- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Earning profit during low volatility

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Since the beginning of the summer, the market has been demonstrating near record low volatility.

According to the BVOL index, daily volatility of bitcoin reached $ 21, which corresponds with the value from November of 2018. This index reflects sliding volatility of the Bitcoin/US Dollar rate over the past 30 days. Daily calculation is based on the Time Weighted Average Price (TWAP). The TWAP is calculated by sampling prices every minute during a 30-minute interval from 11:30 (UTC) to 12:00 (UTC).

3Commas recently launched an Options Bot that allows you to trade options on Deribit.

The Options Bot has a set of ready-made strategies which, if used correctly, can make money on any of the trends, as well as on a lack of a trend.

Which Options Trading strategies should you choose to make money when market volatility is low?

For situations when market volatility is at or near zero, 3Commas offers 2 ready-made Options strategies: Long Butterfly and Long Condor.

Long Butterfly

Long Butterfly strategy is to buy options with a lower strike price (A) and a higher one (C), and sell two options with an average strike price (B).

Let’s look at an example where the expected low volatility will last for two more months.

Select Bitcoin Options, expiration date “2020-09-25” and strategy “Long Butterfly”.

Then adjust the volatility and trend sliders, choosing the right areas to get profit.

If at the moment of expiration the price is in the range from $ 8,000 to $ 10,000, we will make a profit. Maximum profit is at a Bitcoin price level of $ 9,000. In case Bitcoin price is less than $ 8,000 or more than $ 10,000, we will suffer a loss.

As it’s evident from the profit graph, this strategy allows you to get a moderate profit (green area) if prices don’t change, and limits losses if the underlying asset moves rapidly (red area).

Long Condor

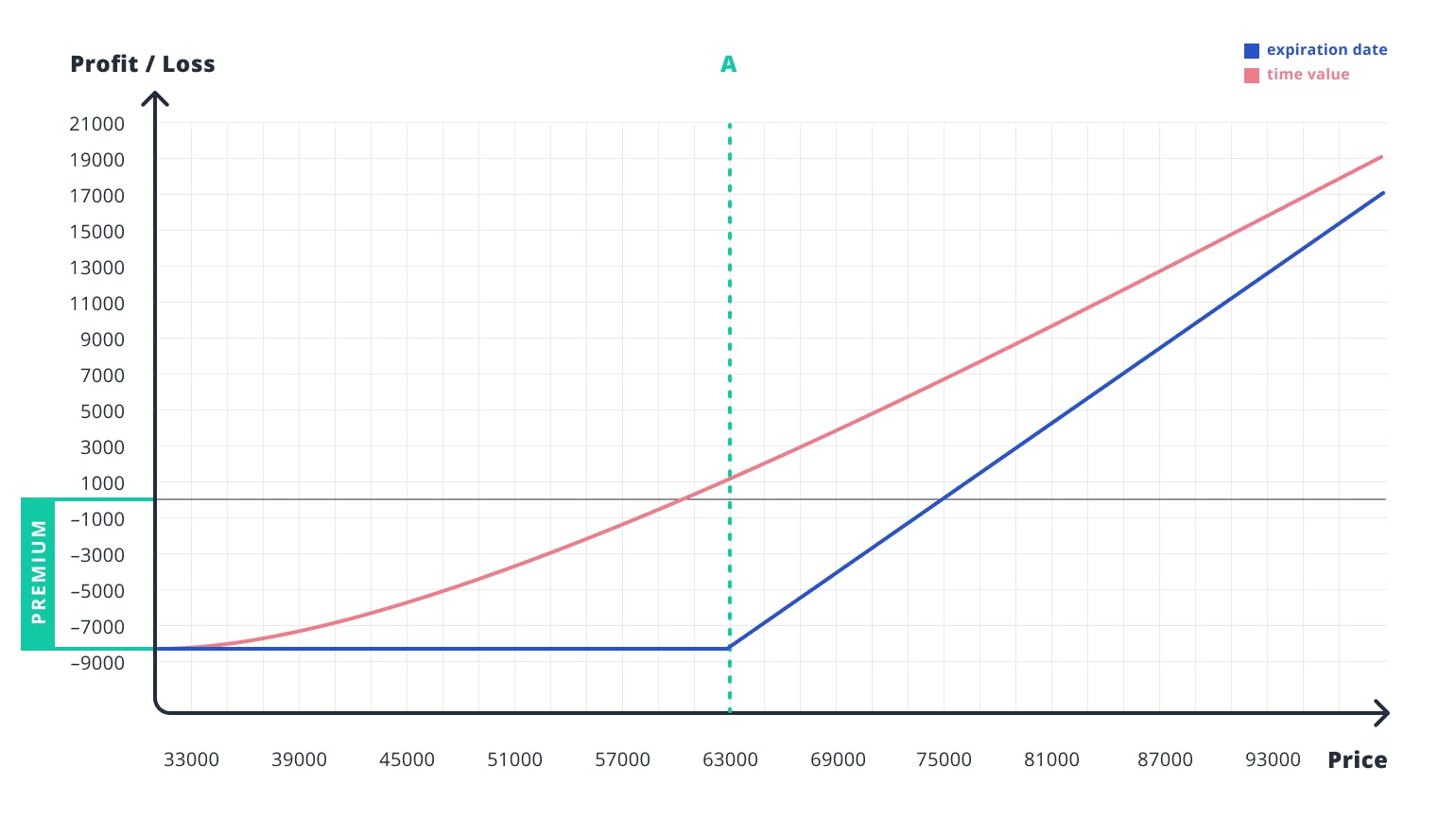

Long Condor strategy allows you to make a moderate profit if prices don’t change, and limits losses if the underlying asset moves. It operates by buying options with strike prices A and D and selling options with strike prices B and C.

In this example, let’s examine low volatility or price drop over the next 9 days.

Select Bitcoin Options, expiration date “2020-07-31” and strategy “Long Condor”.

Let’s try creating a bot using the “Advanced” mode of the Options Bot.

Orders A and D separate the profitable area from the area of losses, orders B and C indicate the limits of the maximum profit area.

As demonstrated here, in case of a price drop we still make profit. We suffer losses only if the price rises above $ 9,120 or falls below $ 7870. Maximum profit area, as it was mentioned earlier, is between B and C.

Looking at Long Condor and Long Butterfly strategies as examples, we explored a way to still profit while Bitcoin price volatility is low, using 3Commas Options Bots and the Deribit crypto-derivatives trading platform.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.