Trend Following Trading Strategy

Follow the flow. Ride strong market trends with smart, automated entries. Harness automation to capture opportunities efficiently.

Strategy overview

Avg. Trade Duration: Days–months

Strategy type: Momentum / Trend Following

Risk Level: Moderate

Recommended Capital: from $2,000

Monitoring Frequency: Daily or Weekly

Skill Level: Beginner to Intermediate

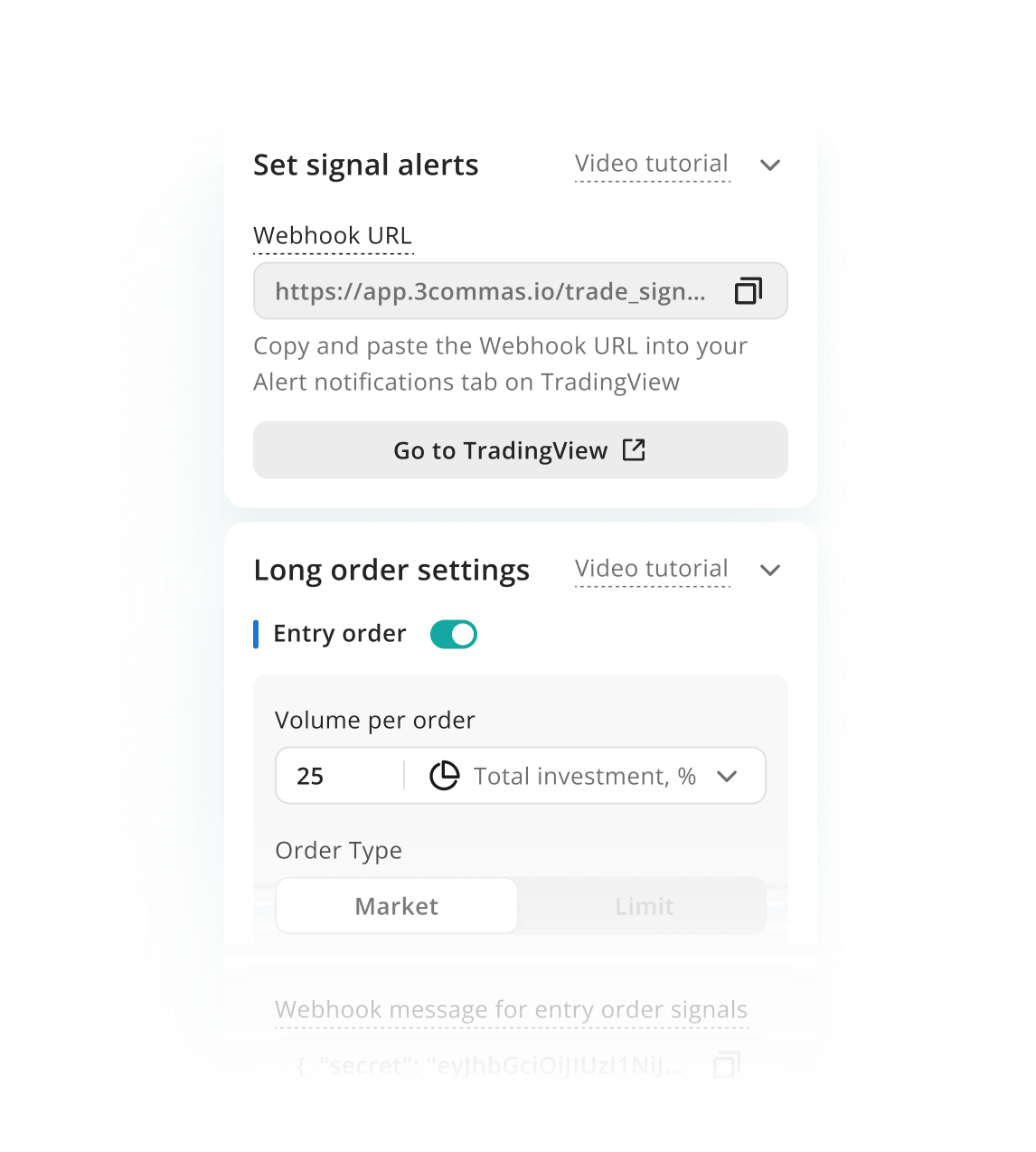

How 3Commas automate day trading strategy?

Signal Bot supports full TradingView Strategy execution via webhook - perfect for entering and managing trades based on your trend indicators and Pine Script logic.

Automatically close a Long and open a Short (or vice versa) when your strategy detects a trend reversal - handled seamlessly by a single Signal Bot.

With Trailing Up and Trailing Down enabled, the Grid Bot can follow strong trends by automatically shifting the grid in the direction of price movement - ideal for capturing profits throughout extended market trends.

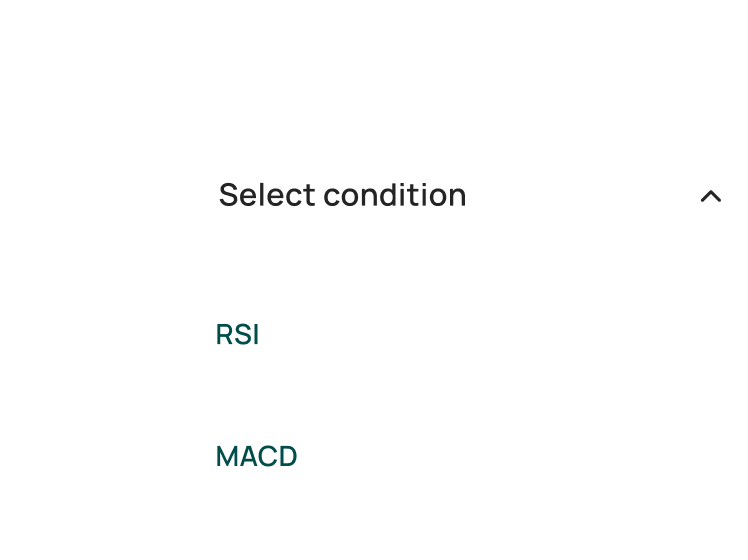

The DCA Bot includes 11+ built-in indicators that can be combined across higher timeframes (1h–1D) to confirm strong trend conditions before entry - for example, when one Moving Average crosses and holds above another, signaling an upward trend.

Use SmartTrade to manually enter trend-following positions and set a complete exit strategy with multiple Take Profit targets. Protect your trades with Stop Loss, Breakeven logic, and Trailing Stop Loss — all in one powerful setup.

Start Trading on 3Commas Today

Seize opportunities that manual traders can't

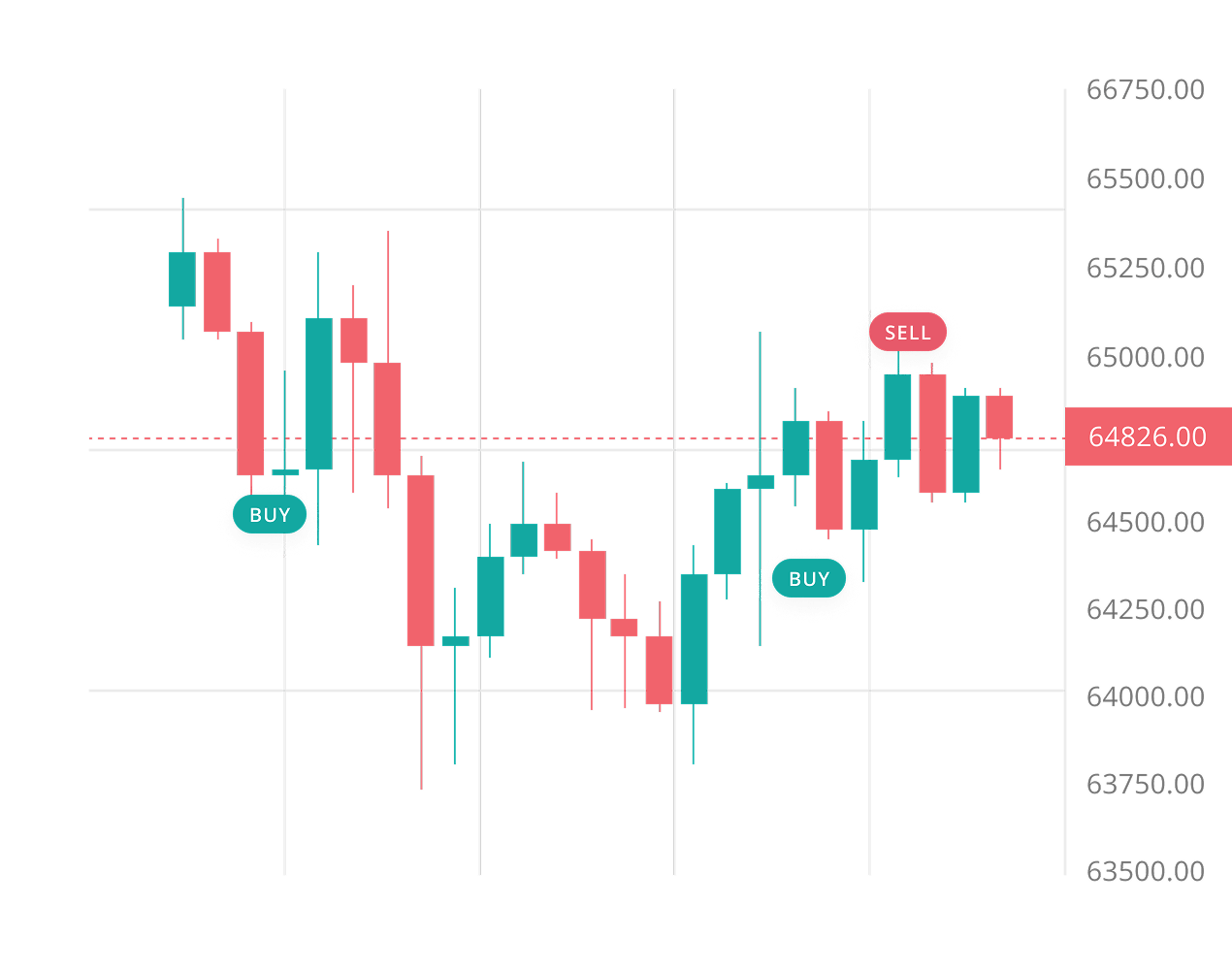

Trend Following- Example

3 Steps to Smarter Trend Trading — Fully Automated, Emotion-Free

1. Detect Momentum with EMA Crossovers

Use a classic trend signal like the EMA 50/200 crossover on a 4H or 1D chart. The DCA Bot monitors the crossover and enters a trade when bullish momentum is confirmed.

2. Add Protection and Smart Scaling

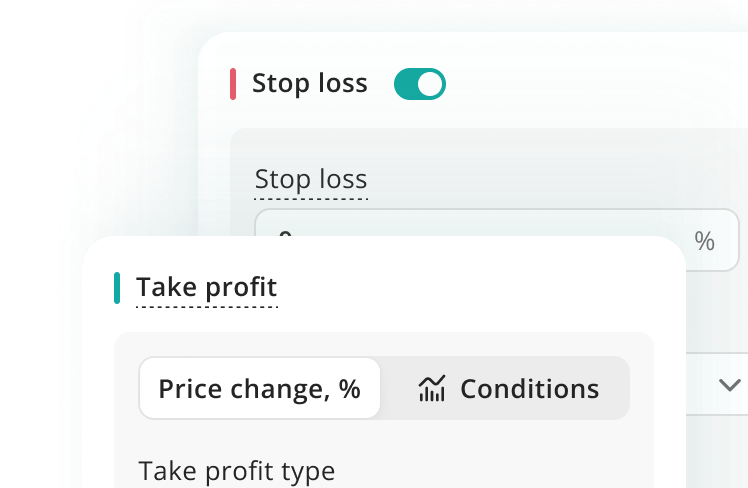

Enable Trailing Stop Loss, Take Profit targets, and DCA entries. The bot will scale into the position during pullbacks and protect profits as the trend develops — all based on predefined logic.

3. Stay in the Trend Without the Stress

Once the trade is active, the bot manages everything: scaling, trailing, and exits — according to your rules. Designed for traders who prefer to follow trends without constant manual intervention.

Ready to let the trend work for you?

Automate your strategy with 3Commas and start trading with confidence today.

What’s the Difference?

Manual Trend Following vs Automated

Manual trading is stressful and slow. Automated Trend Following with 3Commas runs 24/7, reacts instantly, and stays emotion-free — giving you the edge in fast markets.

Manual Trend Following

Automated Trend Following

Trend Entry

Visual confirmation

Auto EMA/MA cross logic

Holding

Emotion-driven exits

Algorithmic trailing

Risk Control

Manual stops

Auto scaling and SL

Trade Volume

Hard to scale

Handles multiple pairs

Monitoring

Daily checks needed

Runs non-stop

Why aren't you trading yet?

Let our technology take care of the tedious tasks while you focus on innovating your Automated Trend Following Strategy

No Credit Card Needed

No Obligations

No Hidden Fees

FAQ

What is a Trend Following Strategy in crypto trading?

A Trend Following Strategy focuses on identifying and riding sustained price movements — either upward or downward — over time. The idea is simple: “buy high and sell higher” (or the reverse for shorting). Traders using this approach aim to enter once a trend is confirmed and stay in the trade until signs of reversal appear. In crypto, where trends can be dramatic and extended, this approach is widely used for both spot and futures trading.

Can I automate the trend following in crypto with 3Commas?

Yes — 3Commas offers full support for Automated Trend Following. You can use a Trend Following Trading Bot configured with indicators like moving averages, ADX, or Supertrend. Bots can be triggered via TradingView alerts or built-in strategies, reacting instantly when trend conditions are met. This reduces lag, improves consistency, and eliminates emotional errors — crucial for trend-based strategies.

How does a Trend Following Trading Bot work?

A Trend Following Trading Bot monitors technical signals to detect the start of a new trend. Once triggered, it enters the trade and may use trailing take-profits or dynamic stop-losses to stay in the trend as long as it's profitable. On 3Commas, you can fine-tune the bot’s logic, set your risk parameters, and even scale into trends gradually. Whether it's a short-term breakout or a multi-week rally, a Trend-Based Trading Bot ensures precise execution.

Why do so many traders use trend following strategies in crypto?

Because trend following fits the nature of crypto markets perfectly. Unlike traditional assets, cryptocurrencies often experience strong, extended price movements — both up and down. A Trend Following Strategy helps traders capture these big moves by entering after a trend is confirmed and staying in the trade as long as momentum continues. This approach doesn’t rely on predicting tops or bottoms — it focuses on reacting to what the market is already doing.

Many traders prefer trend following because it reduces overtrading, simplifies decision-making, and avoids emotional noise. With a Trend Following Trading Bot on 3Commas, it becomes even more powerful — automating entries, exits, and risk management based on your preferred trend indicators. Bots help you stay disciplined and consistent, which is especially important in the fast-moving world of crypto.What indicators are best for trend following strategies?

Popular tools include EMA crossovers, MACD, ADX, Supertrend, and Ichimoku Cloud. These help detect momentum and trend strength. On 3Commas, you can connect TradingView alerts using any of these indicators, and your Trend Following Trading Bot will act immediately when your setup confirms trend continuation or reversal.

Can I combine trend following with other strategies?

Absolutely. Many traders combine trend following with elements of breakout or position trading. For example, a bot may detect a breakout and then use trend logic to manage the position long-term. With 3Commas, you can stack conditions, use multiple signals, and run parallel bots — allowing for complex, layered strategies that match your trading style.