- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

A 2025 Beginner’s Guide to Binance Futures Trading Bot

Are you new to Binance Futures trading bots? This article will teach you how to get started with Binance Futures, as well as how to set up the bot and the risks of using the bot.

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Cryptocurrency trading can be challenging, even for experienced traders in 2025. It is difficult to make consistent, well-informed trading decisions due to market volatility and price fluctuations. Trading bots can be useful in this situation. Trading bots are computer programs that analyze the market, identify trends, and execute trades without the need for human intervention. They can help traders in improving their overall performance, thereby saving time, and reducing the emotional impact of trading.

Binance Futures is one of the cryptocurrency market's most popular platforms for trading bots. Traders can use leverage to engage in margin trading on the Binance Futures platform, increasing their potential rewards but also their risks. Binance futures trading bot is one of the bots that can be used to automate trading on the platform.

This article provides a comprehensive guide to Binance Futures trading bot, including its features, benefits, and potential risks.

Overview of Binance Futures Trading Bot

Binance Futures is a cryptocurrency futures trading platform that allows traders to speculate on the price changes of various cryptocurrencies using leverage. One of Binance Futures' key features is the trading bot, which allows users to automatically automate trading strategies and transactions.

The Binance Futures trading bot is a powerful tool that may help traders keep an eye on the market, analyze trends, and make informed decisions based on current market data. The bot's user-friendly design and easy user interface make it suitable for traders who wish to tailor their trading strategies and adjust the parameters to fit their preferences.

To use the Binance Futures trading bot, traders must first open a Binance account and enable futures trading. They must then link their Binance Futures account to the trading bot using the Binance API key. Once connected, traders can use the bot to execute trades automatically based on their predefined settings.

Features

The following are the main features of the Binance Futures trading bot:

Functionalities

The Binance Futures trading bot has different functionalities that allow users to study the market, identify trading opportunities, and execute transactions without the need for human intervention. The following are the key functionalities of the bot:

Technical Analysis Tools

Traders can use the bot's technical indicators and charting tools to analyze the market and identify trends.

Trading Signals

The bot may generate trading signals that can be used to automatically initiate trades based on user-defined parameters and market data.

Order Types

Traders can define their ideal trade parameters using the bot's support for limit orders, stop-loss orders, and take-profit orders.

Position Management

The bot can keep track of and manage available positions, including automatically closing them based on predefined criteria.

Interfaces

The Binance Futures trading bot has different interfaces through which users can interact with the bot and modify its settings. These interfaces include:

Web Interface

The bot can be accessed via a user-friendly and straightforward web-based interface.

API Interface

Traders can use the bot together with their trading systems and strategies by connecting the bot to the Binance Futures API.

Mobile Interface

The bot offers a mobile interface that allows users to monitor trades and adjust settings while on the go.

Pricing

The Binance Futures trading bot is available in three pricing tiers: a free trial version, a basic version, and a premium version. The free trial version provides access to some of the bot's basic features, while the basic and premium versions provide more advanced support and features. The bot's pricing is competitive when compared to other trading bots on the market, and traders can choose the pricing option that best suits their needs and budget.

Setting Up and Using the Binance Futures Trading Bot

The Binance Futures trading bot is easy to set up and use. This section will walk you through the process of installing and configuring the bot, connecting to the API, and adjusting the settings.

Creating an Account on Binance Futures

The first step in setting up the Binance Futures trading bot is to create an account on the Binance Futures platform. You can do so by visiting the Binance Futures website and registering. This usually requires entering your email address and setting a password.

Connecting to the Binance API

Once you have registered for a Binance Futures account, you must connect to the Binance API for the trading bot to have access to your account and place trades on your behalf. To do this, you must generate an API key on your Binance Futures account and enter it into the settings of your trading bot.

Configuring the Trading Bot

After connecting to the Binance API, you need to configure the trading bot to meet your preferences and trading methods, which includes setting parameters such as the trading pair, order type, leverage, and risk management rules. Some trading bots may also offer advanced features such as backtesting, indicator customization, and automatic portfolio rebalancing.

Testing and Deploying the Trading Bot

Before deploying the trading bot to the live market, you need to test it using a demo account or a small amount of real money. This may help you fine-tune the bot's settings and ensure that it executes transactions in line with your specified criteria. When you are satisfied with the bot's performance, you can deploy it to the live market and leave it to run on its own.

Monitoring and Adjusting the Trading Bot

Although the trading bot is designed to operate autonomously, it is important to monitor its performance and change its settings as needed. This can include tracking the bot's profits and losses, changing risk management rules based on market conditions, and adjusting the stop-loss and take-profit levels.

Top Automated Crypto Trading Bots

Cryptohopper

Cryptocurrency traders can use the automated trading bot Cryptohopper to trade on their behalf using pre-established trading algorithms. This cloud-based platform can be used to build and backtest trading strategies before implementing them on major cryptocurrency exchanges such as Binance, Kraken, and Bitfinex.

Technical indicators, candlestick patterns, and news alerts are some of the tools and features that the platform offers. Users can also create their trading signals and indicators by using the platform's scripting language.

Pros

- It can execute trades automatically based on predefined trading strategies, thereby saving traders a significant amount of time and effort.

- The platform allows traders to backtest their trading strategies, which can help them improve their overall performance and trading algorithms.

- It allows users to trade on many cryptocurrency exchanges at the same time, allowing them to diversify their portfolio and reduce overall risk.

- The platform offers a diverse set of tools and features that can be tailored to individual trading styles and preferences.

- Cryptohopper offers a marketplace where traders may buy and sell trading strategies. This is useful for those that do not have the time or skill to develop their trading strategies.

Cons

- Setting up and configuring the bot requires some technical knowledge and expertise.

- Just like any other trading strategy, there is the risk of losing money when using the bot.

- Traders who rely heavily on automated trading may lose some control over their trades and miss out on opportunities to adjust their strategies in response to market changes.

- Despite offering a free trial, Cryptohopper's pricing plans may be expensive, especially for more sophisticated features.

Bitsgap

Bitsgap is a cloud-based platform with different tools for trading and managing cryptocurrency portfolios. One of the key features of the platform is its trading bot, which allows users to automate their trading strategies and execute trades automatically on many cryptocurrency exchanges.

Bitsgap trading bot uses advanced algorithms to analyze market data and select the trades to execute based on user-defined criteria and parameters. You can configure the bot to use different trading strategies, including arbitrage, trend following, and mean reversion.

Pros

- The bot can review market data and place trades even if the user is not actively following the market.

- It can process market data and execute transactions swiftly, making them substantially faster than human traders. This can improve the effectiveness of a trading strategy and result in higher profits.

- Users can tailor their trading methods to their specific needs and preferences because of the high degree of flexibility.

- Users can create their parameters, such as take-profit and stop-loss settings, to ensure that their bot runs in line with their trading strategies.

Cons

- It carries the risk of losses. Hence, users should carefully review their risk tolerance to ensure that their bot is performing in line with their investment objectives.

- Although the Bitsgap trading bot can be customized, customers have limited control over how the bot makes decisions.

Coinrule

Coinrule allows traders to automate their crypto trading strategies without any programming skills. The platform provides users with a visual editor with a drag-and-drop interface for creating trading rules.

One of the key features of the bot is its simplicity. It is straightforward to set up and use, even for those that are new to trading. The platform also offers different trading indicators and tools, such as market data feeds and technical analysis indicators, to help users develop successful trading strategies.

Pros

- Coinrule's user-friendly drag-and-drop interface allows users to effortlessly build and test trading their strategies.

- The platform provides consumers with a wide range of trading options by supporting many cryptocurrencies and exchanges.

- Coinrule allows users to automate their trading strategies, which can save time and perhaps increase profits.

- The platform has different security features, such as two-factor authentication and API key encryption, to protect user accounts and payments.

- The platform also has a dedicated customer care team to assist customers with any questions.

Cons

- Coinrule has some limitations in terms of customization despite providing several trading templates and tools.

- Coinrule, like any other software, may experience technical difficulties or downtime from time to time, which may have an impact on trading performance.

- Although Coinrule has a free plan, access to more advanced features and tools requires a membership, which some users may find costly.

- The platform's backtesting capabilities are limited when compared to other trading bots.

Pionex

Pionex is a popular cryptocurrency trading bot that is available on several exchanges, including Binance, Huobi, and KuCoin. It is a cloud-based platform that offers customers automated trading algorithms to help them make money in the volatile cryptocurrency market. the bot offers several features such as grid trading, leveraged tokens, and duplicate trading. Pionex also provides leveraged tokens, which track the price of an underlying asset and give leverage to improve the returns of the underlying assets.

Pros

- Pionex offers automatic trading, which can save time and effort for traders who don't want to keep monitoring the markets.

- It offers several trading strategies, including copy trading, leveraged tokens, and grid trading, which can be beneficial to traders with varying risk tolerances.

- Traders can test their strategies before adopting them in real markets using the platform's backtesting features.

- Traders may be able to increase their profits since Pionex charges lower trading fees than many other exchanges.

- Pionex supports trading on multiple exchanges, thereby offering investors more options and liquidity.

Cons

- Although Pionex offers different trading strategies, there may be limitations on how much traders can modify these strategies to match their needs.

- There is a possibility of technical issues or interruptions affecting trading activity since Pionex is a cloud-based platform.

- Since Pionex depends on other exchanges for liquidity, issues or outages on those exchanges may impede trading activity.

- Although Pionex trades on different platforms, the number of trading pairs available on each market may be limited.

Trality

Trality allows users to create and use their trading bots for cryptocurrency exchanges such as Kraken and Binance. The platform has an easy-to-use interface that allows users to import current strategies from the Trality Marketplace or develop theirs using Python.

Trality's trading bots are built on the concept of algorithmic trading, which involves using set rules and instructions to automatically place trades based on market conditions. This method helps traders execute deals quickly and successfully without being influenced by their emotions or making mistakes due to human error.

Pros

- It offers an easy-to-use interface for importing and developing trading strategies.

- It offers different tools for fine-tuning and testing trading strategies.

- It provides risk management tools, including take-profit and stop-loss orders.

- It monitors market conditions in real-time.

- It can execute trades quickly and successfully without allowing emotions or human error to get in the way.

- It allows users to tailor their trading strategies to their personal preferences and risk tolerance.

- It provides a marketplace for sharing and accessing current trading strategies.

Cons

- It requires some coding knowledge for it to be used effectively.

- It depends majorly on historical market data, which is not always a reliable predictor of how the market will behave in the future.

- It could be influenced by technical issues, resulting in unlawful trades or losses.

- Since cryptocurrency markets are so volatile, it may be difficult to develop lucrative trading strategies.

Stoic

Stoic is a cryptocurrency trading bot that works on the Binance exchange. It is compatible with both Binance US and Binance Global. You don't have to continuously check your Binance account, follow TradingView chats with crypto signals, or watch the price of cryptocurrencies on Coinmarketcap when using Stoic.

The bot was developed in 2020 as an iOS and Android trading app. It gives users access to automated crypto trading algorithms via portfolio management.

Pros

- It supports both automatic and manual trading.

- All digital assets remain on the Binance account and are secured by Private keys.

- It supports quick trades and swift profit withdrawals.

- It provides users with regular market updates.

Cons

- It may not be effective in a bull market.

- It works with only the Binance exchange.

Potential Risks and Limitations of Using the Binance Futures Trading Bot

While using a trading bot might offer lots of benefits, it's important to note that there are also potential risks and limitations to consider.

Technical Glitches

Like any software, the Binance futures trading bot can fail for several reasons, such as network issues, power outages, or incorrect configurations. Such flaws might lead to errors when executing trades which can cost the trader a lot of money. As a result, it's important to ensure that the bot is properly configured and to perform any essential updates or maintenance as quickly as feasible.

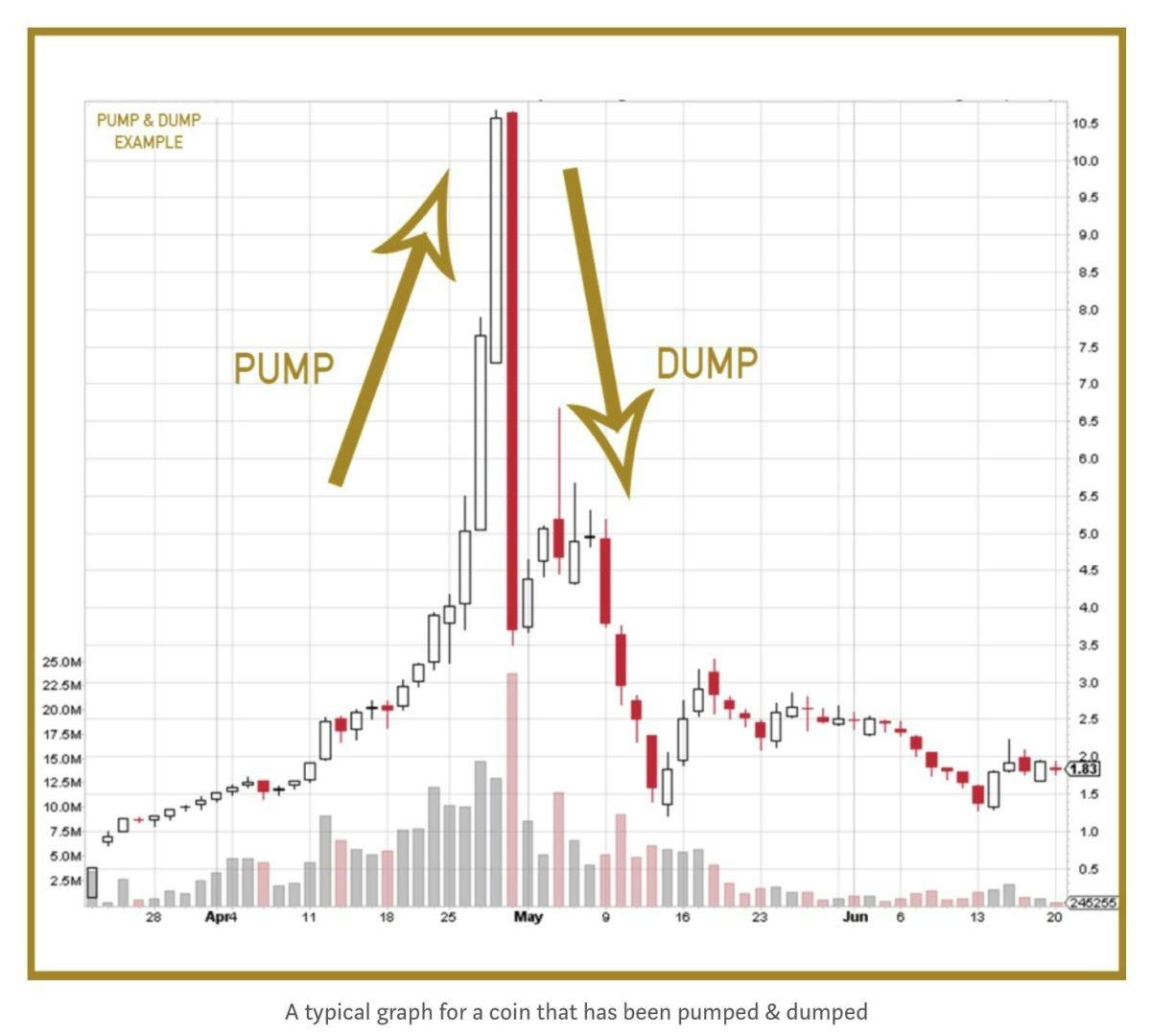

Market Volatility

The crypto market is notorious for fluctuations. When market conditions abruptly change, a trading bot may not always react properly, resulting in unanticipated losses. As a result, it's important to monitor the bot's operation frequently and to intervene manually when the need arises.

Profits Cannot be Guaranteed

The trader's strategy and the fluctuating market conditions can affect the performance of the bot. As a result, it's important not to rely solely on the bot's automated trading and to have realistic expectations for its performance.

Conclusion

The Binance Futures trading bot is a powerful and effective tool for traders interested in automating their trading strategies and getting a competitive advantage in the fast-paced and volatile world of cryptocurrency trading. The bot can help traders optimize their earnings, reduce their risks, and save time and effort by providing real-time market information, tailored trading advice, and automated trade execution.

However, traders should be aware of any potential risks and limitations. The performance of the bot can be affected by technical glitches, unexpected news events, and market volatility and result in losses if not carefully managed. Hence, traders must always exercise caution, monitor the bot's performance, and adjust their strategies when necessary.

What's New in Binance Futures Trading Bots for 2025

The functionality of Binance Futures trading bots has progressed considerably as of 2025, driven by increasing demand for precision, customization, and real-time adaptability. 3Commas, as a software provider, continues to refine its tools for advanced users by introducing features tailored to the needs of professional traders and asset managers.

AI-Enhanced Strategy Automation

Bots now incorporate machine learning models, via custom signal providers, that evaluate multi-dimensional datasets, including historical price action, funding rates, liquidation levels, and macro indicators. These models assist with identifying market inefficiencies and adapting trade parameters without requiring manual intervention. While human oversight remains essential, AI enhances responsiveness to rapid shifts in volatility—particularly in high-leverage environments.

Advanced Strategy Configuration

Beyond preset templates, traders can define layered logic using conditional triggers, trailing inputs, and time-based rules. Custom scripts and integration with third-party signal providers allow asset managers to align automated execution with broader portfolio mandates. Position sizing, hedging parameters, and max drawdown thresholds can now be embedded directly into bot logic.

Signal Sharing and Strategy Benchmarking

Social trading functionality has matured into a more analytical layer within the software. Rather than casual copy-trading, vetted strategy providers publish historical performance with metrics like Sharpe ratio, win rate, and max adverse excursion. This framework enables data-driven decision-making when evaluating strategy alignment with personal or institutional risk appetite.

Security and Operational Oversight

Compliance-minded features such as two-factor API access, trade journaling, and delegated access controls have become essential. 3Commas has responded by offering secure key management and activity logs designed to meet the operational needs of high-frequency and custodial traders. This attention to structure helps reduce friction between manual oversight and algorithmic execution.

Together, these developments signal a broader industry movement toward automation that prioritizes flexibility, accountability, and control. For professionals managing large positions or multiple accounts, the tools now available offer meaningful advantages without sacrificing transparency or oversight.

FAQ

Trading bots are allowed on Binance. Binance provides an API that allows users to connect their trading bots to the exchange and automate their trading strategies. Binance may also monitor bot activity and act if there are any violations.

Binance Futures is not a bot. Binance Futures is a trading platform (provided by Binance) that allows users to trade futures contracts on several cryptocurrencies. The platform offers sophisticated trading tools such as leverage trading and a user-friendly interface.

Developing a Binance futures trading bot requires advanced knowledge in programming, trading strategies, and the Binance API. The steps involved are as follows:

- Choose a programming language.

- Set up the bot development environment.

- Connect to Binance API.

- Develop the trading strategy.

- Implement the trading strategy.

- Test and deploy the trading bot.

Adedamola is a highly resourceful content writer with comprehensive experience in researching and creating simple content that engage and educate the audience. He is interested in improving the marketing results of blockchain and crypto brands through great content.