- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Trading Terminals Breakdown 2025

A trading terminal helps traders make various transactions online and get connected with brokers in real time. Beginners are often confused about how it works, so let’s dive in.

- Introduction

- The main advantages of trading terminals

- Trading terminals for crypto: How are they different?

- Essential features of stock terminals

- A complete list of trading terminals’ functions

- The disadvantages of trading terminals

- To sum up

- What Is a Trade Terminal in 2025? Key Features and Emerging Standards

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Introduction

In the rapidly evolving world of finance, trading has seen a transformative shift from its traditional roots. Gone are the days of physical stock trading, as the internet has ushered in a new era of digital trading. Central to this transformation are trading terminals, powerful software tools that facilitate online transactions and real-time connections with brokers. This article delves into the intricacies of trading terminals, shedding light on their functions, advantages, and differences between traditional stock markets and the dynamic world of cryptocurrency trading.

What is a Trading Terminal?

Trading terminals are sophisticated software applications designed to simplify the complex process of trading financial instruments. They emerged as a response to the migration of stock trading from physical exchanges to online platforms. Instead of relying on phone calls and newspapers, traders can now execute orders, manage portfolios, and access real-time market data with just a few clicks. These terminals are typically set up by brokers to act on behalf of traders, making transactions seamless and efficient.

Advantages of Using Trading Terminals in 2024

- Real-time Data: Trading terminals provide up-to-the-minute pricing information, enabling traders to make informed decisions.

- Speedy Transactions: They execute transactions swiftly, crucial in fast-paced markets.

- Analytical Tools: Sophisticated tools like live charts, probability calculators, and historical data analysis assist traders in making well-informed choices.

- Risk Management: Some terminals offer risk management tools to help minimize losses.

- Control: Traders have full control over their transactions, eliminating the need to rely on intermediaries.

- User-friendly Interface: Data is presented in a visually intuitive manner, often with graphs and charts.

- Digital Data Storage: Terminals reduce paper wastage and securely store user data.

- News Feeds: Many terminals offer tailored news feeds, keeping traders updated on market developments.

- Multi-Market Access: Traders can access data from various markets using a single software platform.

Trading Terminals for Cryptocurrency

While trading terminals have their roots in traditional stock markets, the cryptocurrency space introduces unique nuances:

- Brokerages vs. Exchanges: Unlike traditional stock markets, cryptocurrencies rely on exchanges rather than brokerages for trading. Regulation in the crypto space is often less stringent.

- Different Market Dynamics: Cryptocurrency markets operate 24/7 and exhibit high volatility, in stark contrast to traditional stock markets.

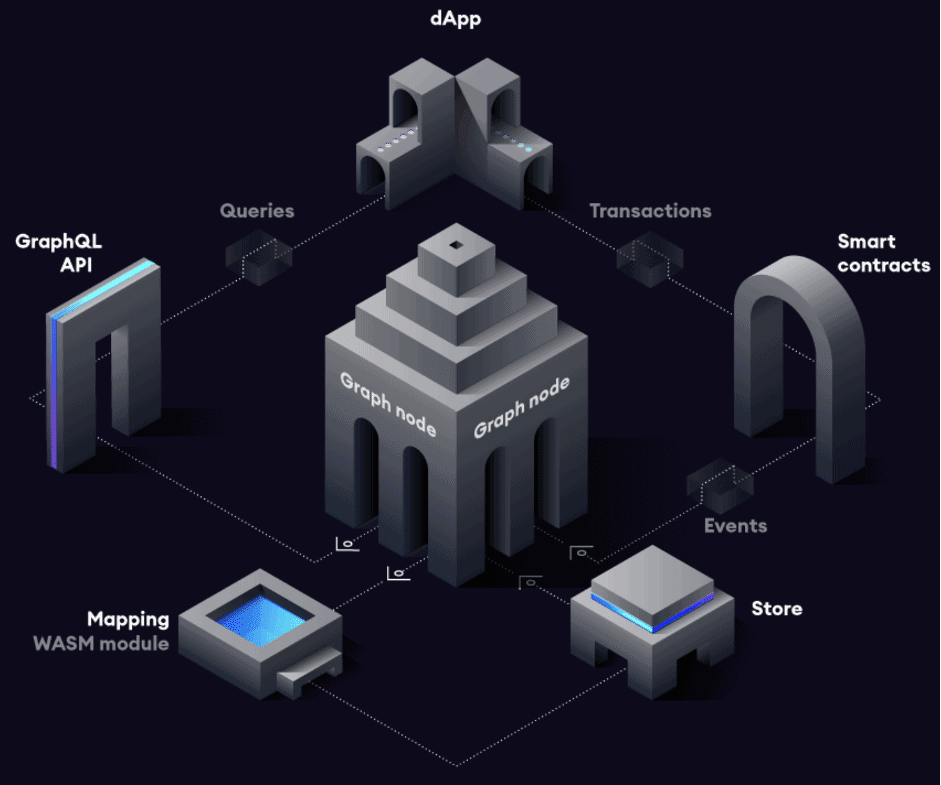

- DeFi and DEX: Decentralized finance (DeFi) and decentralized exchanges (DEX) platforms are gaining prominence, further complicating the regulatory landscape.

However, despite these differences, crypto trading terminals strive to emulate their traditional counterparts to attract investors from traditional markets.

Key Features of Trading Terminals

For both traditional and cryptocurrency markets, key features of trading terminals include:

- Real-time Price Access: Access to real-time market prices is a fundamental feature.

- Order Execution: The ability to buy and sell assets.

- Portfolio Overview: An overview of one's investment portfolio.

- Regulatory and Tax Information: A centralized location for regulatory and tax-related data.

- Funding Options: The option to fund accounts through various payment methods.

In addition to these features, advanced trading terminals offer an array of tools such as news aggregation, price comparisons, event calendars, analytics tools, and tutorials.

Features Unique to Crypto Trading Terminals

Crypto trading terminals often come with additional features:

- Wallet Functionality: Storage and transfer of cryptocurrencies.

- Security Measures: Some offer insurance against hacking.

- Staking: Features for crypto staking with potential returns.

- Access to ICOs and IEOs: Participation in Initial Coin Offerings and Initial Exchange Offerings.

- Trade Signals: Automated triggers for buying or selling assets.

Disadvantages of Trading Terminals

Despite their advantages, trading terminals have drawbacks:

- Reduced Protection from Errors: In the absence of a broker's oversight, traders face increased risks of costly mistakes.

- Potential for Addiction: Continuous trading availability can lead to addiction, exacerbated by the crypto market's 24/7 nature.

- Hacking Risks: Both stock market platforms and crypto exchanges are susceptible to hacking, putting user funds and personal data at risk.

Before the widespread use of the internet, stock trading was a physical activity, with brokers relying on various sources of information (news, phone, newspapers, etc.) to get up-to-date pricing as well as telephones to make trades using brokers onsite at a stock market location. Managing a portfolio was an uphill task.

The internet changed things. As brokerages switched their stock trading online, new trading tools were developed to streamline the processes. One such tool was trading terminals, which is software that helps investors make trades.

Trading terminals allowed brokers to connect with clients in real time by using the internet to execute all sorts of transactions: investors can buy, sell, and manage their portfolios with a few simple clicks from the comfort of their armchair.

The program itself is normally set up by a broker and acts on their behalf.

The main advantages of trading terminals

If you find a broker with a convenient trading terminal, it will make a world of difference to your trading experience.

Here are the main advantages of using a trading terminal:

- It operates in real time and gives you up-to-date pricing.

- It executes fast transactions.

- Analytical tools help you make better-informed trading decisions (live charts, probability calculators, options trading, market watches, real-time profit/loss, merging historical data for price prediction, etc.).

- Some terminals provide traders with risk-management tools to help them avoid losses.

- It gives you full control over your transactions without having to rely on someone else to execute them.

- All the numbers are presented in a user-friendly way with graphs and charts.

- Most trading terminals store user data digitally and securely and eliminate the paper wastage of traditional trade brokerages.

- It offers a dedicated news feed, sometimes even tailormade to an investor’s preferences.

- It’s possible to access various markets’ data using just one piece of software.

The wealth of features offered by the market-leading trading terminals are an excellent addition to an investor’s arsenal. Trading terminals allow investors to be in charge of all their actions. With the features provided, they can learn new trading techniques and optimize their trading profits. When this software is used to its full potential by a confident and careful investor, it can significantly mitigate the risks associated with trading.

Trading terminals for crypto: How are they different?

There are a few noticeable differences between traditional stock markets and crypto markets, and stock market and crypto trading terminals have some differences too. It’s crucial to consider the following three aspects:

Brokerages vs. exchanges

Stock markets are serviced by stockbrokers who provide services to clients. Brokerages must comply with local government regulation, and therefore require personal information to verify user identities.

KYC or Know Your Customer is a regulatory check that financial institutions must complete to show they have verified their customers’ identities. The goal is to prevent crime, fraud, and money laundering.

This is vastly different for crypto. First, there are no brokerages in crypto. Instead, investors rely on crypto exchanges to execute trades on their behalf, and although exchanges may appear similar in functionality to brokerages, they are often quite different below the surface.

Second, some crypto exchanges aren’t regulated at all. Even though some of them are making steps towards complying with financial regulations in their locality, such as anti-money laundering and KYC checks, in reality, it’s often very light compared to the strict regulations that brokerages are subject to. While this may change in the future, crypto exchanges aren’t controlled now because the relevant legislation hasn’t been drawn up yet.

The situation gets even more complicated with the rise of DeFi and DEX platforms, as these protocols are completely decentralized and have no entity to be regulated. So, although crypto exchanges seem to mimic the functionality of a traditional brokerage, they operate differently.

Different markets

Stock market trading terminals are available 24/7, but the markets themselves have limited working hours. That means that you can make a trade order on the weekend, but you’ll have to wait until the trading floor opens on Monday morning for the operation to be executed.

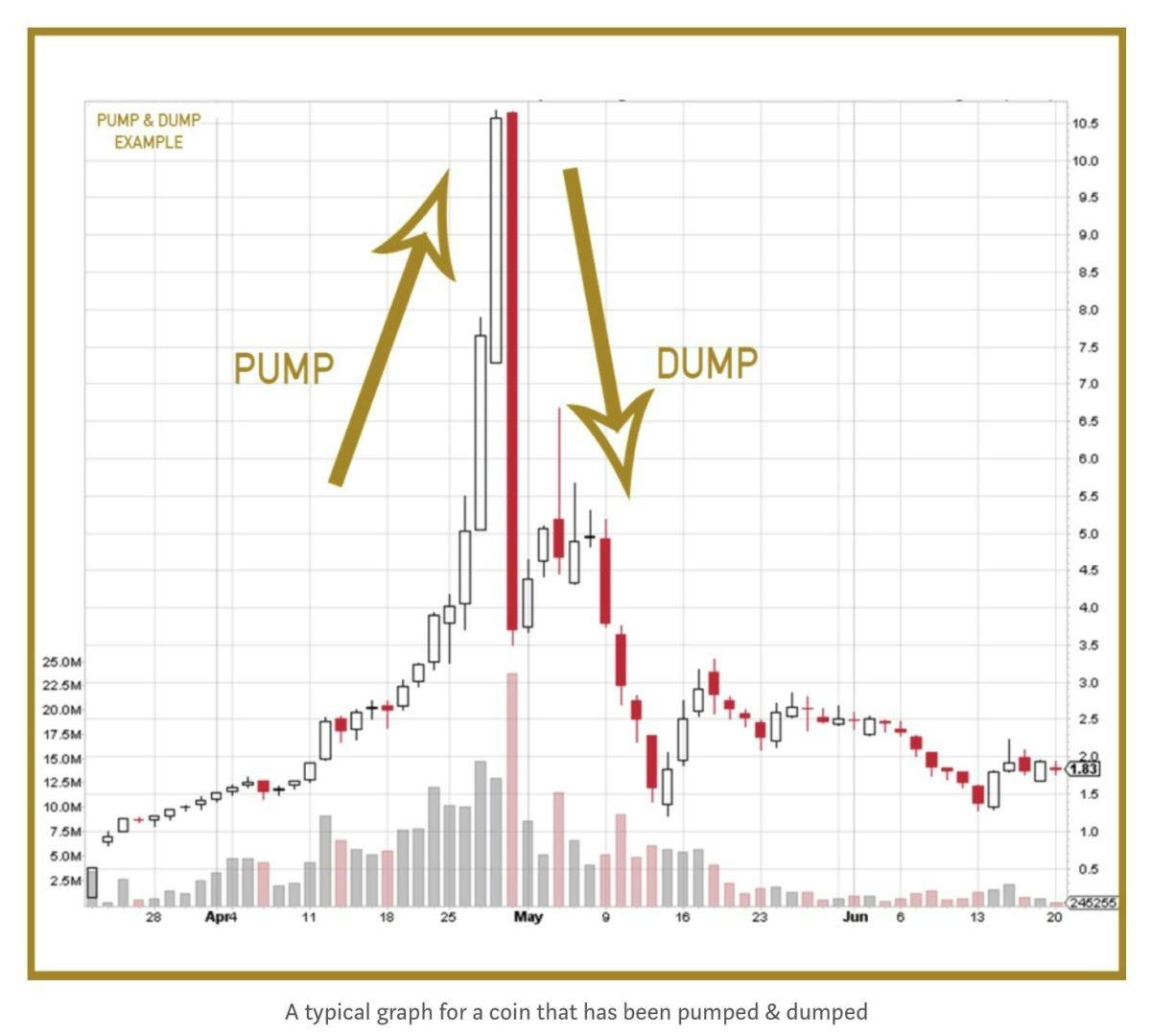

The stock market is considered a mature market compared to the crypto market, meaning, trading volatility in stocks is quite low. Differences of 5-10% are considered severe and volatile.

When you look at the crypto market, both these aspects are different. The crypto market is open twenty-four hours a day, seven days a week. It can also be incredibly volatile, with daily price movements of 5-10% or even more.

As a result of these two peculiarities, trading terminals operate differently between the two markets. It’s not uncommon for crypto exchanges to de-list tokens at a moment’s notice or completely freeze trading across a platform, something that happened on multiple platforms recently with the May crypto crash.

There are still similarities

Aside from the differences mentioned above, trading terminals in the crypto space do their best to mimic the trading terminals in the stock market. This is because they want to attract investors from the stock market and provide the same level of service and functionality to traditional stock traders when they move over to crypto. Thus, you will find that many trading terminals across various markets look similar.

Essential features of stock terminals

Here are the key features of a trading terminal to look out for:

- Ability to access prices in real time.

- Options to buy or sell stock.

- Overall portfolio view to see where your money is invested.

- All regulatory information and tax information in one place.

- Ability to fund your account using major payment routes (PayPal, credit or debit card, bank transfer, etc.).

Any reputable trading terminal provided by a stockbroker should have this set of options. On top of that, there are many additional tools that good stockbrokers offer that prove invaluable when it comes to managing your portfolio.

A complete list of trading terminals’ functions

Because of the wide range of brokerages offering trading terminals, it’s hard to develop a complete list. Full trading terminals are known for their advanced functionality: they are pro versions of “basic” stock terminals.

- News from multiple media outlets that cover markets from around the world.

- Stock market prices collected from reputable sources (typically, large indices) that are then compared against other reputable sources.

- Real-time monitoring of exchange rates to facilitate any trades at the correct exchange rate.

- Upcoming events and trading calendars.

- Analytics tools and visual data, such as graphs, to show historical price movements.

- A tutorial mode for trying out the platform with “dummy money/play money.”

- Detailed company information for all traded stocks and assets.

- Real-time analysis tools, such as current trade volume, percentage of buys vs. sells, etc.

On top of these features, there are a multitude of others. The above should give you an idea of what a quality trading terminal is.

Features of trading terminals for crypto

A crypto trading terminal will also likely offer a few additional tools:

- Wallet functionality (like an exchange wallet) to store crypto, or the possibility to move crypto from the exchange to your private wallet.

- Some exchanges provide insurance for user funds to protect them from hacking.

- With the rise of crypto staking, trading terminals also provide crypto staking features for a percentage return.

- Access to ICOs (Initial Coin Offerings) and IEOs (Initial Exchange Offerings).

- Trade signals. These are generated triggers for buying or selling an asset.

A big omission is that some cryptocurrencies don’t publish team data or founder information, meaning that they may be less transparent than publicly traded companies.

The disadvantages of trading terminals

There are three main disadvantages to using a trading terminal:

Less protection from error

In the past, a stockbroker would oversee each transaction and advise if they felt the trade was risky or unwise. This provided an additional layer of protection for investors. Now, without this layer, investors rely solely on their own judgment, so there are more chances for costly mistakes.

Addiction

An unfortunate by-product of being able to trade around the clock (mainly in crypto, where the market never sleeps) is addiction. The rate of addiction to trading platforms has been rising, and this problem will only worsen because of the anticipated growth of the crypto market.

Trading terminals don’t often carry addiction warnings or advice to help those who can’t switch off from trading. In fact, due to their ease of use, trading terminals can add to this addiction problem.

Hacking

Both stock market trading platforms and crypto exchanges hold a large amount of user funds, and unfortunately, hackers have become increasingly sophisticated. For that reason, many crypto exchanges offer to insure user funds, and brokerages protect user money up to a certain value. This isn’t always the case, though, and it is prudent to check what protection is in place in the event of a hack.

Another type of threat that is common on trading terminals is data hacking, which can lead to identities being stolen, exploited, or misused.

To sum up

Trading terminals have greatly simplified the lives of brokers, traders, and investors. They take the burden off their shoulders by helping manage their assets and carrying out various transactions quickly and efficiently. We expect that there will be even more powerful yet user-friendly terminals in the future so more and more people can get into online trading.

What Is a Trade Terminal in 2025? Key Features and Emerging Standards

A trade terminal is a centralized interface that allows crypto traders and financial professionals to execute, monitor, and manage trades across multiple exchanges from a single dashboard. In 2025, trade terminals have become essential tools for serious hobbyists, institutional investors, and asset managers due to the increasing complexity of digital asset markets and the need for efficiency, control, and risk management at scale.

Core Functions of a Modern Trade Terminal

Trade terminals typically include advanced order types, real-time market data, portfolio tracking, charting tools, and automation capabilities. For high-frequency or multi-account users, they offer faster execution, deeper analytics, and reduced operational overhead.

Unlike standard exchange interfaces, professional-grade terminals provide a cross-exchange overview, supporting diversified execution strategies and improved liquidity access. Features like hotkeys, one-click trading, and customizable workspaces are now baseline expectations for professionals trading in volatile or fast-moving markets.

Additionally, most professional traders in 2025 are using trade automation software with sophisticated bots doing most of the work. In many cases, such as DCA and Signal Bots from 3Commas, a bot trade will be converted into a manual trade and then the user will manage the final close of the deal with a trading terminal to obtain optimal price positions.

2025 Trends Redefining the Trading Terminal

- AI-Augmented Decision Support: Leading trade terminals now integrate AI to support trade analytics, risk modeling, and anomaly detection—helping users uncover hidden patterns and improve timing without replacing trader discretion.

- Automated Strategy Deployment: Automation tools have matured. 3Commas, as an automated trading software provider, now enables asset managers and advanced users to automate trading across portfolios using configurable bots, technical indicators, and external signals—all while maintaining oversight over risk exposure. 3Commas also offers a very robust smart trading terminal that offers several advanced trade options that exchanges do not offer, such as trailing take profit, stop loss, etc.

- Multi-Account Management for Professionals: With growing demand from asset managers, terminals now support secure, permissioned control over multiple client accounts—streamlining trade execution and compliance.

- Regulatory-Ready Architecture: As digital asset regulations advance, terminals are evolving to include built-in compliance tracking, reporting tools, and integrations that make them more compatible with institutional workflows.

Why Trade Terminals Matter

For professionals managing capital in fast-moving markets, the ability to consolidate data, execute trades quickly, and scale strategies across exchanges is no longer optional. Trade terminals serve as the operational core of modern crypto trading—offering the infrastructure needed to maintain precision and control in an increasingly regulated and competitive environment.

FAQ

A trading terminal is software used to access real-time financial information and place orders (buy/sell).

The most important features are:

- the ability to monitor prices in real time,

- placing orders,

- an overall portfolio view,

- regulatory/tax information,

- analytical tools,

- and funding your account using major payment methods.

Trading terminals simplify all your financial operations and provide you with more detailed information about the asset status on the market. This gives investors more information to make successful trades based on their trading strategy.

Most trading terminals store data securely; however, it's best to avoid new software unless you make sure that it has a good reputation. Always check on the security measures utilized by a trading terminal before getting started.

There are three main differences. In crypto, there are no brokers but crypto exchanges. Crypto and stock trading terminals cover different markets. Plus, the crypto market works 24/7, unlike the stock market with its limited working hours.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.

READ MORE

- Introduction

- The main advantages of trading terminals

- Trading terminals for crypto: How are they different?

- Essential features of stock terminals

- A complete list of trading terminals’ functions

- The disadvantages of trading terminals

- To sum up

- What Is a Trade Terminal in 2025? Key Features and Emerging Standards