Scalping Trading Strategy

Automate every move. React instantly to market changes with a strategy built for speed and control

Strategy overview

Avg. Trade Duration: 1min-15min

Strategy type: Short-term

Risk Level: High

Recommended Capital: $500

Monitoring Frequency: Constant

Skill Level: Intermediate to Advanced

How 3Commas automate day trading strategy?

DCA and Signal Bots enable instant trade entries based on signals, while also allowing for simultaneous placement of Take Profit and Stop Loss orders - ideal for fast market conditions.

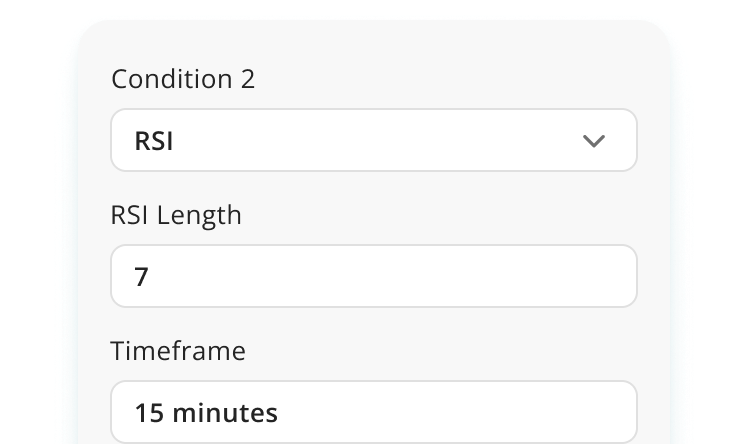

The DCA Bot features over 11+ built-in indicators (like RSI, BB, EMA) to automate entry and exit decisions based on scalping logic using short 3-5 min timeframes.

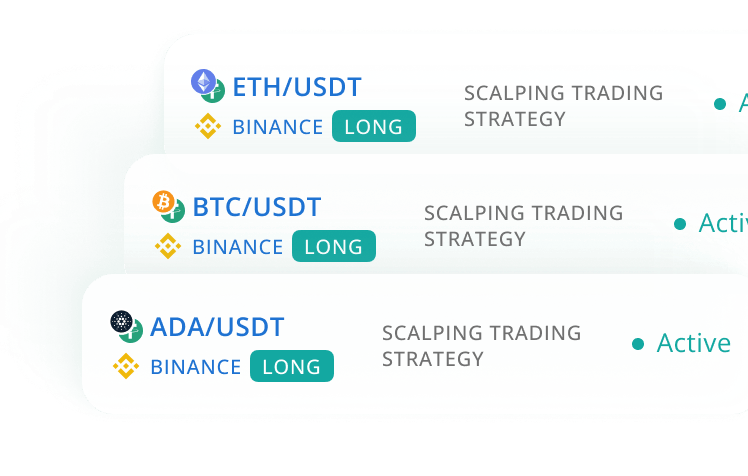

The Grid Bot, configured with tight grid spacing, captures micro price movements, making it perfect for high-frequency scalping.

The Signal Bot supports TradingView Strategies via webhook, allowing full execution of your Pine Script logic with 100% accuracy. Ideal for scalping systems that require split-second reaction and exact trade replication.

Start Trading on 3Commas Today

Seize opportunities that manual traders can't

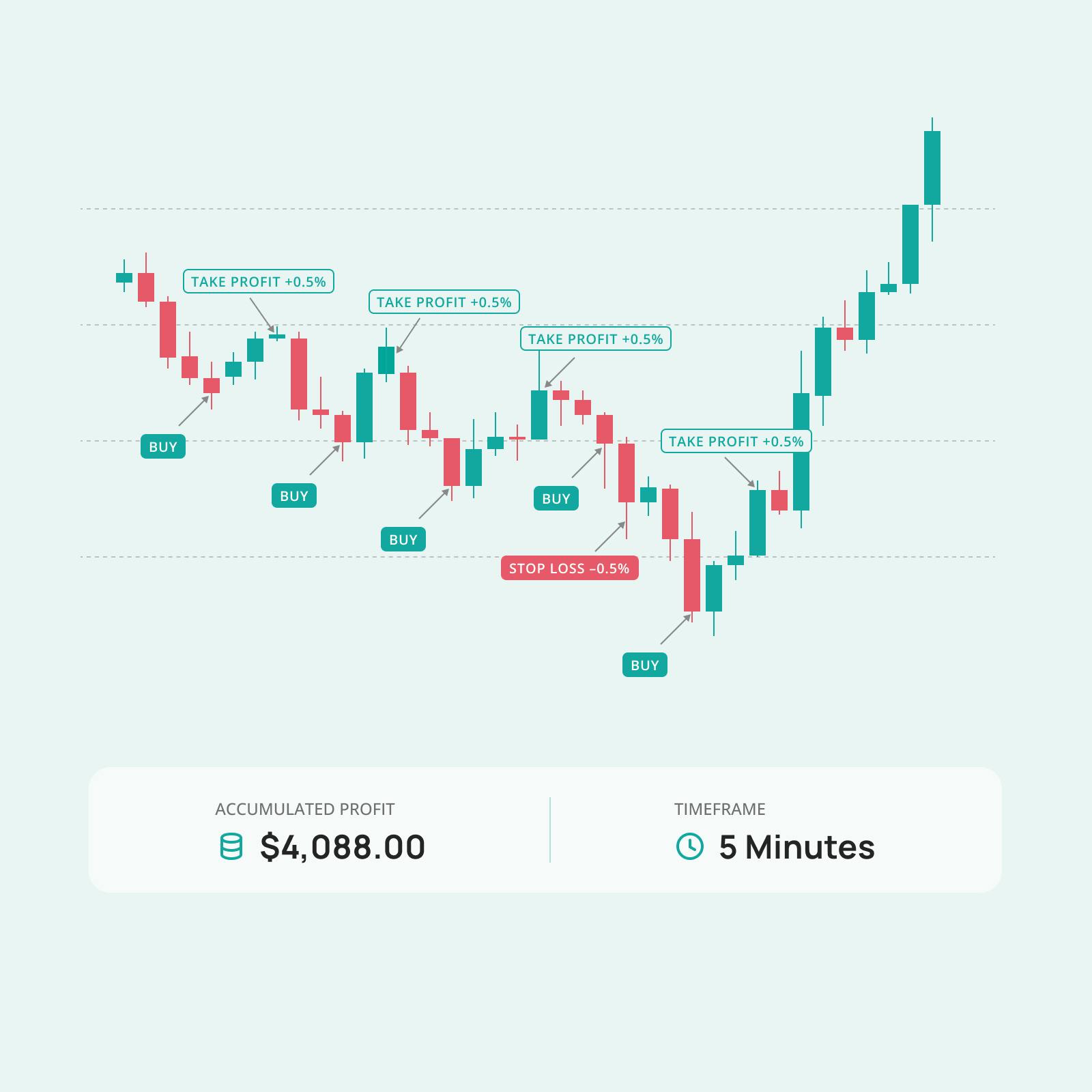

Scalping Trading- Example

3 Steps to Faster Execution — Built for Speed and Precision

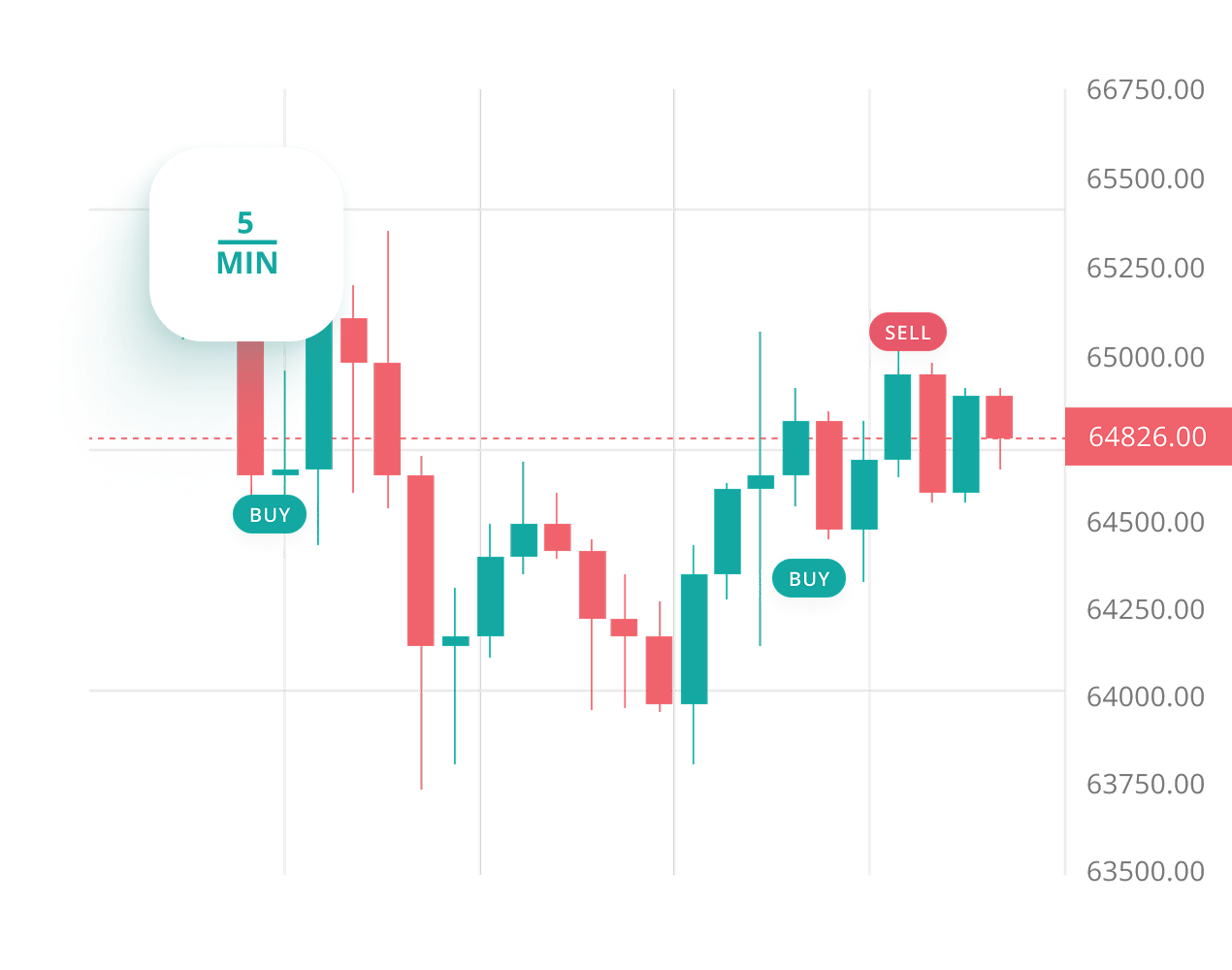

1. Configure Ultra-Short Signals

Use 3–5 min charts with indicators like RSI or EMA crossover. Signal Bot or DCA Bot executes trades instantly via webhook or internal signals.

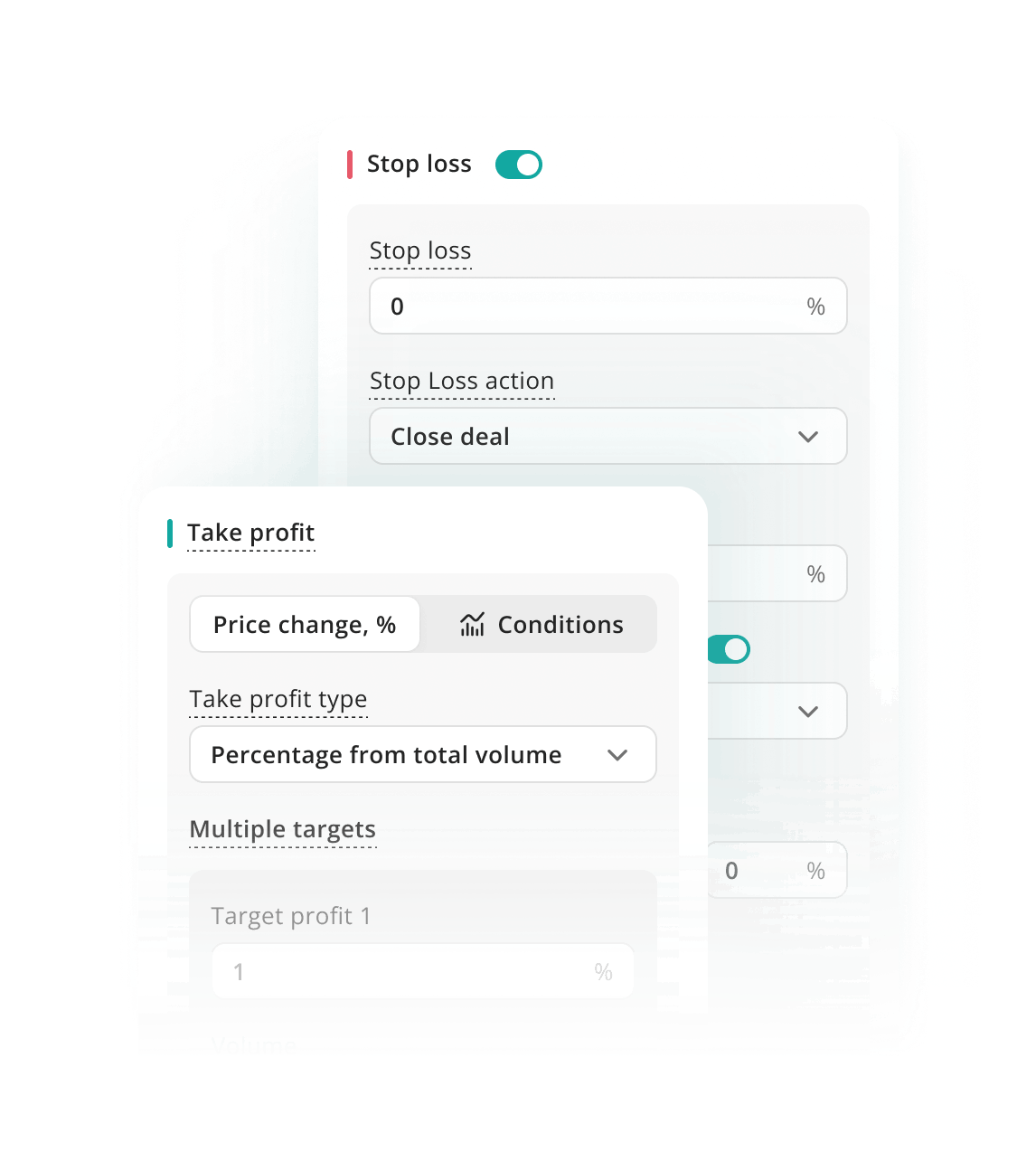

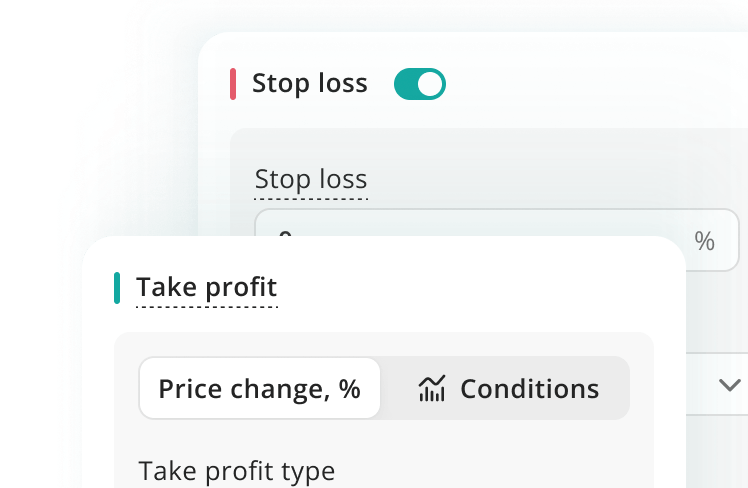

2. Pair with Tight SL/TP and Exit Logic

Set narrow Take Profit and Stop Loss, plus optional trailing to optimize each small move. Built-in logic enforces discipline trade-to-trade.

3. Trade the Noise, Without Burnout

Bot handles multiple fast trades per session with zero delay, reacting faster than any manual process — ideal for volatile, high-liquidity pairs.

Milliseconds matter. Don’t waste them.

Automate your scalping strategy with 3Commas and act on micro-movements in real time.

What’s the Difference?

Manual Scalping vs Automated

Manual trading is stressful and slow. Automated scalping with 3Commas runs 24/7, reacts instantly, and stays emotion-free — giving you the edge in fast markets.

Manual Scalping

Automated Scalping

Attention

Constant monitoring needed

Runs 24/7 without breaks

Emotions

Prone to emotional mistakes

Emotion-free, follows set rules

Speed

Limited by human reaction time

Instant response to signals

Scalability

Hard to scale

Handles multiple trades easily

Consistency

Varies day to day

Consistent execution every time

Risk Control

Manual adjustments

Automatic Stop Loss and Take Profit

Why aren't you trading yet?

Let our technology take care of the tedious tasks while you focus on innovating your Automated Scalping Strategy

No Credit Card Needed

No Obligations

No Hidden Fees

FAQ

Is a Scalping Bot suitable for beginners?

Yes, but some learning is required. 3Commas doesn’t offer a fully pre-configured Crypto Scalping Bot — instead, it gives you powerful tools to create and automate your own strategy. You can use built-in technical indicators, templates, or connect signals from TradingView. The interface is user-friendly, and many traders with basic experience find it easy to get started.

How much time do I need to spend managing the bot?

Very little. Once your Scalping Bot is set up and running, it monitors the market 24/7. Most users only check in periodically to review performance or tweak settings. The main benefit of a crypto scalping bot is that it handles dozens of small trades without requiring your constant attention.

Which exchanges are supported on 3Commas?

3Commas supports a wide range of major crypto exchanges for both spot and futures trading.

Can I backtest my Crypto Scalping Strategy?

Yes — 3Commas offers a built-in backtesting tool for DCA Bot. You can test your scalping setup on historical data before risking real funds. Adjust settings like indicators, timeframes, entry conditions, and safety orders — and instantly see how the strategy would have performed in the past.

Can I use my own TradingView script with the Scalping Bot?

Definitely. The Signal Bot supports webhook integration with TradingView strategies. That means your custom scalping logic — whether it’s based on RSI, MACD, EMAs, or any Pine Script — can trigger real trades with 100% precision. It’s perfect for those running high-frequency or event-based scalping strategies.

What makes an Automated Scalping Bot better than manual trading?

Manual scalping demands full attention and ultra-fast execution, which isn’t always practical. A Crypto Scalping Bot never gets tired or distracted. It operates based on logic, not emotions, and reacts in milliseconds to small price moves. This gives you consistency, scalability, and a serious edge in volatile markets.

Is high-frequency crypto trading risky?

Yes, all trading carries risk — and scalping operates in highly volatile environments. But bots help manage that risk using stop losses, fixed position sizing, and automatic trade controls. On 3Commas, you can define your risk per trade, adjust safety orders, and fine-tune every parameter to match your comfort level.