- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Options Benefits

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

The cryptocurrency options market has exploded in popularity and are more heavily traded than futures and swap markets. News about recent trading volume records has spread to the far corners of the financial world. Even though this financial instrument is still not common for an average crypto trader, the appearance of options on most well-known exchanges is only a matter of time.

In this article, we will explain what options are and talk about their capabilities in simple words. Make yourself a cup of coffee or tea; it will be an interesting and informative journey.

What’s old is new again

The cryptocurrency market is developing rapidly, providing ever more choice for financial instruments and opportunities to speculate with. While the glory of futures hasn’t gone out yet, a new kind of derivatives, the options, has gone through the roof.

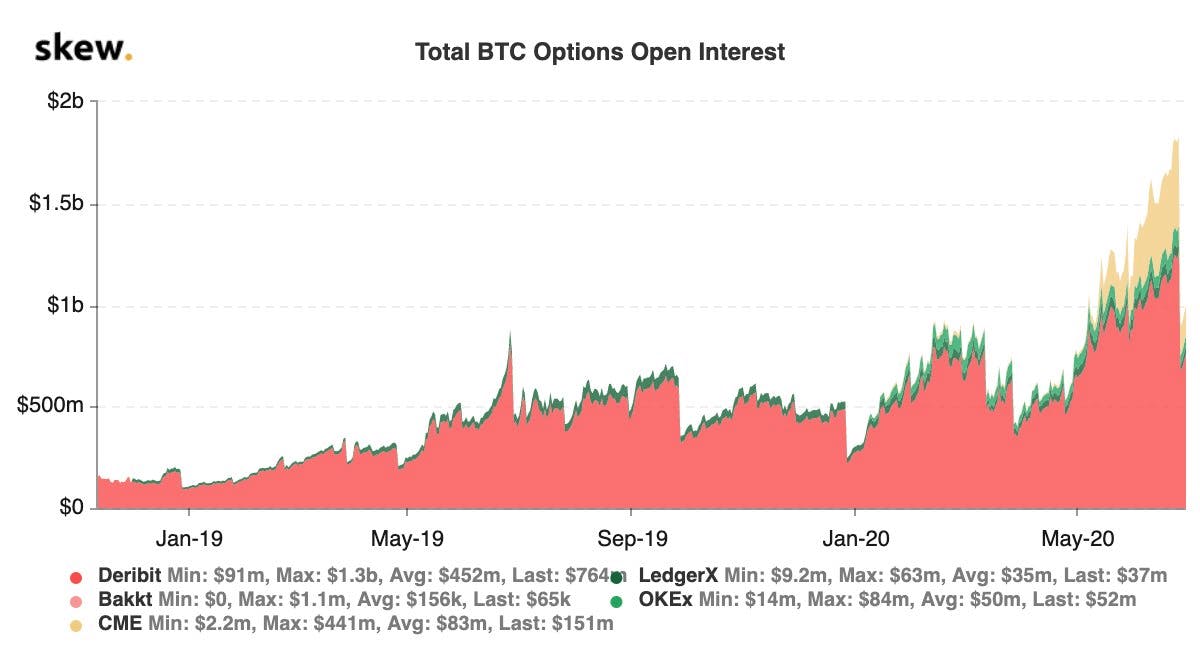

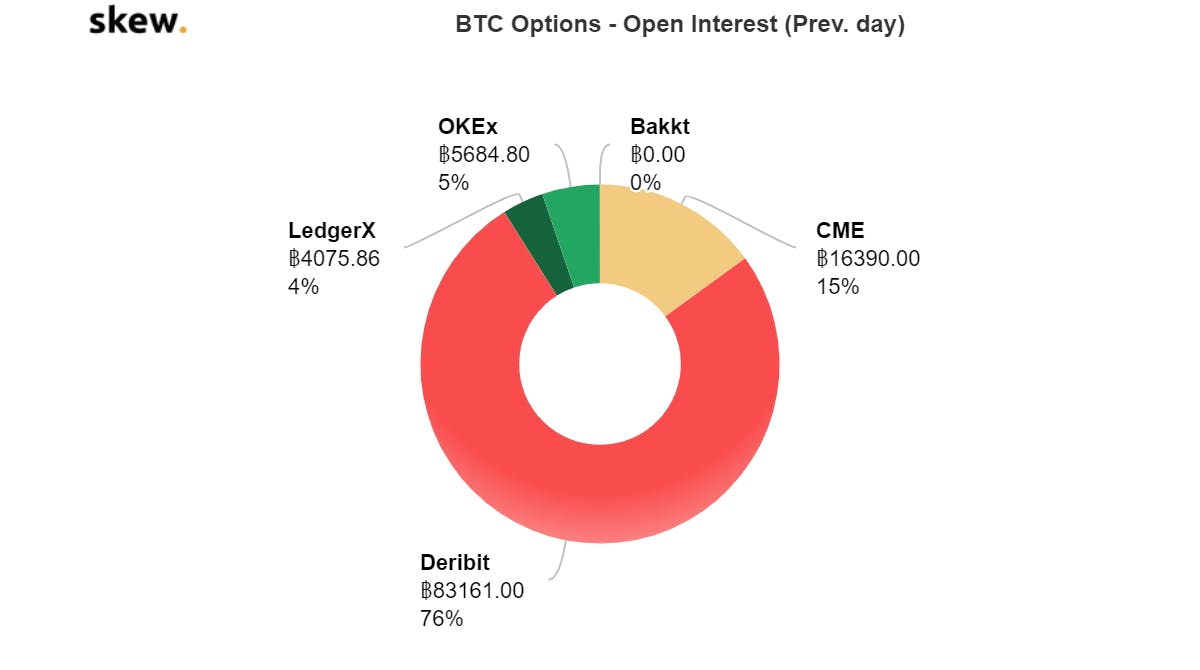

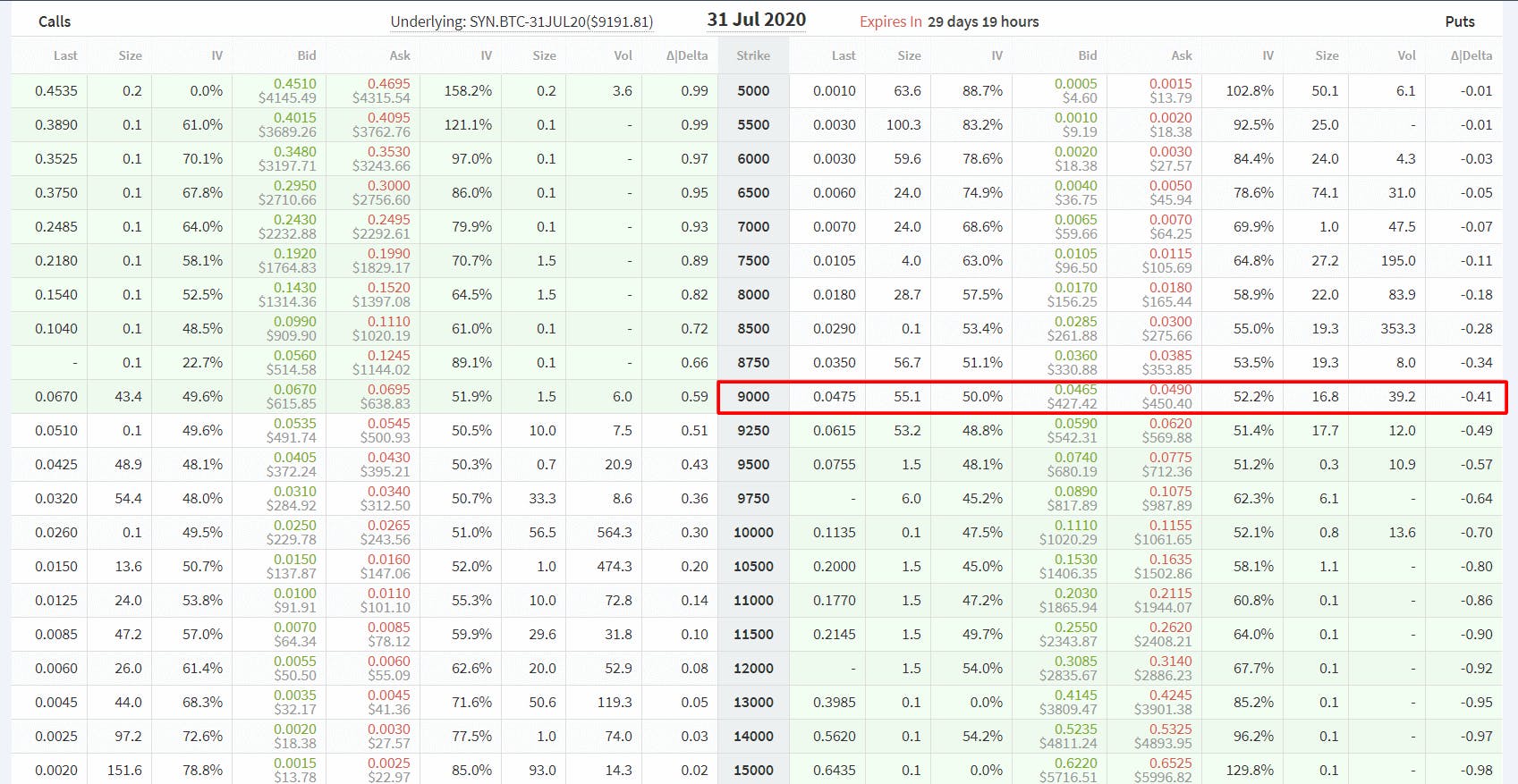

Interest in BTC options increased significantly after extreme market volatility on March 12, 2020. Active growth in open positions of BTC options was observed on all available exchanges. On the Chicago Mercantile Exchange (CME) alone, open interest grew by 10%, and overall the options market grew by 50% over the past month, reaching $ 1.5 billion.

Options are a classic derivative instrument that have come to the cryptocurrency market from traditional financial markets, where such derivatives play a key role.

An Option is a more complex financial instrument than futures and consequently has not yet gained popularity among ordinary traders. However, among professional traders and institutional companies, the demand for these crypto products is growing actively: we can see it from the current statistics in the chart above. Perhaps such a rapid increase in interest for BTC options is caused by a JP Morgan Chase analyst’s recent conclusion, which established that the March crash was the first successful stress test for Bitcoin.

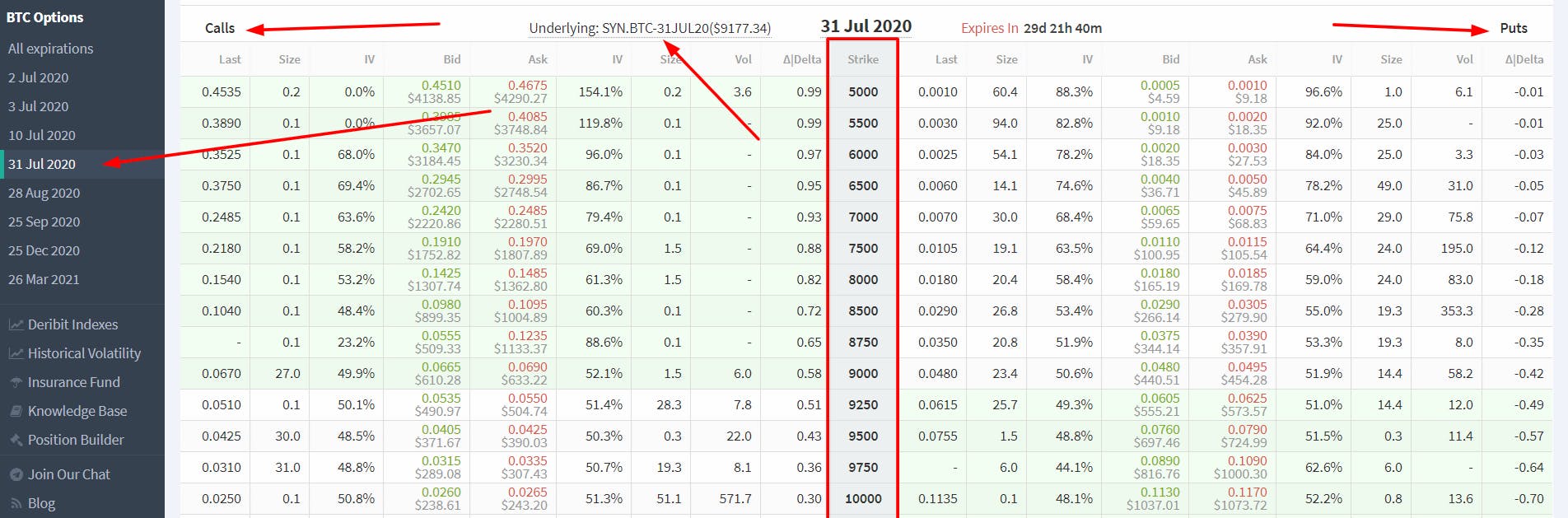

Classic Bitcoin options are now presented on regulated exchanges, catering to large players, such as CME, LedgerX, and Bakkt, as well as on such unregulated exchanges, as OKEx, and Deribit, where Derebit is an absolute record holder in terms of trading volume and open interest (on average up to 85% of the market). In April, Binance launched simplified short-term options targeted at retail traders using mobile applications, while Bitfinex plans to launch cryptocurrency options shortly.

So what is an Option?

First of all, it is important to note that we will not describe binary options that earned a bad reputation and are prohibited in many countries. This article is about classic options settled in BTC.

An Option is a derivative financial instrument based on any underlying asset, in our case BTC or ETN. It is a contract between a buyer and a seller, according to which:

• The buyer receives the right, but not the obligation to buy/sell the asset at a predetermined price on a certain expiration date of the contract;

• The seller undertakes to buy/sell the asset at the buyer’s request, who at the time of the trade pays the seller an option premium – a fixed amount specified in the contract.

• The pre-negotiated price is called a strike. The strike is a key point, the price of an asset, after which the option becomes profitable. All settlements will be made according to that price.

Options may vary by the period during which one can utilize the right to settle them:

• The European option model entitles the buyer to execute the contract exclusively on the expiration date. Such options are offered by CME, Bakkt, OKEx, as well as the market leader Deribit;

• The American option model allows one to utilize this right any day prior to the expiration date. Binance offers such options in a simplified format.

In simple terms, this impacts whether we can close a position at a convenient time before the expiration date or not.

Options in a practical matter

To better understand the mechanism of this contract, let’s take a look at a simple example: you decided to purchase a property and found one at a suitable price. However, you do not have enough funds for this purchase, but you know that after 6 months, you will have the amount on hand. You sign a contract with the owner that during this period (expiration date), you will have the right to buy this property at the original price (strike), but at the same time, you will pay rent for 6 months for this property (premium).

Possible scenarios:

• The market value of this property in six months grows by 20% (higher than the strike). Since the price was fixed, by executing the contract, you will receive a profit of 20%, minus 6 months rent that has already been paid.

• The market value in six months falls by 30%, and you decide to sacrifice the money paid for the rent (the seller’s premium), but opt out of buying real estate since the contract price is too high and you can find a better deal.

Thus, options, in addition to speculation, can be used to hedge your main long or short position. For example, miners actively use a feature of fixing the price of mined coins and protect themselves from market volatility. According to experts, the popularity of options will continue to grow consequently.

Options types

There may be an option for buying or selling an underlying asset (BTC/ETH).

Call option – Gives a trader the right but not the obligation to buy the underlying asset at a specified fixed price in the future.

Put option – Gives a trader the right to sell the underlying asset at a specified fixed price in the future.

Respectively, there are four possible types of options trades:

• Buy a call option;

• Sell a call option;

• Buy a put option;

• Sell a put option.

Such tools open up a variety of new opportunities for speculation. However, due to the more complex structure, options are not suitable for every market participant. Nevertheless, traders with experience in speculative trading can effectively apply option strategies.

Options Strategies

Warning! Options are high-risk financial instruments and should be traded with great caution.

Selling Call and Put options is the most high-risk strategy, suitable only for experienced market participants. Thus, we will review the most common and simple trading strategies taking the purchase of options on the Deribit exchange as an example. Beginners are advised to practice these strategies with paper trading prior to moving forward.

Long Call

Long Call is analogous to the long position. Buying a Call option, you expect an increase in the price of the underlying asset (BTC/ETH) above the strike price on the contract expiration date. If the price drops below the strike, you only risk losing the option premium.

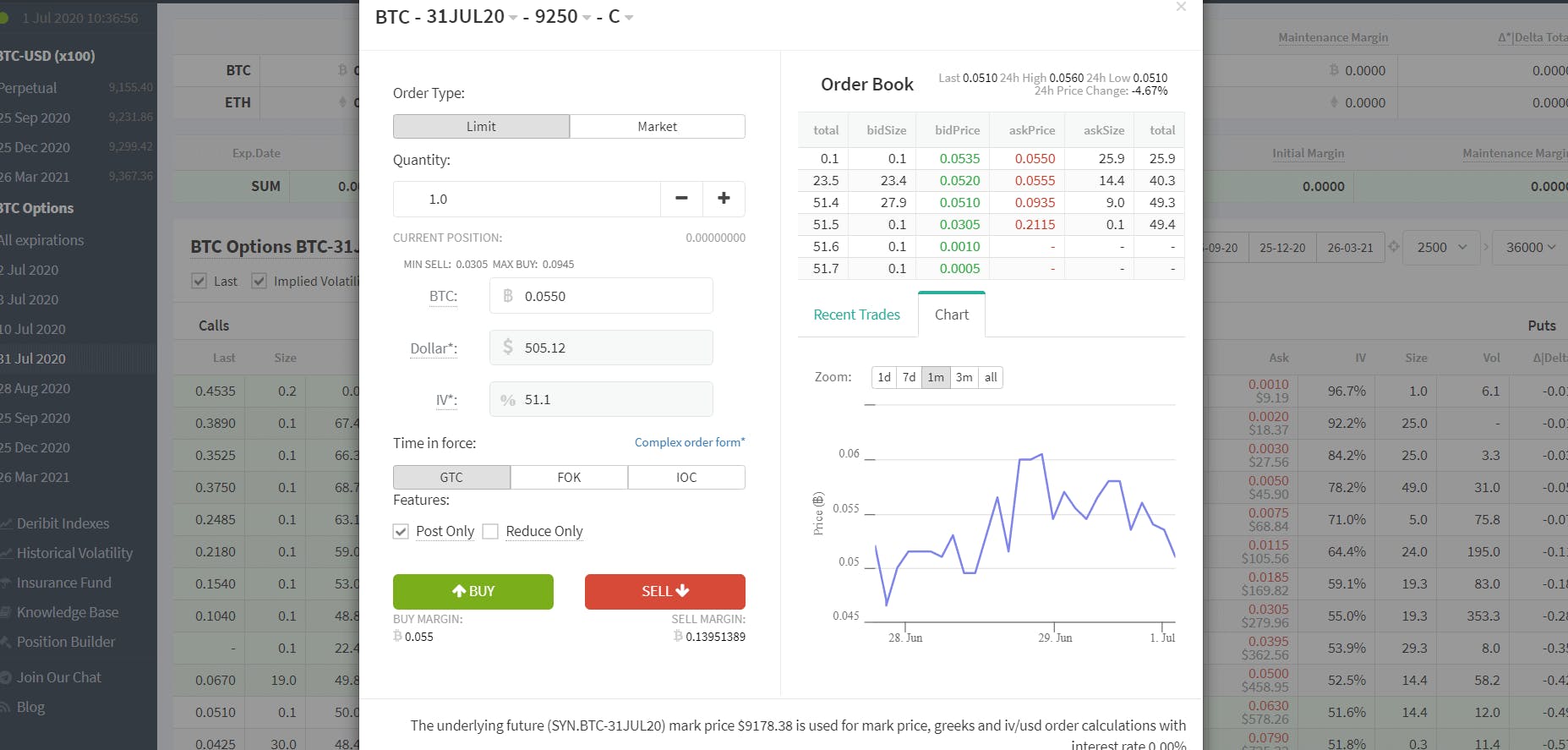

Example: you are buying a BTC call option on Deribit exchange.

• Expiration. You choose a specific expiration date – the date when you believe BTC will rise above the specified strike price. On that day, the exchange will close all trades under this contract and perform settlements automatically.

• Strike is the option’s settlement price, the point after which your BTC option will become profitable. All settlements will be done according to the strike.

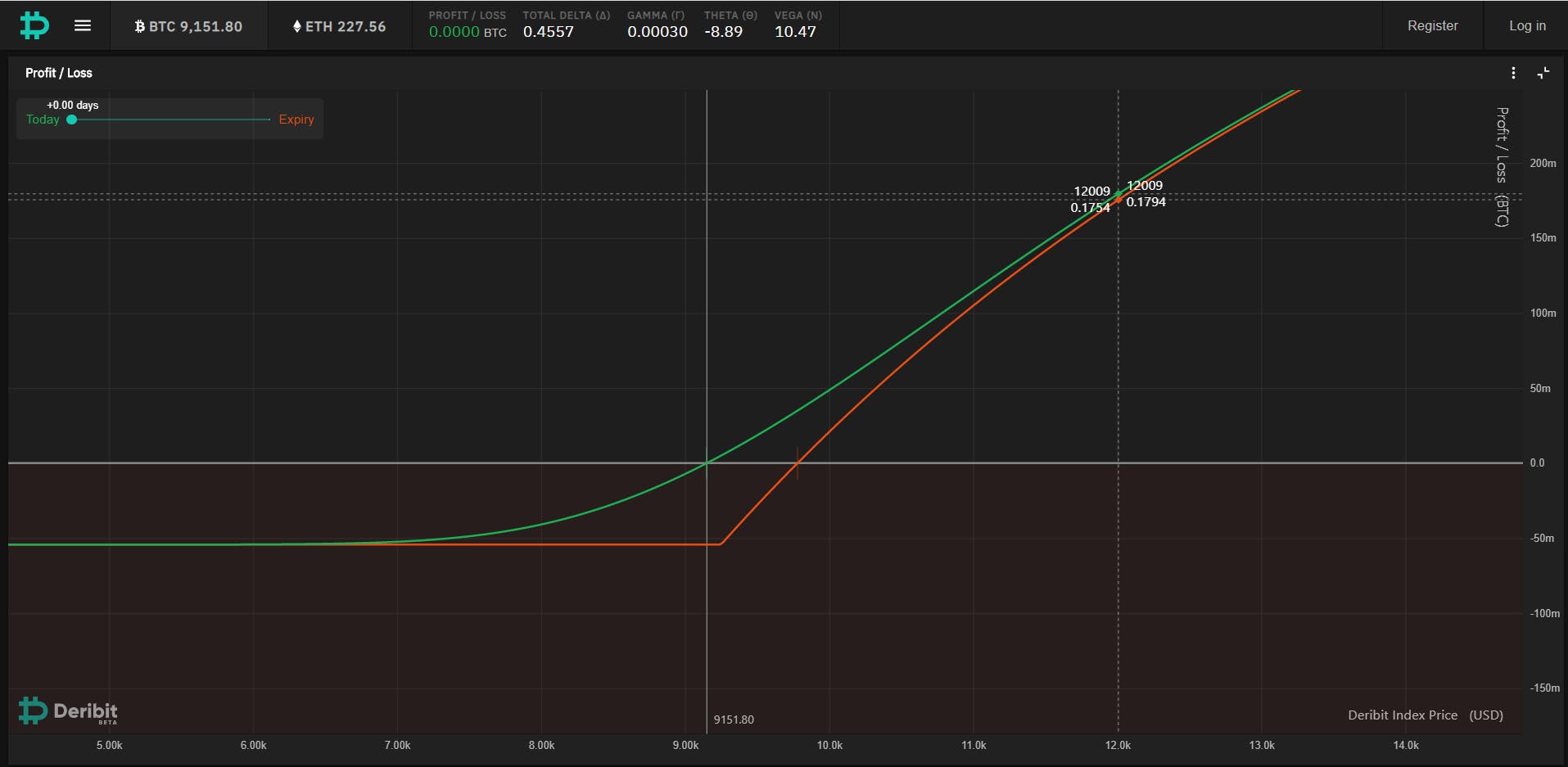

• If you choose an option with a strike of $9250 for the expiration date on July 31, one contract will cost you $505, which is the option seller’s premium (you can also buy a fraction of an option). Any BTC/USD rate below the July 31 strike will bring a loss in the amount of the premium. The option brings profit after the breakeven point of $9755 ($9250 + $505). The potential profit is not limited by anything other than the growth of the BTC rate. With the growth of BTC to $12,000 as of July 31, you will receive a profit of $2152, while you only risk the premium that you have paid while buying the option.

In a volatile cryptocurrency market, experienced investors can turn options into a lucrative tool. The main rule is to reasonably choose the expiration date, strike, and the size of the premium.

- The option premium is an amount that you are willing to lose in case of the unfavorable outcome of your forecast. On the above Deribit exchange graph, the options are in profit with the price above/below the strike and marked green. For such options, the premium and, accordingly, the cost of entering the position is usually higher.

- However, if, for example, you forecast that by the expiration date BTC will increase to $15k, then having bought a cheap option with a strike of $11,500 for $ 82, on July 31 at a price of $15,000 the profit on the option will be $3480. The risk would only be $82, and you can earn 42x. Of course, this is just an example, but it reflects the possibilities of options during periods of strong volatility.

- If there is still a long time before the expiration, and your option is already in profit, you can close an entire position or a part of it by placing a bid in an order book and fix profit at any time before the expiration.

Long Put

Long Put is the equivalent of a short position. Buying a Put option, you expect the price of the underlying asset to drop below the strike at the time of expiration. If the price rises above the strike, you only risk losing the option premium.

This concept is the same as when buying a Call option, but you bet that the price will drop below the strike, and the profit potential is limited by how low the price of the underlying asset goes.

Straddle

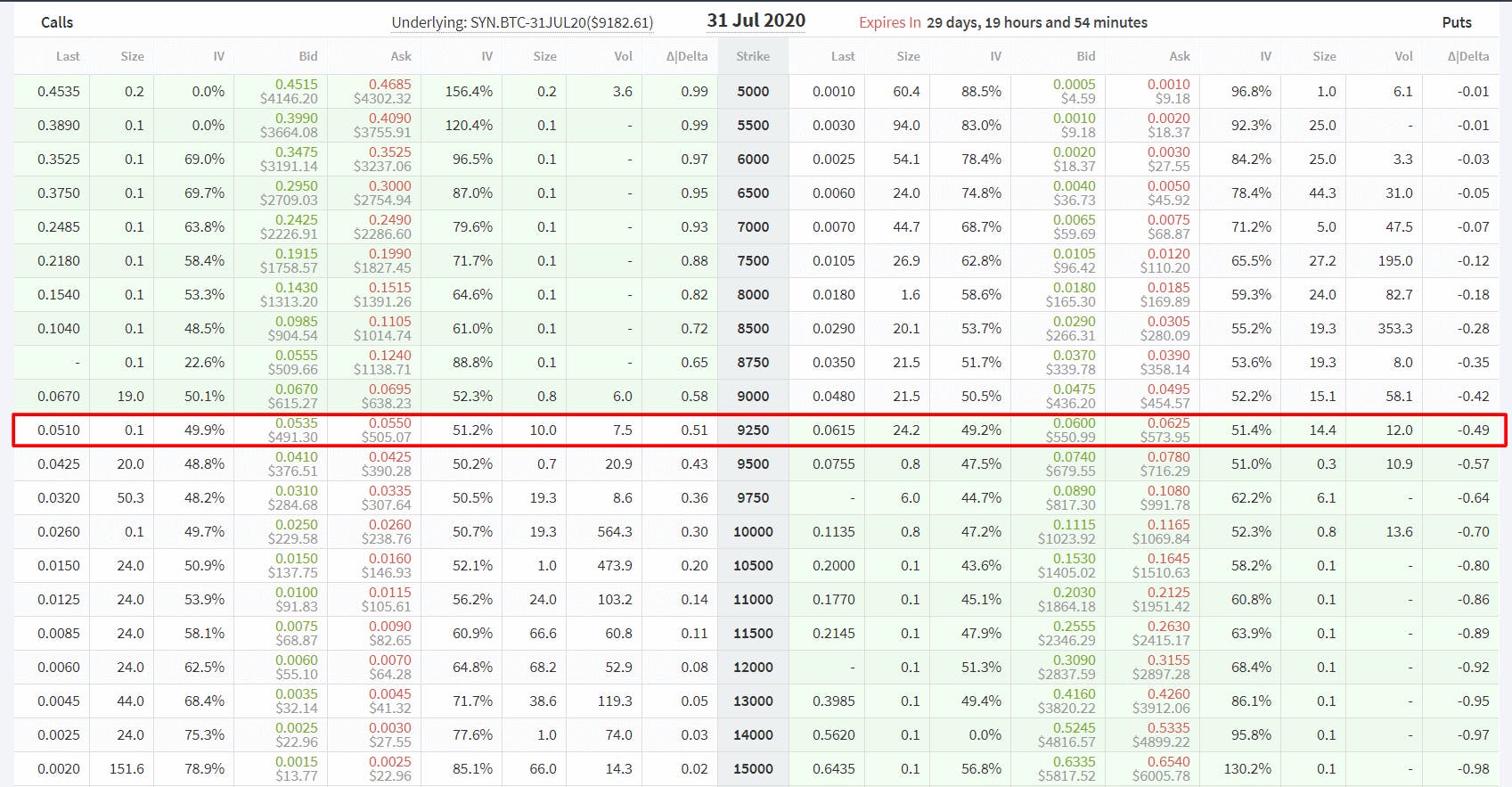

A straddle is analogous to simultaneously being short and long in futures. A strategy where you profit from high volatility buying options with the same strike, but aimed in opposite directions.

For example, we buy two options, one Call and one Put, with the same strike and within the same expiration date.

• We are risking a premium of $505 in one option, and $573 in another, totaling $1078.

• Break-even occurs above $10,330 and below $8170.

• If the market continues its sideways movement, we are risking the sum of both premiums.

• With the growth of BTC to $12,000 on the Call option, our profit will be $2152 minus the premium for the Put option of $573, and as a result, we get $1579.

• If BTC drops, for example, to $7000, under the Put option, our profit will be $1790 minus $505 premium for the Call option. Our balance will be $1280.

• This strategy is only effective in case of strong volatility, since the sum of risks is quite substantial, so you need to carefully choose an entry point.

Strangle

Strangle is a variation of the Straddle strategy, but with different strike points. It is useful when choosing an option to reduce the total amount of premium (reduce risk). You also buy two options, one Call and one Put, within the same expiration date, but with different strikes and, importantly, with lower premiums, reducing the total amount of risks and thereby bringing the breakeven point closer and increasing potential profit. Thus, the Strangle strategy allows you to earn more than the Straddle strategy with an identical amount of risk.

Strangle strategies can be selected based on the different risk/reward ratios, but the further the strike from profit is, the fewer the chances are for the option to make a profit. In this sense, the Straddle is more likely to make a profit. When calculating the Strangle strategies, choose those options that reach a breakeven point faster. It is better to fix profits or diversify risks in advance.

Hedging a primary position

In addition to speculation, Put and Call options can help an investor safeguard their primary position.

Example: you have $10,000 you want to spend on Bitcoin at a price of $ 9,200, and if the rate drops to $7,000 the day after, you will face losses which is never a pleasant experience.

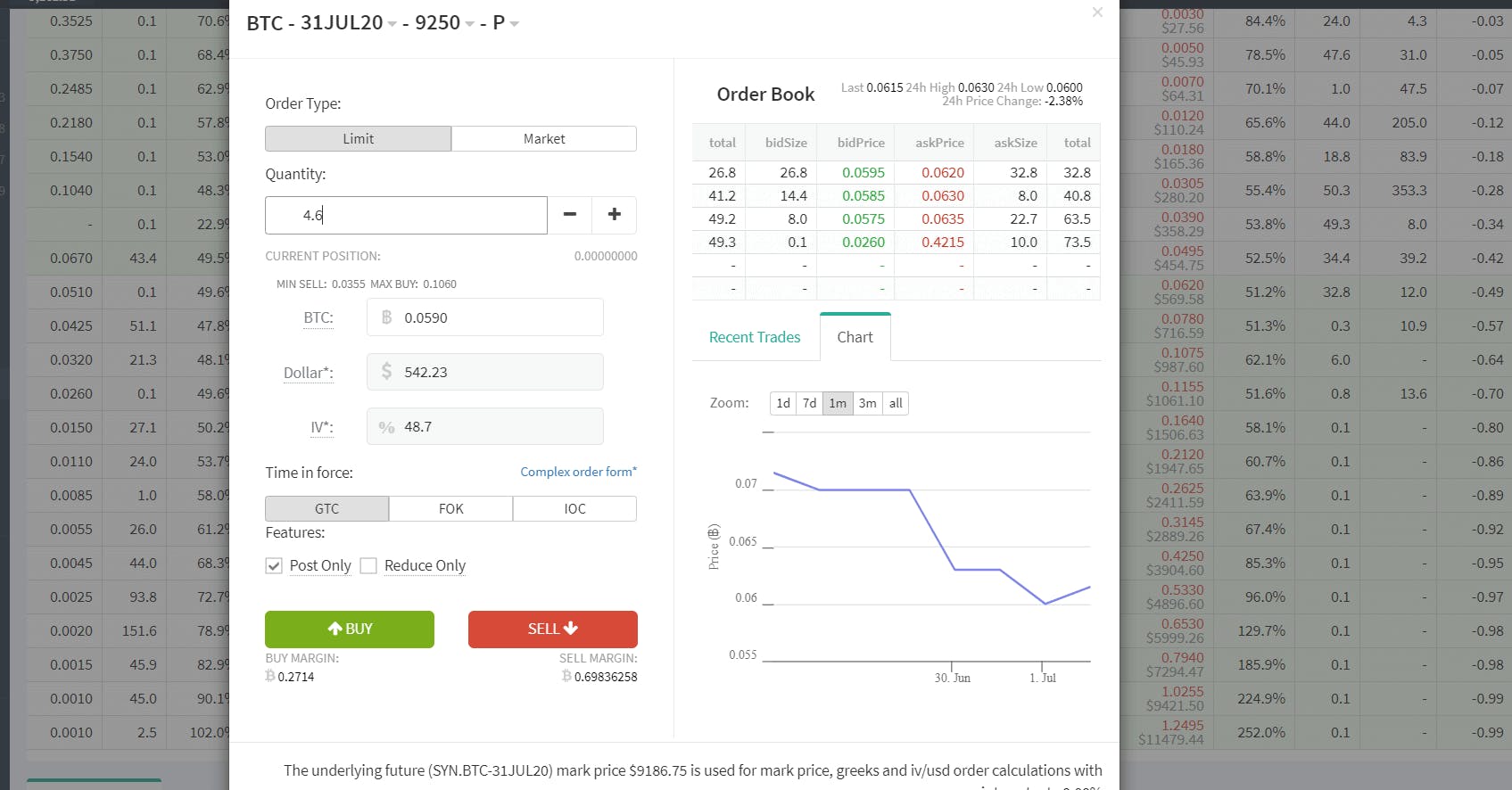

- Such risks can be covered by purchasing a Put option, where you choose a strike based on the purchase price of the asset, analyzing the calculations from the formulas above, and using the exchange calculator. Let’s take a strike of $9250 for the purpose of the example. The date of expiration is conditional.

- We buy 0.81 BTC using 75% of the amount and spend 25% of the amount to buy 4.6 Put option contracts.

- At a premium of $542, we are risking $2500, if BTC does not drop below $9,250, break-even point is at $ 8700.

- If BTC continues a sideways movement up until the expiration date, we risk losing the entire premium sum.

- If BTC rises to $11,000, we will lose $2,500, but our 0.81 BTC will cost $8900 instead of $7500 that we spent to purchase it, $1400 of our expenses will be covered, and we will be able to breakeven in case of further growth of the asset.

- If BTC drops to $7000, then our 4.6 Put options will bring us $8250 of profit, and our 0.81 BTC will cost $5670, therefore we will receive a profit of $3920 from the original amount of $10,000.

All these are just examples of basic strategies, and besides these strategies, there are many more complex and risky ones that you are yet to study yourself if options are something that you are interested in.

When choosing strategies, it is very important to independently and carefully calculate the entry point, based on your personal risk management and financial capabilities.

Nothing ventured, nothing gained.

Options are complex financial instruments that are not suitable for novice traders due to high risks. Nevertheless, experienced market participants, such as speculators, traders, hedge funds and miners, can benefit from such an instrument. Options allow you to use a combination of trading strategies with other instruments and hedge risks on the spot, as well as benefit from volatility at a minimal cost.

Interest in options on the market is growing every day, and soon these derivatives are likely to become the standard for all major cryptocurrency exchanges.