TradingView Automated Trading

Connect TradingView alerts to 3Commas and turn signals into trades on Binance, Bybit, OKX and more. No code: SmartTrade orders, multi-TP, SL, trailing.

Why traders choose 3Commas for TradingView automation

Turn TradingView alerts into automated trades with 3Commas. No coding required — just reliable execution, smart risk controls, and full visibility across top exchanges.

- PRO TRADING

Backtesting

While TradingView strategies can’t be backtested directly, 3Commas lets you simulate trades using indicators and conditions inside DCA bot. Test your setup on historical data to refine entries, exits, and risk management before going live.

- PRO TRADING

15+ supported exchanges

Trade on all major platforms in one place — connect accounts and automate without switching tabs.

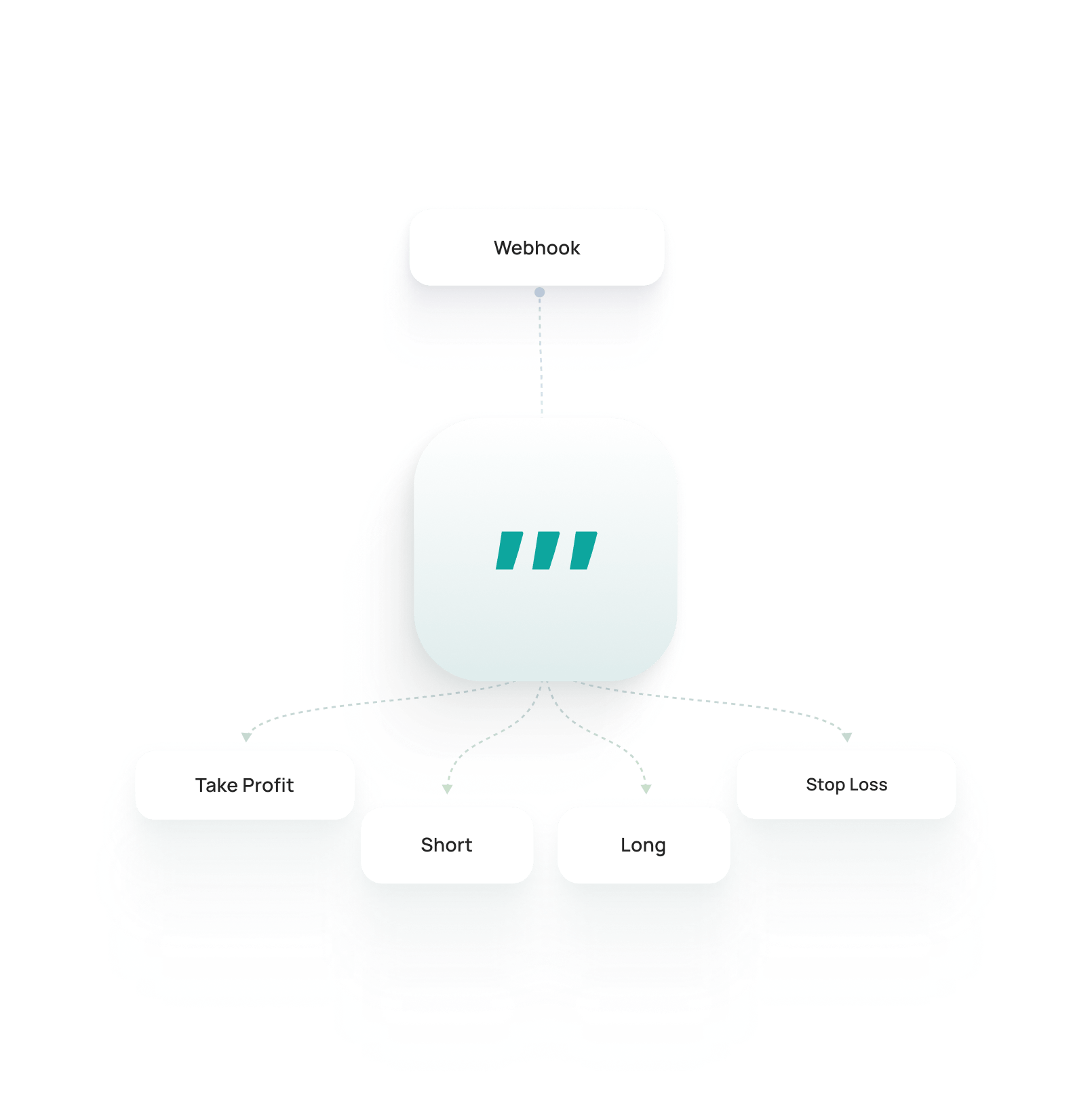

How it works

Automate TradingView alerts with 3Commas in just three steps.

Connect your exchange

Securely link your account with API keys (trade-only, no withdrawal access).

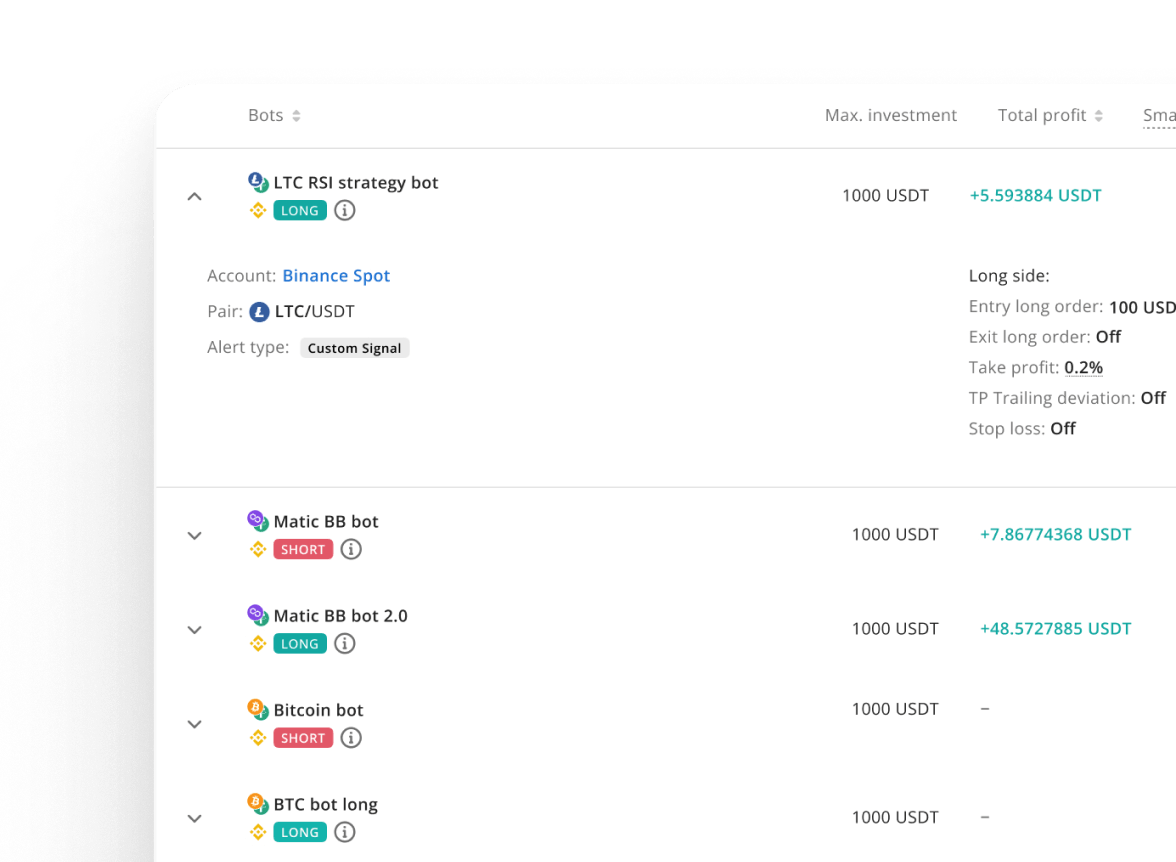

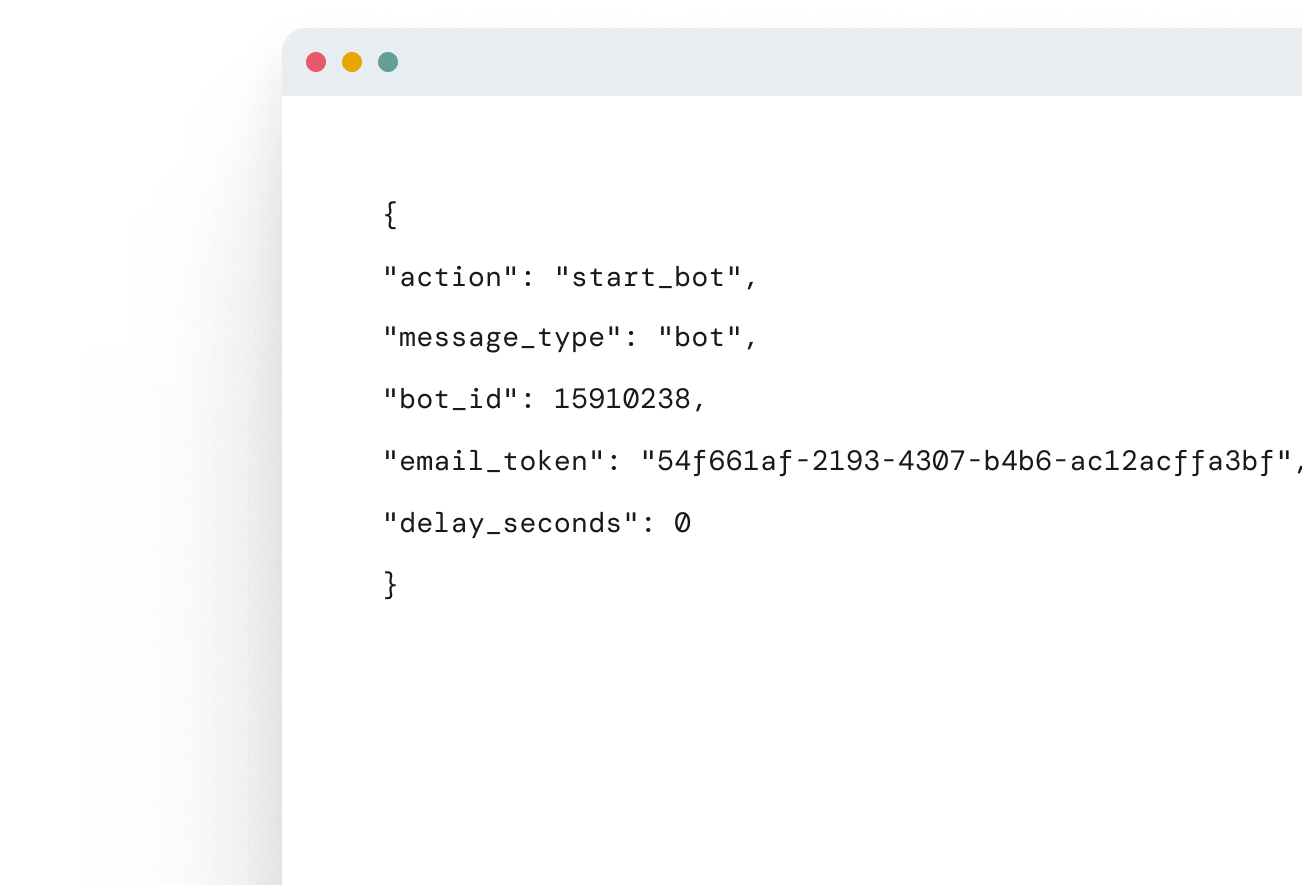

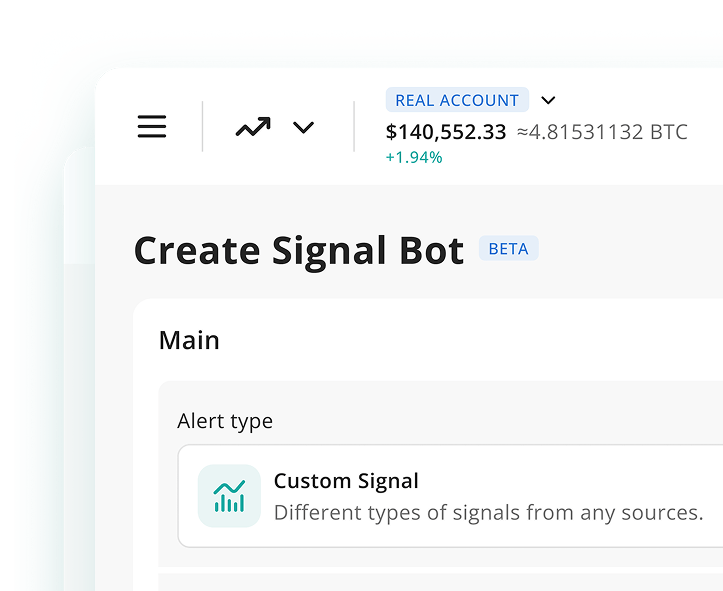

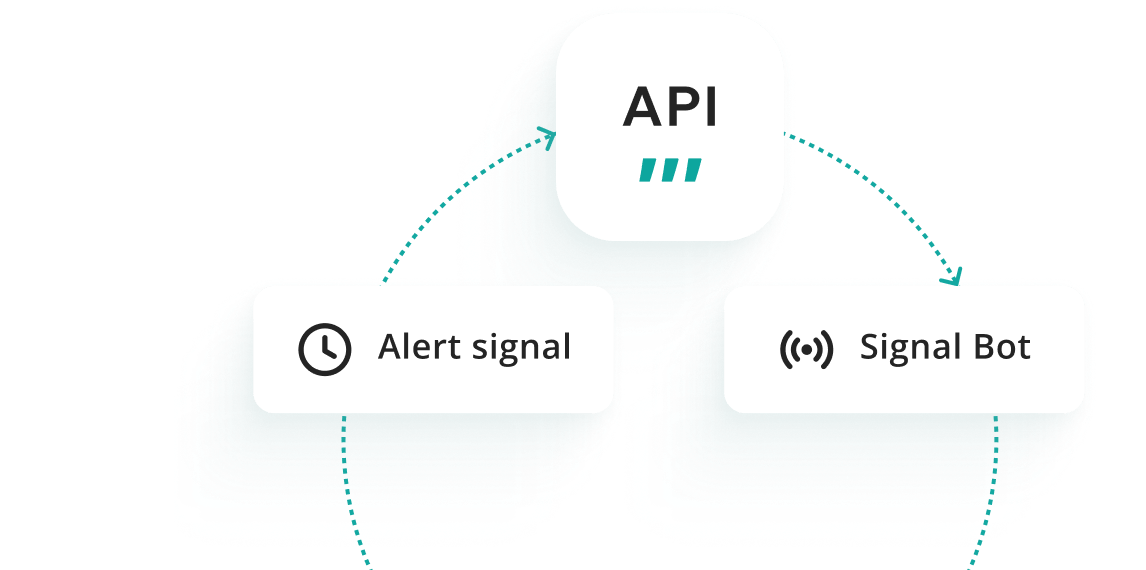

Create a Signal Bot & add webhook

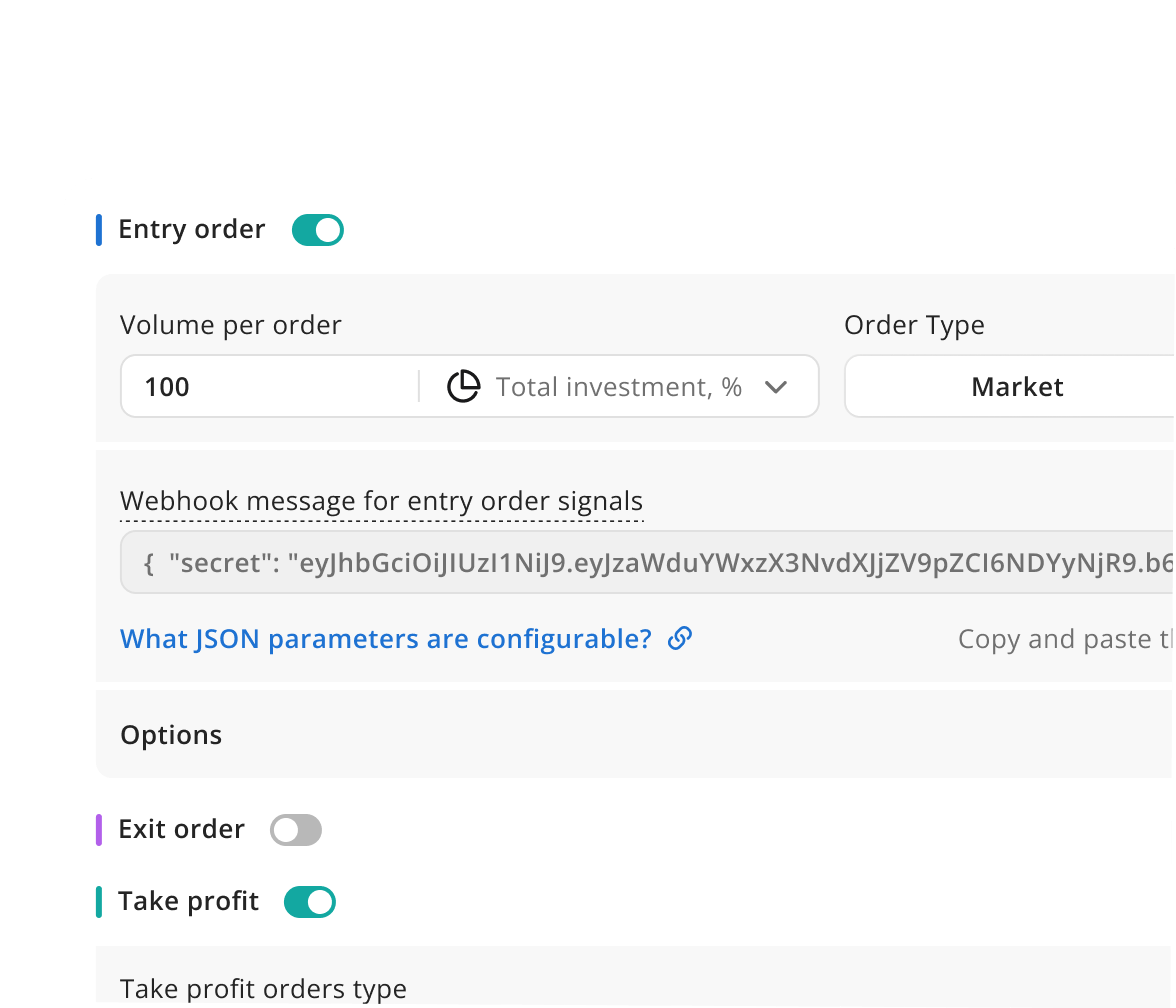

Set up a Spot or Futures bot in 3Commas, copy your unique webhook link, and paste it into a TradingView alert.

Smart Check & go live

Launch the bot and let it execute trades automatically. Monitor performance and adjust anytime.

3Commas TradingView automation

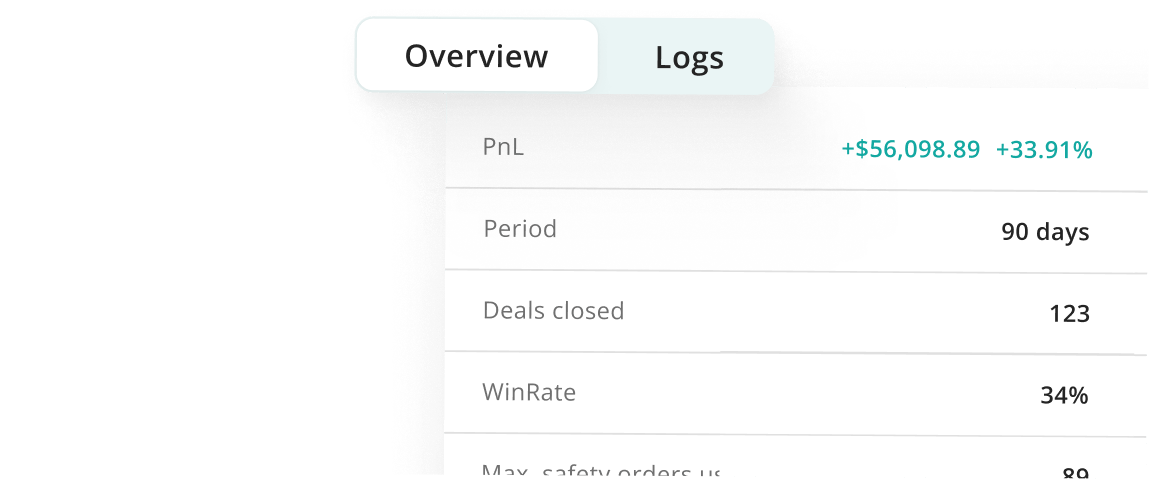

Reliability you can measure

Delivery & retry logic

Each alert gets a unique ID. If an exchange or network hiccups, 3Commas retries automatically within safe limits — so your signals don’t get lost

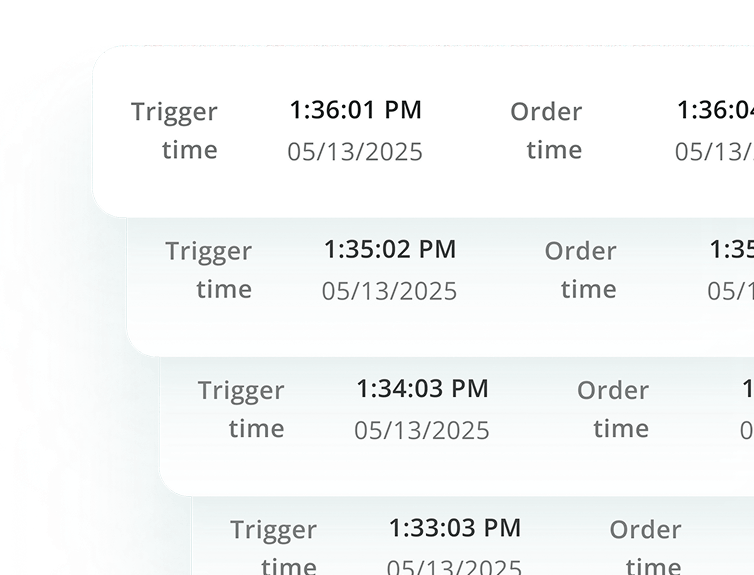

Alert & trade logs

Full transparency: see every alert, decision, and execution step in detailed logs. Filter by bot, pair, or time and export for audits.

Latency insights

Track execution speed at every step — from TradingView to 3Commas, and 3Commas to the exchange. Spot delays early before they cost you fills.

Use cases of using Tradingview on 3commas

Combine TradingView alerts with 3Commas automation to cover different trading styles. From simple entries to full strategies — customize execution and risk management your way.

Send a custom alert from TradingView to open a trade, then let 3Commas handle averaging, take-profits, and stop-losses. Full control without manual clicks

Use TradingView alerts to trigger precise entries and exits. 3Commas executes them instantly with all your risk controls applied.

Catch breakouts via TradingView alerts, while 3Commas splits exits into multiple targets. Lock in gains step by step instead of closing all at once.

Ride the trend using TradingView conditions, and let 3Commas trail your stop-loss dynamically. Protect profits while staying in the move longer.

Run an entire TradingView strategy through 3Commas. See exactly which alerts triggered, which trades opened, and which didn’t — full visibility at every step.

TradingView first — but not only

3Commas executes TradingView alerts out of the box. And if you want more, connect Pine scripts, Zapier, or custom webhooks too.

- PRO TRADING

Templates library

Use ready-made JSON templates for popular strategies (RSI, EMA crossovers, bollinger bands, etc). Copy, tweak, and run in minutes.

- PRO TRADING

Multiple integrations

Go beyond TradingView — connect alerts from Zapier, Make, n8n, or your own webhook server to trigger 3Commas trades.

Map alerts to real orders

Market / Limit / Stop orders

Catch explosive moves as price breaks out of key levels. This approach relies on identifying consolidation zones and waiting for a strong move beyond support or resistance.

Multi Take-Profit (laddered)

Ride multi-day trends and capitalize on market swings. Swing traders often use technical patterns and momentum indicators to time their entries.

Stop-Loss + Trailing + Breakeven

Follow the momentum — stay in trades as long as the trend lasts. Trend followers rely on confirmation signals and avoid guessing market tops or bottoms.

Dynamic qty controls

Size positions by fixed amount, % of balance, or values parsed from the alert (e.g., {qty}, {risk_pct}). Respect exchange min/max rules.

Scale-in / Scale-out

Add to winners or reduce exposure based on new alerts. Combine with timeouts or indicators for rule-based pyramiding.

Futures specifics

Select cross/isolated margin, set leverage in the alert or bot, and open hedged long/short legs when the exchange permits.

Turn alerts into strategies — no coding needed

Turn any alert into a ready-to-trade strategy — no coding needed. Just set take-profits, stop-losses, trailing, cooldowns, or schedules in a simple visual builder. 3Commas will handle the execution exactly as you define.

Visual rule builder with instant preview

Exchange rule checks before saving

Auto-pause & cooldowns during news or volatility

Full control of TP, SL, trailing & order size

Secure by Design. Reliable. Transparent.

Secure Practices

We proactively fortify our security measures to meet evolving threats

Your Funds Solely Accessible By You

3commas does not have access to your funds

Transparent Ecosystem for All Trades

Our software is compliant with stringent regulations so you can put your mind at ease

TradingView automation works with Major Exchanges

Connect your favorite exchange in seconds — either through Fast Connect or by adding API keys manually.

FAQ

What is TradingView?

TradingView is a leading charting and analytics platform where traders can study markets, build strategies, and share ideas. It provides powerful tools for technical analysis, indicators, and alerts used across stocks, forex, and crypto.

TradingView is the largest technical analysis platform in the trading space. Beginners can take advantage of TradingView’s extensive functionality which includes more than 100 indicators for the best analysis of asset price behavior in addition to testing trading strategies. The platform also allows advanced users to create custom indicators and signals. At last, traders can use TradingView’s tools for global markets research, such as the Stock screener or Economic calendar, to find the best assets for analysis.

Does TradingView run the bot itself?

No. TradingView only generates alerts. 3Commas receives those alerts via webhook and executes real trades on your exchange, applying SmartTrade controls like stop-loss and take-profit.

Can I place orders directly in TradingView?

TradingView supports broker connections for some asset classes. For automated crypto trading with risk management, connect your alerts to 3Commas — we’ll place the orders on your linked exchange through API.

Do I need a paid TradingView plan to use webhooks?

Yes. Webhooks are available only on paid TradingView subscriptions. You can still test with manual alerts on free plans, but automation requires webhooks.

Can I pass dynamic variables (side, qty, TP/SL, leverage) from Pine?

Yes. 3Commas reads dynamic variables in your alert payload, so you can run flexible strategies with position sizing, TP/SL, and leverage automatically applied.

Does 3Commas support Spot and Futures (hedge mode, leverage)?

Yes. If your exchange supports it, you can use Spot or Futures, adjust leverage, and choose margin mode — directly in your bot or via alert.

How reliable is execution during volatility?

Very reliable. Every alert is queued with unique IDs, retried if there’s a temporary error, and fully logged with latency stats — so you always see what happened and when.

Can I run one signal to multiple accounts?

Yes. You can mirror the same TradingView alert to multiple accounts or sub-accounts, with individual sizing and limits per account.

Can I test my strategy before going live?

Yes. You can test any TradingView strategy directly in their built-in terminal, which simulates execution, shows fills, logs, and performance — allowing you to validate your setup before running it live.

How are my API keys secured?

Your API keys are encrypted, stored securely server-side, and should be trade-only (no withdrawals). Extra protection is available with 2FA, optional IP allowlisting, and full activity logs.

How to use AI to create a TradingView strategy?

While TradingView itself doesn’t offer AI strategy builders, you can use external tools to generate Pine Script based on text prompts. Once you have your Pine code, add it to TradingView, set alerts, and route them into 3Commas for automated execution.