Meet the New 3Commas AI Assistant

Nov 24, 2025

Automatize sua estratégia de negociação AVAX com execução precisa em uma das blockchains mais rápidas do cripto. A finalidade subsegunda da Avalanche garante que seu bot capture oportunidades de oscilações frequentes de preço de 5-10% sem erros emocionais. Forte liquidez e atividade constante do ecossistema de subnets criam condições ideais para negociação automatizada que responde mais rápido do que execução manual jamais poderia.

Um bot de trading AVAX é um software automatizado que executa negociações em seu nome usando regras predefinidas. Ele funciona como um sistema simples de "se isso acontecer, faça aquilo", operando 24 horas por dia sem ficar cansado ou emocional. O bot aproveita as velocidades de transação subsegunda e alta volatilidade da Avalanche para executar negociações rápida e eficientemente. Com o 3Commas, seus fundos permanecem seguros em sua exchange porque usamos uma abordagem não-custodial. Nos conectamos através de chaves API que não têm permissões de saque, então você mantém controle total do seu dinheiro.

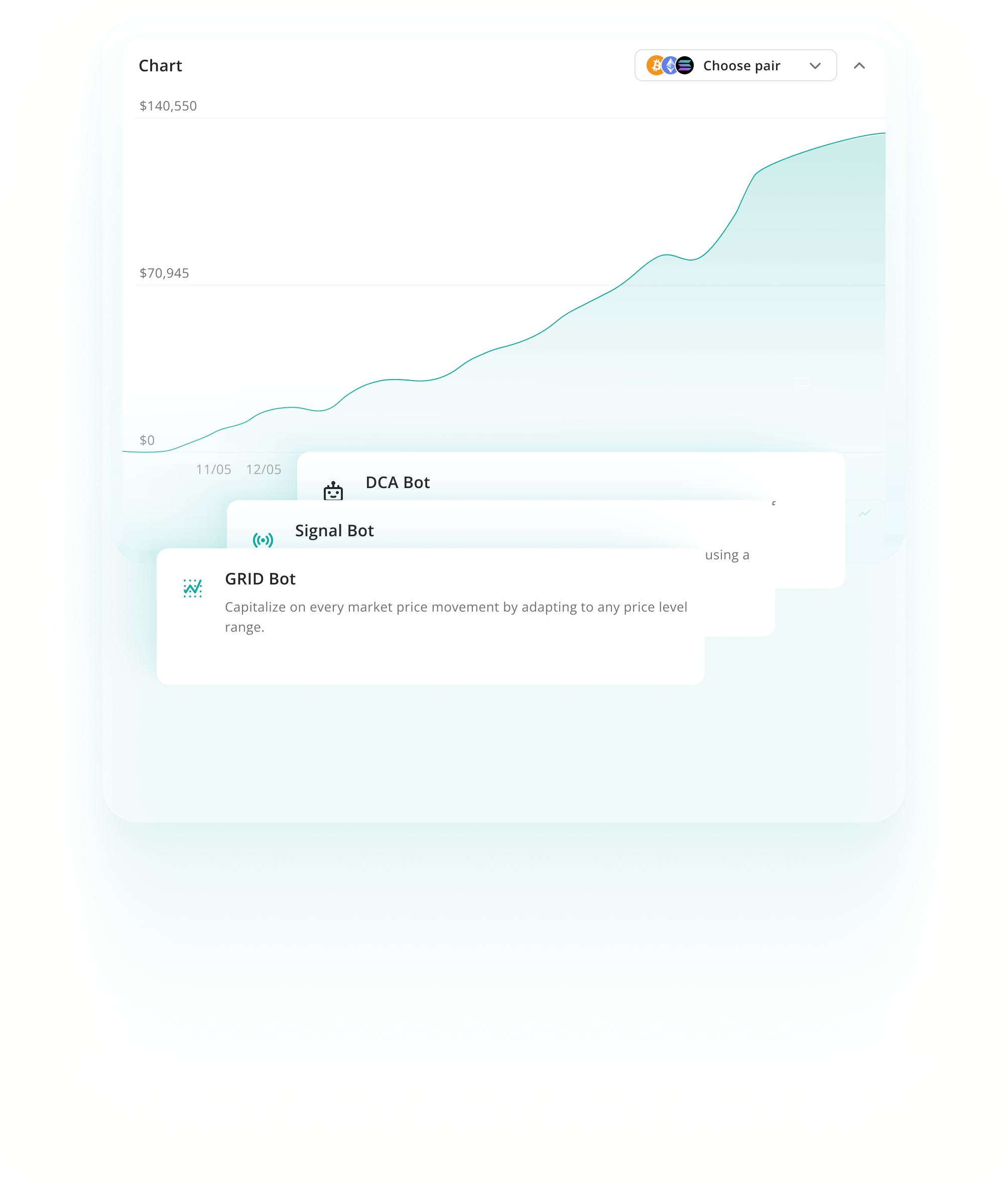

Bots de dollar cost averaging dividem compras em ordens menores acionadas por quedas de preço, baixando sua entrada média. Isso funciona excepcionalmente bem com a natureza volátil da Avalanche, onde pullbacks de 15-20% são comuns mesmo durante períodos de alta. A estratégia reduz risco de timing enquanto constrói posições durante fraqueza temporária.

Saiba maisGrid bots colocam múltiplas ordens de compra e venda em intervalos definidos dentro de uma faixa de preço, lucrando com cada rebote. AVAX regularmente consolida em canais de 20-30% após movimentos acentuados, criando condições ideais. O bot captura lucros em testes repetidos de fronteiras sem exigir timing perfeito ou monitoramento constante.

Saiba maisBots de sinal executam negociações automaticamente quando indicadores técnicos atendem condições predefinidas do TradingView ou alertas personalizados. AVAX responde previsivelmente a sinais de momentum como rebotes RSI de sobrevenda e cruzamentos de médias móveis. Uma vez que tendências se estabelecem, Avalanche tipicamente sustenta movimentos direcionais, tornando sinais técnicos particularmente confiáveis para execução automatizada.

Saiba maisO Backtesting de Avalanche permite testar estratégias com dados históricos para ver como elas poderiam ter se saído. Ajuda a ajustar configurações, avaliar riscos e construir confiança antes de operar ao vivo.

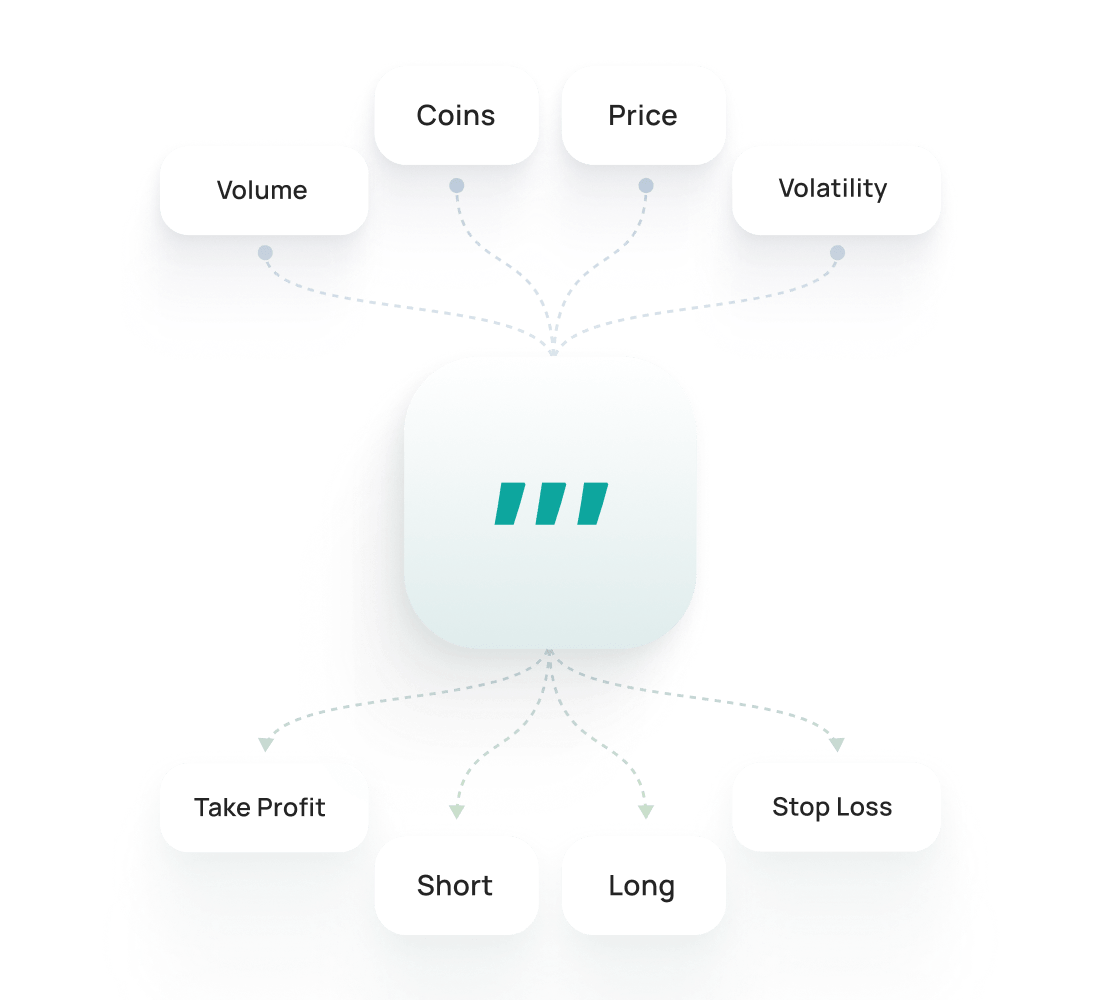

Saiba maisO Avalanche SmartTrade oferece opções avançadas de negociação manual como take-profit, stop-loss, trailing e saídas em múltiplos alvos. O Avalanche Public Presets são estratégias prontas de outros traders que você pode usar instantaneamente ou personalizar conforme sua necessidade.

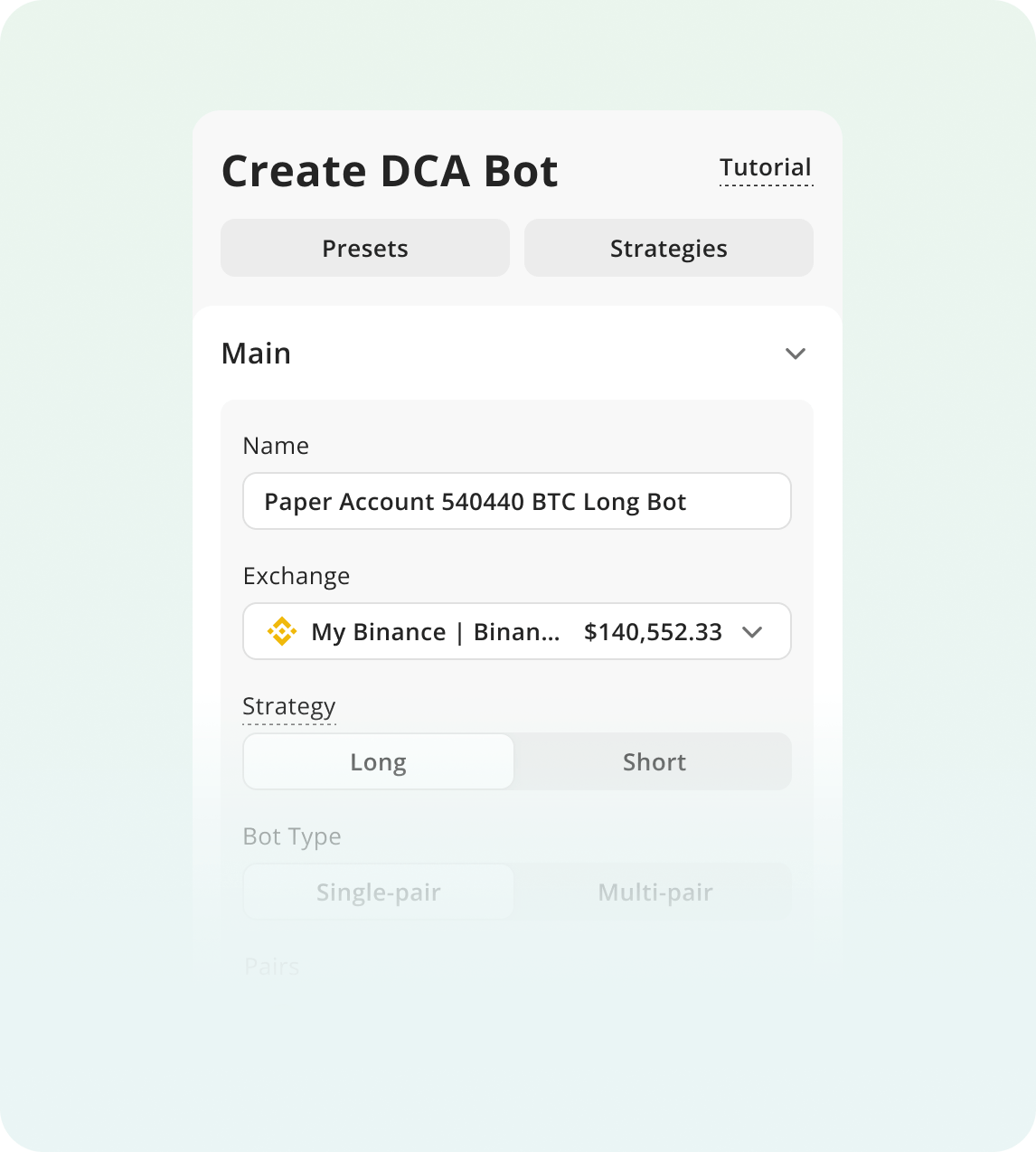

Para começar a negociar com bots:

Cadastre-se na 3Commas e escolha seu plano

Conecte uma Exchange e escolha a estratégia do seu bot.

Configure os parâmetros do seu bot e coloque para rodar!

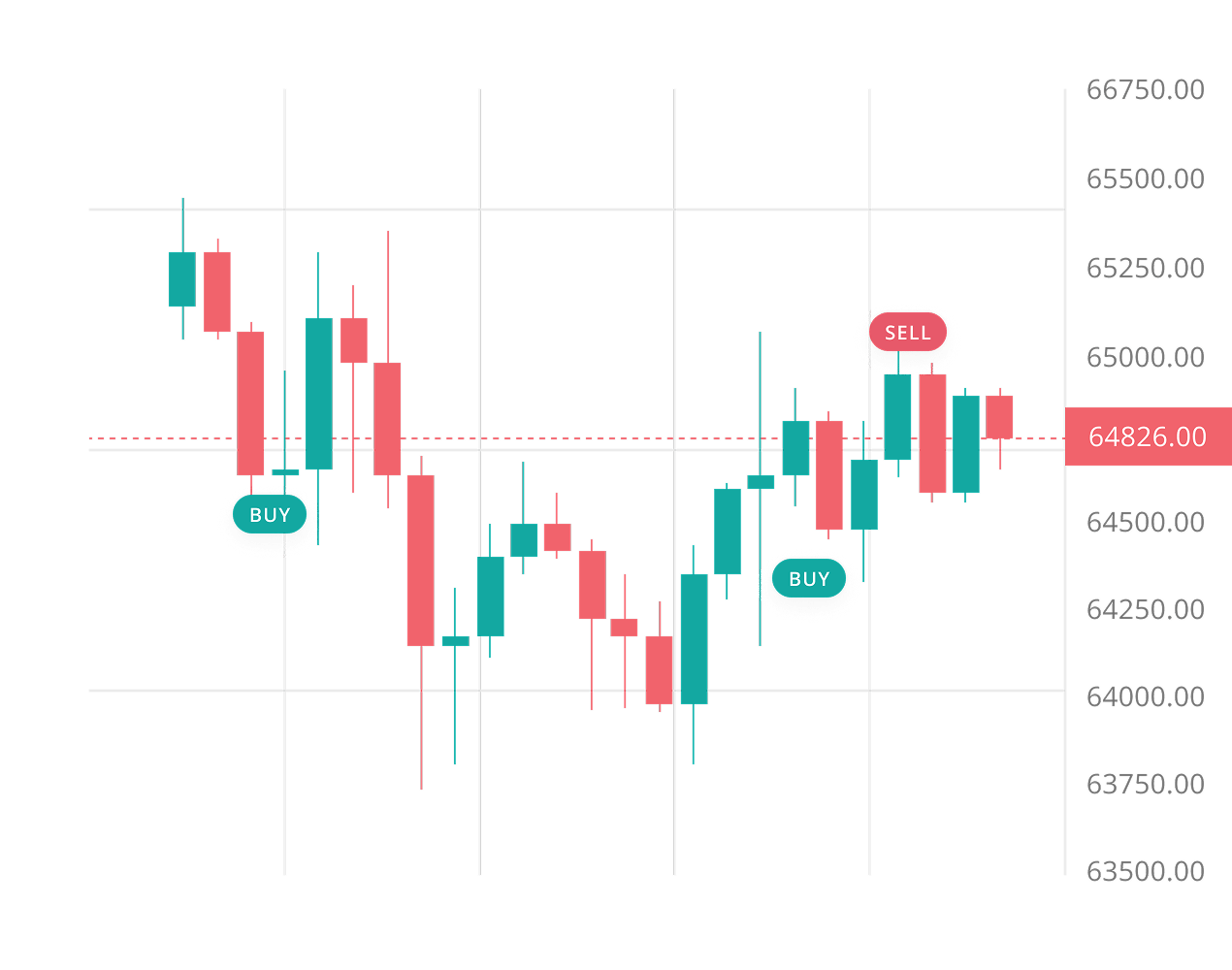

AVAX oscila 5-10% diariamente, criando oportunidades mas desencadeando erros emocionais. Anúncios de subnets provocam rallies repentinos e correções acentuadas que prendem compradores FOMO em picos. Traders manuais perdem movimentos noturnos ou vendem em pânico durante quedas. O bot Avalanche monitora mercados 24/7 sem emoção, executando sua estratégia consistentemente. Trailing Stop Loss trava lucros automaticamente conforme preço sobe, enquanto Take Profit captura ganhos antes de reversões. Automação remove medo e ganância de suas decisões de negociação.

Lançamentos de subnets por grandes empresas criam catalisadores de mercado previsíveis que traders podem se posicionar antes de anúncios.

AVAX serve como gás obrigatório para um ecossistema DeFi próspero, gerando pressão de compra consistente além de negociação especulativa.

Forte liquidez através de exchanges centralizadas e DEXs nativos permite que você execute ordens maiores sem derrapagem significativa.

Defina stop losses mais amplos que o usual para acomodar oscilações diárias de 5 a 10% do AVAX. Stops apertados são acionados facilmente demais neste mercado volátil.

Observe o cronograma de desbloqueio trimestral de tokens de perto. Quando 9+ milhões de tokens AVAX atingem o mercado, espere quedas temporárias de preço e ajuste suas posições de acordo.

Mantenha sua alocação Avalanche abaixo de 20% do seu portfólio cripto total. Diversificação importa mais com ativos voláteis como AVAX, mesmo se o potencial de alta parecer tentador.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active API Keys

5

Active DCA Bots

2

Active Signal Bots

2

Active Grid Bots

20

Active DCA Trades

10

Active Signal Trades

10

Active SmartTrades

100

DCA Backtests

1 year period

100

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active API Keys

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

100

Active DCA Trades

100

Active Signal Trades

50

Active SmartTrades

500

DCA Backtests

2 years period

500

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$140/ month

AI Assistant

Spot & Futures

15

Active API Keys

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active DCA Trades

5K

Active Signal Trades

5K

Active SmartTrades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Execute sua estratégia Avalanche na Binance, Coinbase Advanced, Kraken e mais de 12 outras exchanges suportadas via 3Commas. Conecte via API segura, defina entradas, saídas e riscos uma única vez e deixe a automação rodar 24/7. Um só workspace para todos os ativos significa registros mais limpos, iteração mais rápida e menos oportunidades perdidas nos seus pares de AVAX.

O Backtesting na 3Commas facilita muito a vida. Posso testar ideias, ver o que funciona e evitar erros bobos — tudo sem perder dinheiro. Eu comprei o plano Expert para realizar mais testes.

Por muito tempo usei uma estratégia que considerava lucrativa, mas ao longo do tempo estava perdendo dinheiro devagar. Com o recurso de backtest da 3Commas percebi que só precisava de pequenos ajustes na estratégia para me tornar lucrativo.

Uso a 3Commas há alguns anos e os bots da plataforma, depois que você aprende como funcionam, oferecem retornos interessantes com pouco risco (se você sabe o que está fazendo, é possível conseguir 15–30% ao ano com pouco risco e sem alavancagem). Dá para ganhar dinheiro enquanto dorme e aprender cada vez mais.

O time está sempre disponível, focado nas necessidades do cliente, melhorando o app e o site, e se adaptando às novidades. Trabalho excelente!

Já usei outros bots de negociação, mas esse é bem melhor: consigo controlar perdas e maximizar ganhos com mais facilidade. Vou continuar usando cada vez mais.

Sou novo no mercado cripto e consegui usar o 3Commas facilmente. Aprendi muito com a negociação em modo simulação e me sinto seguro usando a plataforma.

2,0M

Traders cadastrados

Avaliado como Ótimo em

1.479 avaliações

Avaliações Google

4.0

Lucros dependem inteiramente de condições de mercado, sua estratégia e configurações de risco—não há garantias. A alta volatilidade do AVAX cria oportunidades de negociação frequentes, mas também risco. O principal benefício é automação: bots executam sua estratégia 24/7 sem decisões emocionais. Você deve revisar desempenho regularmente e ajustar configurações quando condições de mercado mudarem, mas não precisará observar gráficos constantemente ou colocar cada negociação manualmente.

A configuração inicial leva algum aprendizado, mas o 3Commas torna isso direto. Você conectará sua exchange via API, escolherá um tipo de bot e configurará parâmetros básicos. Estratégias predefinidas e templates ajudam você a começar rapidamente sem construir do zero. Sim, você precisará entender conceitos como níveis de take-profit e stop-losses, mas a interface guia você através de cada etapa. A maioria dos usuários tem seu primeiro bot funcionando em uma hora.

O 3Commas nunca detém sua criptomoeda—é completamente não-custodial. Seus fundos permanecem em sua conta da exchange o tempo todo. As chaves API que você cria apenas concedem permissões de negociação, nunca direitos de saque. Isso significa que o 3Commas pode executar negociações em seu nome mas não pode transferir fundos para fora de sua conta. Você mantém custódia total. Sempre habilite recursos de segurança API como whitelisting de IP para camadas adicionais de proteção.

AVAX combina alta volatilidade com finalidade quase instantânea abaixo de dois segundos, permitindo que bots executem múltiplas estratégias rapidamente com risco mínimo de execução. Sua arquitetura de subnets cria catalisadores de mercado regulares e oportunidades de negociação. Forte liquidez como uma criptomoeda top-20 garante execução suave de ordens. Grid bots prosperam durante fases frequentes de consolidação do AVAX, enquanto bots DCA capitalizam em padrões de volatilidade suportados por fundamentos sólidos.

Obtenha o teste com acesso total a todas as ferramentas de negociação AVAX.