Meet the New 3Commas AI Assistant

Nov 24, 2025

Automatize suas estratégias ADA em torno dos marcos de desenvolvimento previsíveis e upgrades de rede do Cardano. Nosso bot executa negociações com base em suas regras enquanto você ganha recompensas de staking. Sem custódia necessária. Você mantém controle de seus fundos.

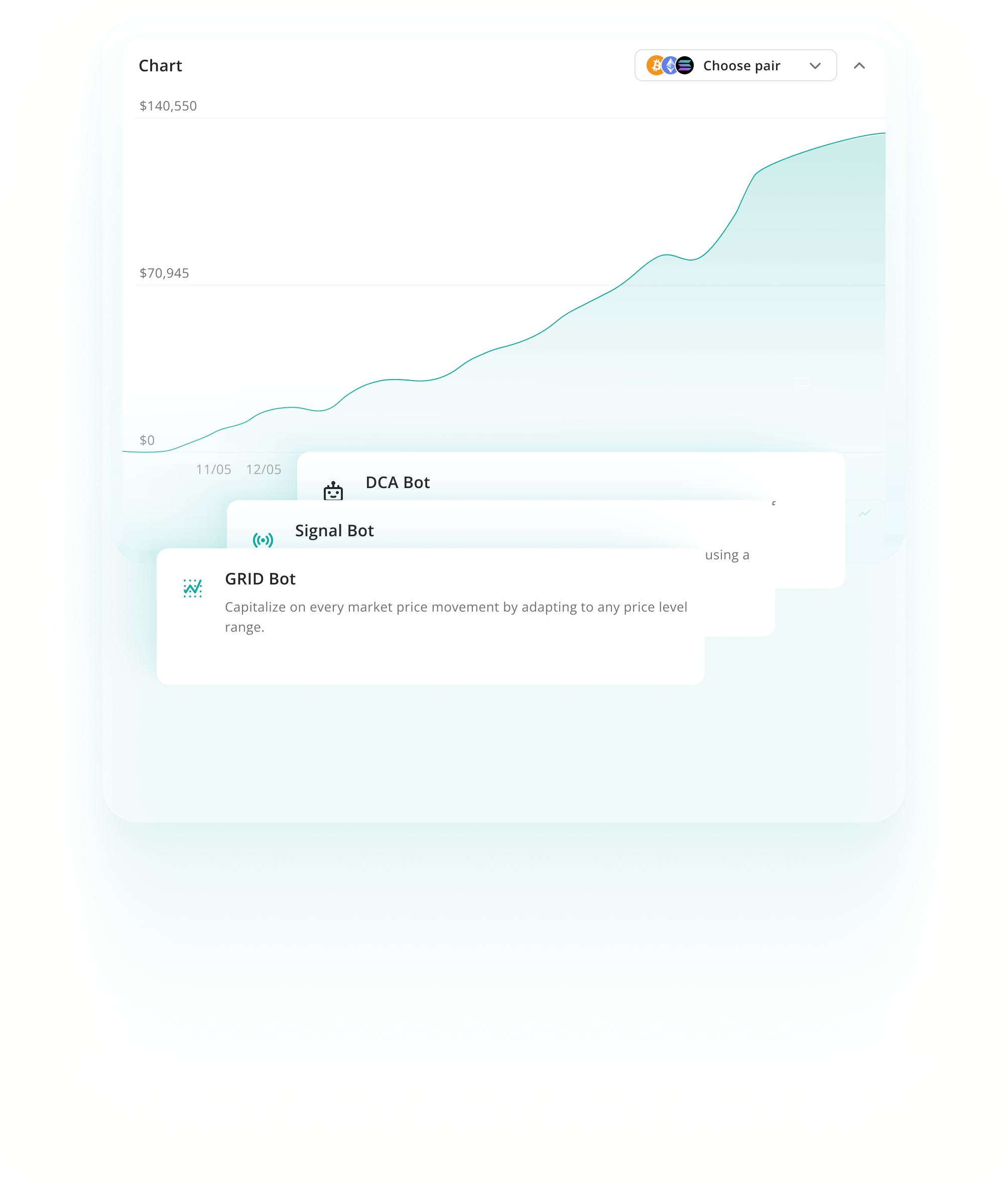

Um bot de trading Cardano é um software automatizado que compra e vende ADA para você com base em regras que você define. Em vez de monitorar gráficos 24 horas por dia, o bot executa negociações instantaneamente quando suas condições são atendidas, como comprar quando ADA cai 2% ou vender após um ganho de 3%. Isso é especialmente útil para Cardano já que seu mercado frequentemente se move durante atualizações de desenvolvimento e upgrades de rede. Com o 3Commas, seus fundos nunca saem de sua exchange. O bot conecta através de chaves API sem permissões de saque, então você mantém controle total de seus ativos enquanto o software cuida do trabalho repetitivo de cronometrar entradas e saídas.

Dollar cost averaging distribui suas compras através de múltiplos intervalos, suavizando seu preço médio de entrada. Este método reduz exposição às oscilações de volatilidade acentuadas do ADA, que frequentemente incluem rallies de 50 a 100% seguidos por correções de 20 a 40%. Adequa traders construindo posições de longo prazo através de ciclos de mercado.

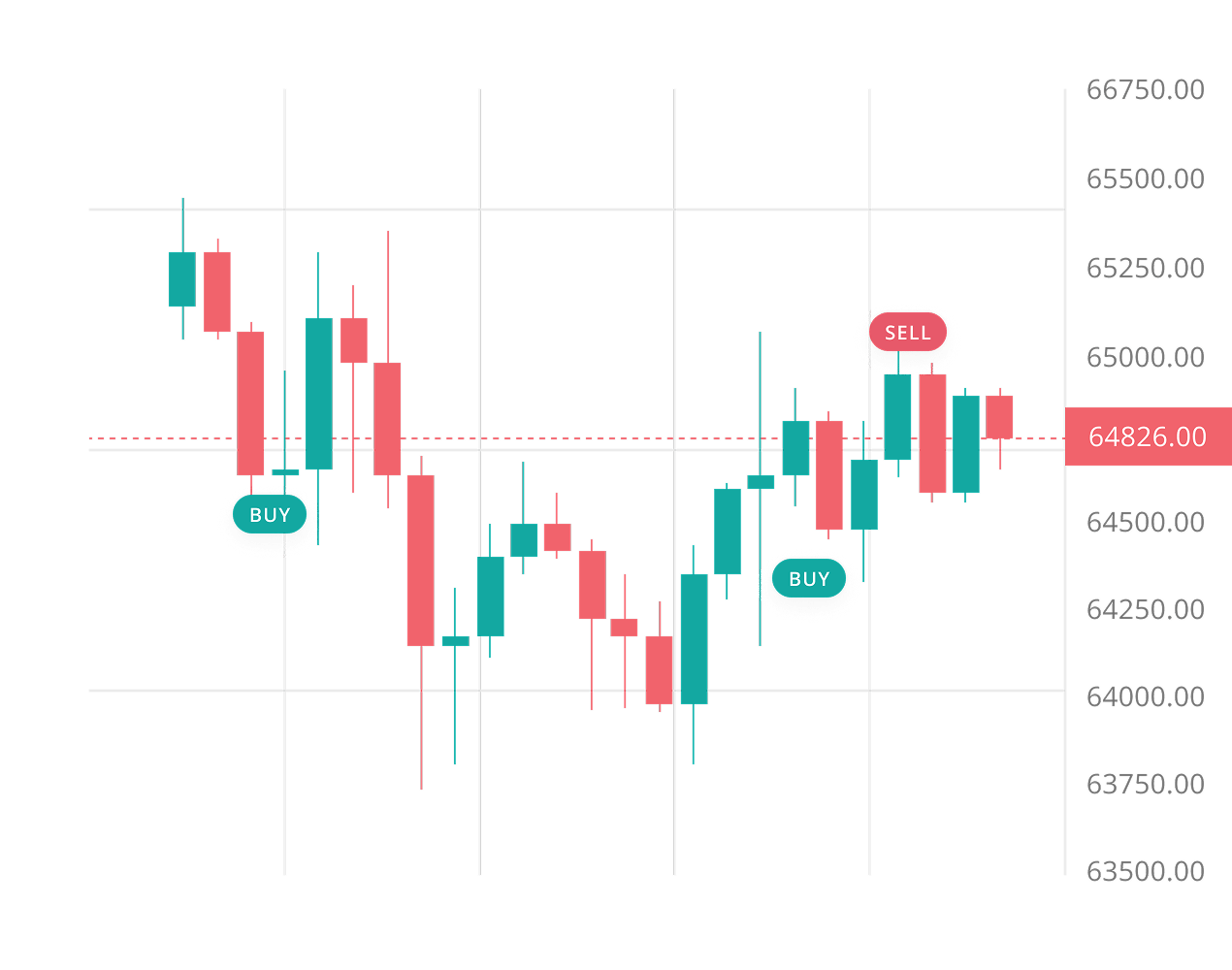

Saiba maisGrid bots colocam ordens de compra e venda automatizadas através de faixas de preço predeterminadas. Esta abordagem funciona bem com a tendência do Cardano de consolidar entre níveis psicológicos como $1,50 e $2,20. A estratégia captura lucros de oscilações de preço repetitivas durante períodos de negociação lateral quando ADA carece de momentum direcional.

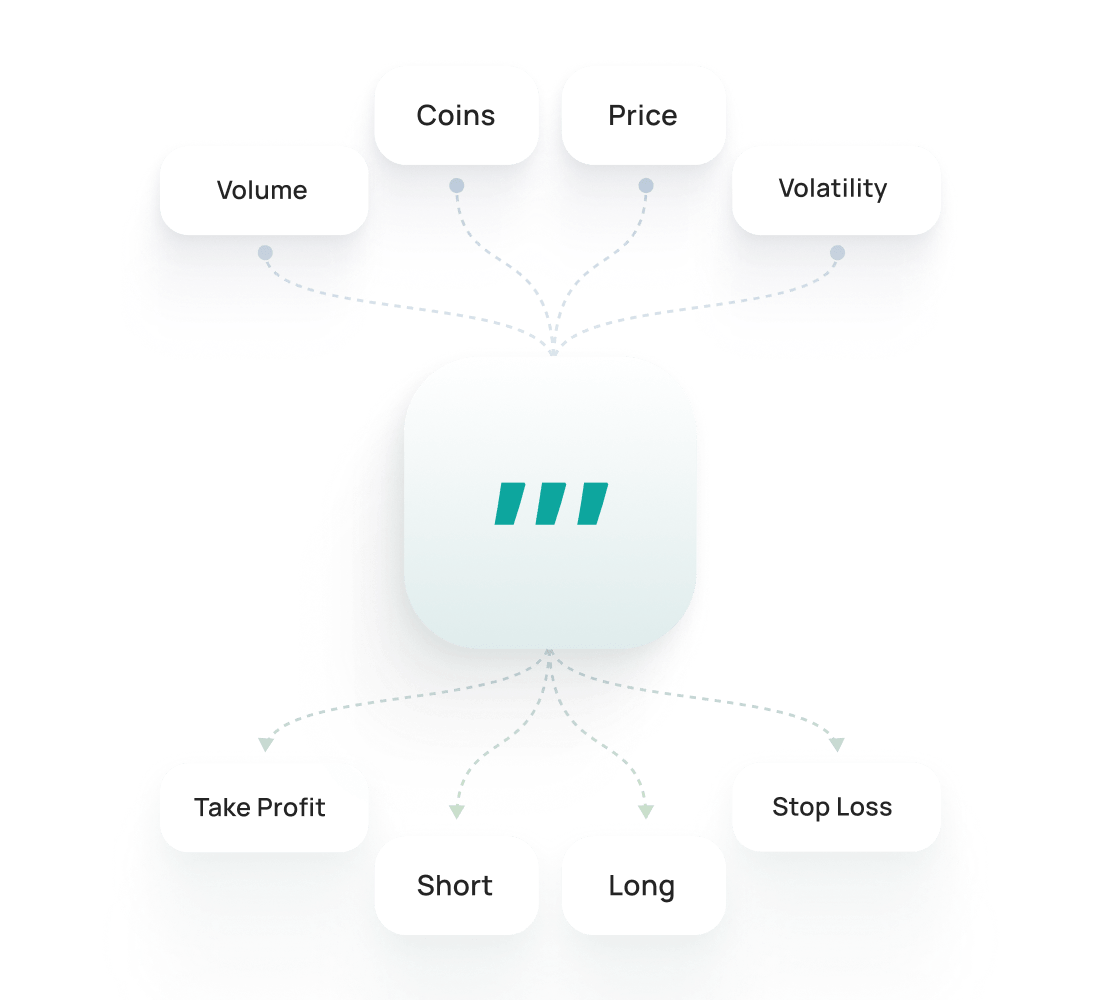

Saiba maisBots de sinal executam negociações com base em indicadores técnicos como divergência RSI, cruzamentos MACD e padrões de volume. Cardano responde previsivelmente à análise técnica, especialmente em torno de marcos de desenvolvimento e upgrades de rede. A estratégia automatiza timing de entrada e saída, removendo tomada de decisão emocional do seu processo de negociação.

Saiba maisO Backtesting de Cardano permite testar estratégias com dados históricos para ver como elas poderiam ter se saído. Ajuda a ajustar configurações, avaliar riscos e construir confiança antes de operar ao vivo.

Saiba maisO Cardano SmartTrade oferece opções avançadas de negociação manual como take-profit, stop-loss, trailing e saídas em múltiplos alvos. O Cardano Public Presets são estratégias prontas de outros traders que você pode usar instantaneamente ou personalizar conforme sua necessidade.

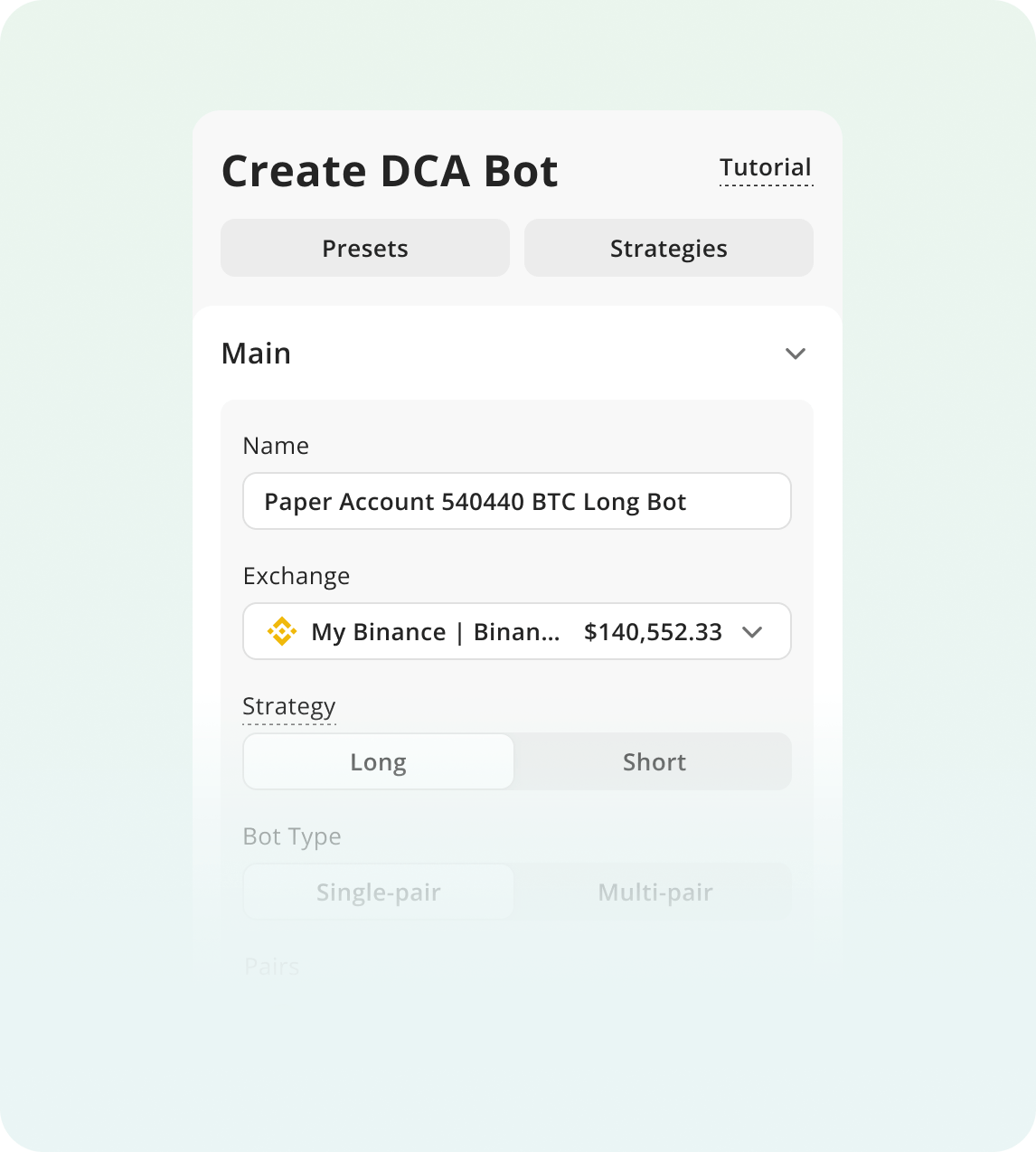

Para começar a negociar com bots:

Cadastre-se na 3Commas e escolha seu plano

Conecte uma Exchange e escolha a estratégia do seu bot.

Configure os parâmetros do seu bot e coloque para rodar!

Negociação manual frequentemente leva a erros custosos. Quando ADA subiu para $0,80 no início de 2024, muitos compraram alto durante FOMO e venderam em pânico a $0,45, travando perdas pesadas. Um bot 3Commas remove essas decisões emocionais inteiramente. Ele monitora mercados Cardano 24 horas por dia, mesmo durante crashes repentinos de fim de semana como a queda de 31% em abril. Recursos integrados como Trailing Stop Loss protegem seus ganhos automaticamente, vendendo estrategicamente em vez de assistir lucros desaparecerem.

As eras de desenvolvimento estruturadas do Cardano criam eventos de roadmap previsíveis que permitem traders se posicionarem antes de upgrades programados e lançamentos.

Recompensas de staking integradas de 3 a 5% APY geram renda passiva enquanto detém ADA, ajudando a compensar custos de negociação durante análise de mercado.

O modelo de transação eUTXO permite calcular custos e resultados exatos antes da execução, eliminando taxas surpresa e tentativas de negociação falhas.

Defina stop losses 8-12% abaixo dos pontos de entrada para acomodar oscilações de preço repentinas do ADA após períodos prolongados de consolidação.

Rastreie votos de governança do Cardano, datas de hard fork e notícias de parcerias de perto, pois esses eventos frequentemente desencadeiam movimentos de preço voláteis.

Nunca aloque mais de 5-10% do seu portfólio cripto para ADA, independentemente da convicção no potencial de longo prazo do projeto.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active API Keys

5

Active DCA Bots

2

Active Signal Bots

2

Active Grid Bots

20

Active DCA Trades

10

Active Signal Trades

10

Active SmartTrades

100

DCA Backtests

1 year period

100

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active API Keys

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

100

Active DCA Trades

100

Active Signal Trades

50

Active SmartTrades

500

DCA Backtests

2 years period

500

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$140/ month

AI Assistant

Spot & Futures

15

Active API Keys

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active DCA Trades

5K

Active Signal Trades

5K

Active SmartTrades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Execute sua estratégia Cardano na Binance, Coinbase Advanced, Kraken e mais de 12 outras exchanges suportadas via 3Commas. Conecte via API segura, defina entradas, saídas e riscos uma única vez e deixe a automação rodar 24/7. Um só workspace para todos os ativos significa registros mais limpos, iteração mais rápida e menos oportunidades perdidas nos seus pares de ADA.

O Backtesting na 3Commas facilita muito a vida. Posso testar ideias, ver o que funciona e evitar erros bobos — tudo sem perder dinheiro. Eu comprei o plano Expert para realizar mais testes.

Por muito tempo usei uma estratégia que considerava lucrativa, mas ao longo do tempo estava perdendo dinheiro devagar. Com o recurso de backtest da 3Commas percebi que só precisava de pequenos ajustes na estratégia para me tornar lucrativo.

Uso a 3Commas há alguns anos e os bots da plataforma, depois que você aprende como funcionam, oferecem retornos interessantes com pouco risco (se você sabe o que está fazendo, é possível conseguir 15–30% ao ano com pouco risco e sem alavancagem). Dá para ganhar dinheiro enquanto dorme e aprender cada vez mais.

O time está sempre disponível, focado nas necessidades do cliente, melhorando o app e o site, e se adaptando às novidades. Trabalho excelente!

Já usei outros bots de negociação, mas esse é bem melhor: consigo controlar perdas e maximizar ganhos com mais facilidade. Vou continuar usando cada vez mais.

Sou novo no mercado cripto e consegui usar o 3Commas facilmente. Aprendi muito com a negociação em modo simulação e me sinto seguro usando a plataforma.

2,0M

Traders cadastrados

Avaliado como Ótimo em

1.479 avaliações

Avaliações Google

4.0

Nenhum bot de trading pode garantir lucros. Bots automatizam a execução de sua estratégia mas não eliminam risco de mercado. ADA experimenta volatilidade significativa, com consolidação lateral prolongada seguida por breakouts acentuados em torno de marcos de roadmap do Cardano. Isso cria oportunidades para grid bots durante períodos de faixa e estratégias de breakout durante mercados de tendência. Sucesso depende de escolher a estratégia certa para condições atuais, gerenciamento de risco adequado e expectativas realistas. Bots removem emoção da negociação, mas não podem prever o futuro.

Conectar sua exchange via API leva apenas minutos. A curva de aprendizado real é configurar parâmetros do bot como faixas de preço, níveis de grid e valores de investimento para seus objetivos específicos. Com ADA, você vai querer considerar a linha do tempo de desenvolvimento do Cardano e upgrades de rede ao definir faixas. Grid bots funcionam bem durante fases frequentes de consolidação do ADA, enquanto bots DCA adequam estratégias de acumulação de longo prazo. O 3Commas fornece templates e presets para ajudar iniciantes a começar rapidamente, e você pode ajustar configurações conforme aprende o que funciona.

Sim. O 3Commas nunca detém seus fundos—seu Cardano permanece em sua conta da exchange o tempo todo. Bots conectam através de chaves API apenas com permissões de negociação, significando que podem executar ordens de compra e venda mas não podem sacar fundos. Esta abordagem não-custodial garante que você mantenha controle completo sobre seu ADA. Ao criar chaves API, nunca habilite permissões de saque. Sua cripto permanece em sua carteira da exchange, protegida pelas medidas de segurança de sua exchange, enquanto o bot simplesmente automatiza sua estratégia de negociação.

Absolutamente. Você pode operar diferentes tipos de bot ao mesmo tempo na mesma conta de exchange. A alta liquidez do ADA nas principais exchanges suporta bem esta abordagem. Por exemplo, você pode executar um grid bot para capturar lucros durante ação de preço lateral do Cardano, um bot DCA para acumulação constante e um bot de sinal para oportunidades de breakout em torno de marcos de desenvolvimento. O modelo E-UTxO do Cardano fornece resultados de transação previsíveis, tornando-o confiável para estratégias automatizadas. Apenas garanta que seu capital total alocado não exceda seu saldo disponível.

Obtenha o teste com acesso total a todas as ferramentas de negociação ADA.