Meet the New 3Commas AI Assistant

24 nov 2025

Automatiza tus estrategias de trading de SOL para capitalizar las velocidades de transacción de subsegundos de Solana y tarifas de fracción de centavo. Ejecuta operaciones de alta frecuencia, captura oportunidades de arbitraje a través de plataformas DeFi, y responde instantáneamente a oscilaciones de volatilidad diarias del 5-15% que el trading manual simplemente no puede igualar. Tus fondos permanecen seguros en tu cuenta del exchange.

Un bot de trading de Solana es un software automatizado que ejecuta tus estrategias de trading de SOL las 24 horas. Reacciona instantáneamente a cambios del mercado basándose en tus configuraciones, lo cual es crucial dada la volatilidad de precio de Solana. El bot aprovecha las velocidades de transacción rápidas y tarifas mínimas de SOL para operar eficientemente. Con 3Commas, tus fondos permanecen en tu cuenta del exchange. Nos conectamos a través de claves API sin permisos de retiro, por lo que mantienes control completo de tus activos.

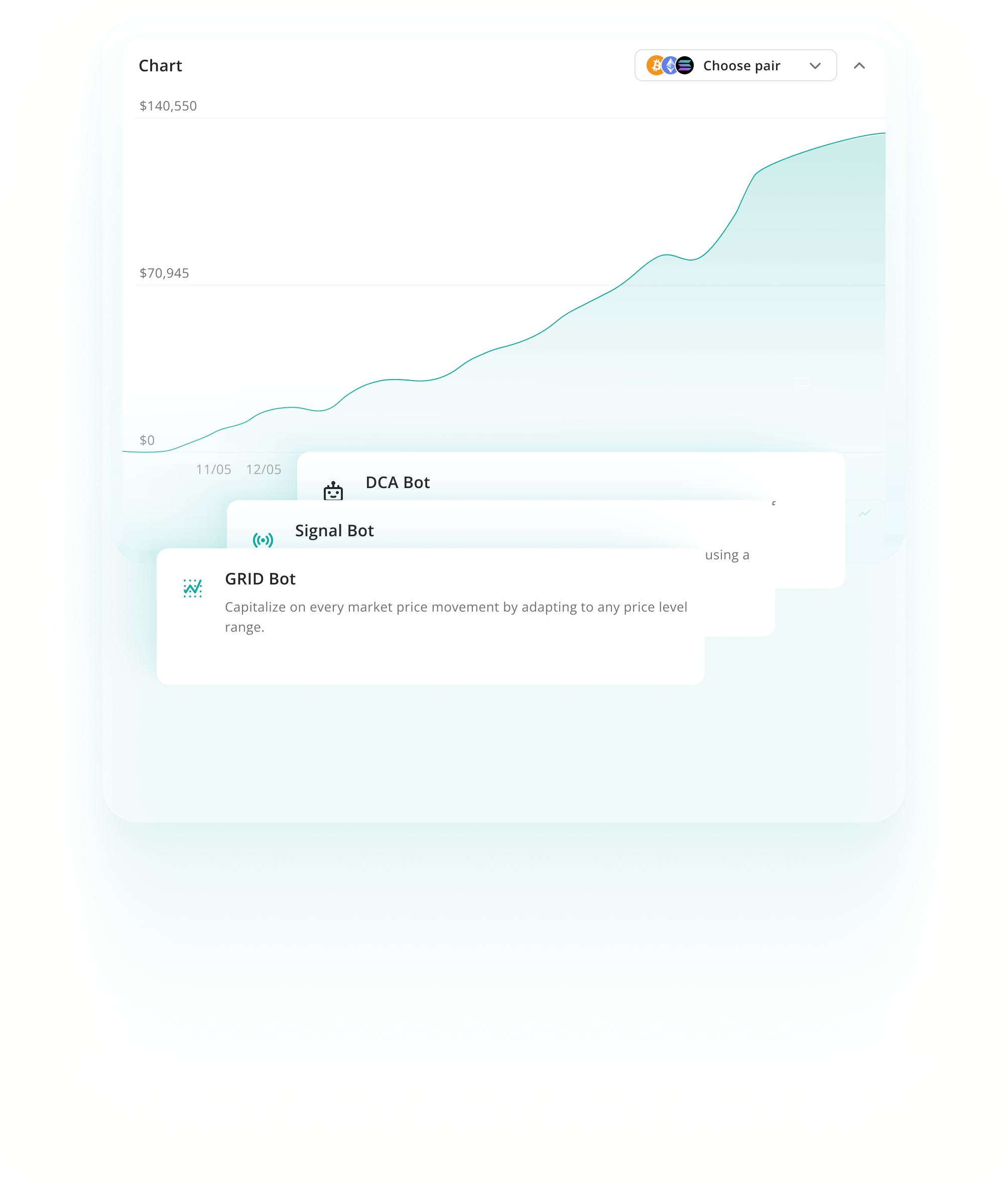

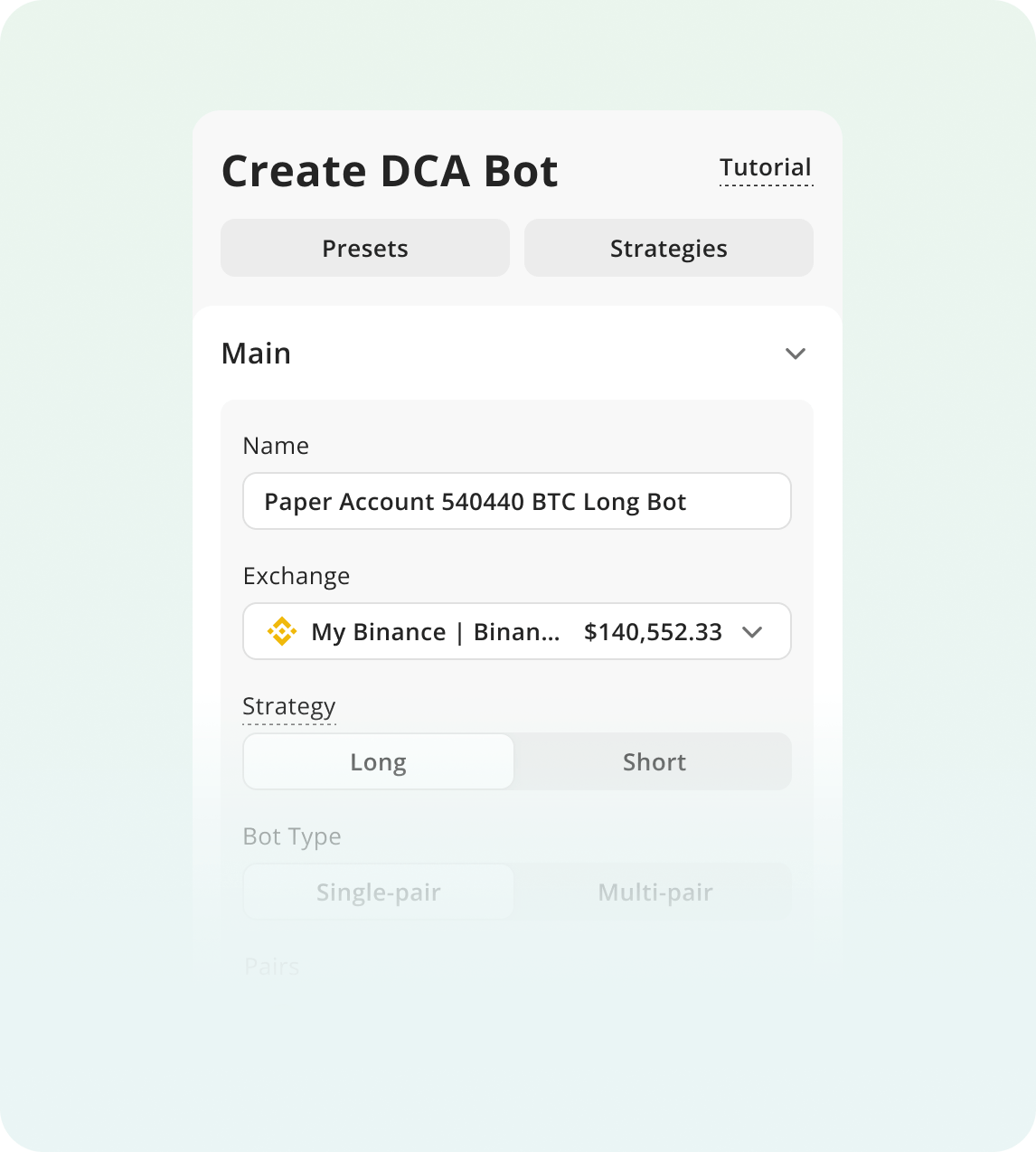

Los bots de Promediación del Costo en Dólares ejecutan compras sistemáticas a intervalos regulares o caídas de precio activadas, distribuyendo tu entrada a través de múltiples transacciones en lugar de una suma única. Este enfoque suaviza el precio de compra promedio durante períodos volátiles. La estrategia funciona particularmente bien con la tendencia de Solana a experimentar caídas bruscas del 20-30% seguidas de recuperaciones rápidas, permitiendo acumulación durante debilidad temporal.

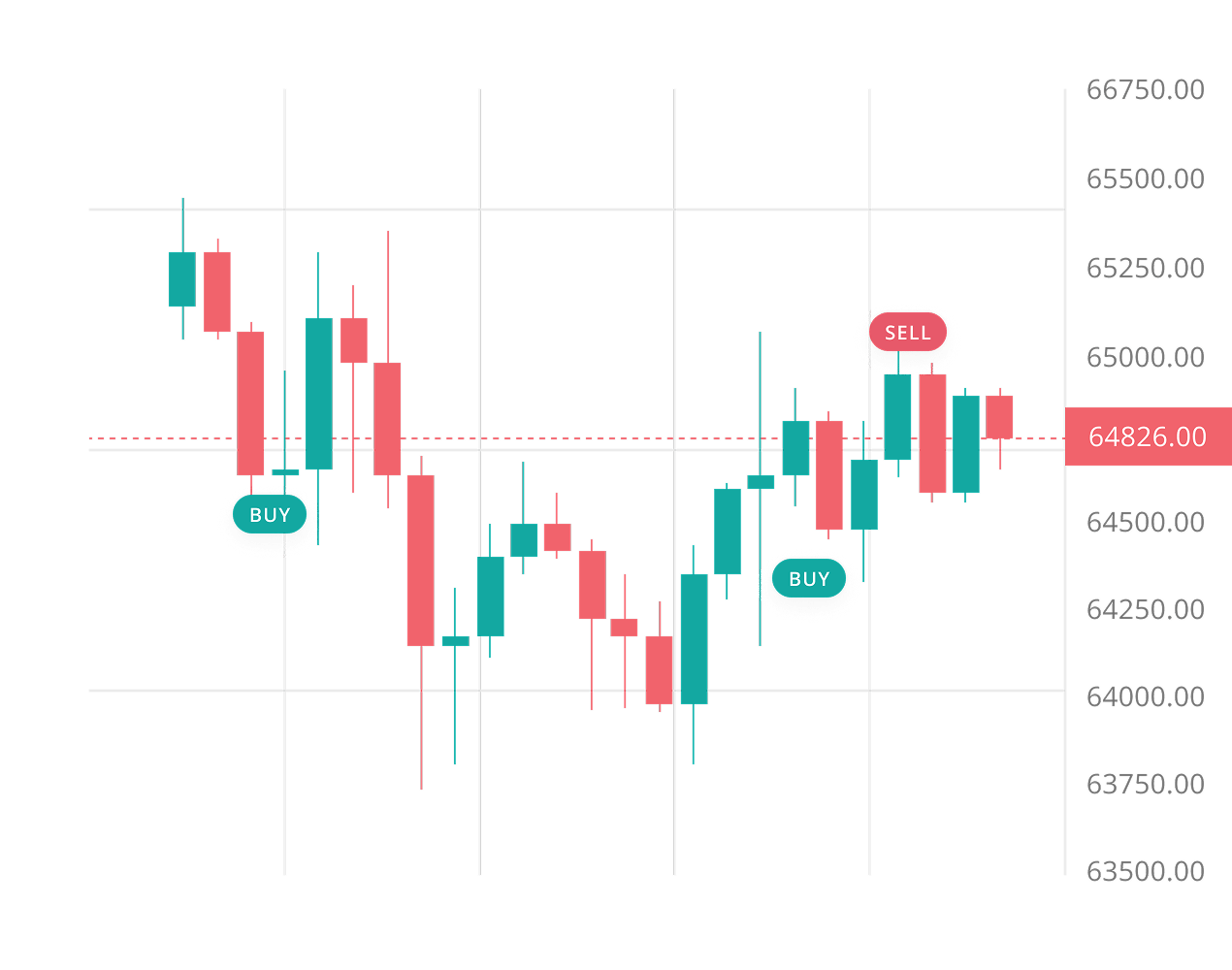

Ver másEste enfoque automatizado coloca múltiples órdenes de compra y venta a intervalos de precio predeterminados dentro de un rango definido. Captura ganancia de cada pequeño movimiento de precio mientras Solana oscila arriba y abajo. Mejor adaptado para fases de consolidación de SOL donde el precio opera lateralmente en canales amplios del 15-25% que pueden persistir por semanas o meses después de movimientos direccionales significativos.

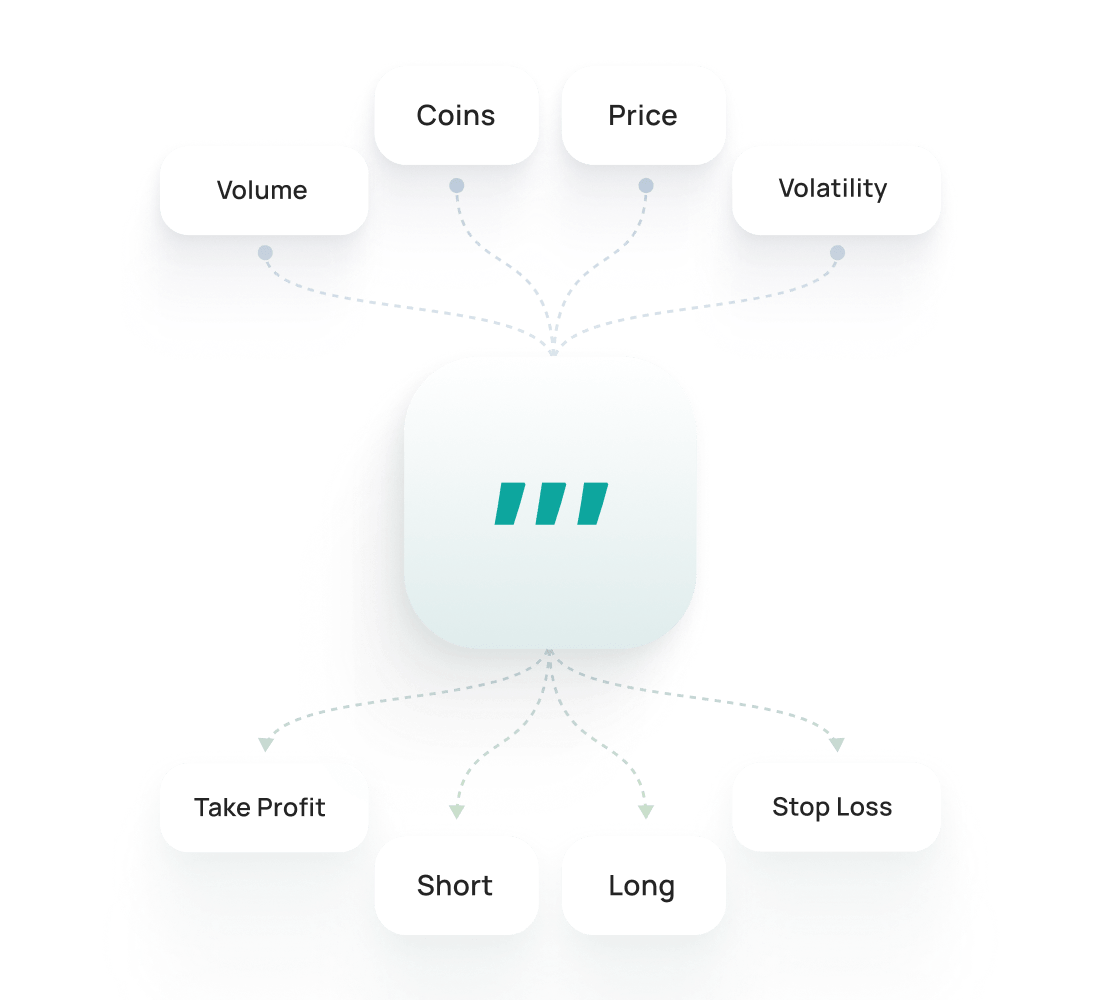

Ver másEstos bots ejecutan operaciones automáticamente cuando condiciones técnicas específicas de TradingView o indicadores personalizados se activan. Señales comunes incluyen cruces de promedios móviles, divergencias de RSI o confirmaciones de MACD. Esta estrategia sobresale con SOL porque el token demuestra fuerte capacidad de respuesta a patrones de análisis técnico, especialmente durante tendencias de momentum establecidas donde el timing de entrada y salida se vuelve crítico para capturar movimientos direccionales.

Ver másEl backtesting de Solana te permite probar estrategias con datos históricos para ver cómo podrían haber funcionado. Te ayuda a ajustar configuraciones, evaluar riesgos y ganar confianza antes de operar en vivo.

Ver másEl SmartTrade de Solana te ofrece opciones avanzadas de trading manual, como take-profit, stoploss, trailing y salidas con múltiples objetivos. Los Presets Públicos de Solana son estrategias listas de otros traders que puedes lanzar al instante o personalizar según tus necesidades.

Para empezar a operar con bots:

Regístrate en 3Commas y elige tu plan

Conecta un Exchange y elige la estrategia de tu bot.

Configura los parámetros de tu bot y ¡ponlo a funcionar!

SOL se mueve rápido. Una caída del 30% puede ocurrir durante la noche mientras duermes, como el crash de abril de 2024 de $175 a $122. El trading manual significa que pierdes oportunidades y tomas decisiones emocionales durante volatilidad. Nuestro bot monitorea mercados 24/7, elimina ventas de pánico y compras por FOMO, y protege tus posiciones con stop losses automáticos y órdenes de toma de ganancias. Estableces la estrategia una vez. El bot la ejecuta sin vacilación, incluso durante oscilaciones de precio salvajes.

El agregador DEX de Jupiter automáticamente te encuentra los mejores precios verificando liquidez a través de docenas de pools de trading de Solana simultáneamente.

Las tarifas de transacción cuestan fracciones de un centavo, lo que significa que puedes ejecutar estrategias rentables de arbitraje y scalping sin que las tarifas consuman tus ganancias.

El próximo cliente validador Firedancer elimina riesgos de punto único de falla y empuja la capacidad de red más allá de un millón de transacciones por segundo.

Establece stop losses más amplios de lo usual para tener en cuenta la volatilidad de SOL. Las oscilaciones diarias del 5-15% son normales, por lo que colocar stops demasiado ajustados te sacará durante acción de precio regular antes de que se desarrolle cualquier tendencia real.

Mantén tamaños de posición pequeños porque Solana conlleva riesgos técnicos únicos. La red ha experimentado interrupciones completas donde tu bot no puede ejecutar operaciones ni ajustar posiciones, dejándote expuesto durante movimientos críticos del mercado.

Monitorea cronogramas de liquidación del patrimonio de FTX y anuncios regulatorios de la SEC de cerca. Estos eventos externos crean presión de venta predecible e incertidumbre legal que puede desencadenar caídas de precio repentinas independientemente de señales técnicas.

Bots principales para trading spot en 1 exchange

$20/ mes

AI Assistant

Solo Spot

1

Claves API Activas

5

Bots DCA activos

2

Signal Bots activos

2

Grid Bots activos

20

Operaciones DCA activas

10

Active Signal Trades

10

SmartTrades activos

100

DCA Backtests

Período de 1 año

100

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Trading de spot y futures con múltiples cuentas

$50/ mes

AI Assistant

Spot y Futuros

3

Claves API Activas

20

Bots DCA activos

20

Signal Bots activos

10

Grid Bots activos

100

Operaciones DCA activas

100

Active Signal Trades

50

SmartTrades activos

500

DCA Backtests

Período de 2 años

500

GRID Backtests

Período de 4 meses

API para desarrolladores

Solo lectura

Ejecución de Pine Script®

Soporte por chat en vivo

Límites excepcionales y trading mediante API

$140/ mes

AI Assistant

Spot y Futuros

15

Claves API Activas

1K

Bots DCA activos

1K

Signal Bots activos

1K

Grid Bots activos

5K

Operaciones DCA activas

5K

Active Signal Trades

5K

SmartTrades activos

5K

DCA Backtests

historial complet

5K

GRID Backtests

Período de 4 meses

API para desarrolladores

Lectura y escritura

Ejecución de Pine Script®

Soporte prioritario por chat en vivo

Ejecuta tu estrategia Solana en Binance, Coinbase Advanced, Kraken y más de 12 exchanges compatibles a través de 3Commas. Conecta mediante una API segura, define entradas, salidas y el riesgo una sola vez, y deja que la automatización opere 24/7. Un solo espacio de trabajo para todas las plataformas significa registros más claros, iteraciones más rápidas y menos movimientos perdidos en tus pares de SOL.

El backtesting en 3Commas hace la vida mucho más fácil. Puedo probar ideas, ver qué funciona y evitar errores tontos, todo sin perder dinero. Compré el plan Expert para hacer más backtests.

Durante mucho tiempo utilicé una estrategia que consideraba rentable, pero a largo plazo iba perdiendo poco a poco. Con la ayuda de la función de backtesting de 3Commas, me di cuenta de que solo necesitaba hacer pequeños cambios en la estrategia para volverme un trader rentable.

He estado con 3Commas durante un par de años y sus bots potentes, una vez que entiendes su mecánica, pueden generar buenos rendimientos con mínimo riesgo (si sabes lo que haces, puedes sacar un 15–30% anual con poco riesgo y sin apalancamiento). Puedes ganar dinero mientras duermes y seguir aprendiendo mientras avanzas.

El equipo siempre está disponible, centrado en las necesidades del cliente, mejorando la app y el sitio web, y adaptándose a todos los cambios. ¡Un trabajo realmente excelente!

He usado otros bots de trading, pero este es mucho mejor, y puedo controlar mis pérdidas y maximizar las ganancias mucho mejor. Seguiré utilizándolo cada vez más.

Soy nuevo en el trading de criptomonedas y he podido usar 3Commas fácilmente. Aprendí mucho con paper trading y me siento seguro usando el sitio.

2,0 M

Traders registrados

Valorado como Excelente en

1,479 reseñas

Reseñas de Google

4.0

Depende de tus objetivos y condiciones del mercado. Los bots no garantizan ganancias—automatizan estrategias de trading que capturan volatilidad a corto plazo. Las oscilaciones diarias frecuentes del 5-15% de Solana crean oportunidades que HODLear pierde, pero también amplifican pérdidas si los mercados se mueven en tu contra. La verdadera ventaja es eficiencia: los bots ejecutan tu estrategia 24/7 sin decisiones emocionales. El éxito requiere gestión de riesgos adecuada, expectativas realistas y entender que ninguna estrategia funciona en todas las condiciones. Piensa en ello como trading activo sin el tiempo constante de pantalla.

La configuración inicial toma 15-30 minutos: conecta tu exchange vía API, elige una plantilla de estrategia y establece tus parámetros de riesgo. Los principiantes a menudo se sienten abrumados por configuraciones de cuadrícula y rangos de precio—comienza con preajustes conservadores en lugar de optimizar todo inmediatamente. Una vez funcionando, revisa tu bot cada pocos días para ajustar por cambios importantes del mercado. La volatilidad de SOL significa que querrás monitorear la estabilidad de red durante períodos de interrupción conocidos. No es ingreso pasivo, pero es mucho menos demandante que el trading manual mientras captura oportunidades que de otra forma perderías.

3Commas es no custodial—nunca mantenemos tus fondos. Tu cripto permanece en tu cuenta del exchange en todo momento. Las claves API solo otorgan permisos de trading, no acceso de retiro, lo cual deshabilitas explícitamente durante la configuración. El peor escenario con configuración adecuada: un bot hace operaciones que no querías, pero tus fondos permanecen seguros en el exchange. No podemos retirar, transferir o acceder a tus activos. Piensa en las claves API como llaves de valet de auto—nos dejan conducir pero no poseer tu auto. Siempre verifica que los permisos de retiro estén deshabilitados.

3Commas soporta múltiples estrategias optimizadas para las características de SOL. Los bots Grid colocan órdenes de compra y venta a intervalos establecidos, obteniendo ganancias de volatilidad. Los bots DCA promedian en posiciones durante caídas. Estrategias adyacentes a HODL como trailing de toma de ganancias capturan alza mientras protegen ganancias. Las bajas tarifas de transacción de SOL hacen viable el trading de cuadrícula de alta frecuencia, a diferencia de cadenas costosas. Puedes ejecutar arbitraje entre DEXs de Solana y exchanges centralizados, o desplegar señales personalizadas de indicadores técnicos. Cada estrategia se adapta a diferentes condiciones del mercado—mercados en rango favorecen cuadrículas, mientras mercados en tendencia funcionan mejor con órdenes de seguimiento.

Obtén una prueba con acceso completo a todas las herramientas para operar SOL.