- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

What Are Cryptocurrency Trading Bots and How Do They Work in 2025?

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

What Are Crypto Trading Bots?

By definition, a crypto trading bot or robot is a piece of software working automatically. Unlike traders, bots perform automatically when pre-built conditions are satisfied. Operating with almost no downtime, these bots analyze the market based on technical indicators, price levels and volatility to decide whether to trade. Which is why such trading systems are widely used on the crypto market and take up to 80% of the whole volume traded.

How Does a Trading Bot Work?

Reliable trading bots operate by adhering to a well-defined and programmed trading strategy, where the rules for opening, maintaining, and closing trades are established; when a trigger is detected, the bot can either notify the user or autonomously execute buy/sell decisions according to pre-defined rules, showcasing how crypto trading bots work in practice.

- Analyze market data

- Evaluate market risks

- Decide whether to buy or sell

- Enter/close a trade

Most robots trade a 15-minute, an hour, or a daily timeframe, blindly following the pre-built algorithm. This way, bots completely eliminate the human factor and emotions. For example, the robot can check the price deviation from the set hourly interval and buy/sell the asset.

Even though complex robots in crypto trading utilize a diverse set of tools to analyze a multitude of cryptocurrency quotes and generate precise signals, certain indicators, such as the Moving Average (MA) technical indicator, stand out as a prominent feature employed by many robot crypto trading systems.

Most robots would buy an asset once its price falls below the average and sell once the quote crosses the average from above. The specific frame depends either on your risk management or the provider’s strategy. As a rule, robots with higher returns (hence, risks) use short frame moving averages like 7-day MA, shown yellow, while less risky robots stick to extended frames like the 50-day MA, shown orange, or the 250-day MA, shown blue.

Types of Bots

All crypto robots have pretty much the same backbone, but each robot has specific nuances that should be considered, as they vary in terms of if/then conditions set to execute trading strategies. Therefore, types of bots and types of trading strategies often correlate and are used interchangeably. The most common types of bots include:

- Arbitrage bots. Arbitrage is a market opportunity based on price imbalances across markets. Simply put, buy lower and sell higher. Arbitrage bots monitor price changes automatically and enter a trade blazingly fast.

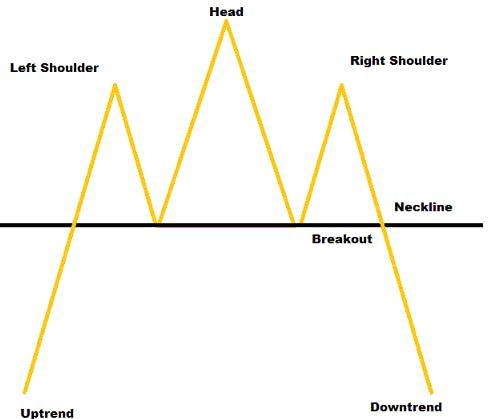

- Trend bots. As the name states, these bots follow the main trend by evaluating an asset’s momentum. Rising trends cause long positions while market dips entail shorts.

- Market Making bots. These bots focus on order book spreads to make profits. The logic is pretty straightforward — whenever an asset is traded actively, spreads widen. The bots monitor markets to spot the biggest spreads.

- Lending bots. Bots lend assets to margin traders, assuming the latter will pay back the interest rate. The clear benefit is automation, as a trader can rely on software rather than setting parameters manually.

Some traders also address high-frequency trading (HFT) bots that can make thousands of deals per second, but such bots are hardly suitable for retail users. HFT bots must have a minimum ping — the time interval during which the signal sent from the operational server passes through the network to another server and comes back. Ideally, the servers should share adjacent locations, as a closer distance means a faster data transfer rate. Estimated expenditures can hit multiple digits and fit trading organizations rather than stand-alone traders.

When it comes to cryptocurrency, a bot in cryptocurrency refers to a computer program that automates trading operations, including high-frequency trading (HFT), enabling rapid execution of numerous transactions per second, typically used by trading organizations rather than retail users due to the associated costs and complexities.

Advantages of Crypto Trading Bots

Trading robots have multiple benefits to offer. Here’s the list of key advantages.

- Bootstrap your efficiency. Robots use backtesting tools, data insights & analysis features, advanced risk evaluation, and more to maximize your trading efficiency.

- Trade 24/7, no downtime. Algorithms do not need any rest and work continuously with no need for breaks, which means they monitor markets and have a higher chance to monetize opportunities you’d otherwise miss.

- Tame your emotions. Imagine controlling the main risk related to trading. Bots follow pre-programmed patterns to trade automatically, with no strings attached.

- Trade in a simple way. You don’t have to be a crypto expert in using bots, as most of them have already analyzed and processed tons of data on your behalf. This is a ready-to-go solution if the trading bot provider is reliable.

Disadvantages of Crypto Trading Bots

There are three core factors to consider when it comes to automated trading software disadvantages.

- Marginal returns might not be the best pick for a veteran trader

- Some trading bots are designed poorly, resulting in losses for a trader

- A bigger part of the market already uses bots and you can rarely outperform larger players like exchanges.

Most automated software providers do not provide valuable products, disguising real returns under loads of formal numbers (which is true but is none of the interest to a trader). However, that’s not the case for the whole market. To avoid this risk you might want to deal only with established brands and check your potential profits in advance. Once you calculate returns, you should also jot down fees. The difference would be your tangible profit.

Are Crypto Trading Bots Worth It?

Once you already understand what bot trading is, you might wonder whether bots actually yield returns. The answer is yes if your bot provider is reliable and trustworthy. The trust issue is a big concern for the whole Web3 community, and bots are not an exception, as many providers gloss over lack of returns or inefficient trading strategies.

To pick a good bot, you might want to have a look at some established trading software providers like 3Commas.

Conclusion

In conclusion, as of 2025, cryptocurrency trading bots continue to play a significant role in the dynamic and ever-evolving world of digital currencies. These automated trading tools have come a long way since their inception, and they are now an integral part of the crypto trading landscape.

We began by defining cryptocurrency trading bots as software programs that execute trading actions automatically based on predefined conditions. These bots are responsible for a substantial portion of the trading volume in the crypto market, often as much as 80%. Their ability to operate without human intervention and their constant analysis of market data make them invaluable tools for traders and investors.

The fundamental working mechanism of a trading bot involves a well-defined trading strategy programmed into the software. When specific market conditions are met, the bot can execute buy or sell orders autonomously or notify the user, depending on the preferences set by the trader. This approach eliminates the emotional aspects of trading, allowing for more rational decision-making.

We explored how trading bots analyze market data, evaluate risks, make trading decisions, and execute trades. Most bots operate on various timeframes, such as 15 minutes, one hour, or daily, following predefined algorithms. While these algorithms can be highly complex, certain technical indicators, such as the Moving Average (MA), are commonly used to generate trading signals. The choice of MA timeframe often reflects the level of risk a trader is willing to take, with shorter timeframes indicating higher risk.

Next, we delved into the different types of cryptocurrency trading bots, each tailored to specific trading strategies:

- Arbitrage bots capitalize on price differences across different markets, aiming to buy low and sell high.

- Trend bots follow the prevailing market trend, taking long positions during upward trends and short positions during market downturns.

- Market Making bots focus on order book spreads to generate profits, exploiting wider spreads during active trading periods.

- Lending bots automate lending activities to margin traders, offering an efficient way to earn interest on assets.

We also mentioned the existence of High-Frequency Trading (HFT) bots, which can execute thousands of trades per second. However, these bots are typically used by institutional trading organizations due to their high costs and complexity.

Moving on to the advantages of using crypto trading bots, we highlighted several key benefits:

- Improved efficiency through backtesting, data analysis, and advanced risk evaluation.

- Continuous 24/7 trading without the need for breaks or rest, allowing traders to capitalize on market opportunities around the clock.

- Emotionless trading, reducing the impact of psychological factors on decision-making.

- Accessibility for traders of various experience levels, as bots can handle data analysis on their behalf.

However, we also discussed the disadvantages of crypto trading bots, including:

- Limited returns, which may not be suitable for experienced traders seeking higher profits.

- Poorly designed bots that can lead to losses.

- Competition from larger players, such as exchanges, that also employ trading bots.

It's crucial to exercise caution when choosing a trading bot provider, as not all of them offer reliable products. Some providers may exaggerate their returns or use complex fee structures that make it challenging to calculate actual profits accurately. To mitigate these risks, traders should consider established brands with a proven track record and carefully evaluate potential returns and fees.

In conclusion, the question of whether crypto trading bots are worth it in 2025 depends on several factors, including the trustworthiness of the bot provider and the specific needs and goals of the trader. While trading bots offer undeniable advantages, including efficiency, 24/7 availability, and emotionless trading, traders must carefully assess their options and choose a bot that aligns with their objectives. In an ever-evolving crypto market, trading bots remain powerful tools that can enhance trading strategies and potentially lead to successful outcomes when used wisely.

2025 Update: The New Paradigm Shift In The Strategies of Crypto Trading With The Use of AI Bots

In 2025, cryptocurrency trading bots are experiencing a surge in popularity and use as a result of innovations in Artificial Intelligence (AI) and the need for more accuracy in trading. These bots now cater to a wider audience ranging from professional portfolio managers to high-frequency traders, providing scalable solutions in both centralized and decentralized markets.

Important Innovations in AI Bots

The Uses of Machine Learning For The Optimization of Strategies: Modern AI crypto trading bots rely on machine learning algorithms to improve strategies through real-time analyses of market activity. This results in increased adaptability of every crypto trading bot, reduced manual effort, automated trade execution accuracy, and improved execution across multi major pairs and altcoins.

Complete Bot Suites: Multiple tools are incorporated into a single solution by the top-tier platforms for the best crypto trading bots which offers great convenience to traders with the grid bot setup and DCA bot auto, integrated signal trading bots among other features. This increases efficiency with seamless multi-exchange strategy execution from one interface.

Improved Access To Markets: Advanced bots are able to interact with both centralized exchanges and on-chain protocols. Users can utilize a cryptocurrency automated trading bot to execute arbitrage, scalping, or swing trading and customize the programmable APIs with trading signals bots to define the conditions.

Integrated Risk Controls: Institutional-grade bots now come with automated portfolio rebalancing, programmable stop-loss strategies, and signal prediction bot integrations that account for volatility, liquidity, and correlation matrices—thereby mitigating exposure to pronounced drawdowns.

3Commas: Software that Powers Professional Automation

As a provider of trading bot software, 3Commas continues to facilitate sophisticated automation processes. Its software enables the integration of crypto trading bots on Binance, Bybit, and other top-tier exchanges supporting DCA bots, signal bots and grid strategies, available either through predefined templates or user-defined templates. Portfolio managers also benefit from its multi-portfolio crypto trading and monitoring execution tools.

Today’s services, whether for bots tailored to individual needs or bots for testing purposes via demo simulations, focus on agility and transparent pricing. 3Commas, for example, reveals the structures of crypto trading bot costs, thereby allowing clients to make strategic decisions when scaling operations.

Best Practices for 2025 Traders

Traders should monitor their systems under any level of automation to make sure the bots are within the strategy parameters, especially when using third party signal bots or auto-executing trade bots in volatile market conditions.

Security and Compliance: As the use of cryptocurrency bot trading tools grows, it is imperative that the trading bot software has secure region-specific authentication measures and compliance with area’s regulations features as protective markers nested within.

Tool Interoperability: Focus on the trading bot platforms that provide easy API access, integrate with both trading signal bots, and allow manual intervention with auto-trading functions.

To sum up, the 2025 landscape revisits the world of cryptocurrency automated trading bots as having markedly more evolved features geared towards higher intelligence and risk management. With advanced AI resources, trading bot software like 3Commas empowers professional traders to implement strategies in a confident, transparent, and flexible manner while removing the need for emotionally charged and speculative decision-making.

FAQs

Not all bots are designed equal, as profits trading, bots depend on the strategy picked. Some reliable bots like 3Commas can make money steadily, especially over the long run.

The price majorly depends on functions provided by the bot — more functions entail a higher price. On average, a monthly subscription for a reliable bot starts from $15, while lifetime offers vary significantly across the board.

A trading bot can be valuable if you use several strategies and allocate your capital accordingly. Depending on your initial capital, bots can make huge annual profits on your behalf.

Depending on your needs, some bots fit better than others. However, you might want to narrow down your selection to reliable bots only. An example of such a bot is 3Commas.

Bots implement various technical indicators and algorithms to check the market and adjust their behavior accordingly, based on the pre-built logic sets. A wide range of tools allows bots to trade quite effectively, making money in an automated manner.

Settings depend on the software provider and may vary slightly across the market. Generally, you should visit the website and follow the clear instructions provided.

You can either build a bot from scratch all by yourself or use presets to avoid coding requirements. For example, 3Commas allows two ways of setting preset bots — adjust their strategies based on your needs manually or automatically.