- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

The Benefits of using a Stop Loss in Crypto Trading in 2025

Stop-loss systems are smarter than ever—here’s how AI bots automate protection in 2025.

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

Using a Stop Loss when trading has multiple benefits you may not have considered… read on to find out more!

What is a Stop Loss?

A Stop Loss is a common term used in trading that you may have heard.

Essentially, a Stop Loss is a set price or percentage of a price of an asset that when reached will automatically close your trade.

Did you know a Stop Loss also has additional benefits, such as:

- Protecting against “Lost Opportunity Cost”

- Sell for a small loss to buy more of the asset at a lower price (also known as a “Short”)

- Protecting your capital (particularly from Liquidation when Margin or Futures trading)

- And you can even trail your Stop Loss to achieve more profit while minimizing your risk

We’ll discuss these points above in further detail throughout this article.

Traditional Stop Loss

In the example of a “Long” trade, when you buy an asset lower and plan to sell it higher to make a profit, the Stop Loss is initially placed beneath the purchase price of the asset, so if price moves down rather than up, the trade is closed and your capital is returned minus the difference that was realized.

Example: You start a trade by purchasing 1 ETH for $1000. You would like to take profit and sell the 1 ETH when the price reaches $1100, yielding 10% or $100 profit on your initial investment (less fees). However, if the price falls, you are trapped in a trade where the 1 ETH you purchased is decreasing in value, and selling 1 ETH for anything less than the $1000 you initially invested results in a loss… this is where a Stop Loss can help you plan for and mitigate this risk..

As Cryptocurrency prices can be very volatile, prices can fall dramatically in moments which does not give a trader or investor an opportunity to react., This is where a pre-set Stop Loss can help protect your capital while you sleep or go about your everyday life.

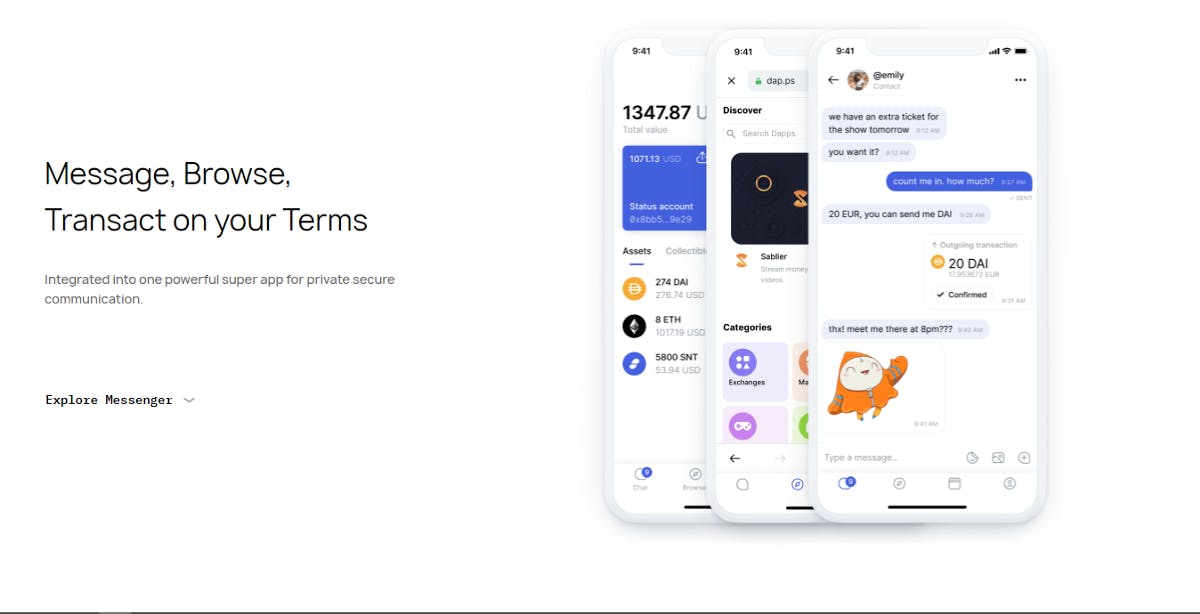

With 3Commas SmartTrade, you can define a Stop Loss condition at the time of your trade that will automatically sell the assets you are holding should prices fall below a threshold you set.

Why would I want to sell for a Loss?

Cryptocurrency markets are cyclical. Often when prices fall dramatically on an asset, prices can reverse and rise quickly (this can be minutes/days/weeks). Some traders believe that holding (also known as “hodl’ing”) on to an asset as price falls is better than selling for a loss, as prices will eventually recover. They may also employ “Dollar Cost Averaging” (DCA) strategies to buy more of the assets at specified intervals as price falls further. This can be an effective strategy if you have additional funds you are investing or speculating in assets you believe have very strong potential to rise much higher in price over a longer period.

However, every strategy has its downfalls, and this is not a good strategy if you have a limited amount of funds, as they can be stuck in a losing trade for a long period of time – even if the trade eventually turns around and closes in profit (this is known as “Lost Opportunity Cost”, or the time that you could have made profits with your assets elsewhere). The psychology of a trader comes into play here; some people think that any loss is a bad thing and might have the unrealistic expectation that all trades must, or will be, successful. We’re here to tell you now that this is not possible,, and even the best traders in the world do not have 100% win-rates.

The Cost of Lost Opportunity

With the above example in mind, holding on to a trade or asset that may have fallen sharply in value (say -30% or more), is not the best course of action if you are a trader with a smaller account. In this same scenario, let’s say you had taken a small loss of 2-5%. By closing the losing trade earlier when prices started to decline, you would have your capital available to invest in better trade opportunities on assets that are rising in value, essentially recuperating the lesser loss of 2-5% versus holding a loss of 30%. This is where our bots come in and can help to earn you continuous profits in spite of market conditions!

Traders or investors with larger accounts might also benefit from selling an asset in their long-term investment portfolio for a small loss as they can actually increase the amount of the asset by buying a larger quantity back at a much lower price, the 3Commas “Smart Cover” is a powerful tool to use in this situation.

A Stop Loss here would have allowed the trader to double their Bitcoin holdings by re-purchasing at a lower cost.

Trailing your Stop Loss for greater profits and less risk

In some situations a Stop Loss can be used to guard profit you have made in an asset as price rises from where you originally purchased it at. You can manually “move your Stop up” (as it is commonly referred to). This is where your asset, for example, has risen 10% in value and you raise the Stop Loss to break-even (the price you originally bought the asset for) or even into profit.

If the trade or investment is performing very well, you may continually move the Stop Loss price up every day or week, to ensure that if the price reverses, your trade will close in profit or break-even and you can assess the next trade you wish to make knowing your funds were protected.

3Commas SmartTrade tools also have the ability to automatically “trail” the Stop Loss value for you by a fixed percentage below the current chart price. As price rises, so will your Stop Loss price. If the asset falls below the threshold you set, the trade is closed. Either way, 3Commas enables you to “set and forget” your trade, alleviating some of the emotions associated with trading cryptocurrencies.

Protecting your capital from Liquidation when Margin or Futures trading

When trading using leverage on Futures or Margin exchanges, you are trading with funds you have borrowed, sometimes by as much as 100 times the capital you have available.

This is incredibly risky as you can be liquidated or “margin called” if the trade enters a loss.

For example, if you created a Long trade with $1 using 100x leverage, you will create a position on the contract being traded for $100. If the price rises by 1% and you close the trade, then you will make $1 profit, effectively doubling your original $1 investment.

However, the additional risk of leverage is that if the price falls 1% then your trade will be liquidated and you will lose the $1 you initially invested.

There are typically two types of Futures or Margin leverage modes offered by exchanges; “Isolated” and “Cross”.

Isolated leverage mode is where the funds used to open the position have a preset amount of margin (calculated when the position is opened), and once this margin is used, the position is liquidated and the amount of funds risked to create the trade are lost. This mode will only risk the amount funds used to create this specific position on the exchange.

Cross leverage mode allows traders to use any unspent balance in their exchange account as margin for any positions they open on contracts; the benefit being that this can greatly offset the liquidation price of trades but with the increased risk that if a trade is liquidation, the entire amount of funds they hold on the exchange account will be lost.

It is therefore critically important to always use a Stop Loss when trading on Futures or Margin exchanges to guard against the possibility of a trader’s entire account from being liquidated.

Summary

A Stop Loss can not only prevent further risk to your capital, but can also be used to safeguard profits on the assets you hold or your profitable active trades.

We hope this article has helped improve your knowledge on Stop Losses and the various ways they can be employed to improve your trading and investing to help maximize your profitability.

Concluding Thoughts on the Implementation of Stop Loss in Crypto Trading

The volatile nature of the cryptocurrency market underscores the importance of having tools and strategies in place that allow traders to mitigate potential losses and safeguard their capital. Mikhail Goryunov's insightful article delves deeply into the multiple facets of the Stop Loss mechanism, a fundamental tool in the trader's toolkit.

Beginning with a fundamental introduction, we learn that a Stop Loss is an automated trigger set at a specific price or percentage which, once reached, closes the trader's position. This serves a dual purpose: it shields from the harsh swings of the market, while simultaneously ensuring that traders don’t miss out on better investment opportunities elsewhere.

One of the primary takeaways from this article is the concept of the "Lost Opportunity Cost." Holding onto declining assets in hopes of a future rally might sometimes work in favor of traders. Still, there are instances where it binds the capital that could be more fruitfully deployed elsewhere. If a trader has a limited capital pool, it becomes even more crucial to ensure that their funds aren't tied up in non-performing assets. By setting a Stop Loss, traders can limit their losses to a manageable percentage, freeing up their capital for other promising ventures.

Another intriguing strategy highlighted is the 'Trailing Stop Loss.' This proactive approach allows traders to adjust their Stop Loss values in correspondence with a rising asset price. By doing so, they are not just safeguarding their initial investment but also the profits they accrue over time. It's a strategy that exemplifies the power of automation in trading; once set, the system handles the adjustments, allowing the trader peace of mind and the freedom to focus on other important trading decisions.

Leveraged trading, as the article indicates, introduces an added layer of complexity and risk. Given the high stakes involved in Futures or Margin trading, where borrowed funds can amplify both gains and losses, a Stop Loss becomes absolutely indispensable. The differentiation between "Isolated" and "Cross" leverage modes underscores the need to understand the specific risks associated with each approach. The nuances of these modes and the associated risks emphasize the importance of using Stop Loss to prevent total capital erosion.

3Commas, with its SmartTrade tools, has incorporated these principles into a seamless trading experience. Tools that can trail the Stop Loss value or define Stop Loss conditions during trade initiation are paramount in today's crypto trading landscape. As Goryunov's article suggests, it's not just about entering a trade but also knowing when to exit, which can make all the difference.

In conclusion, the concept of Stop Loss, while simple in its premise, holds profound implications in the world of crypto trading. Whether a novice trader or a seasoned professional, everyone stands to benefit from implementing a Stop Loss strategy. The unpredictable world of cryptocurrency requires traders to be agile, informed, and always prepared. By harnessing tools and strategies like those discussed in this article, traders can navigate the turbulent waters of the crypto market with greater confidence, security, and success. As the digital assets landscape continues to evolve, so too will the strategies and tools available to traders. But the foundational principle remains the same: protect your capital and maximize opportunities.

Intelligent Stop-Loss Systems for Bots in 2025

Stop-loss strategies in 2025 are no longer simple static orders—they are dynamic, AI-informed protective mechanisms embedded within most automated crypto trading bots. Rather than triggering solely on price thresholds, stop-loss conditions today are informed by trend strength, liquidity gaps, and market sentiment overlays.

Ai crypto bots integrated with real-time news feeds, Twitter sentiment analytics, and on-chain anomaly detection can now adjust stop-loss placement dynamically. For example, a dca bot crypto may widen its stop range when volume spikes suggest a short-term shakeout, while a grid bot may tighten exits when correlation with broader markets breaks down.

These intelligent mechanisms are especially critical for traders running auto trading cryptocurrency strategies overnight or during high-volatility events like ETF announcements or macroeconomic data releases. Instead of relying on rigid rules, bots now evaluate whether exiting a trade will reduce drawdown probability in probabilistic terms.

3Commas users benefit from new bot logic templates that allow stop-loss logic to be set per asset type, timeframe, or trading intent—enabling far more personalized protection systems that align with different levels of risk appetite and trading sophistication.

A proven leader, successful at establishing operational excellence and building high-performance teams with a sharp focus on value creation and customer success.