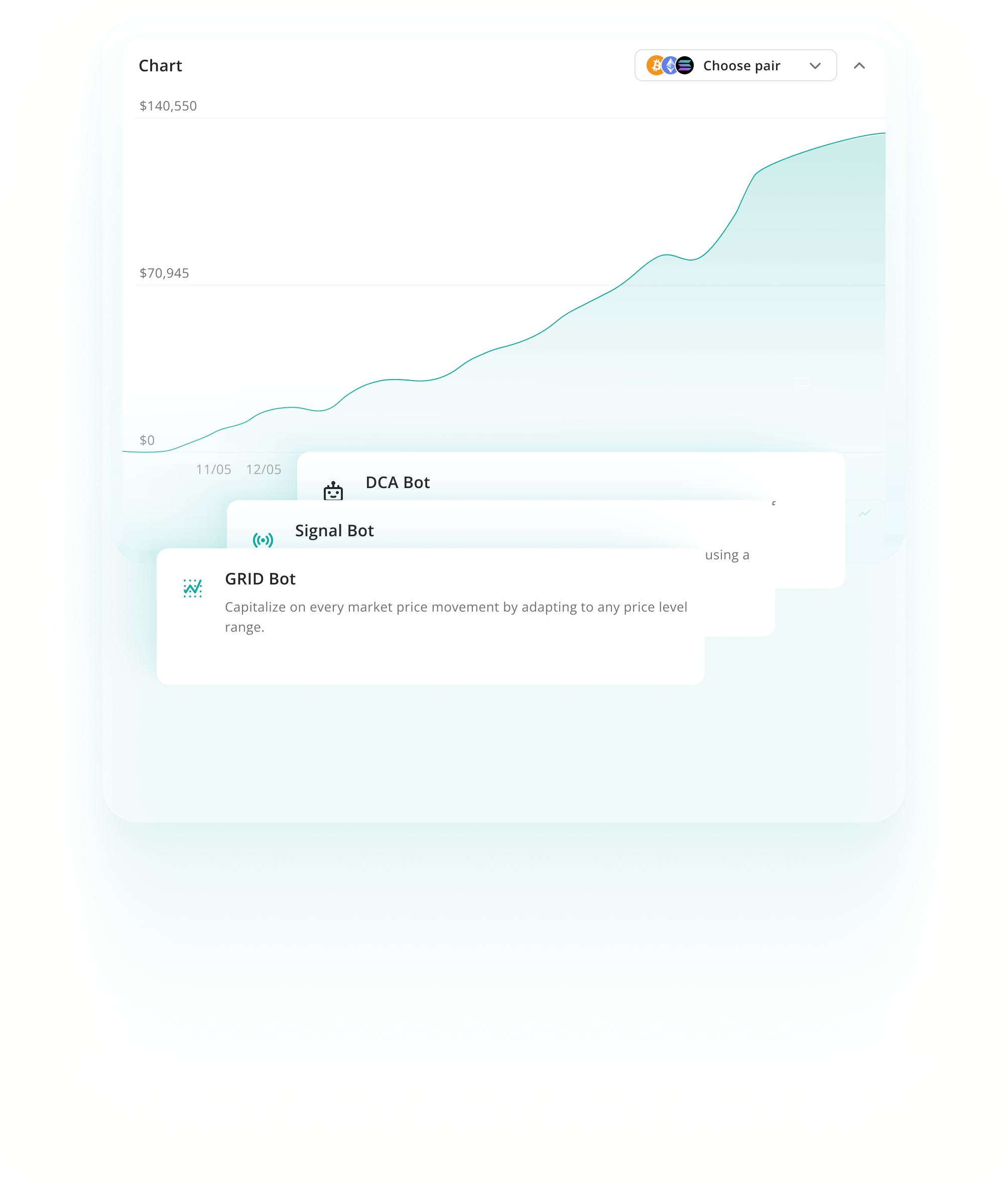

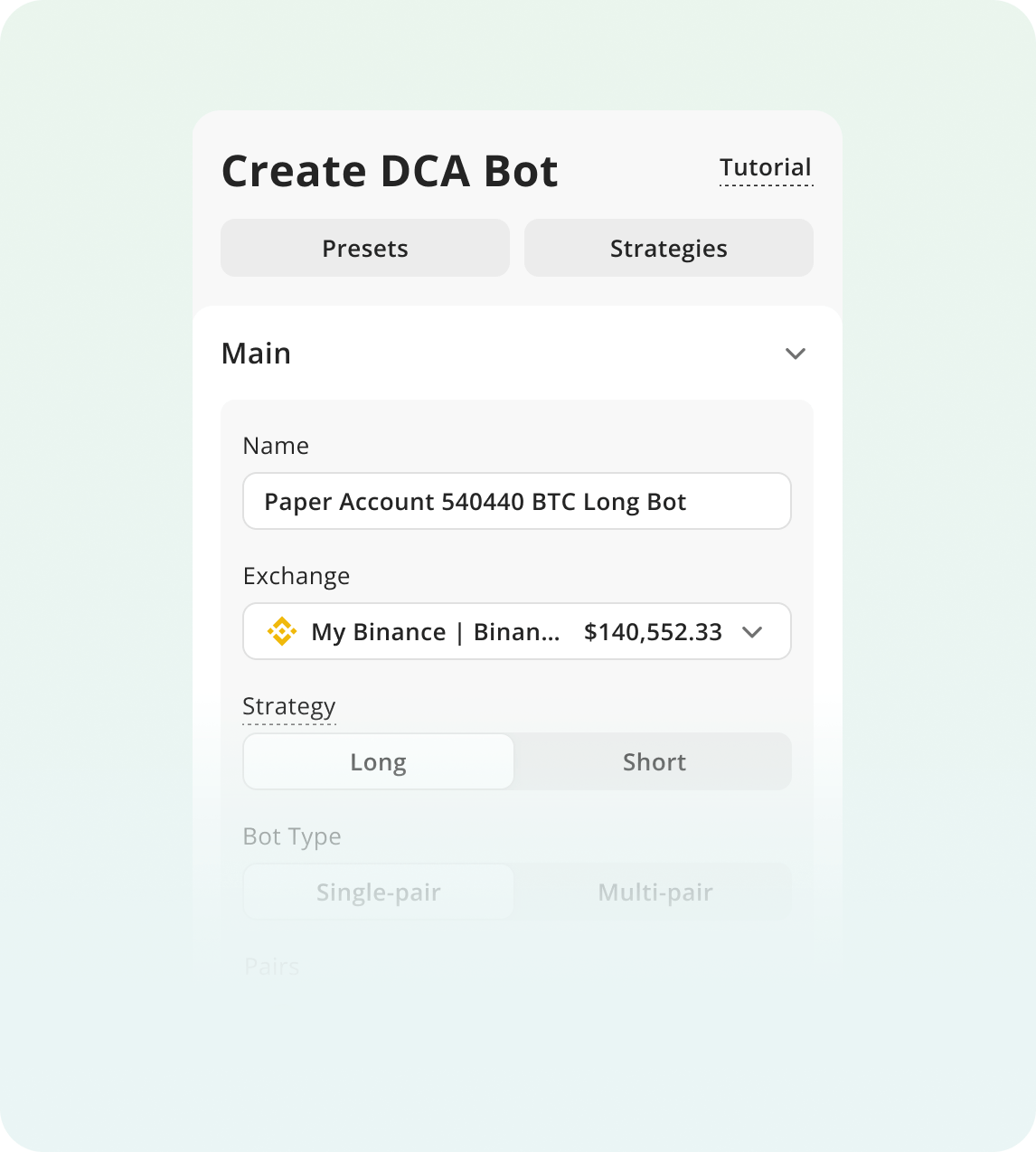

Los Bots DCA distribuyen compras de UNUS SED LEO a través de múltiples intervalos, reduciendo el impacto de picos de volatilidad impulsados por catalizadores. Este enfoque ayuda a gestionar riesgo de timing durante eventos de noticias impredecibles mientras permite a traders construir posiciones gradualmente. La estrategia se alinea bien con la tokenomics deflacionaria de LEO y respaldo de utilidad fundamental, suavizando precios de entrada durante períodos de acumulación extendidos.

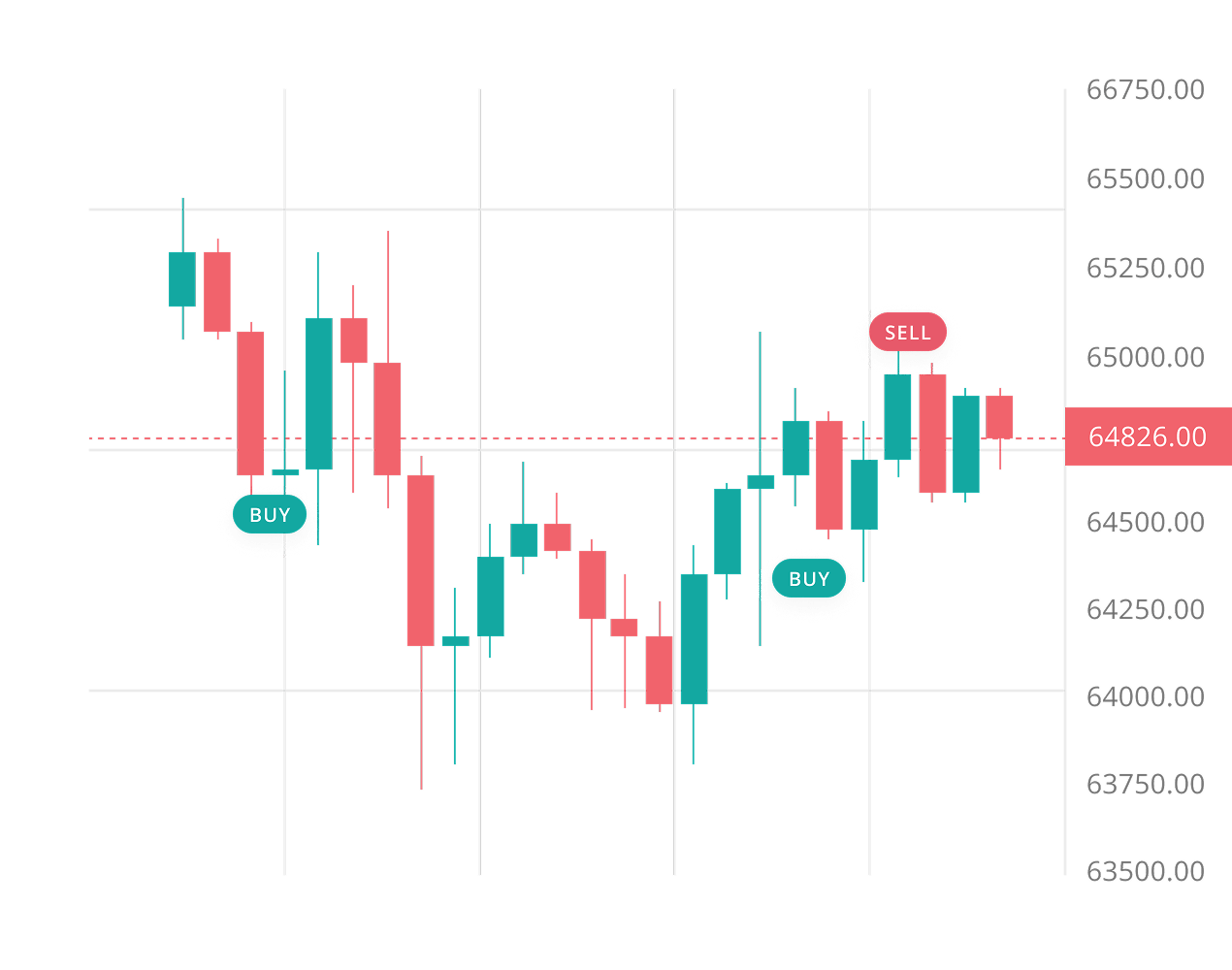

Ver másLos Bots Grid capitalizan la tendencia de LEO a establecer niveles claros de soporte y resistencia durante períodos acotados en rango. El bot coloca múltiples órdenes de compra y venta dentro de canales de precio definidos, obteniendo ganancias de fluctuaciones de precio sistemáticas. Esta estrategia funciona particularmente bien durante las fases de consolidación de semanas de LEO, donde la demanda de utilidad crea niveles de soporte predecibles y rangos de trading naturales.

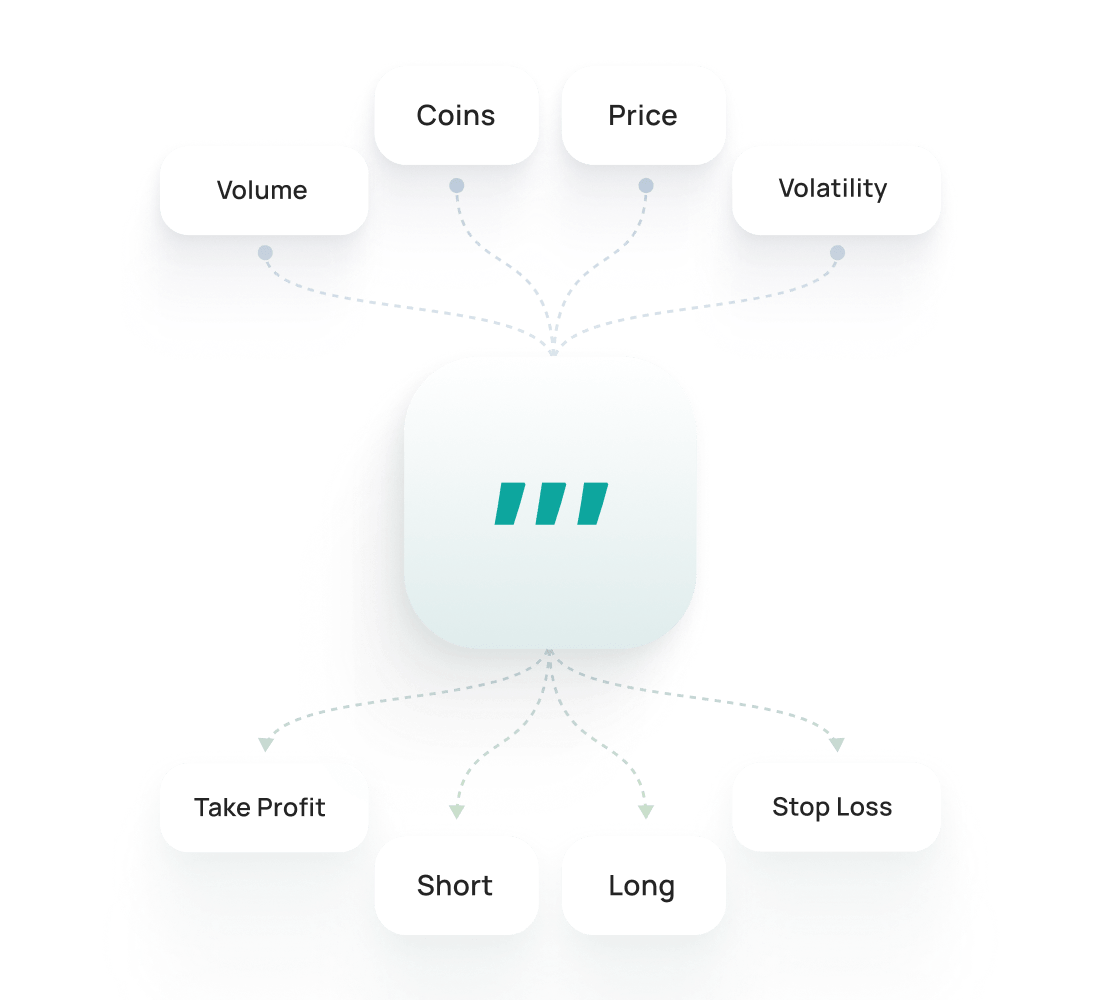

Ver másLos Bots Signal automatizan operaciones de LEO respondiendo a indicadores técnicos como RSI, Bandas de Bollinger y señales de confirmación de MACD. Estos bots ejecutan operaciones cuando se cumplen condiciones predefinidas, eliminando la toma de decisiones emocional. La estrategia resulta efectiva durante períodos acotados en rango de LEO y ayuda a capturar momentum durante breakouts, particularmente cuando señales técnicas se alinean con anuncios de catalizadores del ecosistema.

Ver másEl backtesting de UNUS SED LEO te permite probar estrategias con datos históricos para ver cómo podrían haber funcionado. Te ayuda a ajustar configuraciones, evaluar riesgos y ganar confianza antes de operar en vivo.

Ver másEl SmartTrade de UNUS SED LEO te ofrece opciones avanzadas de trading manual, como take-profit, stoploss, trailing y salidas con múltiples objetivos. Los Presets Públicos de UNUS SED LEO son estrategias listas de otros traders que puedes lanzar al instante o personalizar según tus necesidades.

Para empezar a operar con bots:

Regístrate en 3Commas y elige tu plan

Conecta un Exchange y elige la estrategia de tu bot.

Configura los parámetros de tu bot y ¡ponlo a funcionar!

El trading de LEO presenta desafíos únicos que hacen la automatización esencial. El token experimenta oscilaciones de precio repentinas impulsadas por catalizadores que desencadenan respuestas emocionales. Los traders manuales a menudo compran en picos durante momentos FOMO o venden en pánico durante caídas. Un bot de 3Commas monitorea mercados de LEO continuamente a través de todas las zonas horarias. El crash flash de la sesión asiática de enero de 2025 cayó precios 7.6% mientras traders occidentales dormían. El trading automatizado asegura que nunca pierdas movimientos críticos del mercado. Herramientas integradas de gestión de riesgos como Trailing Stop Loss y Take Profit ejecutan más rápido de lo que los humanos pueden. La volatilidad de LEO durante anuncios requiere decisiones en fracciones de segundo. Los bots eliminan vacilación y aplican disciplina consistente a cada operación.

Los tokens LEO son permanentemente quemados usando el 27% de los ingresos de iFinex, creando reducción de suministro medible y transparente a lo largo del tiempo.

Descuentos directos en tarifas de trading en Bitfinex dan a LEO utilidad real, reduciendo costos para traders activos en lugar de especulación pura.

Pools de liquidez profundos habilitan operaciones de gran volumen con mínimo deslizamiento, a diferencia de tokens de menor capitalización que se mueven bruscamente en órdenes.

Establece stop losses ajustados al operar UNUS SED LEO, especialmente durante eventos de noticias de Bitfinex o anuncios regulatorios importantes que afectan Tether u operaciones de iFinex.

Nunca asignes más del 5% de tu portafolio cripto a LEO debido a riesgos de dependencia de plataforma e impactos regulatorios potenciales en el ecosistema Bitfinex.

Monitorea actualizaciones del DOJ sobre fondos recuperados del hack de 2016 de cerca, ya que estos anuncios desencadenan quemas de tokens inmediatas que crean movimientos de precio repentinos y picos de volatilidad.

Bots principales para trading spot en 1 exchange

$20/ mes

AI Assistant

Solo Spot

1

Claves API Activas

5

Bots DCA activos

2

Signal Bots activos

2

Grid Bots activos

20

Operaciones DCA activas

10

Active Signal Trades

10

SmartTrades activos

100

DCA Backtests

Período de 1 año

100

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Trading de spot y futures con múltiples cuentas

$50/ mes

AI Assistant

Spot y Futuros

3

Claves API Activas

20

Bots DCA activos

20

Signal Bots activos

10

Grid Bots activos

100

Operaciones DCA activas

100

Active Signal Trades

50

SmartTrades activos

500

DCA Backtests

Período de 2 años

500

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Límites excepcionales y trading mediante API

$140/ mes

AI Assistant

Spot y Futuros

15

Claves API Activas

1K

Bots DCA activos

1K

Signal Bots activos

1K

Grid Bots activos

5K

Operaciones DCA activas

5K

Active Signal Trades

5K

SmartTrades activos

5K

DCA Backtests

historial complet

5K

GRID Backtests

Período de 4 meses

API para desarrolladores

Lectura y escritura

Ejecución de Pine Script®

Soporte prioritario por chat en vivo

Ejecuta tu estrategia UNUS SED LEO en Binance, Coinbase Advanced, Kraken y más de 12 exchanges compatibles a través de 3Commas. Conecta mediante una API segura, define entradas, salidas y el riesgo una sola vez, y deja que la automatización opere 24/7. Un solo espacio de trabajo para todas las plataformas significa registros más claros, iteraciones más rápidas y menos movimientos perdidos en tus pares de LEO.

El backtesting en 3Commas hace la vida mucho más fácil. Puedo probar ideas, ver qué funciona y evitar errores tontos, todo sin perder dinero. Compré el plan Expert para hacer más backtests.

Durante mucho tiempo utilicé una estrategia que consideraba rentable, pero a largo plazo iba perdiendo poco a poco. Con la ayuda de la función de backtesting de 3Commas, me di cuenta de que solo necesitaba hacer pequeños cambios en la estrategia para volverme un trader rentable.

He estado con 3Commas durante un par de años y sus bots potentes, una vez que entiendes su mecánica, pueden generar buenos rendimientos con mínimo riesgo (si sabes lo que haces, puedes sacar un 15–30% anual con poco riesgo y sin apalancamiento). Puedes ganar dinero mientras duermes y seguir aprendiendo mientras avanzas.

El equipo siempre está disponible, centrado en las necesidades del cliente, mejorando la app y el sitio web, y adaptándose a todos los cambios. ¡Un trabajo realmente excelente!

He usado otros bots de trading, pero este es mucho mejor, y puedo controlar mis pérdidas y maximizar las ganancias mucho mejor. Seguiré utilizándolo cada vez más.

Soy nuevo en el trading de criptomonedas y he podido usar 3Commas fácilmente. Aprendí mucho con paper trading y me siento seguro usando el sitio.

2,0 M

Traders registrados

Valorado como Excelente en

1,479 reseñas

Reseñas de Google

4.0

Ningún bot de trading puede garantizar ganancias. Los bots de LEO son herramientas de automatización que ejecutan tu estrategia más rápido y consistentemente que el trading manual. Te ayudan a capitalizar los movimientos acotados en rango y patrones de volatilidad de LEO, pero las condiciones del mercado cambian. Aún puedes perder dinero durante tendencias bajistas o eventos inesperados. Los bots funcionan mejor cuando monitoreas el rendimiento, ajustas configuraciones y entiendes que el trading siempre conlleva riesgo independientemente de la automatización.

La configuración toma alrededor de 10-15 minutos incluso para principiantes. Creas una cuenta de 3Commas, conectas tu exchange usando claves API (no se requiere codificación), y eliges una plantilla de bot pre-construida o personalizas tu propia estrategia. La plataforma te guía a través de cada paso con instrucciones claras. La parte más difícil suele ser encontrar la configuración de API de tu exchange, pero 3Commas proporciona tutoriales para cada exchange soportado incluyendo Bitfinex, OKX y KuCoin.

Sí, porque 3Commas es no custodial. Tus tokens LEO y otros fondos nunca salen de tu cuenta del exchange. Las claves API que proporcionas solo otorgan permisos de trading, no derechos de retiro. Esto significa que 3Commas puede colocar órdenes de compra y venta en tu nombre, pero no puede transferir tus activos a ningún lado. Mantienes control completo y puedes revocar acceso instantáneamente eliminando la clave API de tu exchange.

Sí, puedes ejecutar múltiples bots simultáneamente con diferentes estrategias. Por ejemplo, un bot podría ejecutar una estrategia de cuadrícula capitalizando el comportamiento acotado en rango de LEO, mientras otro usa DCA para acumular durante caídas. Cada bot opera independientemente con sus propios fondos asignados y configuraciones. Esto te permite diversificar tu enfoque y probar qué funciona mejor para los patrones de precio únicos de LEO sin poner todo el capital en una estrategia.

Obtén una prueba con acceso completo a todas las herramientas para operar LEO.