- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

What is a grid trading bot in 2025

Grid trading bots can be quite helpful If you're looking for a way to automate your trading and make profits along the way. Especially when trading crypto markets.

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Best Grid Trading Bots For Crypto

This digest is right for you if you’re making your first steps toward automated trading. Here we shed light on grid trading and all related concepts you can think of — what is grid trading, how it works, why you might or might not implement it for profits, and more.

Read on to grasp the core automated trading topic and learn more about the best algorithm trading software providers available. Without further ado, let’s dive in.

What is a Grid Trading Bot?

A grid bot is a powerful trading bot with artificial intelligence (AI), which has begun to be in active demand among traders who use the grid trading strategy.

Grid trading is a popular trading strategy that allows you to profit by placing long and short orders at certain intervals above or below a specified price, creating a grid for trading. Hence the name of the strategy.

What is Grid Trading?

Grid trading is a trading strategy. This strategy implies your trading bot will automatically buy and sell crypto on the spot market. The bot uses a predefined logic set to place orders in specified intervals and price ranges.

Think of the price set as a bar — the orders are placed just above and below the bar, creating an order grid. The main goal associated with the strategy is to profit from volatility, and when it comes to grid trading, identifying the best crypto for grid trading can enhance your ability to capitalize on small price changes and mitigate emotional trading impulses.

Why Use Grid Trading Bots?

Grid bots are quite useful on a sideways market when you’re not sure where the market goes. Moreover, the grid bot’s operational logic allows 100% automatization. If you’re seeking to bootstrap your trading, save time, and make it more efficient all along, grid bot trading might be a good decision.

Here is the list of other reasons why you might want to implement grid trading:

- Avoid emotional crypto trading

- Versatility and diversification

- Enhance your risk management

- Capitalize both on shorts and longs

- Monetize quiet crypto market opportunities

Best Crypto Grid Trading Bots

Let’s analyze key market players to understand which grid bot might be a good fit for your day-to-day trading activities.

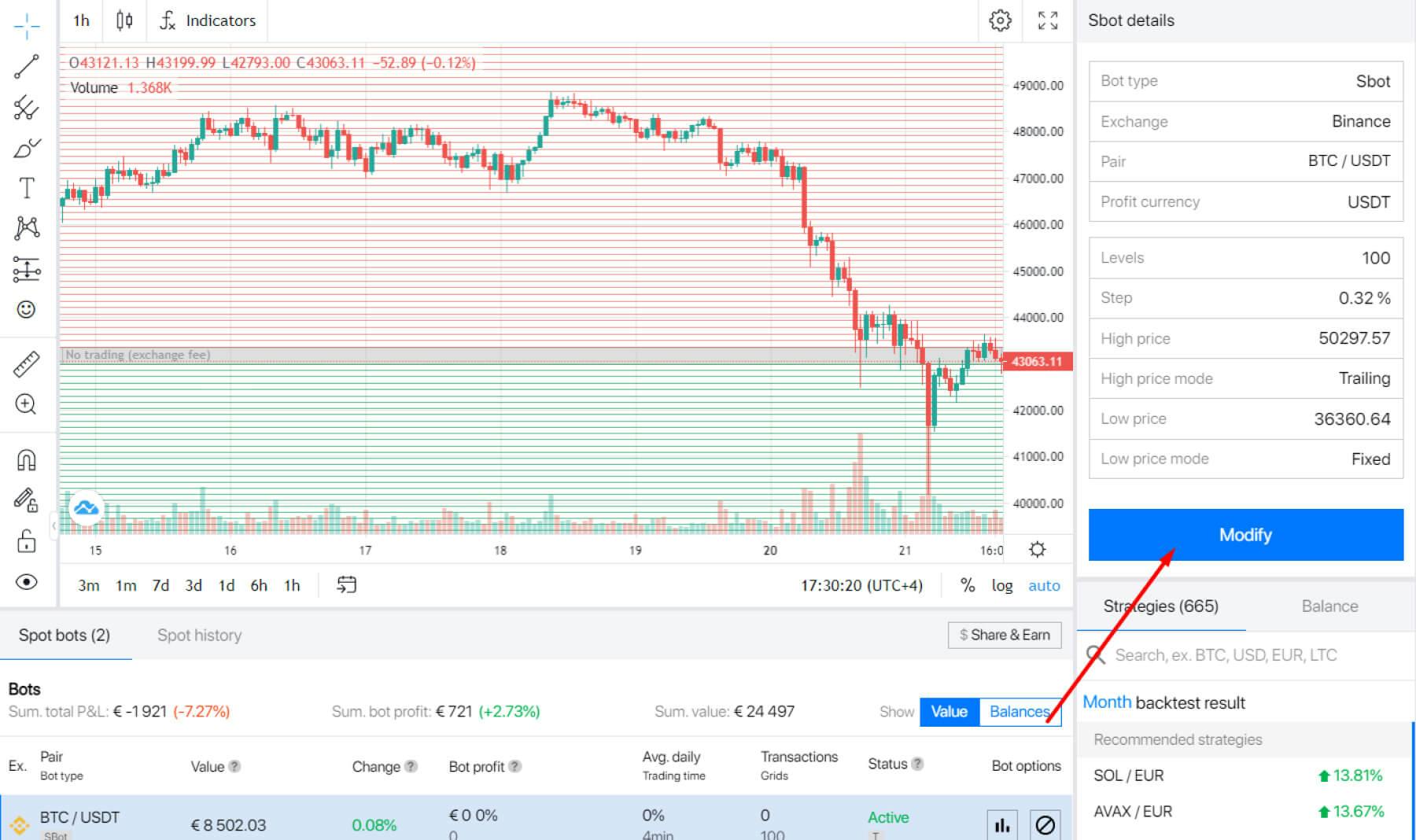

3Commas — Best Grid Trading Bot Overall

3Commas is a comprehensive cryptocurrency trading platform that allows users to use automated trading bots, track and copy traders' trades, and create and monitor the best portfolios of platform users.

The automated trading platform focuses on providing useful tools and simply customizable features that allow traders to create, connect, and adjust their own cryptocurrency trading strategies, while also offering the convenience of accessing and managing their trades through a mobile trading robot.

In addition, users can engage in Smart Trading, which allows them to set multiple orders simultaneously: stop-loss, take-profit, floating and other orders, which can secure your trades during high market volatility, or save a lot of time by leaving positions for automated trading.

Pros | Cons |

|

|

Pionex — Best Trading Bot for Flexible Trading

Pionex is best known for a wide range of bot presets, as it offers as many as 16 bots right away, making it a great platform for traders who are new to trading bots and want to automate their trades, including the option to build their own trading strategy using the [Set Myself] option, all available for free crypto grid bot.

You can use the grid bot to trade 346 assets available on the platform with fees as low as % 0.05, which is one of the market’s lowest fees. On top of that, you get fully-fledged customer support ready to answer any question you may have.

Pros | Cons |

|

|

Bitsgap — Best Trading Bot for Arbitrage Trading

Bitsgap is a world-class automated crypto trading bot allowing users to copy trade, backtest, and modify their trading strategies. For new traders, this web-based platform provides various trading strategies and templates to pick from.

Users can set up the bot to trade automatically 24/7 while making use of the algorithmic and social trading simultaneously. However, the pricing options are quite expensive compared to the market’s average.

Pros | Cons |

|

|

Quadency — Best Trading Bot for Advanced Traders

Quadency is a cloud-hosted crypto trading platform that allows you to either automate your trade or use already available trading bots. Each user gets a set of 8 bots by default. Users can choose between pre-made strategies and 100% custom bots built from scratch.

The platform offers you a wide range of trading bots to pick from, including a Grid bot. While creating a bot, you can select the strategy, exchange, trading pair, investment, and of course set key parameters like [Stop Loss] and [Take Profit].

Pros | Cons |

|

|

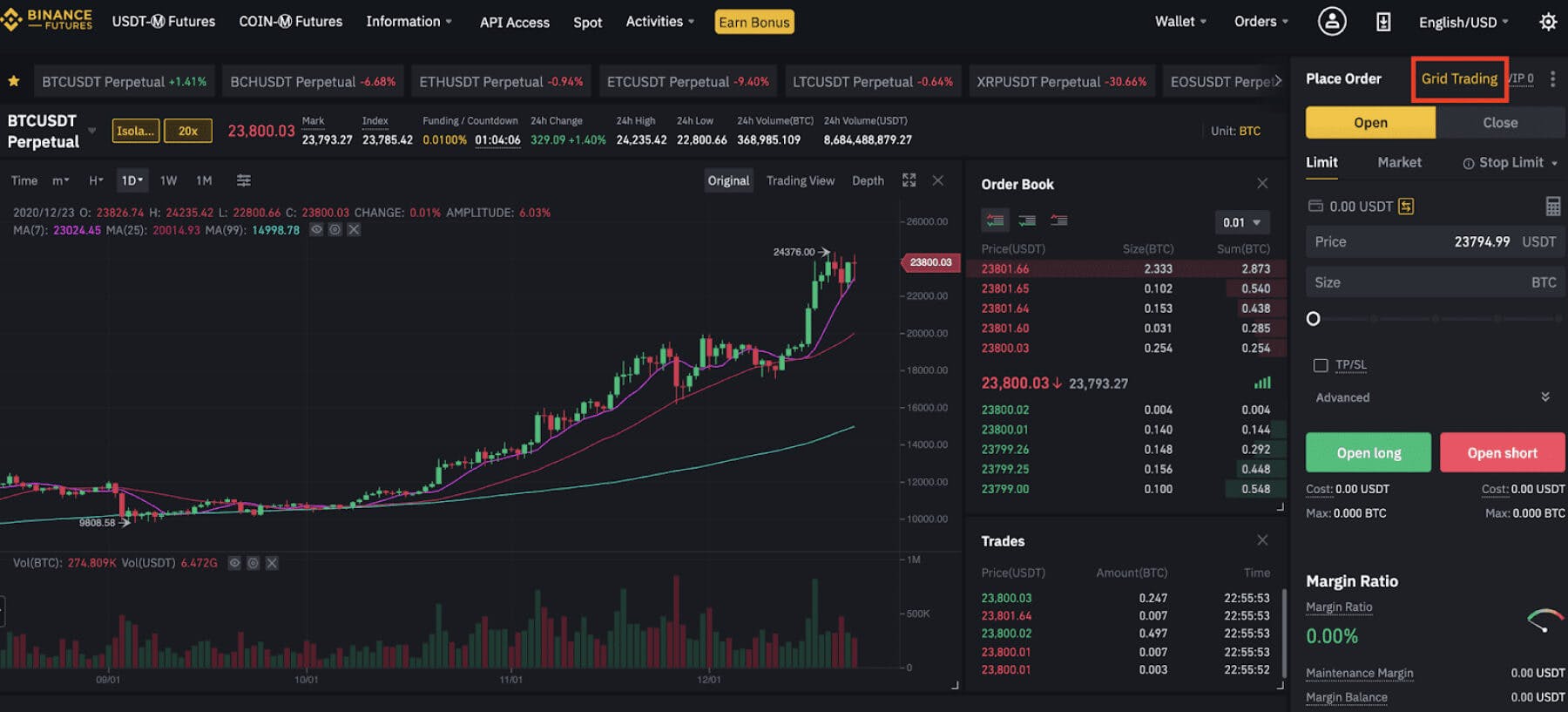

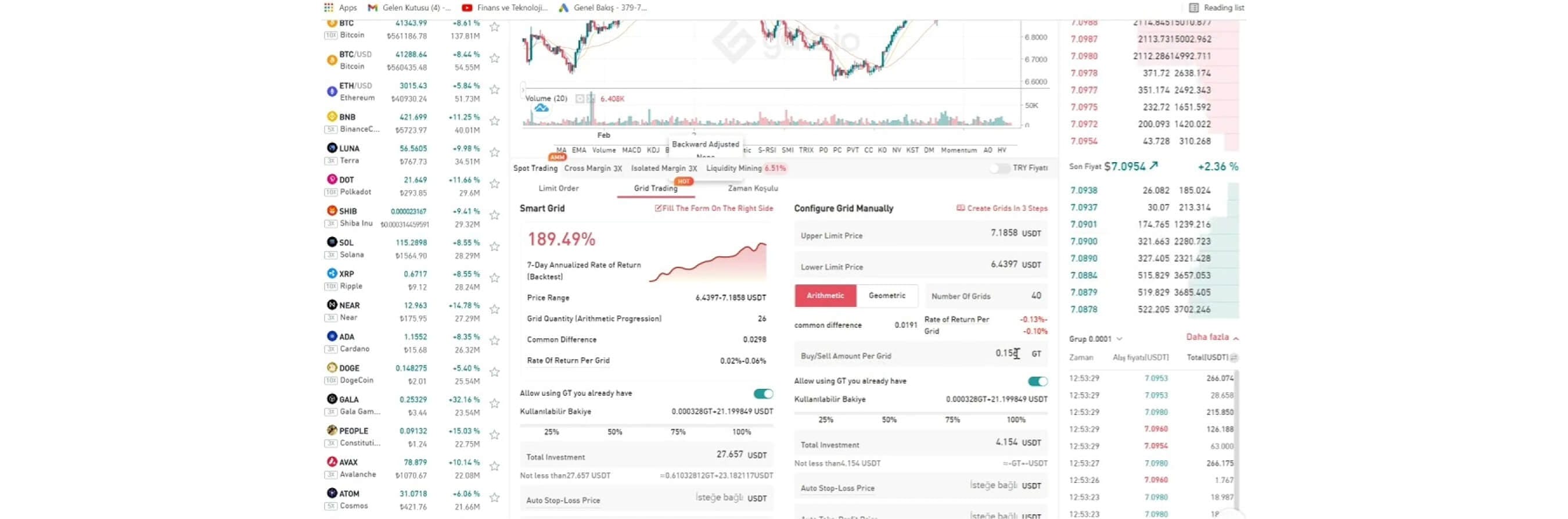

Binance Grid Trading Bot — Best Trading Bot for User Interface

Binance is the biggest crypto exchange working worldwide. It has in-house bots operating in two ways — [Arithmetic] or [Geometric] and three mode [Neutral], [Long], and [Short]

Parameter | Binance Grid Bot |

# of Grid | 149 |

Maximum Grid Bot | 10 for each account |

Trading Fee | 0.1% |

Even though the bot might have the less-risky strategies, it still yields higher risks due to the leverage option. Binance actively encourages traders to use this leverage.

You can always avoid leverage, though, and set [Stop Loss], [Take Profit], and [Start Trigger] to make your trades safer.

Pros | Cons |

|

|

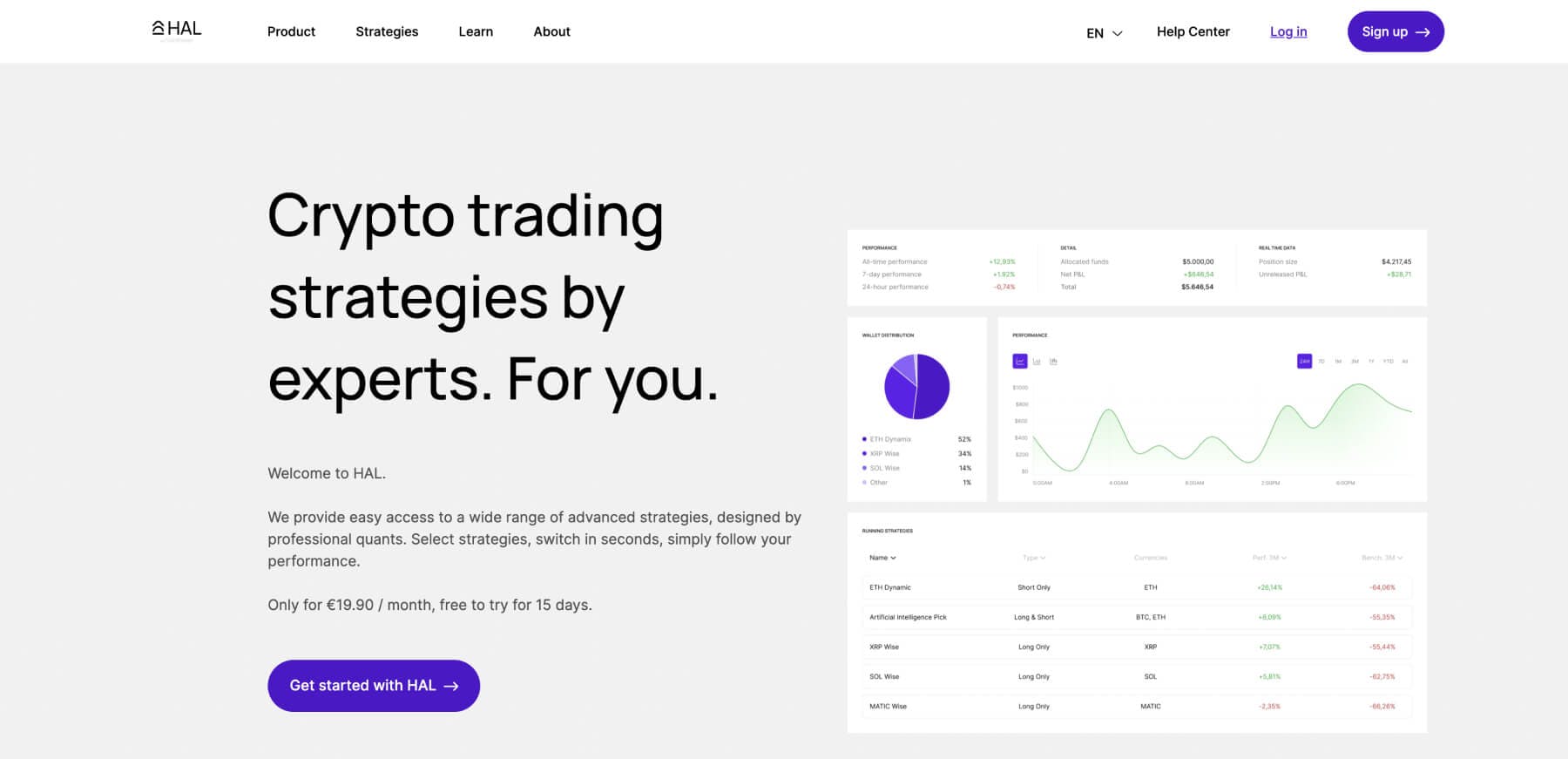

NapBots — Best Trading Bot for Passive Investing

NapBots helps users automate their trades using sets of rules or premade trading templates. The bot is a no-code rule platform that allows traders to automate their trades without programming. The no-code rules only revolve around if-else-then rules that are easily accessible by anyone regardless of your level of expertise.

You can access a wide range of exchanges and assets traded on them to maximize your profits. However, this bot doesn’t have a free trial and costs quite a penny.

The bot set up procedure is demanding in terms of trading knowledge, which makes this bot a good fit for medium-hand traders and professionals, but perhaps not for newbies

Pros | Cons |

|

|

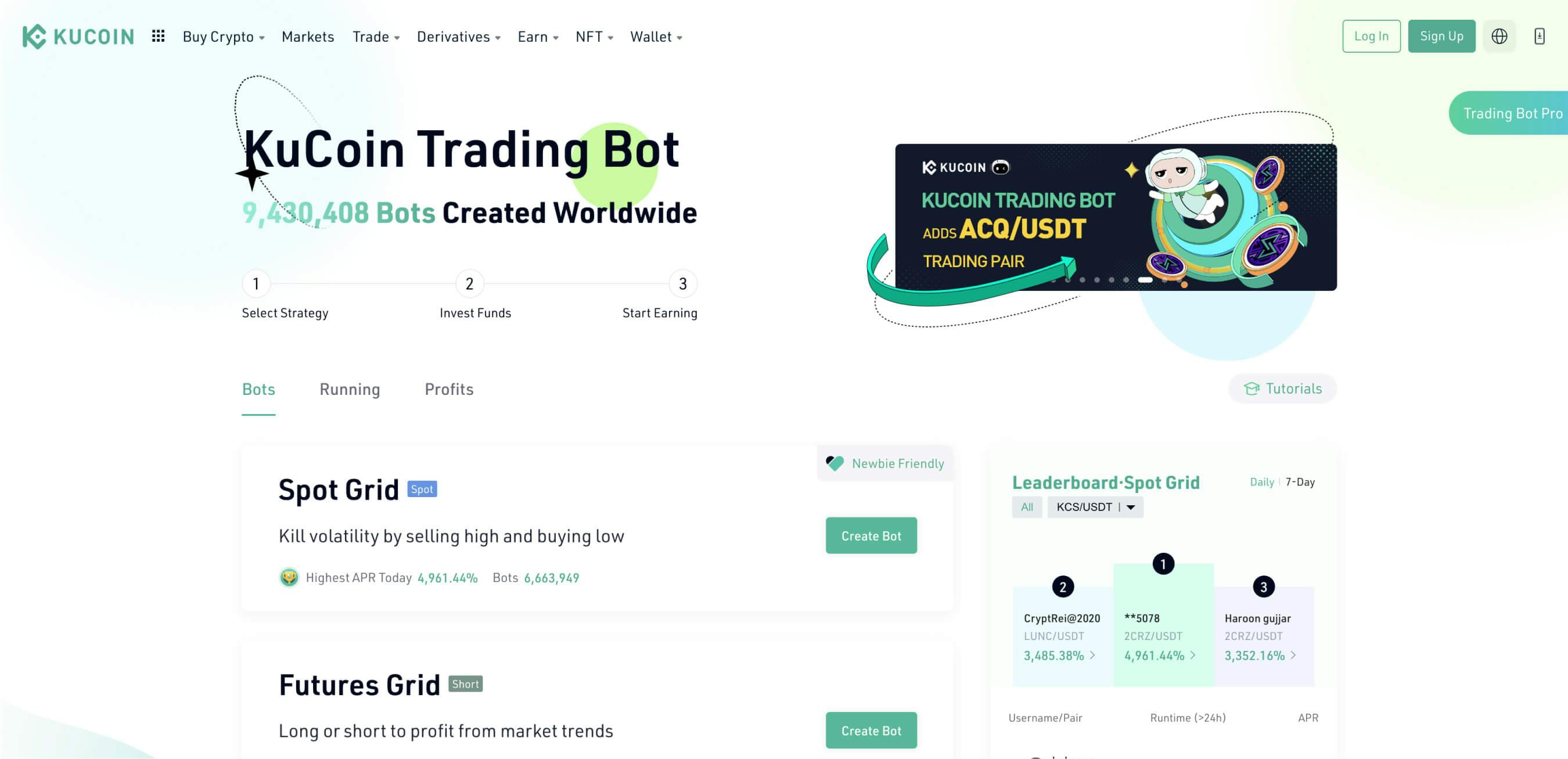

KuCoin — Best Trading Bot for Extra Rewards

KuCoin is a global crypto exchange that supports multiple crypto-asset transactions.

It has recently featured Grid bot & DCA trading for the spot market, while the rest are in works.

Nothing special about this bot, just another exchange clone without particular features. Compared to Binance grid or 3Commas it loses both in terms of technologies and implementation.

Pros | Cons |

|

|

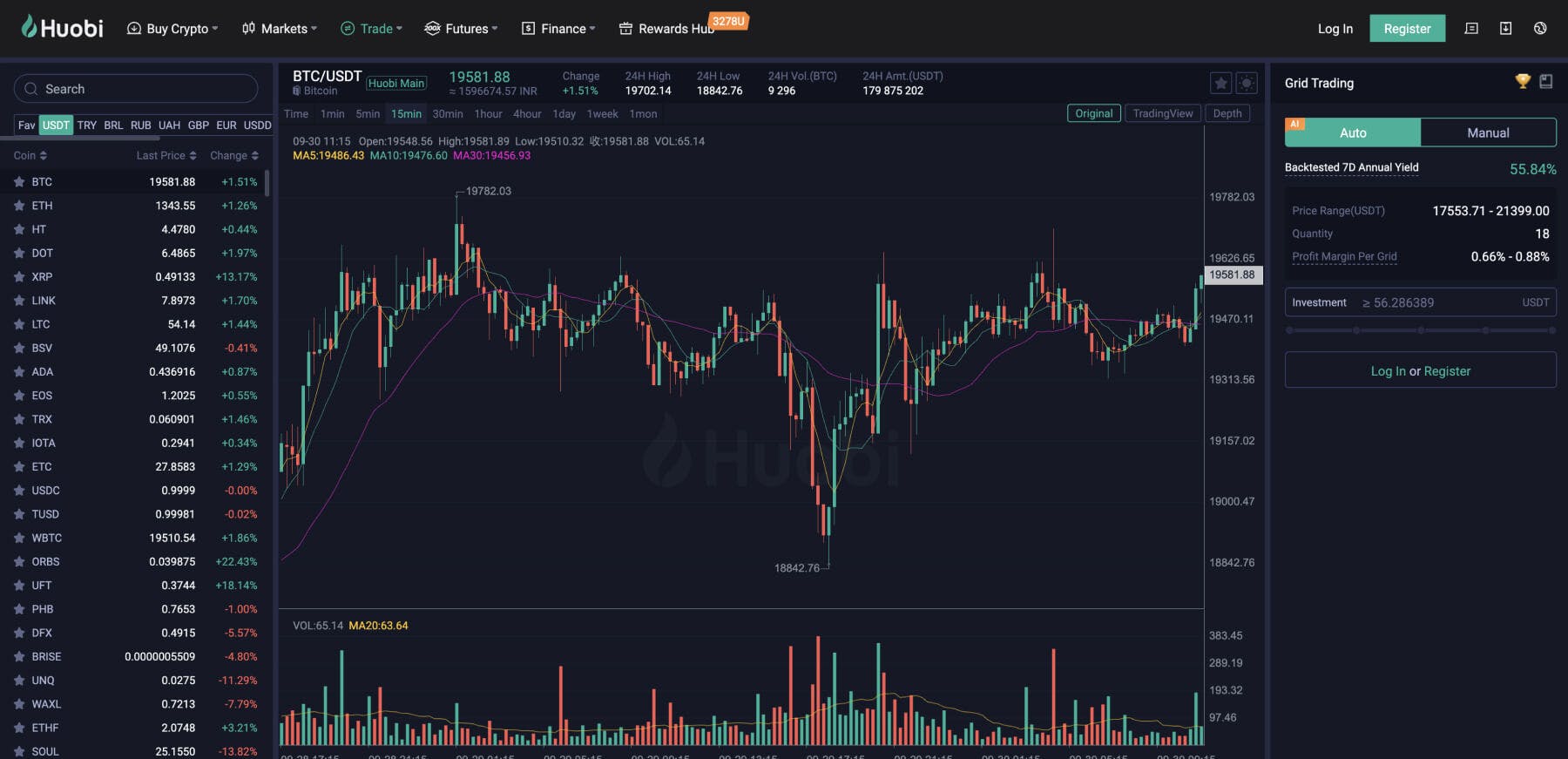

Huobi Global — Best Trading Bot for Alternative Trading

Huobi is another reliable exchange following the common trade — to create internal bots that can help you to automate your trading activities free of charge.

These in-house bots come in two modes:

- Manual Mode is designed to set the grid parameters, including upper/ lower limit, grid number, and invested digital assets, manually. You can also set Stop Loss and triggers. Not suitable for newbies, but hard-end traders should like it.

- Artificial Mode is an automated option for newbies. Huobi bots set all the required parameters automatically. A clear drawback here is that you can’t adjust Stop Loss.

Pros | Cons |

|

|

Gate.io — Best for Trading Bot for Mid-Cap Trading

Gate.io exchange has recently created several algorithms for users to use internally. These bots are fairly easy to build and launch, but you can also copy more experienced traders for a 5% fee. However, you can save on the bot itself, as it comes completely free of charge. On the other hand, you can only trade within Gate.io, which has quite a limited number of crypto pairs.

You should keep your general trading account separately from the bot and prepare your exchange account accordingly to avoid mishaps.

Pros | Cons |

|

|

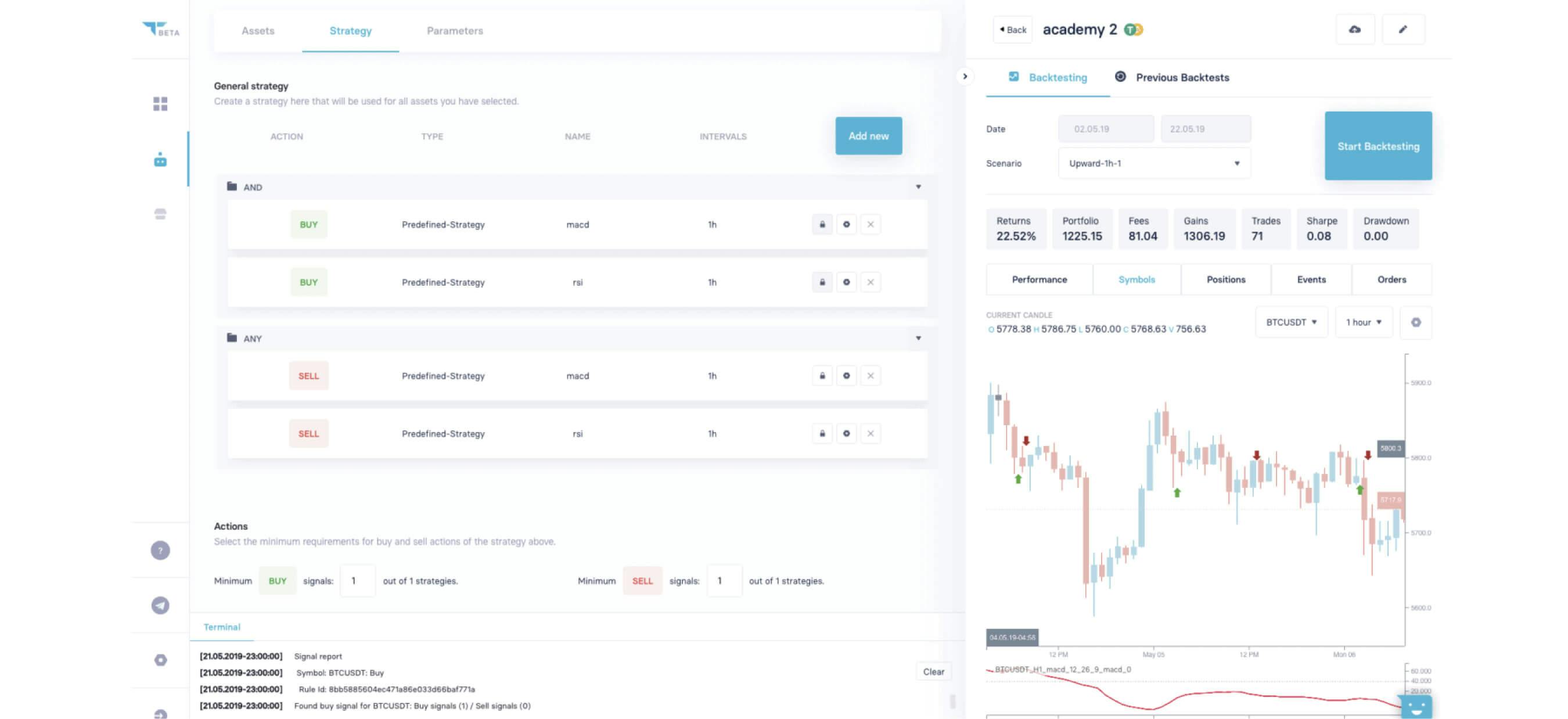

Trality — Best Trading Bot for Developers

Trality is quite a new software provider launched back in 2021. It provides users with various trading tools for building their own distinct trading bots, unlike presets offered by other platforms. Trality also allows both new and experienced traders to backtest and live-trade with their built custom strategies.

It’s best known for its Code Editor, which is said to be the first web-based Python Bot Code Editor. If you’re an advanced trader with coding experience in Python, you can use their code editor to create your advanced strategy.

Pros | Cons |

|

|

Do Trading Bots Work?

A trading bot isn’t a golden pill you take, but a reliable tool to increase your trading capacity and maximize yields if used correctly. Whether the bot will work [yield you profits] or not depends on one simple criteria — it’s code. If the technical and analytical teams work well, the bot can bring tangible results. Unlike many less reliable automated trading software providers, the 3Commas teams put significant effort to develop, test and improve the logic set behind bots. As a result, each 3Commas user can be sure that trading bots developed by 3Commas work well.

Can I make money with Grid Trading Bot?

Trading bots can yield you profits, especially grid trading bots. Grid bots follow the simplest possible logic — make profits regardless of the market situation. The best feature you get is that grid bots neither monitor nor adapt to the market. Instead, they place a grid of buy or sell orders using the averaging principle. The strategy works well on sideways markets with lots of corrections happening. As a result, these bots can make money for you no matter what.

Closing Thoughts

If you ever wondered how to capitalize on grid bots and whether you should try it out, 2024 might be a good year as most markets, including crypto, are sideways.

Grid bots work best in markets without clear trends and can yield substantial profits if you pick a reliable provider and think critically to build & set up your bot.

In conclusion, a grid trading bot represents a powerful tool in the arsenal of today's traders, particularly those navigating the complex world of cryptocurrency markets. This article has taken us on a journey through the fundamentals of grid trading bots, highlighting their functionality, advantages, and key players in the market. As we wrap up this discussion, let's reflect on the key takeaways from our exploration.

Grid trading, as we've learned, is a well-established trading strategy that involves placing both long and short orders at predetermined price intervals, creating a grid-like pattern. The primary objective of this strategy is to capitalize on market volatility, making it particularly suitable for markets that lack clear trends, such as sideways-moving markets. Grid trading bots, equipped with artificial intelligence, bring automation and efficiency to the execution of this strategy.

One of the most compelling reasons to consider utilizing grid trading bots is their ability to eliminate emotional trading. By adhering to predefined rules and logic, these bots execute trades without succumbing to human emotions like fear and greed. This feature not only enhances trading discipline but also reduces the potential for costly errors driven by impulsive decisions.

Grid trading bots offer versatility and diversification, allowing traders to capitalize on both long and short positions. This flexibility enables traders to adapt to changing market conditions and seize opportunities in various directions. Moreover, these bots enhance risk management by automatically setting stop-loss and take-profit orders, helping traders protect their investments.

The discussion wouldn't be complete without exploring some of the top grid trading bot providers. We've looked at market leaders like 3Commas, Pionex, Bitsgap, Quadency, Binance, NapBots, KuCoin, Huobi Global, Gate.io, and Trality. Each of these platforms offers distinct features and caters to different trader profiles. The choice ultimately depends on your specific trading needs and preferences.

However, it's important to note that while these bots can be powerful tools, their effectiveness depends on the underlying code and strategy. The 3Commas team, for instance, is renowned for its commitment to developing and optimizing bot logic to deliver consistent results. Therefore, the quality of your chosen bot and provider matters significantly in determining your success.

Another critical aspect to consider is profitability. Grid trading bots, by design, aim to generate profits in various market conditions, but success is not guaranteed. It depends on market factors, the quality of the bot, and how well it's configured. In general, grid bots thrive in sideways markets with frequent corrections, making them potentially lucrative in today's cryptocurrency landscape.

As we look to the future, 2024 and beyond seem promising for grid trading bots, especially given the prevalence of sideways markets. This strategy's simplicity and potential for consistent returns make it an attractive option for traders seeking automated solutions. However, it's crucial to emphasize the importance of due diligence and critical thinking when selecting a bot and configuring its parameters.

In the end, grid trading bots are not a one-size-fits-all solution, nor are they a guaranteed path to riches. They are tools that, when used wisely and in conjunction with a well-thought-out trading plan, can enhance your trading journey. As with any financial endeavor, there are risks involved, but with the right approach and the right bot, grid trading can be a valuable addition to your trading toolkit. So, whether you're a novice trader taking your first steps into automated trading or an experienced pro looking for an edge, grid trading bots offer a world of possibilities in the ever-evolving world of cryptocurrency markets. It's an exciting time to explore the potential of these bots and see how they can elevate your trading game in the years to come.

FAQ

Grid trading bots can be a reliable tool to increase your trading capacity. Depending on your trading approach, you might want to implement the grid trading strategy and automate it via bots. This way, you can capitalize on the crypto market’s volatility and make yields regardless of the market.

Grid bots can be profitable if designed well. Grid trading and hence well-designed grid trading bots are associated with an excellent risk-to-reward ratio. Regardless of the market’s current state, these bots can yield tangible profits.

Trading bots are allowed by the majority of countries. As long as the team behind the bot meets all the legal criteria, you can safely access the bot.

Infinity grid bot is a type of regular grid trading bot. Unlike a regular grid bot, an infinity grid bot does only have one limit. Most of the time, infinity bots do not have an upper limit.

Most providers do not require you to code a bot. However, some automated trading software providers allow users to program their own bots using logic presets.

Trading bots are associated with some technical and execution risks amplified by folds if the team is not reliable. That is why you should pick a time-tested team behind your bot. The 3Commas automated trading platform is a bright example of a trustworthy grid trading bot.

You can run a grid bot with any amount available on your trading account, including a $100 balance. The bigger your trading balance is, the more yields your grid trading bot can make.

READ MORE

- Best Grid Trading Bots For Crypto

- What is a Grid Trading Bot?

- What is Grid Trading?

- Why Use Grid Trading Bots?

- Best Crypto Grid Trading Bots

- 3Commas — Best Grid Trading Bot Overall

- Pionex — Best Trading Bot for Flexible Trading

- Bitsgap — Best Trading Bot for Arbitrage Trading

- Quadency — Best Trading Bot for Advanced Traders

- Binance Grid Trading Bot — Best Trading Bot for User Interface

- NapBots — Best Trading Bot for Passive Investing

- KuCoin — Best Trading Bot for Extra Rewards

- Huobi Global — Best Trading Bot for Alternative Trading

- Gate.io — Best for Trading Bot for Mid-Cap Trading

- Trality — Best Trading Bot for Developers

- Do Trading Bots Work?

- Can I make money with Grid Trading Bot?

- Closing Thoughts