Meet the New 3Commas AI Assistant

24 nov 2025

Automatiza tus estrategias de trading de ALGO en una red construida para confiabilidad. La finalidad de transacción de 3.3 segundos de Algorand y las tarifas de 0.001 ALGO crean condiciones predecibles para la ejecución del bot. Conéctate vía claves API seguras sin otorgar derechos de retiro, permitiendo que la automatización capture oportunidades a través de los rangos de volatilidad diaria del 3-8% de Algorand.

Un bot de trading de Algorand es un software automatizado que compra y vende ALGO basándose en estrategias preestablecidas. Funciona 24/7 sin decisiones emocionales. El bot aprovecha la finalidad de transacción instantánea de Algorand y las tarifas ultra-bajas para ejecutar operaciones rápida y eficientemente. 3Commas usa claves API que permiten trading pero no pueden retirar fondos. Tus activos permanecen seguros en tu exchange. La automatización te ayuda a responder a los movimientos de precio de ALGO las 24 horas.

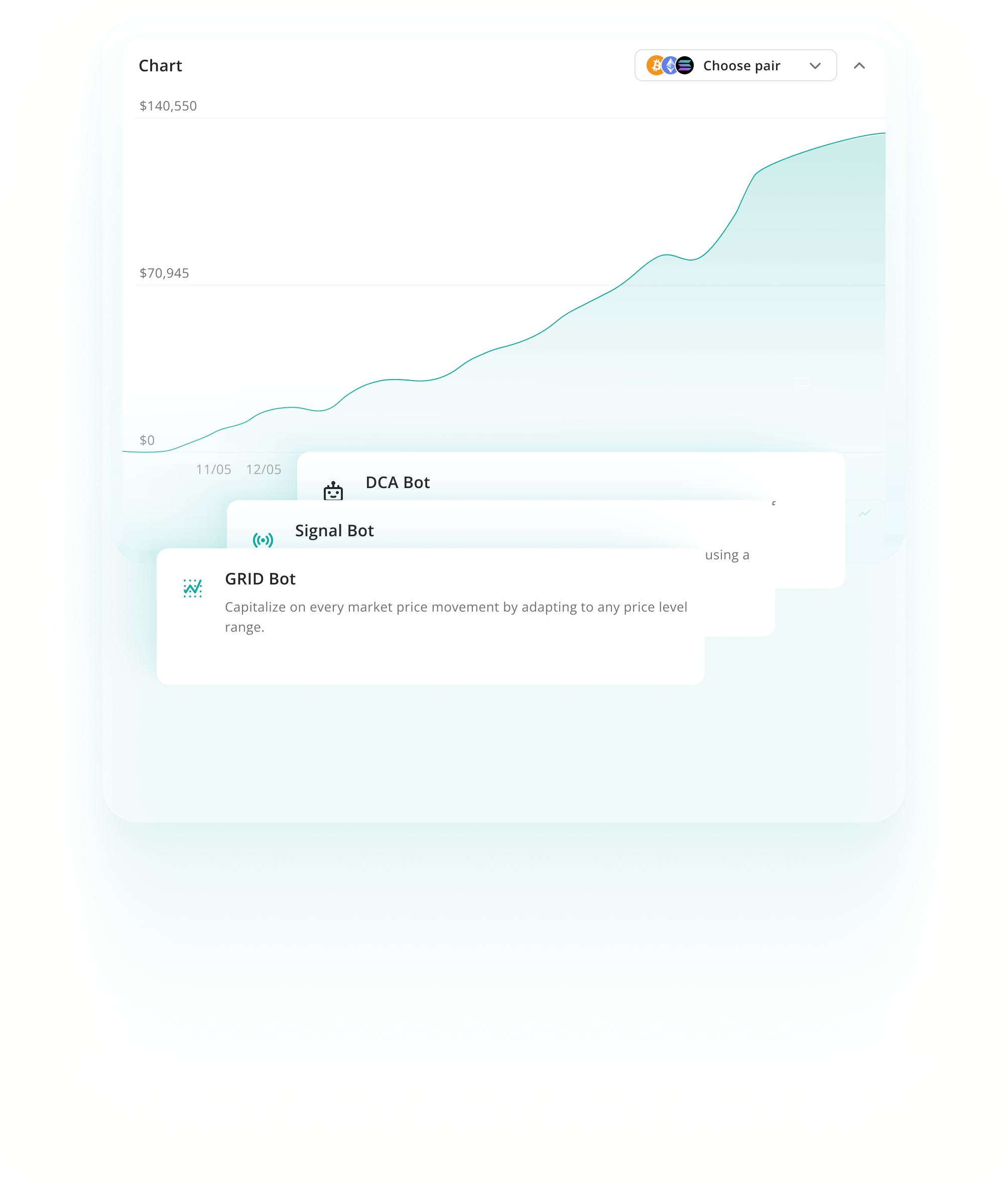

Los bots de promediación del costo en dólares distribuyen las compras a través de múltiples intervalos de tiempo para reducir el impacto de la volatilidad. En lugar de entrar a un punto de precio, el bot compra en etapas durante caídas. Este enfoque funciona bien con las oscilaciones diarias frecuentes del 3-8% de ALGO y movimientos periódicos más grandes.

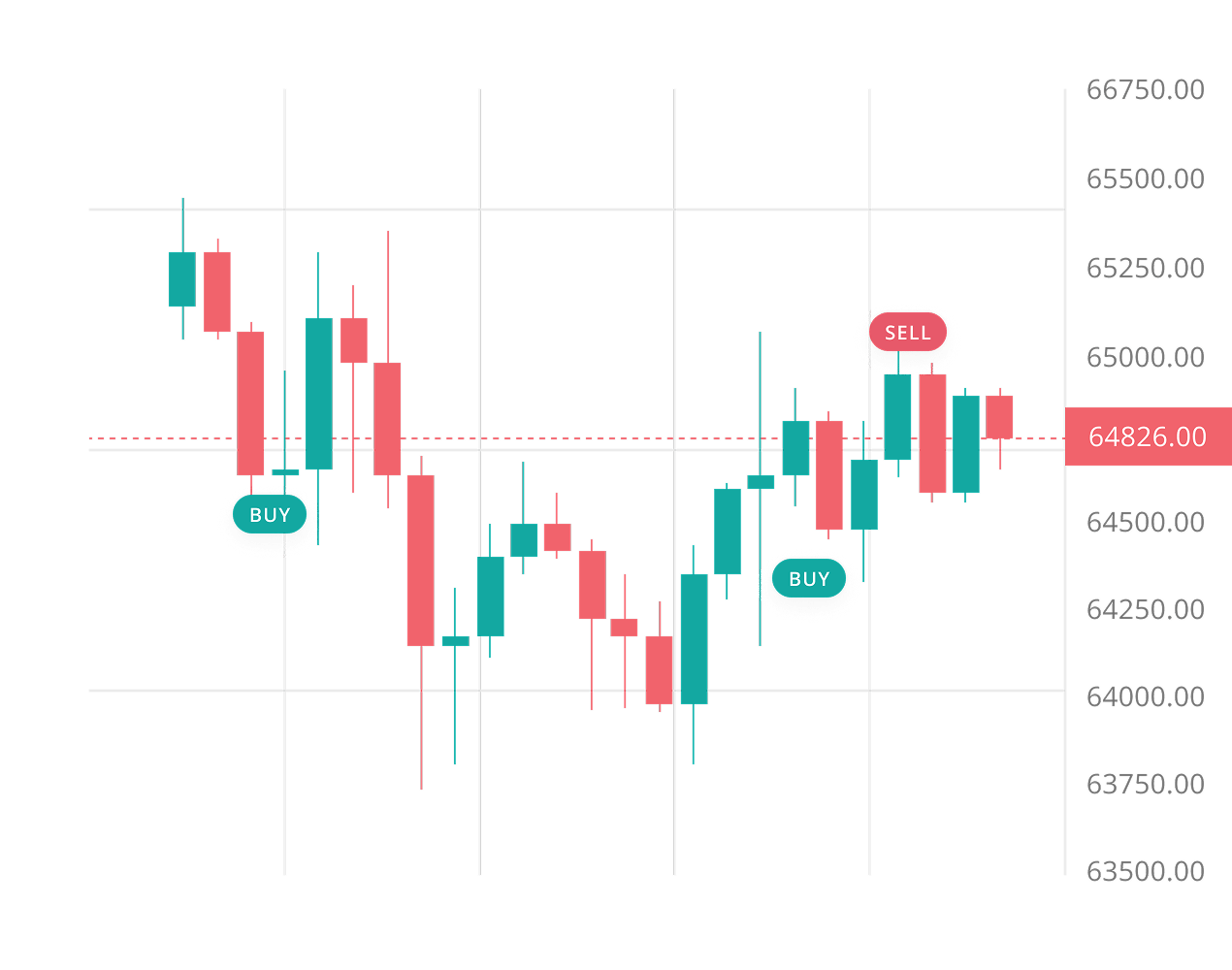

Ver másLos bots de cuadrícula colocan órdenes de compra y venta automatizadas a intervalos preestablecidos por encima y por debajo del precio actual. Obtienen ganancias de la acción de precio lateral comprando bajo y vendiendo alto repetidamente. La liquidez consistente de Algorand y los canales de rango bien definidos lo hacen adecuado para trading de cuadrícula durante períodos de consolidación.

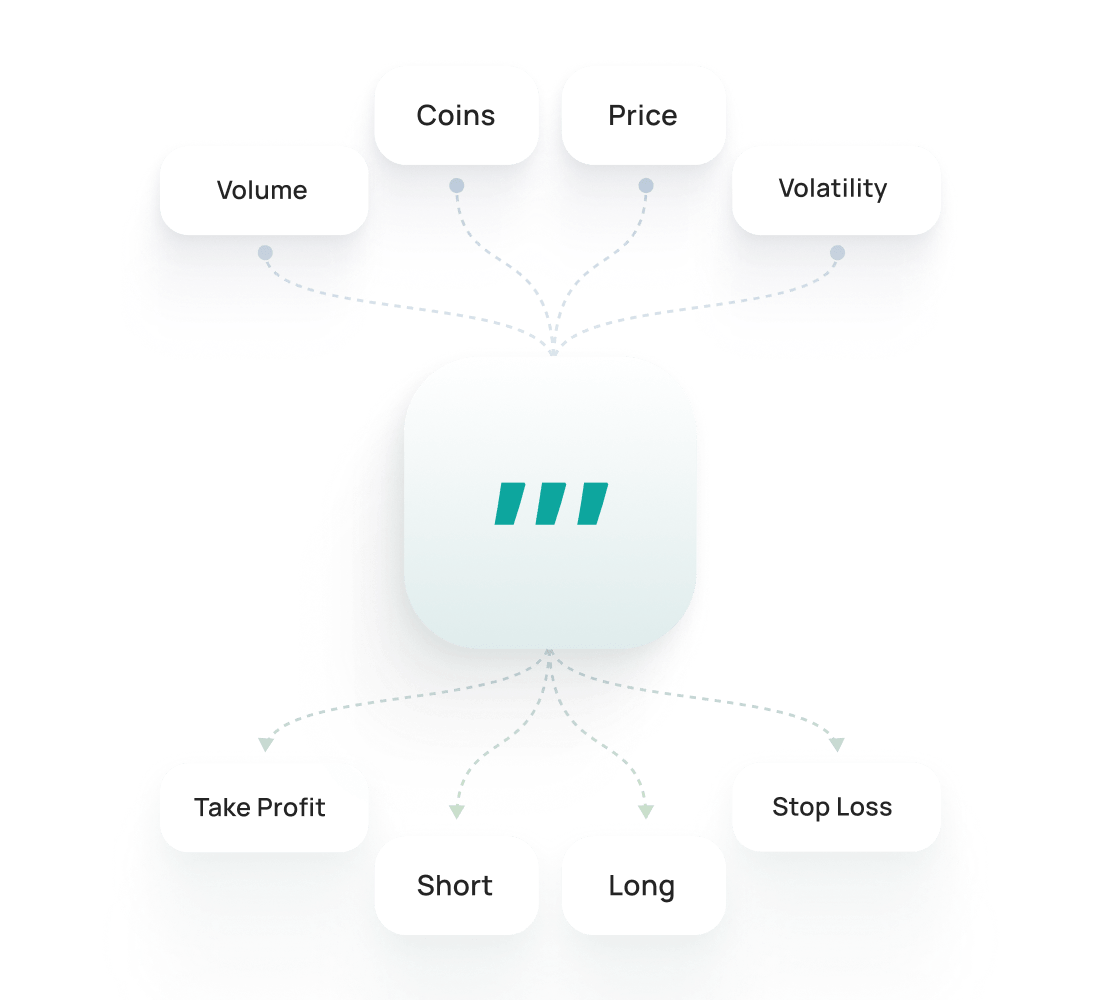

Ver másLos bots de señales ejecutan operaciones automáticamente basándose en indicadores técnicos como RSI, MACD y promedios móviles. Eliminan la emoción del trading al seguir reglas predeterminadas. Estos bots se desempeñan mejor durante tendencias fuertes de Algorand cuando las señales técnicas proporcionan orientación direccional más clara para puntos de entrada y salida.

Ver másEl backtesting de Algorand te permite probar estrategias con datos históricos para ver cómo podrían haber funcionado. Te ayuda a ajustar configuraciones, evaluar riesgos y ganar confianza antes de operar en vivo.

Ver másEl SmartTrade de Algorand te ofrece opciones avanzadas de trading manual, como take-profit, stoploss, trailing y salidas con múltiples objetivos. Los Presets Públicos de Algorand son estrategias listas de otros traders que puedes lanzar al instante o personalizar según tus necesidades.

Para empezar a operar con bots:

Regístrate en 3Commas y elige tu plan

Conecta un Exchange y elige la estrategia de tu bot.

Configura los parámetros de tu bot y ¡ponlo a funcionar!

Los mercados de ALGO nunca duermen, pero tú sí. La finalidad ultrarrápida de 3.3 segundos de Algorand significa que las oscilaciones de precio ocurren instantáneamente, a menudo mientras estás desconectado. Un bot monitorea cada movimiento las 24 horas, ejecutando operaciones basadas en tu estrategia en lugar de pánico o FOMO. Protege tus posiciones con Trailing Stop Loss y órdenes automáticas de Take Profit, eliminando las decisiones emocionales que drenan cuentas. Con tarifas de transacción por debajo de una fracción de centavo, tu bot puede trabajar incansablemente sin que los costos consuman los resultados.

La finalidad de 3.3 segundos de ALGO significa que tu bot ejecuta operaciones con cero riesgo de reversiones de transacciones o bifurcaciones de blockchain.

Las tarifas fijas de 0.001 ALGO por transacción te permiten ejecutar estrategias de alta frecuencia sin consumir tus ganancias.

El Pure Proof-of-Stake de Algorand entrega rendimiento de red consistente, por lo que tus operaciones automatizadas se ejecutan exactamente cuando deberían.

Establece stop losses más amplios del 8-10% para tener en cuenta la volatilidad diaria típica de ALGO, especialmente durante alta actividad del mercado cuando las oscilaciones pueden alcanzar el 20% o más.

Monitorea anuncios de Algorand Foundation y cronogramas de desbloqueo de tokens de cerca, ya que estos eventos a menudo desencadenan movimientos de precio significativos y aumento de presión de venta.

Mantén tamaños de posición conservadores dada la incertidumbre regulatoria de ALGO con la SEC y la presión competitiva de otras blockchains de Capa 1 como Ethereum y Solana.

Bots principales para trading spot en 1 exchange

$20/ mes

AI Assistant

Solo Spot

1

Claves API Activas

5

Bots DCA activos

2

Signal Bots activos

2

Grid Bots activos

20

Operaciones DCA activas

10

Active Signal Trades

10

SmartTrades activos

100

DCA Backtests

Período de 1 año

100

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Trading de spot y futures con múltiples cuentas

$50/ mes

AI Assistant

Spot y Futuros

3

Claves API Activas

20

Bots DCA activos

20

Signal Bots activos

10

Grid Bots activos

100

Operaciones DCA activas

100

Active Signal Trades

50

SmartTrades activos

500

DCA Backtests

Período de 2 años

500

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Límites excepcionales y trading mediante API

$140/ mes

AI Assistant

Spot y Futuros

15

Claves API Activas

1K

Bots DCA activos

1K

Signal Bots activos

1K

Grid Bots activos

5K

Operaciones DCA activas

5K

Active Signal Trades

5K

SmartTrades activos

5K

DCA Backtests

historial complet

5K

GRID Backtests

Período de 4 meses

API para desarrolladores

Lectura y escritura

Ejecución de Pine Script®

Soporte prioritario por chat en vivo

Ejecuta tu estrategia Algorand en Binance, Coinbase Advanced, Kraken y más de 12 exchanges compatibles a través de 3Commas. Conecta mediante una API segura, define entradas, salidas y el riesgo una sola vez, y deja que la automatización opere 24/7. Un solo espacio de trabajo para todas las plataformas significa registros más claros, iteraciones más rápidas y menos movimientos perdidos en tus pares de ALGO.

El backtesting en 3Commas hace la vida mucho más fácil. Puedo probar ideas, ver qué funciona y evitar errores tontos, todo sin perder dinero. Compré el plan Expert para hacer más backtests.

Durante mucho tiempo utilicé una estrategia que consideraba rentable, pero a largo plazo iba perdiendo poco a poco. Con la ayuda de la función de backtesting de 3Commas, me di cuenta de que solo necesitaba hacer pequeños cambios en la estrategia para volverme un trader rentable.

He estado con 3Commas durante un par de años y sus bots potentes, una vez que entiendes su mecánica, pueden generar buenos rendimientos con mínimo riesgo (si sabes lo que haces, puedes sacar un 15–30% anual con poco riesgo y sin apalancamiento). Puedes ganar dinero mientras duermes y seguir aprendiendo mientras avanzas.

El equipo siempre está disponible, centrado en las necesidades del cliente, mejorando la app y el sitio web, y adaptándose a todos los cambios. ¡Un trabajo realmente excelente!

He usado otros bots de trading, pero este es mucho mejor, y puedo controlar mis pérdidas y maximizar las ganancias mucho mejor. Seguiré utilizándolo cada vez más.

Soy nuevo en el trading de criptomonedas y he podido usar 3Commas fácilmente. Aprendí mucho con paper trading y me siento seguro usando el sitio.

2,0 M

Traders registrados

Valorado como Excelente en

1,479 reseñas

Reseñas de Google

4.0

No, los bots de trading de ALGO no garantizan ganancias. Todo trading de criptomonedas involucra riesgo, y las condiciones del mercado pueden cambiar rápidamente. Sin embargo, las herramientas de trading automatizado te ayudan a ejecutar estrategias consistentemente sin toma de decisiones emocional. La finalidad instantánea y las tarifas ultra-bajas de Algorand crean un entorno de trading predecible que reduce costos. Los bots sobresalen en la gestión de riesgos a través de funciones como stop-losses, objetivos de toma de ganancias y dimensionamiento de posiciones. Automatizan la disciplina, no el éxito. Tus resultados dependen de la calidad de la estrategia, las condiciones del mercado y la configuración adecuada.

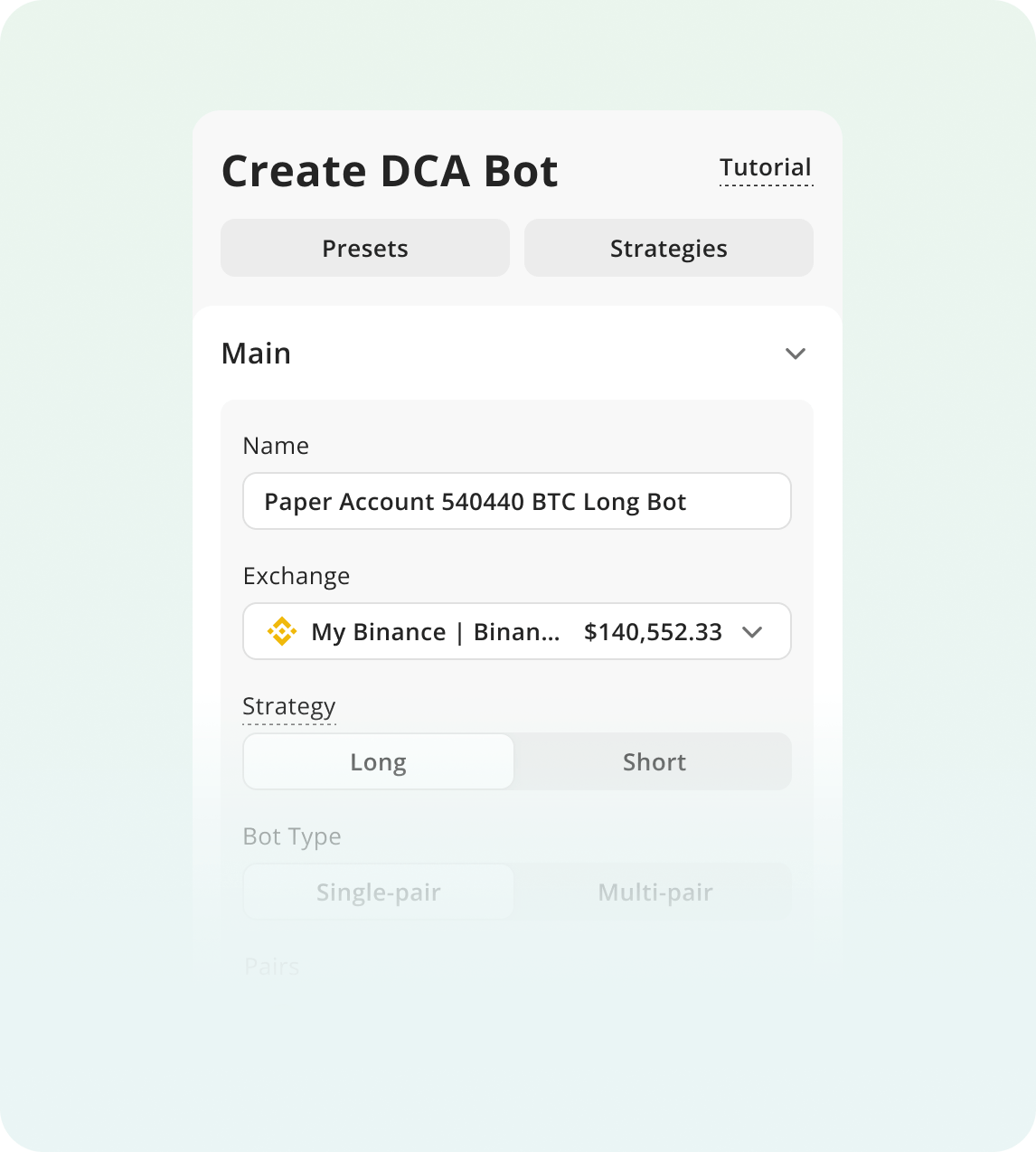

Configurar un bot de ALGO en 3Commas no requiere conocimiento de codificación. El proceso toma 10-15 minutos: crear una cuenta, conectar tu exchange vía claves API y configurar tu estrategia elegida usando plantillas preestablecidas o parámetros personalizados. La plataforma ofrece interfaces amigables para principiantes con flujos de configuración guiados. Seleccionarás tu tipo de estrategia (DCA, Grid o Signal), establecerás tus parámetros de riesgo y activarás el bot. La red estable de Algorand y las bajas tarifas lo hacen ideal para probar estrategias con costo mínimo mientras aprendes la plataforma.

Sí, porque 3Commas es no custodial: tus fondos nunca salen de tu cuenta del exchange. Cuando creas claves API, específicamente deshabilitas permisos de retiro, lo que significa que el bot solo puede ejecutar operaciones, no mover activos fuera del exchange. Tu criptomoneda permanece en tu billetera del exchange bajo tu control. 3Commas no puede acceder a tus fondos. Las mejores prácticas incluyen habilitar lista blanca de IP, usar permisos de solo lectura y trading, y almacenar claves API de forma segura. Mantienes custodia completa mientras el bot automatiza la ejecución de tu estrategia de trading en pares de Algorand.

Sí, puedes ejecutar múltiples bots simultáneamente con diferentes estrategias en tus posiciones de Algorand. Muchos traders combinan bots DCA para acumulación de ALGO a largo plazo, bots Grid para captura de ganancias en rangos acotados y bots Signal para oportunidades de seguimiento de tendencias. Cada bot opera independientemente con parámetros y asignación de capital separados. La finalidad de 3.3 segundos de Algorand y las tarifas de transacción de 0.001 ALGO hacen que ejecutar múltiples estrategias sea rentable. Este enfoque diversifica tu ejecución táctica mientras mantienes supervisión. Solo asegúrate de una asignación de capital adecuada para evitar sobreextenderte a través de estrategias.

Obtén una prueba con acceso completo a todas las herramientas para operar ALGO.