Mean Reversion Trading Strategy

Turn market overreactions into opportunity. Automate entries around key reversals and trade with precision and control

Strategy overview

Avg. Trade Duration: Hours–days

Strategy type: Countertrend / Mean Reversion

Risk Level: Moderate

Recommended Capital: from $1,500

Monitoring Frequency: Regular monitoring required

Skill Level: Intermediate

How 3Commas automate day trading strategy?

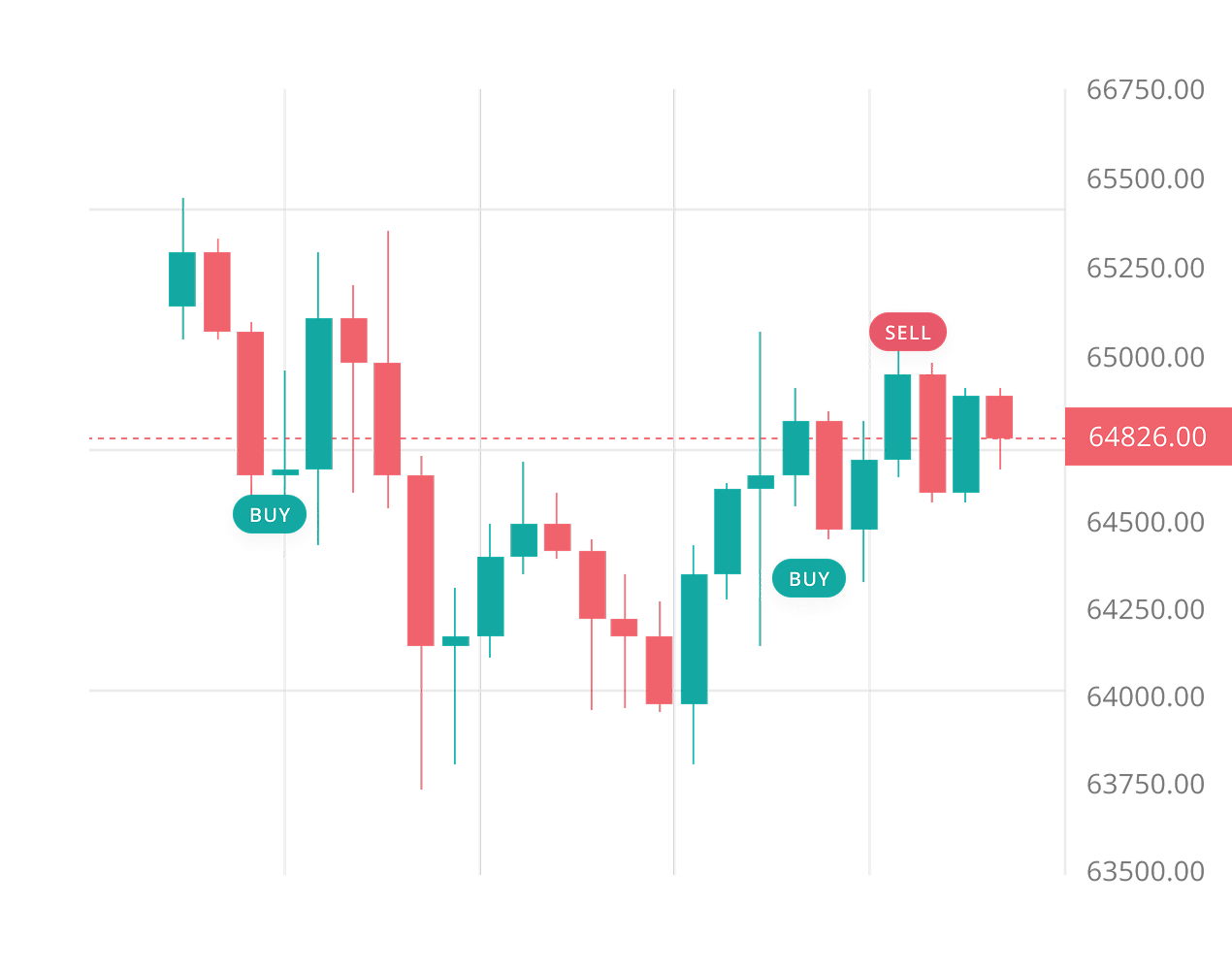

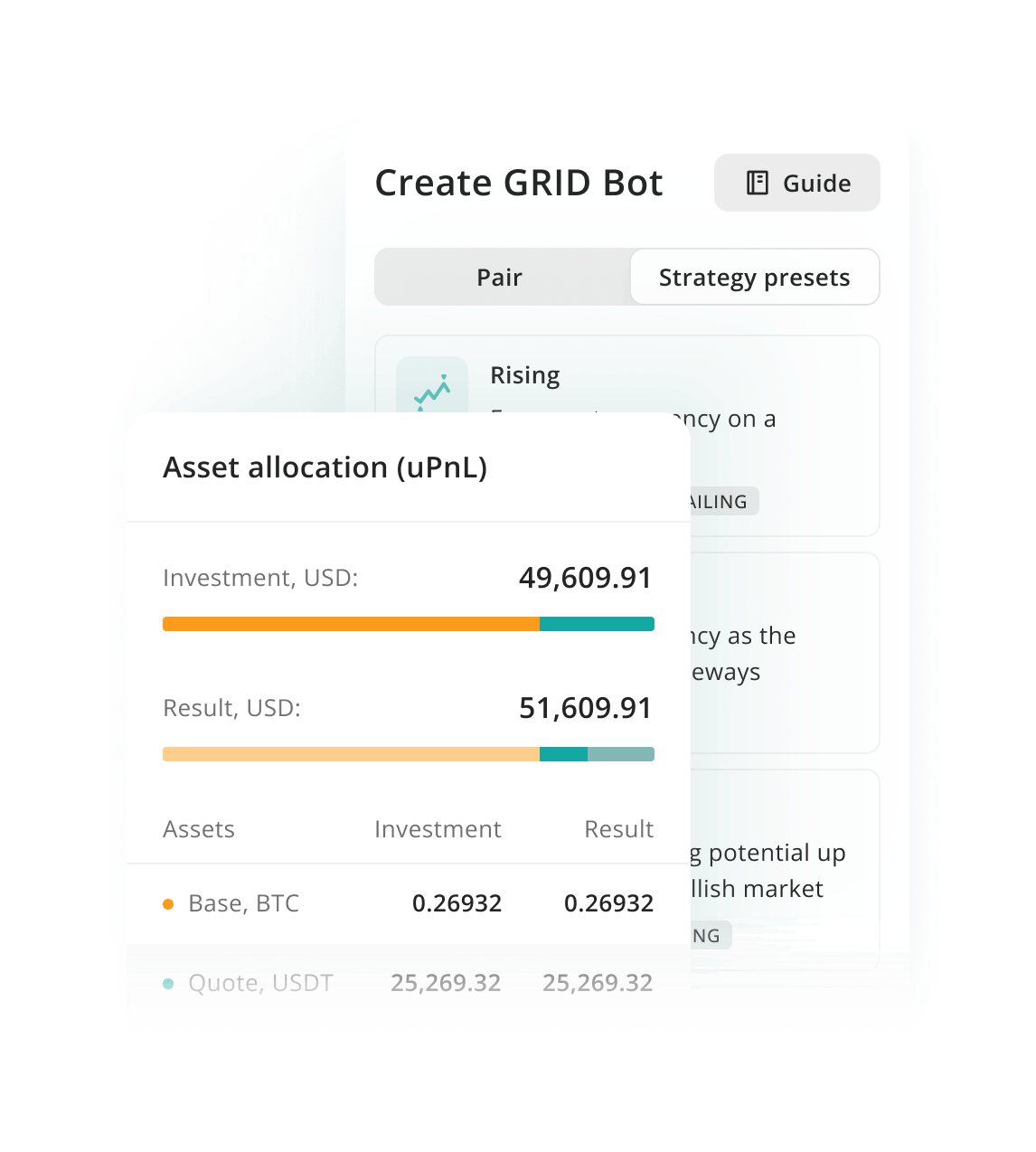

Grid Bot shines in sideways markets - it buys low and sells high within a defined range, perfect for mean reversion logic.

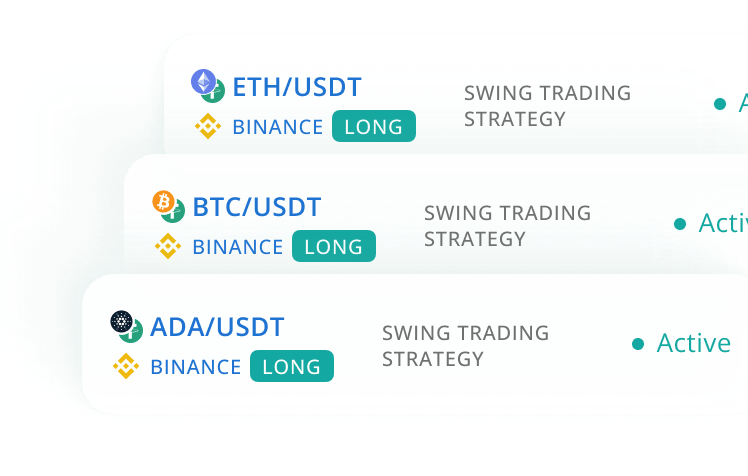

The DCA Bot features over 11 built-in indicators that can be combined on multiple timeframes to identify strong deviation signals and confirm potential price reversals back to the mean. Perfect for mean reversion setups.

DCA and Signal Bots allow you to enter a trade, average out in parts as the price deviates, and take profits at the first recovery. This process can repeat across the entire sideways movement - ideal for range-bound markets.

Signal Bot supports full TradingView Strategy execution via webhook - ideal for automating mean reversion logic based on your Pine Script logic and indicators.

Start Trading on 3Commas Today

Seize opportunities that manual traders can't

Mean Reversion- Example

3 Steps to Capturing Rebounds with Automation — Calm Logic in Ranging Markets

1. Define Extremes with Indicators

Use Bollinger Bands or RSI to mark overbought/oversold conditions. DCA Bot or Signal Bot reacts when price deviates from the mean — opening a position when reversion likelihood is high.

2. Scale In with Logic, Not Emotion

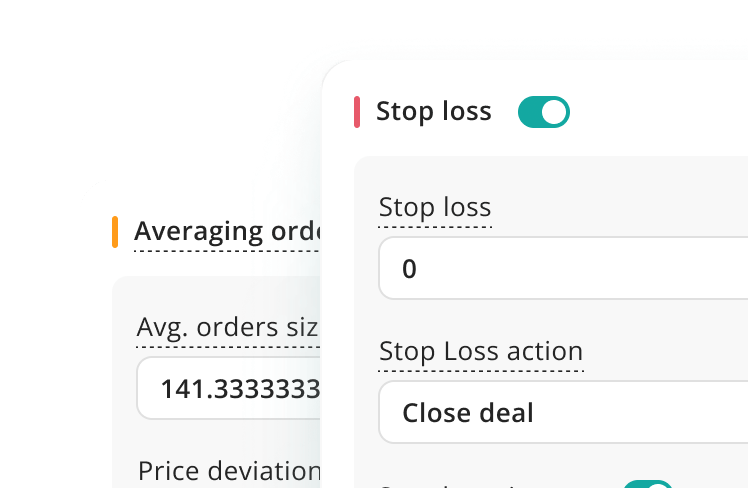

Enable smart DCA safety orders to average down entries across multiple levels. Add a fixed Stop Loss to cap exposure in case price breaks the range.

3. Return to Mean, Hands-Free

Once in position, bots manage exits at pre-set profit targets or when price returns to the midpoint — reducing the need for constant supervision.

The market always comes back — are you ready?

Automate your mean reversion setups with 3Commas and profit from price snapping back to the average.

What’s the Difference?

Manual Mean Reversion Trading vs Automated

Manual trading is stressful and slow. Automated Mean Reversion Trading with 3Commas runs 24/7, reacts instantly, and stays emotion-free — giving you the edge in fast markets.

Manual Mean Reversion Trading

Automated Mean Reversion Trading

Signal Timing

Prone to delays

RSI/BB logic auto-detects extremes

Entry

Discretionary

Based on indicator logic/ strategy logic

Risk Control

Harder to define

Automatic Stop Loss and Take Profit

Consistency

Subjective

100% rule-based

Testing

Manual data checks

Integrated backtest

Why aren't you trading yet?

Let our technology take care of the tedious tasks while you focus on innovating your Automated Mean Reversion Trading Strategy

No Credit Card Needed

No Obligations

No Hidden Fees

FAQ

What is mean reversion in crypto trading?

Mean reversion is a trading concept where asset prices tend to return to their average (or “mean”) over time. When the price moves significantly away from this average — either too high or too low — traders expect it to “revert” back. In crypto mean reversion, this often applies to volatile assets where overbought or oversold conditions create trading opportunities. This approach can be effective during sideways markets, using indicators like Bollinger Bands, RSI, or moving averages.

How does a crypto trading bot help with mean reversion?

Crypto trading bots like those on 3Commas can automate a mean reversion strategy by executing trades whenever the price deviates significantly from the average. Bots remove the emotional component and react instantly to technical conditions. For example, if the price drops far below the 20-period moving average and RSI shows oversold levels, a bot can buy automatically, expecting a price bounce — a classic mean reversion trading move.

Can I automate a mean reversion strategy with 3Commas?

Yes. You can create fully automated mean reversion trading setups on 3Commas using DCA or Grid Bots. These bots can buy as price drops from the mean, and sell once it reverts back — or vice versa. You can also connect crypto trading bots to TradingView signals based on custom scripts using Bollinger Bands or mean-based oscillators. This allows you to run your crypto mean reversion strategies 24/7 with consistent execution.

Is mean reversion effective in crypto markets?

Yes — but only under certain market conditions. Mean reversion strategies work best in ranging or low-volatility environments where price oscillates around a stable average. They are less effective during strong trends. The crypto market is known for high volatility, so it’s essential to pair your mean reversion trading strategy with risk controls like stop-losses and position limits, which are easily managed through automation.

What indicators are commonly used in mean reversion trading?

Common indicators for mean reversion include RSI, Stochastic Oscillator, Bollinger Bands, and moving averages. These help identify overextended price levels. On 3Commas, you can build bots that respond to these indicators directly or receive alerts from TradingView to trigger crypto trading bots based on your specific logic.

Is mean reversion trading risky?

All trading carries risk, and mean reversion is no exception. One major risk is that prices might not revert to the mean quickly — or at all — especially if a new trend forms. To manage this, 3Commas lets you configure safety orders, time-based exits, and max drawdown limits in your mean reversion strategy, making it safer and more structured.