- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

2025 Best Crypto Arbitrage Bots & Platforms for Trading Bitcoin, Ethereum

Ever wondered what a cryptocurrency arbitrage bot is and how you can monetize it? This article breaks down all related concepts and suggests a list of reliable crypto robots you can use to earn.

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Best Crypto Arbitrage Bots & Platforms In 2024

If you are willing to take crypto arbitrage trading for a spin, then you might want to check the best crypto arbitrage bots available. Here’s a list of the most prominent bots.

3Commas

3Commas is one of the top 3 leading crypto bots on the market. In this 3Commas review, we will go over all major features of this crypto trading bot, its main advantages and potential flaws, how it compares to its competition, and what is the best and most efficient strategy to use with 3Commas.

You are convinced crypto is the future and would like to have more of it but you have no budget for bigger purchases nor time for trading and accumulating that way? Ok, then a crypto trading bot like 3Commas might be the solution for you.

Pros

- Smart & Copy trading features, users can copy bots of famous traders in 1 click

- Cloud platform, meaning the bots are up and running no matter what

- User-friendly interface and responsive customer support

- A wide range of automated bots available, fitting any trading strategy

- Well-explained FAQ section

- Allows launching the first DCA bot for free

Cons

- The dashboard might seem a bit overwhelming at the start

- Subscription-based (but has a fully-fledged free version)

Pionex

Pionex is the first free, integrated crypto trading bots exchange worldwide. It was created in 2019 and is one of Asia’s fastest growing platforms with more than 30 million dollars in trade volume daily. It is an automated crypto trading environment. Today there are more than 100,000 users on the exchange, served by a team of over 100 professionals plus the founder and CEO.

The company is licensed under the USA Money Services Business (MSB) with the Singapore Monetary Authority (MAS). Liquidity motors from both Huobi Global and Binance are included so that the crypto trading bots can comply with orders 24/7. BitUniverse has also backed Pionex. This along with the investments of renowned Chinese venture capital firms including ZhenFund and Gaorong Capital has given even more legitimacy to the company.

Pros

- Has a mobile application

- Fully customisable interface

- A set of 12 bots available

- Fees are as low as 0.05% for takers/makers

- Liquidity back-up from Binance & Huobi

- More than 40 funding crypto assets available

- Licensed by US FinCEN

Cons

- No fiat funding

- Poor customer care

Bitsgap

Other automated trading platforms got us accustomed to some mandatory features in a good bot: it should run on a cloud accessible via all devices, it should have arbitrage opportunities, signals, and support a lot of exchanges. Bitsgap does all of that with their platform and adds extra features with arbitrage and demo interface.

The number of supported exchanges is impressive – 25. This fact also means more arbitrage opportunities since there are a lot of exchanges that are tracked and hence there is a high probability of finding a big price difference between them. Bitsgap is a big platform that has a wide range of users.

So Bitgsap is a platform that supports trading, portfolio tracking, arbitrage, signals, bots – a full spectrum of crypto assets services that can be managed from one dashboard. Of course, Bitsgap also has a demo version that you can take for a test ride and try out all your strategies without risking real money.

Pros

- Supports 25 exchanges

- Intuitive interface

- Free trial option

- Advanced dashboard providing market signals

- Fairly easy to start arbitraging

Cons

- Not quite affordable, as the Pro plan costs $149 monthly

- Bots are limited in functions

Coinrule

Coinrule is a smart assistant that helps to build a trading bot in a few easy steps. Coinrule’s approach is unique among competitors. Its logic embraces the needs of all traders, and its user-friendly interface allows everyone to create a trading bot from scratch. All you need to do is to connect your exchange to Coinrule via an API connection. There are detailed guides that will guide you through the process with no hurdles.

You can run multiple bots across all coins available on the market, or all the coins held in the user’s exchange wallet. Thanks to this option, it’s possible to build rules that act as a Global Portfolio Stop Loss or a Global Buy-the-Dip, for example. Including more coins at the same time in a single trading bot significantly increases the possibility to catch more market opportunities.

Even if the bot runs heavy calculations when more coins are added to the strategy, that doesn’t seem to slow down the triggers and the executions. Coinrule is connected directly via WebSocket to each integrated exchange and that translates into low latencies reactions to market moves.

Pros

- Highly customizable

- More than 150 trading presets

- Free trial plan lasting 30 days

- No fees

Cons

- The Pro plan costs $449.99 monthly

- Only supports 10 exchanges, including Binance, Kraken & Coinbase

Quadency

Quadency is a full-fledged cryptocurrency trading platform that offers a single interface for all your crypto needs – from managing portfolio, manual and automated trading to news & research segment for deeper, fundamental portfolio analytics of digital assets you find interesting.

Quadency is suitable for both beginners and professional traders.

Pros

- Features a single price tier

- Integrates 12 different exchanges and supports all major CEX

- Official partners including Binance & Kraken

- Has backtest ability

- A set of 8 Quadency automated bots available

Cons

- Supports only spot trading

- Has no mobile app

Napbots

NapBots, a trademark of Napoleon Crypto Group is a popular crypto trading platform designed with a focus on the most liquid cryptocurrencies. This AI-powered cryptocurrency trading robot came into existence in 2018 and already has more than 100,000 trades executed with over 7,000 community members currently registered on the platform. NapBots offers 20 different highly performing strategies and automated executions on major crypto exchange platforms including Binance Future, Bitstamp, Kraken, and many more.

Napoleon Crypto launched the NapBots trading bot with the help of expert quant traders who previously managed billions of worth of assets at top-tier financial corporations. The platform is under the supervision of professional data scientists, expert traders, advanced developers, and a dedicated customer support team.

Pros

- All the liquid cryptocurrencies are supported including Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, Binance Coin, and EOS.

- Multiple trading horizons are available, which can range from hourly to weekly with the provided uncorrelated strategies

- Provision of several strategies such as the long-only and long-short strategies, trend following, and mean reversal strategies

- Access to top crypto platforms such as Binance Future, Bitfinex, Kraken, Bitstamp, OKEx, or Bitpanda Pro

- Constant development and research run by the company to update and launch new strategies or work on improvements of the already existing ones

Cons

- NapBots requires a paid subscription plan with three subscription pack options. The price ranges between 7 to 99 euros per month

- Relatively complicated set-up even with the help of the tutorials. Some traders complaint that they were confused during the set-up procedures

- In total, Napbots takes in commission around 2% monthly or 24% management fees per annum depending on your subscription pack, which is more expensive than the market average

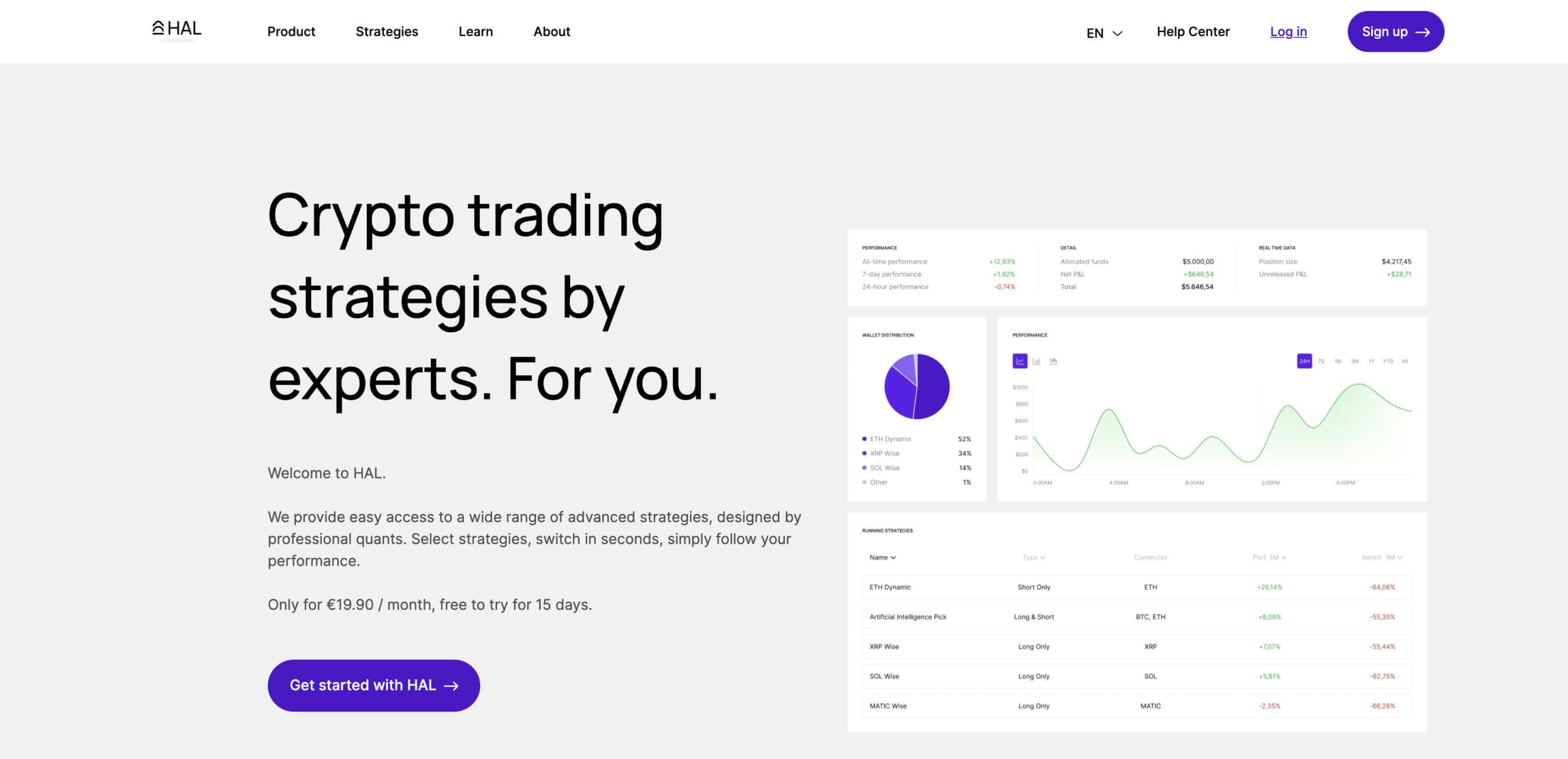

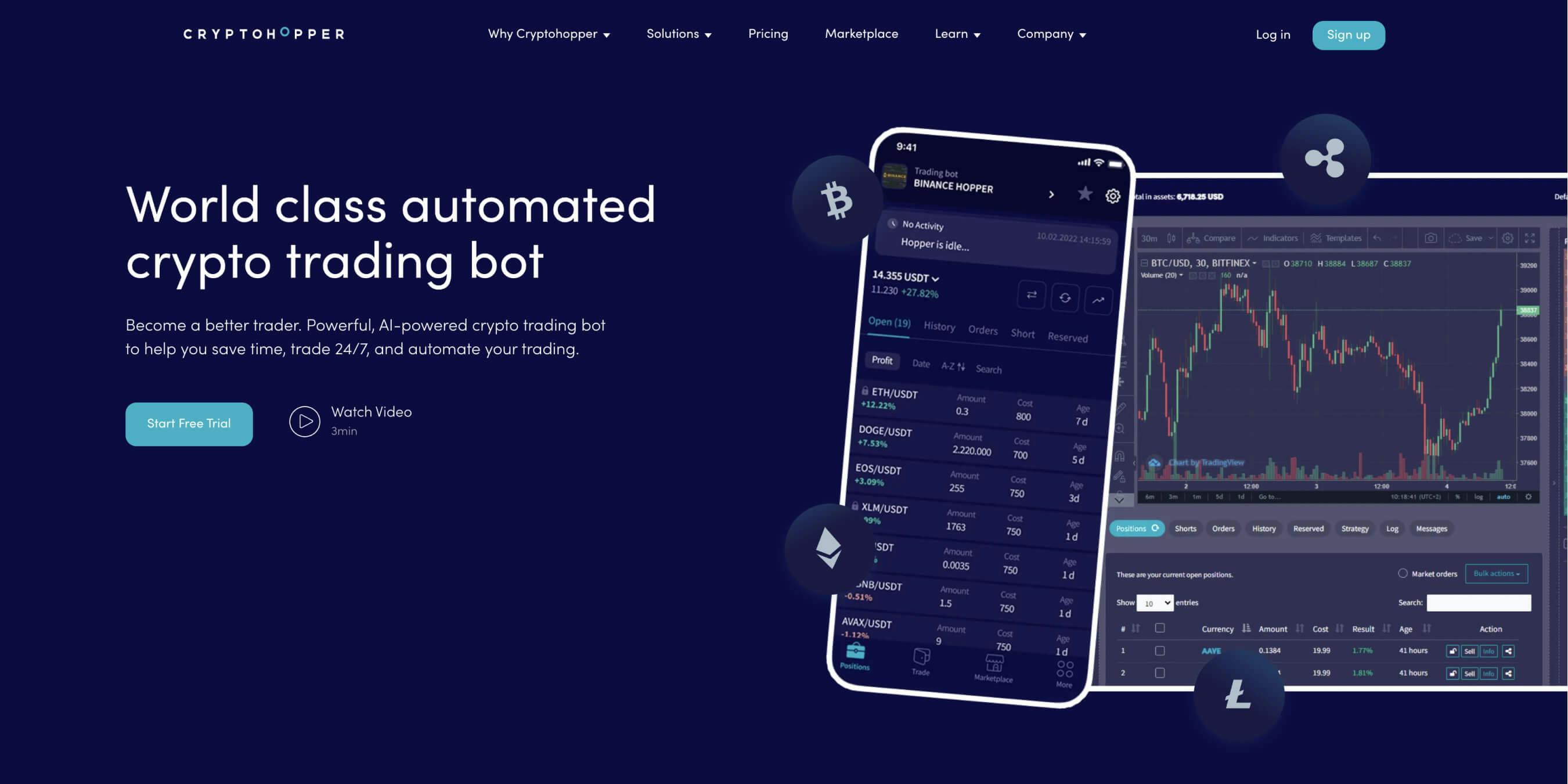

Cryptohopper

Pros

- Crypto can be traded on any of the partner exchanges from the terminal

- Profitable partnership and investment program

- Service for copying transactions and auto-trading bots

- A wide range of trading instruments

- Can connect accounts from diverse exchanges

- Significant trading volume

- Has a large signal marketplace

Cons

- Free version lacks functionality

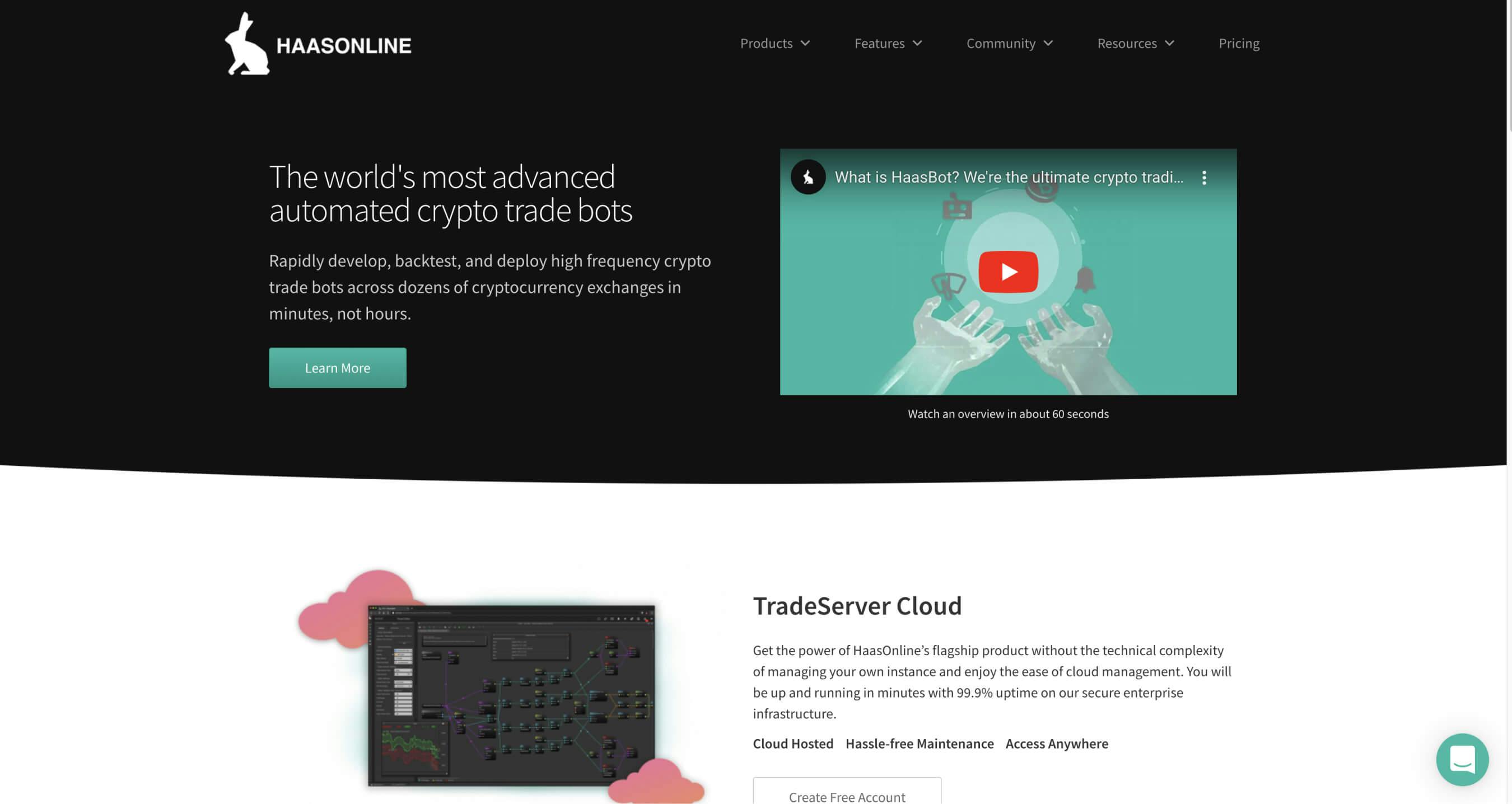

HaasBot

HaasBot is both a premium cryptocurrency trading robot and the “premier feature of the HaasOnline Trade Server”. HaasOnline is the website and parent company behind the HaasBot cryptocurrency trading robot.

As a cryptocurrency trading robot, HaasBot offers users a wide selection of options that will help traders maximize profits from the volatile crypto market. This robot is one of the most established trading robots with the best algorithms in the industry. With the platform’s ability to let you place trades without restrictions and partner with several exchanges, the chances of making profits are increased.

The parent company, HaasOnline, has been present in the cryptocurrency market since 2014, just 5 years after Bitcoin was launched. The company was established with the primary aim of helping cryptocurrency enthusiasts, professional traders and institutional investors find a better bearing in terms of their trades. With a plethora of trading strategies and lots of other advanced automated trading functions, the company helps you hedge risks and make more profits.

Continue reading this HaasBot review to find out the most unique features of the HaasBot cryptocurrency trading robots, the potential downsides, and some of the working products already in use across different trading platforms.

Pros

- A wide range of crypto assets and trading indicators

- Multiple exchanges & trading robots are available

- Comes with a free trial license lasting up to 14 days

- No trading volume limits

Cons

- Сomplex customization, as it lacks user-friendly guidance

- More expensive compared to other bots

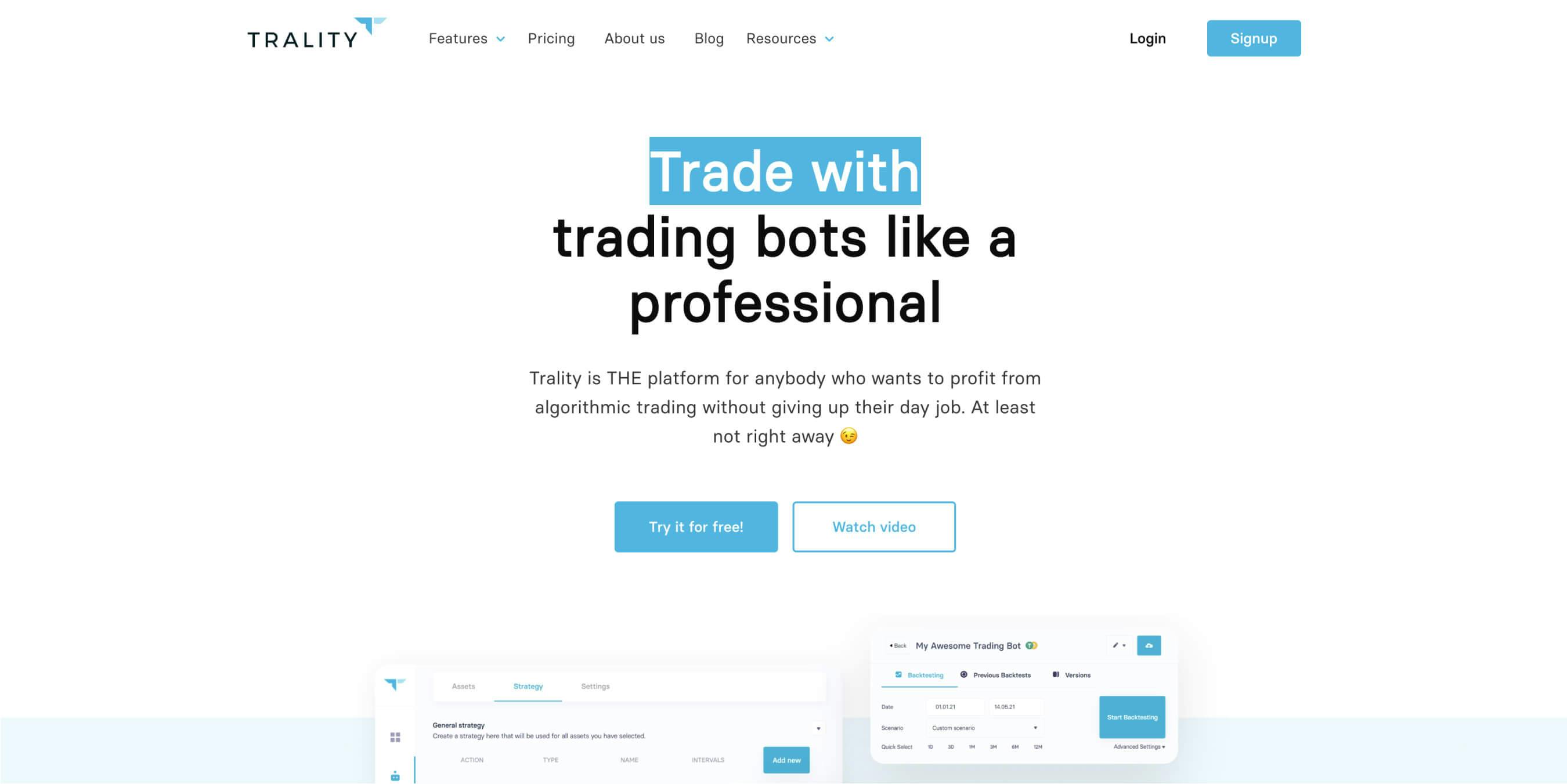

Trality

The Trality platform has become popular due to its flexibility and ease of use. In addition to its user-friendly interface, the platform promotes learning and advancement for crypto traders within its community driven infrastructure.

Another great advantage of the Trality platform is its paper trading and backtesting capabilities. The Trality platform lets you see how your trading strategies and algorithms would have performed historically and then practice trading using virtual money before you commit any funds. This feature also lets you save your backtesting history, and the platform provides a wealth of historical information. You can also use many different algorithmic testing scenarios, including custom time frames.

The platform’s 2 main tools are the Rule Builder and the Code Editor. The Rule Builder lets you design and build a trading bot by simply dragging and dropping different indicators and strategies. The Code Editor is geared towards traders familiar with Python coding and lets them use their coding knowledge to build custom algorithms for more advanced strategies.

Pros

- In-browser Python code editor

- Drag-and-drop rule builder interface

- Bot creation from scratch

- Good pick for pro traders

- Cloud-based access

Cons

- Lacks exchanges

- No mobile app

GunBot

GunBot is another crypto arbitrage bot designed to bootstrap your yields through routine automatization. It focuses on buy and sell methods, which define when the bot is allowed to place orders. There are 15 strategies available to start off arbitraging right away, and an unlimited number of options to build by yourself.

The pricing plans are flexible yet different when compared to other bots, as GunBot offers life-time plans unlike commonly used monthly subscriptions or fixed packages.

Pros

- High-value software provider for beginners & intermediate arbitrageurs.

- Wide range of funding options

- Ever-growing variety of assets available to trade.

- Supports over 11 crypto exchanges, including margin trading opportunities

- Advanced customer support system

- Provides a fully-fledged demo version to test the platform

Cons

- Package offers are one-time purchases only

- Hardly suitable for newbies

- No trial account

- Not cloud-based, which makes it vulnerable

- Doesn’t make any profit-related claims

Shrimpy

Shrimpy is an excellent choice for arbitrage bot trading if you want to bootstrap your crypto trades to the next level. It’s the leading tool in the portfolio rebalancing market, thanks to its user-friendly interface, customer support, and multiple features.

You don’t have to log in separately to each crypto exchange to perform buy and sell trades, as the portfolio manager allows you to allocate your overall portfolio using simple percentages with a visual snapshot and statistics. Instead, you can automatically adjust the allocation of each asset based on the market by changing the percentages which will execute the trades on your behalf. Shrimpy offers a free trial to test out features first, while the paid packages include automatic portfolio rebalancing, strategy optimizing and back-testing tools. Shrimpy is currently supporting over 16 major crypto exchanges and the number of partners only grows.

Pros

- No trading fees

- Connects multiple crypto trading exchanges into the one platform

- Manages your entire crypto portfolio with a user-friendly interface and tools

- Tracks your portfolio performance and automatically adjusts investment strategy

- Provides copy trading

- Growing social trading community & rewards

- Automates trading strategies using various indicators and crypto tools

Cons

- Doesn’t provide trading signals in any form

What Is Crypto Arbitrage?

Crypto arbitrage is price speculation to make money on it. In other words, you’re buying a digital asset like Bitcoin, Ethereum or any other crypto on one platform and selling the same asset on another platform for a higher price. The difference in price is your profit.

The core difference between crypto and traditional arbitrage is volatility associated with crypto. Most crypto assets are more volatile than traditional assets, implying potentially higher profits but also slippage risks. Which is why performing crypto arbitrage trades manually is often too slow to succeed, so arbitrage trading bots are often used in crypto markets as well.

Differences in price for the same asset are usually very miniscule, so traders seeking to profit from crypto arbitrage need to trade large volumes very quickly. Which in turn requires a trader to have multiple accounts across several exchanges, funds available on each exchange, and a special account for deposit/withdrawal fees. Arbitrage has a high entry barrier, but still attracts savvy traders.

How Does Cryptocurrency Arbitrage Work?

Remember the major UST nosedive? It was a clear arbitrage opportunity as the price was inconsistent across multiple exchanges. Imagine you buy UST at the rate of $0.5 and sell it for $0.55 per UST over the short term. You would make $0.05 per UST traded, or $50 gains for 1000 UST.

You could perform the trade either on the same exchange or use multiple platforms, as there are two main types of arbitrage trading:

- Triangular arbitrage: You arbitrage within a single exchange, a.k.a. cross-currency arbitrage. This type usually involves two main arbitrage assets and a third asset for withdrawal of your profits.

- Spatial arbitrage: You trade an asset simultaneously on > 2 exchanges. This type implies trading the same asset on at least two exchanges, accumulating crypto as profits. Spatial arbitrage is a more popular strategy compared to single-exchange arbitrage.

What Are The Pros and Cons of Crypto Arbitrage?

Arbitrage has pros and cons as any other business. Here’s a quick breakdown.

Crypto Arbitrage Pros

- Flexibility. You can arbitrage remotely and anytime from anywhere in the world

- Reliability. Limited risk of losing your funds, as price fluctuations drop and recover fast

- High gains. Fast and steady returns per arbitrage session. On average, you can make as high as 4% of your capital within an hour.

- Crypto as a market. Crypto trading is still unregulated and inconsistent, meaning the legal information across CEX is transferred slowly, which is double as important for panic events like the recent UST depeg. There are also fewer arbitrageurs compared to stock, bond, or any other investment market.

Crypto Arbitrage Cons

- Blocking cards. You will need a spare bank card in your pocket, as there is a chance of blocking due to high turnover in the account.

- Required speed. Price gaps usually don’t last very long. You need to be attentive to monetize the opportunities.

- Price Slippage. When a transaction costs more than you expected to pay, it can wipe out your profits. Slippage happens if your order dams the cheapest offer on the order book.

- Fees. Arbitrage is associated with multiple deals on a regular basis, each sucking out money in the form of fees. Even average fees can anchor your profits, especially if margins are low.

How To Choose A Cryptocurrency Arbitrage Platform

Web is full of arbitrage platforms, but not all of them are built equal — some vary significantly in terms of trading strategies, others focus on quality but lack affordable plans, while the rest provide neither of the above. Let’s break down key components that might play a big role when you opt for an arbitrage platform.

Safety

Regardless of the platform, you’ll have to share your wallet keys and account data with the bot. Which is why it’s extremely important to pick a rock-solid software provider able to protect your data no matter what. Here are some tips to follow:

- Avoid applications with a poor review score or no

- Steer clear of applications with no security audit reports

- Make sure to disable auto-withdrawal functions on accounts you grant access to

- You might want to prefer open-source over anything else, as it’s the most reliable option

Community is yet another significant placeholder, as it plays an essential role in helping you spot a safe app. Any business is about people building, surrounding, and following it. If the app yields good results, people will follow and form a vast fanbase along the way.

That’s why you should always keep reviews in mind. An excellent way to find some valuable, reasonable, and reliable comments is Reddit. The number of people following a bot also matters, but the size of arbitrage communities is tiny. You might want to pick a bot with at least several thousand followings. Otherwise, you risk running into a scam.

Bots with fewer followers are not necessarily some sort of scheme, but it might be challenging to solve software-related issues if you have no one to share with. The community can help, and it usually does so even faster than customer support.

Exchanges Supported By The Crypto Arbitrage Bot

Arbitrage strategies tend to be more effective if a trader uses many platforms and assets. The logic is pretty straightforward: more platforms = more assets traded = more arbitrage opportunities. As a result, experienced traders are looking for software supporting as many crypto exchanges as possible.

Any crypto arbitrage software should have integration with exchanges like Binance, Coinbase Pro, Kraken, OkeX, Gemini, Huobi, KuCoin — the more, the better. A prominent example would be 3Commas supporting 23 major exchanges.

Price Justification Of Crypto Arbitrage

Even the best bot won’t make you profits if it’s too expensive, as such bots might eat out all the money you made. Which is why the software’s cost, trading fees and commissions are important criteria when it comes down to arbitrage.

As a rule of thumb, the more you pay for software, the more functions it provides. You should find software that provides free features first, so you can try them out and decide whether you want to proceed. Once you like some features, you can pick a cheap paid plan for the second test.

Most go-ahead platforms provide monthly subscription plans to avoid overcharging. In other words, try to find a platform that won’t charge you too much for using the arbitrage functions. If a platform provides only a one-time payment or any kind of life-long packages, that’s a red flag for sure.

Simplicity

Unless you're a veteran trader & programmer, you should focus on simple platforms requiring no technical skills. Some platforms are more user-friendly than others, and you should take that into account when picking an arbitrage bot.

Bots like Blackbird target pro traders and programmers, implying you would need coding skills to customize and adjust trading strategies, track some data, etc. Not to mention ununified interfaces, forcing traders to use external services like data aggregators and charts.

Easy-to-use bots provide access to a wide range of crypto tools under the platform’s roof, so you don’t have to switch tabs each time. It might seem small, but the difference in the complexity, functions at hand, and the automated processes available might play big numbers over the long run.

Backbone Software

Arbitrage is the game of speed, as the difference in the price is all about fractions of a second.

Therefore, the arbitrage software must operate as fast as possible to spot, process, and carry out such opportunities. Moreover, bots compete with each other because the price gaps are quite limited in volume. Only the fastest and most reliable bots can monetize on price divergence.

A cloud-based bot is a good way to start, as it implies a software provider has an established server structure that won’t let you down. Most cloud-based providers are fast enough to embrace 99% of arbitrage deals.

Closing Thoughts

Crypto arbitrage is a great opportunity to make stable income from cryptocurrency if you understand what you are doing. In practice, this means that there are a number of pitfalls that you should consider in order to make money in this direction.

As a rule, the technical component is the main difficulty of arbitrage, because the profit depends directly on the ability to find and implement information in the shortest possible time. In order to avoid having to do it manually, you can use a customized bot, which will execute specific instructions in a predetermined price range. In this way, you will minimize your risks and increase your chances of making a profit.

But you should always remember that the market is full of inefficient and outright fake bots, which can empty your wallet. You should not be deceived by free programs and cheap services because it is very dangerous and can lead to the loss of all your funds. Instead of taking your word for it, you can choose arbitrage bots with positive reviews like 3Commas.

FAQs

Crypto arbitrage bots might drive a cash flow despite the market’s conditions because each market always has price divergence across its assets. Automated bots monetize such assets much quicker than human traders.

Arbitrage bots can be profitable if the price differences exist. Instead of doing the transactions by yourself, you delegate tasks, which might accelerate the process and boost the efficiency.

Arbitrage is a legal market opportunity. Since software merely automates these opportunities, crypto arbitrage is 100% legal activity.

Your ideal Bitcoin arbitrage bot might change based on your preferences. Some notable bot software providers include 3Commas, HaasBot, Pionex, and more.

Each coin might be an excellent opportunity to monetize. More popular coins with higher liquidity have a smaller chance for a price gap, while smaller coins tend to differ in price more frequently.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.