Meet the New 3Commas AI Assistant

24 nov 2025

Automate your ETH trading on the world's leading smart contract platform. Navigate Ethereum's high volatility and 24/7 market with precision execution. Our bot monitors opportunities around the clock, removing emotion from your trades while capitalizing on ETH's liquidity and technical patterns you'd otherwise miss.

An Ethereum trading bot is automated software that executes ETH trades for you based on pre-set rules and strategies. It operates 24/7, monitoring the market and capturing opportunities you'd miss while sleeping or working. The bot follows your strategy with precision, removing emotional decisions from trading. 3Commas connects to exchanges through API keys with trading permissions only—withdrawal rights are explicitly disabled, meaning your funds never leave the exchange. Your crypto stays secure in your exchange account.

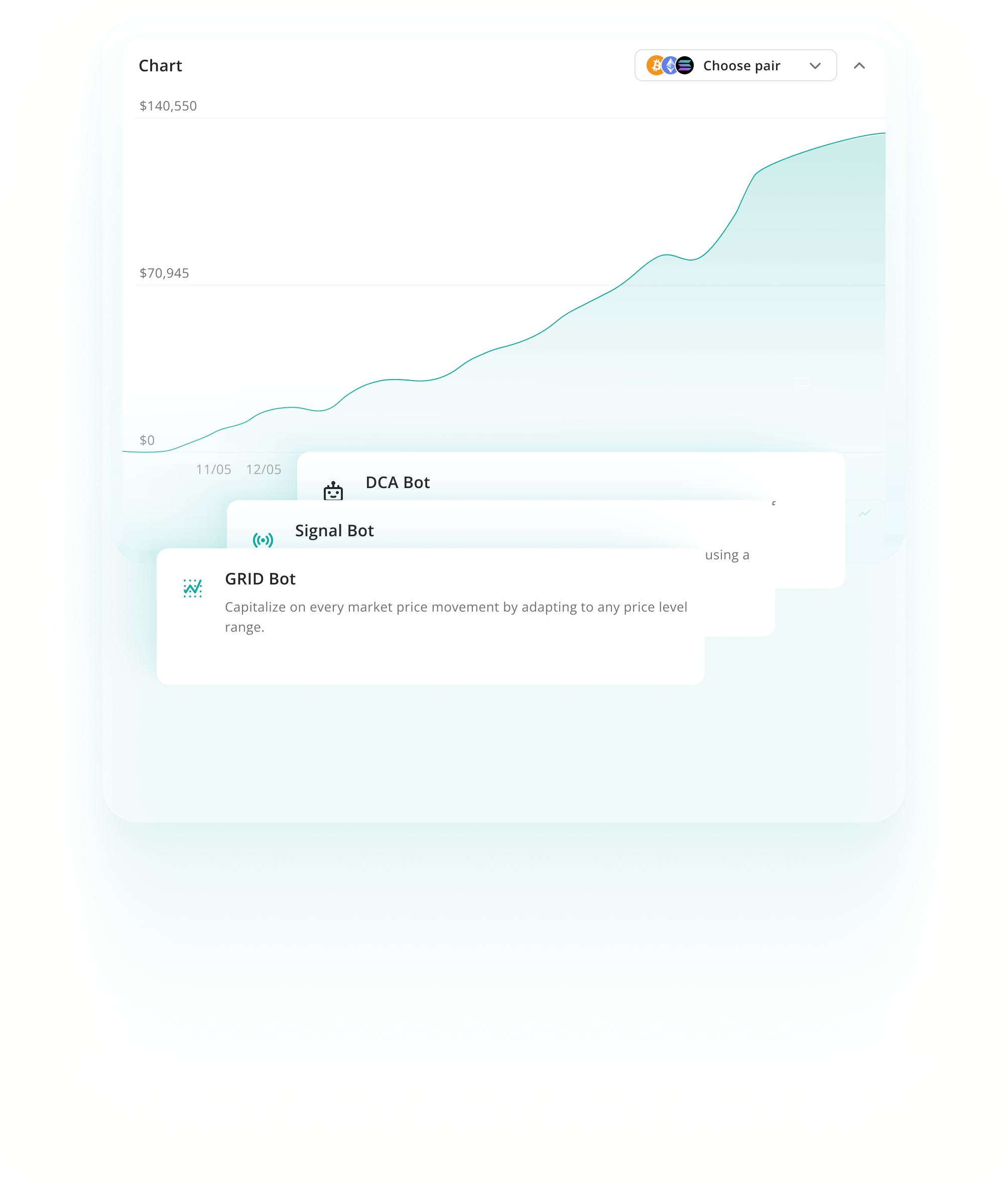

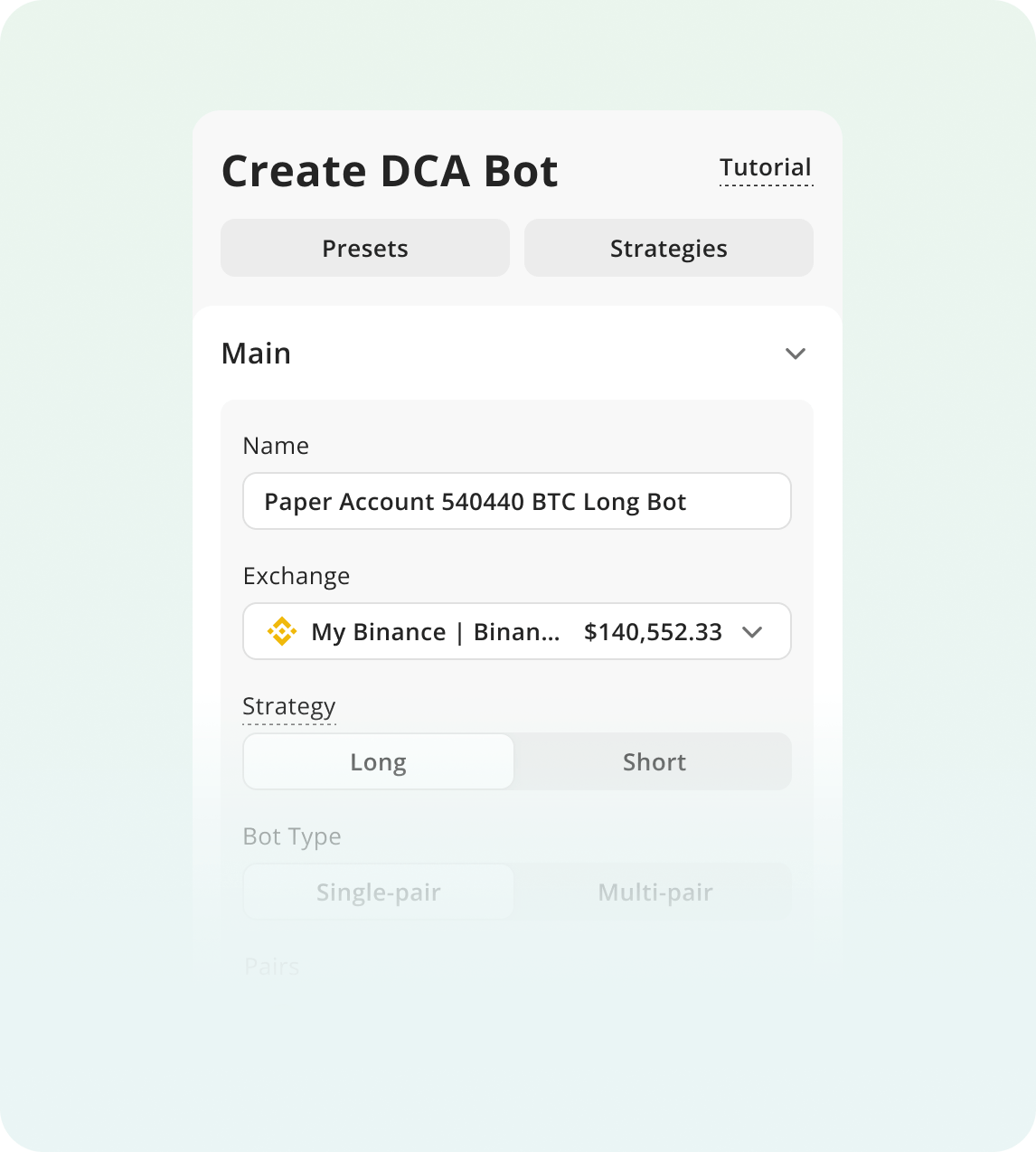

Dollar-cost averaging bots spread ETH purchases over time, reducing the impact of volatility on your entry price. This approach removes timing pressure during Ethereum's sharp sentiment-driven swings. It's particularly effective for long-term accumulation, smoothing out daily fluctuations while capitalizing on broader uptrends.

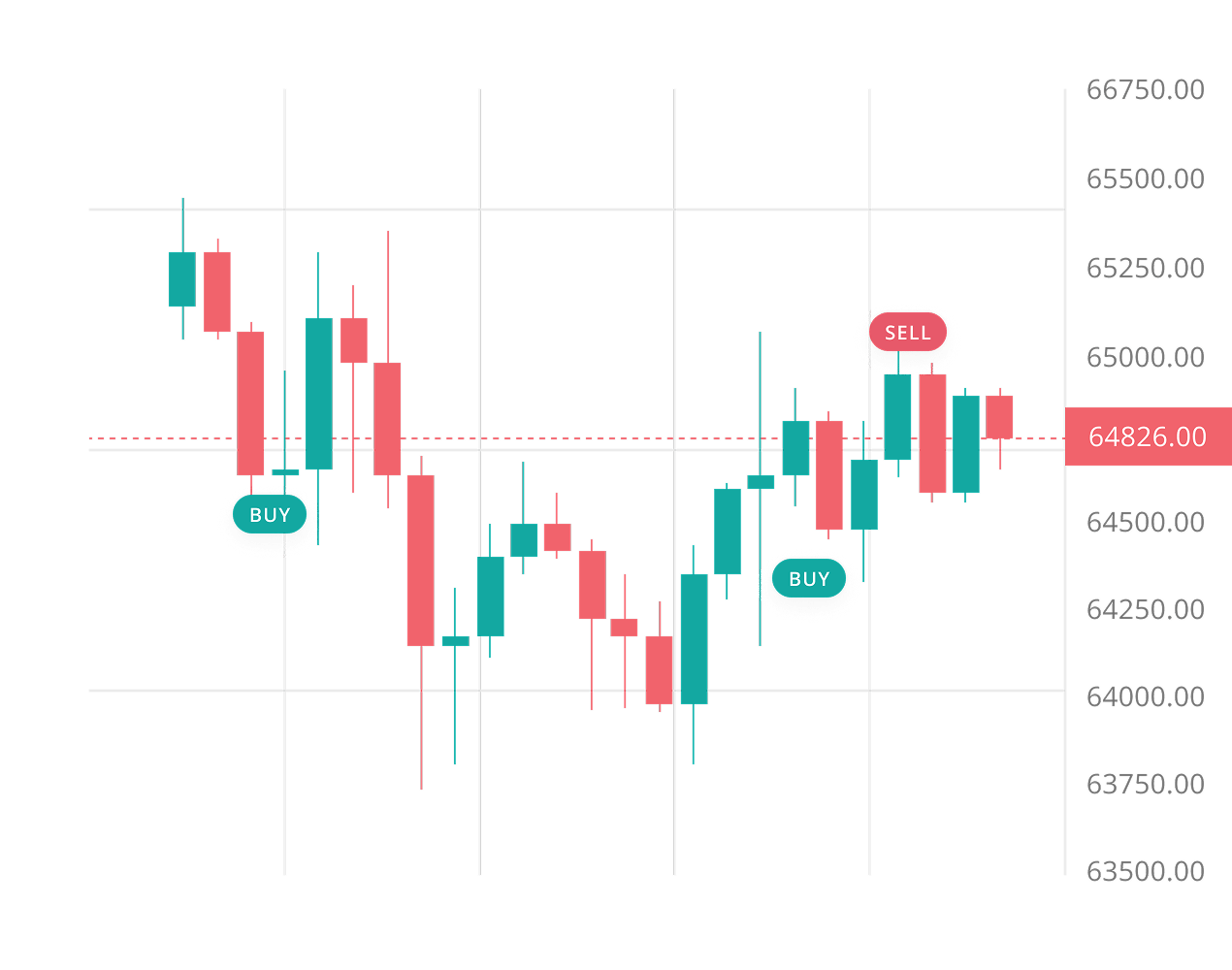

Ver másGrid bots place multiple buy and sell orders across ETH's price range, profiting from repetitive bounces. They excel in sideways markets like Ethereum's 2025 consolidation between $4,200-$5,500. The strategy systematically captures small gains from predictable price swings while managing downside through defined ranges.

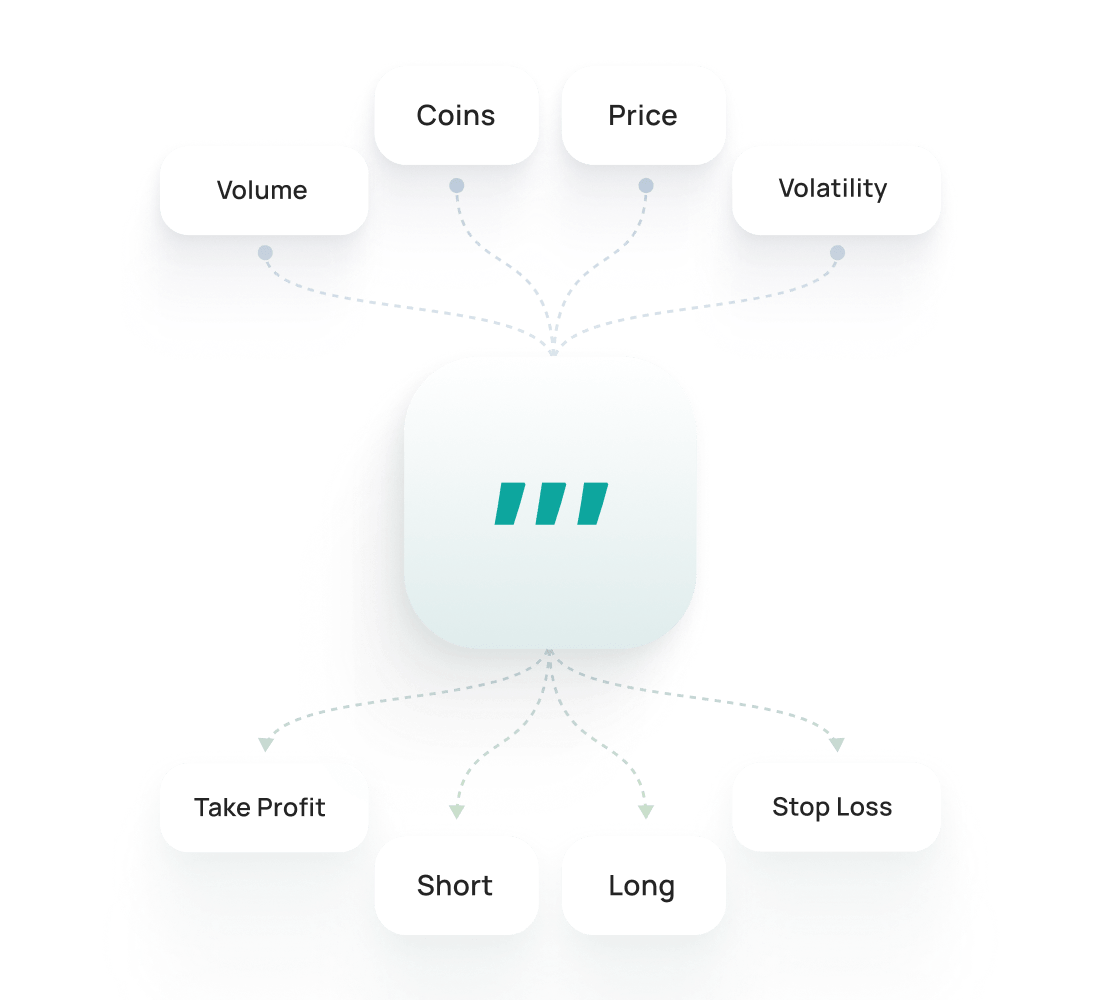

Ver másSignal bots execute trades automatically when technical indicators trigger. ETH responds well to momentum signals like RSI oversold conditions, EMA crossovers, and MACD divergences. This strategy capitalizes on Ethereum's technical responsiveness while maintaining disciplined entries and exits based on predefined conditions rather than emotions.

Ver másEl backtesting de Ethereum te permite probar estrategias con datos históricos para ver cómo podrían haber funcionado. Te ayuda a ajustar configuraciones, evaluar riesgos y ganar confianza antes de operar en vivo.

Ver másEl SmartTrade de Ethereum te ofrece opciones avanzadas de trading manual, como take-profit, stoploss, trailing y salidas con múltiples objetivos. Los Presets Públicos de Ethereum son estrategias listas de otros traders que puedes lanzar al instante o personalizar según tus necesidades.

Para empezar a operar con bots:

Regístrate en 3Commas y elige tu plan

Conecta un Exchange y elige la estrategia de tu bot.

Configura los parámetros de tu bot y ¡ponlo a funcionar!

Manual ETH trading exposes you to costly emotional decisions—buying peaks during FOMO or panic-selling dips. Ethereum moves 24/7, and you can't watch charts constantly. Flash crashes happen while you sleep. A 3Commas bot monitors markets around the clock, executing trades without emotion. Built-in Trailing Stop Loss and Take Profit features protect your capital automatically, locking in gains before reversals hit. You get consistent, disciplined trading—without the stress.

ETH's deep liquidity across exchanges lets you execute large trades with minimal slippage—often under 0.1% on million-dollar orders.

Post-Merge fee burning creates deflationary pressure during high network usage, reducing ETH supply while demand from DeFi and NFTs stays constant.

Native staking yields 3-5% APY, giving you baseline returns while holding and creating opportunity cost that supports price stability.

Set stop-losses wider than 6-8% to avoid being stopped out by ETH's normal volatility, and increase to 12-15% during network upgrades or major regulatory announcements.

Monitor Ethereum-specific catalysts like protocol upgrades, major DeFi exploits, ETF developments, and staking issues, as these events can trigger 10-15% price swings within hours.

Never risk more than 2-3% of your total portfolio on a single ETH trade, and diversify across multiple assets to protect against Ethereum-specific risks.

Bots principales para trading spot en 1 exchange

$20/ mes

AI Assistant

Solo Spot

1

Claves API Activas

5

Bots DCA activos

2

Signal Bots activos

2

Grid Bots activos

20

Operaciones DCA activas

10

Active Signal Trades

10

SmartTrades activos

100

DCA Backtests

Período de 1 año

100

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Trading de spot y futures con múltiples cuentas

$50/ mes

AI Assistant

Spot y Futuros

3

Claves API Activas

20

Bots DCA activos

20

Signal Bots activos

10

Grid Bots activos

100

Operaciones DCA activas

100

Active Signal Trades

50

SmartTrades activos

500

DCA Backtests

Período de 2 años

500

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Límites excepcionales y trading mediante API

$140/ mes

AI Assistant

Spot y Futuros

15

Claves API Activas

1K

Bots DCA activos

1K

Signal Bots activos

1K

Grid Bots activos

5K

Operaciones DCA activas

5K

Active Signal Trades

5K

SmartTrades activos

5K

DCA Backtests

historial complet

5K

GRID Backtests

Período de 4 meses

API para desarrolladores

Lectura y escritura

Ejecución de Pine Script®

Soporte prioritario por chat en vivo

Ejecuta tu estrategia Ethereum en Binance, Coinbase Advanced, Kraken y más de 12 exchanges compatibles a través de 3Commas. Conecta mediante una API segura, define entradas, salidas y el riesgo una sola vez, y deja que la automatización opere 24/7. Un solo espacio de trabajo para todas las plataformas significa registros más claros, iteraciones más rápidas y menos movimientos perdidos en tus pares de ETH.

El backtesting en 3Commas hace la vida mucho más fácil. Puedo probar ideas, ver qué funciona y evitar errores tontos, todo sin perder dinero. Compré el plan Expert para hacer más backtests.

Durante mucho tiempo utilicé una estrategia que consideraba rentable, pero a largo plazo iba perdiendo poco a poco. Con la ayuda de la función de backtesting de 3Commas, me di cuenta de que solo necesitaba hacer pequeños cambios en la estrategia para volverme un trader rentable.

He estado con 3Commas durante un par de años y sus bots potentes, una vez que entiendes su mecánica, pueden generar buenos rendimientos con mínimo riesgo (si sabes lo que haces, puedes sacar un 15–30% anual con poco riesgo y sin apalancamiento). Puedes ganar dinero mientras duermes y seguir aprendiendo mientras avanzas.

El equipo siempre está disponible, centrado en las necesidades del cliente, mejorando la app y el sitio web, y adaptándose a todos los cambios. ¡Un trabajo realmente excelente!

He usado otros bots de trading, pero este es mucho mejor, y puedo controlar mis pérdidas y maximizar las ganancias mucho mejor. Seguiré utilizándolo cada vez más.

Soy nuevo en el trading de criptomonedas y he podido usar 3Commas fácilmente. Aprendí mucho con paper trading y me siento seguro usando el sitio.

2,0 M

Traders registrados

Valorado como Excelente en

1,479 reseñas

Reseñas de Google

4.0

No, Ethereum bots don't guarantee profit. They're automation tools, not money-printing machines. Bots execute strategies faster and more consistently than manual trading, which helps capitalize on ETH's 3-6% daily volatility and $15-30B trading volume. But success depends entirely on your strategy, current market conditions, and active monitoring. Even the best bot can lose money in unfavorable conditions. Think of bots as tools that remove emotion and execute your plan precisely, not as guaranteed winners.

Technical setup takes minutes—connect your exchange API, choose a bot type, and you're running. The real challenge is strategic setup. Many beginners fail because they don't understand parameters like take profit levels, safety orders, or grid ranges. Start small and treat your first bot as a learning experience. Most platforms offer template strategies you can copy and adjust. The technical part is easy. Learning what settings work for ETH's volatility patterns takes practice and patience.

3Commas is non-custodial, meaning they never hold your funds. Your ETH stays on your exchange account—Binance, Kraken, Coinbase, wherever you trade. 3Commas only uses API keys to execute trades on your behalf. For maximum security, always disable withdrawal permissions when creating your API key. This means even if your API was compromised, nobody could withdraw your funds. The bot can only trade. You maintain full custody at all times through your exchange account.

Yes, you can run multiple bots simultaneously with different strategies. ETH's characteristics make it ideal for various approaches: Grid bots profit from sideways consolidation, DCA bots accumulate during dips for long-term holding, and Signal bots react to technical indicators or ecosystem news. You might run a Grid bot during ranging markets while a DCA bot builds your position. Each bot operates independently, so you can diversify your approach based on market conditions and your goals.

Obtén una prueba con acceso completo a todas las herramientas para operar ETH.