- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

How to Use Moving Averages Effectively in 2025 Trading

Moving averages are used in technical analysis to determine support and resistance levels. They also smooth out price action. Read on to learn how you can use moving averages in trading.

- What is a Moving Average?

- Types of Moving Average

- SMA vs EMA

- Examples of Trades

- Overview of EMA Trading Bot

- Optimized Moving Average strategy on Trend

- Optimized RSI Strategy For Reversals

- Automate Your Moving Average Trading Strategies with 3Commas Moving Average Trading Bot

- Conclusion

- The Application of Artificial Intelligence within Moving Averages in 2025 Crypto Trading

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Using technical indicators can be a game-changer in trading. The moving average (MA) is a widely used method for revealing prevailing and developing trends. They are important tools for traders in 2025.

However, most traders make some fatal mistakes when trading with moving averages, which can be avoided if you know what you're doing. Aside from spotting trends, MAs can also be used to locate key support and resistance zones.

Simple moving averages (SMAs) take the average price over a set period as their focus, while exponential moving averages (EMAs) give more importance to more recent prices and are thus the more popular MAs.

This guide explores how moving averages can be used effectively for crypto trading.

What is a Moving Average?

The Moving Average is a technical indicator that provides the average price of an asset over a set period. MA is one of the most frequently used indicators in trading due to its reliability and simplicity. A moving average is simply the average of a particular data set over a given period.

This data, in most cases, is represented by the closing prices of an asset for a certain period. To calculate a moving average you need a certain amount of previously acquired information. For instance, a five-day moving average requires five days' worth of data, and a 200-day moving average requires 200 days of data.

The main purpose of the MA tool is to “smooth” the information provided by a chart, defining the general trend of an asset. The MA line itself serves as an additional tool for confirming the direction of an asset’s price movement, and can also indicate a trend change.

Types of Moving Average

There are several types of MA. In general, one doesn’t have to calculate the moving averages manually. The main priority is to understand the principle of choosing the best period for each trading situation. The most popular moving averages are:

Simple Moving Average (SMA)

This is the most basic moving average, which is a simple calculation of the average price of a set of values over a given period.

For instance, to calculate the SMA for a 20-day period, you need to take the closing prices of the last 20 candles on a 1-day chart and divide the result by 20.

Here is an example of how simple moving averages smooth out price movements. The chart below plots three different SMAs on a 1-day BTC/USDT chart. As you can see, the longer the period of the SMA, the more it lags behind the price.

Notice how the 62 SMA is further away from the current price than the 30 and 5 SMAs. This is because the 62 SMA adds up the closing prices of the last 62 periods and divides them by 62. The longer the SMA period, the slower the indicator reacts to price movement.

The SMAs on this chart show the general mood of the market at a given time. Here we can see that the pair is following an upward trend. Instead of just looking at the current market price, the moving averages give us a broader view and help estimate the general direction of the price movement.

Exponential Moving Average (EMA)

The Exponential Moving Average gives more weight to recent period prices while the SMA is calculated based on a representation of the average of all prices taken over a particular period.

The formula for the EMA is as follows:

EMA = closing price × the multiplier + EMA (previous day) × (1 – multiplier)

There are two moving averages on the 4-hour Bitcoin chart above (SMA 60 and EMA 60). Note that the red line (EMA 60) is closer to the price than the yellow line (SMA 60). At the same time, if the trend changes, EMA changes its direction more quickly than SMA does.

That is because the exponential moving average puts more weight into the latest candles, which allows you to “filter out” the fake signals provided by the SMA. For example, in case of a sharp collapse of an asset within a single candle, the SMA will continue to move in an upwards direction for some time, while the EMA will give an idea of the price reversal earlier.

Weighted Moving Average (WMA)

It gives even higher priority to recent periods than the exponential moving average (EMA) because it assigns linearly weighted values to ensure that the most recent prices have a greater impact on the indicator than older prices.

SMA vs EMA

If you want a moving average that reacts fairly quickly to price action, the short timeframe EMA is your best choice. It can help you catch new local trends very early, meaning you won’t miss out on a significant amount of potential profit when you open a trade. The downside of using the exponential moving average is that it often gives fake signals during asset consolidation periods.

The SMA, on the other hand, serves as a good confirmation of a trend movement and can save your deposit from numerous false signals. However, this type of indicator reacts to price action slower, so if you rely solely on the SMA you can miss a lot of potential profits by opening a trade late.

When to Use SMA vs EMA

The longer the time period of a moving average, the slower it reacts to changes in price. If everything else remains equal, an EMA will have a closer correlation with price than an SMA.

Hence, the EMA is often thought to be better for day trading than for trading over longer periods. Its effectiveness in long-term trading is limited by the very features that make it useful in the first place.

Since the EMA tends to move with price more quickly than the SMA, it is often whipsawed, which makes it a bad signal for entering or leaving "slower" chart timeframes (such as the daily timeframe).

The SMA's slower lag helps to smooth price action over longer periods, making it a useful trend indicator that allows one to hold long positions when price is above the SMA and short positions when price is below the SMA.

So, SMA vs EMA, which one should you choose? The choice is up to you.

Many investors use multiple moving averages to get a clearer picture of the market. To determine the overall trend, they may use an SMA over a longer time frame and then use an EMA over a shorter time frame to determine when the right time to enter a trade.

Examples of Trades

So, let’s first look at defining a trend with the SMA. If the price is above the moving average, the asset is in an uptrend and often the SMA (as well as the EMA) can serve as a dynamic support.

For instance, a breakthrough and a retest of the SMA 60 on the Bitcoin 4H chart in the green zone and a drop below the SMA in the red zone.

A similar example is a drop below the SMA 28, the asset enters a local downtrend.

To avoid following false indicator signals, traders often draw several moving averages on the chart at once. If, in this case, the SMA based on a shorter period is above the longer timeframe SMA, the asset is in an uptrend. Notice how the lines are almost touching, confirming the up-trend (on the chart SMA 60 is marked yellow and SMA 30 is red).

Another way to use two SMAs is to enter a position as the lines cross. In the chart below, the SMA based on a shorter period crosses the longer timeframe SMA, indicating a change in trend (from an uptrend to a downtrend).

This gives the trader confirmation to open a short position. Moving averages are lagging indicators, so a position should be opened sometime after the signal. Remember, the lower the period, the shorter this time interval is.

During the current Bitcoin price rally, the SMA 200 on the 4H chart served as excellent dynamic support. The chart has touched and even briefly crossed the line several times, but over the past few months, all of these interactions have only provided an excellent signal for opening a long position.

Moving averages are just one of the tools that traders use to execute quality trades. That is, this indicator is best used in combination with horizontal support/resistance levels and trendlines.

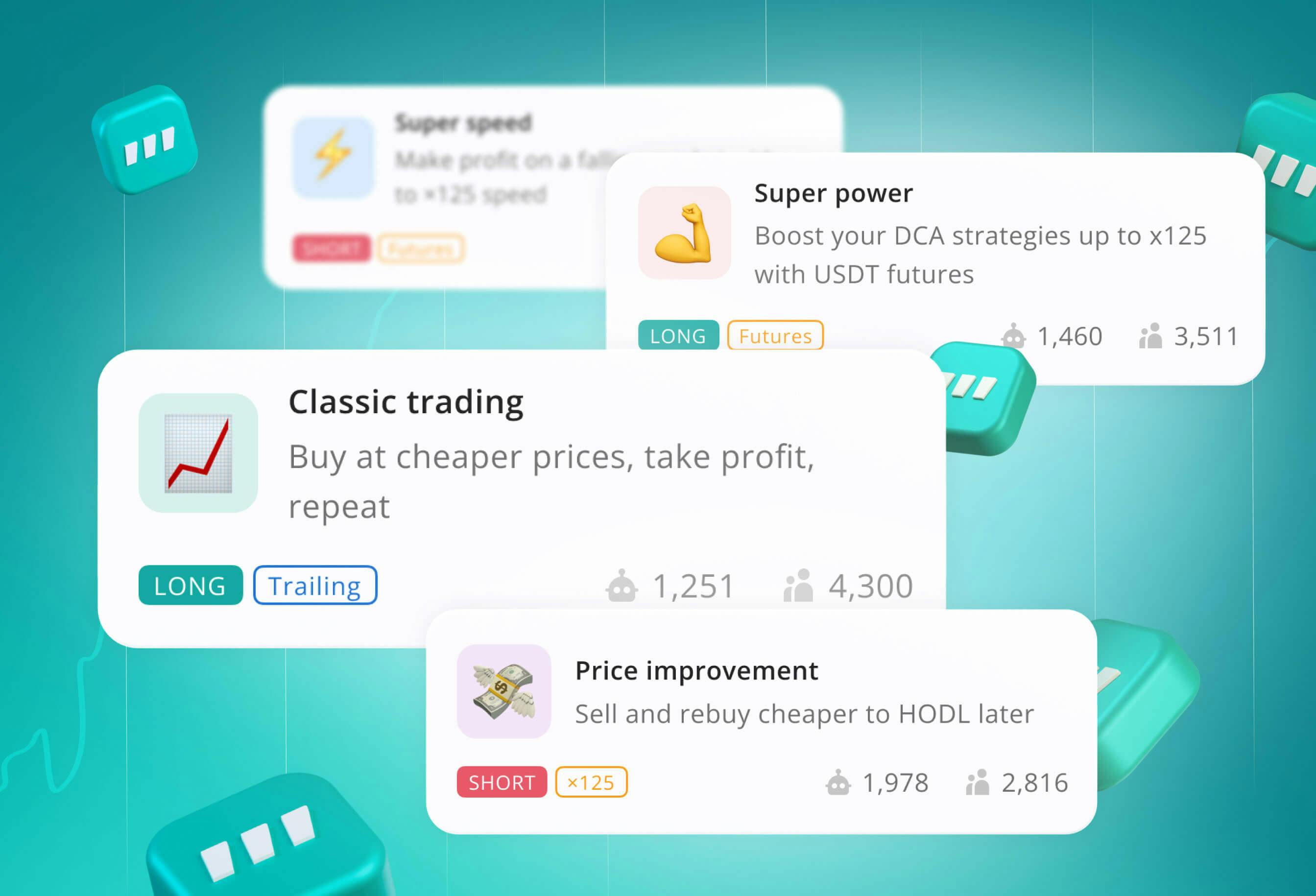

Overview of EMA Trading Bot

An EMA trading bot is a common moving average trading bot. The bot assigns more weight to the latest closing prices of the EMA. So, the way the bot works will be influenced more by recent price levels.

An EMA trading bot can detect trends and reversals by trading automatically against the markets of the user’s choice. This moving average trading bot works using the EMA crossover strategy. Additional risk management tools are included in an EMA trading bot's arsenal. After setting the bot to trade on the markets of your choice, you can sit back and enjoy the profits from the effective EMA crossover strategy.

How an EMA Trading Bot Works

The EMA trading bot is an algorithmic tool that generates signals to buy and sell cryptocurrencies based on the intersection of moving averages. Users can set their stop-loss, take-profit, EMA (both long and short) line periods, and lot size.

The EMA trading bot's rules specify buy triggers when the fast EMA crosses the slow EMA from bottom to top and sell triggers when the fast EMA crosses the slow EMA from top to bottom. An EMA trading bot performs great when markets are trending, but it struggles in ranging markets.

The EMA trading bot from 3Commas comes equipped with resources that will guide you on how to activate the bot in just a few minutes. The resources will also show you how to configure the EMA trading bot for your favorite timeframes and markets.

Optimized Moving Average strategy on Trend

Understanding how to trade with the trend is essential for developing a successful trend trading strategy. Profiting from a sustained price movement is the goal of trend traders. A trader in a trending market needs to be on high alert for any signals of a potential reversal that could derail their trade.

Importance of a Trend-Following Strategy

There are several benefits of trading with the trend rather than against it. The main benefits of this method are:

- It can result in greater profits.

- The transaction costs in trend trading are lower.

- It is more efficient and saves time.

Trend Trading With Moving Averages

Most trend traders use trend-following systems they've developed rather than looking at charts manually. Technical indicators on the chart are one example of a setup that falls into this category. It is possible to do so with the assistance of several trend-following indicators, such as Moving Averages.

When looking for trends, simple and smoothed moving averages perform the best. To analyze trends, a trader can choose from a variety of MA periods. Traders typically rely on the 200-period simple moving average. It reveals the directional bias of the market.

It is simple to implement a 200-period simple moving average. Buying pressure is present if the price is rising higher than the moving average. When prices, on the other hand, fall below the 200-period simple moving average, a downward trend is almost certain to start.

The chart above shows that when price was trading above the moving average, it was forming higher highs and higher lows. When it was trading below the moving average, however, it was making lower lows and lower peaks.

Optimized RSI Strategy For Reversals

It's no surprise that the RSI is the most popular momentum indicator given the many benefits it provides, especially in ranging markets. It's also easier to understand because it's constrained to a range from 0 to 100.

Due to its widespread use, the RSI can influence market prices as traders and portfolio managers act in response to the indicator's signals.

Values below 30 on the RSI are typically used to identify good buying opportunities. You could get stuck in a losing trade if the RSI stays in oversold territory for an extended period. It makes sense to hold off until the trend reversal is confirmed.

You can get favorable trading conditions by combining a low RSI reading (below 40) with a short-term moving average (in this case, MA9.

Automate Your Moving Average Trading Strategies with 3Commas Moving Average Trading Bot

Many traders rely on moving averages for trading. The problem is, as with almost all indicators, if you want to trade in a short time frame, you will almost certainly miss the exact right time to execute the trade.

There are a few advantages to automating the entry of these trades. You don't have to sit in front of a screen or be constantly connected to your phone to receive alerts from your broker. Imagine investing a lot of time and effort to learn the market and develop a strategy, only to miss the buy signal when your conditions are met.

Moving average trading bots can help you find trending assets and you can then automate the entry process using different moving averages.

With 3Commas moving average trading bot, you can automate your trading strategies and never miss a chance to make money.

Conclusion

The moving average is widely used among cryptocurrency traders because of its versatility and flexibility. Apart from this, it is also a useful tool for determining the trend's direction and, by extension, which side of the trade to take. The moving average can also help in spotting oversold and overbought regions, thereby predicting rallies and corrections.

Moving averages based on a longer time frame are smoother than the ones with a shorter period as their base. Using an exponential moving average can help you identify trends faster, but it often produces a lot of false signals.

Simple moving averages are slower to react to price action but will keep you away from rushing into opening a position. However, they can hold you back from making a trade, and lead to missing out on potential profits.

We hope this blog has provided valuable insights into using moving averages (MAs) effectively in cryptocurrency trading. The article introduces MAs, their types (Simple Moving Average, Exponential Moving Average, and Weighted Moving Average), and discusses the advantages and disadvantages of each. It also explores how traders can use MAs to identify trends, support and resistance levels, and potential entry and exit points. Additionally, the article touches upon the use of EMA trading bots and trend-following strategies with MAs.

In conclusion, the use of moving averages is a crucial aspect of cryptocurrency trading in 2025. These technical indicators offer traders valuable insights into market trends and can assist in making informed trading decisions. Whether one prefers the responsiveness of Exponential Moving Averages or the stability of Simple Moving Averages, understanding the nuances of each type is essential for success in the ever-changing cryptocurrency market.

Moreover, the article emphasizes the importance of combining moving averages with other technical analysis tools, such as support/resistance levels and trendlines, for a comprehensive trading strategy. Additionally, the use of trading bots, particularly EMA-based bots, can automate trading processes and help traders capitalize on market opportunities efficiently.

As the cryptocurrency market continues to evolve in 2025, traders who master the art of using moving averages effectively will have a valuable edge in navigating the dynamic and often volatile landscape of digital assets.

The Application of Artificial Intelligence within Moving Averages in 2025 Crypto Trading

By 2025, it seems like every company is putting more focus on integrating Artificial Intelligence (AI) technology with traditional decision making tools such as moving averages in crypto markets. This marks an evolutionary step in the “set and forget” paradigm where strategies are predefined and “set” rules are implemented to automated machinery, towards more real-time responsive systems that shift and adapt to stimuli. What traders are looking for is the opportunity to not dilute their funds with the necessity of having bots with contingency strategies ready to take advantage of sudden market shifts that invalidate or reduce the effectiveness of a strategy that is working well.

What the end users want are bots and automated trading tools that can shift strategies when market movements trigger user-defined conditions.

AI Powered Advancements In Movement Averages

AI is able to adjust the length of moving averages based on market activity. This would imply that averages in more volatile markets/lower macro economic stability would be shorter to capture momentum. In more stable periods, longer averages capture noise and emphasizes broader shifts in the market. The ability to shift average periods automatically, without manual intervention, means there is no longer the need for constant micromanagement.

Modeling And Confirmation Of Signals

AI is actively identifying trends from historical datasets and calculating their chances of occurrence in the future. These insights feed into custom signals and can measure data trends such as the average of short period measures being higher than long term measures, providing traders with additional confirmatory information. These principles reinforce confidence in market trends, both entering and exiting, without the need for absolute certainty.

More Sophisticated Computers with the Same Level of Trading Risk Management

Automated trading powered by AI and moving averages now allow traders to implement rule-based strategies at scale. These systems execute trades consistently in a disciplined series of automatic responses to crossovers and other signals. Nonetheless, supervision is vital and with automated trading software there are usually custom alerts that can be set up to notify the appropriate users and managers when the criteria for notification is met. Besides, as automation improves, signified trading still requires well-defined stop-loss limits and protected risk levels controlled through diversified opportunistic positions.

Furthermore, even as automation advances, systematic trading still demands clearly defined stop-loss limits and risk management strategies that rely on diversified portfolios to mitigate potential losses.

The combination of AI’s flexibility and the rigidly defined moving averages enables more nuanced guiding tools that dynamically adapt to markets for traders, providing better alignment towards achievable goals while control over strategy and risk is preserved for 2025 crypto traders.

Moving Average FAQ

The 50-day, 100-day, and 200-day moving averages are the most widely used for spotting major, long-term support and resistance levels and overall trends. In trading, the 200-day moving average is given more attention.

There is a popular belief that a crypto is in a bullish trend when its 50-day moving average is higher than its 200-day moving average. When the 200-day moving average drops below the 50-day average, this is seen as a bearish sign.

If they are set up correctly, moving average trading bots can be profitable. A profitable return can be expected from the best crypto trading bots, so be sure to put them through a thorough test run before purchasing one. The foundations of success in crypto trading are education, strategy, and experience. Knowing how moving average trading bots work is, therefore, crucial.

Yes, traders use bots. A trading bot is an algorithm-based computer program that is programmed to make more profitable purchases and sales of assets than a human being. These automated trading systems analyze a wide variety of information before making trades based on predetermined criteria. The bot takes different steps in taking a trade.

A moving average trading bot is profitable provided it is properly set up. Your earnings will likely range from $2,000 to $3,000 per month on average, though, once again, this will vary greatly from trader to trader.

Many people believe that once they begin using moving average trading bots, everything will improve, but this is not always the case. You need to understand how these trading bots work so that you can use them correctly.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.

READ MORE

- What is a Moving Average?

- Types of Moving Average

- SMA vs EMA

- Examples of Trades

- Overview of EMA Trading Bot

- Optimized Moving Average strategy on Trend

- Optimized RSI Strategy For Reversals

- Automate Your Moving Average Trading Strategies with 3Commas Moving Average Trading Bot

- Conclusion

- The Application of Artificial Intelligence within Moving Averages in 2025 Crypto Trading