- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Best Crypto Trading Tools — 2025 Reviews & Comparison

Whether you’re trading, investing, or doing anything related to crypto, the chances are you want to make it as efficient as possible. Which is why the best crypto trading tools are so crucial. In this article you will spot useful tools related to crypto — be it project analysis, data comparison, insights & discoveries, and more.

- What are crypto tools in 2025?

- Why does every investor need crypto tools in 2025?

- Best Centralized Exchanges (CEX) Tools

- Best Decentralized Exchange (DEX) Tools

- Best Trading Platforms Tools

- Best Charting Tools

- Best Market Data Tools

- Best Calendar Tools

- Network Statistics Tools

- News Aggregators

- Best Trading Bots

- Best Crypto Tax Tools

- Portfolio Tracking Tools

- Best Rebalancing Tools

- Best Crypto Wallets

- Best Mining Tools

- Best Blockchain Exploring Tools

- What's New in Crypto Trading Tools for 2025

- AI Automated Trading Systems

- AI is already central to executing many trades. Bots that analyze datasets in real time can implement automated strategy changes as soon as the user-created conditions have been met, which is more efficient. Companies like 3Commas have added AI-powered instruments that assist in the management and implementation of complex trading strategies, using Grid, Signal, and DCA bots for example.

- Advanced Portfolio Management

- Integrations of DeFi and TradFi

- Improved Regulatory Guidelines

- 3Commas Software Updates Since Original Publication of Article

- Signal Bot with TradingView

- DCA Bot Backtesting Beta

- Improvements to Grid Bots

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

What are crypto tools in 2025?

In the ever-evolving world of cryptocurrencies, the importance of crypto tools has grown exponentially. Comparable to how a mechanic relies on a comprehensive toolkit to repair a vehicle, individuals in the crypto realm—ranging from novices to seasoned traders—need a diverse array of tools to navigate the intricate and dynamic terrain of cryptocurrency. These tools not only enhance comprehension but also empower users to make well-informed decisions in a field known for its volatility and complexity.

For this 2025 update, we will delve deeper into various categories of crypto tools. This includes cutting-edge on-chain data products, versatile aggregators, innovative NFT platforms, robust DeFi tools, and the burgeoning sector of TradFi & Web3 FinTech hubs. Moreover, we will spotlight influential Twitter personalities who offer acute analysis on macroeconomic, microeconomic, and NFT trends within the crypto community.

On-Chain Data Products: These are the backbone of blockchain analytics, providing in-depth insights into transaction volumes, network activities, and token distributions across different blockchains. On-chain data products are pivotal for assessing the health and viability of various blockchain projects, offering a granular view of the underlying mechanics and user behaviors on these networks.

Aggregators: Serving as the information epicenter for cryptocurrency enthusiasts, aggregators compile and display data from a multitude of sources. They simplify the tracking of metrics for major cryptocurrencies like Bitcoin and Ethereum. These platforms are a one-stop solution for comprehensive market data, updates on different projects, news, and analytics, keeping users abreast of the latest developments and aiding in data-driven decision-making.

NFT Platforms: As Non-Fungible Tokens (NFTs) continue to capture the public's imagination, NFT platforms have become crucial in the digital asset space. These platforms not only facilitate the trading and ownership of NFTs but also serve as a creative outlet for artists and a vibrant marketplace for collectors. They cater to a wide range of digital assets, from unique digital art pieces to collectibles, offering a diverse ecosystem for NFT enthusiasts.

DeFi Tools: Decentralized Finance (DeFi) tools are at the forefront of redefining traditional financial paradigms, offering open, permissionless, and transparent financial services. This category encompasses decentralized exchanges, lending platforms, and yield aggregators, among others. These tools provide users with opportunities to engage in various DeFi protocols, enabling them to earn passive income or access a broad spectrum of decentralized financial services.

TradFi & Web3 FinTech Hubs: These hubs represent a groundbreaking convergence of traditional finance (TradFi) and blockchain technology (Web3). They offer hybrid solutions that amalgamate the reliability of traditional financial systems with the innovative features of cryptocurrencies. These platforms frequently provide services like fiat-to-crypto conversion gateways, asset custody solutions, and tokenization of assets, catering to a wide array of financial needs and preferences.

Twitter Accounts: Twitter has emerged as a vital platform for crypto discourse, hosting numerous accounts dedicated to disseminating insights and trends in the crypto market. These accounts range from offering macro and microeconomic analyses to specializing in NFT trends, providing a wealth of information for traders and investors to tap into.

In the following sections, we will provide an in-depth exploration of each category, spotlighting prominent Centralized and Decentralized Exchanges, sophisticated trading platforms, advanced charting tools, comprehensive market data and news aggregators, detailed network statistics, timely event calendars, insightful research reports, efficient trading bots, crypto tax tools, all-encompassing portfolio trackers, rebalancing and Web3 wallet tools, comprehensive mining hubs and calculators, and extensive blockchain explorers. Stay tuned for a thorough rundown of the premier crypto tools across each category for 2025.

Why does every investor need crypto tools in 2025?

In the dynamic and complex world of cryptocurrency trading and investing, staying informed and making data-driven decisions is not just advantageous, it's essential. The landscape in 2025 demands a more nuanced approach than ever before. To thrive and enhance performance over time, investors must engage in continuous analysis and monitoring of their portfolios and the broader market. This includes meticulously tracking transactions, identifying areas for improvement, and basing decisions on solid, analytical insights.

The challenge, however, lies in the fact that traditional crypto exchanges, while offering basic functionalities like trading terminals and charting tools, fall short in delivering comprehensive analytical capabilities. To bridge this gap and refine their investment strategies, investors and traders are increasingly turning to a variety of specialized crypto tools.

Project Aggregators: These tools serve as a central repository of information on various blockchain projects. They provide detailed insights into project objectives, underlying technology, team backgrounds, market capitalization, and more. Such aggregators are invaluable for investors looking to research and compare different projects side by side, facilitating more informed investment decisions.

On-Chain Data Hubs: Offering both real-time and historical data, these hubs are critical for understanding the inner workings of blockchain networks. They provide essential metrics such as transaction volumes, network activity, token distribution, and more. Investors leveraging these insights can better gauge the health and potential of specific blockchains, recognize market trends, and craft investment strategies based on concrete data.

Comparison Tables & Graphs: These visual tools enable investors to contrast and compare various cryptocurrencies across multiple parameters, including market cap, trading volume, and price performance. By distilling complex data into easy-to-understand tables and graphs, they simplify the decision-making process, helping investors select investment options that align with their goals and risk tolerance.

Upcoming Drops & Initial Offerings: Staying ahead in the crypto market often means being the first to know about new opportunities. Tools that alert users to upcoming token drops, initial coin offerings (ICOs), and other investment prospects are crucial. They ensure investors have the information needed to participate in promising projects right from their inception.

Utilizing these varied crypto tools allows investors to streamline their investment process, minimize errors, and attain a deeper, more comprehensive market understanding. These tools offer a suite of advanced analytics and efficient tracking capabilities that surpass what traditional exchanges can provide.

In the following sections of this article, we will explore specific categories of crypto tools in more detail. These include Centralized and Decentralized Exchanges (CEX and DEX), trading software, charting tools, market data and news aggregators, network statistics, event calendars, research reports, trading bots, crypto tax tools, portfolio trackers, rebalancing and Web3 wallet tools, mining hubs and calculators, and blockchain explorers. Each category of tool plays a distinct role in enabling investors and traders to effectively navigate the multifaceted crypto landscape of 2025.

Best Centralized Exchanges (CEX) Tools

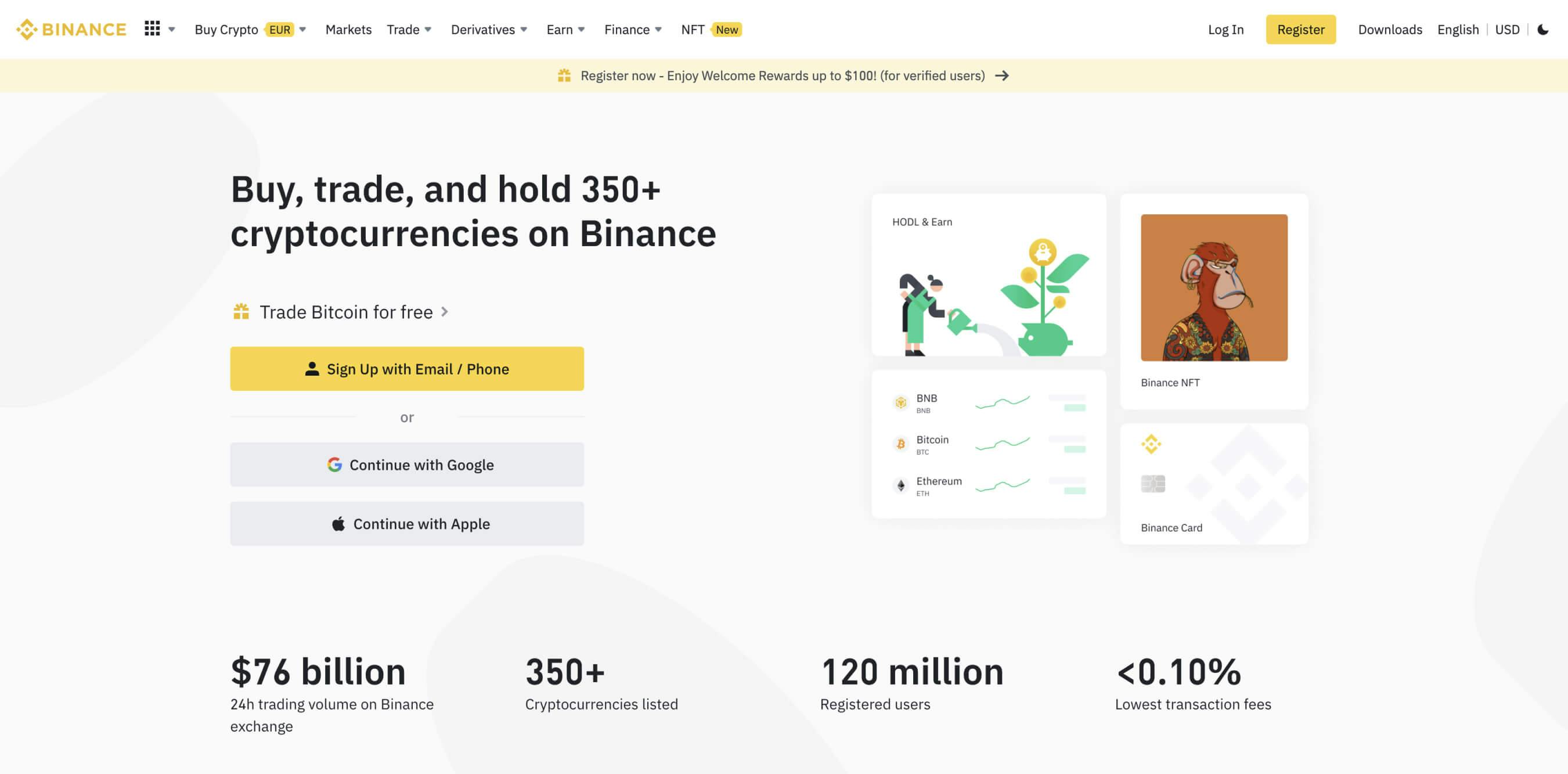

Binance

Binance is the largest cryptocurrency trading software in the world. There are many reasons why, but robust trading pair selection, high liquidity, and fairly low commissions take the lion’s share of the job.

The company operates actively through Web3 space, investing in new projects, supporting ecosystems, and developing its own products. One of the major related projects is Trust Wallet, which tends to compete with Metamask. Binance is also a strategic investor to core blockchain projects like Polygon, Solana, and more.

Binance, as one of the world's leading cryptocurrency exchanges, stands out due to several key value propositions that distinguish it from its competitors:

- Extensive Range of Cryptocurrencies: Binance offers a wide variety of cryptocurrencies for trading, including major coins like Bitcoin (BTC) and Ethereum (ETH), as well as a large selection of altcoins. This diversity caters to both mainstream and niche market interests, providing users with a broad spectrum of investment opportunities.

- Competitive Fees: Binance is known for its relatively low trading fees, which is a significant draw for users. The fee structure is tiered, based on the user's trading volume and BNB (Binance Coin) holdings, offering further discounts and making it attractive for both high-volume traders and casual investors.

- Advanced Trading Options: The software caters to both beginners and experienced traders by offering a range of trading options. This includes spot trading, futures trading, margin trading, and decentralized finance (DeFi) products, allowing users to engage in various trading strategies.

- High Liquidity: Binance boasts high liquidity, meaning users can buy and sell large amounts of cryptocurrencies with minimal slippage. This is a crucial factor for traders who need to execute large trades quickly and efficiently.

- User-Friendly Interface: Despite offering advanced features, Binance maintains a user-friendly interface suitable for beginners. This balance of simplicity and sophistication ensures that new users can navigate the platform easily while experienced traders can access advanced tools without hassle.

- Security Measures: Binance places a strong emphasis on security, implementing a range of measures to protect user funds. These include two-factor authentication (2FA), device management, and cold storage for the majority of funds, amongst other security protocols.

- Global Reach and Accessibility: Binance serves a global audience with multilingual support and a variety of fiat-to-crypto trading pairs, making it accessible to a wide user base around the world.

- Binance Ecosystem: Beyond the exchange, Binance has developed an ecosystem that includes its own blockchain – Binance Smart Chain (BSC), a native cryptocurrency (BNB), a decentralized exchange (DEX), a launchpad for new tokens, and various other financial services, providing users with a comprehensive crypto experience.

- Customer Support: Binance offers robust customer support with a variety of channels for assistance, including live chat and an extensive knowledge base, which is an important aspect for many users.

- Innovative Features: Binance is known for constantly innovating and adding new features to its platform, keeping it at the forefront of the cryptocurrency exchange industry. This includes integrating the latest trends and technologies in the crypto space.

While these value propositions make Binance a strong player in the cryptocurrency exchange market, it's important for users to consider their specific needs and conduct due diligence before choosing any platform for their cryptocurrency transactions.

Pros

- Low fees and discounts for BNB holders

- A wide range of crypto tools and assets available

- Multiple services related to crypto

- No minimum deposit to start off

- Fairly easy to open an account

- Fiat and crypto deposits

Cons

- Not available for US citizens

- Large corporate, highly centralized

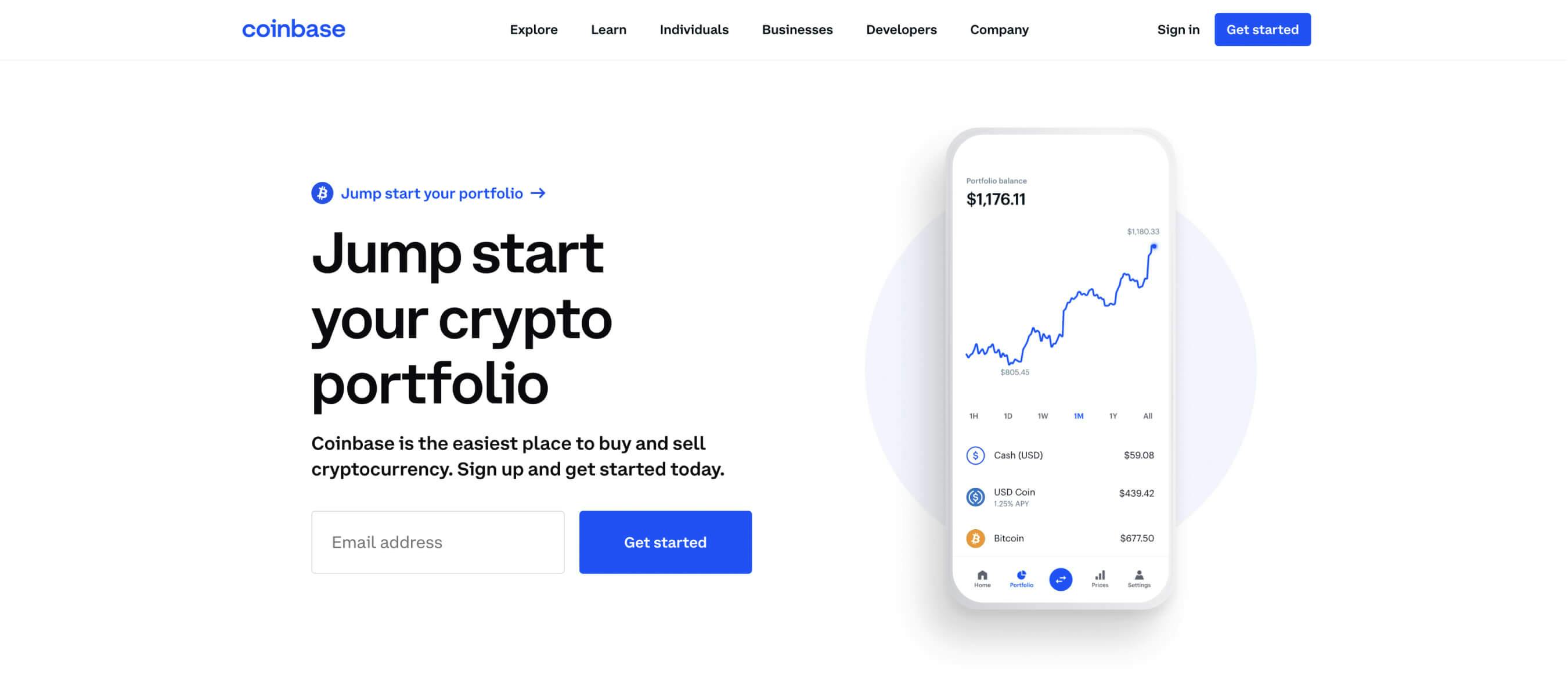

Coinbase

Coinbase is another large company. Even though it’s not as large as Binance, Coinbase dominates the U.S market and has been recently listed on stock exchanges, showing big ambitions and plans to conquer the rest of the world somewhere in the future.

Coinbase, as one of the most prominent cryptocurrency exchanges, particularly in the United States, offers several key value propositions that distinguish it from its competitors:

- User-Friendly Interface: One of Coinbase's most significant advantages is its intuitive, easy-to-use interface. It's designed to be accessible for beginners, making it an ideal entry point for those new to cryptocurrency trading.

- Regulatory Compliance and Security: Coinbase is known for its strong emphasis on regulatory compliance and security. It operates in accordance with various regulatory standards and has a reputation for providing a secure platform for users, which includes insurance for digital assets stored on the exchange.

- Wide Range of Supported Fiat Currencies: Unlike many other exchanges, Coinbase supports a broad range of fiat currencies, facilitating easy and direct fiat-to-crypto and crypto-to-fiat transactions. This feature is particularly beneficial for users in regions with less commonly supported local currencies.

- Educational Resources: Coinbase offers a variety of educational materials through Coinbase Learn, helping new users understand the basics of cryptocurrencies and blockchain technology. They also have a unique feature that rewards users with cryptocurrency for learning about new coins and tokens.

- Reputation and Trustworthiness: As one of the earliest exchanges in the crypto space, Coinbase has established a strong reputation and high level of trust among its user base. This trust is further bolstered by its public listing on the NASDAQ stock exchange.

- Wide Range of Cryptocurrencies: Although not as extensive as some competitors, Coinbase still offers a significant selection of cryptocurrencies for trading, catering to both mainstream and more diverse crypto interests.

- Institutional Services: Beyond serving individual retail investors, Coinbase also provides services tailored to institutional clients, including Coinbase Custody, which offers high-level security and comprehensive insurance coverage.

- Staking and Rewards: Coinbase allows users to earn rewards through staking certain cryptocurrencies. This feature enables users to earn passive income from their crypto holdings.

- Mobile App and Wallet Services: Coinbase offers a highly rated mobile app, making it convenient for users to trade and manage their crypto portfolios on the go. They also provide a separate, secure wallet app for users who prefer to store their cryptocurrency outside the exchange.

- USD Coin (USDC) Support: Coinbase is a key supporter of USD Coin (USDC), a stablecoin pegged to the US dollar. This provides users with a stable digital currency option for transactions and trading.

These value propositions make Coinbase a preferred choice for many users, particularly those new to cryptocurrency or those looking for a straightforward, secure platform for trading and investing. However, it's important for users to assess their individual needs and preferences when choosing a cryptocurrency exchange.

Pros

- Over 450 crypto trading pairs available

- Listed on stock exchange

- User-friendly mobile app

- Has integrated Web3 wallet

- Users can get Coinbase Pro to lower fees

- Both newbie and experienced users can trade and invest easily

Cons

- Limited altcoin pairs

- Customer support issues

- Relatively high fees without Coinbase Pro

Best Decentralized Exchange (DEX) Tools

If you’re not a big fan of KYC or prefer investing in smaller projects, decentralized exchanges are just for you. Sometimes you may not find assets traded on DEX anywhere else, which is why you should know about these tools.

UniSwap

Uniswap, as a leading decentralized exchange (DEX) in the cryptocurrency space, offers several distinct value propositions that differentiate it from traditional centralized exchanges and other DEX platforms:

- Decentralization: Uniswap epitomizes the ethos of decentralization in the crypto world. Unlike centralized exchanges, it operates on a fully decentralized and automated protocol, which means there is no central authority controlling the exchange. This decentralization reduces the risk of censorship and centralized points of failure.

- Permissionless and Trustless Transactions: One of Uniswap's core strengths is its permissionless nature. Anyone can use the platform to swap tokens, provide liquidity, or even create new markets without needing approval from a governing body. This openness fosters a trustless environment where smart contracts handle transactions, eliminating the need for intermediaries.

- Liquidity Pools and Yield Farming: Uniswap's liquidity pools are a key feature, allowing users to earn income by providing liquidity to the exchange. This is done by depositing pairs of tokens into smart contracts, which are then available for trading on the platform. Yield farming on Uniswap can offer significant returns, drawing in liquidity providers.

- Simple and Intuitive Interface: Despite being a decentralized and complex protocol, Uniswap offers a user-friendly interface that makes it easy for users to swap tokens, add liquidity, and participate in yield farming. This accessibility is crucial for attracting a broader user base, including those who may be new to decentralized finance (DeFi).

- Automated Market Maker (AMM) Model: Uniswap utilizes an innovative AMM model, which sets it apart from traditional order book-based exchanges. Prices are determined algorithmically based on the ratio of tokens in each liquidity pool, which ensures constant liquidity and less slippage for large orders.

- Token Accessibility: Being an open protocol, Uniswap supports a vast array of Ethereum-based ERC-20 tokens. This inclusivity allows for a wider range of trading pairs than many centralized exchanges, including access to newer or less-known tokens.

- No Listing Fees: There are no fees or permissions required to list a new token on Uniswap, which contrasts sharply with the often expensive and selective process of token listing on centralized exchanges. This feature encourages a diverse array of projects to be accessible for trading.

- Anonymity and Privacy: Uniswap doesn't require users to undergo KYC (Know Your Customer) procedures, offering a higher degree of privacy and anonymity. This aspect is particularly valued by users who prioritize privacy in their transactions.

- Integration with the Ethereum Ecosystem: As a protocol built on Ethereum, Uniswap is seamlessly integrated with the broader Ethereum ecosystem, including wallets, other DeFi platforms, and smart contract applications.

- Community Governance: Uniswap has introduced a governance token, UNI, which gives holders a say in the development and changes to the protocol. This community-driven approach to governance aligns with the decentralized nature of the platform.

These value propositions highlight Uniswap's unique place in the cryptocurrency landscape. It's particularly appealing to users who prioritize decentralization, privacy, and access to a wide range of tokens. However, as with any platform, users should consider their own requirements and the inherent risks of DeFi before engaging with Uniswap or similar services.

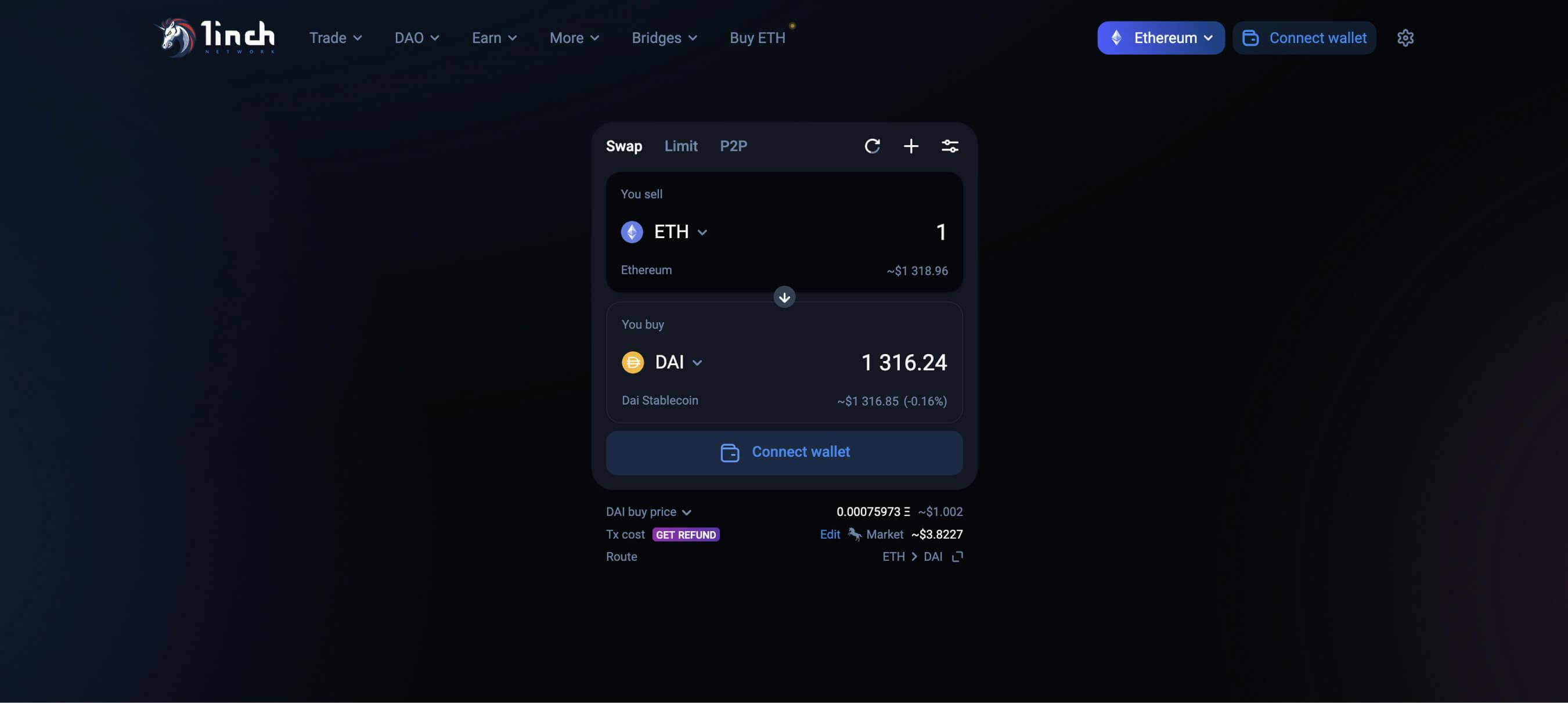

1inch

1inch, as a decentralized exchange aggregator, offers several key value propositions that set it apart from traditional decentralized exchanges (DEXs) and other aggregators in the cryptocurrency space:

- Aggregation of Multiple DEXs: 1inch's primary value proposition is its ability to aggregate liquidity from various decentralized exchanges. This pooling of liquidity sources allows users to get better exchange rates than they might find on any single DEX. By scanning multiple exchanges, 1inch ensures users receive optimal swap rates with lower slippage.

- Reduced Transaction Costs: Through its efficient routing algorithm, 1inch minimizes transaction costs. By splitting a single transaction across multiple DEXs, it not only finds the best price but also reduces the impact of large trades on the market, potentially leading to lower transaction fees.

- User-Friendly Interface: Despite the complexity of its underlying technology, 1inch offers a user-friendly interface. This accessibility is key for attracting both seasoned DeFi users and newcomers to the space, making the process of swapping tokens straightforward and less intimidating.

- Non-Custodial Service: 1inch adheres to the ethos of decentralization by offering a non-custodial service. This means users retain full control of their funds throughout the trading process, as opposed to entrusting them to a third party, enhancing security and reducing counterparty risk.

- Pathfinder Algorithm: 1inch's Pathfinder is an API that finds the best paths across various liquidity sources for a token swap. This algorithm considers not just the best rates but also transaction fees, slippage, and other factors to optimize trades.

- Governance and Utility Token: The 1inch token serves as both a governance token and a utility token within the platform. Token holders can participate in the governance process, influencing decisions about the development of the protocol.

- Liquidity Protocol: 1inch's liquidity protocol (previously known as Mooniswap) offers unique features for liquidity providers, including better rates for traders and protection against front-running and price slippage.

- Optimization for Large Trades: 1inch is particularly well-suited for large trades. Its algorithm efficiently handles large orders by distributing them across multiple DEXs, which is beneficial for users looking to execute large transactions without excessively impacting the market.

- Wide Range of Supported Tokens: As it aggregates multiple DEXs, 1inch supports a wide range of ERC-20 tokens, providing users with access to a broad spectrum of trading pairs.

- Active Development and Innovation: The 1inch team is known for their active development and constant innovation. They frequently update their platform and algorithms to improve user experience and adapt to changes in the DeFi ecosystem.

These features position 1inch as a potent tool in the DeFi space, particularly appealing to those looking for efficient, cost-effective, and secure token swapping capabilities. However, users should always conduct their own research and consider their individual needs and the risks associated with DeFi and crypto trading.

PancakeSwap

PancakeSwap, a leading decentralized exchange (DEX) on the Binance Smart Chain (BSC), offers several distinctive value propositions that set it apart from its competitors in the cryptocurrency space:

- Built on Binance Smart Chain (BSC): One of the key advantages of PancakeSwap is its foundation on the Binance Smart Chain, which offers high transaction speeds and lower fees compared to Ethereum-based DEXs. This makes it an attractive platform for users seeking more efficient and cost-effective transactions.

- Automated Market Maker (AMM): As an AMM, PancakeSwap allows users to trade digital assets against liquidity pools and earn fees for providing liquidity, rather than trading through a traditional market of buyers and sellers. This model simplifies trading and liquidity provision.

- Variety of Yield Farming and Staking Options: PancakeSwap offers a wide array of yield farming and staking opportunities. Users can earn the platform's native token, CAKE, by staking LP (Liquidity Provider) tokens, and participate in syrup pools to earn other tokens.

- Native Token Utility (CAKE): The platform's native token, CAKE, is used for governance, staking, and participation in yield farming. Holding CAKE also gives users a say in the platform’s governance through voting on proposals.

- Lottery and NFTs: Beyond standard DEX features, PancakeSwap also offers unique services like a crypto lottery and NFT trading, which add an element of fun and additional opportunities for users to engage with the platform.

- User-Friendly Interface: Despite offering a range of complex DeFi services, PancakeSwap boasts a user-friendly interface that is accessible to both beginners and experienced DeFi users, making it easier to navigate the world of decentralized finance.

- Strong Community and Social Features: PancakeSwap has a vibrant and active community, supported by strong social features on the platform. This community aspect fosters a sense of user engagement and belonging, which is important in the DeFi space.

- Regular Updates and Innovations: The platform is known for its continuous improvements and updates, including new features and services, which keep it competitive and relevant in the rapidly evolving DeFi sector.

- Token Swaps with Diverse Range of Assets: PancakeSwap supports a wide range of tokens for swapping, providing users with extensive options for trading various digital assets within the BSC ecosystem.

- Integration with Binance Ecosystem: Given its connection with Binance Smart Chain, PancakeSwap benefits from the broader Binance ecosystem, including potential for integration and collaboration with other Binance-related services.

These value propositions make PancakeSwap a compelling choice for users interested in engaging with DeFi, especially those who prioritize low transaction fees, fast speeds, and a wide range of DeFi activities. As with any DeFi platform, users should conduct thorough research and understand the risks before participating.

Best Trading Platforms Tools

Going one step away from centralized and decentralized exchanges, we approach trading platforms. Think of a hub that connects fragmented exchanges in one, easy-to-take format.

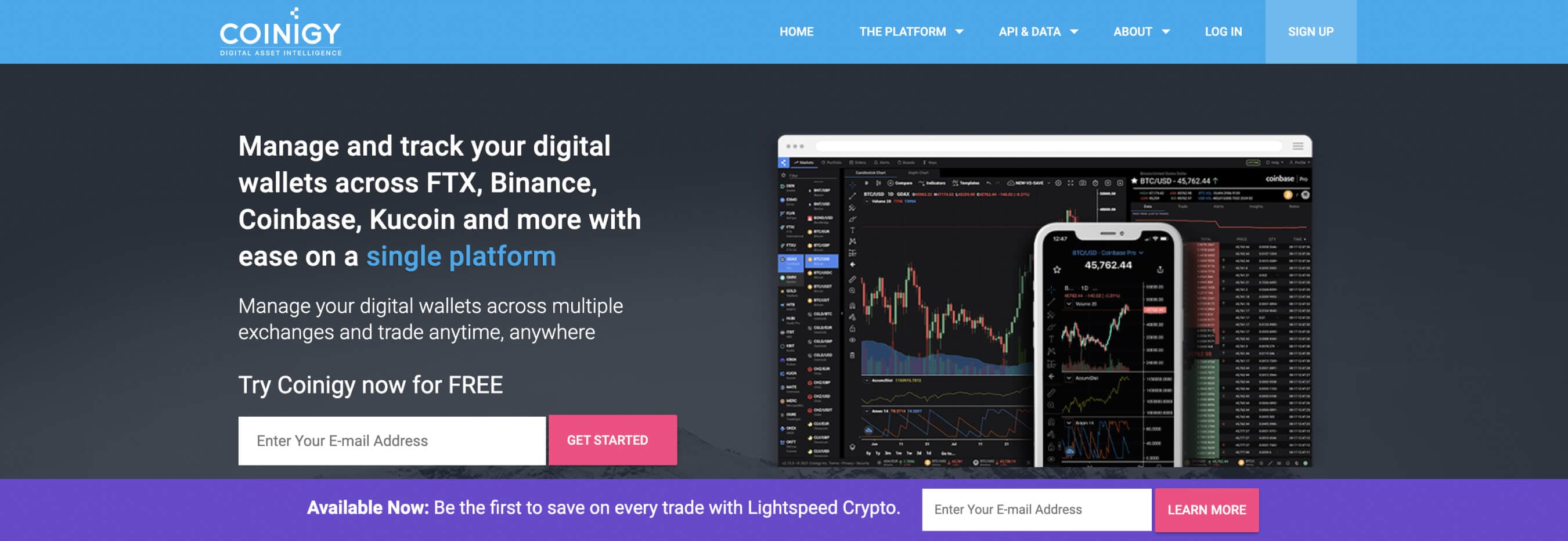

Coinigy

Coinigy stands out in the cryptocurrency trading and analysis landscape primarily for its robust API integration capabilities, distinguishing it significantly from many competitors:

- Extensive API Integration: Coinigy's main draw is its advanced API integration feature, which allows users to connect with numerous cryptocurrency exchanges. This integration enables traders to execute trades, access real-time market data, and manage their portfolios across various platforms from a single Coinigy account.

- Automated Trading Strategies: The API support caters to more tech-savvy users and developers, offering the flexibility to create automated trading strategies. This is particularly appealing for those looking to implement algorithmic trading, where trades are executed automatically based on pre-set criteria.

- Custom Development Opportunities: Coinigy’s API provides the groundwork for developers to build customized trading tools and applications. This level of customization is a significant advantage for users who require tailored solutions for their trading needs.

- Real-Time Data Access: Through its API, Coinigy offers real-time market data from multiple exchanges. This feature is crucial for traders who rely on up-to-the-minute information to make informed trading decisions.

- Enhanced Security for API Interactions: Coinigy places a high emphasis on security, especially in API interactions. The platform ensures that users' API keys and personal data are protected with industry-standard encryption and security protocols.

Altrady

Altrady, as a cryptocurrency trading platform, offers several key value propositions centered around its exchange aggregation capabilities, distinguishing it from competitors in the market:

- Multi-Exchange Integration: Altrady's standout feature is its ability to integrate multiple cryptocurrency exchanges into one platform. This allows users to manage accounts and trade on various exchanges, such as Binance, Coinbase Pro, Kraken, and others, all from a single Altrady interface. This consolidation simplifies the trading process, especially for those managing multiple exchange accounts.

- Unified Trading Interface: With exchange aggregation, Altrady provides a unified trading interface. This enables traders to execute trades, monitor market movements, and manage their portfolios across different exchanges seamlessly. The consistency of this interface, regardless of the exchange, makes for a more efficient and user-friendly trading experience.

- Centralized Portfolio Management: Altrady offers comprehensive portfolio management tools that aggregate data from all connected exchanges. This feature gives users a holistic view of their assets across various platforms, making it easier to track overall performance and make informed trading decisions.

Best Charting Tools

A charting tool is a must-have of any decent trader and longer term investor. Graphical instruments can hint at a good entry/close level, a possible breakout or pullback, market manipulations, and much more.

TradingView

TradingView stands out in the realm of cryptocurrency charting and analysis tools, offering several distinct value propositions that set it apart from its competitors:

- Comprehensive Charting Tools: TradingView is renowned for its extensive range of charting tools. These tools offer a wide array of technical indicators, chart patterns, and drawing tools, catering to both novice traders and experienced technical analysts. The platform's versatility in charting is a significant draw for users who require detailed technical analysis.

- User-Friendly Interface: Despite the complexity of its tools and data, TradingView maintains a user-friendly interface. This accessibility is key for attracting a broad range of users, from beginners in crypto trading to professional traders and analysts.

- Community-Driven Insights and Ideas: TradingView hosts a vibrant community of traders and analysts who share their insights and trading ideas. This feature is a major asset, as users can access a wealth of crowd-sourced market analysis and trading strategies, which is not commonly found in other charting platforms.

- Real-Time Data and Market Coverage: The platform offers real-time data and extensive market coverage, including a wide range of cryptocurrencies and exchanges. This comprehensive market data is crucial for traders who need up-to-date information for effective decision-making.

- Cross-Asset Analysis: Apart from cryptocurrencies, TradingView provides tools for the analysis of other asset classes like stocks, forex, and commodities. This cross-asset functionality is particularly beneficial for traders who operate in multiple financial markets.

- Customizable Alerts: Users can set customizable alerts based on specific indicators, economic events, or price movements. These alerts enable traders to stay informed of market conditions and react swiftly to trading opportunities.

- Integration with Brokers: TradingView integrates with various brokerage platforms, allowing users to execute trades directly from the charting interface. This seamless integration between analysis and trading streamlines the trading process.

- Paper Trading Feature: The platform offers a paper trading feature, enabling users to practice their trading strategies in a risk-free environment. This is especially useful for beginners or for testing new trading approaches.

- Mobile Accessibility: TradingView's mobile app provides users with the flexibility to monitor the markets and perform chart analysis on the go, a crucial feature in the fast-moving world of cryptocurrency trading.

- Customization and Personalization: The platform allows extensive customization and personalization of charts, watchlists, and layouts. Users can tailor the interface to their specific needs and preferences, enhancing their analysis and trading experience.

These features make TradingView a highly attractive option for a wide range of users seeking advanced, yet accessible, cryptocurrency charting and analysis tools. It caters to those who require in-depth technical analysis, real-time data, community insights, and cross-market capabilities. As with any tool, traders should consider their individual requirements and the platform's compatibility with their trading strategies.

Cryptowat.Ch

CryptoWat.ch is a notable player in the realm of cryptocurrency charting and analysis, offering several key value propositions that distinguish it from other charting platforms:

- Real-Time Market Data: CryptoWat.ch provides real-time data across a multitude of cryptocurrency exchanges. This feature is crucial for traders who need up-to-the-minute information to make informed decisions, especially in the highly volatile crypto market.

- Comprehensive Exchange Coverage: The platform covers a wide range of cryptocurrency exchanges, offering users the ability to view and analyze data from multiple sources in one place. This extensive coverage is particularly valuable for traders looking to compare prices and identify arbitrage opportunities across different exchanges.

- Advanced Charting Tools: CryptoWat.ch offers robust charting tools that cater to the needs of both novice and experienced traders. These tools include a variety of technical indicators, chart types, and drawing tools, enabling detailed market analysis.

- Seamless Integration with Kraken: Being part of the Kraken ecosystem, CryptoWat.ch offers seamless integration with the Kraken exchange. This integration allows users of Kraken to directly manage trades and view their Kraken portfolios within the CryptoWat.ch interface, providing a streamlined experience for those users.

- Customizable Dashboards and Alerts: Users can customize their dashboards to focus on the data and markets that are most relevant to them. Additionally, the platform offers customizable alerts, notifying users of significant price movements or other market changes.

Best Market Data Tools

Without data you’re just another person with an opinion — the age old quote still holds true, especially for digital markets like crypto. Aggregators can edge you forward if you use them or drag down completely, in case you disregard data completely.

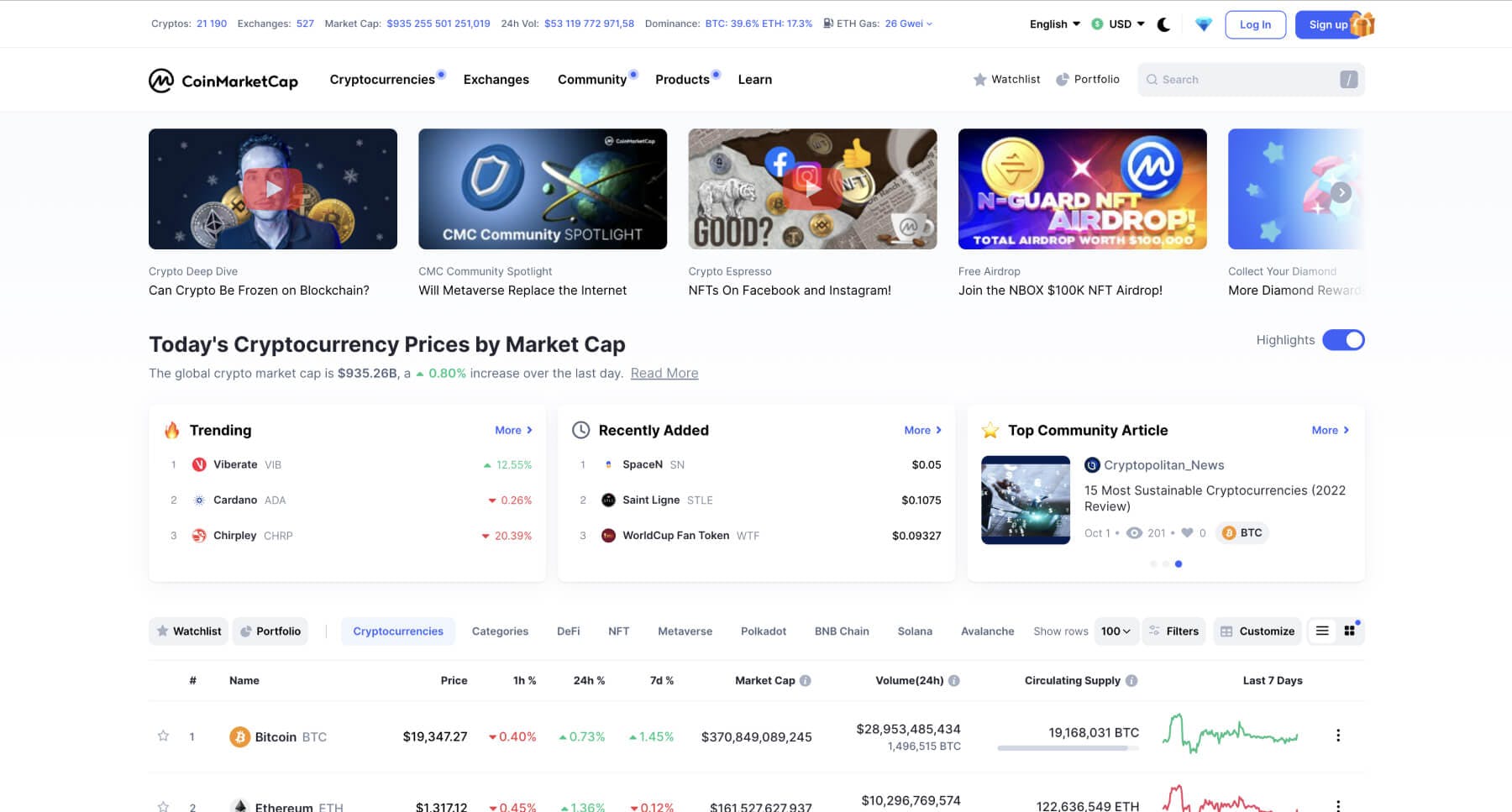

Coinmarketcap (CMC)

CoinMarketCap, one of the most recognized cryptocurrency market data platforms, offers several key value propositions that set it apart from its competitors:

- Extensive Cryptocurrency Database: CoinMarketCap boasts a vast database of cryptocurrencies, providing users with information on a wide range of coins and tokens, including many smaller or less known projects. This comprehensive listing is a significant resource for users looking to research and compare a diverse array of crypto assets.

- Market Capitalization Focus: The platform is particularly known for its focus on the market capitalization of cryptocurrencies. This emphasis allows users to understand the relative size and market dominance of different cryptocurrencies, which is a critical metric in the crypto space.

- Historical Data: CoinMarketCap provides extensive historical data for cryptocurrencies, including historical price charts, market cap, and volume data. This historical perspective is invaluable for trend analysis and understanding the long-term performance of crypto assets.

- User-Friendly Interface: The platform is designed with a clear and user-friendly interface, making it accessible and easy to navigate for both newcomers and experienced users in the cryptocurrency market.

- Real-Time Price Tracking: CoinMarketCap offers real-time price tracking across various exchanges, providing users with up-to-date information on crypto asset prices, which is essential for making timely investment decisions.

- Liquidity and Trading Volume Data: Apart from market capitalization, the platform also provides data on liquidity and trading volumes, which are crucial metrics for assessing the market activity and viability of trading a particular cryptocurrency.

- Global Metrics and Crypto Indices: CoinMarketCap aggregates global metrics for the crypto market, including total market cap, Bitcoin dominance, and other aggregated indices. These global insights are beneficial for understanding the overall health and trend of the cryptocurrency market.

- Portfolio Tracking Features: Users can track their cryptocurrency portfolios directly on the platform, allowing for easy monitoring of portfolio performance and asset distribution.

- Educational Resources: CoinMarketCap offers educational content, including articles, glossary terms, and methodology explanations, helping users to learn more about cryptocurrencies and the market.

- API Services: For developers and more advanced users, CoinMarketCap provides API services, enabling access to their data for use in custom applications, analysis, or algorithmic trading.

These features make CoinMarketCap a comprehensive and widely-used resource in the cryptocurrency community, particularly appealing to those who need detailed market data, historical insights, and a broad overview of the crypto space. However, users should also consider their specific needs and may want to use multiple sources for market data to get a more rounded view of the market.

Pros

- The largest and most prominent aggregator at the moment

- Has a lot of projects listed, checked and verified on a daily basis

- Grows faster than any other crypto market data aggregator

Cons

- Complicated user interface

- Was acquired by Binance in 2020

- Has clickbait articles & videos

- Suffers from price lags

- Might disregard liquidity and has arguable CEX evaluation model

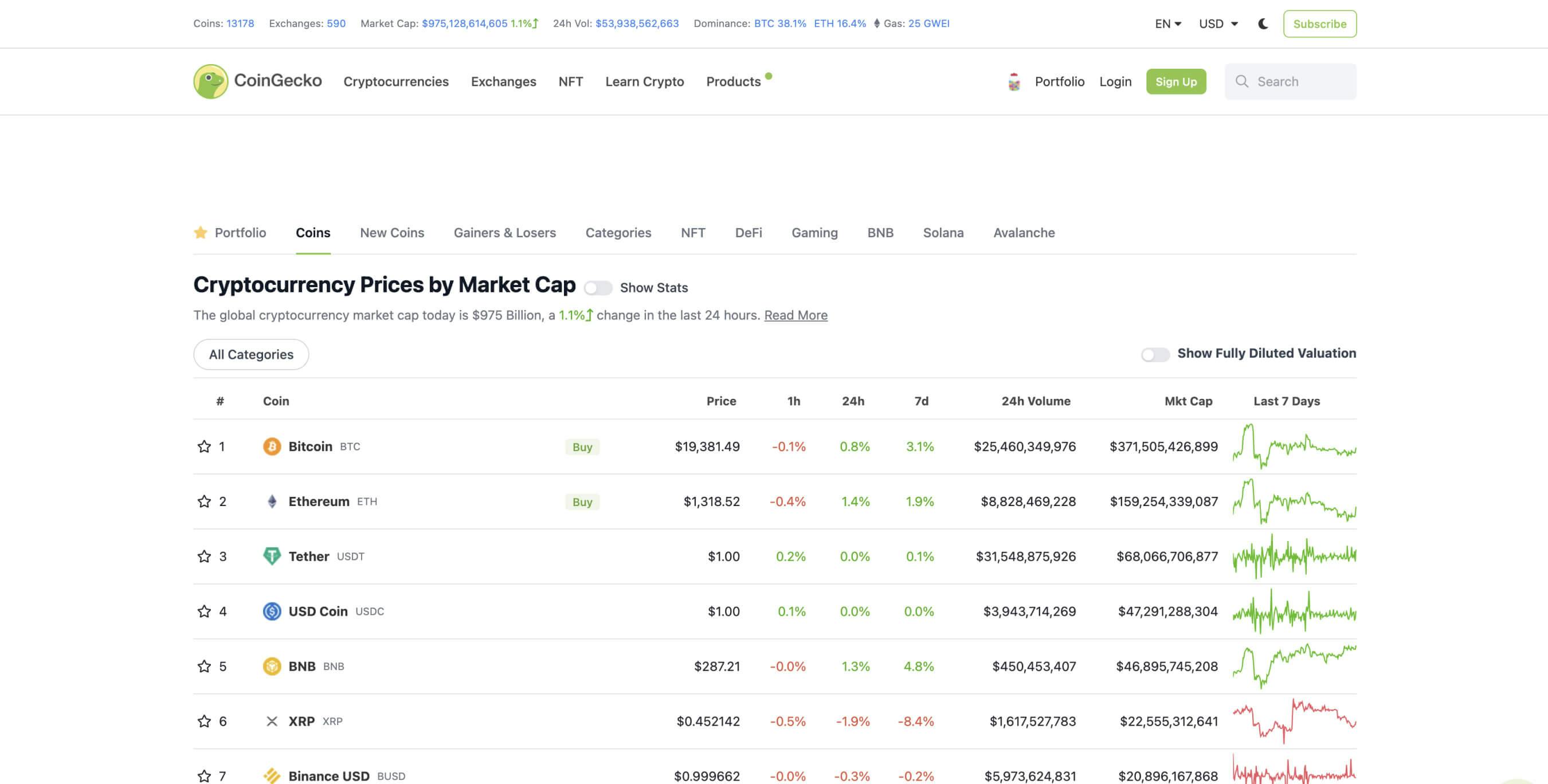

Coingecko

CoinGecko stands out in the cryptocurrency market data space with several distinct value propositions that differentiate it from its competitors:

- Wide Range of Tracked Assets: CoinGecko tracks a broad spectrum of digital assets, including many smaller and emerging cryptocurrencies. This diversity in its listings makes it a comprehensive resource for users interested in exploring beyond the mainstream crypto assets.

- In-Depth Market Data: The platform provides detailed market data for each listed cryptocurrency. This includes not just price, market cap, and volume but also data on liquidity, developer activity, community metrics, and sentiment analysis. Such depth of information is valuable for users looking for a holistic view of a crypto asset's market presence.

- User Experience and Interface: CoinGecko is known for its user-friendly interface and easy navigation. The platform's design enhances user experience, making it accessible to both beginners and experienced crypto enthusiasts.

- Real-Time Price Updates: Like its competitors, CoinGecko offers real-time price tracking across multiple exchanges. This feature is crucial for users who need up-to-the-minute pricing information for trading and investment decisions.

- Additional Metrics: CoinGecko distinguishes itself by providing additional metrics such as the CoinGecko Trust Score, which helps users assess the reliability and liquidity of exchanges. It also tracks derivative markets, offering insights into futures and options trading in the crypto space.

- Portfolio Tracking Tools: The platform includes portfolio tracking features, allowing users to manage and monitor their crypto investments efficiently. This feature is particularly useful for keeping track of diversified crypto holdings.

- Educational Resources and Community Engagement: CoinGecko offers a range of educational materials, including guides, glossaries, and market reports, which are beneficial for users looking to deepen their understanding of the crypto market. Additionally, the platform fosters community engagement, which can be valuable for gaining diverse perspectives.

- API Access for Developers: CoinGecko provides an API that developers can use to access its extensive market data, enabling integration into custom applications, websites, and trading systems.

- Integration of DeFi Metrics: Recognizing the growing importance of decentralized finance (DeFi), CoinGecko includes comprehensive data and metrics on DeFi projects, which is a significant advantage for users interested in this rapidly evolving sector.

- Global Reach and Accessibility: The platform supports multiple languages and provides global market data, making it accessible and relevant to a worldwide user base.

These value propositions make CoinGecko a robust and versatile tool for users who need detailed, real-time market data and insights into a wide range of cryptocurrencies, including emerging and niche assets. Its additional features like DeFi metrics, educational resources, and community engagement further enhance its appeal in the diverse world of cryptocurrency.

Pros

- Stand-alone data aggregator, not owned by anyone

- Evaluates all exchanges equally

- Provides more information on tokens & coins

Cons

- Less prominent aggregator with a smaller visitor base

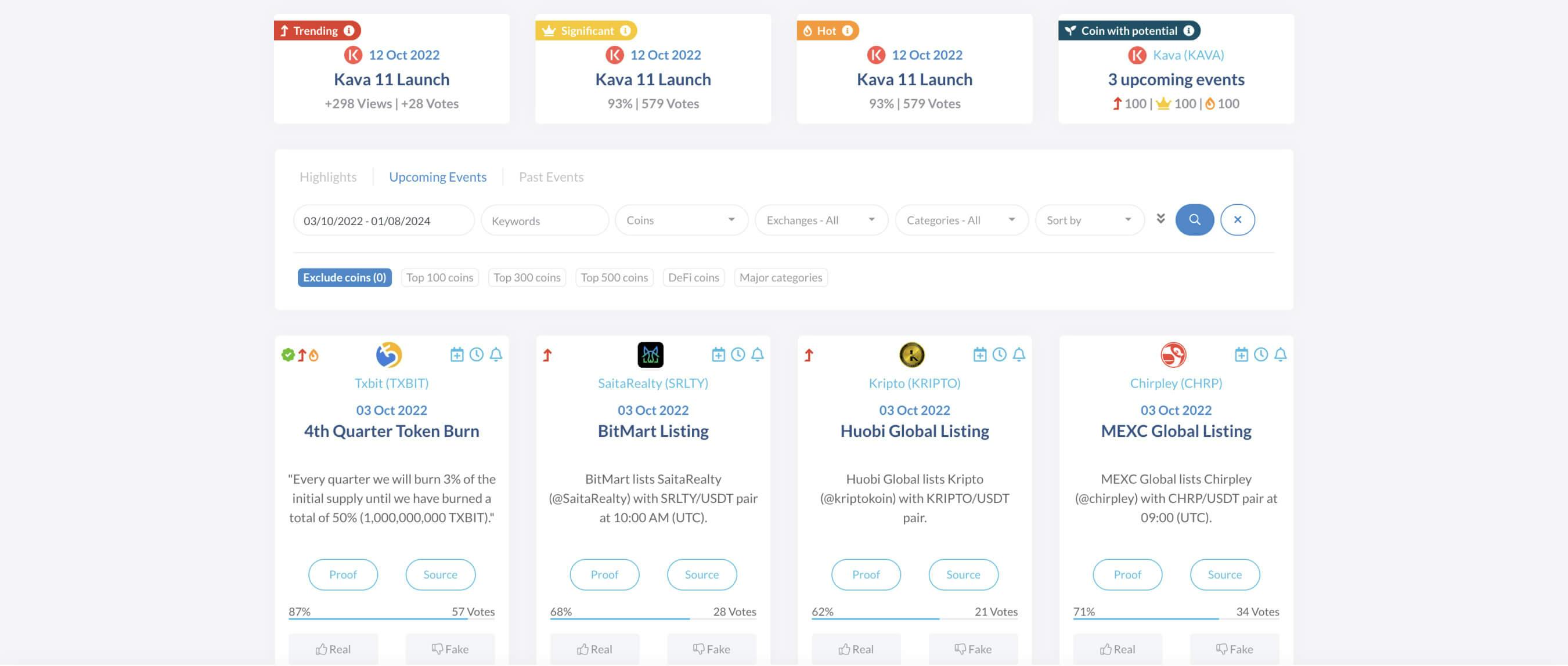

Best Calendar Tools

Calendars might help you in scheduling crypto activities. Instead of keeping multiple launches in mind, you can check any major calendar tool and know for sure whether an NFT collection is being minted today or tomorrow.

CoinMarketCap

CoinMarketCap is a free web-based calendar of crypto events that displays the latest information, including current sentiments on a certain asset, or important milestone for some DeFi protocol, NFT collection, Web3 marketplace, and more. You can sort and filter the calendar’s events by numerous tags to simplify tracking.

The project’s profound community and content verification team maintains data and manages insights in an amazing way, making the platform a great tool to spot upcoming events you’d otherwise never know about.

Coindar

Coindar is another free collaborative calendar for all crypto events. It covers all events that help crypto traders make better decisions, including short-term and long-term investment, trading, flipping, and more. Coindar is one of the most reliable and up-to-date collaborative databases in the industry.

At the moment, it tracks > 1650 profiles on Twitter, sharing media buzz so loud, you would never miss it. Another great benefit is a collection of 1600 digital assets under your glass.

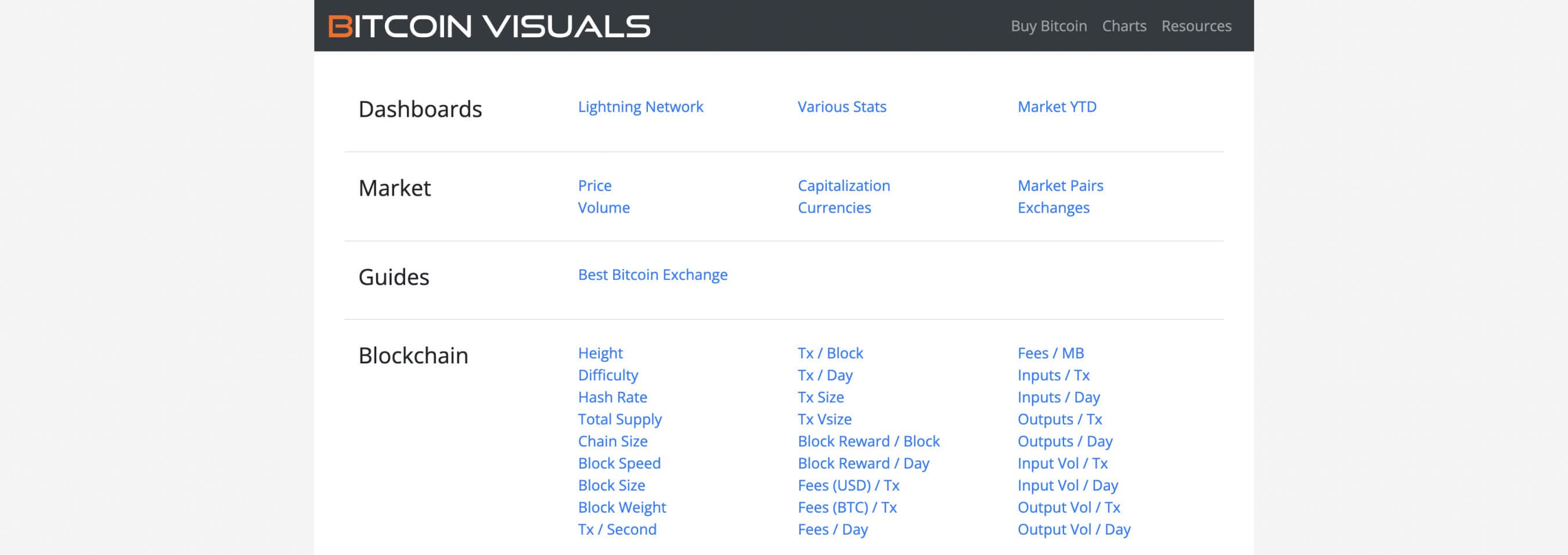

Network Statistics Tools

The history of crypto is emphatically the history of statistics, which is why you might want to pay extra attention to network-related tools.

BitcoinVisuals

BitcoinVisuals makes Bitcoin data more accessible — all under one roof, including blockchain, lightning network, market data, and more. You can track crucial stats to trade BTC derivatives or spot, predict a lower entry point for investing over the long haul, check halving state, hash rate, etc.

Cryptomiso

CryptoMiso ranks crypto based on GitHub activity stats. GitHub is somewhat like a software development hub commonly known as a place to share opinions, brainstorm new ideas, share something related to IT & Blockchain, etc.

Even though GitHub updates do not affect the projects’ future in a straightforward way, it might be of interest to some investors, as developers always drive the project over the long run. CryptoMiso currently monitors over 250 projects.

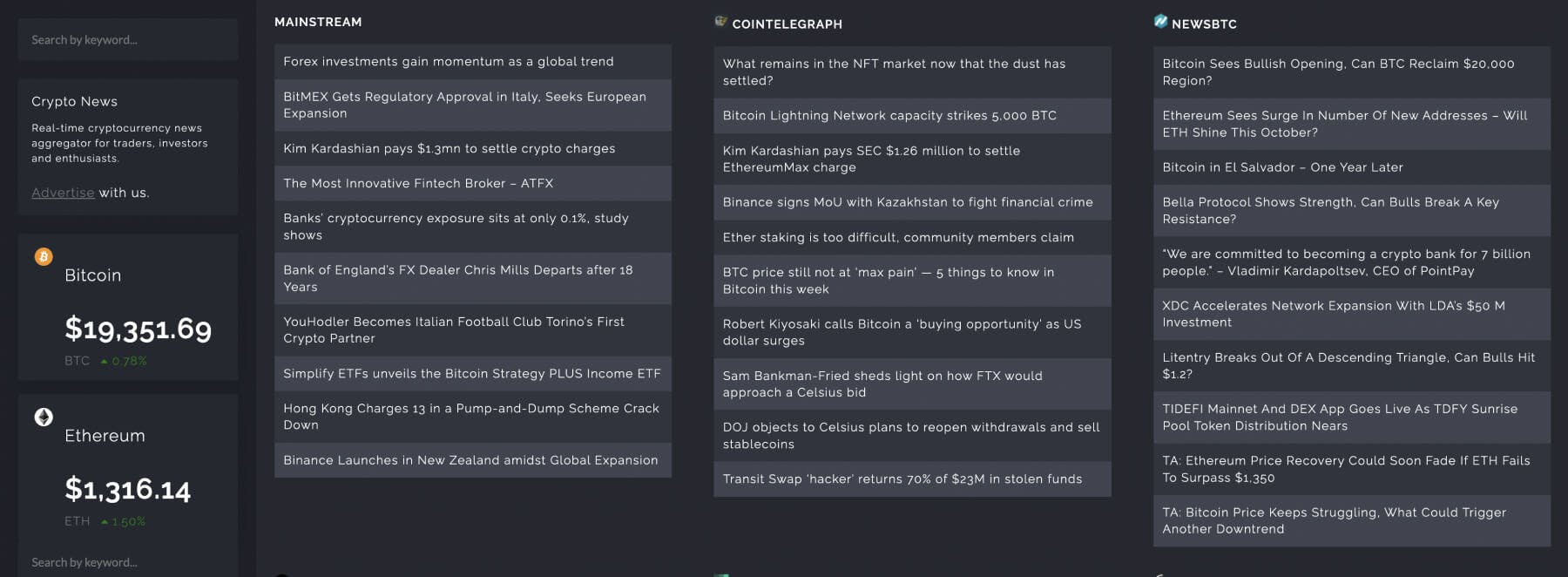

News Aggregators

If the world is a fast-paced place to be, crypto has something to say about it twice as much. Simply put, news makes a difference when it comes to such a volatile asset class as crypto.

Cryptopanic

CryptoPanic aggregates news to help users and traders stay up to date with the recent events. This way, traders can monitor the latest news and understand the reasons behind subsequent price changes.

The service collects news from multiple websites, sorts them out and delivers as fast as possible in an automated way. By crawling through social media, news portals, magazines, blogs, and more, CryptoPanic helps its users to take responsible asset-related decisions once the news is out.

CoinSpectator

CoinSpectator is one of leading crypto aggregators, providing not only real-time news and data, but also features like portfolio tracking, price alerts, and a social media feed.

The team of experienced writers, analysts, and developers pushes the platform far beyond a mere news aggregator service. Instead, CoinSpectator offers insightful real-time indices, smooth interface, price predictions and altcoin breakdowns. Whether you're a casual investor or a die-hard trader, the platform can hit it out of the ballpark.

Best Trading Bots

If you ever wanted to automate your trading experience, this is a way to save both your time and money. Not to mention your emotions affected by negative trades.

3Commas — Best Trading Bot Overall

3Commas is a cryptocurrency trading software known for its automated trading bots and advanced trading tools. Its central value propositions compared to competitors typically include:

- Automated Trading Bots: 3Commas offers a range of automated trading bots that can execute trades 24/7 based on preset criteria. This includes the Grid Bot, DCA (Dollar-Cost Averaging) Bot, and Options Bot. These bots can help users take advantage of market opportunities without the need to be constantly monitoring the market.

- Advanced Trading Tools: The software provides advanced tools like smart trade and portfolio management features, allowing traders to set up stop-loss, take-profit, and trailing stop orders, which can be more complex and flexible than what some other software makers offer.

- User-Friendly Interface: 3Commas is often praised for its user-friendly interface, making it accessible to both beginner and advanced traders. This includes clear dashboard overviews, easy-to-navigate menus, and a simple process for setting up and managing bots.

- Integration with Major Exchanges: The software integrates with a number of major cryptocurrency exchanges, including Binance, Bitfinex, Coinbase Pro, and others. This allows users to manage multiple exchange accounts and trade across them from a single 3Commas interface.

- Educational Resources and Community: 3Commas offers a variety of educational resources and has a strong community presence. This includes tutorials, guides, and a community forum where users can share strategies and tips.

- Risk Management Features: The software includes features that help manage and mitigate risk, such as the ability to set maximum trading limits and other risk parameters.

- Performance Analytics: Traders can track the performance of their bots and adjust strategies accordingly. The analytics tools on 3Commas can provide insights into trading patterns and results.

- Customization and Strategy Options: The software offers a high degree of customization in terms of trading strategies. Users can create their own trading strategies or follow strategies created by other successful traders.

Comparatively, while other software might offer some of these features, 3Commas is often recognized for combining them into a comprehensive and user-friendly package. However, it's important for users to conduct their own research and consider their individual trading needs and risk tolerance when choosing a trading software.

Pros

- Smart and copy trading features to follow experienced users and achieve their results

- Complete trade automation through DCA, Grid, and futures bots

- Advanced analytics & informative dashboard

- 100% cloud software, leaving no security breaches

- Intuitive interface & mobile app available

- Detailed FAQ section

- Deep liquidity aggregated

Cons

- Might seem a bit complex at first

- Automated bots require a subscription

HaasBot

Haasbot is an automated cryptocurrency trading platform known for its complex features, primarily catering to experienced traders. Key aspects include:

- Complex Algorithmic Trading: Haasbot offers advanced trading algorithms and technical indicators, but this complexity can be daunting for beginners.

- Variety of Bot Types: While it provides various bots like Trade Bots and Arbitrage Bots, users might find the array overwhelming.

- High Customization: The platform allows extensive customization, but this can make it less accessible for those new to trading bots.

- Backtesting and Paper Trading: These features are useful for testing strategies, but they require a good understanding of market dynamics.

- Supports Many Exchanges: Compatibility with multiple exchanges is offered, though managing multiple exchanges can be challenging.

- Market Data Analysis Tools: Provides comprehensive market data analysis, but effectively using these tools requires advanced trading knowledge.

- Customer Support and Community: Despite offering support and a community, newcomers might still find the platform's complexity hard to navigate.

- Emphasis on Security: Focuses on security, but like all trading platforms, it cannot entirely eliminate the inherent risks of cryptocurrency trading.

Overall, Haasbot is more suited for those with substantial trading experience. Its complexity and extensive features, while advantageous for seasoned traders, might be overwhelming for beginners or those seeking a more straightforward trading experience.

Pros

- Fits both newbies, experienced, and pro traders

- Proven track of records, as trading results have been backtested and simulated

- Over a 100 bots available

- Supports multiple exchanges and crypto assets

Cons

- No free trial available

- More expensive than the market average

- You have to download and install the bot, which makes the process time-consuming and sets a security precedent

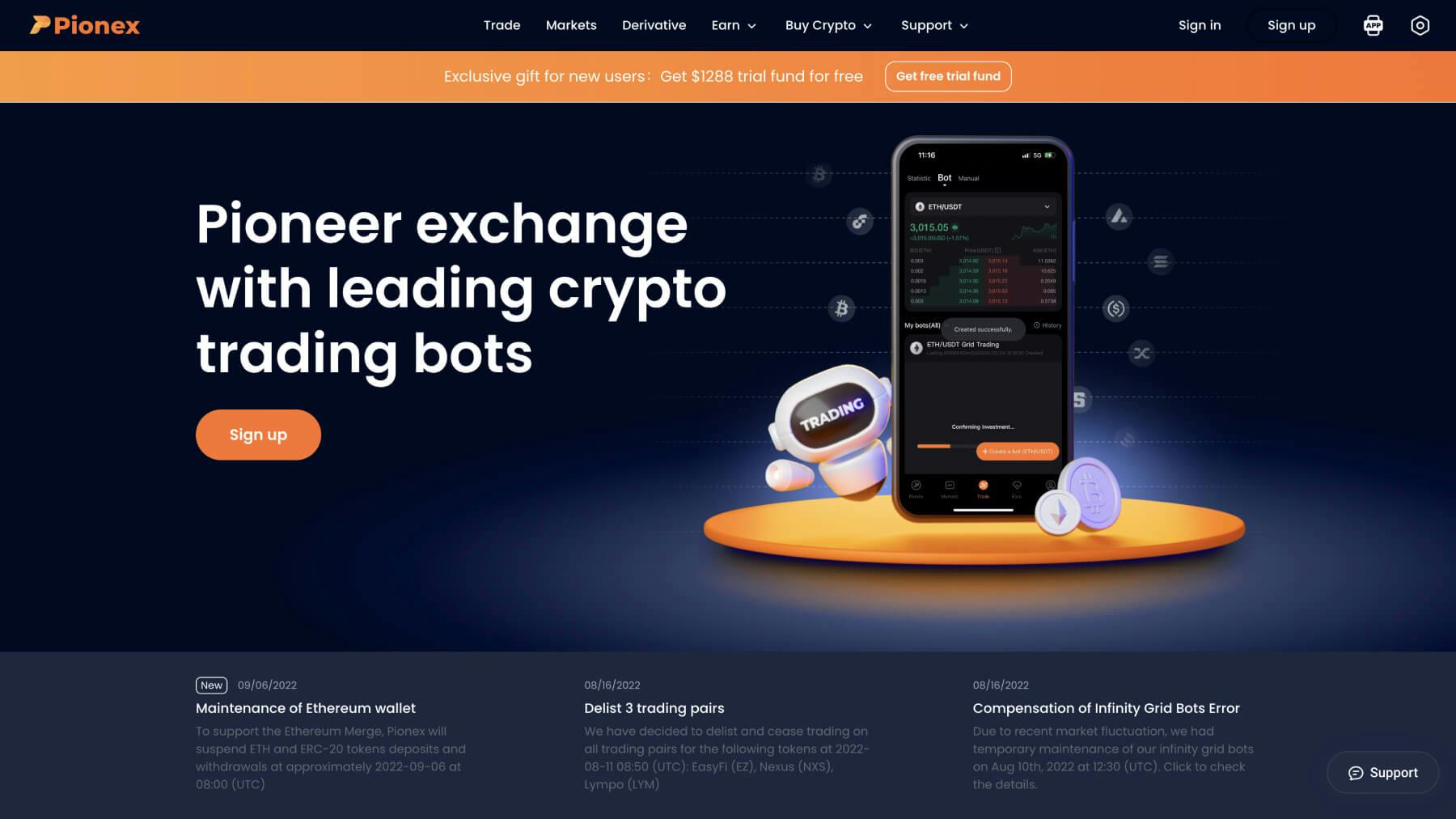

Pionex

Pionex is an automated cryptocurrency trading platform known for certain features, but it also has limitations compared to its competitors:

- Built-in Trading Bots: Pionex offers a range of in-built bots like Grid Trading Bot and Arbitrage Bot, but these can be less customizable compared to those on more advanced platforms.

- Low Trading Fees: The platform boasts low trading fees, though this advantage must be weighed against the potential limitations in bot performance and strategy options.

- Simple User Interface: Pionex is user-friendly, suitable for beginners, but may lack the depth required by more experienced traders.

- License and Regulation: It's one of the few platforms with a U.S. MSB (Money Services Business) license from FinCEN, which adds a layer of credibility, yet regulatory status doesn't guarantee trading success or security.

- Integration with Major Exchanges: While Pionex aggregates liquidity from Binance and Huobi, traders are limited to the liquidity and trading pairs available on these exchanges.

- Limited Customization and Analytical Tools: It offers some basic customization and analytics, but advanced traders might find these tools insufficient for complex strategies.

- Mobile App Accessibility: The availability of a mobile app is convenient, but mobile trading can be less efficient for complex analysis and strategy management.

In summary, Pionex can be a good choice for beginners due to its simplicity and low fees, but more experienced traders might find it lacking in terms of customization, advanced tools, and trading options.

Pros

- Competitive trading fees

- Over 100 thousand customers

- Multiple trading bots available

- Fiat and crypto deposits

Cons

- Poor customer support

- Some users claim the website might suddenly freeze

Best Crypto Tax Tools

Back in 2012 crypto investors and traders had no choice but fill their taxes manually, scrupulously calculating and adding up each transaction across multiple markets. Things have changed for the better since then. Nowadays, you can use a wide range of tax reporting & managing tools.

Token Tax

TokenTax is an easy way to report any crypto capital gains and income taxes to your state government. The platform helps you to calculate the applicable crypto taxes and generate the necessary crypto tax forms automatically.

It literally has no competitions, as none of the tax service providers support all major exchanges. You can import all the trading data from an exchange and upload it to TokenTax to generate all the tax forms you might potentially need. The form list includes, 8949, TurboTax, FBAR, FATCA and more.

Cointracking.Info

![]()

CoinTracking is the world’s first crypto tax reporting solution founded nearly a decade ago. More than 1.1 millions customers, collectively holding $42 Billion worth of assets in their portfolios, cooperate with tax advisors and lawyers to fill their taxes globally.

Portfolio Tracking Tools

Trackers help you manage asset flow within your portfolio. It’s a good way to stay in touch with your crypto finances.

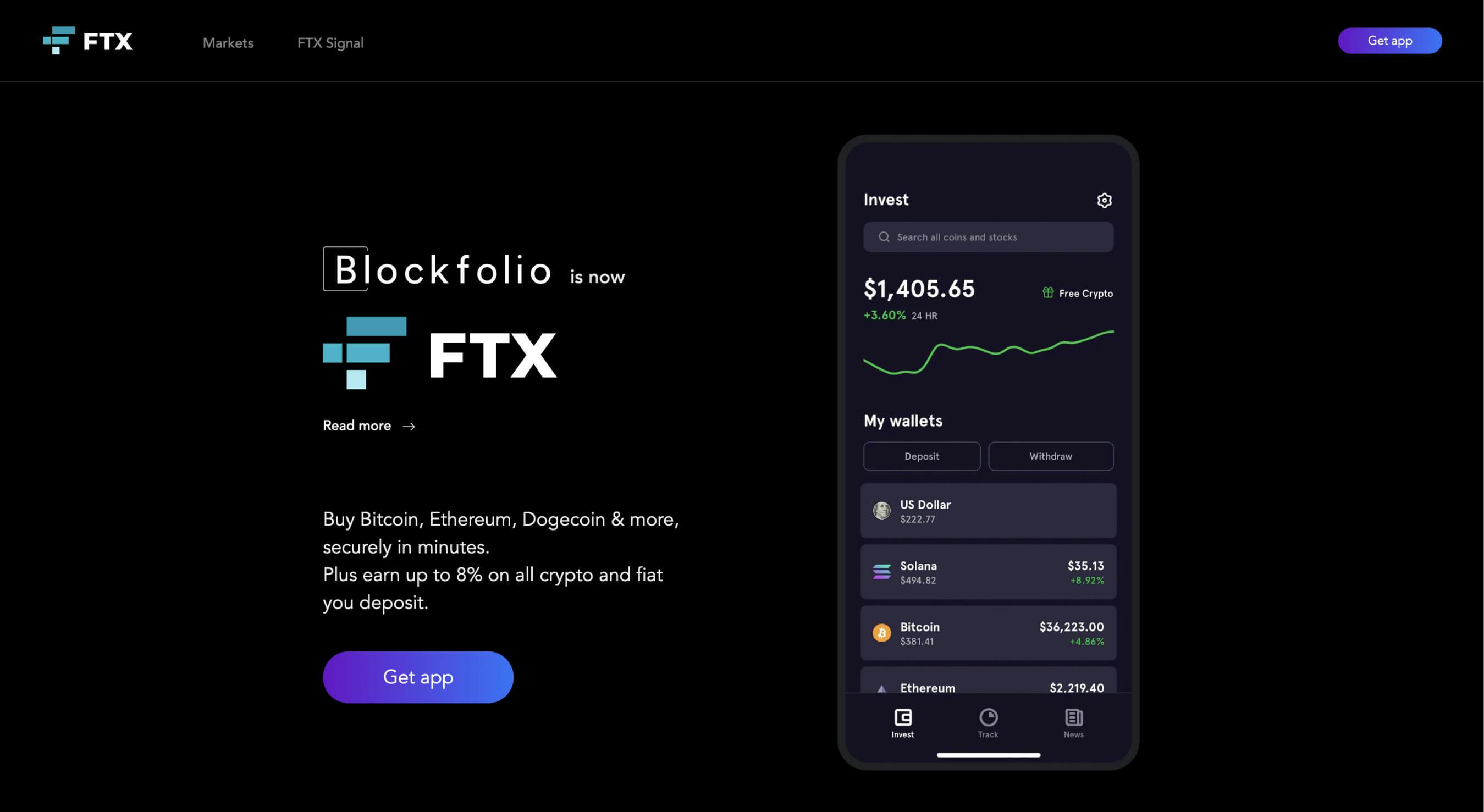

Blockfolio

Blockfolio is a widely-known tracking app and most crypto enthusiasts use the platform to manage their Web3 wealth properly. Even though it has many rivals, Blockfolio stays head and shoulders above any other platform. Perhaps, because it was among the first ones to launch back in 2014 and has been developing since then.

No platforms supply as many functions and customization features as Blockfolio does — a bright example would be the Blockfolio Signal service and the ability to buy/sell crypto directly within the Blockfolio app without any fees.

Coinstats

CoinStats is a portfolio manager for tracking all trades of digital currencies. It provides valuable analysis data for trades made, volume traded, profits gained, losses occurred and your overall net worth. You can either enter your trades manually or import them from any supported exchange.

Cointracking

![]()

Cointracking is a cryptocurrency research and portfolio tracker app. You can search through the extensive asset list, visit social pages, blog, and more to complete your research and make important decisions related to your portfolio.

Cointracking also features price alerts, going far beyond price-related notifications. Instead, once you mark some asset as an important one, you’ll get relevant news and all other assets might be converted if you want to. You can also automatically track your net worth and profit loss by connecting a Web3 wallet/exchange.

On top of that, you access advanced tax tools, including annual tax return, FBAR, Form 8949 and the German Income Tax Act.

Best Rebalancing Tools

Holding 50 tokens at the same time might be quite a challenge. Simply put, you might want to rebalance your portfolio — add some new assets, remove older ones, change the allocation, and more. This way you not only maintain a steady risk level but also your results will align with investment goals, which is not always the case for an unbridled portfolio.

3Commas

Even some experienced 3Commas users have no clue about the portfolio rebalancing feature the platform offers. Perhaps, because the feature is not obvious.

Once you join the platform and create your own portfolio/follow someone else’s, you can schedule a rebalancing interval. In other words, 3Commas will automatically rebalance your portfolio leaning on your strategy.

The feature is quite helpful if you leverage other functions as well — for example, if you set up a bot and connect it to any supported exchanges. This way, a trading bot makes profits, while the rebalancing feature will manage your portfolio afterward. Completely automated trading requiring minimal efforts can make your life much easier.

Pros

- Has a free trial period to try portfolio features before subscribing

- Responsive customer support ready to answer your questions

- Supports major crypto exchanges like Binance, ByBit, and more.

- Allows copy trading to automatically follow someone else’s portfolio

- Over 1,100 highly positive reviews on TrustPilot

Cons

- Paper trading requires subscription

Shrimpy

Similar to 3Commas, the platform has portfolio rebalancing tools. You can do so either manually or use auto-rebalancing. The tool is completely free, but supports a limited number of exchanges, which might limit some traders and investors.

Best Crypto Wallets

As interest toward Web3 speeds up, users engage more actively across various ecosystems, which implies a unified access method common for any kind of Web3 experience. Be it dApps (decentralized applications), tokens, NFTs — wallet is like a key to enter the domain and interact with it afterward.

Metamask

MetaMask is one of the leading crypto wallets to access Web3, DeFi, and NFTs. It’s easy-to-use, as you can integrate the wallet into your Chrome browser within minutes.

Trust Wallet

Trust wallet is another popular option to experience Web3, as it’s owned by the biggest crypto exchange Binance. The wallet allows you to buy, store, and collect NFTs, trade & earn interest on crypto, and more. As many as 25 million people already use Trust Wallet.

Best Mining Tools

Mining is another crypto-related industry that requires using several services to track and manage data in a proper way. Let’s break down key services you may need when it comes to mining.

Nicehash

NiceHash is the largest marketplace to connect hash power sellers & miners to buyers. As a result, users can monetize their hardware and its power by solving hashing algorithms. You can visit the platform to leverage your PC, laptop, or mining rigs and sell out the power you already have or are willing to get anytime soon.

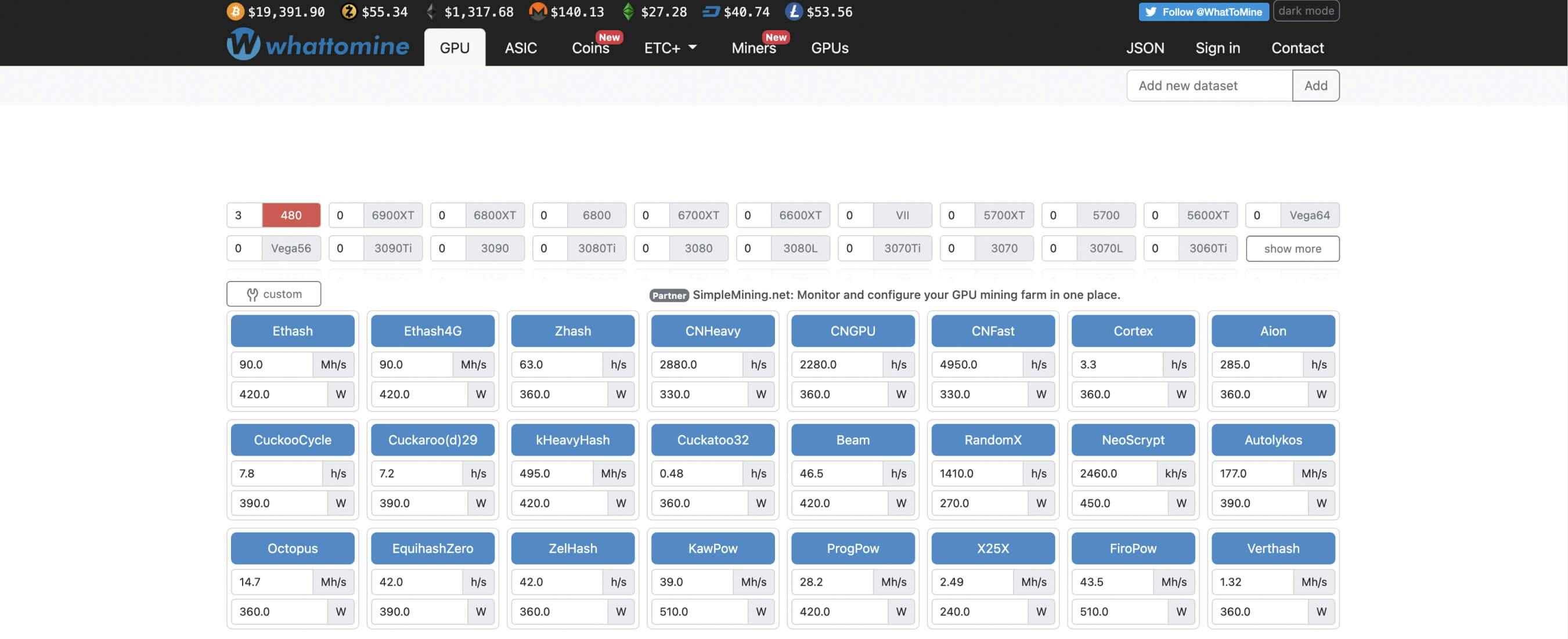

Whattomine

WhatToMine is a sought-after mining profit calculator crypto coins miners widely use. While some miners use the tool to calculate potential profits they can make on a specific coin, others compare several coins to get the most rewarding directions.

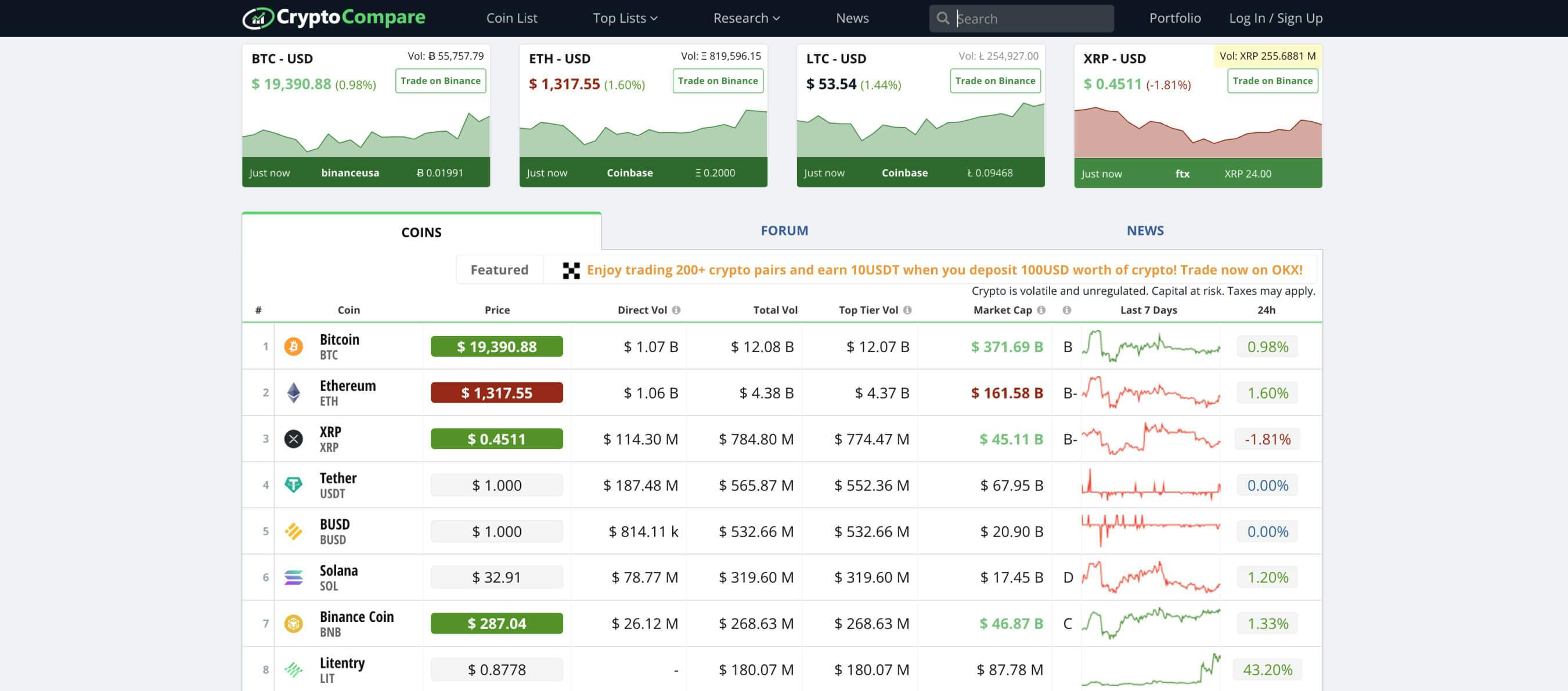

Cryptocompare

CryptoCompare provides clear, deep and concise data to bridge the gap between the crypto asset and TradFi markets. You can access > 5,000 assets and over 250,000 pairs here — all to compare markets, evaluate assets, catch some financial insights related to trade, order book, social, or historical data.

Best Blockchain Exploring Tools

Explorers give you control over any past transaction, wallet, smart contract, NFT, and anything else related to the blockchain you might want to check.

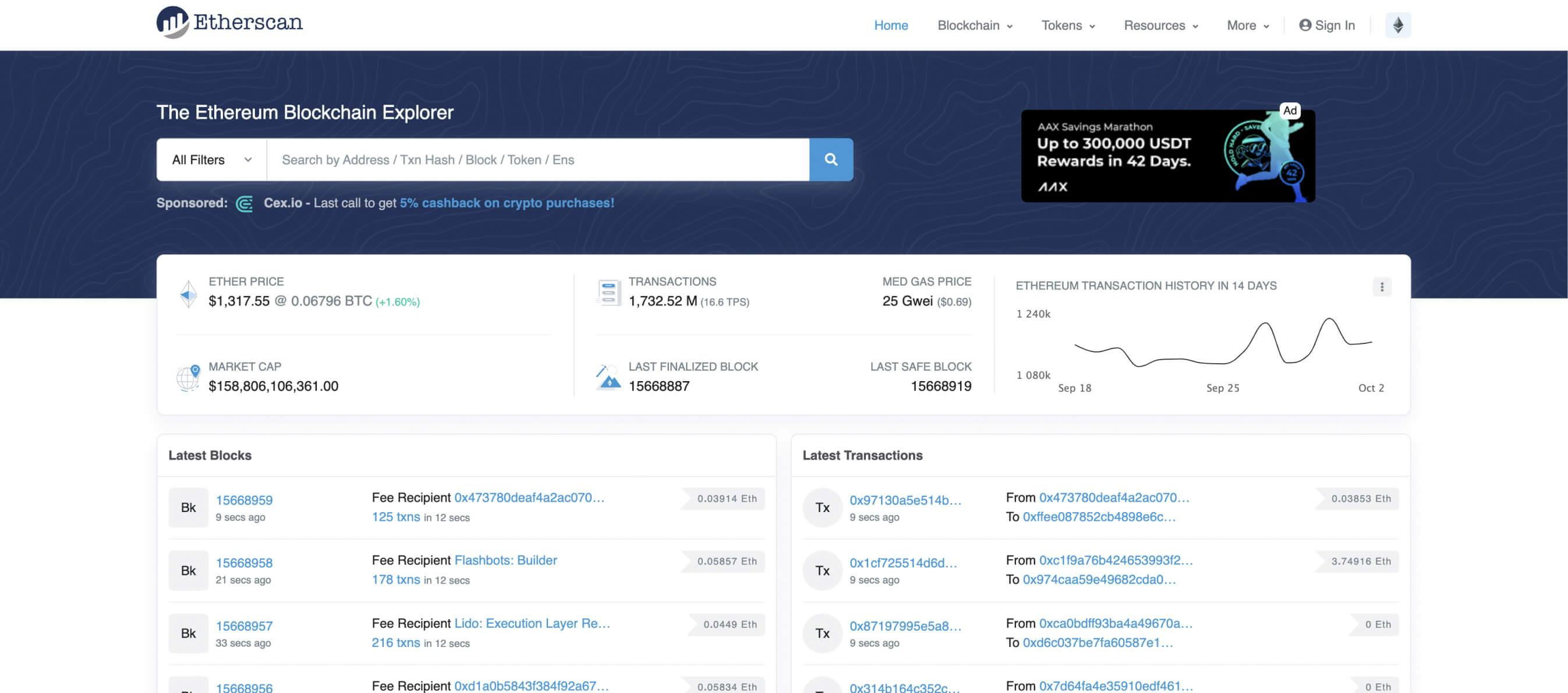

Etherscan

The most popular explorer at the moment, as it tracks one of the biggest and widely used chains — Ethereum. You can check any OpenSea transaction here as well as many DeFi protocols.

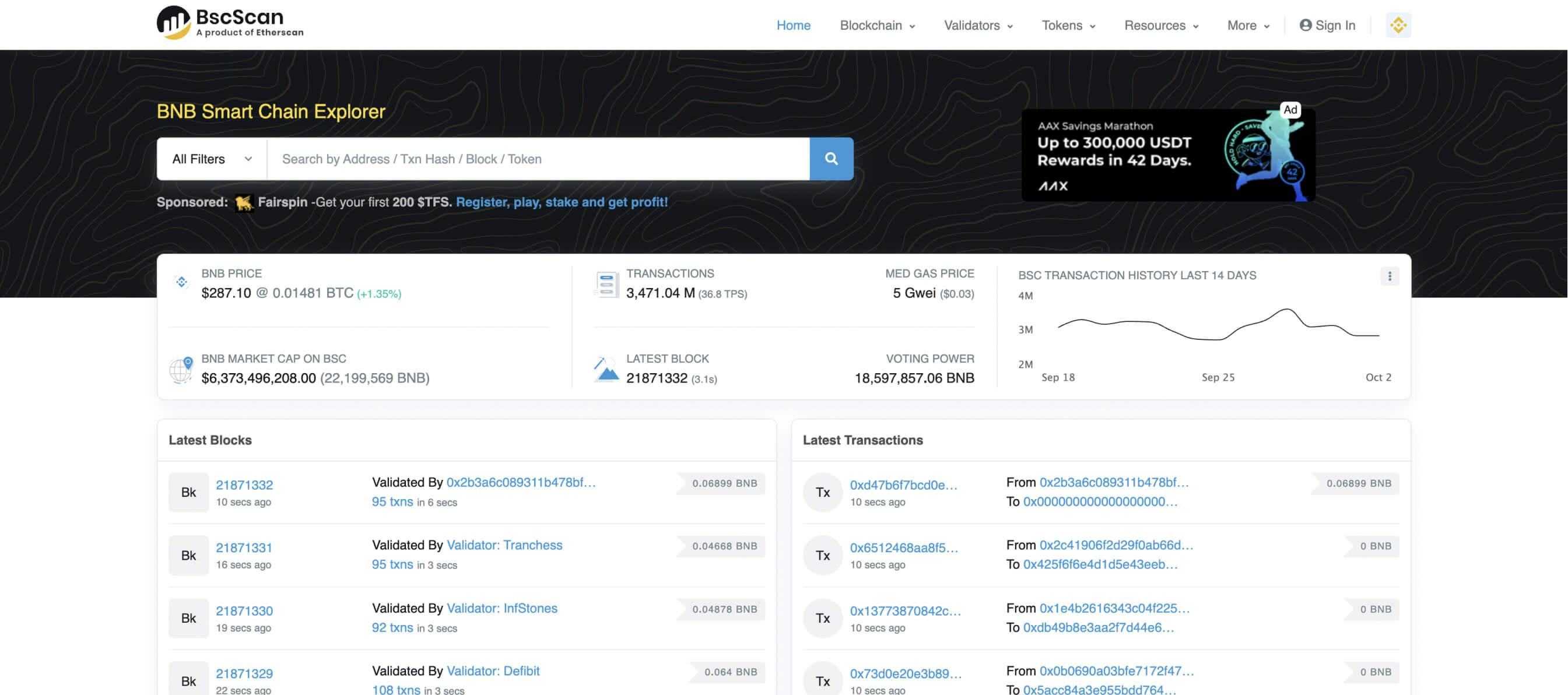

BscScan

A bit less prominent, but still a popular explorer is designed to track anything related to Binance Smart Chain. Widely used to track transactions from/to Binance exchange and track NFT auctions held by the exchange.

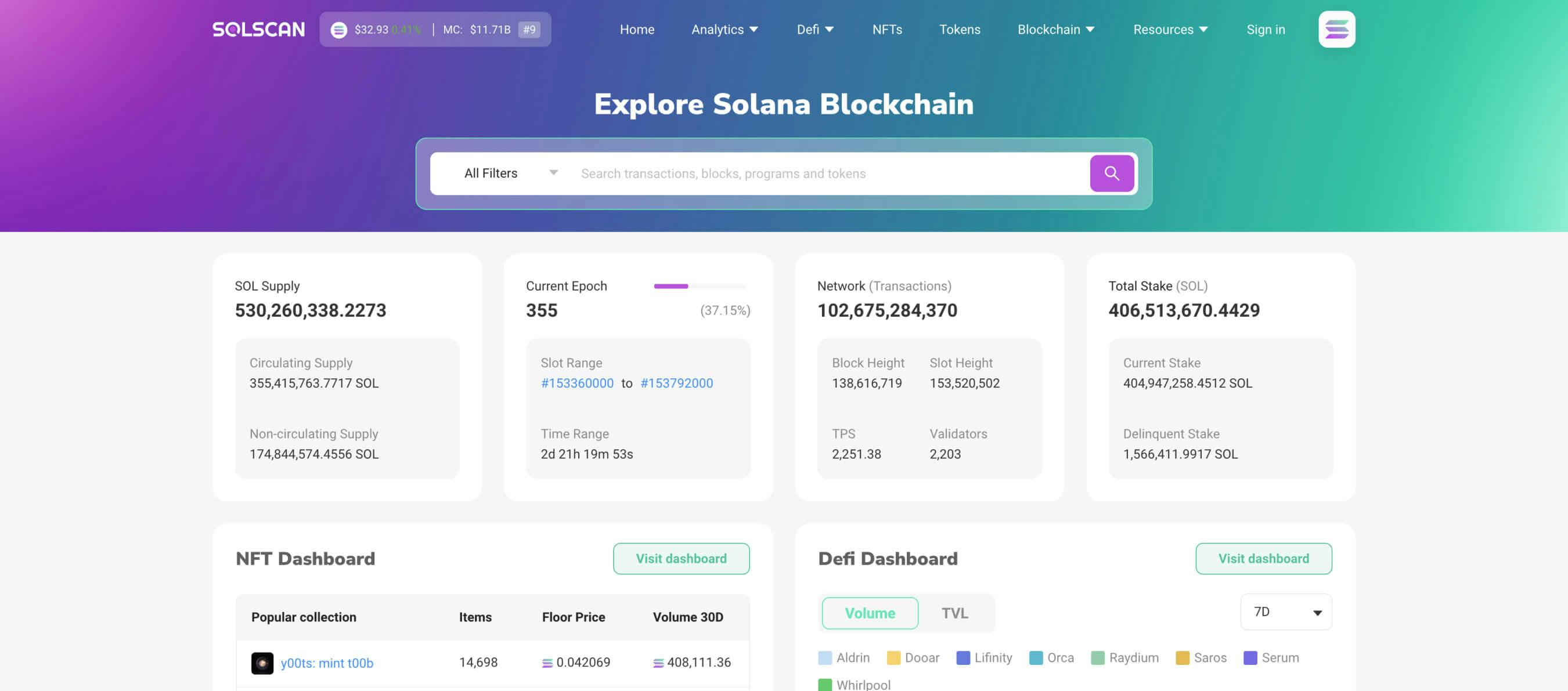

SolScan

Another explorer made for Solana users. Quite popular recently due to the Solana NFT spike. Anything Solana — make sure to check it here. If you regularly use Solana or do any troubleshooting, understanding how to use a blockchain explorer is extremely useful.

What's New in Crypto Trading Tools for 2025

As in previous years, 2025 continues to advance crypto trading through smarter automation, tighter connections with traditional finance, and user-friendly tools. The latest enhancements seem practical whether one is managing a portfolio, optimizing trade execution strategies, or looking for efficiency in a turbulent market.

Key Industry Trends

AI Automated Trading Systems

AI is already central to executing many trades. Bots that analyze datasets in real time can implement automated strategy changes as soon as the user-created conditions have been met, which is more efficient. Companies like 3Commas have added AI-powered instruments that assist in the management and implementation of complex trading strategies, using Grid, Signal, and DCA bots for example.

Advanced Portfolio Management

Traders now use unifying dashboards which enhance business intelligence (BI) capabilities by enabling performance tracking across several exchanges and viewing the overall portfolio performance all from one convenient UI. Additionally, traders get access to integrated tax reporting and analytics for risk-adjusted returns. These tools save time and make monitorable performance more user-friendly to achieve, thereby benefitting high-frequency, large volume traders and freeing them from tedious administrative work.

Integrations of DeFi and TradFi

Decentralized systems have advanced, and companies are building more reliable infrastructure for borrowing, lending, and hedging. Also, TradFi is incorporating blockchain into their systems enabling them to on-chain and off-chain trade in a formerly restricted environment.

Improved Regulatory Guidelines

Cross markets, stronger participation by institutions has been observed due to the supporting business guidelines within those jurisdictions. This improvement is also assisting in the growth of digital asset providers and in the establishment of funds, regulated derivatives, and other derivative products. In areas where crypto has government support, such as the United States, growth and innovation is bringing more investment options and blockchain services to B2B and B2C customers.

3Commas Software Updates Since Original Publication of Article

Signal Bot with TradingView

Allows the user to automate the execution of trades on the basis of alerts received from custom signals created directly in TradingView charts using webhooks. Launched in 2023, Signal Bot is able to execute on multiple exchanges and is equipped with a multi-tiered rule based architecture to suit professional and institutional crypto traders.

DCA Bot Backtesting Beta

DCA Bot Backtesting beta version was released which allows traders to run a simulation of specific strategies on past data. Along with automatic reinvestment and risk mitigation logic that was added, users can now better adjust the potential outcomes of their DCA Bot based on how it performs under historical market scenarios.

Improvements to Grid Bots

3Commas has enhanced the Grid Bots ability to trail vertically, improving price range shift responsiveness and allowing bots to operate better in anticipation driven markets. Now, when a coin begins moving out of the established range, but isn’t seeing overly large price swings, Grid Bot can now follow it either up or down, automatically resetting the grid lines to match the new range.

Bots can be deployed instantly by integrating a Crypto Screener that filters specific trading pairs based on user settings, boosting the quality of signals performance by removing coin pairs that are facing liquidity problems on that particular exchange that could potentially delay trade execution, for example.

FAQs

Crypto trading is quite a demanding process that requires several types of helping software. Even though you don’t have to use any additional software, it might make your trading experience less time-consuming and more pleasant.

Many traders use the TradingView dashboard and chart to analyze their trades, build key levels, indicators, and more on a daily basis. However, there are plenty of tools to choose from in case you don’t like any particular platform.

It’s up to your judgment, as each analyst might make mistakes. Some honorable mentions would include Alessio Rastani, CryptoCapo, TraderCZ, Eric Krown and more.

Bots can generate profits regardless of the market conditions. However, you should pick and set your bot up carefully, as there are many variables to consider.

The cost of your bot would depend on the functions it carries — more functions usually mean a higher price. However, you might want to avoid excessively cheap bots, as they could be outdated and inefficient. An average monthly cost floats around $15 for basic plans.

As much as 80% of the entire crypto market is automated. Depending on your trading strategy, you might not want to compete with algorithms, as they would easily outperform any trader, even the most experienced one. Consider either picking a robot or changing your strategy to compete with other traders rather than robots.

READ MORE

- What are crypto tools in 2025?

- Why does every investor need crypto tools in 2025?

- Best Centralized Exchanges (CEX) Tools

- Best Decentralized Exchange (DEX) Tools

- Best Trading Platforms Tools

- Best Charting Tools

- Best Market Data Tools

- Best Calendar Tools

- Network Statistics Tools

- News Aggregators

- Best Trading Bots

- Best Crypto Tax Tools

- Portfolio Tracking Tools

- Best Rebalancing Tools

- Best Crypto Wallets

- Best Mining Tools

- Best Blockchain Exploring Tools

- What's New in Crypto Trading Tools for 2025

- AI Automated Trading Systems

- AI is already central to executing many trades. Bots that analyze datasets in real time can implement automated strategy changes as soon as the user-created conditions have been met, which is more efficient. Companies like 3Commas have added AI-powered instruments that assist in the management and implementation of complex trading strategies, using Grid, Signal, and DCA bots for example.

- Advanced Portfolio Management

- Integrations of DeFi and TradFi

- Improved Regulatory Guidelines

- 3Commas Software Updates Since Original Publication of Article

- Signal Bot with TradingView

- DCA Bot Backtesting Beta

- Improvements to Grid Bots