- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

Forgotten Cryptocurrencies of the 2017 ICO Boom

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Many cryptocurrencies that held dominant positions during the 2017 ICO boom have lost their popularity. New promising crypto projects with stronger communities and breakthrough solutions regularly emerge on the crypto market. To maintain the project’s status and reputation, developers must actively work on improving the software and regularly release updates, fueling their communities interest and support. In this article, we’ll discuss why many cryptocurrencies fizzled out after their peak in 2017.

Lisk (LSK)

Lisk (LSK) was one of the top 20 blockchain platforms in 2017, boasting a capitalization of over $2.3 billion. Lisk was a part of many major crypto investors’ portfolios and the project was considered one of the most promising… but something changed.

Lisk, founded in 2016, is a Swiss cryptocurrency platform designed for building blockchain applications. Lisk creators focused on making blockchain accessible to a wide range of users in which developers could deploy their own application on the Lisk blockchain or even run their own blockchain. Lisk was one of the first crypto projects to implement the Delegated Proof-of-Stake (DPoS) consensus algorithm, which is now the most popular consensus algorithm amongst blockchain projects.

DPoS allows participants to stake cryptocurrencies without the need to deploy their own node, enabling users without access to high amounts of liquidity. In August 2019, the developers updated the Lisk desktop application, but since then no major updates have been released. Lisk currently ranks 101 on CoinMarketCap, with ROI from the day of listing equal to 1,492%.

The LSK exchange rate reached its all-time high (ATH) of $35.49 in February 2018. Since then, the price has fallen 96.6% to $1.21 at the time of publishing this blog. Even with the promising hopes of the project, the lack of developers’ activity leads to lower investor interest as other new or more active blockchains/crypto projects continue to surface regularly.

During 2020, the project had rolled out 3 test networks: Betanet v3, Betanet v4, and Betanet v5. Lisk has emphasized building frameworks for developers, changed the database system to EmbeddedDB, and added support for linking to the IPC framework. If developers stay active and start a full-fledged blockchain network, the situation may change.

Status (SNT)

Status (SNT) quickly became one of the most successful ICO projects of 2017. During the crowd sale the project raised $107 million and found itself among the top 40 crypto projects with a market cap of nearly $800 million. At the time many investors were rushing to get into ICOs with expectations for them to replicate the success of Ethereum (ETH), EOS (EOS), Tezos (XTZ), and other sensational platforms. As a result, competent marketing was all that was necessary to attract large investments to almost any project and many fraudulent ICOs subsequently raised millions of dollars. For example, ModernTech’s fraudulent projects PinCoin and iFan managed to raise $660 million – more than TRON (TRX) and Tezos (XTZ) combined.

The SNT token resulted in its ICO investors suffering more than a 49% loss, and relative to its all-time high, the cryptocurrency fell by 94.7% from $0.57 to $0.031. Despite this, the token is still traded on major crypto exchanges such as Binance, Huobi Global, OKEx, and many others.

Status was not the only failure of 2017 despite the fact that tokensale managed to raise impressive amounts. Numerous other projects have become alienated as well:

- Dragonchain (DRGN) – $320 million raised at the ICO;

- Bancor (BNT) – $153 million;

- Bankera (BNK) – $150 million;

- Polymath (POLY) – $96 million.

Contrary to belief or expectations, the project is not entirely dead. The creators of Status regularly hold meetups & webinars, and in December 2020, they launched the CryptoAtelier app, a workspace for creative individuals.

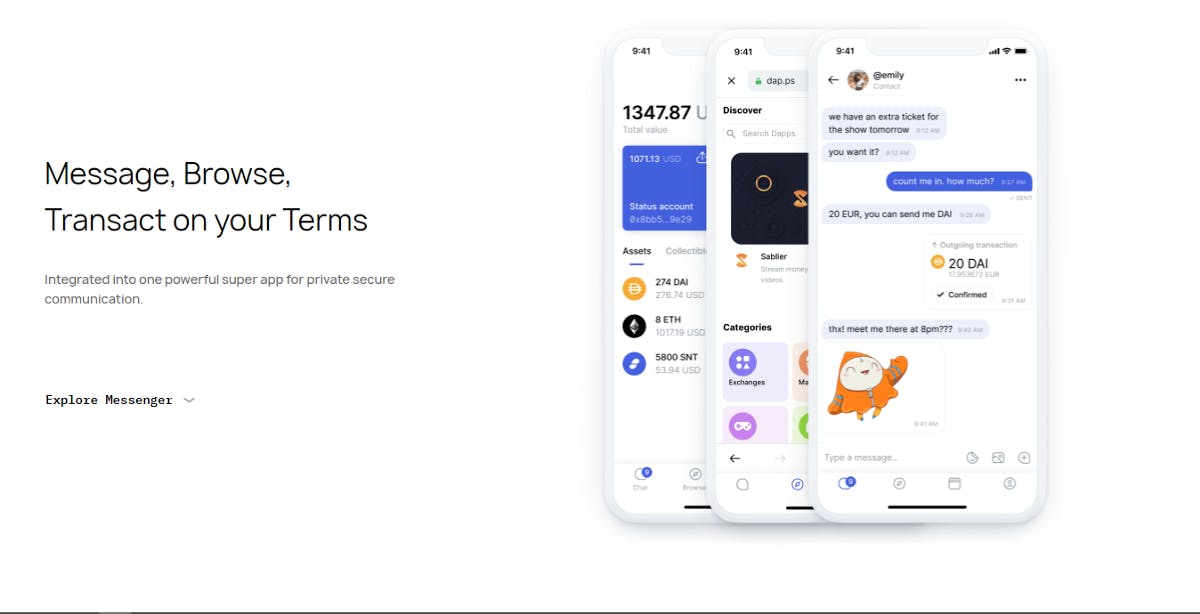

Status developers also released their own mobile cryptocurrency wallet for iOS and Android which is different from many other apps. The Status app’s unique feature is a combination of a secure wallet, a DApp-browser, and a messenger – a very convenient for many users as no other cryptocurrency wallets have a built-in messenger.

Nano (NANO)

Originally known as RiaBlocks (XRB) upon its release in 2014, XRB coins were distributed for free via a faucet which solely required the completion of a CAPTCHA to receive the tokens.In 2018 the creators initiated rebranding, and the cryptocurrency was renamed to NANO (NANO). NANO now trades as low as $3.00 with approximately 133 million NANO in circulation. Relative to its all-time high (ATH) of $37.62, the NANO exchange rate has fallen by over 91.9%.

The NANO blockchain was intended for commercial payments as the platform thrives at processing transactions quickly, allowing payments to be made without delays and with minimal fees. The developers have not released a single major update in the last two years, which is why interest in the coin has likely faded and many crypto investors have forgotten about it. Nevertheless, early investors can still realize profits exceeding 9,000% since its first listing on exchanges.

In the second half of 2020, developers released WeNano – an app aimed at expanding the community that uses cryptocurrency for payments. The number of WeNano users exceeded 10,000, who cumulatively made more than 2,500 payments. The app is now currently focused primarily on growing its Brazilian userbase.

Populous (PPT)

Populous (PPT) cryptocurrency is a clear example of how a founders’ indifferent attitude towards the project can lead to a significant drop in investor interest. Since January 2018, PPT cryptocurrency has fallen a dramatic 99.4%, from $69.52 to $0.40 at the time of this blog.

Populous does not boast high returns for the early investors because the cryptocurrency’s ROI is at -85.71%. The idea behind Populous lies in so-called “Invoice Finance,” which is a form of funding which instantly unlocks the cash tied up in outstanding sales invoices. The developers chose a rather narrow direction so the demand for the Populous platform can be described as weak..

The cryptocurrency was popular among traders in 2017 & 2018, securing its position in top 30 coins by market cap, exceeding $1.5 billion. But after the onset of “crypto winter,” many have forgotten about PPT and now the token holds 195th position on the CMC list.

In 2020, the developers released the PopDeFi protocol, which allowed PPT holders to add tokens to the liquidity pool and borrow/lend cryptocurrency to other users. So far, it is a test MVP and the protocol is being audited by the well-known cybersecurity company, Hacken.

Bonus: Dash (DASH)

Dash (DASH) shouldn’t be called a “Forgotten Cryptocurrency” as the coin still holds 34th place on CoinMarketCap’s list and remains in high demand. Nevertheless, it can hardly be considered a success. In 2017, Dash was one of the top ten cryptocurrencies by capitalization; so why did Dash join this list? The fact is that against the backdrop of the crypto boom, the DASH coin, like many other altcoins, turned out to be highly overvalued.

Dash is an open-source cryptocurrency created to build a fast and private global payment blockchain network. The cryptocurrency’s name comes from the “Digital Cash” expression. Fun fact: the famous cryptocurrency exchange Binance followed a similar technique as its name consists of the words Bitcoin + Finance.

Dash cryptocurrency utilizes the X11 hashing algorithm and is one of the first digital assets, which implemented a hybrid Proof-of-Work (PoW) + Proof-of-Stake (PoS) mechanism. However, in order to receive rewards, holders need to run a master node, and must subsequently hold several thousand dollars worth of DASH to take advantage of staking benefits. Therefore, the cryptocurrency has not been that popular among holders in the long-term. Dash still remains one of the demanded coins in the darknet, along with Monero (XMR) and Zcash (ZEC). Users’ transactions are mixed while being sent, making it nearly impossible to trace the sender and the recipient.

Throughout six months of 2017, the DASH exchange rate rose tenfold to $1,607. During the prolonged crypto market correction, the price fell just as hard, and the token now trades at $108 (93% lower than its ATH). Despite this, early investors’ ROI is over 9,000%, making DASH a profitable investment even given such a staggering drop.

Dash is releasing a cloud-based platform for decentralized applications and crypto payments. Application data and APIs are stored in a distributed manner, making the process more secure. Dash will be the first cryptocurrency to function as a cloud service and developers are also introducing concepts such as the Dash Platform User Name Service (DPNS), DPP protocol, and DAPI. DPNS will eliminate long and complex addresses for DASH transactions and utilize usernames instead.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.