Meet the New 3Commas AI Assistant

Nov 24, 2025

Automate your SOL trading strategies to capitalize on Solana's sub-second transaction speeds and fraction-of-a-cent fees. Execute high-frequency trades, capture arbitrage opportunities across DeFi platforms, and respond instantly to 5-15% daily volatility swings that manual trading simply can't match. Your funds stay secure in your exchange account.

A Solana trading bot is automated software that executes your SOL trading strategies around the clock. It reacts instantly to market changes based on your settings, which is crucial given Solana's price volatility. The bot takes advantage of SOL's fast transaction speeds and minimal fees to trade efficiently. With 3Commas, your funds stay in your exchange account. We connect through API keys without withdrawal permissions, so you keep full control of your assets.

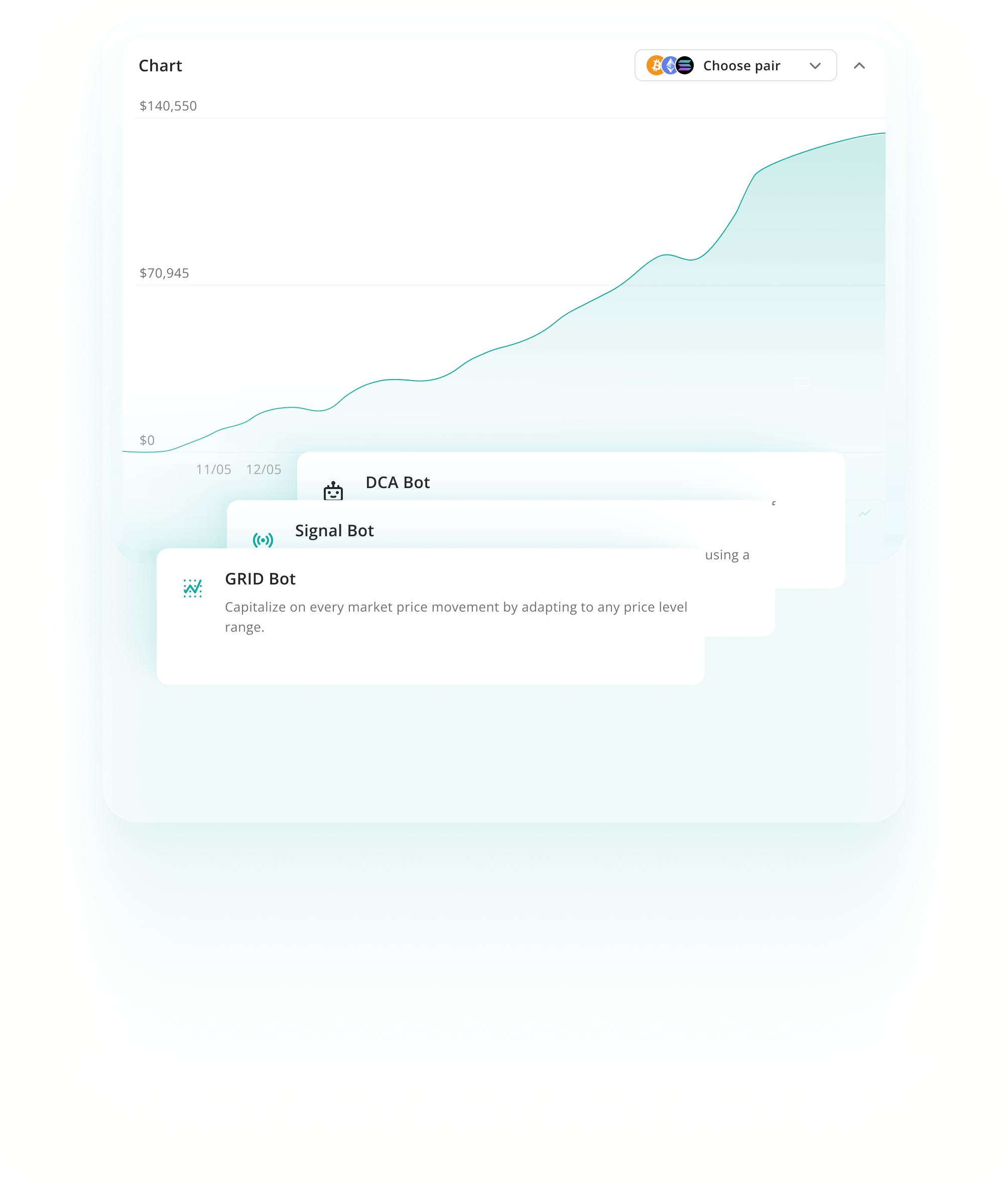

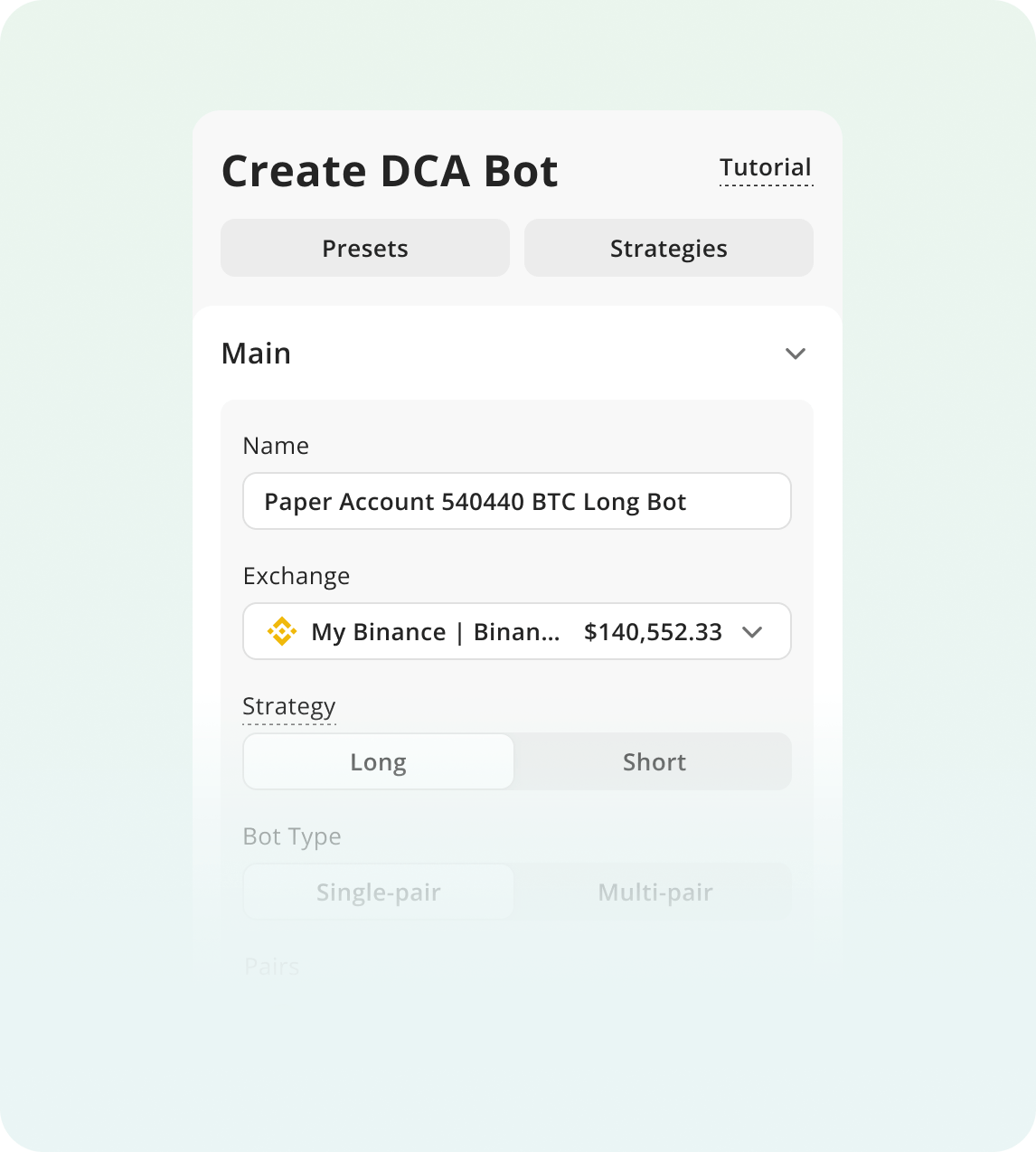

Dollar Cost Averaging bots execute systematic purchases at regular intervals or triggered price drops, spreading your entry across multiple transactions rather than one lump sum. This approach smooths out the average purchase price during volatile periods. The strategy works particularly well with Solana's tendency to experience sharp 20-30% drawdowns followed by rapid recoveries, allowing accumulation during temporary weakness.

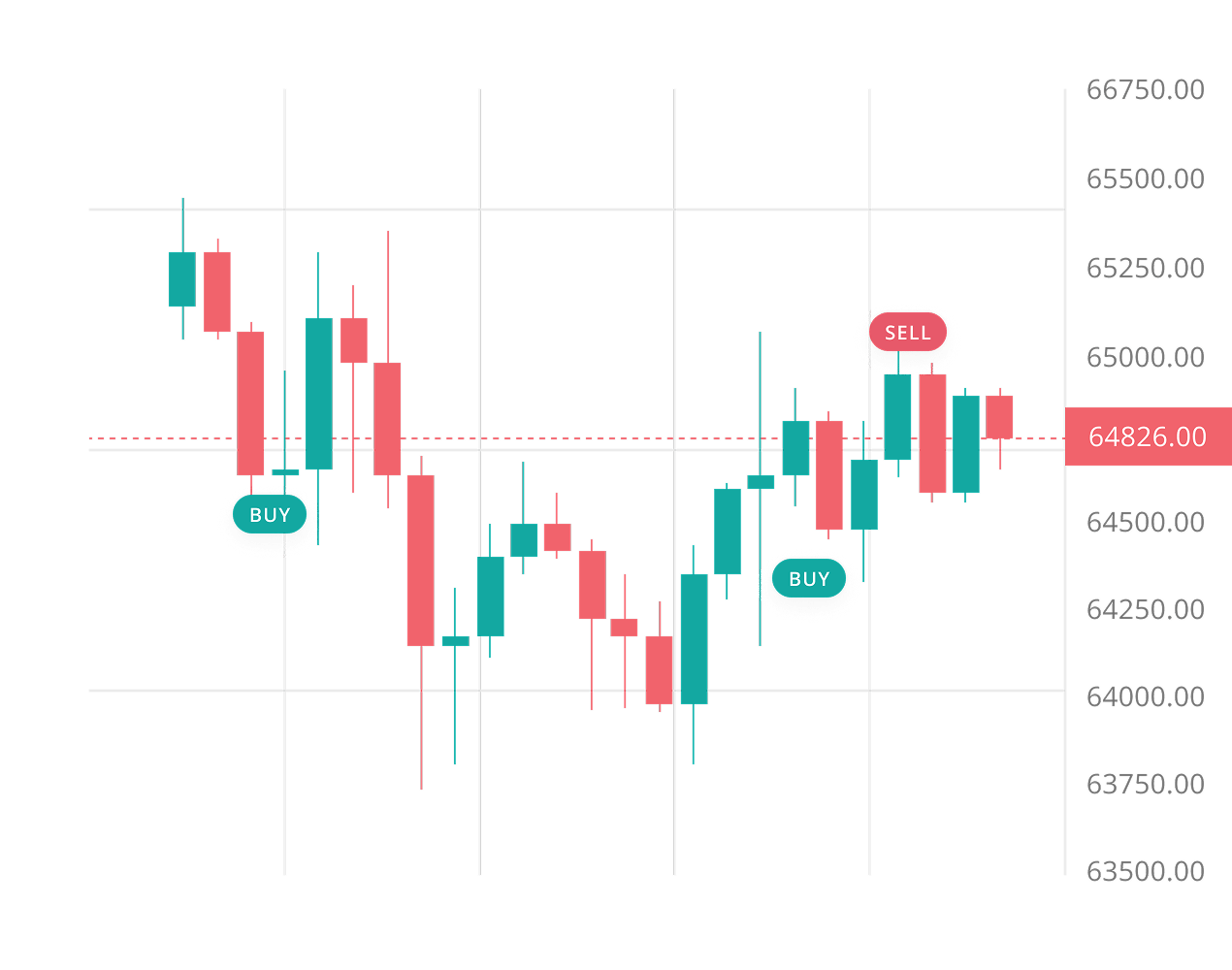

Learn moreThis automated approach places multiple buy and sell orders at predetermined price intervals within a defined range. It captures profit from each small price movement as Solana oscillates up and down. Best suited for SOL's consolidation phases where the price trades sideways in 15-25% wide channels that can persist for weeks or months after significant directional moves.

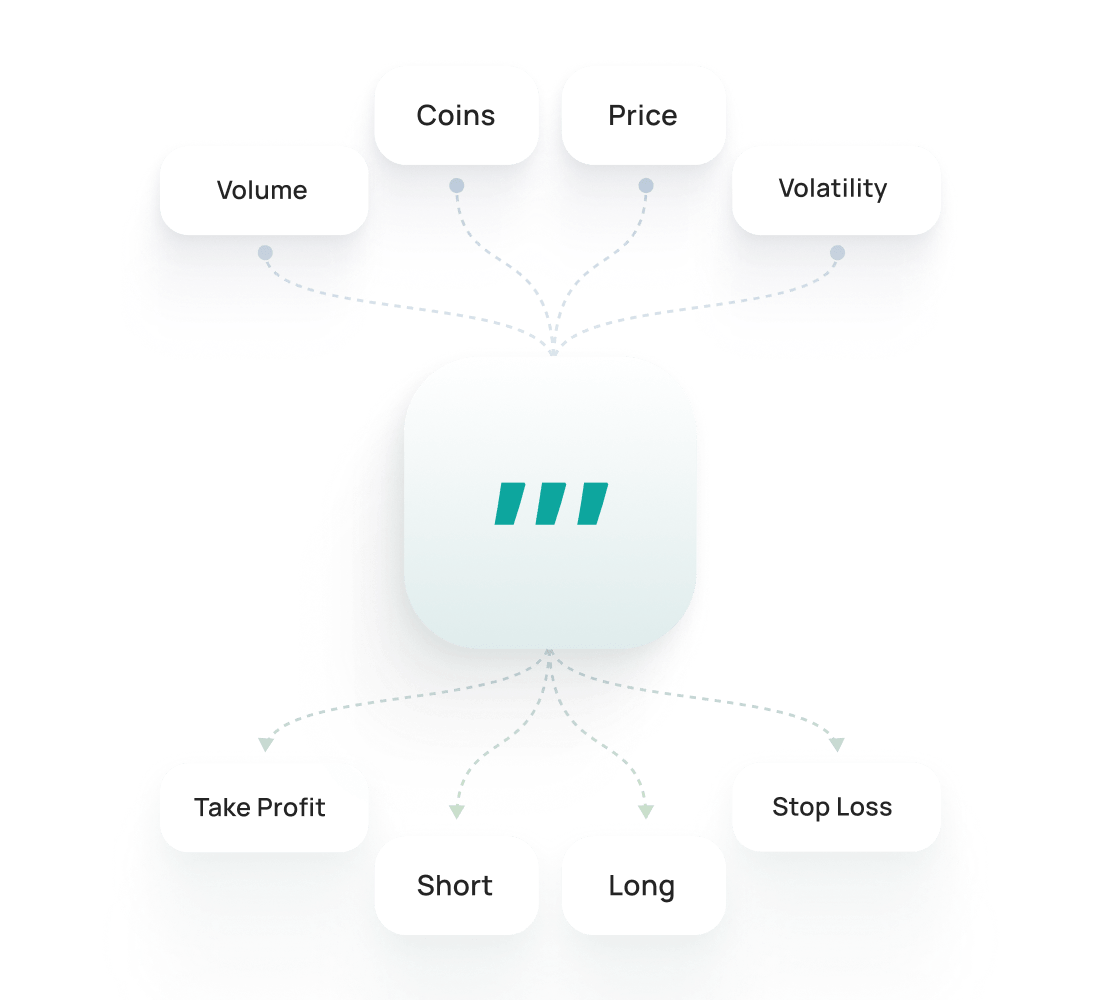

Learn moreThese bots execute trades automatically when specific technical conditions from TradingView or custom indicators are triggered. Common signals include moving average crossovers, RSI divergences, or MACD confirmations. This strategy excels with SOL because the token demonstrates strong responsiveness to technical analysis patterns, especially during established momentum trends where entry and exit timing becomes critical for capturing directional moves.

Learn moreThe Solana Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe Solana SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The Solana Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

To begin trading with bots:

Sign Up for 3Commas and choose your plan

Connect an Exchange and choose your bot strategy.

Configure your bot parameters and run your bot!

SOL moves fast. A 30% drop can happen overnight while you sleep, like the April 2024 crash from $175 to $122. Manual trading means you miss opportunities and make emotional decisions during volatility. Our bot monitors markets 24/7, removes panic selling and FOMO buying, and protects your positions with automatic stop losses and take profit orders. You set the strategy once. The bot executes it without hesitation, even during wild price swings.

Jupiter's DEX aggregator automatically finds you the best prices by checking liquidity across dozens of Solana trading pools simultaneously.

Transaction fees cost fractions of a penny, which means you can run profitable arbitrage and scalping strategies without fees eating your gains.

The upcoming Firedancer validator client removes single point of failure risks and pushes network capacity beyond one million transactions per second.

Set stop losses wider than usual to account for SOL's volatility. Daily swings of 5-15% are normal, so placing stops too tight will get you stopped out during regular price action before any real trend develops.

Keep position sizes small because Solana carries unique technical risks. The network has experienced complete outages where your bot cannot execute trades or adjust positions, leaving you exposed during critical market moves.

Monitor FTX estate liquidation schedules and SEC regulatory announcements closely. These external events create predictable selling pressure and legal uncertainty that can trigger sudden price drops regardless of technical signals.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active API Keys

5

Active DCA Bots

2

Active Signal Bots

2

Active Grid Bots

20

Active DCA Trades

10

Active Signal Trades

10

Active SmartTrades

100

DCA Backtests

1 year period

100

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active API Keys

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

100

Active DCA Trades

100

Active Signal Trades

50

Active SmartTrades

500

DCA Backtests

2 years period

500

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$140/ month

AI Assistant

Spot & Futures

15

Active API Keys

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active DCA Trades

5K

Active Signal Trades

5K

Active SmartTrades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Run your Solana strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your SOL pairs.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

It depends on your goals and market conditions. Bots don't guarantee profits—they automate trading strategies that capture short-term volatility. Solana's frequent 5-15% daily swings create opportunities that HODLing misses, but they also amplify losses if markets move against you. The real advantage is efficiency: bots execute your strategy 24/7 without emotional decisions. Success requires proper risk management, realistic expectations, and understanding that no strategy works in all conditions. Think of it as active trading without the constant screen time.

Initial setup takes 15-30 minutes: connect your exchange via API, choose a strategy template, and set your risk parameters. Beginners often feel overwhelmed by grid settings and price ranges—start with conservative presets rather than optimizing everything immediately. Once running, check your bot every few days to adjust for major market shifts. SOL's volatility means you'll want to monitor network stability during known outage periods. It's not passive income, but it's far less demanding than manual trading while capturing opportunities you'd otherwise miss.

3Commas is non-custodial—we never hold your funds. Your crypto stays on your exchange account at all times. API keys only grant trading permissions, not withdrawal access, which you explicitly disable during setup. Worst case scenario with proper configuration: a bot makes trades you didn't want, but your funds remain secure on the exchange. We can't withdraw, transfer, or access your assets. Think of API keys like valet car keys—they let us drive but not own your car. Always verify withdrawal permissions are disabled.

3Commas supports multiple strategies optimized for SOL's characteristics. Grid bots place buy and sell orders at set intervals, profiting from volatility. DCA bots average into positions during dips. HODL-adjacent strategies like take-profit trailing capture upside while protecting gains. SOL's low transaction fees make high-frequency grid trading viable, unlike expensive chains. You can run arbitrage between Solana DEXs and centralized exchanges, or deploy custom signals from technical indicators. Each strategy suits different market conditions—ranging markets favor grids, while trending markets work better with trailing orders.

Get trial with full access to all SOL trading tools.