Position Trading Strategy

Focus on the bigger picture. Automate long-term entries and stay committed without daily market noise.

Strategy overview

Avg. Trade Duration: Weeks–months

Strategy type: Long-term Position Trading

Risk Level: Moderate-Low

Recommended Capital: from $3,000

Monitoring Frequency: Weekly or monthly checks

Skill Level: Beginner to Intermediate

How 3Commas automate day trading strategy?

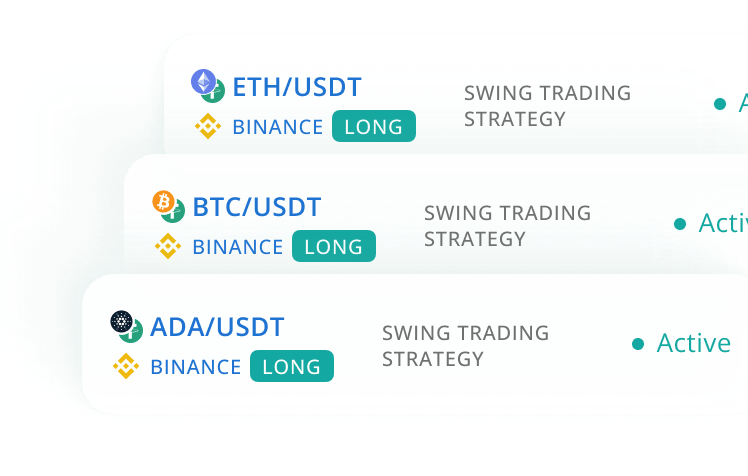

Signal Bot supports full TradingView Strategy execution via webhook - ideal for position traders using weekly or daily trend-based setups powered by your Pine Script logic and indicators.

The DCA Bot features 11+ built-in indicators that can be used across higher timeframes (1D, 1W) to confirm long-term trends and optimize position entries and exits. A great fit for traders aiming to ride major market moves.

Use SmartTrade to manually enter large positions and set a complete exit strategy with multiple Take Profit targets. Protect your trades using Stop Loss, Breakeven logic, and Trailing Stop Loss - all in one setup.

A single Signal Bot can fully automate position flips — closing a Long and opening a Short (or vice versa) based on your strategy logic and signals. Ideal for position traders who follow long-term trend reversals with clear logic.

Start Trading on 3Commas Today

Seize opportunities that manual traders can't

Position Trading- Example

3 Steps to Long-Term Trend Participation — Automated and Objective

1. Use Macro Signals or Long-Term Indicators

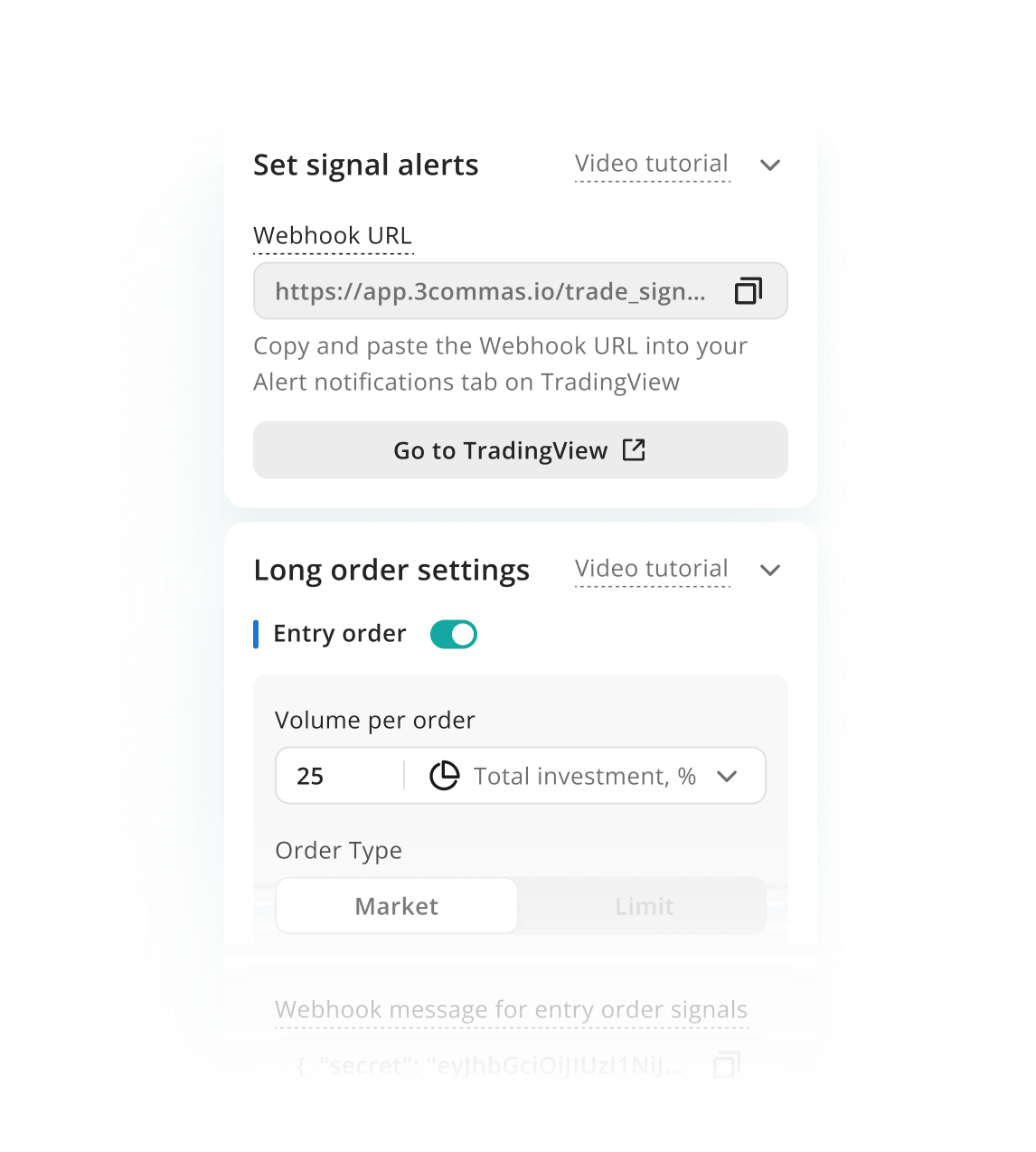

Set up signals based on 1D or 1W charts using moving averages or fundamental-based alerts from TradingView. Signal Bot can execute orders based on these triggers.

2. Automate Entry Scaling and Capital Allocation

DCA Bot helps structure long-term entries by spreading buys over time or pullbacks. Use fixed capital limits and SL to keep risk aligned with your profile.

3. Stay Invested, Without the Noise

Once a trade is open, the bot tracks your parameters. With longer holding periods, there's no need for daily management — just periodic review as trends evolve.

Thinking long-term? So are we.

Automate your position trades with 3Commas and let the market work in your favor over time.

What’s the Difference?

Manual Position Trading vs Automated

Manual trading is stressful and slow. Automated Position Trading with 3Commas runs 24/7, reacts instantly, and stays emotion-free — giving you the edge in fast markets.

Manual Position Trading

Automated Position Trading

Trade Setup

Long manual analysis

Rule-based entry, integrated backtest

Patience

Requires discipline

Auto-managed duration

Risk Control

Manual size/stops

Pre-defined position sizing

Alerts

Manual or external tools

Internal solution

Consistency

Prone to biases

Runs logic only

Why aren't you trading yet?

Let our technology take care of the tedious tasks while you focus on innovating your Automated Position Trading Strategy

No Credit Card Needed

No Obligations

No Hidden Fees

FAQ

What is position trading in crypto?

Position trading is a long-term approach where traders hold assets for weeks, months, or even years, aiming to profit from major price trends. Unlike day trading or scalping, position traders rely on fundamental analysis, macro trends, and technical signals from higher timeframes (like weekly or monthly charts). In the context of crypto position trading, this approach suits investors who believe in long-term growth and want to avoid short-term volatility.

Can I automate a position trading strategy with 3Commas?

Yes. 3Commas supports position trading strategies using Smart Trade, DCA Bots, and TradingView signals. You can automate long-term entries and scale into positions over time, while setting clear take-profit and stop-loss levels. This makes it easier to manage long-term crypto trading without constantly watching the market. Bots can also monitor multiple coins for your ideal entry criteria and alert you when conditions are met.

Is 3Commas good for long-term crypto trading?

Absolutely. With features like automated portfolio rebalancing, Smart Trade terminal, and crypto trading bots, 3Commas is well suited for long-term crypto trading. It supports risk management tools like trailing stops, safety orders, and time-based exit rules — which are crucial for any serious position trading strategy.

What’s the difference between position trading and swing trading?

Position trading involves holding trades for a much longer period — from weeks to months — and is focused on capturing large market cycles. In contrast, swing trading targets smaller moves and typically holds positions for a few days. Position traders are more tolerant of short-term drawdowns and place fewer trades overall. This makes position trading more aligned with investor psychology than active speculation.

Is position trading risky in crypto?

Yes — like any trading style, position trading carries risk, especially in volatile crypto markets. The key is to manage that risk over time. On 3Commas, you can define max exposure per coin, automate dollar-cost averaging, and use bots to avoid emotional mistakes. These features make crypto position trading safer and more disciplined.

What type of trader should consider position trading?

If you’re patient, don’t want to monitor charts daily, and believe in the long-term growth of crypto, you might be a natural position trader. This strategy fits investors with a strong conviction in macro trends and a preference for strategic, low-frequency trading. With 3Commas, you can still benefit from automation while keeping a long-term focus.