- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Crypto Staking 101: A Popular Way to Earn Passive Income in 2025

Staking allows crypto holders to put their cryptocurrencies to work and earn passive income without selling their digital assets. Read on to learn how crypto staking works.

- Understanding Crypto Staking

- What is Crypto Staking?

- How Does Crypto Staking Work?

- Cryptocurrencies You Can Stake

- How Can You Start Staking?

- What is Proof of Stake?

- Joining a Staking Pool

- Risks of Crypto Staking

- How Profitable is Staking?

- Why Can’t You Stake All Cryptocurrencies?

- When You Should or Shouldn’t Stake Cryptocurrency

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

In the ever-evolving world of cryptocurrencies, the concept of earning passive income has gained significant attention. One of the most popular methods for achieving this is through crypto staking. In this comprehensive guide, we will delve into the intricate world of crypto staking, demystifying the process, understanding its mechanisms, and exploring the cryptocurrencies that allow you to participate.

Understanding Crypto Staking

At its core, crypto staking involves harnessing the power of your cryptocurrencies to support a blockchain's operations and, in turn, earn additional cryptocurrency as rewards. This process primarily thrives on the proof-of-stake (PoS) consensus model, an eco-friendly alternative to the energy-intensive proof-of-work (PoW) mechanism used by cryptocurrencies like Bitcoin.

Participants in crypto staking, often referred to as validators or stakers, play a vital role in validating transactions and adding new blocks to a blockchain. However, this role comes with a certain level of risk. Validators stake their own cryptocurrency as collateral, which can be partially or entirely forfeited if they make errors in validating fraudulent data. Conversely, successful validation of legitimate transactions earns them cryptocurrency rewards.

The Inner Workings of Crypto Staking

Crypto staking primarily operates on the PoS consensus model, a system that ensures the integrity of the network by making malicious activities costly for validators. Validators are incentivized with rewards, usually in the form of the native cryptocurrency, for their commitment to the network. The more cryptocurrency they stake, the higher their chances of proposing new blocks and earning more rewards.

Moreover, crypto staking doesn't require individual stakeholders to stake their own cryptocurrencies exclusively. In most cases, validators join forces in staking pools, gathering funds from various token holders through delegation. This approach not only lowers the entry barrier but also encourages broader participation in staking. Anyone who holds cryptocurrency can partake in this rewarding venture by delegating their assets to stake pool operators.

However, maintaining order in the crypto staking ecosystem is essential. Validators face potential penalties for even minor infractions, such as prolonged offline periods, resulting in the freezing or loss of their funds. This process, known as "slashing," has been witnessed in blockchains like Ethereum and Polkadot.

Cryptocurrencies Open for Staking

Several cryptocurrencies offer the opportunity for staking, each with its unique features and rewards. Here are a few notable examples:

- Solana (SOL): Solana's native token, SOL, powers a smart contract platform designed for decentralized applications (dApps). Validators and delegated stakers contribute to the Solana network's stability and are eligible for staking rewards.

- Cardano (ADA): Cardano, a third-generation blockchain platform, facilitates smart contract execution using ADA, its native currency. Cardano's staking system allows users to earn passive income by delegating stakes and participating in stake pools.

- Polkadot (DOT): Polkadot is a blockchain interoperability protocol that connects multiple chains into a unified network. Users can choose to validate transactions or observe validator behavior to earn staking rewards through Polkadot's nominated proof-of-stake (NPoS) consensus algorithm.

Getting Started with Crypto Staking

While crypto staking may initially appear daunting, it is relatively straightforward once you grasp the basics. Here's a step-by-step guide:

- Acquire a Proof-of-Stake Cryptocurrency: Begin by researching and purchasing a cryptocurrency that operates on the PoS model. Familiarize yourself with its staking processes, rewards, and workings.

- Transfer to a Blockchain Wallet: Ensure your cryptocurrency is stored securely in a blockchain wallet, providing added protection and control over your assets.

- Join a Staking Pool: Most PoS cryptocurrencies utilize staking pools, where you can stake your cryptocurrency through your wallet to increase your chances of earning rewards.

- Evaluate Risks: Understand the risks associated with crypto staking, including liquidity risk, market risk, validator costs, and the potential for loss.

The Potential of Crypto Staking

Crypto staking presents an opportunity to earn passive income, with interest rates sometimes exceeding 10% or 20% annually. It's a profitable way to invest your cryptocurrency, provided you carefully assess the associated risks.

In conclusion, crypto staking has become a favored avenue for cryptocurrency enthusiasts looking to grow their holdings without the need to actively trade. By embracing the PoS consensus model and exploring cryptocurrencies like Solana, Cardano, and Polkadot, you can embark on a journey toward financial growth and sustainability in the ever-evolving landscape of digital assets. Whether you are a seasoned crypto investor or a newcomer, this guide will empower you with the knowledge and tools to navigate the world of crypto staking with confidence.

Staking is a term you'll hear a lot as a cryptocurrency investor. Crypto staking is a process through which many cryptocurrencies verify their transactions and allows participants earn passive income on their cryptos.

Cryptocurrencies that execute their transactions via the proof-of-stake model can be staked. Unlike the proof-of-work mechanism, the proof-of-stake model uses less power.

Some cryptocurrencies have very high-interest rates for staking, making it a great way to earn passive income. It is important to understand how crypto staking works before getting started. That is what this article will achieve.

What is Crypto Staking?

Crypto staking involves temporarily locking cryptocurrencies for a predetermined period to support a blockchain’s operation. It allows participants to earn more cryptocurrency.

The proof-of-stake consensus model is widely used by blockchains. Those who wish to "stake" cryptocurrency to validate transactions and add new blocks to the blockchain are required to do so under this system.

The practice of staking aids in the verification of transactions and data to be added to a blockchain. Staking is a type of insurance in which people lock up amounts of cryptocurrency in exchange for the chance to validate new transactions.

They risk losing all or part of their investment if they make an error validating potentially fraudulent data. However, they receive more cryptocurrency rewards for validating correct, legitimate transactions and data.

How Does Crypto Staking Work?

As stated earlier, staking is possible through the proof-of-stake consensus model. This is a method that allows some blockchains to choose honest nodes and make sure that new blocks of data are added to the network.

The process discourages dishonest practices in the network by making it costly for validators, (also called "stakers"), to acquire and hold a predetermined number of tokens. If anyone corrupts the blockchain via any malicious activity, the value of its native token would go down, costing the person or people who did it money.

Validators are incentivized with rewards in the native cryptocurrency for their commitment. The more one stakes, the higher the chance they have to propose a new block and earn more rewards.

The stake does not need to contain just one person’s cryptocurrencies. In most cases, validators coordinate a staking pool to gather funds from token holders via delegation, thereby lowering the entry barrier and making it easier for more people to take part in staking. Anyone who owns crypto can take part in staking and earn rewards for participating in verifying blockchain transactions through the delegation of their cryptocurrencies to stake pool operators.

To maintain order, validators can be punished for even minor issues, such as going offline for an extended period, by being removed from the consensus process and having their funds frozen or lost. The latter refers to "slashing," and it has occurred on a few blockchains, like Ethereum and Polkadot.

Cryptocurrencies You Can Stake

Solana (SOL)

The Solana (SOL) blockchain-based smart contract platform is designed for deploying dApps (decentralized applications). Its native token, SOL, can be used to execute on-chain transactions and settle network fees.

Those who contribute to the Solana network as validators or delegated stakers are eligible to receive staking rewards. The Solana network relies on its validators, who handle transactions and maintenance. SOL holders that give their SOL tokens to stake pool operators in exchange for staking rewards are known as delegated stakers.

If you're a validator, you're responsible for keeping a validation node (also known as a "cluster") online and running at peak performance. Slashing is a feature of Solana and occurs when validators are either malicious or perform poorly. Validators can charge delegators commission fees to help cover the cost associated with running a cluster.

Cardano (ADA)

Cardano (ADA) is a "third-generation" blockchain platform that aims to facilitate the creation and execution of smart contracts. Cardano's native currency, ADA, is used for rewarding network security and facilitating transactions on the network.

Cardano's staking system allows users to earn passive income by delegating stakes and running a stake pool. Staking pools let people with ADA delegate their ADA without having to run a node or use special hardware.

Stake pool operators are responsible for managing all aspects of a stake pool. Individuals who can reliably operate a network node are essential to the safety of the network as a whole. Since the chances of being chosen as a "slot leader" increase with the total amount of ADA staked, the Cardano network employs game theory to determine which stake pool will create the next block on the chain.

When a pool is chosen as slot leader and validates a transaction block, it receives a reward, which is then split among stake delegators.

Polkadot (DOT)

Polkadot is a blockchain interoperability protocol that links multiple chains into a single network. This lets different chains process transactions and shares data at the same time. DOT, the native token of Polkadot, is primarily used for governance, staking, and connecting to new "parachains."

With Polkadot's nominated proof-of-stake (NPoS) consensus algorithm, users can choose between validating transactions on the network and watching the behavior of validators to earn staking rewards.

Slashing also occurs on this blockchain when a validator does something malicious. When such occurs, both the validator and the person who nominated them to lose their staked DOT.

How Can You Start Staking?

Crypto staking can seem complicated at first but it’s quite easy once you get the hang of it. The following is a step-by-step guide for staking cryptocurrency:

Buy crypto that uses the proof-of-stake model

Not all cryptocurrencies can be staked; you'll need one that uses proof of stake to validate transactions.

You should start by researching the various proof-of-stake cryptocurrencies you're interested in to learn more about how they work, their stake rewards, and their staking processes. Once you understand these, you can then search for the crypto you want and buy it on cryptocurrency exchanges and apps.

Transfer the cryptocurrency to a blockchain wallet

A cryptocurrency can be staked on the same exchange where it was bought, as some exchanges offer their staking programs for certain coins.

Blockchain wallets, also known as crypto wallets, are widely regarded as the most secure places to keep cryptocurrencies. The quickest way to get a wallet is to use a free software wallet, but you can also buy hardware wallets.

Select the cryptocurrency you wish to deposit into your wallet and click the "Generate Wallet Address" button. Paste this address into your exchange account, and your crypto will be transferred from the exchange to your wallet.

Join a staking pool

Most cryptocurrencies use staking pools where crypto traders pool their resources to increase their chances of earning staking rewards. Once you've found a pool, all you have to do to start earning rewards is stake your cryptocurrency to it through your wallet.

Before joining a staking pool, you need to consider the pool’s APY, rewards, risks, and lock-in period.

What is Proof of Stake?

Proof of stake is a process through which many cryptocurrencies verify transactions. Cryptocurrencies use this method to verify transactions since they are decentralized and not controlled by a financial institution.

In proof of stake, crypto holders stake their coins in exchange for the right to verify and add new blocks of transactions to the blockchain. It is an alternative way for validating cryptocurrency transactions. It is also an energy-efficient alternative to proof-of-work, which is the first consensus mechanism that was developed for cryptocurrencies.

Joining a Staking Pool

Joining a staking pool that is run by another user is an alternative to giving your staking decisions to an exchange. You'll need to understand how crypto wallets work and how you can connect them to the validator's pool before you can do this.

It is important to consider a validator’s track record before joining a staking pool. You can see if a pool operator has been fined in the past for mistakes or malicious acts. Some even detail their terms and conditions protecting participants that delegate tokens, among other details like the commissions or fees.

You should also choose an established pool. However, you might not want to go for the biggest pool. Since blockchains are meant to be decentralized, there is no need for a single group to have too much influence.

Risks of Crypto Staking

Liquidity Risk

If you stake a micro-cap altcoin with low exchange liquidity, it may be hard to sell your asset or trade your staking returns for bitcoin or stablecoins. Liquidity risk can be reduced by staking assets with high trading volumes on exchanges.

Market Risk

When participants stake their cryptocurrencies, they risk a decline in the price of the asset or assets staked.

For instance, if you stake an asset and earn 20% APY, but its value drops by 60% over the year, you will end up losing money.

Therefore, cryptocurrency investors should not base their staking asset decisions solely on annual percentage yield (APY) figures but rather on a variety of other factors.

Validator Costs

In addition to the risks that come with running a validator node or giving staking to a third-party service, staking cryptocurrency costs money.

Staking with a third-party provider usually costs a few percentage points of the staked rewards, while running your validator node will cost you money for hardware and electricity.

Loss

If you don't take appropriate precautions, you could lose access to your wallet's private keys or have your funds stolen.

Regularly back up your wallet and keep your private keys in a secure location, whether you are staking or "hoarding" your digital assets.

Staking with apps (where you have control of the private keys) is better than staking with services that hold your private keys for you.

How Profitable is Staking?

The main benefit of staking is to earn passive income. Hence, crypto staking is a profitable way of investing money. The interest rates can be quite high; in some cases, they can be more than 10% or 20% per year.

Why Can’t You Stake All Cryptocurrencies?

Not all cryptocurrencies can be staked. Only cryptocurrencies that use the proof-of-stake model can be staked. Many cryptos use the proof-of-work model to add blocks to their blockchains, which has the drawback that it requires a lot of computing power.

When You Should or Shouldn’t Stake Cryptocurrency

If you have cryptocurrency that you can stake but don't intend to trade it anytime soon, you should stake it. Staking requires no effort on your part, and you'll earn more cryptocurrency as a result.

What should you do if you do not have any crypto to stake at the moment? Considering the gains that staking can offer, it's worth finding cryptocurrencies that can be staked. This is possible with a lot of cryptocurrencies, but make sure to check if each one is a good investment before buying it.

The proof-of-stake consensus model is not only beneficial to crypto investors, but also to cryptocurrencies. Cryptocurrencies can use proof-of-stake to validate large volumes of transactions at low costs. Since you now have a good knowledge of what staking entails, you can start researching cryptocurrencies that can be staked.

2025 Trends: Restaking, Liquid Staking, and Automation in Staking Strategy

In 2025, staking has become more sophisticated—both in terms of protocol structure and portfolio integration. While the basics of proof-of-stake remain intact, strategies now involve restaking protocols, liquid staking derivatives (LSDs), and cross-protocol automation. These developments are particularly relevant for traders and asset managers using automated crypto trading software to optimize capital deployment across yield-generating opportunities.

Restaking—a new frontier in staking utility—enables users to reuse the same staked assets to secure multiple networks. Protocols like EigenLayer have introduced programmable trust systems that allow ETH to simultaneously secure middleware and emerging decentralized infrastructure layers. This practice can create higher potential returns, but it also introduces greater complexity and operational risk. Asset managers evaluating restaking allocations must factor in smart contract risk, validator slashing conditions, and potential liquidity fragmentation.

Liquid staking derivatives (LSDs) such as those offered by Lido, Rocket Pool, and Ether.fi have become the default choice for institutions seeking exposure to staking yields without locking up liquidity. These assets—like stETH or rETH—are often integrated into auto crypto trading bots and AI crypto trading software to dynamically rebalance portfolios or collateralize yield-generating positions. The ability to automate staking allocation through a bot for cryptocurrency trading or auto trading bot crypto has become essential for managing risk-adjusted returns in real time.

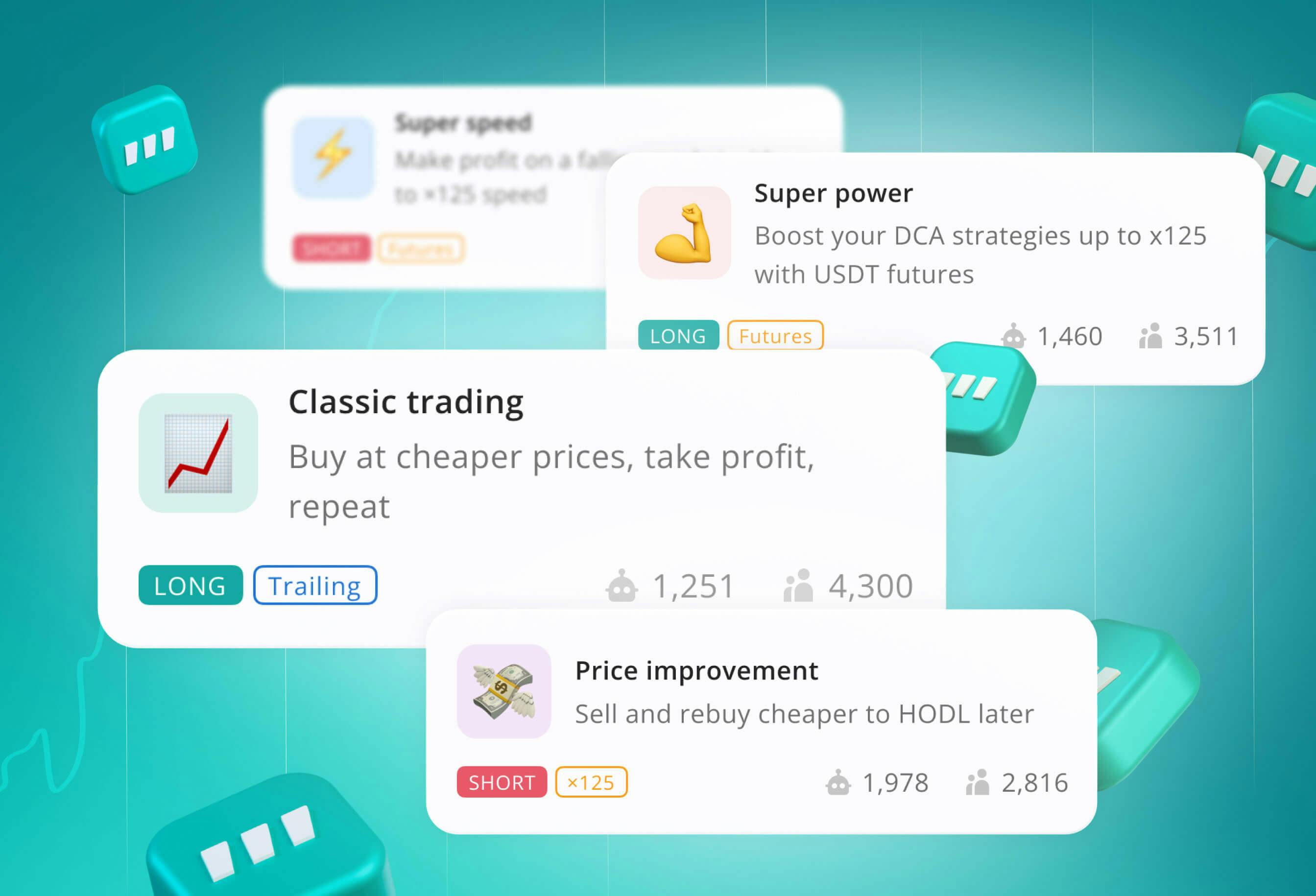

Meanwhile, the integration of staking data into AI bot trading crypto platforms like those offered by 3Commas gives professional traders access to consolidated performance views, alert systems, and customizable triggers. These tools help synchronize staking positions with broader automated crypto trading strategies—whether through DCA bots, Grid Bots, or multi-asset rebalancers.

As the crypto staking landscape continues to mature, professional-grade solutions are evolving from passive yield setups into fully integrated strategy layers. Traders and asset managers using AI crypto bots or automated trading bot cryptocurrency solutions should carefully evaluate how staking fits into broader portfolio logic, especially when liquidity, governance exposure, and multi-chain interoperability come into play.

Crypto Staking FAQ

If you already own some cryptocurrency, you can use it to validate other people's transactions on the blockchain network and earn more cryptocurrency in the process. Hence, staking can be a means through which crypto holders can earn passive income.

The decision to stake your cryptocurrency may be determined by your confidence in its long-term value. For instance, If you trust the Ethereum network, the daily fluctuations in price may not force you to sell.

Crypto staking involves temporarily locking up cryptocurrency to receive rewards or earn interest as a form of passive income. This is made possible by blockchain technology, which verifies cryptographic transactions and stores the resulting data.

READ MORE

- Understanding Crypto Staking

- What is Crypto Staking?

- How Does Crypto Staking Work?

- Cryptocurrencies You Can Stake

- How Can You Start Staking?

- What is Proof of Stake?

- Joining a Staking Pool

- Risks of Crypto Staking

- How Profitable is Staking?

- Why Can’t You Stake All Cryptocurrencies?

- When You Should or Shouldn’t Stake Cryptocurrency