- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Fiat currencies

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

In early history, economic relations were based on barter: merchants used to exchange goods for other goods directly, and there were no universal means of payment. However, later on, the barter was replaced with coins made of precious metals, followed by paper notes. Central banks obtained a monopoly over money production and gradually shaped a monetary system that would not limit currency inflows. This is a simplified overview of how fiat currencies emerged and evolved in the first half of the 20th century.

Each of us regularly transacts with money: we pay the bills, transfer money to companies and individuals, buy groceries, and more. We use fiat money almost every day, but what do we know about it? In today’s review, we will explore what fiat currencies are, talk about their characteristics, and how they differ from cryptocurrencies. So, let’s begin.

What is a fiat currency?

Fiat currencies are fiduciary money that is not backed by anything like gold, silver, or any other valuable commodity. The word fiat comes from Latin and translates as “let it be done.” This means that their value is determined by the government that issued the currency, and not the intrinsic value of the banknotes themselves. The value of Fiat currency depends solely on the trust of people using them, and governments regulate this value via interest rates and a number of other instruments.

Each country or government has its own legal currency. In Russia it’s the ruble, in the USA it’s the dollar, in Japan it’s the yen, etc. The national currency is the only legal means of payment in a state where it was issued. However, there are exceptions; for example, in countries that are part of the E.U., euros are used as the primary national currency.

The emergence of fiat currencies

Barter preceded the emergence of money. Traders used to simply exchange one product for another. But such a system was far from perfect — it could not scale, and it could turn out that you might need something but had nothing the merchant wanted in exchange. Gradually, towns and cities began to move to a universal monetary system, where the buyer could purchase any product according to its value. Besides, this system made it easier to determine the value of goods.

The first known form of money appeared in Mesopotamia almost 5000 years ago and was called the shekel, while the first mints date back to around 650 – 600 B.C. in Asia Minor (Lydia, Ephesus, and Ionia.) Coins were often used to cover military expenses. The Lydians were the first ones who, by the direction of King Croesus, had used gold coins. Other states quickly adopted the initiative and the use of gold coins spread around the world. Silver, bronze, and copper coins were also common.

The Chinese were the first to create round bronze coins with a square hole in the middle. Nowadays, this shape of coins can often be found on pendants and other decorations. Chinese were also the first ones to come up with paper money. In the 10th century A.D., Chinese officials experimented with money and used sheets of paper to represent and be equivalent in value to gold. The famous explorer and writer Marco Polo noted in his manuscripts that the Chinese emperor of the Song dynasty could make as many notes as he desired, which led to rampant inflation. Thus during the reign of the Ming dynasty, paper money had to be abolished. Since then, paper banknotes did not come into use until the 17th century in Europe. People only started to trust money after paper notes received backing by government reserves.

The Gold Standard

At the beginning of the 20th century, the U.S. adopted the gold standard. This meant that printed money was underpinned by being convertible back into gold. Everyone could come to the bank and exchange their bills for gold stored in reserves, and banks had to oblige. However, in the 1920s, the Great Depression began, which caused people and institutions to hoard gold.

The supply of gold became restricted, and the state simply did not have enough gold reserves to carry out monetary policy and manage money circulation. As a result, the government concluded that the economy needed a money supply increase, while the gold backing had limited the ability to issue the notes. Therefore, the gold standard had to be abandoned. This led to the emergence of fiat money as we know it.

The arguments in favor of gold-backed currencies boiled down to the fact that they guaranteed a more stable exchange rate and were less prone to inflation since gold had been a scarce commodity continually increasing in value. But governments needed room to maneuver so that they could print banknotes without limitations to meet the current needs of the economy.

Many years later, this became the reason behind the creation of cryptocurrencies.

The first cryptocurrency Bitcoin was created in 2009 as an alternative to “traditional money”. It was a response to the 2008 global financial crisis. Cryptocurrencies have pointed out the imperfections of the current monetary system that allowed states to control the value of fiat currencies by releasing an unlimited amount of money into circulation.

Cryptocurrencies have no physical form. The holders manage their funds by controlling public keys. One of the main features of most cryptocurrencies is their limited supply. For example, there will only be 21 million bitcoins created. And, given the irrecoverable loss of some of the coins, the total number will not even reach 20 million.

Another key feature is decentralization. Each participant of a Proof-of-Work based cryptocurrency has equal rights in terms of currency issuance. In Bitcoin, this process is called mining, analogous to gold mining. No wonder Bitcoin is called “digital gold”. Bitcoin is scarce just like gold, but the difference is that Bitcoins are mined digitally using the computing power of special ASIC devices.

Fiat versus Crypto

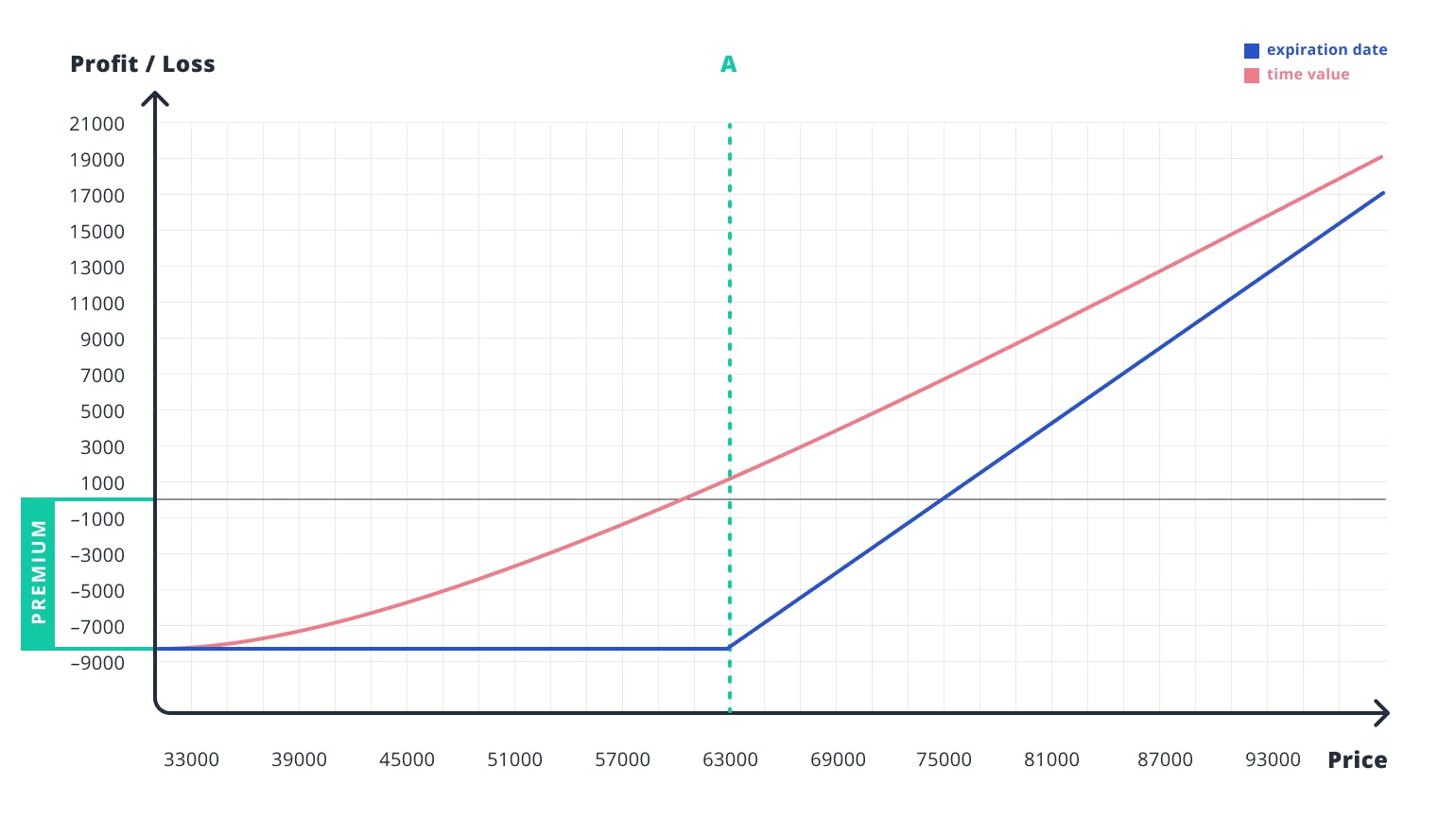

Fiat money still holds a significant advantage: merchants are used to fiat, which is much more stable than crypto. This is justified by high liquidity and higher capitalization, which is the total value of all assets in circulation. The dollar’s aggregate capitalization exceeds the one of Bitcoin by orders of magnitude: $1.4 trillion against $169 billion. The lower the capitalization, the higher the volatility. This means that with the same volume of purchase or sale, the value of different currencies will change at different rates. The selling pressure, which would not noticeably change the dollar exchange rate, can bring Bitcoin down by 50% or more.

Opponents of fiat point out that the latter is not backed by anything. In fact, nearly no asset is backed by anything these days. One might contest that stocks, for example, are secured. But with what? Stocks entitle one to own a certain share of the company. We can assume that the company’s turnover backs the stocks, but this statement wouldn’t be correct. Stock value rather depends on the turnover and financial performance of companies, which is not quite the same. The backing is when you can come to a bank or other organization, hand over a document, and receive an underlying asset in an equivalent amount.

However, stocks are only tied to the company’s performance and generally depend directly on the corresponding figures, as well as on future forecasts and positive expectations of investors. And this is their significant drawback. Cryptocurrencies, on the other hand, are not so tightly dependent. However, despite the fact that cryptocurrencies are actually sovereign, there is an obvious correlation between them and the stock indices. For example, in the spring of 2020, during the COVID-19 pandemic crisis, the correlation between Bitcoin and the S&P 500 reached an all-time high of 0.92. This means that bitcoin practically followed the movements of the stock market.

Cryptocurrencies and fiat money have only one common similarity, and that’s the lack of backing by physical assets.

Advantages and Disadvantages of Fiat Money

Fiat currencies are an undisputed leader in one field: fiat is the only legal form of money. Despite the centralization of cryptocurrencies, governments and legislatures remain centralized institutions. If the government outlaws cryptocurrencies, they will simply go into the shadows. Simply put, most cryptocurrencies are decentralized, which makes them censorship-resistant, while fiat currencies are not. Now let’s list some of the pros and cons of fiat currencies.

Control. The issuance of fiat money is regulated by one of the central authorities of a particular country. No individual has the right to replicate national currency. In the ecosystem of Bitcoin and other cryptocurrencies, everyone can create (mine) new units without any license. The government also controls the circulation of money: almost all monetary transactions are being recorded and can be easily tracked. This is especially true for digital fiat currencies. Bitcoin transactions are harder to track, and they offer more privacy.

Unlimited creation. Central banks can issue an infinite amount of currency units, while the emission of crypto assets in most cases is known in advance, strictly limited, and cannot be changed. This adds value to crypto-assets, although there are exceptions. For example, creators of the Ethereum cryptocurrency have not determined the limit for the emission of ETH.

Centralization. Centralized management imposes other restrictions as well. Banks can block transactions and accounts. In fact, it turns out that they manage customer accounts. Cryptocurrency users are the only ones who can access a non-custodial wallet and have full control of their funds through the private keys. On the other hand, if the crypto holder loses the password, private key, and a seed-phrase associated with the wallet, the access to the funds will be lost forever.

Stability. Fiat is more stable compared to other assets, both traditional and digital. The cryptocurrency rate can change by 50% or even more in a single trading day. Few people use cryptocurrencies as a means of payment due to counterparty risks.

What’s next?

The future of cryptocurrencies and fiat money remains unclear. However, we are certain of one thing: the current financial system is unstable and imperfect. Therefore, sooner or later, it will be replaced by a novel improved digital economy. At the same time, we do not yet know when this will happen and what will replace fiat currencies. The cryptocurrency market is still very young, and it needs to solve many issues before cryptocurrencies gain mass adoption around the world.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.