- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Knowledge DeFi’cit: getting rid of the human factor

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

The OKEx October 16th situation, when more than $2.3 billion of users’ funds were frozen under the influence of the regulator, clearly showed the critical shortcomings of centralized exchanges. In this “Knowledge DeFi’cit” article, we will describe how DeFi exchanges can be used to trade in a decentralized manner, staying in control of your funds.

DeFi exchangers

The human factor and many other circumstances often become a threat to your deposit security in the wallets on centralized exchanges. What if it was possible to exchange assets directly between users with the help of a smart contract on an established blockchain?

DeFi exchanges solve this problem; all you need to do is connect your MetaMask wallet.

On the DeFi Pulse service page, you can study the current statistics of the DEX market, as well as DeFi exchanges’ rating. At the moment, Uniswap DEX is the leader with a dominance of over 60%.

MetaMask recently reported that since May 2019, the number of active wallet users had grown 400% to exceed 1 million in October 2020, and the total amount of funds blocked in DeFi broke a new record to exceed $12 billion for the first time. Security, provided by decentralization and smart contracts, is attracting more and more users; the popularity and trading volumes of DeFi exchanges are constantly growing.

How this works

Let’s take the example of the market leader – the decentralized exchange Uniswap.

Uniswap is a decentralized protocol built on the Ethereum blockchain, allowing blockchain developers, liquidity providers, and traders to execute transactions and exchange assets directly between their wallets. All you need to do is send tokens from a wallet to the Uniswap smart contract’s address, which enforces the exchange’s rules. Uniswap uses several decentralized tools:

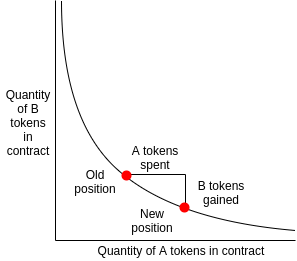

- Liquidity pools – instead of order books, Uniswap uses stimulating liquidity pools – these are reserve volumes of tokens, which are stored in smart contracts and are available to users for exchange. Users who choose to provide liquidity are rewarded with a percentage of each transaction fee. Any Internet user can become a liquidity provider and receive interest;

- Automatic market maker mechanism – the price of assets in the pool is determined algorithmically, depending on the ratio of assets in the pool at the time:

Features

- Blockchains and smart contracts allow exchanging assets directly between users and without the need for a third party, such as a centralized exchange, where it is necessary to deposit funds into the exchange account in advance in order to make purchase/sale transactions. This can make your funds vulnerable to various risks, following the example of OKEx;

- The possibility of arbitrage between the pools and profiting from the difference in asset prices, as well as the possibility of passive income in the form of transaction remuneration;

- Any user can list and exchange their tokens.

Complications

- Absence of auditing contracts, UX complexity, centralized development, and the risk of a smart contract hack, entailing the risk of losing money;

- Blurred responsibility;

- Low performance, high commissions.

In the following “Knowledge DeFi’cit” articles, we will continue informing you about the current situation on the DeFi market and specific lucrative cases in this direction. Good luck, everyone!

Disclaimer: The contents of this article are not intended to be financial advice and should not be treated as such. 3commas and its authors do not take any responsibility for your profits or losses after you read this article. The article has been presented to provide readers with general information. There is only personal experience described herein. The user must do their own independent research to make informed decisions regarding their crypto investments.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.