Breakout Trading Strategy

Catch the momentum as it starts. Automate breakout entries and stay aligned with high-impact market shifts

Strategy overview

Avg. Trade Duration: Hours–days

Strategy type: Momentum / Breakouts

Risk Level: Medium-High

Recommended Capital: from $1,500

Monitoring Frequency: Active monitoring

Skill Level: Intermediate

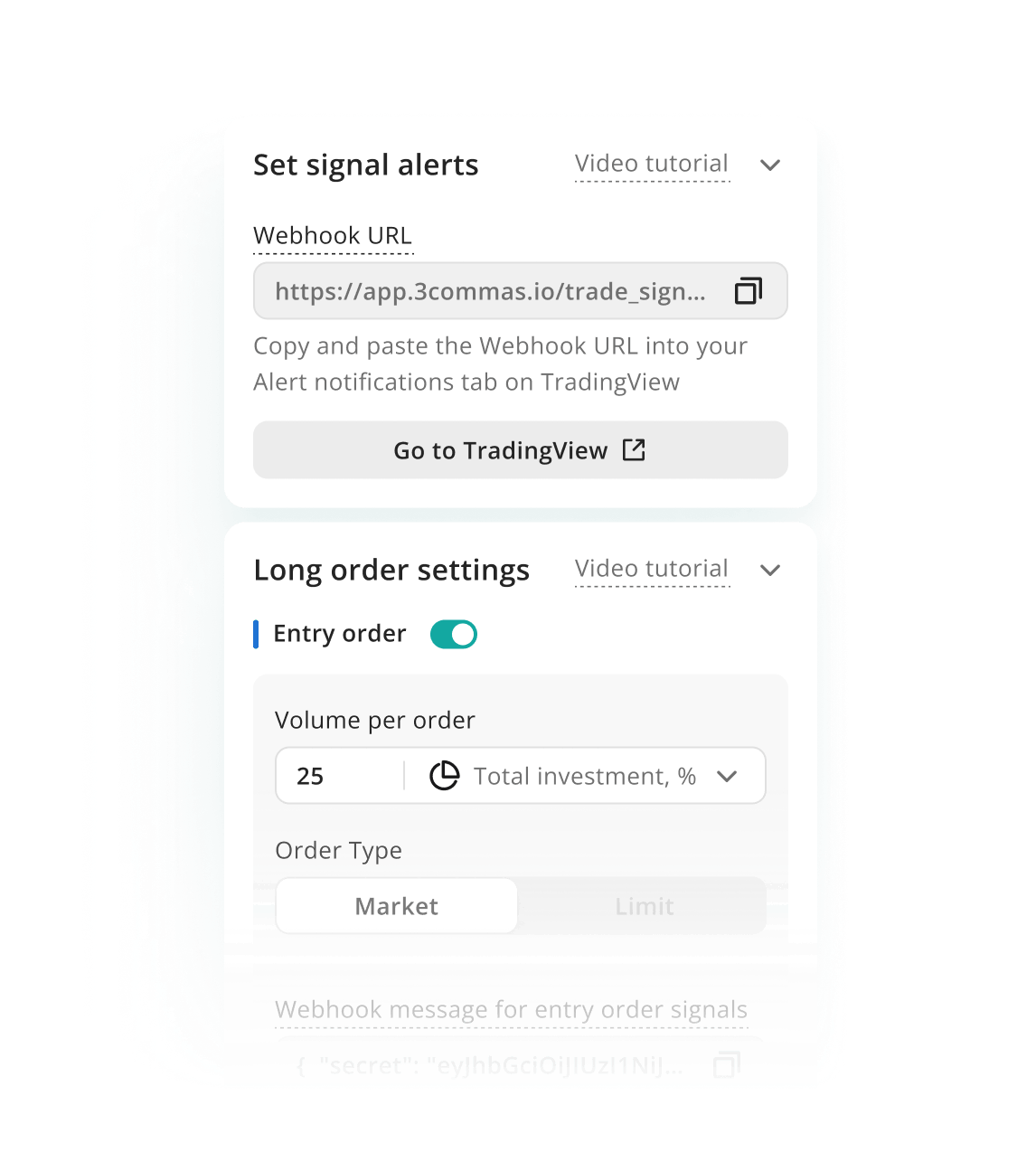

How 3Commas automate day trading strategy?

Signal Bot supports full TradingView Strategy execution via webhook - ideal for breakout strategies with precise Pine Script logic.

Send breakout alerts from TradingView or external sources directly to DCA or Signal Bots to enter trades at the moment of the breakout.

Protect trades using Stop Loss, Stop Loss Breakeven, and Trailing Stop Loss - key tools for managing risk on failed breakouts or fakeouts.

With Hedge Mode, one Signal Bot can simultaneously manage Long and Short breakouts - or reverse a position if the price breaks back in the opposite direction.

Start Trading on 3Commas Today

Seize opportunities that manual traders can't

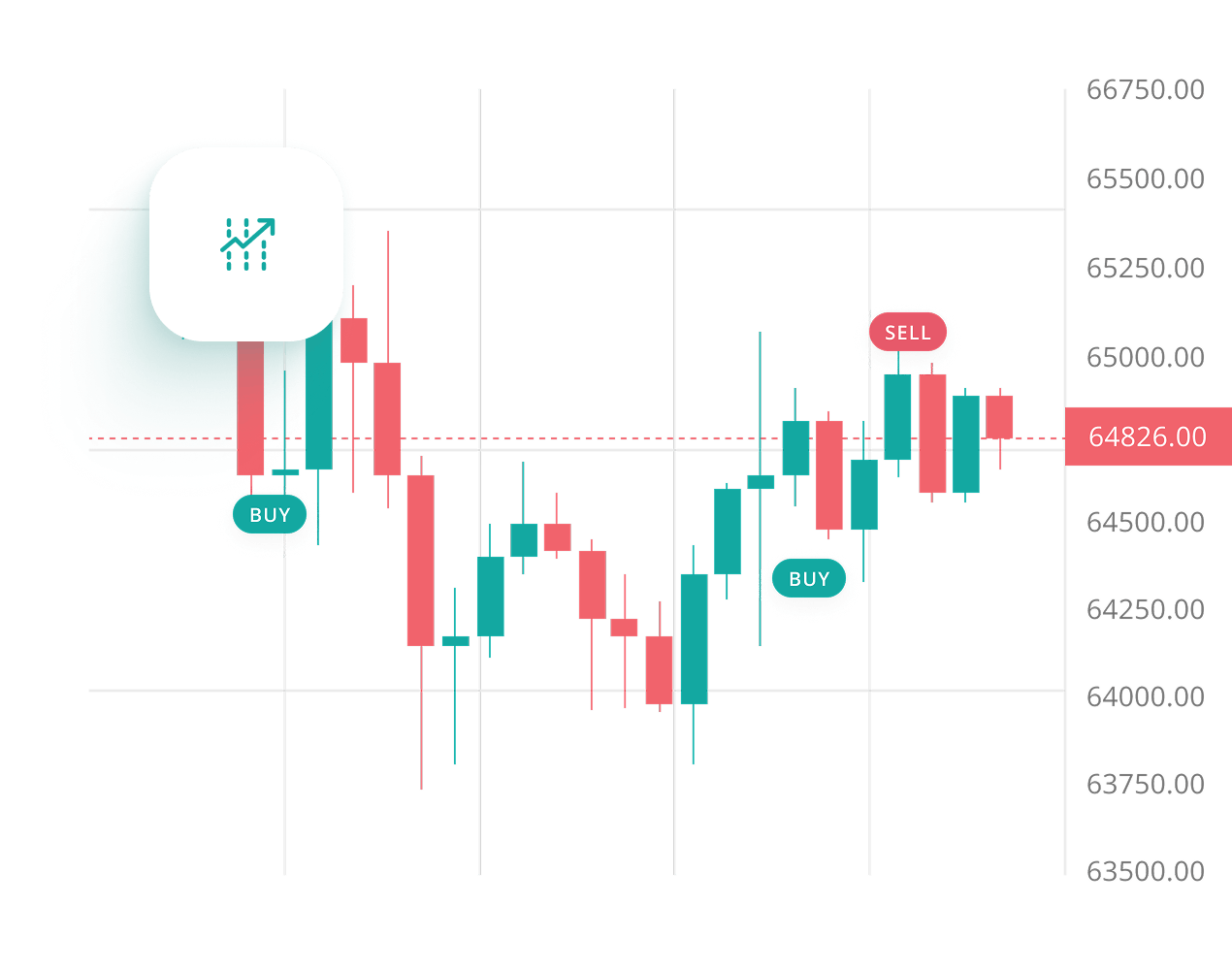

Breakout Trading- Example

3 Steps to Automating Breakout Trades — Fast, Structured, Consistent

1. Identify Key Levels with TradingView

Use TradingView to define support and resistance zones. The Signal Bot reacts to alerts when price breaks out, executing entries exactly as defined in your logic.

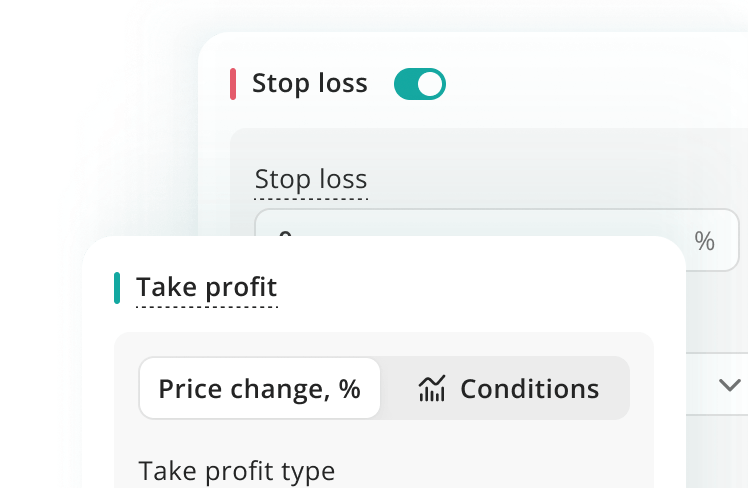

2. Manage Risk with SL and TP Logic

Combine fixed Stop Loss, Take Profit, and optional trailing to manage post-breakout volatility. Set these once — the bot applies them automatically.

3. Let the Bot Handle the Surge

Once a breakout is confirmed, the bot manages the trade using your strategy parameters. No need to monitor charts — execution remains consistent, even in volatile moves.

Ready to catch the next big breakout?

Automate your breakout strategy with 3Commas and never miss explosive market moves.

What’s the Difference?

Manual Breakout Trading vs Automated

Manual trading is stressful and slow. Automated Breakout Trading with 3Commas runs 24/7, reacts instantly, and stays emotion-free — giving you the edge in fast markets.

Manual Breakout Trading

Automated Breakout Trading

Setup Time

Manual chart analysis

Pre-set breakout rules

Reaction

Delay due to human input

Instant breakout execution

False Signals

Harder to filter manually

Auto-filtered with indicators

Emotions

Can chase breakouts

Rules-based, emotionless

Risk Control

Manual Stop Loss

Automatic Stop Loss and Take Profit

Consistency

Varies per session

Identical every time

Why aren't you trading yet?

Let our technology take care of the tedious tasks while you focus on innovating your Automated Breakout Trading Strategy

No Credit Card Needed

No Obligations

No Hidden Fees

FAQ

How does a Breakout Trading Bot work in crypto?

A Breakout Trading Bot is designed to detect and act on strong price movements that break through key support or resistance levels. These breakouts often signal the start of a new trend. On 3Commas, you can automate such setups by combining technical indicators (like Bollinger Bands, volume spikes, or moving averages) with bots that instantly enter trades when breakout conditions are met. This is especially useful for Breakout Crypto Trading, where speed and timing are critical.

Can I automate a breakout trading strategy on 3Commas?

Yes, 3Commas fully supports Automated Breakout Trading. You can use DCA or Grid Bots triggered by TradingView alerts to open positions when your Breakout Strategy conditions are met. Whether you rely on volatility indicators or price action, your bot will execute trades instantly — removing emotional decision-making and ensuring consistency.

What makes breakout trading different from other strategies?

Unlike mean reversion or swing trading, breakout trading aims to capture fast, explosive price moves. Traders enter positions right as the price "breaks out" of a defined range. This method often leads to rapid gains but requires strict risk management due to false breakouts. A Crypto Breakout Bot helps handle these setups with precision, using stop-losses, trailing exits, and layered entries to manage volatility.

Is breakout trading risky?

Yes, it can be. False breakouts are common, especially in crypto. However, using a Breakout Trading Bot helps reduce the emotional and timing risks involved. On 3Commas, you can define exact risk levels per trade, automate exits, and set cooldown timers — making your Breakout Strategy more controlled and repeatable.

What indicators are best for a breakout strategy?

Popular indicators for a Breakout Strategy include Bollinger Bands, Donchian Channels, volume spikes, and support/resistance levels. You can create alerts in TradingView using these tools and link them to your Crypto Breakout Bot on 3Commas via webhook — giving you fully automated and highly reactive breakout execution.

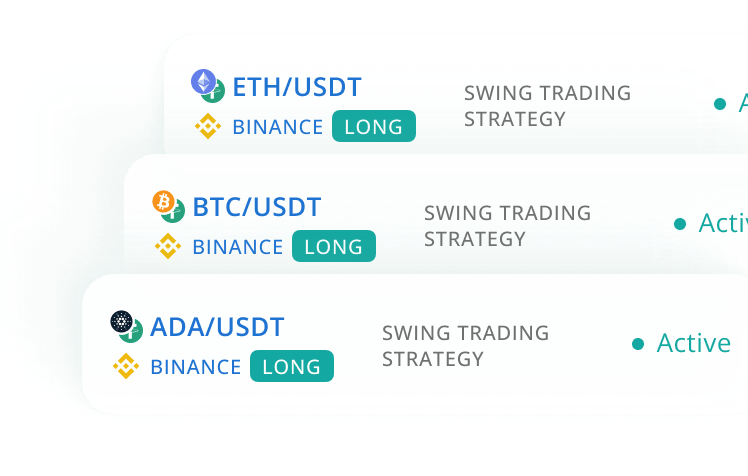

Can I use a breakout bot across multiple coins?

Absolutely. 3Commas allows you to deploy your Breakout Crypto Bot across multiple trading pairs. You can monitor multiple assets at once, each with its own entry and exit logic. This diversification increases your chances of catching valid breakouts without overexposing a single position.