Swing Trading Strategy

Automate your trades and stay one step ahead of market swings. Designed for confident, medium-term moves with less noise

Strategy overview

Avg. Trade Duration: Several days–weeks

Strategy type: Medium-term Swing Trading

Risk Level: Moderate

Recommended Capital: from $2,000

Monitoring Frequency: Daily

Skill Level: Beginner to Intermediate

How 3Commas automate day trading strategy?

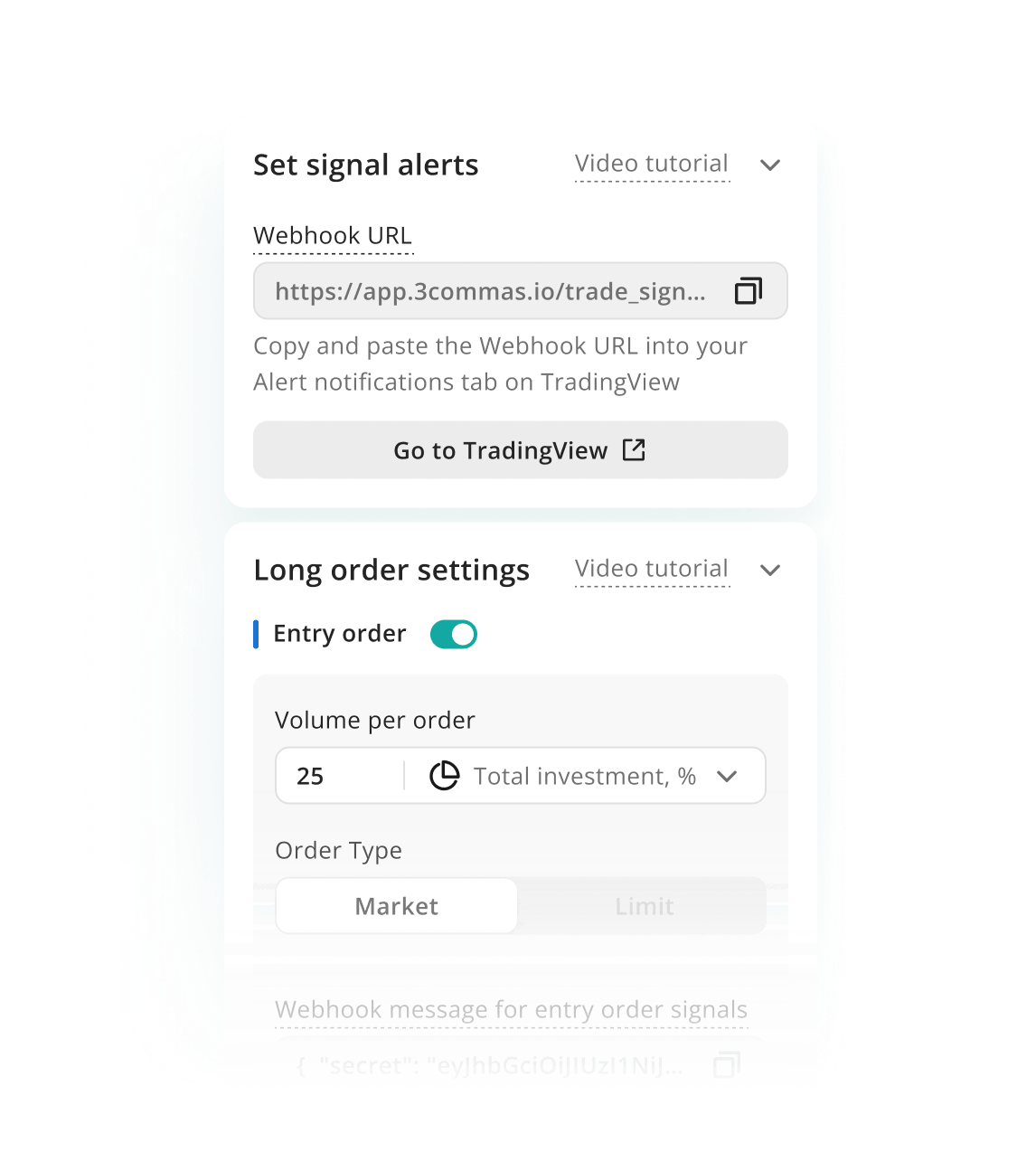

Signal Bot can fully replicate TradingView strategies via webhook, enabling multi-day Pine Script logic to run hands-free.

The DCA Bot features over 11 built-in indicators that can be combined on 1h and 4h timeframes to spot high-confidence swing entries and averages with clear momentum or trend confirmation.

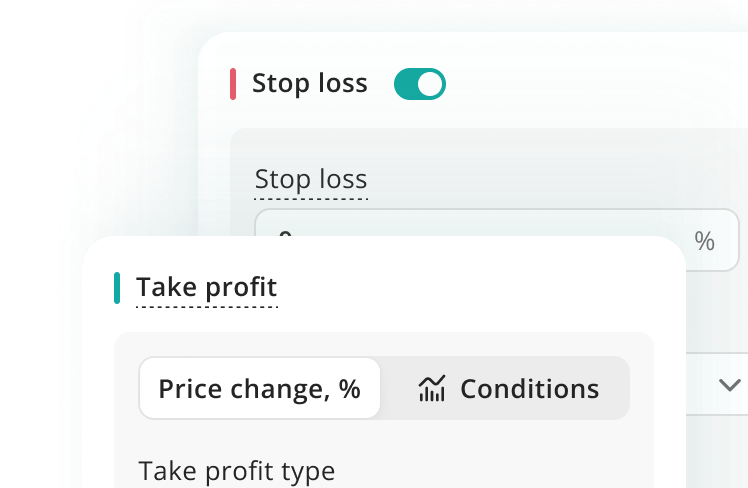

DCA and Signal Bots support Multiple Take Profits with a trailing option on the final target for extended moves. Stop Loss, Trailing Stop Loss, and Breakeven logic help secure gains during market reversals.

SmartTrade lets swing traders open positions manually, then automate risk management with Multiple Take-Profit levels, Stop Losses, trailing, and breakeven logic.

With Hedge Mode enabled, a single Signal Bot can manage both Long and Short positions simultaneously, or automatically reverse a position in the opposite direction based on your strategy logic and signals.

Start Trading on 3Commas Today

Seize opportunities that manual traders can't

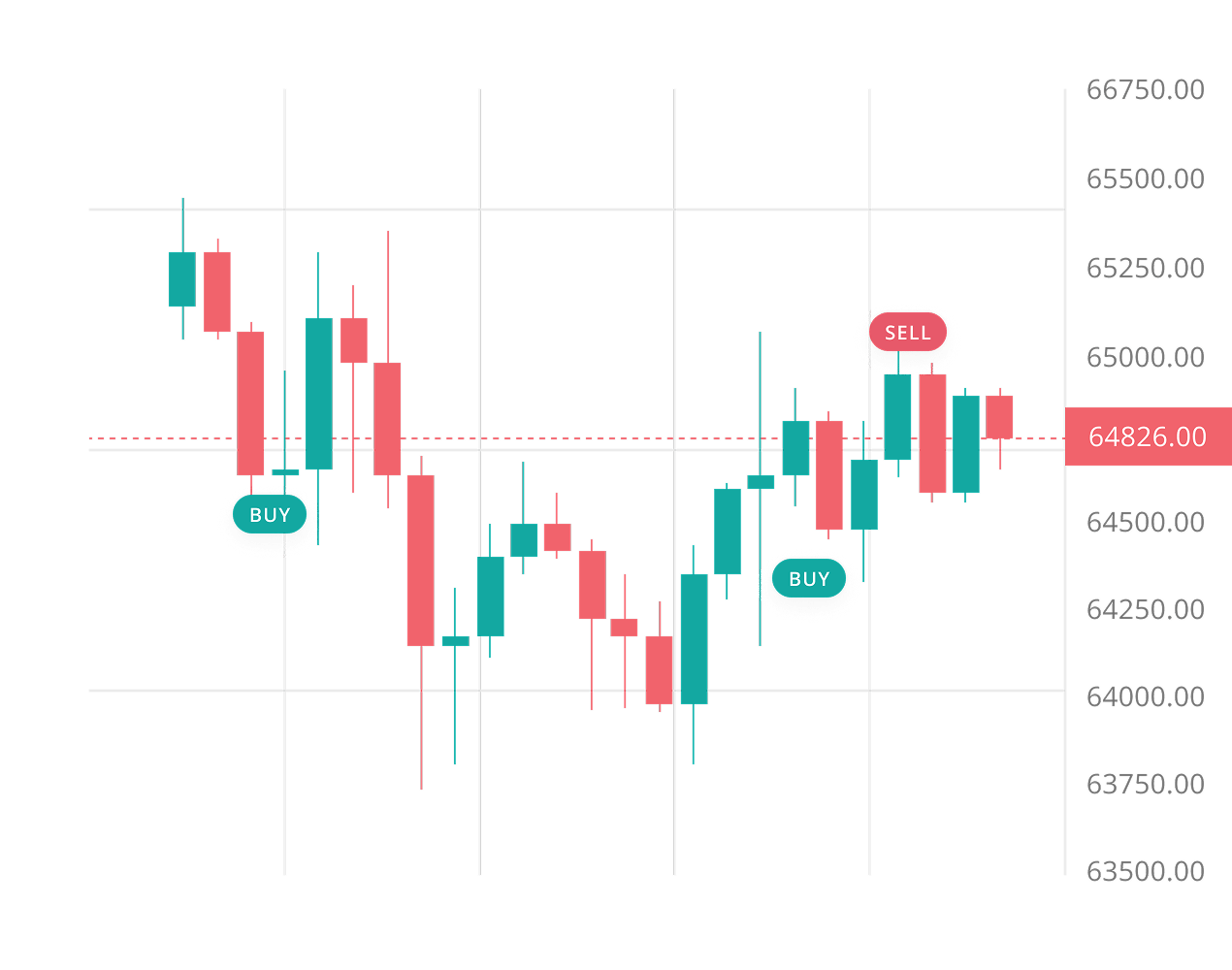

Swing Trading- Example

3 Steps to Automating Swing Entries — Smooth Management for Multi-Day Moves

1. Detect Momentum Shifts with Indicators

Set up signals using RSI, MACD, or Stochastic on the 1H–4H chart. DCA or Signal Bot can execute when specific momentum conditions are met.

2. Layer Entries and Manage Exits

Configure scaling entries with DCA logic. Add smart Take Profit levels and a Trailing Stop to protect gains as the swing unfolds over days.

3. Minimal Oversight, Maximum Structure

Once a swing is in play, the bot manages positions based on your setup. This removes the need to intervene frequently, while keeping the strategy on track.

Ready to ride the swings with precision?

Let 3Commas automate your swing trades so you can capture multi-day moves with ease.

What’s the Difference?

Manual Swing Trading vs Automated

Manual trading is stressful and slow. Automated Swing Trading with 3Commas runs 24/7, reacts instantly, and stays emotion-free — giving you the edge in fast markets.

Manual Swing Trading

Automated Swing Trading

Entry Timing

Depends on screen time

Based on indicator triggers

Trade Duration

Manually managed

Auto exit on targets

Emotions

May exit too early

Follows the plan

Risk Control

Manual trailing

Built-in trailing stop

Backtesting

Time-consuming

Built-in backtesting tool

Alerts

Needs 3rd-party tools

Internal solution

Why aren't you trading yet?

Let our technology take care of the tedious tasks while you focus on innovating your Automated Swing Trading Strategy

No Credit Card Needed

No Obligations

No Hidden Fees

FAQ

How can I use swing trading tools for crypto on 3Commas?

A Swing Trading Tool helps traders capture medium-term price movements that last from a few hours to several days. On 3Commas, these tools include Smart Trade, DCA Bots, and custom TradingView signal integration. You can set clear entry/exit levels, automate position sizing, and manage trades across multiple exchanges — making it a powerful Crypto Swing Trading Tool for those who don’t want to monitor markets constantly.

Can I automate a swing trading strategy with 3Commas?

Yes, 3Commas supports Automated Swing Trading using bots that follow your defined strategy. You can automate entries based on indicators like RSI, MACD, or EMAs, and let the bot handle exits using trailing take-profits or time-based logic. This way, your Swing Trading Strategy runs around the clock without manual intervention — perfect for traders who want consistency and efficiency.

What makes swing trading different from day trading?

Swing trading focuses on capturing bigger price moves over longer periods (hours to days), while day trading usually involves quick trades within the same day. Swing traders rely on broader technical patterns and less frequent monitoring. With tools like the Swing Trading Crypto Bot on 3Commas, you can automate these longer setups while maintaining full control over risk and position management.

Is 3Commas a good Swing Trading Tool for beginners?

Yes, 3Commas is beginner-friendly, with simple UI and pre-set strategies to help new traders get started. You can use templates, safe presets, and real-time support to build confidence in your trades. Many users find it to be the best Swing Trading Tool for easing into more advanced strategies over time.

Can I backtest a swing trading strategy on 3Commas?

Definitely. 3Commas allows you to backtest your automated swing trading setups using historical data. You can fine-tune entry indicators, timeframe settings, and risk controls before deploying your Swing Trading Crypto Bot with real funds. This is ideal for validating strategies and learning how they perform in different market conditions.

How much time do I need to spend managing swing trades?

Not much. With 3Commas automation, most swing traders only check in once or twice a day. Bots can manage trade logic, while notifications keep you updated on progress. This makes swing trading an efficient option for people with limited time but a strategic approach.