Meet the New 3Commas AI Assistant

Nov 24, 2025

Perp-style futures. Now live for US traders

Trade futures on Coinbase US with full bot support

Automate your UNUS SED LEO trading with 3Commas bots. LEO is the utility token of the iFinex ecosystem, offering real fee discounts on Bitfinex. Its range-bound price behavior suits grid strategies during consolidation. Remove emotional decisions and trade LEO systematically through API-connected automation while managing platform-specific risks.

A UNUS SED LEO trading bot is automated software that buys and sells LEO tokens based on rules you define. It works like cruise control for trading: you set your strategy, and it executes trades 24/7 without emotions getting in the way. LEO's price patterns make it especially suitable for automated grid strategies. 3Commas connects to your exchange through API keys with trading permissions only, never withdrawal access. Your funds always stay on your exchange, giving you full control and security.

DCA Bots spread UNUS SED LEO purchases across multiple intervals, reducing the impact of catalyst-driven volatility spikes. This approach helps manage timing risk during unpredictable news events while allowing traders to build positions gradually. The strategy aligns well with LEO's deflationary tokenomics and fundamental utility backing, smoothing entry prices over extended accumulation periods.

Learn moreGrid Bots capitalize on LEO's tendency to establish clear support and resistance levels during range-bound periods. The bot places multiple buy and sell orders within defined price channels, profiting from systematic price fluctuations. This strategy works particularly well during LEO's weeks-long consolidation phases, where utility demand creates predictable support levels and natural trading ranges.

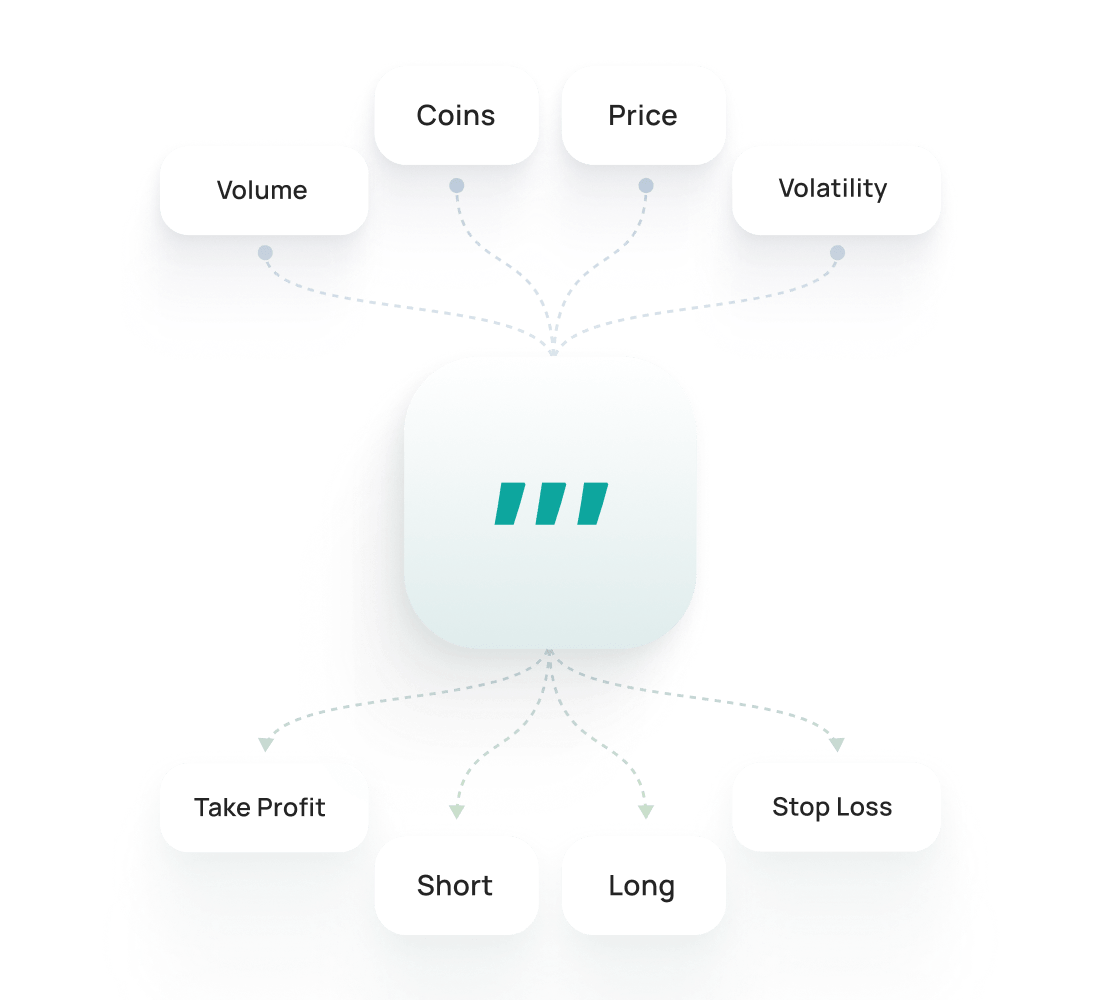

Learn moreSignal Bots automate LEO trades by responding to technical indicators like RSI, Bollinger Bands, and MACD confirmation signals. These bots execute trades when predefined conditions are met, removing emotional decision-making. The strategy proves effective during LEO's range-bound periods and helps capture momentum during breakouts, particularly when technical signals align with ecosystem catalyst announcements.

Learn moreThe UNUS SED LEO Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe UNUS SED LEO SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The UNUS SED LEO Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

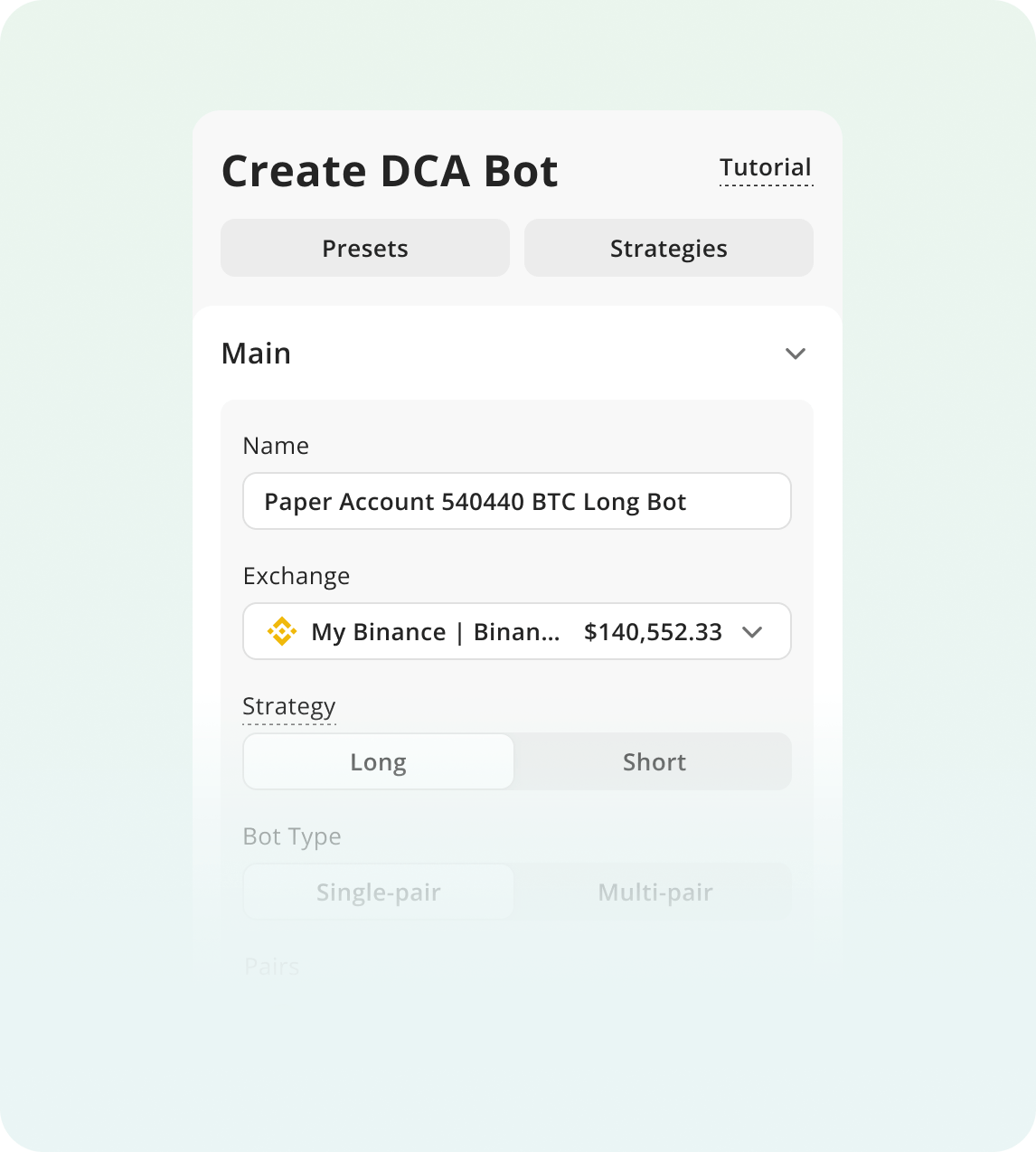

To begin trading with bots:

Sign Up for 3Commas and choose your plan

Connect an Exchange and choose your bot strategy.

Configure your bot parameters and run your bot!

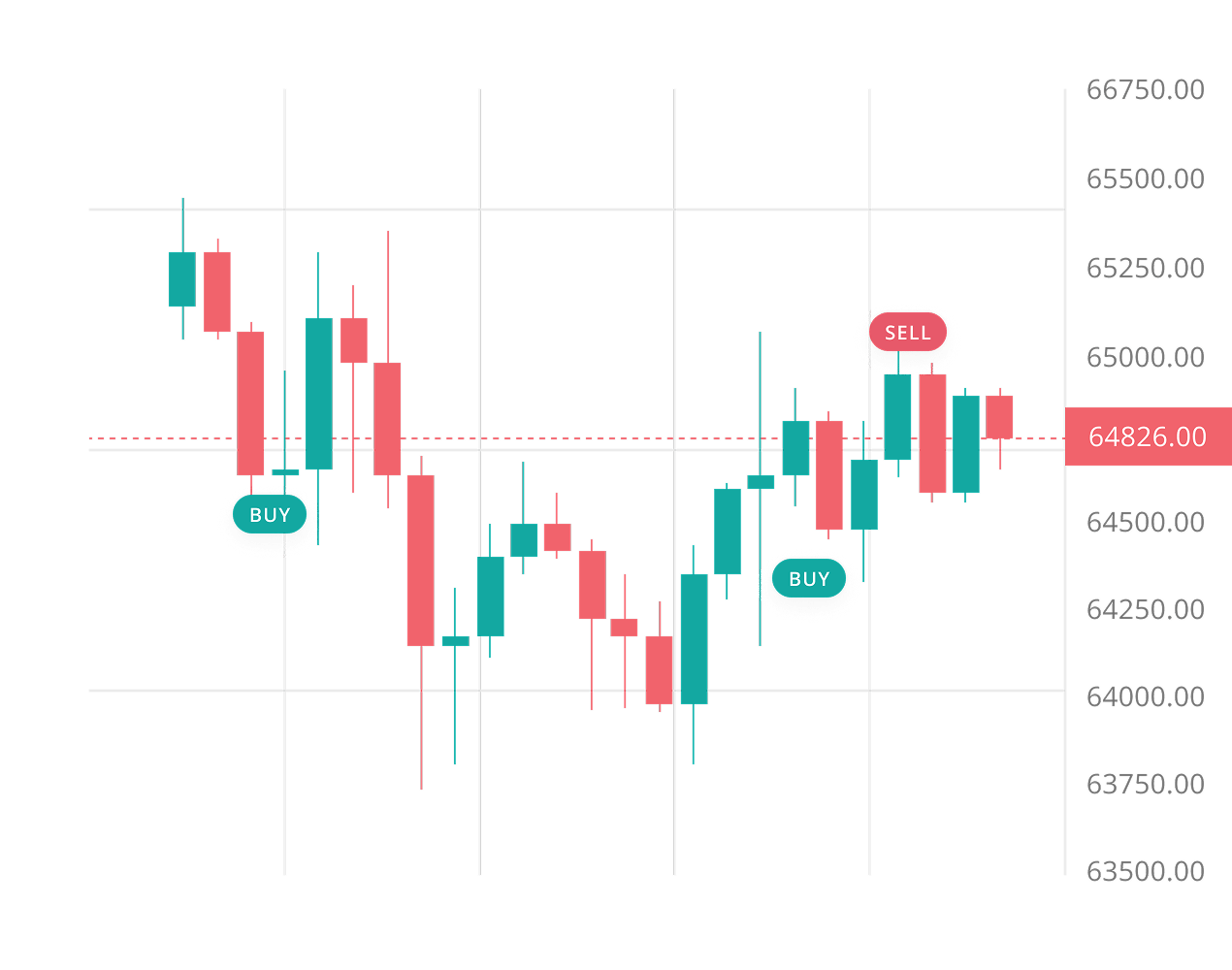

LEO trading presents unique challenges that make automation essential. The token experiences sudden catalyst driven price swings that trigger emotional responses. Manual traders often buy at peaks during FOMO moments or panic sell during dips. A 3Commas bot monitors LEO markets continuously across all time zones. The January 2025 Asian session flash crash dropped prices 7.6% while Western traders slept. Automated trading ensures you never miss critical market movements. Built in risk management tools like Trailing Stop Loss and Take Profit execute faster than humans can. LEO's volatility during announcements requires split second decisions. Bots remove hesitation and apply consistent discipline to every trade.

LEO tokens are permanently burned using 27% of iFinex revenues, creating measurable and transparent supply reduction over time.

Direct trading fee discounts on Bitfinex give LEO real utility, reducing costs for active traders rather than pure speculation.

Deep liquidity pools enable large volume trades with minimal slippage, unlike smaller cap tokens that move sharply on orders.

Set tight stop losses when trading UNUS SED LEO, especially during Bitfinex news events or major regulatory announcements affecting Tether or iFinex operations.

Never allocate more than 5% of your crypto portfolio to LEO due to platform dependency risks and potential regulatory impacts on the Bitfinex ecosystem.

Monitor DOJ updates about recovered 2016 hack funds closely, as these announcements trigger immediate token burns that create sudden price movements and volatility spikes.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active API Keys

5

Active DCA Bots

2

Active Signal Bots

2

Active Grid Bots

20

Active DCA Trades

10

Active Signal Trades

10

Active SmartTrades

100

DCA Backtests

1 year period

100

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active API Keys

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

100

Active DCA Trades

100

Active Signal Trades

50

Active SmartTrades

500

DCA Backtests

2 years period

500

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$140/ month

AI Assistant

Spot & Futures

15

Active API Keys

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active DCA Trades

5K

Active Signal Trades

5K

Active SmartTrades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Run your UNUS SED LEO strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your LEO pairs.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

No trading bot can guarantee profits. LEO bots are automation tools that execute your strategy faster and more consistently than manual trading. They help you capitalize on LEO's range-bound movements and volatility patterns, but market conditions change. You can still lose money during downtrends or unexpected events. Bots work best when you monitor performance, adjust settings, and understand that trading always carries risk regardless of automation.

Setup takes about 10-15 minutes even for beginners. You create a 3Commas account, connect your exchange using API keys (no coding required), and choose a pre-built bot template or customize your own strategy. The platform guides you through each step with clear instructions. The hardest part is usually finding your exchange's API settings, but 3Commas provides tutorials for every supported exchange including Bitfinex, OKX, and KuCoin.

Yes, because 3Commas is non-custodial. Your LEO tokens and other funds never leave your exchange account. The API keys you provide only grant trading permissions, not withdrawal rights. This means 3Commas can place buy and sell orders on your behalf, but cannot transfer your assets anywhere. You maintain complete control and can revoke access instantly by deleting the API key from your exchange.

Yes, you can run multiple bots simultaneously with different strategies. For example, one bot could run a grid strategy capitalizing on LEO's range-bound behavior, while another uses DCA to accumulate during dips. Each bot operates independently with its own allocated funds and settings. This lets you diversify your approach and test what works best for LEO's unique price patterns without putting all capital into one strategy.

Get trial with full access to all LEO trading tools.