Turn Price Levels on Your Chart into a Profit-Making Bot Setup

Mar 10, 2026

Automatize suas estratégias de negociação ALGO em uma rede construída para confiabilidade. A finalidade de transação de 3,3 segundos da Algorand e taxas de 0,001 ALGO criam condições previsíveis para execução de bot. Conecte via chaves API seguras sem conceder direitos de saque, permitindo que a automação capture oportunidades nas faixas de volatilidade diária de 3-8% da Algorand.

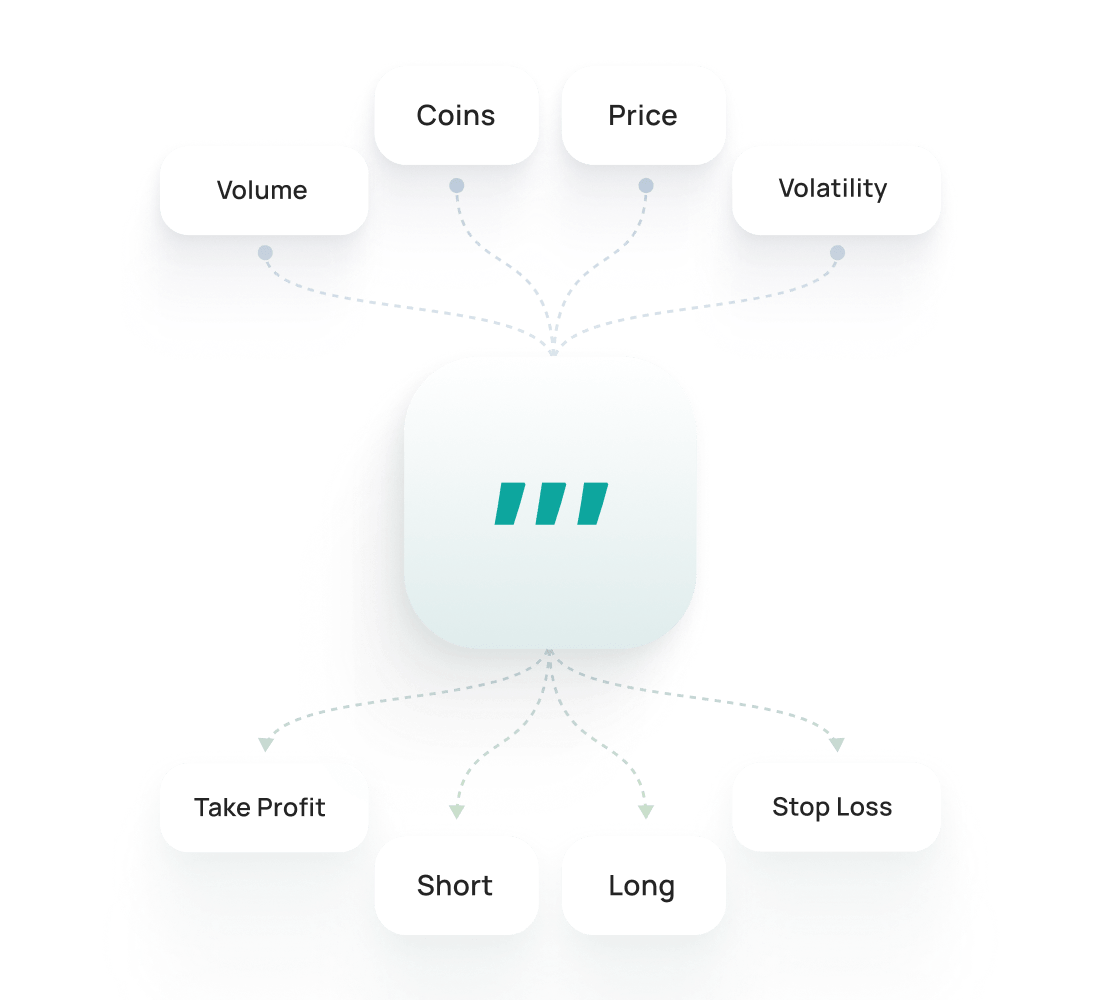

Um bot de trading Algorand é um software automatizado que compra e vende ALGO com base em estratégias predefinidas. Ele funciona 24/7 sem decisões emocionais. O bot aproveita a finalidade de transação instantânea e taxas ultra-baixas da Algorand para executar negociações rapidamente e eficientemente. O 3Commas usa chaves API que habilitam negociação mas não podem sacar fundos. Seus ativos permanecem seguros em sua exchange. A automação ajuda você a responder aos movimentos de preço da ALGO 24 horas por dia.

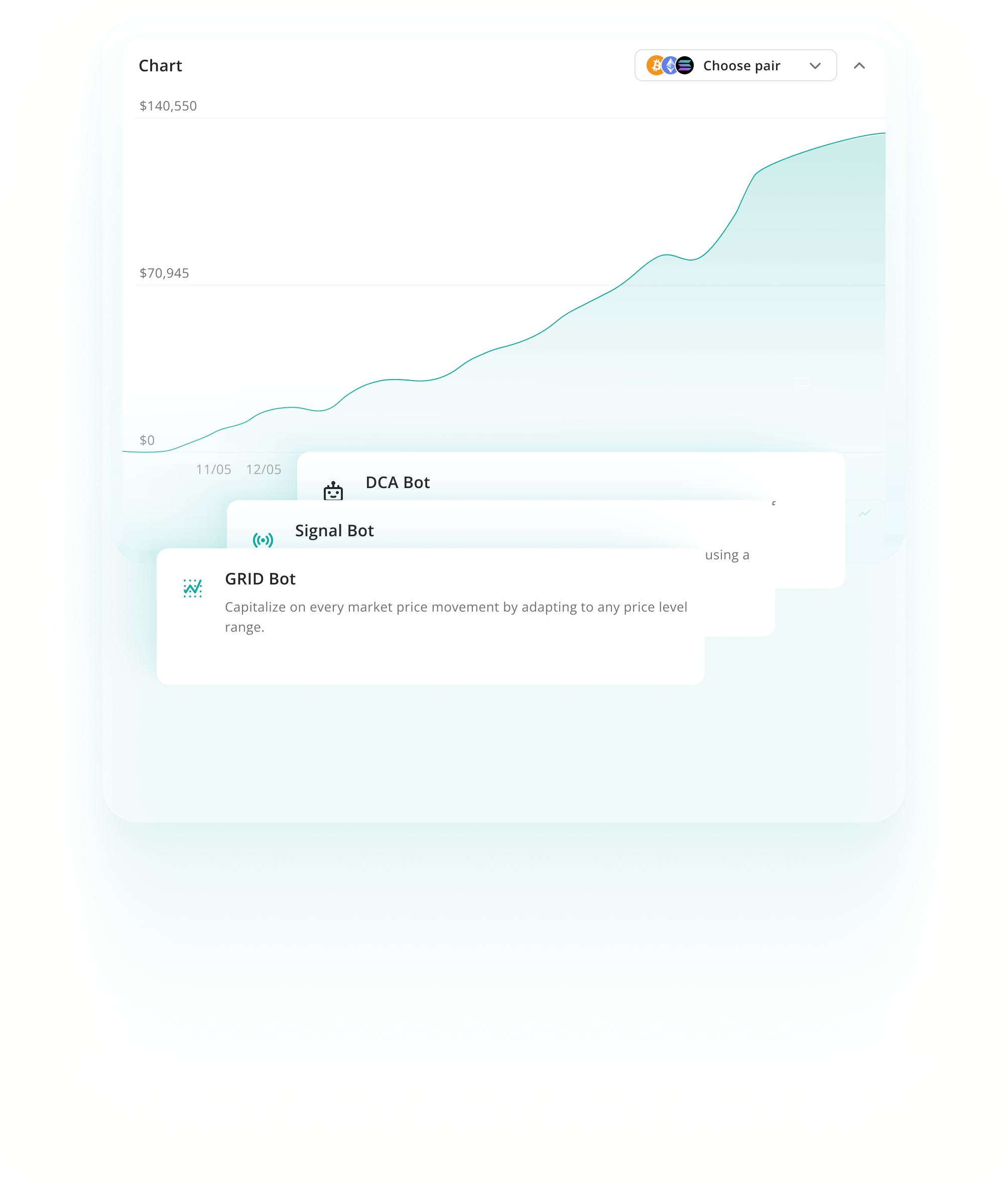

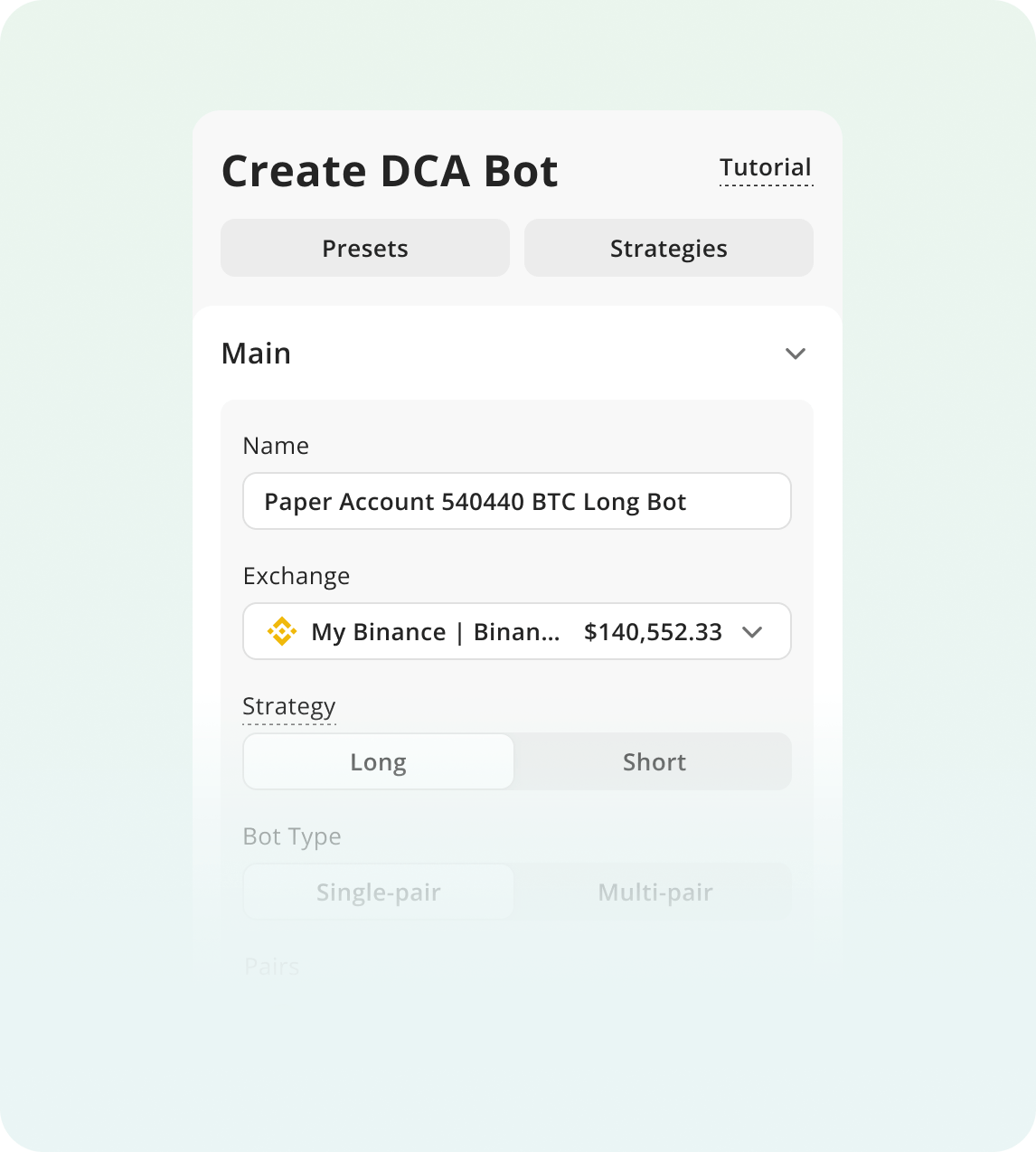

Bots de dollar cost averaging distribuem compras através de múltiplos intervalos de tempo para reduzir o impacto da volatilidade. Em vez de entrar em um ponto de preço, o bot compra em estágios durante quedas. Essa abordagem funciona bem com as oscilações diárias frequentes de 3-8% da ALGO e movimentos periódicos maiores.

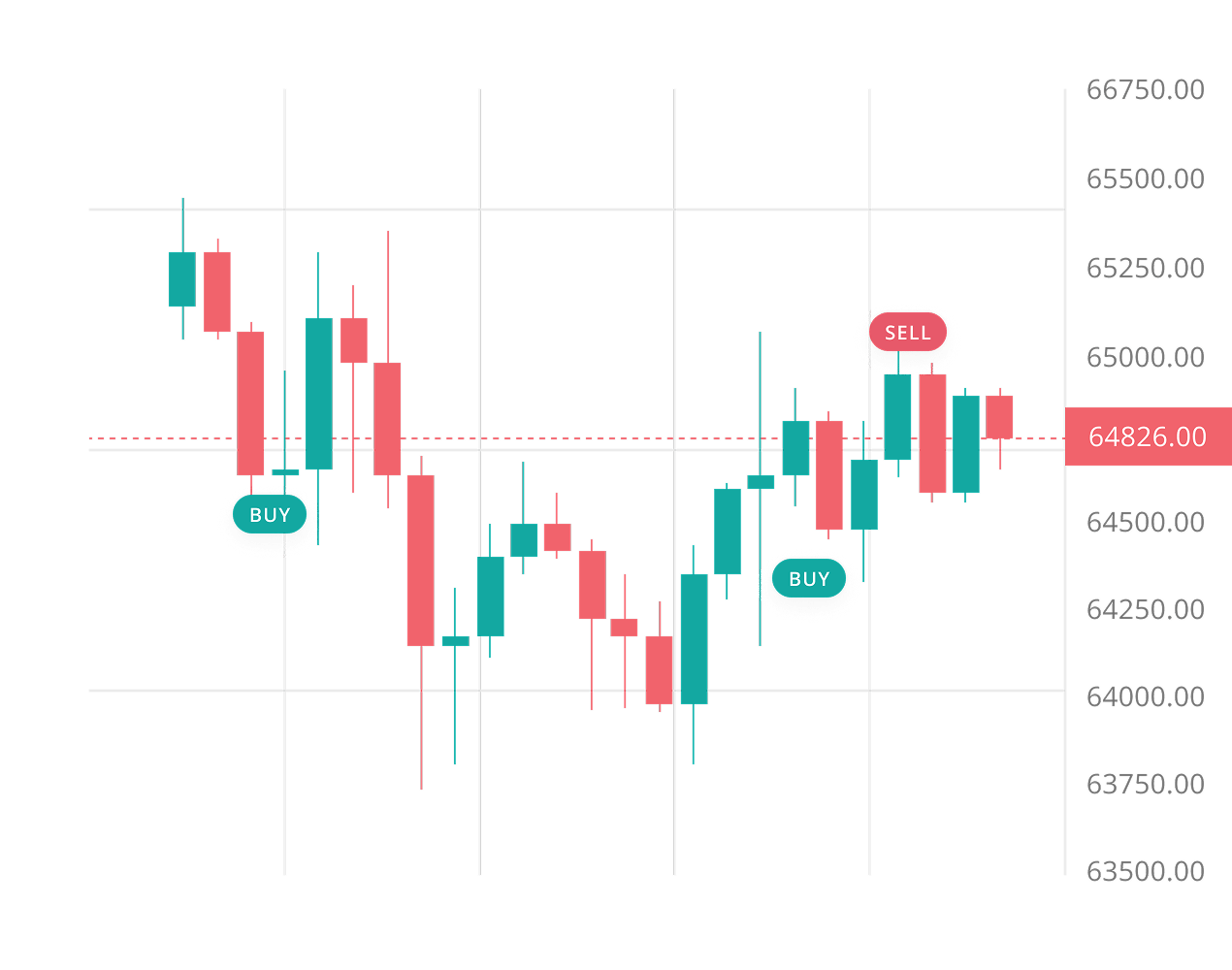

Saiba maisGrid bots colocam ordens de compra e venda automatizadas em intervalos predefinidos acima e abaixo do preço atual. Eles lucram com ação de preço lateral comprando baixo e vendendo alto repetidamente. A liquidez consistente e canais de faixas bem definidos da Algorand a tornam adequada para grid trading durante períodos de consolidação.

Saiba maisBots de sinal executam negociações automaticamente com base em indicadores técnicos como RSI, MACD e médias móveis. Eles removem emoção da negociação seguindo regras predeterminadas. Esses bots têm melhor desempenho durante tendências fortes da Algorand quando sinais técnicos fornecem orientação direcional mais clara para pontos de entrada e saída.

Saiba maisO Backtesting de Algorand permite testar estratégias com dados históricos para ver como elas poderiam ter se saído. Ajuda a ajustar configurações, avaliar riscos e construir confiança antes de operar ao vivo.

Saiba maisO Algorand SmartTrade oferece opções avançadas de negociação manual como take-profit, stop-loss, trailing e saídas em múltiplos alvos. O Algorand Public Presets são estratégias prontas de outros traders que você pode usar instantaneamente ou personalizar conforme sua necessidade.

Para começar a negociar com bots:

Cadastre-se na 3Commas e escolha seu plano

Conecte uma Exchange e escolha a estratégia do seu bot.

Configure os parâmetros do seu bot e coloque para rodar!

Mercados ALGO nunca dormem, mas você sim. A finalidade relâmpago de 3,3 segundos da Algorand significa que oscilações de preço acontecem instantaneamente, frequentemente enquanto você está offline. Um bot monitora cada movimento 24 horas por dia, executando negociações baseadas em sua estratégia em vez de pânico ou FOMO. Ele protege suas posições com Trailing Stop Loss e ordens Take Profit automáticas, removendo as decisões emocionais que drenam contas. Com taxas de transação abaixo de uma fração de um centavo, seu bot pode trabalhar incansavelmente sem custos comendo seus resultados.

A finalidade de 3,3 segundos da ALGO significa que seu bot executa negociações com zero risco de reversões de transação ou forks de blockchain.

Taxas fixas de 0,001 ALGO por transação permitem que você execute estratégias de alta frequência sem comer seus lucros.

O Pure Proof-of-Stake da Algorand entrega desempenho de rede consistente, então suas negociações automatizadas executam exatamente quando deveriam.

Defina stop losses mais amplos que 8-10% para acomodar a volatilidade diária típica da ALGO, especialmente durante alta atividade de mercado quando oscilações podem atingir 20% ou mais.

Monitore anúncios da Fundação Algorand e cronogramas de desbloqueio de tokens de perto, pois esses eventos frequentemente desencadeiam movimentos de preço significativos e aumento de pressão de venda.

Mantenha tamanhos de posição conservadores dada a incerteza regulatória da ALGO com a SEC e pressão competitiva de outras blockchains Layer 1 como Ethereum e Solana.

Bots principais para trading Spot em 1 exchange

$20/ mês

Assistente de IA

Apenas Spot

1

Chaves API Ativas

5

Bots de DCA em Funcionamento

2

Active Signal Bots

2

Active Grid Bots

20

Negociações ativas de DCA

10

Negociações ativas de Signal

10

SmartTrades Ativas

100

Backtests de DCA

Período de 1 ano

100

Backtests de GRID

Período de 4 months

API para desenvolvedores

Somente leitura

Execução de Pine Script®

Suporte via chat ao vivo

Trading Spot e Futuros com múltiplas contas

$50/ mês

Assistente de IA

Spot e Futuros

3

Chaves API Ativas

20

Bots de DCA em Funcionamento

20

Bots de Signal em Funcionamento

10

Bots de Grid em Funcionamento

100

Negociações ativas de DCA

100

Negociações ativas de Signal

50

SmartTrades Ativas

500

Backtests de DCA

Período de 2 years

500

Backtests de GRID

Período de 4 months

API para desenvolvedores

Somente leitura

Execução de Pine Script®

Suporte via chat ao vivo

Limites excepcionais e trading via API

$140/ mês

Assistente de IA

Spot e Futuros

15

Chaves API Ativas

1K

Bots de DCA em Funcionamento

1K

Bots de Signal em Funcionamento

1K

Bots de Grid em Funcionamento

5K

Negociações ativas de DCA

5K

Negociações ativas de Signal

5K

SmartTrades Ativas

5K

Backtests de DCA

Histórico completo

5K

Backtests de GRID

Período de 4 months

API para desenvolvedores

Leitura e escrita

Execução de Pine Script®

Suporte prioritário via chat ao vivo

Execute sua estratégia Algorand na Binance, Coinbase Advanced, Kraken e mais de 12 outras exchanges suportadas via 3Commas. Conecte via API segura, defina entradas, saídas e riscos uma única vez e deixe a automação rodar 24/7. Um só workspace para todos os ativos significa registros mais limpos, iteração mais rápida e menos oportunidades perdidas nos seus pares de ALGO.

O Backtesting na 3Commas facilita muito a vida. Posso testar ideias, ver o que funciona e evitar erros bobos — tudo sem perder dinheiro. Eu comprei o plano Expert para realizar mais testes.

Por muito tempo usei uma estratégia que considerava lucrativa, mas ao longo do tempo estava perdendo dinheiro devagar. Com o recurso de backtest da 3Commas percebi que só precisava de pequenos ajustes na estratégia para me tornar lucrativo.

Uso a 3Commas há alguns anos e os bots da plataforma, depois que você aprende como funcionam, oferecem retornos interessantes com pouco risco (se você sabe o que está fazendo, é possível conseguir 15–30% ao ano com pouco risco e sem alavancagem). Dá para ganhar dinheiro enquanto dorme e aprender cada vez mais.

O time está sempre disponível, focado nas necessidades do cliente, melhorando o app e o site, e se adaptando às novidades. Trabalho excelente!

Já usei outros bots de negociação, mas esse é bem melhor: consigo controlar perdas e maximizar ganhos com mais facilidade. Vou continuar usando cada vez mais.

Sou novo no mercado cripto e consegui usar o 3Commas facilmente. Aprendi muito com a negociação em modo simulação e me sinto seguro usando a plataforma.

2,0M

Traders cadastrados

Avaliado como Ótimo em

1.479 avaliações

Avaliações Google

4.0

Não, bots de trading ALGO não garantem lucro. Toda negociação de criptomoeda envolve risco, e condições de mercado podem mudar rapidamente. No entanto, ferramentas de negociação automatizadas ajudam você a executar estratégias consistentemente sem tomada de decisão emocional. A finalidade instantânea e taxas ultra-baixas da Algorand criam um ambiente de negociação previsível que reduz custos. Bots se destacam em gerenciamento de risco através de recursos como stop-losses, alvos take-profit e dimensionamento de posição. Eles automatizam disciplina, não sucesso. Seus resultados dependem de qualidade de estratégia, condições de mercado e configuração adequada.

Configurar um bot ALGO no 3Commas não requer conhecimento de codificação. O processo leva 10-15 minutos: crie uma conta, conecte sua exchange via chaves API e configure sua estratégia escolhida usando templates predefinidos ou parâmetros personalizados. A plataforma oferece interfaces amigáveis para iniciantes com fluxos de configuração guiados. Você selecionará seu tipo de estratégia (DCA, Grid ou Signal), definirá seus parâmetros de risco e ativará o bot. A rede estável e taxas baixas da Algorand a tornam ideal para testar estratégias com custo mínimo enquanto você aprende a plataforma.

Sim, porque o 3Commas é não-custodial—seus fundos nunca saem de sua conta da exchange. Quando você cria chaves API, você especificamente desabilita permissões de saque, o que significa que o bot só pode executar negociações, não mover ativos para fora da exchange. Sua criptomoeda permanece em sua carteira da exchange sob seu controle. O 3Commas não pode acessar seus fundos. Melhores práticas incluem habilitar whitelisting de IP, usar apenas permissões de leitura e negociação, e armazenar chaves API com segurança. Você mantém custódia total enquanto o bot automatiza a execução de sua estratégia de negociação em pares Algorand.

Sim, você pode executar múltiplos bots simultaneamente com estratégias diferentes em suas posições Algorand. Muitos traders combinam bots DCA para acumulação de ALGO de longo prazo, bots Grid para captura de lucro em faixas e bots Signal para oportunidades de seguimento de tendência. Cada bot opera independentemente com parâmetros e alocação de capital separados. A finalidade de 3,3 segundos e taxas de 0,001 ALGO da Algorand tornam a execução de múltiplas estratégias econômica. Essa abordagem diversifica sua execução tática enquanto você mantém supervisão. Apenas garanta alocação de capital adequada para evitar sobreextensão entre estratégias.

Obtenha o teste com acesso total a todas as ferramentas de negociação ALGO.