- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Will Halving Raise the BTC Rate to $12,000?

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

The most anticipated event in the crypto world in 2020 is the bitcoin halving. How will it affect the price of digital gold and the overall cryptocurrency market?

Halving is a reduction of the reward miners collect for adding a new block to the blockchain. The cryptocurrency program code contains language which triggers the halving events automatically. It is present not only in bitcoin but also in litecoin, ethereum, and several other coins using the Proof-of-Work (PoW) consensus algorithm.

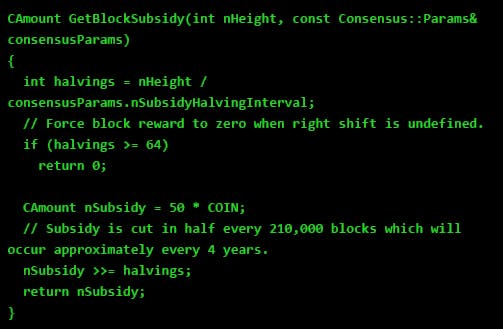

The part of bitcoin code responsible for halving

On the Bitcoin network, halving happens every 210,000 blocks. It first occurred on November 28, 2012, almost four years after the network launched. During this period, 10,500,000 BTC were mined, which is precisely half of the total that will ever exist. After the first reduction of the reward, miners began to receive 25 BTC for the mined block, instead of 50 BTC. The second time the halving occurred on July 9, 2016, and the block reward reduced to 12.5 BTC. A total of 32 halvings will take place. Based on calculations, in the end, the reward for the mined blocks will be 0.000000005820766091 BTC.

The next halving will occur in May of this year (the reward for miners will be reduced to 6.25), and many expect extraordinary price growth by this date. We will examine in more detail whether it is worth waiting for this event, and if so, what price levels we can expect.

Why We Need Halving

Halving plays a crucial role in the economic model of bitcoin and similar PoW altcoins. The creator of Ethereum Vitalik Buterin explained this idea by comparing bitcoin with gold: “Gold reserves in the world are limited, and with each gram mined, it becomes more and more difficult to get the remaining unmined gold. As a result of such a limited supply, gold has retained the value of an international medium of exchange and store-of-value for more than six thousand years, and there is hope that Bitcoin will do the same”. We can say that the task of halving is to increase the complexity of Bitcoin mining and the distribution of its emission for 130 years. Halving helps curb hyperinflation and makes Bitcoin a more scarce asset, which should have a positive effect on its value in the future.

Bitcoin Cycles

Let’s take a look at the bitcoin all-time chart:

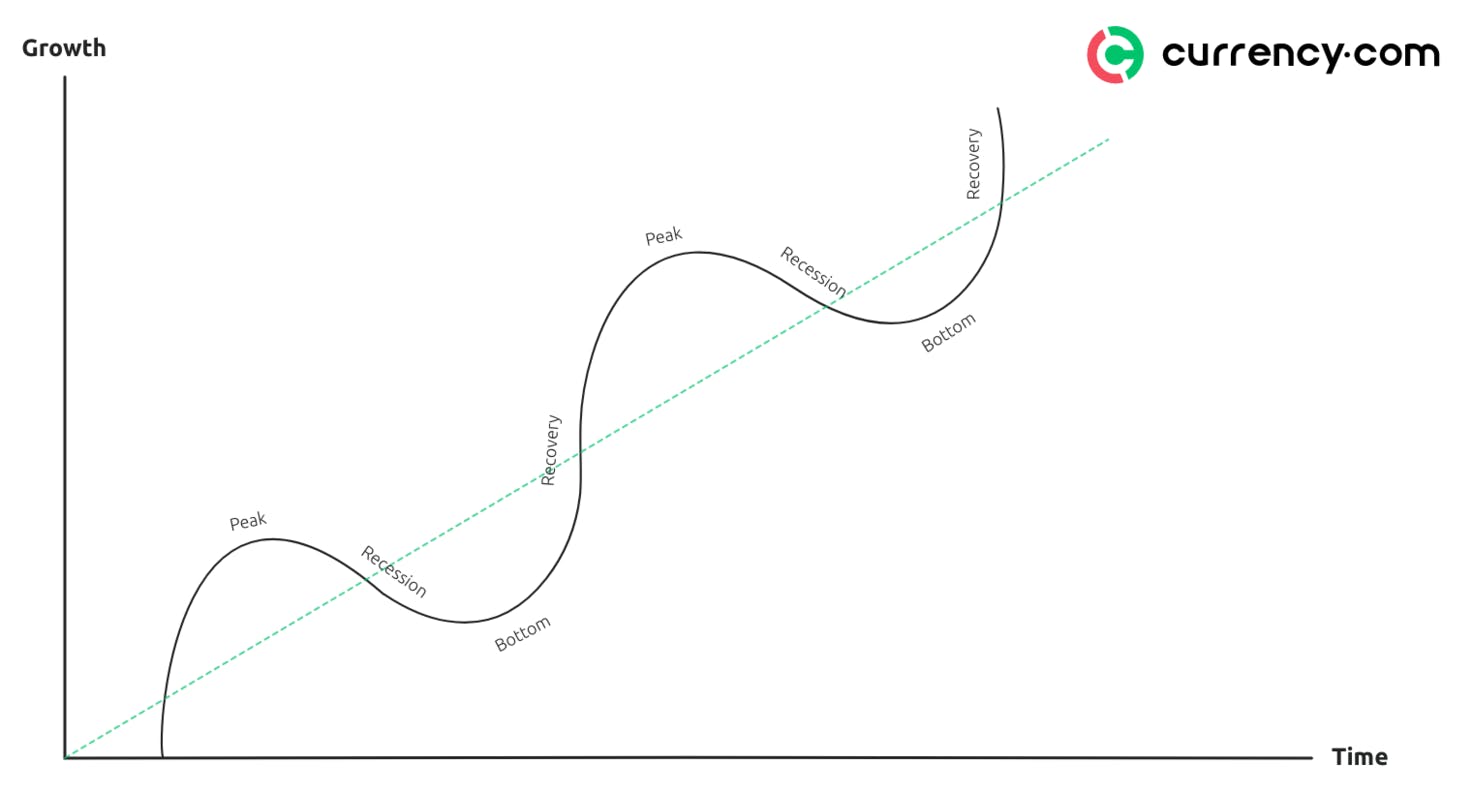

It appears that previous halving events indicate the onset of a bull cycle. After halving the miners’ reward, the price of bitcoin grew exponentially and reached new heights. Also, on the graph, cyclicity is noticeable.

A similar model, called “Kitchin Cycles”, presents boom and bust cycles every 2–4 years. It’s possible that Satoshi Nakamoto initially envisioned and implemented such an economic model in Bitcoin’ code. BTC halving occurs every four years, reducing inflation and increasing demand, which fits perfectly into the Kitschin’s cycles model.

Let’s take a closer look at each bitcoin cycle.

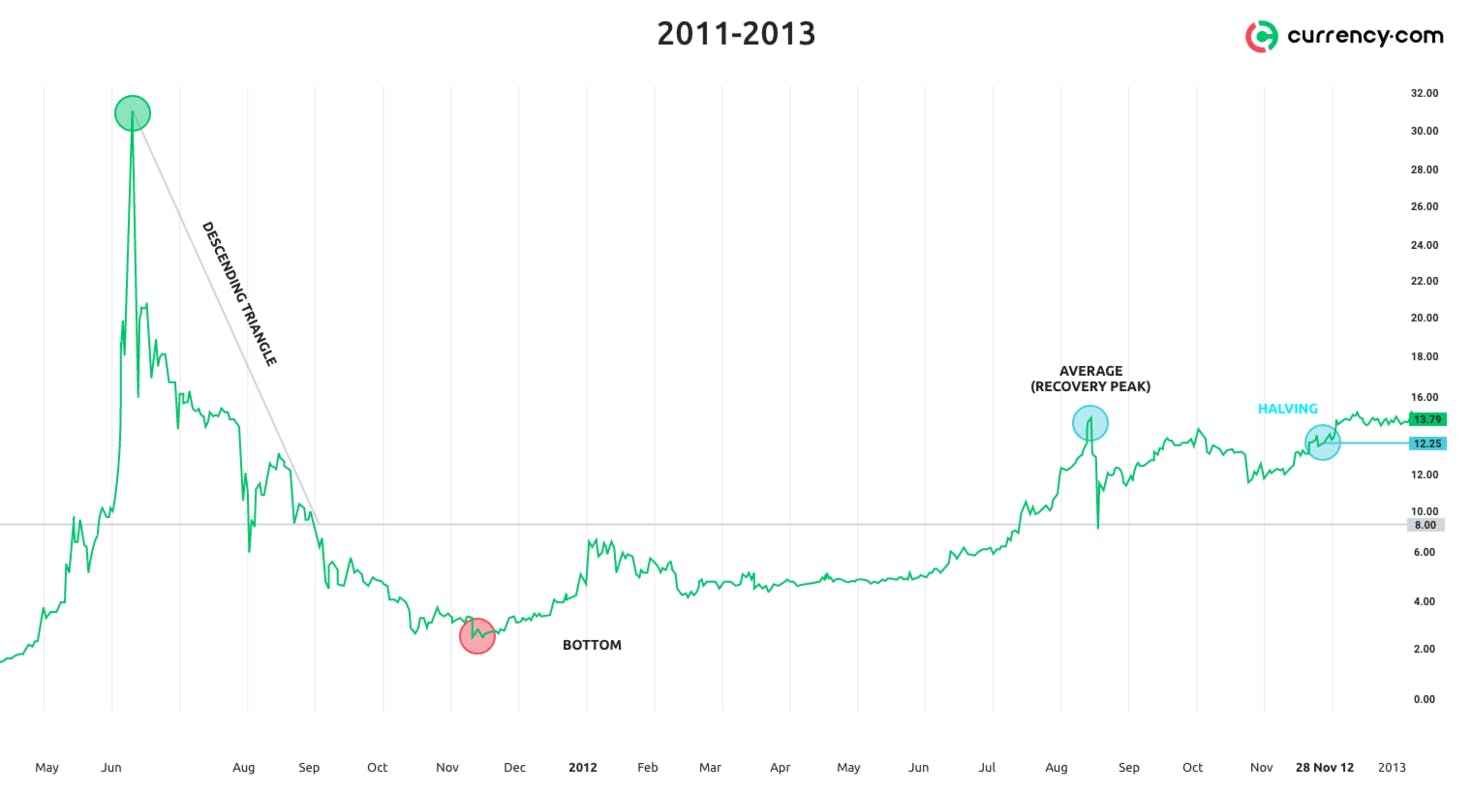

2011–2013

Bitcoin saw its first high in June 2011 when it reached $30, followed by a sharp decline in price. The bottom reached around $2. Then the recovery process began, and the price returned to average values around $15. On halving day, November 28, 2012, the price was $12.25, which is close to the average level of the previous peak. Thirteen months after halving, bitcoin reached a new height.

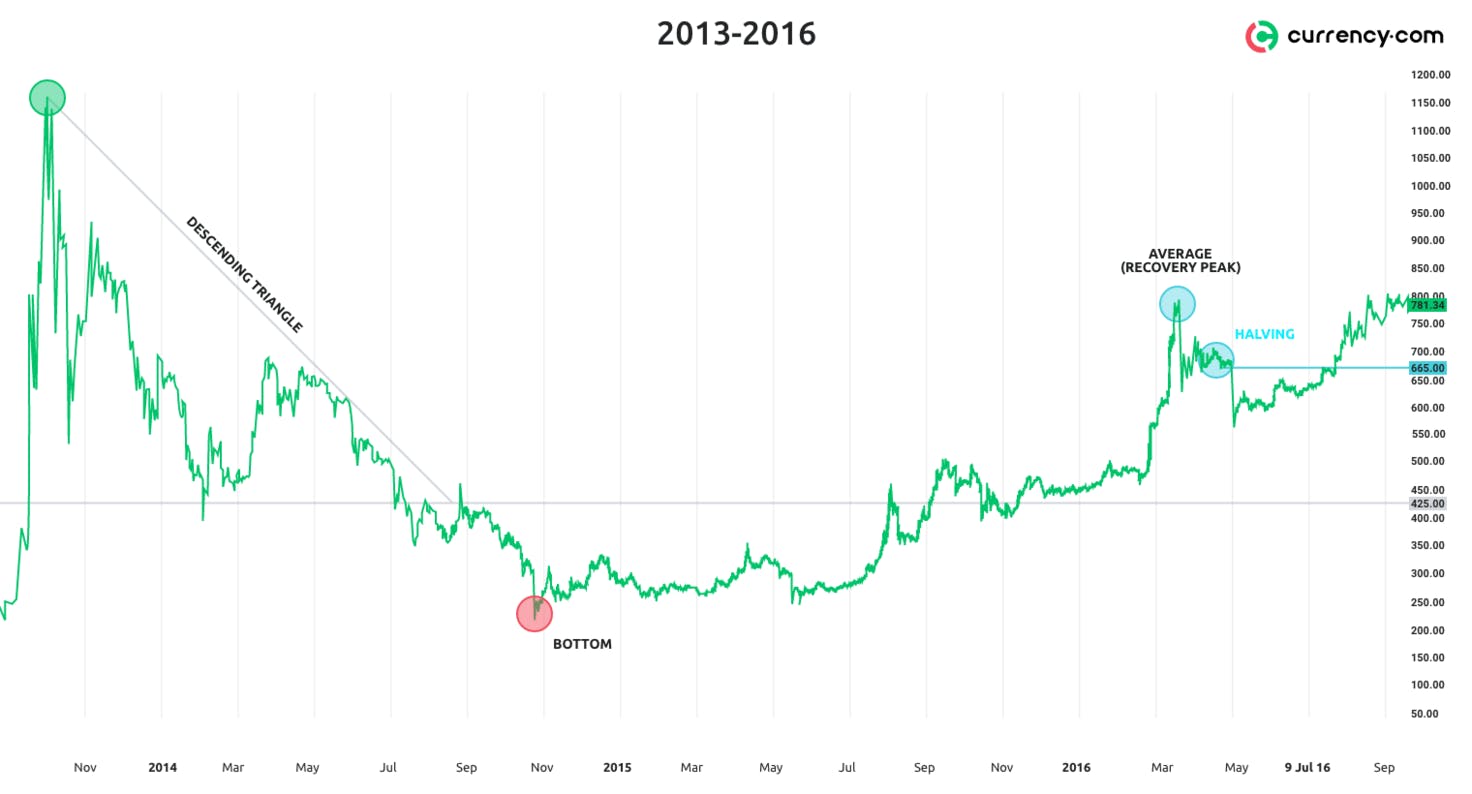

2013–2016

Over the next couple of years, from December 2013 to July 2016, the picture was almost the same (peak — drop — bottom — recovery to average — halving — peak). At that time, the maximum price was $1,177, and the minimum was $163, meaning the average was $784. The price approached the halving at $665. Seventeen months after halving, the price reached a new peak.

2017–2020 (We are here)

In December 2017, Bitcoin reached its all-time high of $20,089, followed by a bearish decline, a bottom at $3,148, and a recovery. The average price obtained from the previous peak is $13,830. If the model described above is correct, then the 2020 halving event would theoretically push the price higher to around the $12,000 level. . But why?

The difference between the price of restoration and the price on the day of halving is usually 9–10%. In 2012, the recovery price was $15, or 46.87%, from the previous peak at $32. The price on the halving day was $12, or 37.5%, from the last spike to $32. The difference between the two values is 9.37%.

In 2016, the recovery price was $784, or 66.6% of the previous peak at $1,177. The price on the halving day was $665, or 56.49%. The difference between the two values is 10.11%.

Following this logic, $13,830 is 69.86% of the peak at $20,089. Respectively, by halving, the price will be approximately 59.8% -60.8% of the peak or $11,836 — $ 12,034, which corresponds to a key resistance level of $12,000, which paves the way for bitcoin to new growth.

But it is worth noting that we have a sample of only two halvings, which is not at all suitable for compiling accurate statistics. Let’s not forget about the demo version of bitcoin, litecoin. Which, after halving the award to the miners, also halved the price.

Summing up, wewants to note that halving is very important for bitcoin, but do not entertain false expectations of a million dollars per coin. May 2020 will most likely not see such levels. Statistics show that the day of halving, the price is at near-average values from the previous peak, which should be about $12,000 on the day of halving in May 2020.

Growth after halving begins almost immediately, but it progresses gradually, updating the historical maximum only after 5–7 months. Also, keep in mind that the halving effect may have been already priced in (“buy the rumours — sell the news”). While the model is sound, other macro conditions such as liquidity influenced by stock and bond markets, regulatory pressures, geo-political events and overall investor sentiment, can play a role in this nascent asset class, so DYOR!

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.