Meet the New 3Commas AI Assistant

2025年11月24日

使用 3Commas 机器人自动化您的 UNUS SED LEO 交易。LEO 是 iFinex 生态系统的实用代币,在 Bitfinex 上提供真正的费用折扣。其区间波动的价格行为在盘整期间适合网格策略。在通过 API 连接的自动化管理平台特定风险的同时,消除情绪决策并系统化交易 LEO。

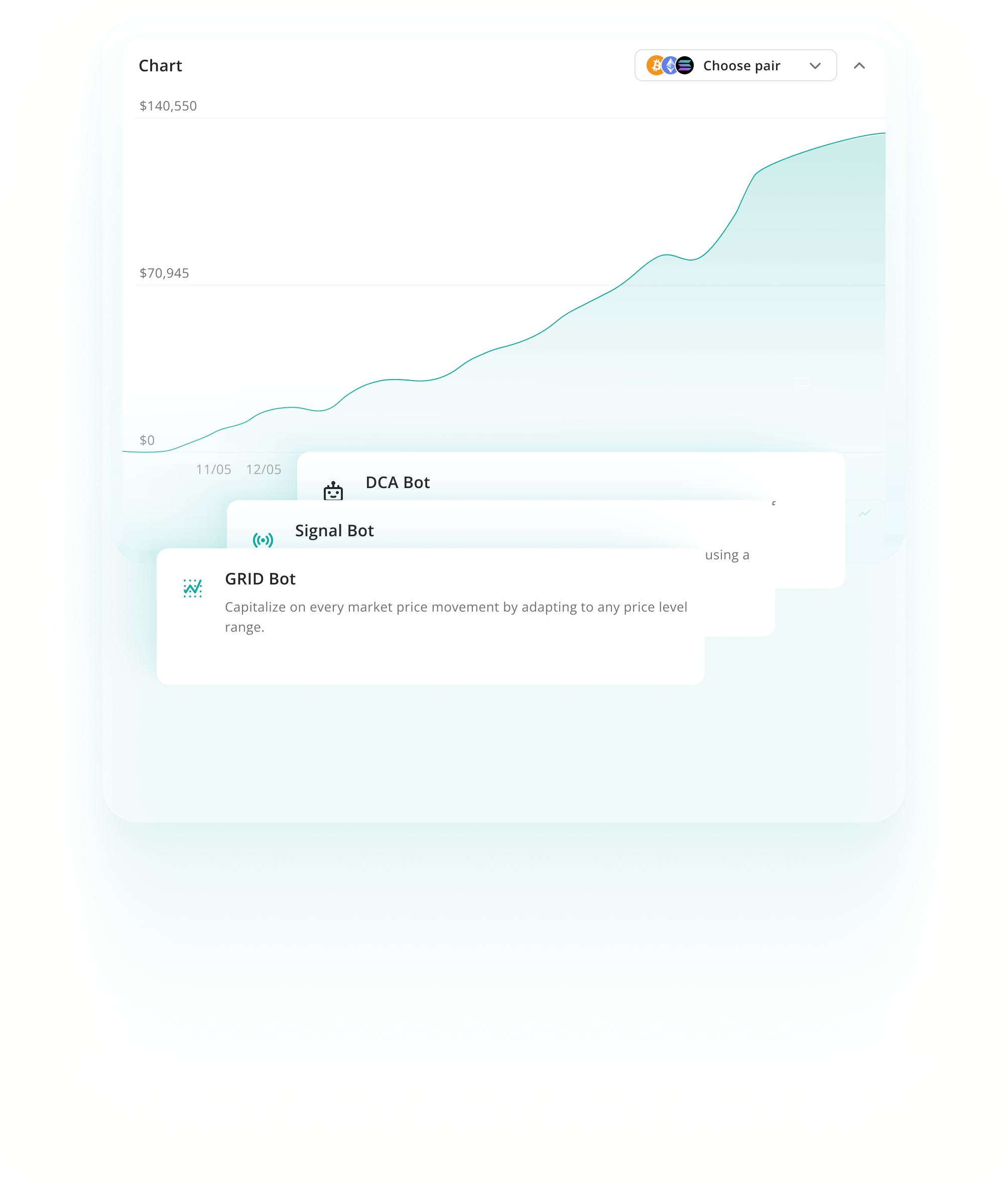

UNUS SED LEO 交易机器人是根据您定义的规则自动买卖 LEO 代币的自动化软件。它就像交易的巡航控制:您设置策略,它全天候执行交易,情绪不会妨碍。LEO 的价格模式使其特别适合自动化网格策略。3Commas 通过仅具有交易权限的 API 密钥连接到您的交易所,从不具有提现访问权限。您的资金始终停留在您的交易所,为您提供完全的控制和安全性。

定投机器人跨多个间隔分散 UNUS SED LEO 购买,降低催化剂驱动的波动性飙升的影响。这种方法有助于在不可预测的新闻事件期间管理择时风险,同时允许交易者逐步建立仓位。该策略与 LEO 的通缩代币经济学和基本实用支持相一致,在延长的积累期间平滑入场价格。

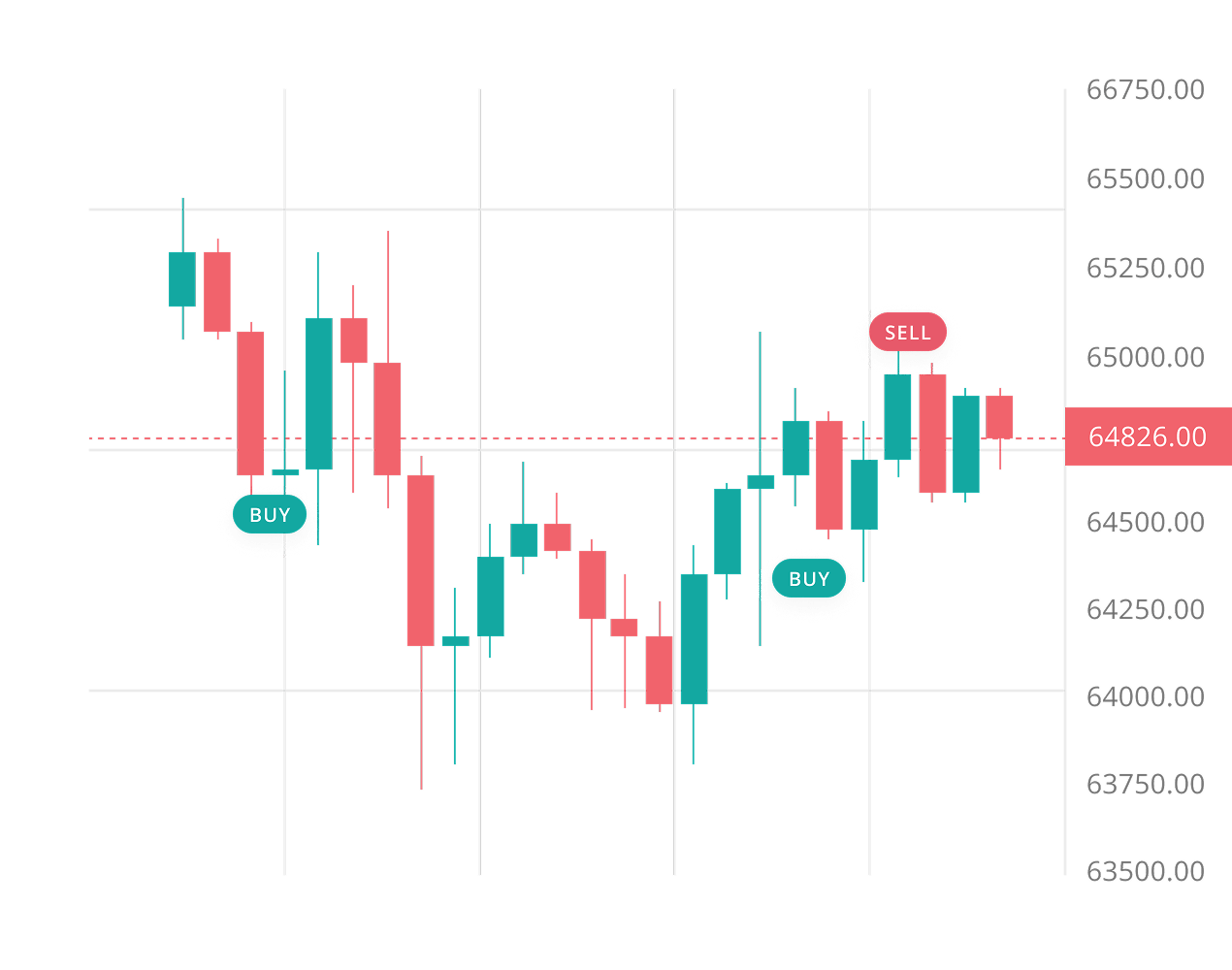

了解更多网格机器人利用 LEO 在区间波动期间建立明确支撑和阻力水平的趋势。机器人在定义的价格通道内放置多个买入和卖出订单,从系统性价格波动中获利。这种策略在 LEO 长达数周的盘整阶段特别有效,其中实用需求创造可预测的支撑水平和自然交易区间。

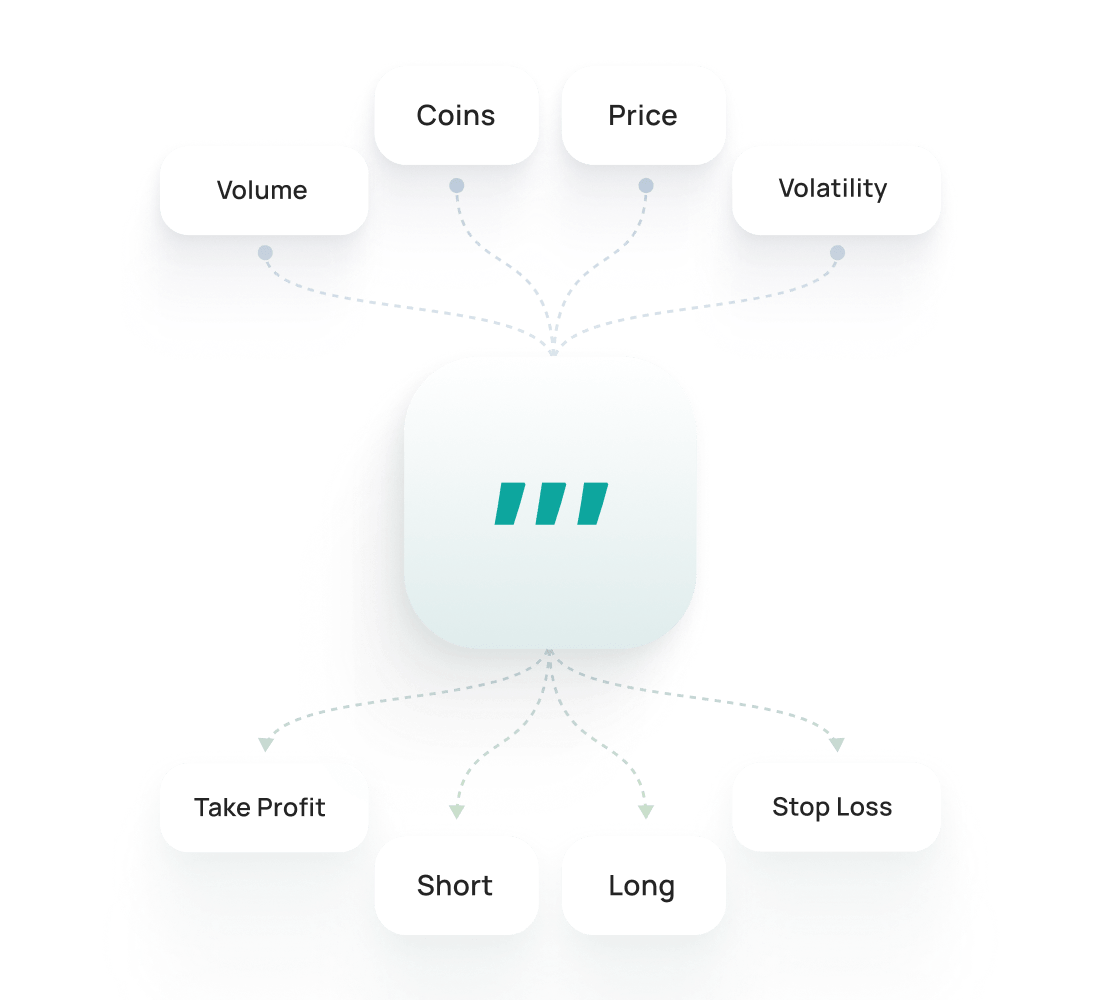

了解更多信号机器人通过响应 RSI、布林带和 MACD 确认信号等技术指标自动化 LEO 交易。这些机器人在满足预定义条件时执行交易,消除情绪决策。该策略在 LEO 的区间波动期间证明有效,并有助于在突破期间捕获动量,特别是当技术信号与生态系统催化剂公告一致时。

了解更多UNUS SED LEO 回测功能允许你在历史数据上测试策略,了解它们可能的表现。它能帮助优化参数,评估风险,并在实盘交易前建立信心。

了解更多UNUS SED LEO SmartTrade为你提供更高级的手动交易选项,例如止盈、stoploss、跟踪止损和多目标出场。UNUS SED LEO 公开预设为你带来来自交易员的现成策略,可以一键启动或根据自身需求自定义。

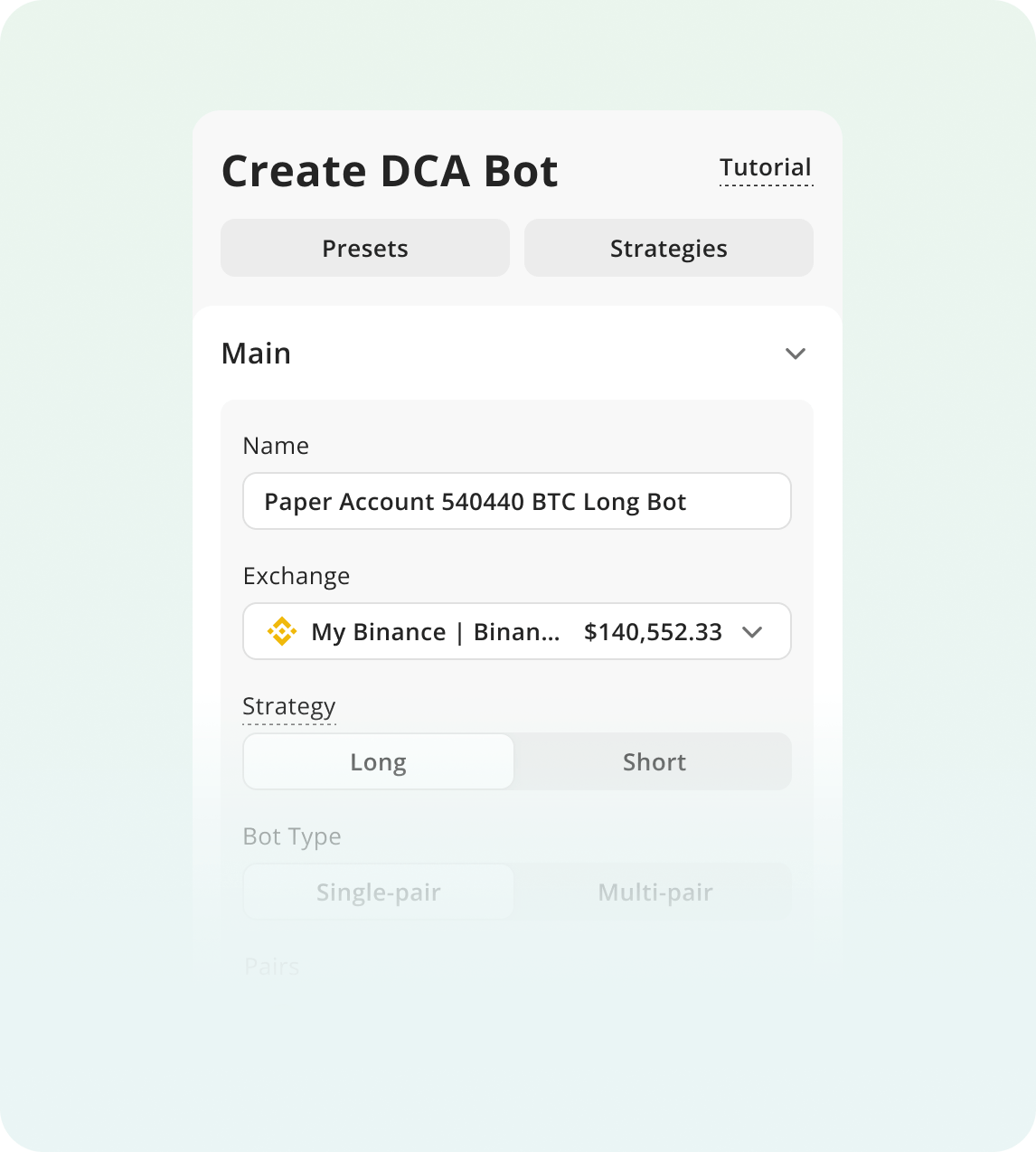

开始使用机器人交易:

注册 3Commas并选择你的套餐

连接交易所并选择你的机器人策略。

配置你的机器人参数并运行机器人!

LEO 交易提出了使自动化成为必要的独特挑战。代币经历触发情绪反应的突然催化剂驱动的价格波动。手动交易者通常在 FOMO 时刻在峰值买入或在低点恐慌抛售。3Commas 机器人在所有时区持续监控 LEO 市场。2025 年 1 月亚洲时段的闪崩在西方交易者睡觉时使价格下跌了 7.6%。自动化交易确保您永远不会错过关键的市场波动。追踪止损和止盈等内置风险管理工具比人类更快地执行。LEO 在公告期间的波动性需要瞬间决策。机器人消除犹豫,并对每笔交易应用一致的纪律。

LEO 代币使用 iFinex 收入的 27% 永久销毁,随时间创造可衡量和透明的供应减少。

在 Bitfinex 上的直接交易费折扣为 LEO 提供了真正的实用性,为活跃交易者降低成本,而不是纯粹的投机。

深度流动性池使大量交易以最小滑点进行,与在订单上急剧波动的较小市值代币不同。

在交易 UNUS SED LEO 时设置紧密止损,特别是在影响 Tether 或 iFinex 运营的 Bitfinex 新闻事件或重大监管公告期间。

由于平台依赖风险和对 Bitfinex 生态系统的潜在监管影响,永远不要将您加密投资组合的 5% 以上分配给 LEO。

密切监控关于 2016 年被盗资金回收的 DOJ 更新,因为这些公告触发立即的代币销毁,产生突然的价格波动和波动性飙升。

单一交易所的现货核心机器人

$20/ 月度

AI Assistant

仅限现货

1

活跃的 API 密钥

5

DCA 机器人运行中

2

信号机器人运行中

2

网格机器人运行中

20

活跃的 DCA 交易

10

Active Signal Trades

10

活跃的 SmartTrade

100

DCA 回测

1 年 周期

100

网格回测

4 个月 周期

开发者 API

只读

Pine Script® 执行

在线聊天支持

多账户现货与合约交易

$50/ 月度

AI Assistant

合约 合约

3

活跃的 API 密钥

20

DCA 机器人运行中

20

信号机器人运行中

10

网格机器人运行中

100

活跃的 DCA 交易

100

Active Signal Trades

50

活跃的 SmartTrade

500

DCA 回测

2 年 周期

500

网格回测

4 个月 周期

开发者 API

只读

Pine Script® 执行

在线聊天支持

卓越限制与 API 交易

$140/ 月度

AI Assistant

合约 合约

15

活跃的 API 密钥

1K

DCA 机器人运行中

1K

信号机器人运行中

1K

网格机器人运行中

5K

活跃的 DCA 交易

5K

Active Signal Trades

5K

活跃的 SmartTrade

5K

DCA 回测

完整历史记录

5K

网格回测

4 个月 周期

开发者 API

读写

Pine Script® 执行

优先实时聊天支持

通过 3Commas,把你的UNUS SED LEO策略运用于 Binance、Coinbase Advanced、Kraken 及其他 12 家以上支持的交易所。用安全的 API 连接,定义一次进出场和风险,剩下交给自动化全天候执行。多个交易市场统一工作台,意味着更清晰的日志、更快的迭代,以及更少错过你LEO对的交易机会。

3Commas 的回测功能让一切变得更简单。我可以尝试想法,验证有效性,避免愚蠢错误——而且不必冒任何资金风险。我购买了 Expert 套餐,能做更多回测。

很长一段时间我一直使用一套我认为盈利的策略,但长期下来却在慢慢亏损。借助 3Commas 回测功能,我意识到只需要对策略做小调整,就能成为赚钱的交易员。

我使用 3Commas 已有几年。只要掌握了这些强力机器人的运行机制,它们就能在风险极低(我知道我在做什么的情况下,年化收益在 15-30%,不用杠杆)的前提下带来不错的回报。你可以睡觉也赚钱,边用边学习不断成长。

团队一直在线,专注客户需求,持续改进应用和网站,并紧跟市场发展步伐。做得非常棒!

我用过其他的交易机器人,但这个真的更好,能让我有效控制亏损、最大化收益。我会一直用下去。

我刚接触加密货币交易,使用 3Commas 很轻松。通过模拟交易学到很多,对这个网站使用也很放心。

200 万

已注册交易员

被评为优秀于

1,479 条评价

Google 评价

4.0

没有交易机器人能保证利润。LEO 机器人是自动化工具,比手动交易更快、更一致地执行您的策略。它们帮助您利用 LEO 的区间波动和波动性模式,但市场条件会变化。在下跌趋势或意外事件期间,您仍然可能亏损。当您监控表现、调整设置并了解交易无论自动化如何始终承载风险时,机器人效果最佳。

即使对初学者来说,设置也只需约 10-15 分钟。您创建 3Commas 账户,使用 API 密钥连接交易所(无需编码),并选择预构建的机器人模板或自定义您自己的策略。平台通过清晰的说明引导您完成每个步骤。最难的部分通常是找到交易所的 API 设置,但 3Commas 为每个支持的交易所(包括 Bitfinex、OKX 和 KuCoin)提供教程。

是的,因为 3Commas 是非托管的。您的 LEO 代币和其他资金永远不会离开您的交易所账户。您提供的 API 密钥仅授予交易权限,不授予提现权限。这意味着 3Commas 可以代表您下买卖订单,但无法将您的资产转移到任何地方。您保持完全控制,并可以通过从交易所删除 API 密钥立即撤销访问权限。

是的,您可以同时运行具有不同策略的多个机器人。例如,一个机器人可以运行利用 LEO 区间波动行为的网格策略,而另一个使用定投在低点积累。每个机器人使用自己分配的资金和设置独立运行。这使您能够分散您的方法并测试最适合 LEO 独特价格模式的方法,而无需将所有资本投入一个策略。

体验试用,全面解锁所有LEO交易工具。