- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

How to Streamline Your DeFi Trading Strategy With Uniswap Trading Bot in 2025

Discover the benefits, risks, and strategies of using a Uniswap trading bot. Automate your trades and optimize your performance in the Uniswap ecosystem.

- Overview of Uniswap Trading Bot

- Benefits of Using a Uniswap Trading Bot

- Key Features and Functionalities of Uniswap Trading Bots

- Risks and Challenges of Uniswap Trading Bots

- Technical Complexities and Potential Vulnerabilities

- Smart contract risks

- Software glitches

- Market Volatility and Unpredictable Price Movements

- Impermanent loss

- Flash crashes and whipsaws

- Regulatory Considerations and Compliance Issues

- Regulatory uncertainty

- Know Your Customer (KYC) and Anti-Money Laundering (AML)

- Over-Reliance on Automated Strategies

- Limited adaptability

- Emotional and psychological factors

- Best Practices for Using Uniswap Trading Bots

- Examples of Successful Uniswap Trading Bot Strategies

- Conclusion

- Leveraging AI-Driven Automation for Advanced Uniswap Trading in 2025

- Strategy Optimization with Hooks in Uniswap v4

- Trading Scenario 1: Fee Tier Automation in Volatile Pairs

- Custom Liquidity Strategies at the Pool Level

- Trading Scenario 2: Reactive Range Rebalancing for Stablecoin Pairs

- Intelligent Order Execution and Aggregation

- Scenario 3: Multi-Asset Portfolio Execution During Rebalancing Windows

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

In recent years, the DeFi (decentralized finance) world has experienced significant growth, with Uniswap emerging as a key decentralized exchange (DEX) protocol. Users can trade cryptocurrencies directly from their wallets using Uniswap, thereby providing a decentralized and permissionless trading experience.

As Uniswap trading volumes and liquidity continue to increase, traders are resorting to automated solutions to maximize their trading potential. Trading bots offer several benefits to Uniswap traders, including automation, increased productivity, and higher precision.

Understanding the essence of trading bots in the Uniswap ecosystem is important for traders trying to maximize their trading potential and remain competitive in the ever-growing DeFi landscape.

This article explores the concept of Uniswap trading bots and their significance in the Uniswap ecosystem.

Overview of Uniswap Trading Bot

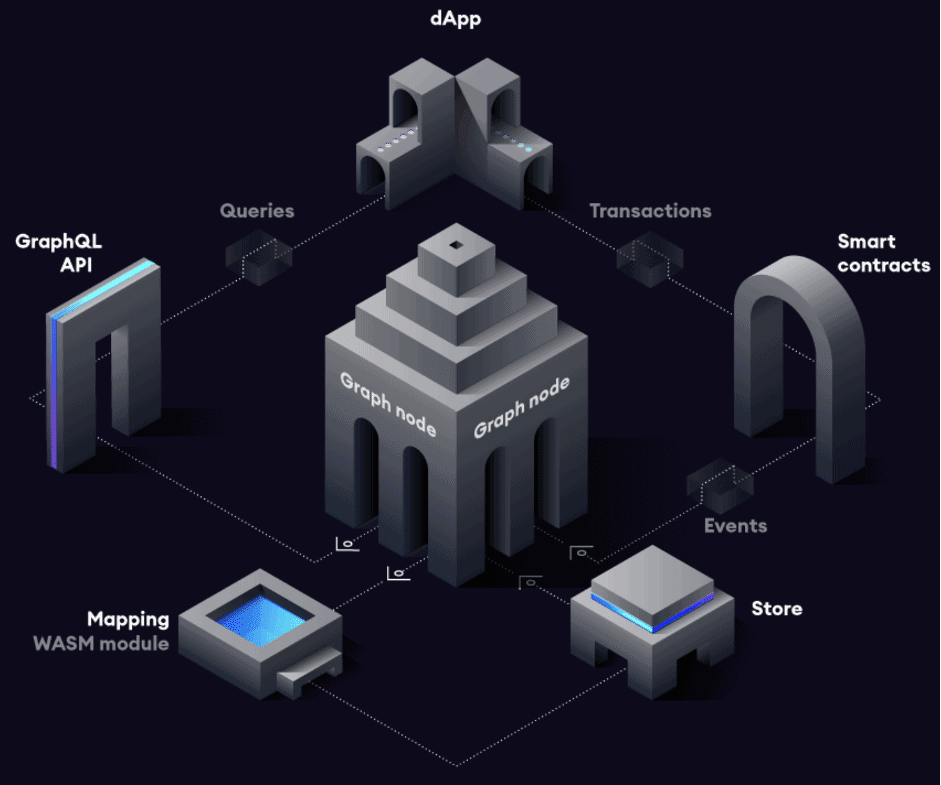

A trading bot is an automated tool that executes trades in the cryptocurrency market on behalf of traders. It uses pre-programmed techniques and algorithms to assess market conditions, find trading opportunities, and execute transactions without the need for human interaction.

Uniswap is a blockchain-based decentralized exchange (DEX) protocol. It allows users to exchange cryptocurrencies directly from their wallets, thereby eliminating the need for middlemen. A Uniswap trading bot interacts with Uniswap smart contracts to execute different trading strategies.

Uniswap trading bots are typically designed to execute services like liquidity provision, arbitrage, and market-making. These bots exploit user-created liquidity pools to process trades and receive fees in return.

The trading bot continuously scans the market, monitors price fluctuations, evaluates liquidity pools, and seeks profitable trading opportunities based on specified techniques and algorithms. Once it identifies a favorable condition, the bot executes the trade automatically using the Uniswap smart contracts.

Benefits of Using a Uniswap Trading Bot

Here are some of the main benefits of using a Uniswap trading bot:

Automation of Trading Activities

Uniswap trading bots are designed to execute trades based on predefined parameters and strategies. Users can save significant time and effort by automating the trading process, which would otherwise be spent manually watching the market and executing trades. This allows traders to focus on other areas of their investment plans.

Enhanced Efficiency and Speed

Uniswap trading bots are fast and efficient. They can monitor market conditions quickly, identify potential trading opportunities, and execute trades in milliseconds. This quick response time is important in the very volatile cryptocurrency market, where prices can fluctuate drastically.

Users can take advantage of favorable market conditions and reduce the chance of losing out on good trading opportunities by taking advantage of the speed of trading bots.

Improved Accuracy and Precision

Uniswap trading bots are programmed to adhere to specific guidelines and procedures without any emotional influence. This removes the human aspect from trading decisions, lowering the possibility of mistakes or impulsive trading.

Bots can evaluate massive volumes of data and execute trades based on established algorithms, resulting in more precise and accurate trading decisions.

Mitigation of Human Emotions

Fear, greed, and excitement are all emotions that can impair a trader's judgment and contribute to bad decision-making. Trading bots remove these emotional components from trading activities.

They execute trades according to established strategies, eliminating the influence of human biases and emotions. This can lead to more rational and objective trading decisions, which can improve overall performance.

24/7 Availability and Continuous Monitoring

Uniswap trading bots work around the clock, allowing traders to capitalize on trading opportunities at any time, even when they are unable to actively watch the market. The bots can evaluate market conditions, monitor price fluctuations, and execute trades based on predefined parameters in real-time.

This round-the-clock availability ensures that traders do not miss out on potentially profitable chances that may arise during non-trading hours.

Key Features and Functionalities of Uniswap Trading Bots

Some of the main features and functionalities that make Uniswap trading bots excellent trading tools include the following:

Automated Market Analysis and Strategy Execution

Uniswap trading bots monitor market patterns, price fluctuations, and liquidity conditions in real-time using advanced algorithms. These bots can process huge volumes of data quickly and uncover profitable trading opportunities that human traders may miss.

Once the bot detects an appropriate trading strategy, it executes trades automatically based on predefined parameters and criteria.

Liquidity Provision and Management

Uniswap trading bots allow users to become liquidity providers by properly maintaining their liquidity holdings. These bots can monitor liquidity pools, detect imbalances, and modify liquidity supply automatically to preserve optimal trading conditions.

Traders can earn fees and even profit from arbitrage opportunities within the Uniswap ecosystem by supplying liquidity.

Use of Flash Loans

Flash loans are a feature specific to DeFi platforms such as Uniswap. Trading bots can use flash loans to temporarily access large sums of capital, allowing them to execute complex trading methods that require significant funds.

Users can leverage flash loan functionality to exploit price differences, undertake arbitrage, or execute other time-sensitive trading maneuvers in a single transaction.

Risk Management and Stop-Loss Mechanisms

Uniswap trading bots’ risk management capabilities help protect traders’ funds. These bots allow traders to set stop-loss orders and risk-management strategies based on predefined thresholds or market situations.

Trading bots can help limit losses and provide sensible risk management by automatically executing trades or taking preventive measures when certain criteria are met.

Portfolio Tracking and Performance Analysis

Uniswap trading bots offer full portfolio tracking and performance analysis capabilities to users. These capabilities allow traders to track the efficiency of their trading strategies, assess the profitability of individual assets or liquidity pools, and make data-driven decisions.

Users can get detailed insights into their trading actions and optimize their future strategies by accessing historical data, real-time statistics, and customizable reports.

Risks and Challenges of Uniswap Trading Bots

While Uniswap trading bots provide several benefits and opportunities, it is important to recognize the potential risks associated with their use. Understanding these risks can help traders make informed decisions and put appropriate risk management techniques in place.

Technical Complexities and Potential Vulnerabilities

Smart contract risks

Since Uniswap operates on smart contracts, it may be vulnerable to hacking attempts. Financial losses could result from a flaw in the trading bot's code or an exploit in the smart contract infrastructure.

Software glitches

Trading bots, like any software, can have flaws that affect their performance or cause unwanted actions. To reduce such risks, it is important to use reliable and fully tested bots.

Market Volatility and Unpredictable Price Movements

Impermanent loss

Liquidity providers face the risk of impermanent loss in Uniswap. This occurs when the value of their assets deviates considerably from a comparable position in the underlying tokens.

Flash crashes and whipsaws

Price swings in cryptocurrency markets can be abrupt and dramatic, resulting in flash crashes or whipsaws. If a trading bot lacks adequate risk management techniques, it may execute trades at unfavorable prices or incur huge losses.

Regulatory Considerations and Compliance Issues

Regulatory uncertainty

The regulatory environment for cryptocurrencies and decentralized exchanges such as Uniswap is continually changing. To maintain lawful and ethical trading operations, traders who use trading bots should be knowledgeable about applicable legislation, tax duties, and compliance requirements.

Know Your Customer (KYC) and Anti-Money Laundering (AML)

Certain trading activities may be subject to AML and KYC requirements, depending on the country. Trading bots must be programmed to meet these requirements to reduce legal risks.

Over-Reliance on Automated Strategies

Limited adaptability

Trading bots follow established algorithms and strategies. These strategies may become less effective or fail to adjust amid rapidly changing market conditions or during large events. Using automated strategies without human intervention can lead to missed opportunities or increased risk exposure.

Emotional and psychological factors

Although trading bots remove human emotions from the decision-making process, traders who use them are still susceptible to their influence. The temptation to override the bot's judgments or to make rash trades based on market moods can result in poor results.

Best Practices for Using Uniswap Trading Bots

It is important to follow specific best practices when using Uniswap trading bots to enhance your trading experience and reduce any risks. Consider the following practices for effectively using Uniswap trading bots:

Conduct thorough research and due diligence

- Understand the basics of Uniswap, decentralized financing (DeFi), and automated trading.

- Compare the features, security measures, and reputation of various trading bot providers.

- Consider the trading bots' previous performance and user reviews before making a decision.

Choose a reputable and secure trading bot provider

- Look for trading bot platforms that are well-established and trusted and that place emphasis on security and user safety.

- Confirm if the trading bot provider uses strong security measures such as encryption, two-factor authentication (2FA), and secure API calls.

- Determine whether the platform has frequent security audits and a transparent bug bounty program.

Optimize trading strategies and risk management parameters

- Understand the bot's trading strategies and tailor them to your risk tolerance and investment goals.

- Establish suitable risk management measures, such as stop-loss limits and position sizing, to safeguard your capital from excessive losses.

- Review and fine-tune your strategies regularly based on market conditions and performance analyses.

Regularly monitor and adjust bot settings

- Regularly check your trading bot's performance and its impact on your portfolio.

- Stay current on market trends, news, and regulatory developments that may affect the performance of your trading bot.

- Make changes to your bot's settings as needed, especially during times of extreme volatility or market interruption.

Examples of Successful Uniswap Trading Bot Strategies

Uniswap trading bots have become increasingly popular in the DeFi space due to their ability to automate trading methods and capitalize on opportunities in the ever-evolving cryptocurrency markets. Here are some successful Uniswap trading bot strategies that are beneficial to traders and investors.

Arbitrage Opportunities

Arbitrage is a popular trading method that involves exploiting price differences between markets or exchanges. Uniswap trading bots can detect price differences between Uniswap and other decentralized or controlled exchanges and execute transactions to capitalize on these possibilities.

Traders might profit from price inefficiencies by purchasing low on one exchange and selling high on another.

Liquidity Provision and Yield Farming

Uniswap is well-known for its decentralized liquidity pools, in which users can contribute liquidity in exchange for fees and benefits. Trading bots can be programmed to maximize liquidity provision schemes by monitoring pool sizes automatically, rebalancing funds, and altering positions based on market conditions.

This strategy allows traders to optimize their earnings from Uniswap fees and yield farming chances.

Market-Making and Price Prediction

Market-making is a trading strategy in which traders place both buy and sell orders to offer continuous liquidity to the market. Uniswap trading bots can function as market makers by constantly updating the order book based on changing market conditions.

These bots keep the bid-ask spread small and help to increase the overall liquidity of the Uniswap market, attracting more traders and reducing price slippage.

Furthermore, some powerful Uniswap trading bots predict price changes using machine learning and data analysis approaches. These bots can make intelligent decisions on when to buy or sell specific tokens by analyzing historical data, market trends, and relevant indicators, optimizing trading methods, and enhancing profitability.

Conclusion

In 2023, Uniswap trading bots continue to be influential tools in the DeFi sector, granting traders heightened efficiency, accuracy, and automation. These bots have revolutionized the manner in which individuals engage with Uniswap, offering manifold advantages to both seasoned and novice traders.

Adhering to best practices remains crucial when employing Uniswap trading bots. This entails comprehensive research, choosing esteemed bot providers, refining trading techniques and risk management protocols, and frequently adjusting bot configurations in line with the dynamic market landscape.

Looking ahead, advancements and innovations are anticipated within the Uniswap trading bot sphere. As the DeFi landscape perpetually matures, Uniswap trading bots are set to integrate even more advanced features and methodologies, thus affording traders enhanced avenues for profit-making and risk mitigation.

Leveraging AI-Driven Automation for Advanced Uniswap Trading in 2025

Uniswap remains a cornerstone of decentralized trading infrastructure, but in 2025, capitalizing on its full potential requires more than liquidity provisioning and simple swap execution. With the rollout of Uniswap v4 and the emergence of intent-based architectures, professional traders are using AI-driven automation to access deeper efficiency, execution logic, and routing customization.

Strategy Optimization with Hooks in Uniswap v4

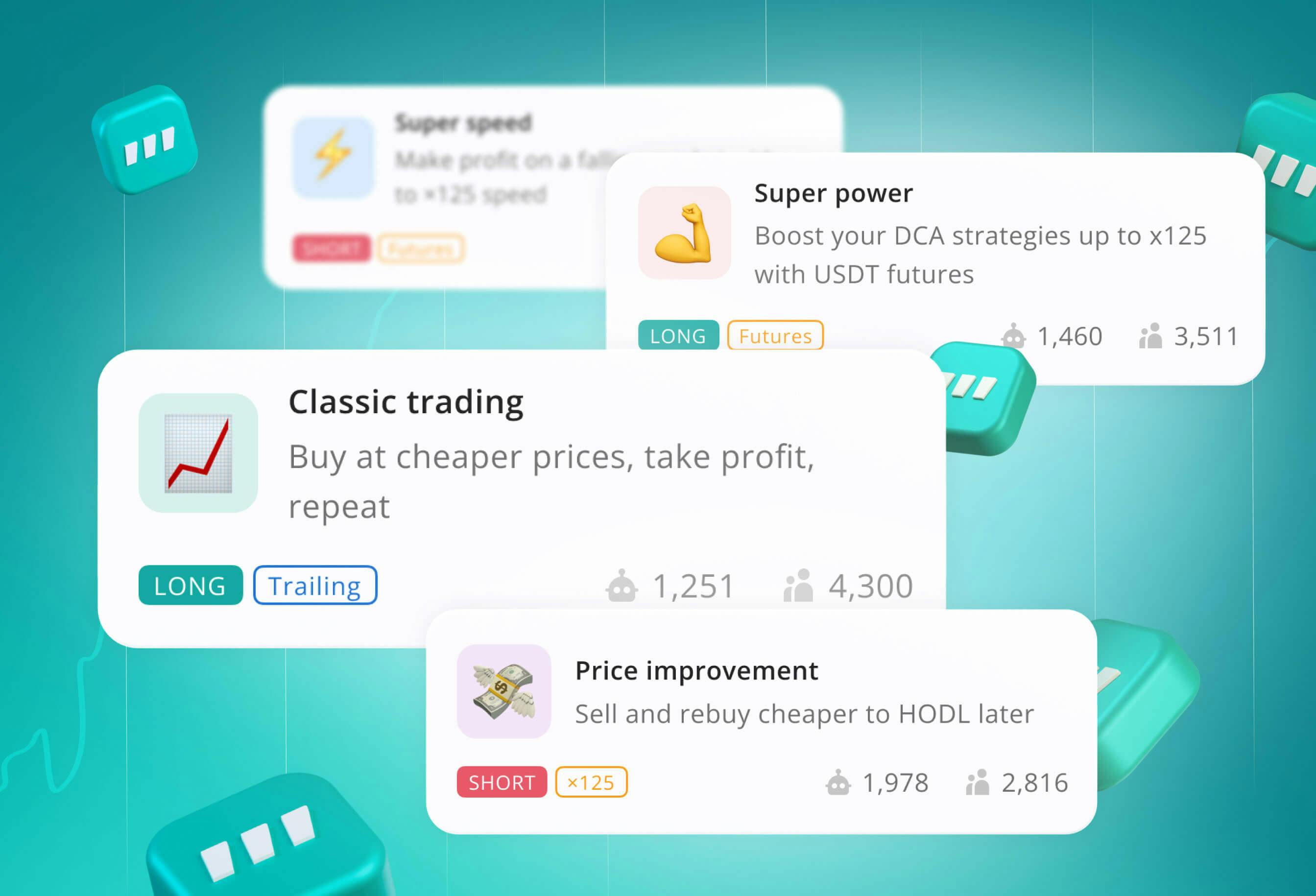

Uniswap v4 introduces a major architectural shift with “hooks”—programmable logic that can be inserted at different stages of a pool’s lifecycle. This allows traders to automate tasks like dynamic fee adjustments, custom slippage tolerances, and on-chain execution triggers. When paired with AI-powered bots provided by software providers like 3Commas, these hooks become a programmable canvas for executing adaptive strategies that respond to market microstructure changes in real time.

Trading Scenario 1: Fee Tier Automation in Volatile Pairs

A trader managing a high-volume ETH/OP pool uses a bot that automatically shifts the pool’s fee tier from 0.05% to 0.30% when short-term volatility spikes beyond a defined threshold. This strategy, deployed via Uniswap v4 hooks, helps preserve margins during periods of high arbitrage flow without requiring manual reconfiguration.

Custom Liquidity Strategies at the Pool Level

Concentrated liquidity positions remain at the core of Uniswap's design. AI-enhanced tools now allow traders to set position ranges using predictive models that incorporate price action trends, on-chain volume patterns, and even MEV-aware routing data. This gives professionals the ability to automate granular rebalancing and reduce impermanent loss risk by fine-tuning exposure boundaries based on current market behavior rather than static intervals.

Trading Scenario 2: Reactive Range Rebalancing for Stablecoin Pairs

In a USDC/DAI liquidity pool, a trader deploys an automated strategy that continuously narrows or widens the active range based on real-time volatility bands and stablecoin peg strength. When depegging risk rises—identified by data feeds tracking Curve and Aave lending markets—the bot contracts the range and exits exposure to protect capital.

Combined with 3Commas’ Smart Trade infrastructure, users can manage complex strategies such as passive LP yield harvesting with trailing logic or automatic repositioning when certain volatility thresholds are met.

Intelligent Order Execution and Aggregation

With increased competition among routing protocols and aggregators, securing the most efficient trade path is no longer guaranteed by single-DEX execution. AI-enabled bots can now factor in gas fee differentials, route complexity, and predicted slippage to determine when Uniswap is the optimal venue—or when to split order flow across complementary protocols. Bots integrated with Uniswap’s new singleton architecture and flash accounting features can batch orders and execute multi-hop trades with improved gas efficiency, giving traders greater control over execution costs.

Scenario 3: Multi-Asset Portfolio Execution During Rebalancing Windows

An asset manager uses a bot to rebalance a portfolio of ETH, LDO, and RPL across Uniswap and Balancer. The bot checks gas fee conditions, evaluates real-time liquidity depth on each pool, and splits orders accordingly—executing portions on Uniswap when v4’s new singleton router offers a net savings, while diverting others to Balancer to minimize slippage across lower-liquidity pairs.

FAQ

Yes, bots can trade on Uniswap. Uniswap enables automated trading, allowing trading bots to execute trades, monitor markets, and implement trading strategies by using smart contracts. Bots analyze data to find profitable opportunities, provide liquidity, and help with yield farming.

Customizable trading strategies like market-making and arbitrage can be automated by leveraging Uniswap's decentralized structure. Users must specify parameters and risk management criteria while bots handle trade execution. Trading bots on Uniswap optimize trading methods, increase efficiency, and capitalize on DeFi opportunities.

A Uniswap bot is an automated trading system that runs on the decentralized Uniswap exchange. It executes trades, analyzes data, and manages positions using predetermined rules and algorithms. These bots provide benefits including automated market analysis, quick execution, and advanced trading methods.

Some of the risks of using a Uniswap bot are technical difficulties, market volatility, and regulatory considerations. Users should conduct extensive research, select reputable providers, and exercise risk management.

Uniswap bots are useful tools for traders to optimize and automate their platform activity, improving productivity and perhaps increasing profitability.

Uniswap, a decentralized trading protocol built on Ethereum, has several unique features. It uses automated market-making and liquidity provision via pools, thereby allowing anybody to become a liquidity provider and earn fees.

Users can effortlessly swap ERC-20 tokens without requiring permission or trust, at a clear and fair price. Uniswap is decentralized, open source, and community-driven, allowing token holders to actively participate and control the platform.

It fosters interoperability since it is compatible with the Ethereum ecosystem. These features have made Uniswap popular by democratizing access to decentralized trading while also maintaining security and efficiency.

Adedamola is a highly resourceful content writer with comprehensive experience in researching and creating simple content that engage and educate the audience. He is interested in improving the marketing results of blockchain and crypto brands through great content.

READ MORE

- Overview of Uniswap Trading Bot

- Benefits of Using a Uniswap Trading Bot

- Key Features and Functionalities of Uniswap Trading Bots

- Risks and Challenges of Uniswap Trading Bots

- Technical Complexities and Potential Vulnerabilities

- Smart contract risks

- Software glitches

- Market Volatility and Unpredictable Price Movements

- Impermanent loss

- Flash crashes and whipsaws

- Regulatory Considerations and Compliance Issues

- Regulatory uncertainty

- Know Your Customer (KYC) and Anti-Money Laundering (AML)

- Over-Reliance on Automated Strategies

- Limited adaptability

- Emotional and psychological factors

- Best Practices for Using Uniswap Trading Bots

- Examples of Successful Uniswap Trading Bot Strategies

- Conclusion

- Leveraging AI-Driven Automation for Advanced Uniswap Trading in 2025

- Strategy Optimization with Hooks in Uniswap v4

- Trading Scenario 1: Fee Tier Automation in Volatile Pairs

- Custom Liquidity Strategies at the Pool Level

- Trading Scenario 2: Reactive Range Rebalancing for Stablecoin Pairs

- Intelligent Order Execution and Aggregation

- Scenario 3: Multi-Asset Portfolio Execution During Rebalancing Windows