Meet the New 3Commas AI Assistant

24 nov 2025

Automatiza tu trading de AAVE para capturar oportunidades en mercados 24/7 sin decisiones emocionales. Nuestros bots ejecutan operaciones a través de tus claves API del exchange, ayudándote a obtener ganancias de la volatilidad consistente del token mientras mantienes custodia completa de tus fondos.

Un bot de trading de Aave es un software que compra y vende tokens AAVE automáticamente por ti basándose en estrategias que configuras. Funciona 24/7, ejecutando operaciones cuando se cumplen tus condiciones sin necesidad de que observes los gráficos. Esto importa porque AAVE regularmente experimenta oscilaciones de precio del 5 al 15% diarias con fuerte liquidez, creando oportunidades que los traders humanos a menudo pierden. Con 3Commas, tus fondos permanecen completamente seguros en tu exchange. El bot se conecta a través de claves API que solo permiten trading, con todos los permisos de retiro bloqueados.

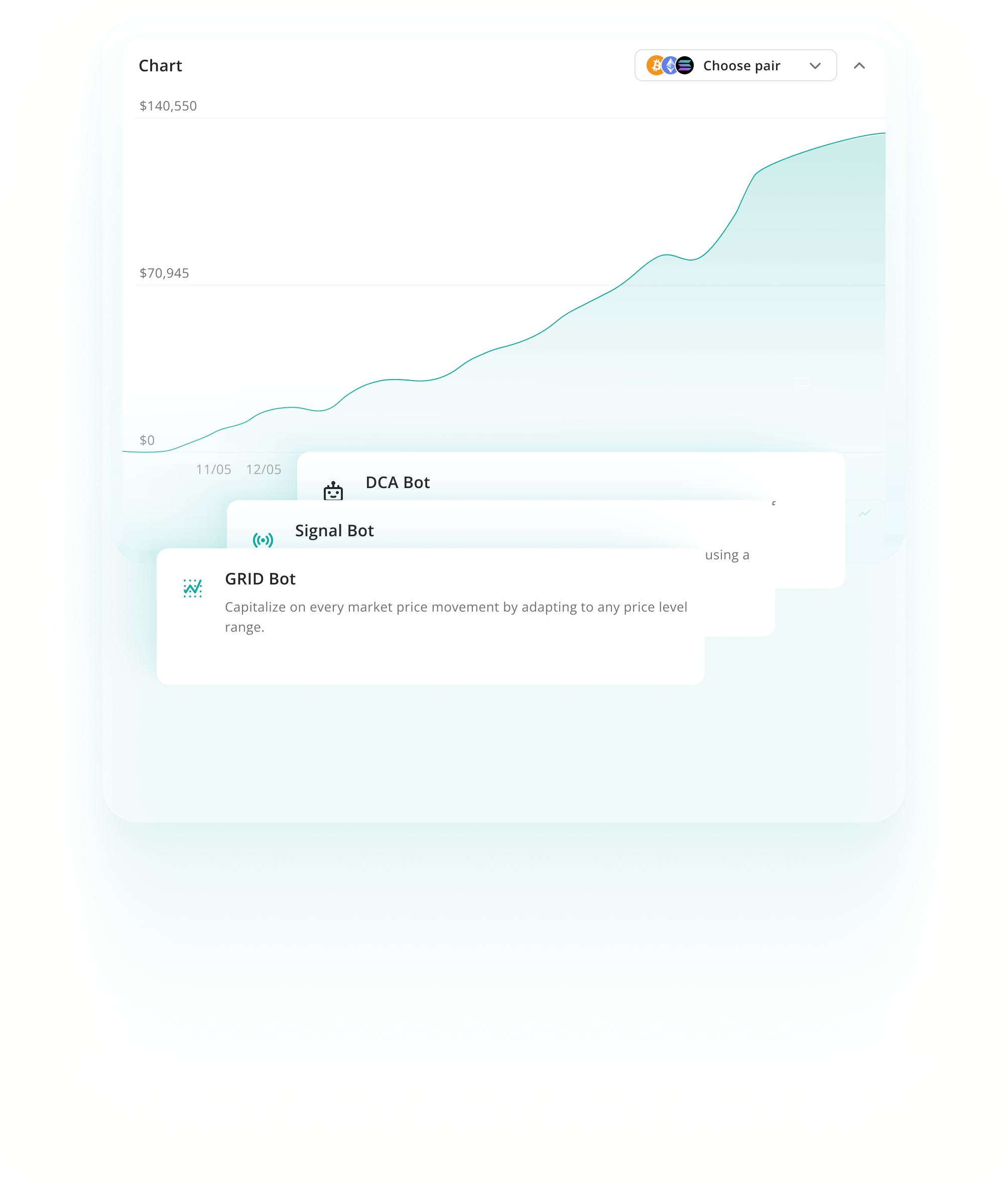

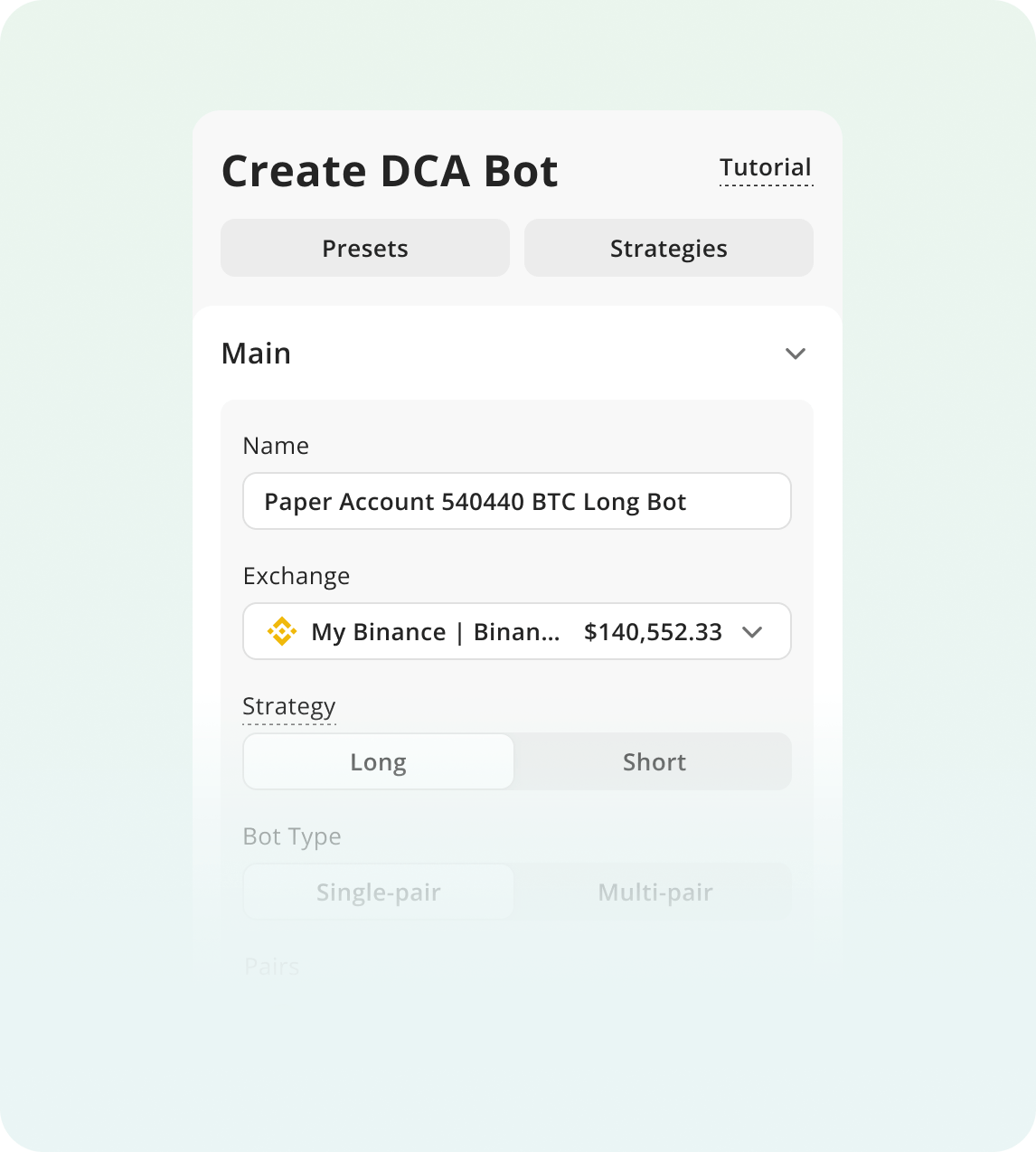

Los bots de promediación del costo en dólares compran AAVE a intervalos regulares o después de caídas de precio. Esto distribuye tus puntos de entrada a través de diferentes precios, reduciendo el impacto de la volatilidad. DCA funciona bien cuando cronometrar las entradas es difícil. La alta volatilidad de AAVE hace que la acumulación sistemática sea más confiable que intentar entradas únicas.

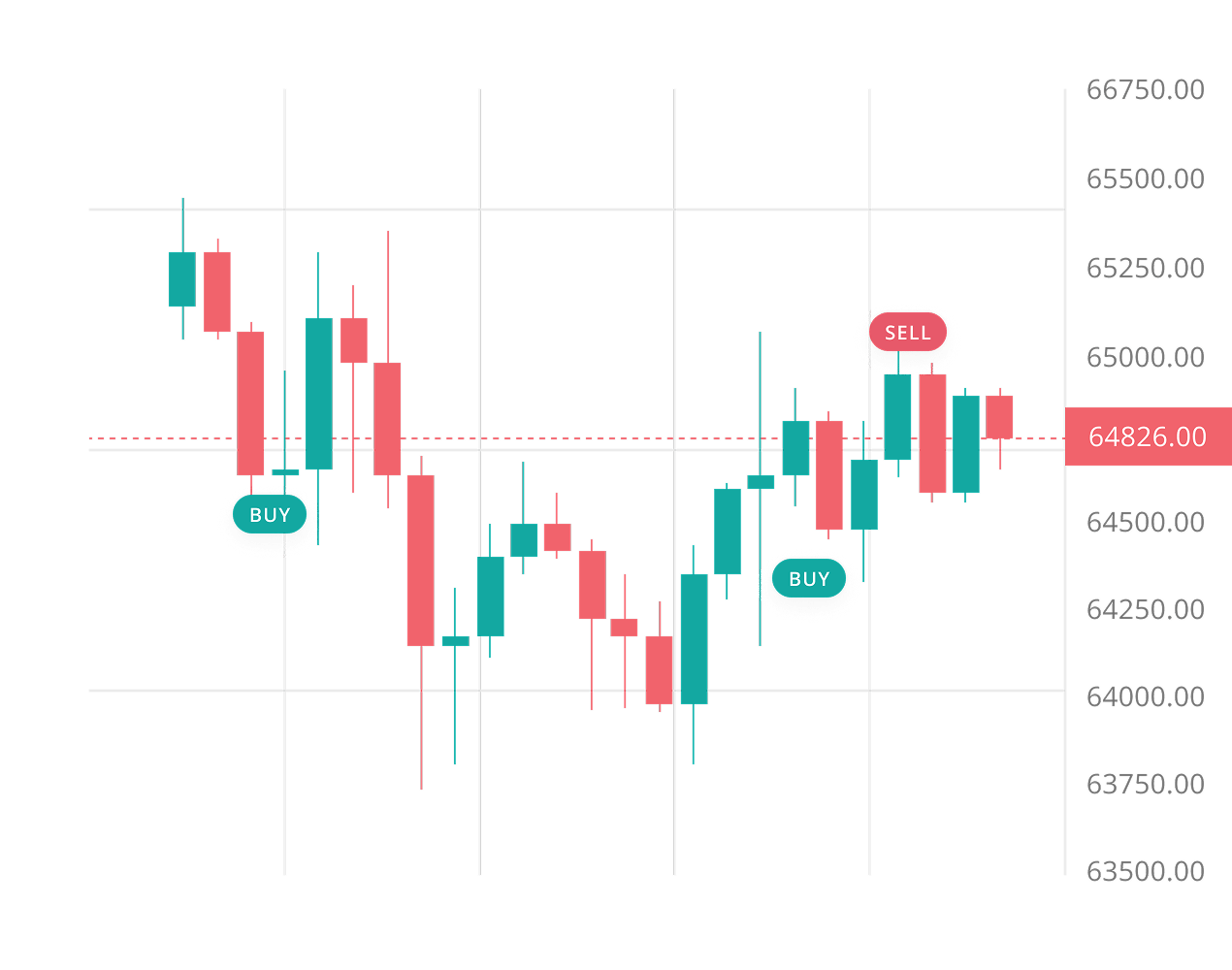

Ver másLos bots de cuadrícula colocan múltiples órdenes de compra y venta dentro de un rango de precio establecido. Obtienen ganancias cuando AAVE oscila entre niveles de soporte y resistencia. Esta estrategia funciona mejor durante períodos de consolidación. Las oscilaciones frecuentes del 5-15% de AAVE hacen que el trading de cuadrícula sea particularmente efectivo para capturar pequeñas ganancias repetidas.

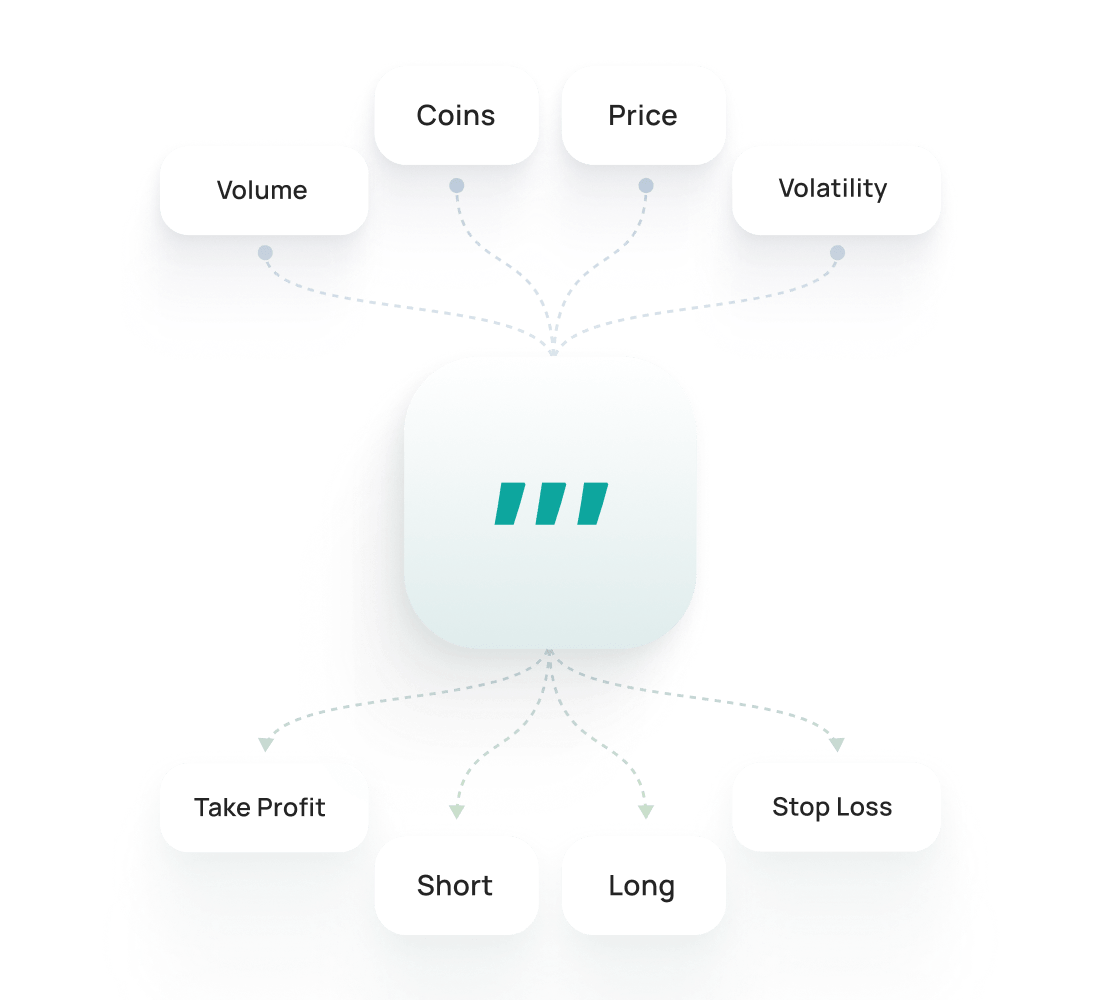

Ver másLos bots de señales ejecutan operaciones automáticamente cuando se activan indicadores técnicos. Responden a señales de RSI, MACD y promedios móviles sin monitoreo manual. Esta estrategia se desempeña mejor durante períodos de tendencias claras. Los fuertes movimientos direccionales de AAVE durante mercados alcistas y bajistas crean oportunidades confiables para trading basado en análisis técnico.

Ver másEl backtesting de Aave te permite probar estrategias con datos históricos para ver cómo podrían haber funcionado. Te ayuda a ajustar configuraciones, evaluar riesgos y ganar confianza antes de operar en vivo.

Ver másEl SmartTrade de Aave te ofrece opciones avanzadas de trading manual, como take-profit, stoploss, trailing y salidas con múltiples objetivos. Los Presets Públicos de Aave son estrategias listas de otros traders que puedes lanzar al instante o personalizar según tus necesidades.

Para empezar a operar con bots:

Regístrate en 3Commas y elige tu plan

Conecta un Exchange y elige la estrategia de tu bot.

Configura los parámetros de tu bot y ¡ponlo a funcionar!

La volatilidad de AAVE crea oportunidades constantes, pero el trading manual significa luchar contra tus emociones durante oscilaciones repentinas. No puedes observar el mercado 24/7, y vender en pánico durante caídas te cuesta dinero. Nuestro bot de Aave elimina las decisiones emocionales por completo. Monitorea la acción del precio las 24 horas, ejecuta tu estrategia sin vacilación y protege tus posiciones con trailing stop losses automáticos y órdenes de toma de ganancias. Obtienes trading disciplinado mientras duermes.

AAVE impulsa el protocolo de préstamos DeFi más grande con liquidez consistentemente alta y volumen de trading diario de $50M a $200M.

El token ofrece utilidad genuina a través de derechos de gobernanza, recompensas de staking en el Safety Module y descuentos en tarifas para préstamos de la stablecoin GHO.

Las oscilaciones de precio diarias del 5 al 15 por ciento de Aave crean oportunidades confiables para estrategias de bots Grid y DCA automatizadas.

Establece stop losses de al menos 15-20% por debajo de tu punto de entrada para tener en cuenta la volatilidad típica de Aave sin ser detenido por fluctuaciones de precio normales.

Monitorea actualizaciones del protocolo como mejoras de V3 y adopción de la stablecoin GHO, ya que estos desarrollos pueden desencadenar movimientos de precio significativos en cualquier dirección.

Limita tu posición de AAVE a un pequeño porcentaje de tu portafolio total, especialmente si estás manteniendo otros tokens DeFi que tienden a moverse juntos.

Bots principales para trading spot en 1 exchange

$20/ mes

AI Assistant

Solo Spot

1

Claves API Activas

5

Bots DCA activos

2

Signal Bots activos

2

Grid Bots activos

20

Operaciones DCA activas

10

Active Signal Trades

10

SmartTrades activos

100

DCA Backtests

Período de 1 año

100

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Trading de spot y futures con múltiples cuentas

$50/ mes

AI Assistant

Spot y Futuros

3

Claves API Activas

20

Bots DCA activos

20

Signal Bots activos

10

Grid Bots activos

100

Operaciones DCA activas

100

Active Signal Trades

50

SmartTrades activos

500

DCA Backtests

Período de 2 años

500

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Límites excepcionales y trading mediante API

$140/ mes

AI Assistant

Spot y Futuros

15

Claves API Activas

1K

Bots DCA activos

1K

Signal Bots activos

1K

Grid Bots activos

5K

Operaciones DCA activas

5K

Active Signal Trades

5K

SmartTrades activos

5K

DCA Backtests

historial complet

5K

GRID Backtests

Período de 4 meses

API para desarrolladores

Lectura y escritura

Ejecución de Pine Script®

Soporte prioritario por chat en vivo

Ejecuta tu estrategia Aave en Binance, Coinbase Advanced, Kraken y más de 12 exchanges compatibles a través de 3Commas. Conecta mediante una API segura, define entradas, salidas y el riesgo una sola vez, y deja que la automatización opere 24/7. Un solo espacio de trabajo para todas las plataformas significa registros más claros, iteraciones más rápidas y menos movimientos perdidos en tus pares de AAVE.

El backtesting en 3Commas hace la vida mucho más fácil. Puedo probar ideas, ver qué funciona y evitar errores tontos, todo sin perder dinero. Compré el plan Expert para hacer más backtests.

Durante mucho tiempo utilicé una estrategia que consideraba rentable, pero a largo plazo iba perdiendo poco a poco. Con la ayuda de la función de backtesting de 3Commas, me di cuenta de que solo necesitaba hacer pequeños cambios en la estrategia para volverme un trader rentable.

He estado con 3Commas durante un par de años y sus bots potentes, una vez que entiendes su mecánica, pueden generar buenos rendimientos con mínimo riesgo (si sabes lo que haces, puedes sacar un 15–30% anual con poco riesgo y sin apalancamiento). Puedes ganar dinero mientras duermes y seguir aprendiendo mientras avanzas.

El equipo siempre está disponible, centrado en las necesidades del cliente, mejorando la app y el sitio web, y adaptándose a todos los cambios. ¡Un trabajo realmente excelente!

He usado otros bots de trading, pero este es mucho mejor, y puedo controlar mis pérdidas y maximizar las ganancias mucho mejor. Seguiré utilizándolo cada vez más.

Soy nuevo en el trading de criptomonedas y he podido usar 3Commas fácilmente. Aprendí mucho con paper trading y me siento seguro usando el sitio.

2,0 M

Traders registrados

Valorado como Excelente en

1,479 reseñas

Reseñas de Google

4.0

Ningún bot garantiza ganancias. Los bots de trading de AAVE automatizan la ejecución de tu estrategia y te ayudan a capitalizar la volatilidad sin observar gráficos constantemente. Tus resultados dependen de las condiciones del mercado, la estrategia que elijas y tus configuraciones de riesgo. Los bots eliminan la emoción del trading y pueden operar 24/7, pero aún requieren monitoreo y ajustes periódicos. Piensa en ellos como herramientas que mejoran la eficiencia, no máquinas mágicas de hacer dinero.

Para nada. No necesitas habilidades de codificación ni experiencia técnica para ejecutar un bot de AAVE en 3Commas. La plataforma usa plantillas preestablecidas para estrategias populares como bots DCA y Grid. Simplemente conectas tu exchange, seleccionas AAVE como tu par de trading, eliges tu estrategia y ajustas parámetros básicos como monto de inversión y rangos de precio. La mayoría de los usuarios completan su primera configuración de bot en menos de 10 minutos.

Sí. 3Commas opera como una plataforma no custodial, lo que significa que tus fondos nunca salen de tu cuenta del exchange. Cuando te conectas vía API, solo otorgas permisos de trading, no derechos de retiro. El bot ejecuta órdenes de compra y venta en tu nombre, pero tu AAVE y otros activos permanecen asegurados en tu exchange. Mantienes control completo y puedes revocar el acceso API en cualquier momento.

Un solo bot ejecuta una estrategia, pero puedes operar múltiples bots simultáneamente en el mismo par AAVE. Muchos traders ejecutan un bot Grid para obtener ganancias de las oscilaciones de precio mientras también ejecutan un bot DCA para acumular durante caídas. Cada bot funciona independientemente con su propia asignación de capital. Esto te permite diversificar tu enfoque y adaptarte a diferentes condiciones del mercado sin tener que elegir solo un método.

Obtén una prueba con acceso completo a todas las herramientas para operar AAVE.