- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

How to Short Bitcoin (BTC) in 2025

- Introduction:

- Bitcoin Trading Strategies: Long vs. Short

- Bitcoin Shorting Visualized

- Bitcoin (BTC) Longs: What’s That About?

- To Short or Not to Short: A 2025 Outlook

- 5 Ways to Short BTC

- When Should You Short-Sell BTC?

- How to Make Bitcoin Shorting a Part of Your Trading Strategy

- How to Short Bitcoin: Short-Selling Example Step-by-Step Guide

- Best Exchanges & Trading Platforms for BTC Shorting

- BTC Shorting Risks

- Conclusion

- 2025 Update: Strategic Considerations for Shorting Bitcoin

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Introduction:

In the ever-evolving world of cryptocurrency trading, strategies like HODLing and "Buy the Dip" (BTD) are widely discussed and embraced. However, a lesser-known but equally important tactic is shorting Bitcoin (BTC), which allows traders to profit when prices are on a downward trajectory. In this updated article, we'll delve into the intricacies of shorting BTC, shedding light on how to execute this strategy effectively, the platforms that facilitate it, and the latest developments in cryptocurrency trading as of 2025.

Summary:

As cryptocurrency markets continue to mature, the importance of knowing how to short Bitcoin cannot be overstated. Shorting, in essence, involves betting on the price decline of an asset, making it a more complex strategy than simply buying and holding. This article will guide you through the fundamentals of shorting BTC and help you navigate the intricacies of this trading approach, taking into account the latest trends and insights from 2025.

Understanding Shorting and Its Importance:

To comprehend shorting, it's crucial to distinguish between two fundamental trading strategies: long and short. Long positions entail buying an asset with the expectation that its value will rise, leading to a profit based on the price increase. Shorting, conversely, involves selling an asset in anticipation of its price decline, presenting a more intricate process.

The shorting process revolves around borrowing an asset and selling it at the current market rate. Traders then wait for the asset's price to fall, repurchase it at a lower rate, and repay the borrowed amount with interest. The profit is derived from the price differential. However, if the asset's price rises, the trader incurs losses.

Benefits of Shorting BTC:

Shorting BTC provides a unique set of advantages, particularly when markets are in a downtrend. While a traditional long-only strategy may yield profits in bullish conditions, it can lead to significant losses during bear markets. Shorting, on the other hand, allows traders to capitalize on declining market trends, ensuring they don't miss out on opportunities when prices are falling.

Additionally, shorting enables traders to engage with the market comprehensively, as it grants them access to profit potential during not only uptrends but also sideways movements and downtrends. This flexibility in strategy can be a significant asset in a volatile and dynamic cryptocurrency market.

Methods for Shorting BTC in 2025:

The article explores various methods for shorting BTC, adapting to the changing landscape of cryptocurrency trading in 2025. These methods include:

- Margin Trading: Cryptocurrency margin trading platforms enable traders to leverage borrowed funds to execute short trades. Prominent exchanges like AvaTrade, Plus500, and Markets.com offer margin trading services.

- Futures Markets: BTC has established a presence in the futures market, where traders can speculate on both price increases and decreases. Platforms such as IQ Option and AvaTrade facilitate BTC futures trading.

- Binary Options: Binary options trading allows investors to short Bitcoin by placing put orders. Leading binary option platforms like IQ Option and Binary.com provide opportunities for traders to profit from BTC price declines.

- Prediction Markets: Prediction markets offer a unique approach to shorting Bitcoin, allowing traders to create events and bet on specific outcomes related to BTC's price movement. Predictious is an example of a prediction market for BTC.

- Short-Selling on Cryptocurrency Exchanges: While not suitable for all investors, actively buying and selling BTC and other cryptocurrencies on exchanges can be a profitable short-selling strategy.

When to Short-Sell BTC:

Determining the optimal time to short-sell BTC requires careful consideration of market conditions. Traders must identify weakening cryptocurrencies and use technical analysis to pinpoint entry and exit points accurately. Monitoring short-term price indicators and recognizing key patterns can be essential in making informed short-selling decisions.

Managing Shorting Risks:

The article underscores the importance of risk management when shorting BTC. While shorting offers profit potential during price declines, it also exposes traders to significant risks. For instance, unexpected price surges can lead to substantial losses, emphasizing the need for sufficient trading capital and risk mitigation strategies.

Any crypto trader should know how to profit when prices fall by shorting Bitcoin (BTC). You often hear about strategies, such as HODL and BTD, but in the world of cryptocurrencies, shorting is much less discussed. In this article, we will show you how to short bitcoins to profit from a bear market.

Shorting is essentially the practice of betting on the price of a falling asset. However, this is something more complicated than a bullish move. It’s easy to go bull: you just buy BTC and store it. Shorting, however, is a very different process. Keep reading to learn about fun stuff like leverage, short-selling BTC, the process of doing it, and which exchanges are the best to get satisfying results

Bitcoin Trading Strategies: Long vs. Short

Shorts and longs are essentially sell and buy strategies in trading. Most cryptocurrency assets are characterized by high volatility. The use of shorts and longs enables traders to profit from price fluctuations.

A long strategy is buying an asset in the expectation that it will rise in price. The amount of profit depends on the increase in the value of the investment.

A short strategy is the sale of a financial instrument in the expectation that it will fall in price. However, the mechanics of shorting are somewhat more complicated.

Under this scheme, a trader borrows an asset and sells it on the open market at its current price. Then they wait for the fall in the rate, buy the amount of the asset that they borrowed at a lower rate, and pay the debt with interest. The trader retains the profit received due to price changes. Otherwise, if the asset price rises, the investor will suffer a loss.

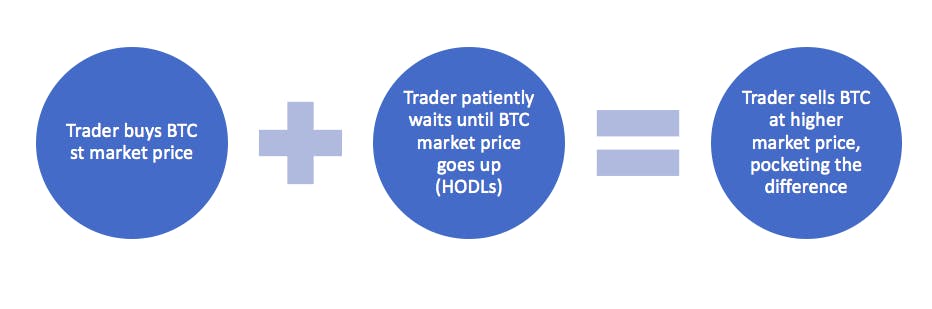

Bitcoin Shorting Visualized

Short-selling is a 3-way process:

It’s important to note that the short seller will profit only if the price drops. If it goes up, the short seller will see a loss. You can enjoy a detailed read about how to short BTC (or other cryptocurrencies) by following this link.

Bitcoin (BTC) Longs: What’s That About?

For example, you buy a cryptocurrency, expecting that, after some time, its value will rise, and you will be able to sell it profitably. Let’s say you bought BTC for $500, and then sell it for $600, earning $100 for each coin if the cryptocurrency rate goes up. This is the most common and straightforward strategy for making money on cryptocurrency movements. To put it simply, long is a strategy in which you open positions to buy crypto, relying on the growth of its market value.

Playing only by long is, in principle, a wrong approach. This deprives the investor of interest at the moment when the market falls, although it is possible and necessary to earn money in a falling market. Besides, trading only by a long strategy leads to natural losses in a falling market, when a person accustomed to playing long tries to play against the market. A trader must take advantage of all the market offers and play both up and down.

To Short or Not to Short: A 2025 Outlook

When there is a market uptrend, everything is clear: you buy BTC and wait for the right moment to grab your profit. You can, of course, enter the market tactically unsuccessfully and buy at the local maximum, but if the trend is strong, you will gain profit sooner or later.

But what to do when the market falls, and you’re in the win? Try the “bounce” method: buy crypto, hoping for a local minimum, and then quickly get rid of it, keeping in mind that any trend is generally to go downward. A hazardous activity, but sometimes an entirely successful one.

In general, however, this leads to the fact that you buy, and the market goes further down, leaving you two options: to become an investor, hide under a rock for a long time and wait for a trend change, or hit rock bottom by closing the position at a loss.

To not get yourself into this nightmare, it is better to play not against the trend, but according to the trend. This is what the short is for. It’s a bearish game when you see a downtrend, and you have money. Of course, you can make a mistake at the moment of entering the market and sell not at the maximum, but if you guessed right in the general trend, you would still gain profit.

There is a risk because of leverage, rather than shorting. And the more leverage, the greater the risk. If we talk about trading with first leverage using the shorting strategy, then this is almost the same as buying crypto with your own money in terms of risk. It’s just that in one case, you are bullish and buy a certain number of shares with your own money. In the other case, you expect the market to decline and, having a leverage of 1 to 1, borrow and sell the same number of shares as in the first case.

After all, the market can be in three states: uptrend, sideways drift, or downtrend. It is possible to buy crypto during an uptrend and a sideways trend, but a bullish trend on a downtrend will inevitably lead to losses. This means that if you only play bullish, then at least 30% of the market will pass you by. Shorting allows you to participate in the market for 100%.

5 Ways to Short BTC

For some perspective, BTC and other cryptos astronomically rose in value in 2018, and this didn’t stop investors from looking into going short even then. For investors who also want to take advantage of a falling market, shorting BTC and other digital currencies can pay off. Let’s take a look at how to go short on BTC:

1. Margin trading

One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. Many exchanges offer this type of trading, in which investors can “borrow” money from a broker to place a trade. It is important to understand leverage so that you do not have unpleasant surprises. The world’s most popular bitcoin exchanges offering margin trading are AvaTrade, Plus500, and Markets.com.

2. Futures markets

Bitcoin, like other investment products, has long entered a futures market. During a futures trade, a buyer buys a contract that specifies the price at which the underlying asset will be sold. When you buy a futures contract, you, as an investor, assume that the underlying asset’s price will increase in the near future. Selling a futures contract shows a bearish mindset and predicts that the price will fall soon. Selling futures contracts is an excellent way to short bitcoin. Futures markets are somewhat challenging to find, but you can buy and sell BTC futures, such as IQ Option and AvaTrade.

3. Binary options trading

Call and put options are also investment products that allow investors to short Bitcoin and other cryptocurrencies. If you want to short cryptocurrencies or other currencies, you place a put order. Via an options contract, you can sell Bitcoin or other cryptocurrencies at the price of today, later in the future, even if the price falls. Among the best binary option trading platforms of 2020 are IQ Option and Binary.com.

4. Prediction markets

You can also short Bitcoin via so-called prediction markets. They have been around for some time for other investment products. Via prediction markets, investors can create an event and bet on it. For example, you can bet on whether BTC rises by a certain percentage or amount. If others bet oppositely, you as an investor win the others’ amount, if you are correct. Predictious is an example of a prediction market for BTC.

5. Short-selling on cryptocurrency exchanges

While this method may not be for all investors, it can be lucrative. With this method, you actively buy and sell BTC and other cryptocurrencies to profit from the price difference. You sell high, wait for the price to drop again, repurchase tokens, and sell them again when they increase in price. If the price doesn’t change, you don’t lose anything and just hold the coins a little longer.

When Should You Short-Sell BTC?

Deciding when to sell is more difficult for short cryptocurrencies, as their liquidity is not always high. The so-called squeeze is not excluded, in which you lose money instead of earning. In the long term, shorting BTC or altcoins is generally not recommended, as you can gradually drain your deposit.

Some marketplaces have lending that allows users to get coins to go short. Of course, the service is paid – on average, BTC is given at 0.2% per day. You can short cryptocurrencies on exchanges, such as Poloniex or Bitfinex. They have detailed manuals describing how the mechanism works.

The essence of working with a bear market is to use different opportunities for shorting. Each of the positions is used based on market behavior. The first option involves the selection of coins that are moving towards resistance. The second option consists of working with coins of minimum coiled spring or relative strength. If used correctly, both tactics allow you to find weak currencies, the rate of which should fall soon.

After a trader identifies the currencies that are falling in price, they must accurately determine the moment of shorting. This will affect the profit of the entire operation. You need to not just look at the chart online, but resort to technical analysis. With its help, the starting point of the shorting game is determined.

A signal that it is time to stop may be a triangle – the cryptocurrency chart movement along with a geometric figure or a double top’s appearance when the rate jumps several times in a short time. When the value of an asset decreases in the market, pay attention to short-term price indicators.

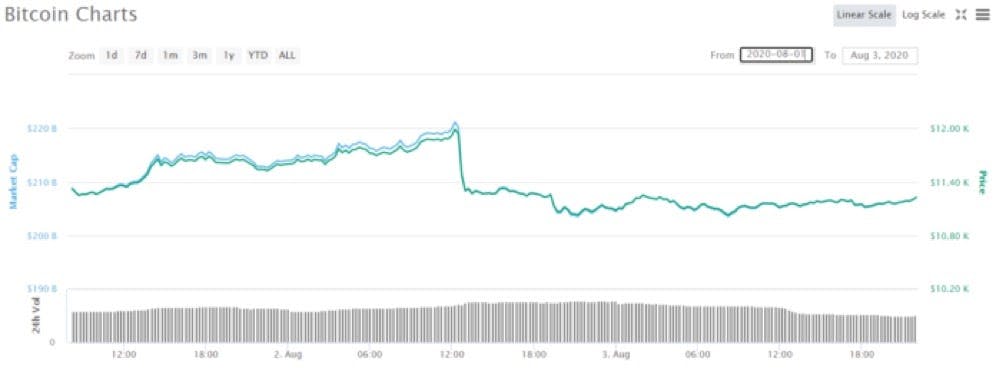

If the market is in a downtrend but does not match a downtrend’s characteristics, it is better to analyze short-term price indicators. Only a sharp drop in the price of an asset can bring the maximum profit, so the moment of opening and closing a transaction should be carefully selected.Here’s a chart that shows a sharp drop and following stability of BTC in August of 2020:

image credit: coinsnetwork.com

How to Make Bitcoin Shorting a Part of Your Trading Strategy

There are two main ways of making shorting a part of your trading strategy.

The first one is a gradual build-up of a position on a decline to sell further when the trend changes. This method of sequentially buying at a lower and lower level is also called averaging.

For example, during the correction of Bitcoin prices in June of 2017 from the level of $2,900, it was possible to make several buy transactions at a specific interval (at the levels of $2,800, $2,600, $2,400, $2,200, $2,000), having received an average acquisition cost of $2,400. After that, already on the return of the price of $ 2,900, the income in percentage terms is more than 20%.

The second strategy, which is riskier, is based on the use of short positions. This name has nothing to do with the duration of transactions, but short positions are not held for months as a rule. When shorting, a trader borrows BTC and sells it on the market at the current price (for example, at $2,800).

After the price has decreased, the trader buys back the cryptocurrency at a lower price ($2,400), pays back the borrowed, and profits on the difference between the purchase and sale costs. In this example, the payoff would be approximately 14%.

When shorting BTC, one simple rule should be remembered: even if the value of the cryptocurrency has fallen by two times, you will earn no more than 50%, while if the price doubles, the losses will amount to 100%. Thus, extreme caution is required in such a bearish game, because the cryptocurrency market has more than once surprised even experienced traders with the swift change of trends.

Of the two strategies outlined above, the first is easier to apply and is suitable for most medium- and long-term investors. Nevertheless, many of them, observing another decline in the market, fear that if the price falls for too long and falls to the minimum level, it may happen that there is simply no one to sell the cryptocurrency.

No matter how long the period of the price decline (and only BTC history has more than ten long-term falls), the correction sooner or later ends, and the price reaches its next maximum.

How to Short Bitcoin: Short-Selling Example Step-by-Step Guide

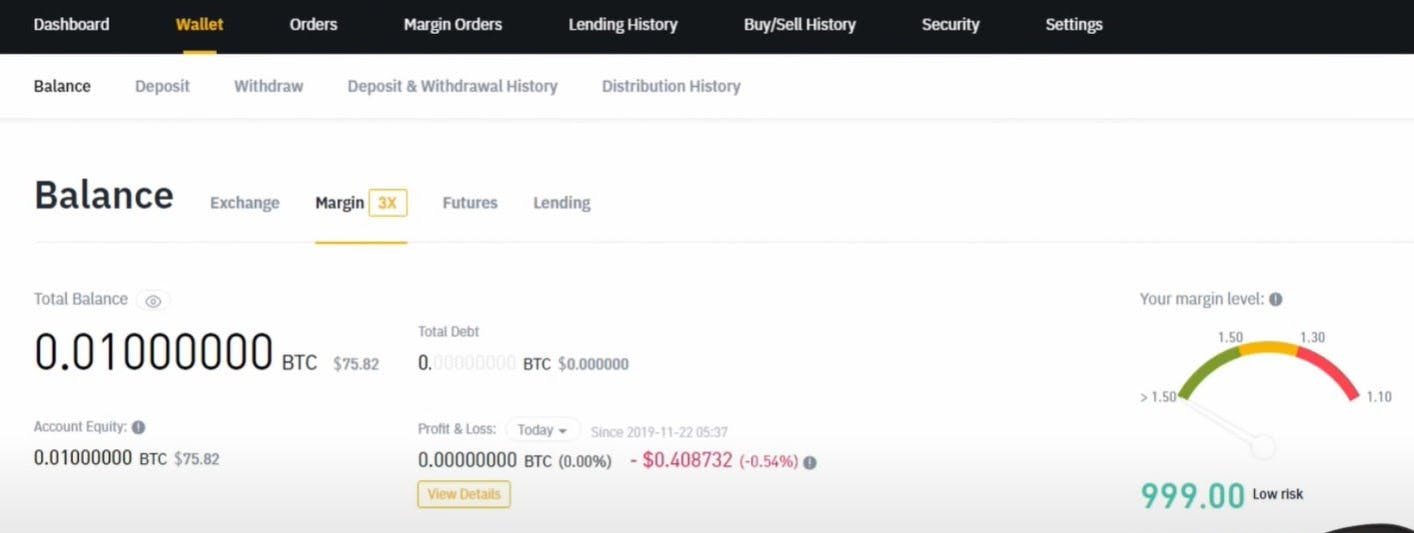

We’ll show you how to short-sell your BTC on Binance. This is how your account equity can look like. You can first borrow, then go about your technical analysis, etc.

Get on the margin exchange. Make sure you have the “M” selected because it shows all the pairs you can trade on margin:

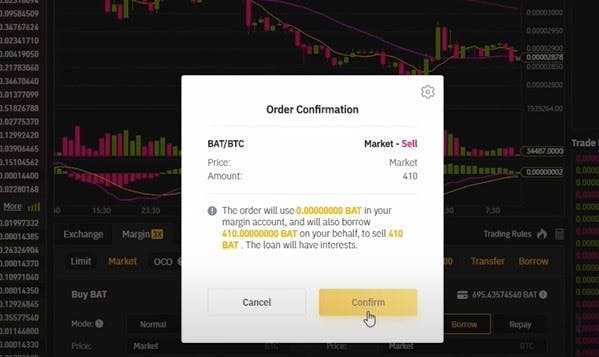

Now you’re going to sell your BTC in anticipation that its price will drop. If you go on the tab shown on the screenshot, the exchange will tell you your risks:

When you borrow your BTC, you’ll see a pop-up you’ll need to confirm:

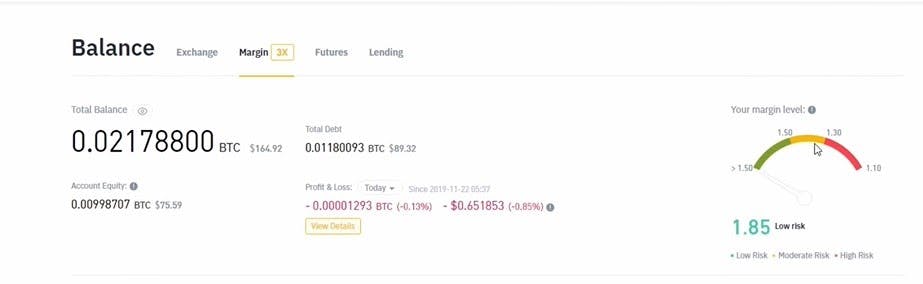

This is how your account will look if you’ve successfully short-sold your BTC:

This should give you a basic idea, but make sure to check out the tutorial on YouTube:

Best Exchanges & Trading Platforms for BTC Shorting

On most exchanges that provide margin trading services, the process of borrowing cryptocurrency for sale, in short, is automated. BTC is lent by other investors, receiving a fee in the form of interest income depending on the loan term’s length. The rates vary but rarely drop below 2% per month. The possibility of BTC shorting is available on such popular exchanges as Binance, Bitfinance, Kraken, and Coinbase.

BTC Shorting Risks

Going short involves a lot of risks. Of course, the price of a coin may suddenly rise after an investor has just sold the coins in the hope of being able to repurchase them later at a lower price. At that time, the investor should have gone long because now he is making a loss by buying back the coins at a higher price. Of course, the same goes for going long while prices are falling.

Let’s say you shorted 100 USD worth of BTC back when prices were only 10 USD per coin. That means you short-sold ten coins. Let’s assume that you have yet to repurchase the coins, meaning that you still have to pay the owner back with ten BTC. Now imagine that all of a sudden, the price went up to 4000 USD. The ten BTC you need to pay back now turned into 40,000 USD!

When short-selling, you must have sufficient trading capital to keep your current position open. You make a profit as soon as the price has dropped to the price you set in advance. Until then, the price of your crypto can fluctuate.

When the price goes the opposite direction of your target, if the price goes up, your goal is for the price to fall: your position is red. Your status will turn green as soon as the price is at the height that you have set in advance. It is also possible not to set a target, but only a direction.

Conclusion

Perhaps now you’re ready to make Bitcoin shorting a part of your trading strategy. Use our short-selling example step-by-step guide with links to official data and YouTube videos. That said, make sure to consider BCT shorting risks. Shorting can be an effective investment strategy, but it is much more risky than long-term or averaging. Only experienced traders who can comprehensively analyze market dynamics should open short positions for large amounts.

2025 Update: Strategic Considerations for Shorting Bitcoin

As of 2025, shorting Bitcoin requires a more calculated approach due to shifting market structures, regulatory guidance, and technological innovation. Professional traders and asset managers should weigh several key developments:

Enhanced Trading Infrastructure and AI Integration

The adoption of automated crypto trading bots and AI trading bot systems has transformed short-selling strategies. Sophisticated crypto trading bots now analyze large datasets in real time, offering refined entry and exit points for short positions. Tools such as AI crypto trading bots and AI bot crypto trading software can be integrated directly into trading workflows for precision and scalability.

Evolving Compliance and Oversight

Clearer global regulations around short selling and digital assets have increased the need for strict adherence to trading standards. With automated crypto trading platforms often integrated with exchanges, regulatory compliance is now embedded into software logic. Traders using auto trading crypto bots must ensure they operate within legal frameworks to avoid exposure to sanctions or account restrictions.

Market Depth and Volatility Risk

Liquidity for short positions has improved, particularly with the rise of crypto trading bot platforms supporting derivatives. However, volatility remains elevated—especially during macro-driven events—making automated risk controls essential. Many professionals now deploy crypto signal bots alongside their AI bot trading crypto systems to manage real-time risk dynamically.

Institutional Trading Tools

The increase in institutional adoption of automated trading bot crypto solutions has introduced more competition and market sophistication. Institutions frequently rely on crypto trading software that integrates shorting capabilities with predictive analytics and portfolio hedging. Retail and independent professionals may find opportunities by leveraging similar AI for crypto trading systems that can simulate institutional strategy behaviors.

Execution and Automation Advances

Execution technology has evolved beyond manual triggers. Today's automated cryptocurrency trading bots use algorithmic models to adapt to rapid market changes and improve trade accuracy. These bots can identify arbitrage or overextension in price trends, automating short entries based on strategy parameters without constant oversight.

In summary, shorting Bitcoin in 2025 is best approached with a toolkit that includes AI crypto trading software, institutional-grade analytics, and automated safeguards. Understanding the capabilities of automated trading cryptocurrency systems—while staying within regulatory bounds—can help traders engage responsibly with this high-risk strategy.

FAQs

There is no minimum amount to short a stock.

This is a bull and bear market. It depends on your expertise and calculations.

It’s not dangerous, but it is a risky area. If prices suddenly go up, you can lose all funds invested.

If you short a stock and it goes to zero, you’re in the win. This is the sole purpose of shorting.

No. It is much easier to go for the long run and wait until the coin goes up in value. This does not mean it’s not more profitable if you make the right calculations.

It’s not against the law. This question depends on your own beliefs on what is ethical and what isn’t. Any action, especially in trading, is relative to the traders’ own ethical framework.

No. You need to monitor the market and decide when the time is best to buy, borrow, and sell.

The contents of this article are not intended to be financial advice and should not be treated as such. 3commas and its authors do not take any responsibility for your profits or losses after you read this article. The info contained herein is based on data that was gathered from a variety of sources. This should not be used as a parameter for investing. The user must do their own independent research to make informed decisions regarding their crypto investments.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.

READ MORE

- Introduction:

- Bitcoin Trading Strategies: Long vs. Short

- Bitcoin Shorting Visualized

- Bitcoin (BTC) Longs: What’s That About?

- To Short or Not to Short: A 2025 Outlook

- 5 Ways to Short BTC

- When Should You Short-Sell BTC?

- How to Make Bitcoin Shorting a Part of Your Trading Strategy

- How to Short Bitcoin: Short-Selling Example Step-by-Step Guide

- Best Exchanges & Trading Platforms for BTC Shorting

- BTC Shorting Risks

- Conclusion

- 2025 Update: Strategic Considerations for Shorting Bitcoin