Meet the New 3Commas AI Assistant

Nov 24, 2025

Perp-style futures. Now live for US traders

Trade futures on Coinbase US with full bot support

Automate your ADA strategies around Cardano's predictable development milestones and network upgrades. Our bot executes trades based on your rules while you earn staking rewards. No custody required. You stay in control of your funds.

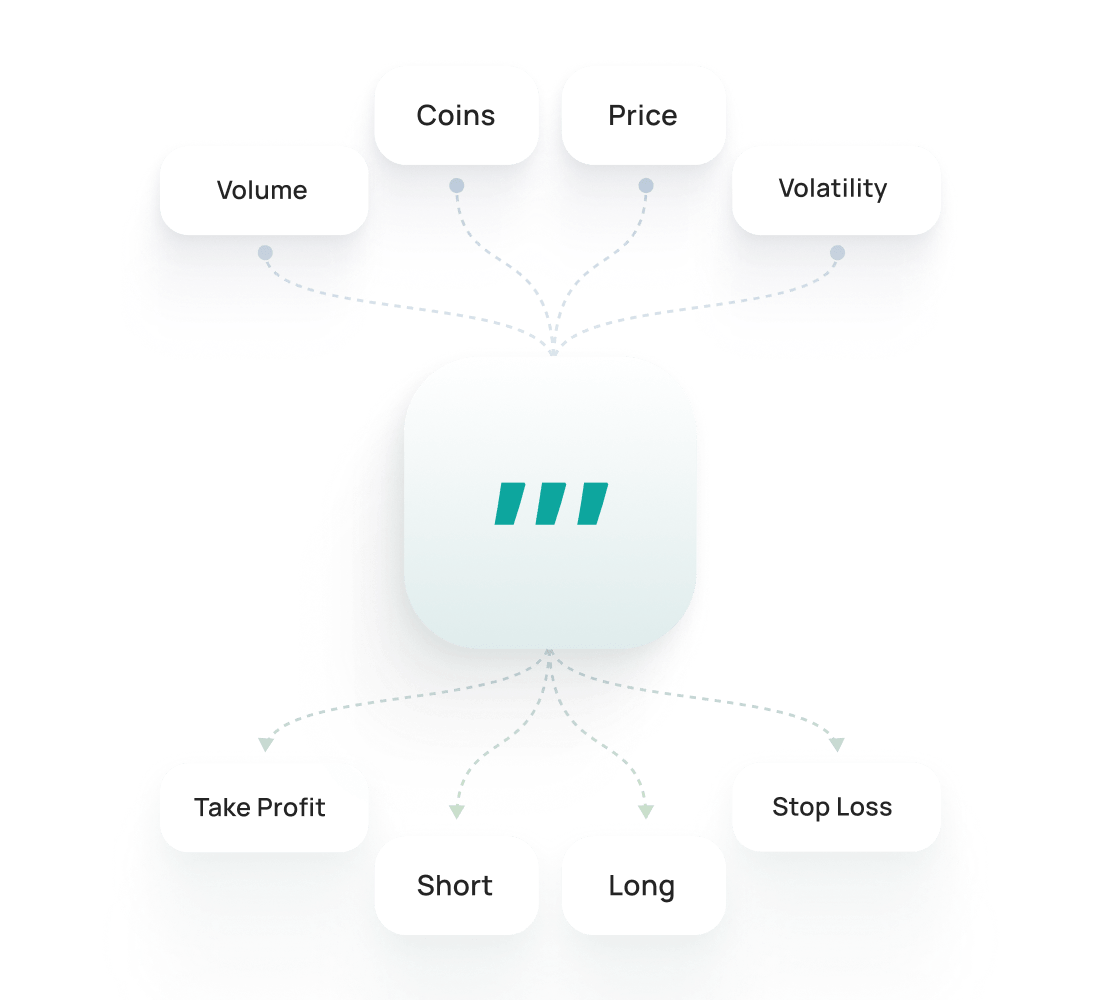

A Cardano trading bot is automated software that buys and sells ADA for you based on rules you set. Instead of monitoring charts around the clock, the bot executes trades instantly when your conditions are met, like purchasing when ADA dips 2% or selling after a 3% gain. This is especially useful for Cardano since its market often moves during development updates and network upgrades. With 3Commas, your funds never leave your exchange. The bot connects through API keys without withdrawal permissions, so you maintain full control of your assets while the software handles the repetitive work of timing entries and exits.

Dollar cost averaging spreads your purchases across multiple intervals, smoothing your average entry price. This method reduces exposure to ADA's sharp volatility swings, which often include 50 to 100% rallies followed by 20 to 40% corrections. It suits traders building long term positions through market cycles.

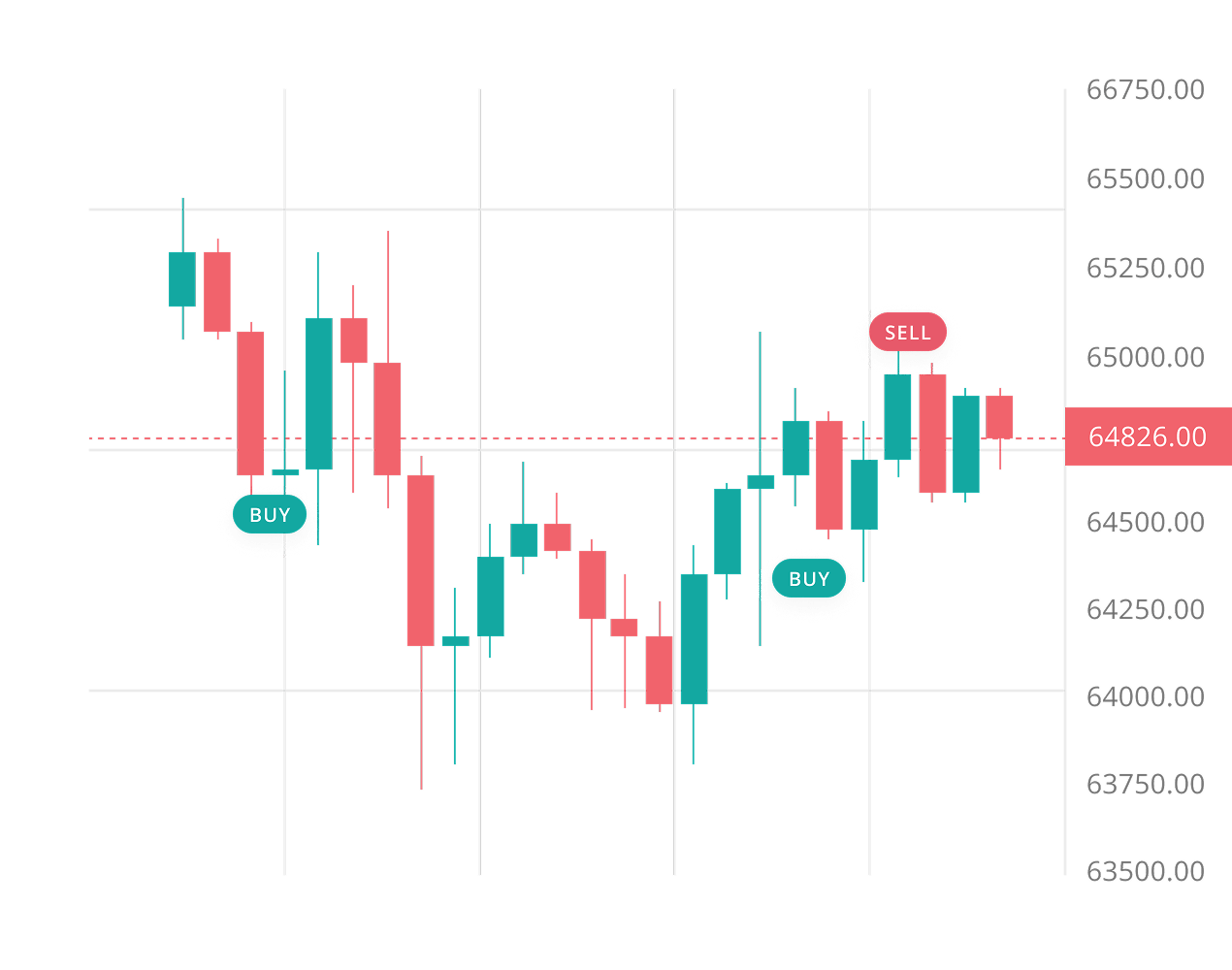

Learn moreGrid bots place automated buy and sell orders across predetermined price ranges. This approach works well with Cardano's tendency to consolidate between psychological levels like $1.50 and $2.20. The strategy captures profits from repetitive price swings during sideways trading periods when ADA lacks directional momentum.

Learn moreSignal bots execute trades based on technical indicators like RSI divergence, MACD crossovers, and volume patterns. Cardano responds predictably to technical analysis, especially around development milestones and network upgrades. The strategy automates entry and exit timing, removing emotional decision making from your trading process.

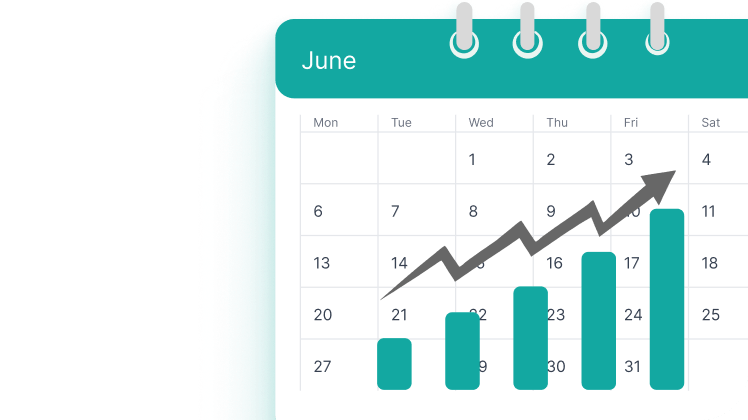

Learn moreThe Cardano Backtesting lets you test strategies on historical data to see how they might have performed. It helps refine settings, evaluate risks, and build confidence before trading live.

Learn moreThe Cardano SmartTrade gives you advanced manual trading options like take-profit, stop-loss, trailing, and multi-target exits. The Cardano Public Presets are ready-made strategies from traders that you can launch instantly or customize to fit your needs.

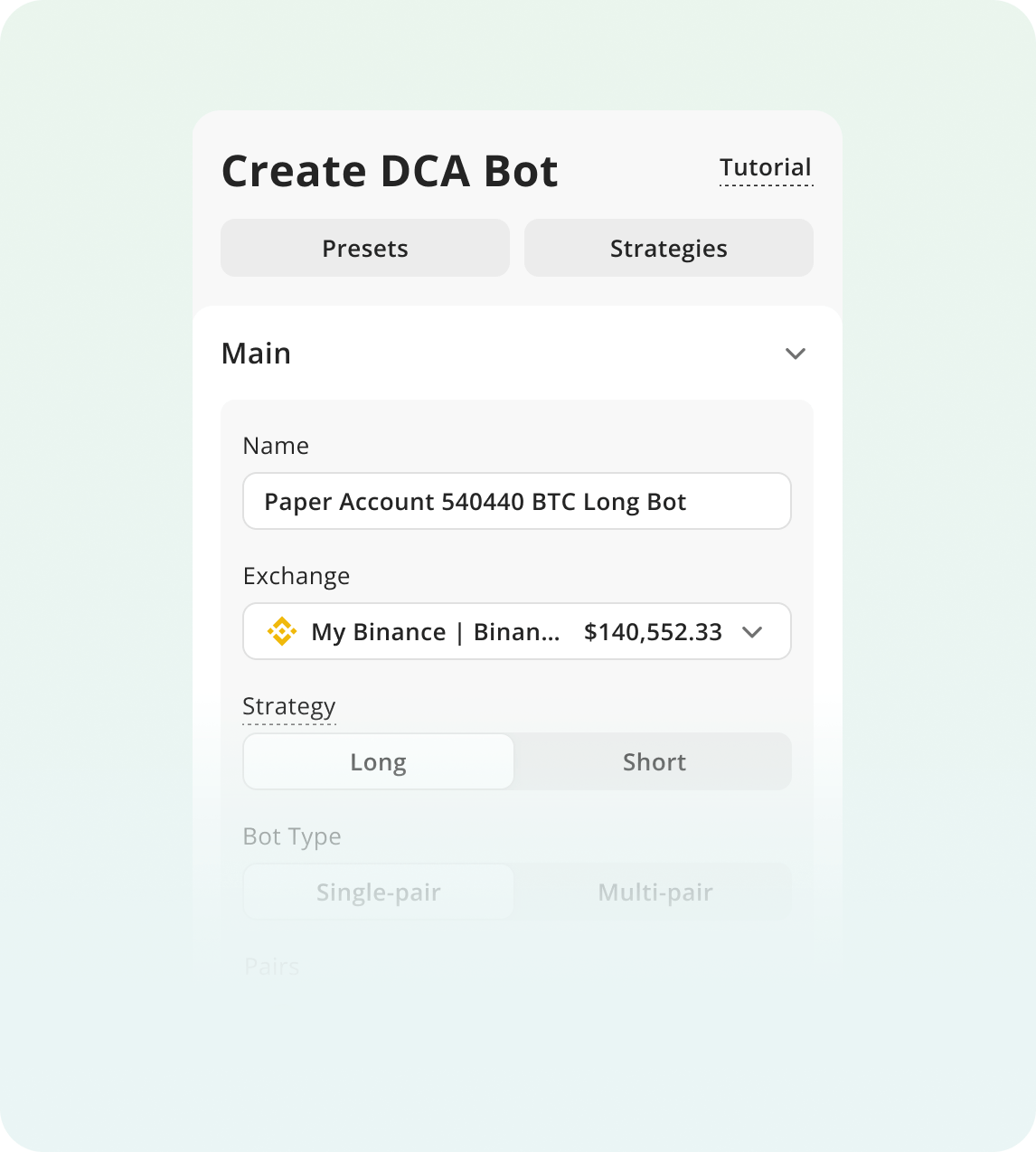

To begin trading with bots:

Sign Up for 3Commas and choose your plan

Connect an Exchange and choose your bot strategy.

Configure your bot parameters and run your bot!

Manual trading often leads to costly mistakes. When ADA surged to $0.80 in early 2024, many bought high during FOMO and panic sold at $0.45, locking in heavy losses. A 3Commas bot removes these emotional decisions entirely. It monitors Cardano markets around the clock, even during sudden weekend crashes like the 31% drop in April. Built-in features like Trailing Stop Loss protect your gains automatically, selling strategically instead of watching profits vanish.

Cardano's structured development eras create predictable roadmap events that allow traders to position before scheduled upgrades and re

Built-in staking rewards of 3 to 5% APY generate passive income while holding ADA, helping offset trading costs during market analysis.

The eUTXO transaction model lets you calculate exact costs and outcomes before execution, eliminating surprise fees and failed trade attempts.

Set stop losses 8-12% below entry points to account for ADA's sudden price swings after extended consolidation periods.

Track Cardano's governance votes, hard fork dates, and partnership news closely, as these events often trigger volatile price movements.

Never allocate more than 5-10% of your crypto portfolio to ADA, regardless of conviction in the project's long term potential.

Core bots for spot trading at 1 exchange

$20/ month

AI Assistant

Spot only

1

Active API Keys

5

Active DCA Bots

2

Active Signal Bots

2

Active Grid Bots

20

Active DCA Trades

10

Active Signal Trades

10

Active SmartTrades

100

DCA Backtests

1 year period

100

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Multi-account spot and futures trading

$50/ month

AI Assistant

Spot & Futures

3

Active API Keys

20

Active DCA Bots

20

Active Signal Bots

10

Active Grid Bots

100

Active DCA Trades

100

Active Signal Trades

50

Active SmartTrades

500

DCA Backtests

2 years period

500

GRID Backtests

4 months period

Developers API

Read only

Pine Script® execution

Live Chat Support

Exceptional limits and API trading

$140/ month

AI Assistant

Spot & Futures

15

Active API Keys

1K

Active DCA Bots

1K

Active Signal Bots

1K

Active Grid Bots

5K

Active DCA Trades

5K

Active Signal Trades

5K

Active SmartTrades

5K

DCA Backtests

full history

5K

GRID Backtests

4 months period

Developers API

Read & Write

Pine Script® execution

Priority Live Chat Support

Run your Cardano strategy across Binance, Coinbase Advanced, Kraken and 12+ other supported exchanges via 3Commas. Connect with a secure API, define entries, exits, and risk once, and let automation execute 24/7. One workspace for all venues means cleaner logs, faster iteration, and fewer missed moves on your ADA pairs.

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

I've been with 3Commas for a couple of years now, and its powerful bots, once you understand their mechanics, can generate good returns with minimal risk (if you know what I'm doing, I'm making 15–30% pa with little risk and no leverage). You can earn money while you sleep and continue to learn as you progress.

The team is always available, focusing on customer needs, improving the app and website, and adapting to all developments. Pretty excellent job!

I have used other trading bots, but this one is much better, and I am able to control my losses and maximize my profits much better. I'll keep using this more and more.

I am new to crypto trading and have been able to use 3Commas easily. I learned a lot from paper trading and feel safe using the site.

2.0M

Traders Registered

Rated Great on

1,479 reviews

Google Reviews

4.0

No trading bot can guarantee profits. Bots automate your strategy execution but don't eliminate market risk. ADA experiences significant volatility, with extended sideways consolidation followed by sharp breakouts around Cardano roadmap milestones. This creates opportunities for grid bots during range-bound periods and breakout strategies during trending markets. Success depends on choosing the right strategy for current conditions, proper risk management, and realistic expectations. Bots remove emotion from trading, but they can't predict the future.

Connecting your exchange via API takes just minutes. The real learning curve is configuring bot parameters like price ranges, grid levels, and investment amounts for your specific goals. With ADA, you'll want to consider Cardano's development timeline and network upgrades when setting ranges. Grid bots work well during ADA's frequent consolidation phases, while DCA bots suit long-term accumulation strategies. 3Commas provides templates and presets to help beginners start quickly, and you can adjust settings as you learn what works.

Yes. 3Commas never holds your funds—your Cardano stays on your exchange account at all times. Bots connect through API keys with trading permissions only, meaning they can execute buy and sell orders but cannot withdraw funds. This non-custodial approach ensures you maintain complete control over your ADA. When creating API keys, never enable withdrawal permissions. Your crypto remains in your exchange wallet, protected by your exchange's security measures, while the bot simply automates your trading strategy.

Absolutely. You can operate different bot types at the same time on the same exchange account. ADA's high liquidity on major exchanges supports this approach well. For example, you might run a grid bot to capture profits during Cardano's sideways price action, a DCA bot for steady accumulation, and a signal bot for breakout opportunities around development milestones. Cardano's E-UTxO model provides predictable transaction outcomes, making it reliable for automated strategies. Just ensure your total allocated capital doesn't exceed your available balance.

Get trial with full access to all ADA trading tools.