Meet the New 3Commas AI Assistant

2025년 11월 24일

SOL 트레이딩 전략을 자동화하여 솔라나의 1초 미만 트랜잭션 속도와 극소량의 수수료를 활용하세요. 고빈도 거래를 실행하고, DeFi 플랫폼 간 차익거래 기회를 포착하며, 수동 거래로는 따라잡을 수 없는 일일 5-15% 변동성에 즉시 대응하세요. 자금은 거래소 계정에서 안전하게 유지됩니다.

솔라나 트레이딩 봇은 24시간 내내 SOL 트레이딩 전략을 실행하는 자동화 소프트웨어입니다. 설정에 따라 시장 변화에 즉시 반응하며, 이는 솔라나의 가격 변동성을 고려할 때 매우 중요합니다. 봇은 SOL의 빠른 트랜잭션 속도와 최소 수수료를 활용하여 효율적으로 거래합니다. 3Commas를 사용하면 자금은 거래소 계정에 유지됩니다. 출금 권한이 없는 API 키를 통해 연결하므로 자산에 대한 완전한 통제권을 유지합니다.

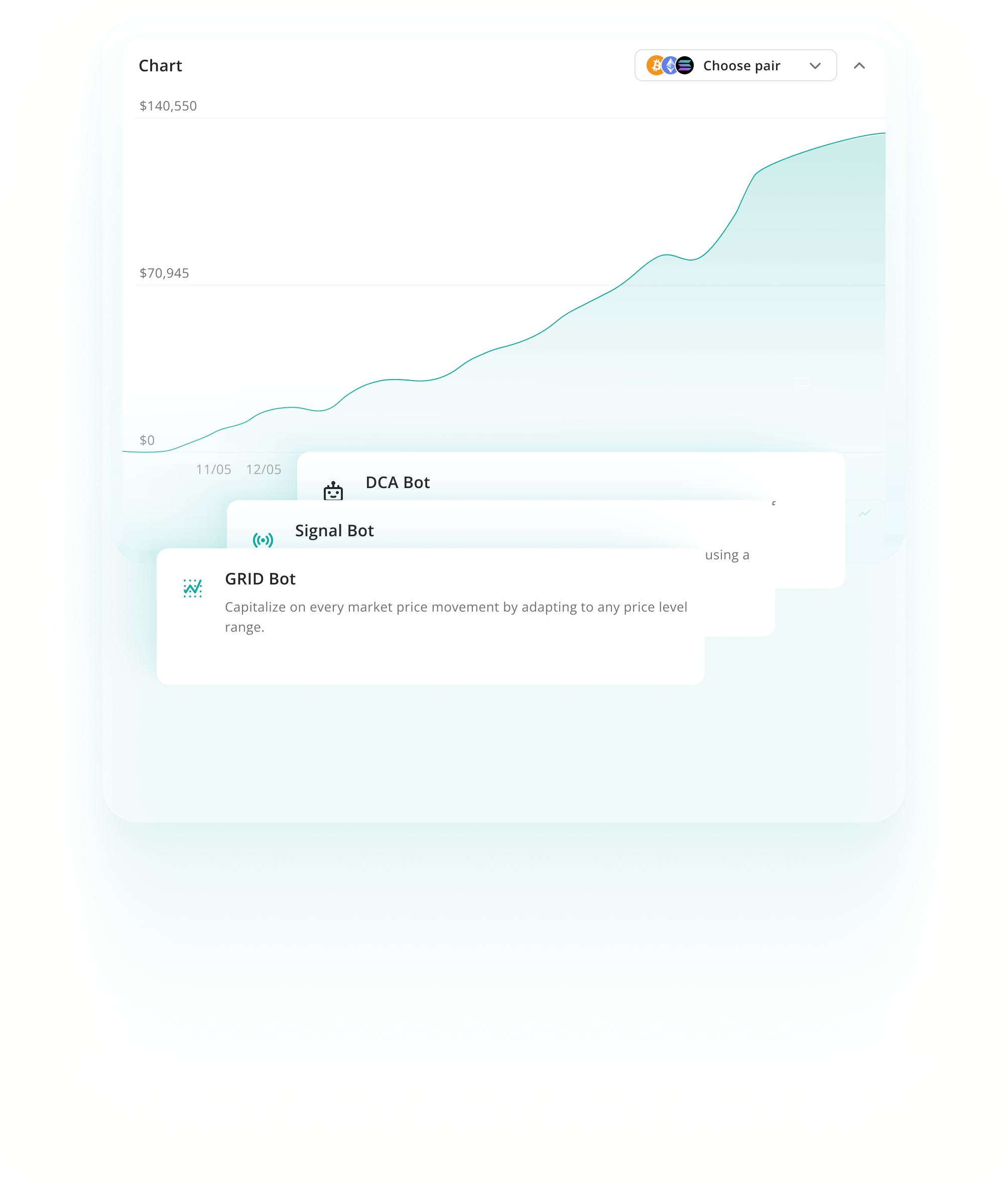

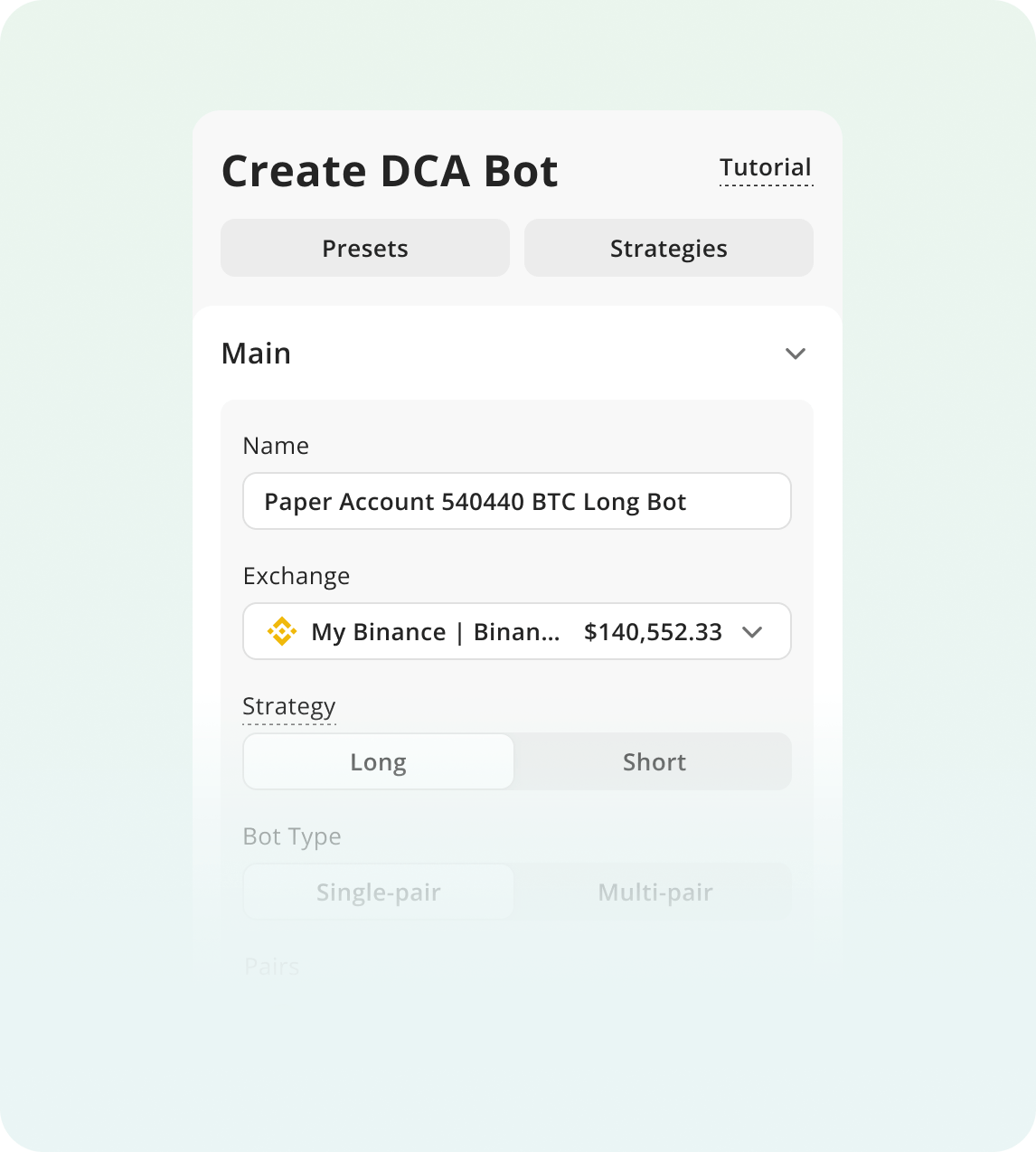

달러 코스트 애버리징 봇은 일괄 투자가 아닌 정기적인 간격 또는 트리거된 가격 하락 시 체계적인 매수를 실행하여 여러 트랜잭션에 걸쳐 진입을 분산시킵니다. 이 접근 방식은 변동성이 큰 기간 동안 평균 매수 가격을 완화합니다. 이 전략은 20-30%의 급격한 하락 후 빠른 회복을 경험하는 솔라나의 경향과 특히 잘 맞아떨어져, 일시적인 약세 기간 동안 축적을 가능하게 합니다.

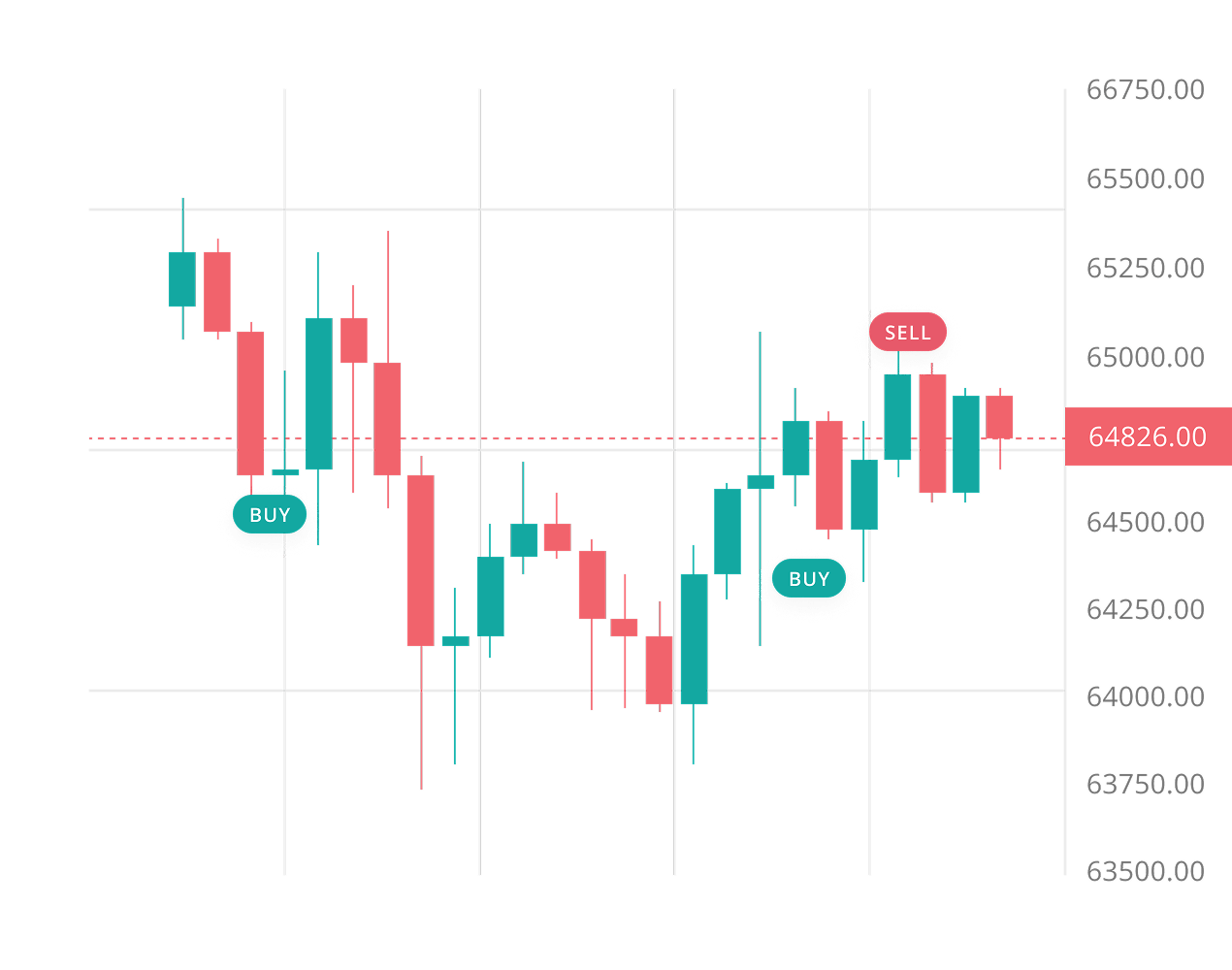

자세히 알아보기이 자동화된 접근 방식은 정의된 범위 내에서 미리 결정된 가격 간격으로 여러 매수 및 매도 주문을 배치합니다. 솔라나가 위아래로 진동하면서 각각의 작은 가격 움직임에서 수익을 포착합니다. SOL의 통합 단계에 가장 적합하며, 중요한 방향성 움직임 이후 몇 주 또는 몇 달 동안 지속될 수 있는 15-25% 폭의 채널에서 가격이 횡보할 때 효과적입니다.

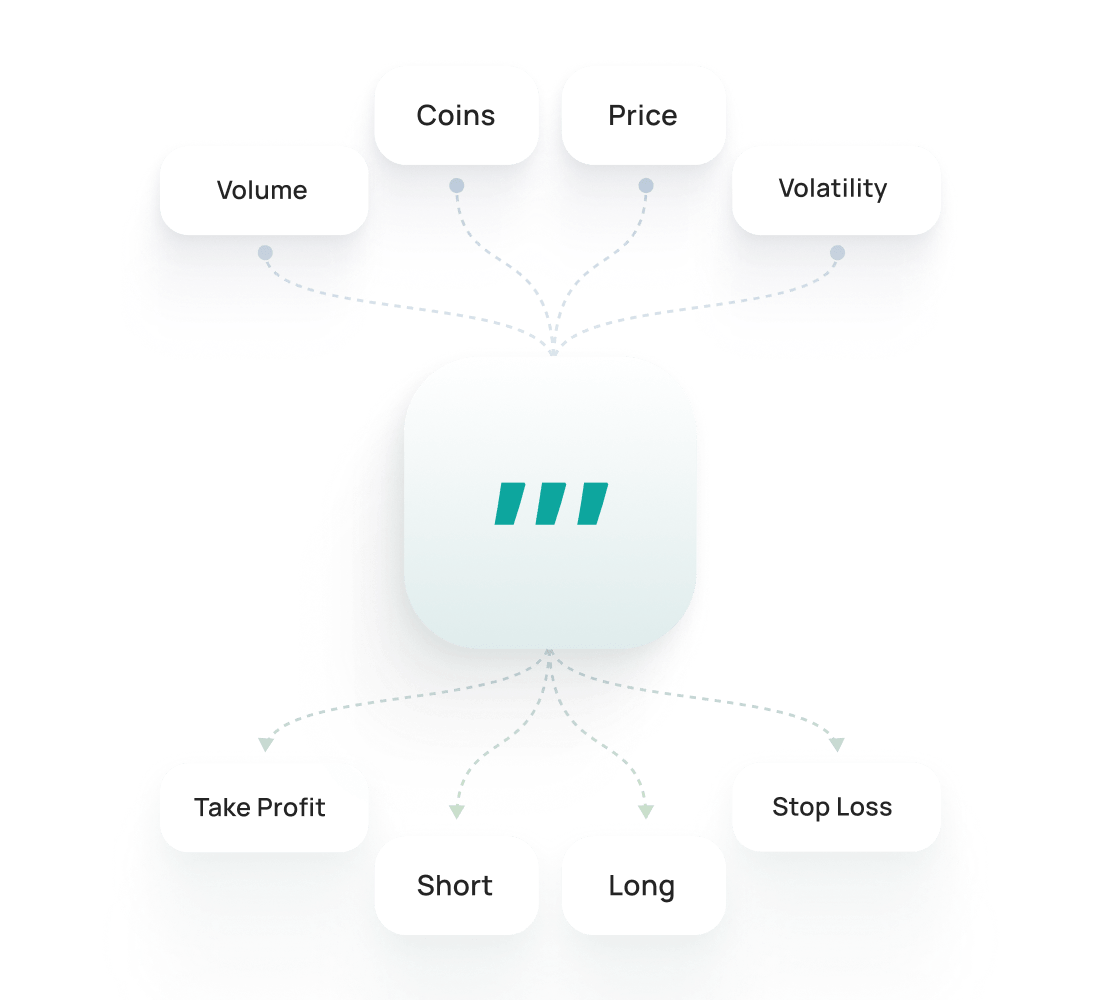

자세히 알아보기이러한 봇은 TradingView 또는 사용자 정의 지표의 특정 기술적 조건이 트리거될 때 자동으로 거래를 실행합니다. 일반적인 시그널에는 이동평균 크로스오버, RSI 다이버전스 또는 MACD 확인이 포함됩니다. 이 전략은 SOL에서 뛰어난 성과를 발휘하는데, 토큰이 기술적 분석 패턴에 강한 반응성을 보이기 때문이며, 특히 확립된 모멘텀 트렌드 중에 진입 및 퇴출 타이밍이 방향성 움직임을 포착하는 데 중요할 때 그렇습니다.

자세히 알아보기솔라나 백테스팅을 통해 과거 데이터를 기반으로 전략을 테스트하여 실제 거래 전 얼마나 효과적이었을지 확인할 수 있습니다. 설정을 정교하게 다듬고, 위험을 평가하며, 실거래 전 자신감을 쌓는 데 도움이 됩니다.

자세히 알아보기솔라나 SmartTrade는 익절, stoploss, 트레일링, 다중 목표가 청산 등 다양한 수동 거래 옵션을 제공합니다. 솔라나 공개 프리셋은 즉시 실행하거나, 내게 맞게 커스터마이즈 할 수 있는 트레이더들이 만든 전략입니다.

봇 거래를 시작하려면:

3Commas 가입 및 플랜 선택

거래소 연결 및 봇 전략 선택

봇 파라미터를 설정하고 실행하세요!

SOL은 빠르게 움직입니다. 2024년 4월 $175에서 $122로 추락한 것처럼 30% 하락이 밤새 일어날 수 있습니다. 수동 거래는 기회를 놓치고 변동성 중에 감정적인 결정을 내리게 됩니다. 우리의 봇은 24/7 시장을 모니터링하고, 패닉 매도와 FOMO 매수를 제거하며, 자동 손절매 및 이익실현 주문으로 포지션을 보호합니다. 전략을 한 번 설정하면 봇이 거침없이 실행하며, 극심한 가격 변동 중에도 그렇습니다.

Jupiter의 DEX 애그리게이터는 수십 개의 솔라나 트레이딩 풀에서 동시에 유동성을 확인하여 자동으로 최상의 가격을 찾아줍니다.

트랜잭션 수수료가 몇 센트도 안 되기 때문에 수수료가 수익을 잠식하지 않고 수익성 있는 차익거래 및 스캘핑 전략을 실행할 수 있습니다.

곧 출시될 Firedancer 검증자 클라이언트는 단일 장애 지점 위험을 제거하고 네트워크 용량을 초당 백만 건 이상의 트랜잭션으로 확장합니다.

SOL의 변동성을 고려하여 평소보다 넓게 손절매를 설정하세요. 일일 5-15% 변동은 정상이므로 손절매를 너무 타이트하게 설정하면 실제 트렌드가 발전하기 전에 정상적인 가격 움직임 중에 청산될 수 있습니다.

솔라나는 고유한 기술적 리스크를 수반하므로 포지션 크기를 작게 유지하세요. 네트워크가 완전한 중단을 경험한 적이 있어 봇이 거래를 실행하거나 포지션을 조정할 수 없어 중요한 시장 움직임 중에 노출된 상태로 남게 됩니다.

FTX 자산 청산 일정과 SEC 규제 발표를 면밀히 모니터링하세요. 이러한 외부 이벤트는 기술적 시그널과 관계없이 갑작스러운 가격 하락을 유발할 수 있는 예측 가능한 매도 압력과 법적 불확실성을 만듭니다.

한 개 거래소에서 Spot 거래를 위한 핵심 봇

$20/ 월

AI Assistant

현물만

1

활성 트레이딩 계정

5

DCA 봇 실행하기

2

시그널 봇 실행하기

2

그리드 봇 실행하기

20

活跃的 DCA 交易

10

Active Signal Trades

10

활성 SmartTrades

100

DCA 回测

1 年 기간

100

网格回测

4 个月 기간

개발자용 API

只读

Pine Script® 실행

在线聊天支持

다중 계정 Spot 및 Futures 거래

$50/ 월

AI Assistant

현물 및 선물

3

활성 트레이딩 계정

20

DCA 봇 실행하기

20

시그널 봇 실행하기

10

그리드 봇 실행하기

100

活跃的 DCA 交易

100

Active Signal Trades

50

활성 SmartTrades

500

DCA 回测

2 年 기간

500

网格回测

4 个月 기간

개발자용 API

只读

Pine Script® 실행

在线聊天支持

뛰어난 한도 및 API 거래

$140/ 월

AI Assistant

현물 및 선물

15

활성 트레이딩 계정

1K

DCA 봇 실행하기

1K

시그널 봇 실행하기

1K

그리드 봇 실행하기

5K

活跃的 DCA 交易

5K

Active Signal Trades

5K

활성 SmartTrades

5K

DCA 回测

전체 히스토리

5K

网格回测

4 个月 기간

개발자용 API

读写

Pine Script® 실행

우선 라이브 채팅 지원

솔라나 전략을 Binance, Coinbase Advanced, Kraken 및 3Commas의 12개 이상의 지원 거래소에서 실행할 수 있습니다. 안전한 API로 연결하고, 진입/청산·위험을 한 번 설정하면 자동화 시스템이 24/7로 매매를 실행합니다. 한 공간에서 모든 거래소를 관리하면 거래 기록이 깔끔하고, 반복 작업이 빨라지며, SOL 페어에서 기회를 놓칠 일이 줄어듭니다.

3Commas의 백테스팅 기능 덕분에 트레이딩이 훨씬 쉬워졌습니다. 아이디어도 시도해보고, 어떤 전략이 잘 맞는지 확인하며, 바보 같은 실수를 하지 않을 수 있습니다. 실제 돈을 잃지 않으면서 말이죠. 더 많은 백테스트를 하고 싶어서 Expert 플랜을 구입했습니다.

오랫동안 내가 수익성이 있다고 생각한 전략을 사용했지만, 장기적으로는 점점 손실만 봐왔습니다. 3Commas의 백테스팅 기능을 통해 전략에 소폭 변화만 줘도 수익성 있는 트레이더가 될 수 있음을 깨달았습니다.

저는 몇 년째 3Commas를 사용하고 있고, 봇의 메커니즘만 이해하면 강력한 수익을 적은 위험으로 낼 수 있습니다(제가 아는 한, 레버리지 없이도 연 15~30% 수익을 얻고 있습니다). 자는 동안에도 수익이 발생하고, 사용하면서 계속 배워갈 수 있습니다.

팀이 항상 고객의 니즈를 중시하고, 앱과 웹사이트를 지속적으로 개선하며, 모든 변화에 빠르게 대응해줍니다. 정말 훌륭합니다!

다른 트레이딩 봇도 써봤지만 이 봇이 훨씬 낫고, 손실을 더 잘 통제하면서 수익도 극대화할 수 있었습니다. 앞으로도 계속 사용할 예정입니다.

저는 크립토 트레이딩이 처음인데 3Commas를 쉽게 사용할 수 있었고, 페이퍼 트레이딩으로 많은 것을 배웠으며 이 서비스를 안전하게 느끼고 있습니다.

2.0M

등록된 트레이더

Great로 평가받음

1,479개의 리뷰

Google 리뷰

4.0

목표와 시장 조건에 따라 다릅니다. 봇은 수익을 보장하지 않으며, 단기 변동성을 포착하는 거래 전략을 자동화합니다. 솔라나의 빈번한 일일 5-15% 변동은 HODLing이 놓치는 기회를 창출하지만, 시장이 불리하게 움직이면 손실도 증폭됩니다. 진정한 이점은 효율성입니다: 봇은 감정적 결정 없이 24/7 전략을 실행합니다. 성공을 위해서는 적절한 리스크 관리, 현실적인 기대, 그리고 모든 조건에서 작동하는 전략은 없다는 이해가 필요합니다. 지속적인 화면 시간 없이 적극적으로 거래하는 것으로 생각하세요.

초기 설정에는 15-30분이 소요됩니다: API를 통해 거래소를 연결하고, 전략 템플릿을 선택하고, 리스크 매개변수를 설정합니다. 초보자는 종종 그리드 설정과 가격 범위에 압도당합니다 - 모든 것을 즉시 최적화하기보다는 보수적인 프리셋으로 시작하세요. 실행 후 며칠마다 봇을 확인하여 주요 시장 변화에 맞춰 조정하세요. SOL의 변동성은 알려진 중단 기간 동안 네트워크 안정성을 모니터링하고 싶어질 것입니다. 수동적 수입은 아니지만 수동 거래보다 훨씬 덜 까다로우면서 놓칠 기회를 포착합니다.

3Commas는 비수탁형입니다 - 우리는 결코 자금을 보유하지 않습니다. 암호화폐는 항상 거래소 계정에 남아 있습니다. API 키는 거래 권한만 부여하며 출금 액세스는 부여하지 않습니다. 설정 중에 명시적으로 비활성화합니다. 적절한 구성의 최악의 시나리오: 봇이 원하지 않는 거래를 하지만 자금은 거래소에서 안전하게 유지됩니다. 우리는 출금, 이체 또는 자산에 액세스할 수 없습니다. API 키를 대리 주차 키처럼 생각하세요 - 운전은 할 수 있지만 차를 소유할 수는 없습니다. 항상 출금 권한이 비활성화되어 있는지 확인하세요.

3Commas는 SOL의 특성에 최적화된 여러 전략을 지원합니다. 그리드 봇은 설정된 간격으로 매수 및 매도 주문을 배치하여 변동성에서 수익을 얻습니다. DCA 봇은 하락 중에 포지션으로 평균을 냅니다. 이익실현 추적과 같은 HODL 인접 전략은 상승세를 포착하면서 이익을 보호합니다. SOL의 낮은 트랜잭션 수수료는 고빈도 그리드 거래를 실행 가능하게 만들며, 비싼 체인과는 다릅니다. 솔라나 DEX와 중앙화 거래소 간 차익거래를 실행하거나 기술 지표의 사용자 정의 시그널을 배포할 수 있습니다. 각 전략은 다른 시장 조건에 적합합니다 - 레인징 마켓은 그리드를 선호하고, 트렌딩 마켓은 추적 주문과 더 잘 작동합니다.

모든 SOL 거래 도구를 완전히 이용할 수 있는 체험판을 만나보세요.