Day Trading Strategy

Stay in control, even in fast-moving markets. Automate your intraday trades and react with precision to every signal

Strategy overview

Avg. Trade Duration: 1–8 hours

Strategy type: Intraday Trading

Risk Level: Medium-High

Recommended Capital: from $1,000

Monitoring Frequency: Frequent throughout day

Skill Level: Intermediate

How 3Commas automate day trading strategy?

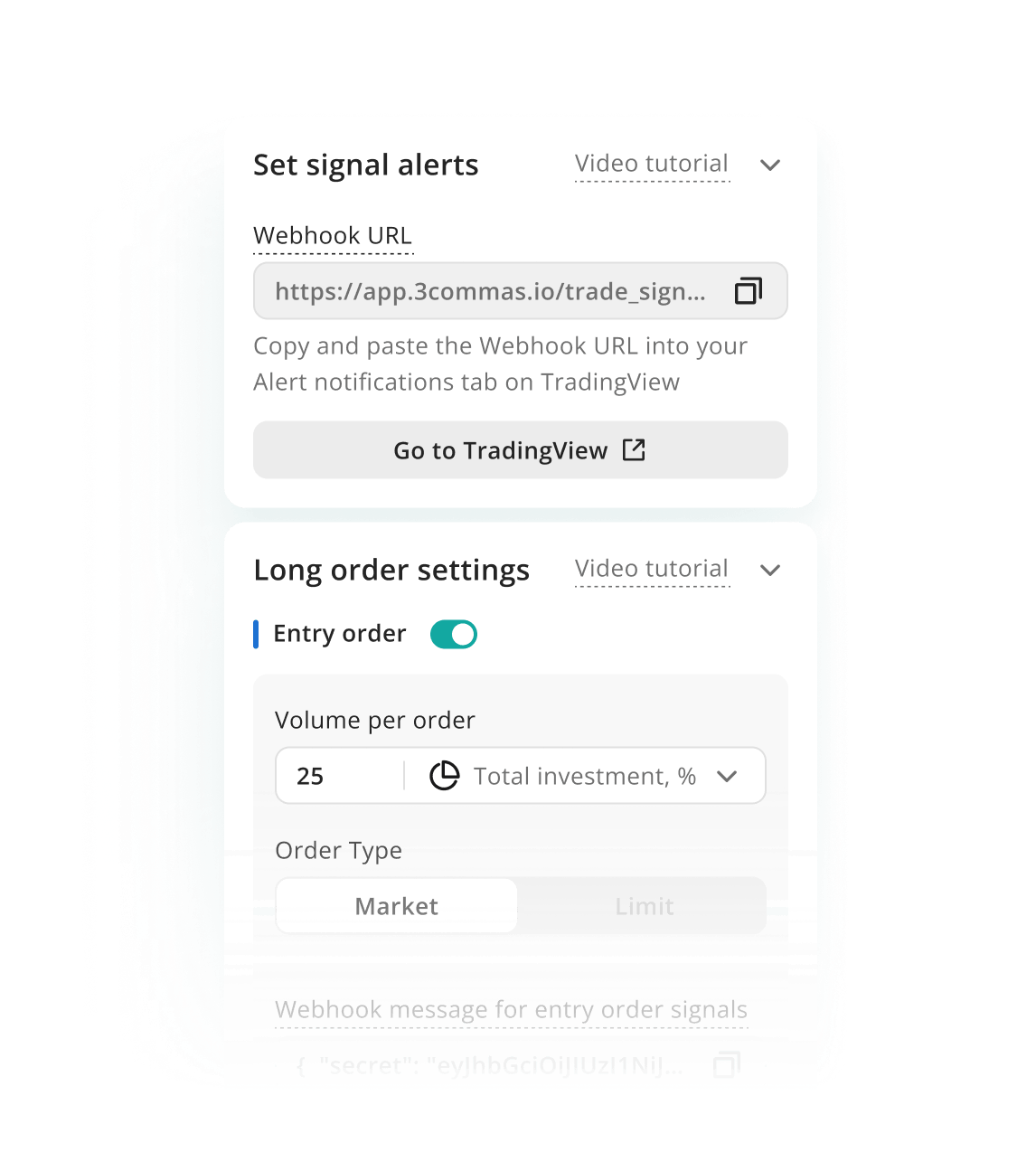

Signal Bot can fully execute TradingView strategies via webhook, replicating Pine Script logic with 100% accuracy - perfect for intraday systems.

The DCA Bot features over 11 built-in indicators that can be combined on 30-minute and 1-hour timeframes to generate accurate intraday entry and averaging signals.

Automate trades like a pro with Multiple Take Profit and a trailing feature on the final target to maximize gains. Protect your balance with Stop Loss, Trailing Stop Loss, and SL Breakeven logic - essential tools for navigating longer intraday swings.

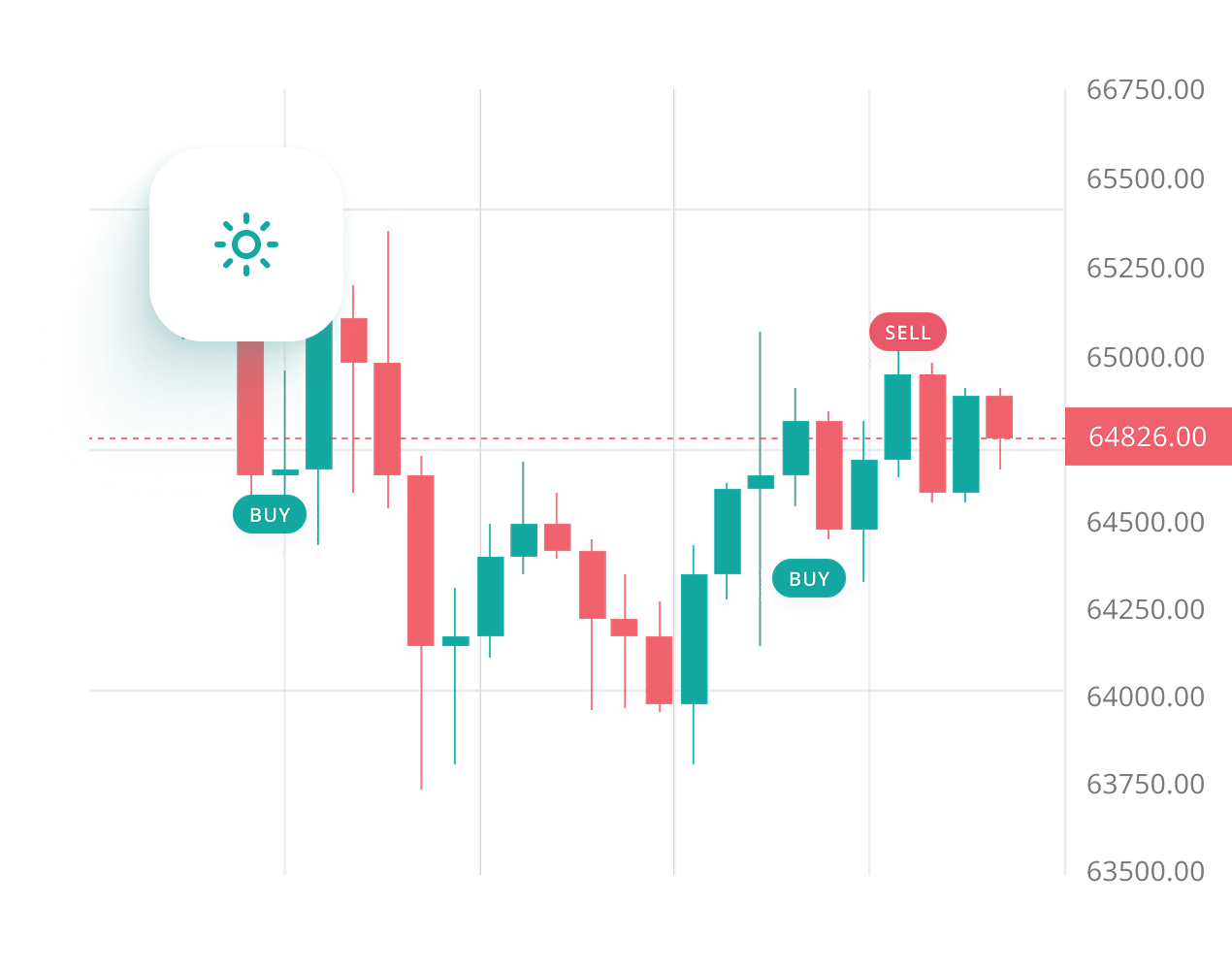

DCA and Signal Bots can respond to TradingView alerts or other webhooks in real time, opening Buy/Sell orders instantly — ideal for time-sensitive intraday setups.

SmartTrade lets day traders manually open positions while automating risk management with Multiple Take Profit levels, Stop Loss, trailing, and breakeven logic.

Start Trading on 3Commas Today

Seize opportunities that manual traders can't

Day Trading- Example

3 Steps to Streamlined Intraday Trading — Fast, Logical, and Monitored

1. Set Reliable Signals for Intraday Moves

Use 15-min to 1-hour signals from TradingView or internal indicators. Bot can execute trades instantly once conditions align.

2. Automate Risk and Position Management

Add Take Profit, Trailing Stop Loss, and optional DCA for re-entries. Trades are adjusted automatically without micromanagement.

3. Monitor Markets Without Overload

The bot tracks setups across the day — executing consistently and emotion-free. You stay informed, not exhausted.

Stay sharp — even when the market isn’t.

Automate your intraday trades with 3Commas and stay one step ahead, every hour of the day.

What’s the Difference?

Manual Day Trading vs Automated

Manual trading is stressful and slow. Automated Day Trading with 3Commas runs 24/7, reacts instantly, and stays emotion-free — giving you the edge in fast markets.

Manual Day Trading

Automated Day Trading

Screen Time

High screen time

Low maintenance once set

Speed

Slower reaction

Millisecond execution

Emotions

Can impact decisions

Rules > emotions

Risk Control

Manual exits

Automatic Stop Loss and Take Profit

Execution

Click-based

Webhook/API-based

Why aren't you trading yet?

Let our technology take care of the tedious tasks while you focus on innovating your Automated Day Trading Strategy

No Credit Card Needed

No Obligations

No Hidden Fees

FAQ

Why do day traders use 3Commas for crypto trading?

Day traders choose 3Commas because it combines speed, automation, and flexibility. It’s a powerful crypto day trading platform that offers tools for quick entries and exits, bot automation, and integrated TradingView signals. You can manage trades across exchanges in one interface and fine-tune risk parameters — all in real time. This makes it a go-to solution for intraday crypto trading.

What are the best Day Trading Tools on 3Commas?

The best Day Trading Tools on 3Commas include Smart Trade for manual control, DCA and Grid Bots for automation, TradingView integration for technical signals, and performance analytics for ongoing strategy optimization. These tools help you execute precise entries, manage risk with stop-loss and take-profit orders, and automate repetitive tasks — making 3Commas a Best Day Trading Platform for Crypto.

Can I automate a crypto day trading strategy?

Absolutely. On 3Commas, you can fully automate your crypto day trading strategy using DCA or Grid Bots. These bots follow your rules for entry and exit, so you can trade based on moving averages, RSI, MACD, or custom TradingView signals. This removes emotional decision-making and allows your strategy to run 24/7, even when you’re offline.

Is Day Trading crypto risky?

Yes, day trading crypto is inherently risky due to market volatility. However, 3Commas helps you manage that risk with powerful Day Trading Tools like trailing stop-loss, multi-pair tracking, and fixed position sizing. The platform also provides analytics to measure performance and improve strategies over time — making it a safer way to engage in Crypto Day Trading.

How much time does crypto day trading take?

Manual day trading requires a lot of screen time and quick decision-making. But with 3Commas, you can drastically reduce the time spent by using bots and automation tools. Most users check in a few times a day to review trades or adjust settings. This makes 3Commas a perfect Day Trading Platform for people who want to stay active in the market without being glued to charts.

Can I test my day trading strategy before going live?

Yes — 3Commas includes a backtesting feature that allows you to simulate how your day trading strategy would have performed in the past. This helps you optimize your setup before using real funds on a Crypto Day Trading Platform.