- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Trade automation with Trading View in 3Commas in 2025

Explore the enhanced integration of TradingView and 3Commas in 2025, featuring AI-powered trade logic, advanced Signal Bots, and professional automation tools for asset managers. Learn how these platforms empower dynamic and precise cryptocurrency trading strategies.

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Many traders select their own Technical Analysis indicators and strategies using TradingView. Of course, trade execution requires you to connect your exchange with 3Commas. However, TradingView only works with Poloniex, so the question is how to leverage TradingView’s indicators on other exchanges?

3Commas provides a solution with the auto trading Bots where you can create your custom strategies.

Example

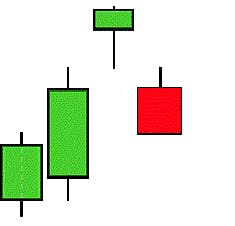

In this example, we will use a simple yet effective strategy that relies on Crossing Moving Averages. This is a template that can be applied to any given set of Technical Indicators you may choose to include with your strategy.

In this case, we are showing the 30-minute timeframe chart for ETH \ USDT and two exponential moving averages (EMA) with a period of 9 and 21, respectively. When the fast-moving EMA (9) crosses the slow-moving EMA (21) in an upward direction (bottom to top), Technical Analysis typically indicates a Buy signal – When the cross happens in the downward direction (top to bottom), a Sell signal is generated.

Configuring the 3Commas Bot

In the My Bots menu, select Create a Bot.

After selecting the currency in which you wish to take profit (Base or Quote) ND order size, select Market Order. This is important if you wish to execute all signals given. All other settings are left as is in the above screenshot.

Next, we need to the Trade Start Conditions. The Take Profit condition would not work in this scenario since the Sell order is also triggered by a Signal rather than pre-set target. To prevent a Take Profit order to occur prior to a Sell signal being given, we set an unrealistic target, that is unlikely to be hit, of up to 50% (50% is the maximum value allowed)

The next screen – Stop Loss is left Off

Safety Orders are not needed so we set the value to Zero

For the last screen, Additional Settings, we use the default values for this particular strategy.

We click Create a Bot and scroll through the list of settings, as in the attached screenshot.

We leave this window open and proceed to set the TradingView alerts so 3Commas receives the signals required to execute the chosen strategy

Setting TradingView Alerts.

There are two alerts: a buy signal and a sell signal, so a paid TradingView account is required.

1. Click the right button on the chart and “Add Alert”.

2. Generally, for all notifications in the “Actions” item, select send an email via sms and type the following address – signals@robot.3commas.io.

3. Also for all notifications, select the repeat frequency once a minute (screenshot)

Buy signal

Next, we switch to the 3commas bot settings list window and copy the message code for the signal to start the transaction.

We insert this code in the TradingView notification window right here.

Click – Create an Alert when a buy signal is ready. A sell signal is generated in the same manner

Alert settings – Alert to cross downwards, from top to bottom.

And to take the message code from the settings list of 3commas bot, this one.

Done! The bot is launched and your strategy will start working immediately after receiving the first notification.

Following this template, you can automate any custom or built-in strategy and leverage any number of TradingView indicators and signals with 3Commas

Good luck trading!

Enhancing Trade Automation with TradingView and 3Commas in 2025

As the cryptocurrency market matures, the integration between TradingView and 3Commas has significantly expanded, empowering users with more dynamic and precise automation tools. The combination of signal-based automation and AI-powered trade logic is now central to high-frequency and institutional-grade trading setups.

Signal Bot and AI Integration

In 2025, 3Commas continued to add capabilities to Signal Bot, a robust feature that links TradingView alerts with automated crypto trading actions. Traders can now build advanced strategies using TradingView’s charting capabilities, while executing those strategies through 3Commas’ automation framework in real time.

The latest updates incorporate AI bot crypto trading functionality, enabling bots to react to both technical indicators and external data inputs such as market sentiment and volatility. This makes it possible to deploy an AI crypto bot that adjusts strategies dynamically, responding to live market conditions instead of static triggers alone.

For professionals and asset managers managing diversified portfolios, the ability to integrate automated crypto trading bots across multiple accounts has become a cornerstone of operational efficiency. Using 3Commas as an automation software provider, they can scale execution strategies with precision and oversight.

Professional Automation Tools for Asset Managers

3Commas now supports institutional traders with tools specifically built for multi-client environments. Features like automated trading bot batch deployment, account grouping, and centralized monitoring help ensure consistent execution across accounts.

Advanced portfolio controls also include auto trading crypto bot capabilities, allowing for synchronized strategy updates and trade orders to be processed at scale. This setup is particularly valuable when managing altcoin-focused portfolios with altcoin bot trading setups that require rapid adjustments based on liquidity and spread changes.

Enhanced Strategy Logic and Security

Risk management remains essential in every automation stack. New features now enable automated cryptocurrency trading bots to incorporate layered stop-loss logic, volatility triggers, and trade volume filters. The bots can be configured to follow AI-generated insights, using reinforcement learning to improve over time—building what many refer to as AI cryptocurrency trading bot intelligence into each decision cycle.

Additionally, bot trading software within 3Commas now includes features for throttling execution frequency, customizing slippage tolerances, and setting time-based trade intervals to better align with compliance and client mandates.

Final Thoughts

The TradingView and 3Commas integration has advanced far beyond the 2019 use cases. With the rise of AI trading bot crypto tools and deeper institutional adoption, professional traders now rely on integrated systems that offer both control and adaptability. 3Commas has evolved into a complete automated crypto trading software suite—designed not just for retail traders, but also for those managing complex portfolios across diverse markets.

Whether deploying a bot to trade crypto based on custom TradingView signals or running a fully automated crypto trading bot suite across client accounts, today’s traders need scalable, intelligent solutions. And 3Commas delivers on that demand—without hype, and with a clear focus on precision and accountability.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.