- All

- Tools

- Analytics

- Technical Analysis

- Trading

- Blockchain

- DeFi

- Guides

- Company News

- Educational

- Opinion

- Price Predictions

- Market News

- News

- Trading cases

- Practical guides

- Exchanges

- Trading signals

- Cryptocurrency

- Crypto bots

- Other

Become a crypto master

Learn everything about crypto,

trading and bots

How To Day Trade Cryptocurrency as a Full-Time Job in 2025

Wouldn't it be great to wake up in your pajamas and make more money in just two hours than you would typically make in an entire week at your day job? Well, you can make this a reality by day trading cryptocurrency. Keep reading to find out how!

Start Trading on 3Commas Today

Get full access to all 3Commas trading tools with free trial period

If you're considering quitting your job to day trade cryptocurrency as a full-time job, it's important to understand what you're getting into in 2025.

Cryptocurrency day trading is a risky venture that is not for everyone, and before you take the plunge, there are several things you should consider.

Statistics show that approximately 95% of cryptocurrency day traders end up losing money, which is why it's important to educate yourself about the ins and outs of this type of trading.

This guide aims to provide you with all the information you need to make an informed decision about whether day trading cryptocurrencies is right for you. We will start by defining what cryptocurrency day trading is, and then we will walk you through the steps you need to take to become a full-time cryptocurrency day trader.

Summary:

Day trading cryptocurrency can offer the potential for significant profits, but it's a risky endeavor that requires careful consideration and preparation. This article explores the steps and strategies involved in becoming a full-time cryptocurrency day trader. It highlights the importance of choosing the right trading platform, selecting the right cryptocurrencies, and implementing a trading strategy tailored to your goals. The article also delves into the tax implications and risks associated with day trading, emphasizing the need for risk management and staying informed about market trends.

Introduction:

Day trading cryptocurrency as a full-time job may seem like a dream come true, offering the promise of substantial profits and flexible working hours. However, it's crucial to approach this endeavor with caution and full awareness of the risks involved. The cryptocurrency market is known for its extreme volatility and inherent uncertainties. This article serves as a comprehensive guide, providing valuable insights into the world of cryptocurrency day trading.

Understanding Cryptocurrency Day Trading:

Cryptocurrency day trading involves buying and selling digital assets within a single trading day, with the aim of profiting from price fluctuations. While this concept shares similarities with traditional stock trading, it's important to note that crypto day trading comes with higher risks due to the market's volatility.

Steps for Day Trading Cryptocurrency:

- Choose a Trading Platform: Selecting the right cryptocurrency trading platform is crucial. Factors to consider include the platform's years of operation, supported cryptocurrencies, fees, deposit methods, and user reviews. Regulatory compliance, especially for US-based traders, should also be a primary concern.

- Select the Cryptocurrencies to Trade: Opt for cryptocurrencies with high liquidity and volatility, as these are favored by day traders. Liquidity ensures that orders can be executed quickly, while volatility increases the profit potential.

- Develop a Cryptocurrency Day Trading Strategy: Establish a specific trading strategy tailored to your preferences and risk tolerance. Popular strategies include scalping, range trading, arbitrage, bot trading, copy trading, and technical analysis. Each strategy has its own set of advantages and disadvantages.

Technical Analysis:

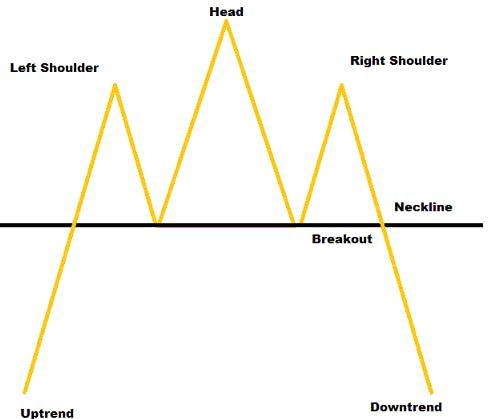

Technical analysis is a crucial tool for cryptocurrency day traders, involving the use of various indicators and chart patterns to make informed trading decisions. Some of the essential technical analysis tools include candlestick charts, support and resistance levels, trend lines, moving averages, Relative Strength Index (RSI), and Bollinger Bands.

Pros and Cons of Day Trading Cryptocurrency:

Pros:

- Accessibility: Cryptocurrency trading is open to almost everyone, with no significant entry barriers.

- Market Availability: Cryptocurrency markets operate 24/7, providing flexibility for traders.

- No Third Parties: Transactions can be conducted without intermediaries due to blockchain technology, reducing costs.

Cons:

- High Risk: Inexperienced traders are at risk of substantial losses.

- Lack of Regulation: Cryptocurrency markets remain largely unregulated, exposing traders to potential fraud and scams.

- Security Threats: Cyberattacks can result in the loss of funds stored in wallets and exchanges.

Managing Risk:

Effective risk management is essential for day trading success. Traders should set clear limits on the capital they are willing to risk on each trade, diversify their strategies, and stay disciplined to avoid emotional biases that can lead to poor decisions.

What is Cryptocurrency Day Trading?

Stock market traders occasionally make some deals to end the day with larger holdings than they began within a single trading day. The same applies to the cryptocurrency market. You should, however, note that cryptocurrency day trading is riskier than stock trading.

Your goal in a single trading session is to profit from sudden price movements. Your assets will be worth more than you initially had if everything is done correctly. The first steps you need to take are to have the right trading strategy and also choose the cryptocurrency that you want to trade. We will shed more light on this in the next section.

Steps for Day Trading Cryptocurrency

Due to the volatile nature of crypto assets and the liquidity of the cryptocurrency markets, day trading cryptocurrencies is a high-risk endeavor. For consistent trading success, cryptocurrency day traders need a deeper understanding of blockchain technology and cryptocurrencies compared to traditional markets like equities.

Although crypto day traders need various tools and resources to be successful, they don't need to sign up for a brokerage or margin account. This gives them more flexibility to execute short-term deals than stock traders.

Follow the steps below to start day trading cryptocurrencies as a full-time job:

Choose a Trading Platform

The choice of the right crypto trading platform is the most important initial step to take as a day trader. It is crucial to remember that US-based traders can only use crypto-trading platforms that are regulated in the country; this should be a key factor to consider when shopping for a crypto trading platform.

To choose a crypto trading platform, day traders need to consider the exchange liquidity, asset liquidity, and fees. The values of digital assets might change substantially because of how unstable the cryptocurrency market is. Hence, traders looking to maximize gains in the crypto market should act quickly.

Highlighted below are the main factors that should be considered before choosing a cryptocurrency trading platform:

Years of Operation

The number of years a platform has been in operation can give insight into its stability and credibility.

Supported Cryptocurrencies

It is important to know the cryptocurrencies that you can trade on the platform that you want to choose. Altcoin day traders would favor a smaller exchange that supports more cryptocurrencies and trading pairs over larger ones with fewer choices.

Fees

Crypto trading platforms impose transaction fees for trading. They make money from transaction fees that they charge customers. The structure of the transaction depends on the strategy of the platform.

Deposit Methods

Similar to a brokerage, users must fund their exchange accounts with money. Although many crypto trading platforms accept wires and bank transfers, fewer platforms support credit card funding, PayPal transfers, and gift card transfers.

User Reviews

It is also advisable to go through users’ reviews while deciding on the crypto trading platform to use.

Liquidity

This shows how quickly and easily one asset can be changed into another without affecting its price. Traders can instantly buy or sell assets with a modest spread between the bid and ask prices on the most liquid cryptocurrency exchanges.

Choose the Cryptocurrencies You Want to Trade

Here are the factors to consider before choosing a cryptocurrency for day trading:

High Liquidity

Tokens with high liquidity are beneficial to day traders. High liquidity means that your buy and sell orders can be filled quickly. Although this is frequently associated with large volumes, liquidity is seen as a more crucial indicator for day trading.

High Volatility

Your profits as a day trader come from the change in the price of an asset throughout a trading session. A highly volatile token will have higher highs and lower lows, boosting your chance of making money. Most day traders trade cryptocurrencies that have significant intraday volumes to profit from the spread.

Choose a Cryptocurrency Day Trading Strategy

To effectively day trade cryptocurrencies as a full-time job, you need to have a specific strategy. This means having a plan for getting out and knowing what you want from a deal. Once you've worked out these details, you may begin looking for trading opportunities that meet your requirements.

Having a specific cryptocurrency day trading strategy will help you to reduce losses and increase profits. There are several popular cryptocurrency day trading strategies. Some of them include:

Scalping

Scalping aims to make money off of slight price changes. Although it can be used in any time frame, it is usually used in shorter time frames (such as 1 minute or 5 minutes). This technique involves buying and selling crypto assets in quick succession.

To reduce their transaction costs, scalpers often hunt for coins with high liquidity and small spreads. Some of the most popular cryptocurrencies for scalping include Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

Range Trading

This strategy involves looking for coins that alternately fluctuate between two prices. These coins typically have high liquidity, meaning that many people regularly buy and sell them. As a result, it is easy to enter and exit transactions quickly.

Also, these coins have a tendency to be less volatile, which means that price swings are less likely to occur suddenly. The cryptocurrency pairs with strong liquidity and relatively low volatility are ideal for range trading.

Arbitrage

Arbitrage is the practice of buying cryptocurrencies on one market and then reselling them on a different market for a profit. The "spread" refers to the discrepancy between an asset's buy and sell prices. Since the cryptocurrency business is mostly unregulated, anyone can start an exchange. This might result in significant spread variations due to the disparities in asset liquidity and trading volume.

Most traders who trade in the cryptocurrency market keep a portfolio on the exchange they use. To start an arbitrage, it is advisable to open accounts on exchanges where you think the prices for the same asset will be noticeably different.

For instance, Bitcoin was traded in South Korea for 40% more than it was in the United States. This was referred to as the "kimchi premium," and it appeared several times. Just buying bitcoin on American platforms and selling it right away on South Korean exchanges was profitable for traders.

When trying to arbitrage, traders should also consider trading fees. Profits from the trading spread may be offset by the costs associated with placing a trade on an exchange.

Bot Trading

Bot trading is a trading strategy that involves using bots for high-frequency or range trading to make profits passively. The bot will handle the execution of all trades and divide your funds across profitable positions, thereby streamlining the trading process.

Copy Trading

This trading strategy is ideal for newbies or those who wish to trade cryptocurrency but don’t have the time or expertise to do so themselves. Copy trading, as the name suggests, is when a cryptocurrency trader copies the trades of another trader. When the trader that you’re copying buys or sells, you will do the same.

Here are some things that you need to pay attention to before you start copy trading:

- Find a reliable and reputable trader that you can copy.

- Note that the fact that a trader has experienced success in the past does not guarantee future success.

- Avoid putting all your eggs in one basket. You should copy different traders when copy trading, just as you diversify your portfolio by trading different assets. By doing so, you'll be able to cut your losses and profit from different market sectors.

Technical Analysis

Technical analysis entails using mathematical indicators to investigate statistical trends and predict where prices will go in the cryptocurrency market. This is done by looking at historical price movements and data volume to understand how the market works and forecast how it will affect future price changes.

Technical analysis looks at the cryptocurrency markets and finds places to trade using price changes and patterns that can be seen on charts. A cryptocurrency's historical trading activity and price fluctuations are important indicators that determine the future price and activity of the cryptocurrency.

Top Indicators For Technical Analysis

Technical analysis is done in cryptocurrency trading by using the following tools and indicators:

Candlestick Chart

Cryptocurrency traders use candlestick charts because they provide more information on price movement. Each candlestick displays the activity surrounding the time frame chosen for trade analysis.

For instance, if a trader chooses a 4-hour timeframe, each candlestick will indicate the price movement every four hours.

A candlestick is made up of wicks and a body. The body might be red or green. Green candlesticks show that a trade closed above the price at which it had started. The initial price is shown at the base, and the ending price is shown at the top.

The red candlesticks, on the other hand, indicate that the trade closed below its initial price. The price range is shown by the candlestick's wick. The highest price is shown by the top of the wick, and the lowest price is shown by the bottom of the wick.

Support and Resistance

Understanding support and resistance levels can help you understand the important price levels in a cryptocurrency chart. Support and resistance are specific price ranges that the market finds difficult to break. The difference between a support level and a resistance level is the point at which prices cease advancing in one direction or the other.

The support level appears to be the point at which asset prices bounce back. As soon as the market dips to the support level, it starts to rise again. The price, however, decreases back after it reaches the resistance level, which serves as an upper barrier.

As soon as bullish pressure hits the resistance, the price is likely to start falling again. On the other hand, a bullish reversal is more likely to happen at the support, which would cause the price to go up.

Trend Lines

Trend lines are in different shapes and are used to figure out what might be happening in the market. Moreover, traders use many trend lines to create more intricate patterns. A trend line connects many high and low price points. The closer the prices are to the trend line, the stronger the trend is.

Moving Average

Moving averages help in tracking price trends by averaging the historical prices of a crypto asset over a specific time frame. They provide information about the direction of the market and aid in choosing a reasonable trade entry price.

There are two popular types of moving averages: the simple moving average, which displays the average of all prices over a specific period, and the exponential moving average, which prioritizes the most recent values without fully taking earlier price changes into account.

Relative Strength Index (RSI)

RSI refers to an oscillatory indicator that is used to determine if an asset is overbought or oversold. It ranges between 0 and 100. When the RSI of a cryptocurrency is below 30, it is oversold, and when it goes beyond 70, it shows that the price of the cryptocurrency is overbought. An oversold situation indicates a potential buy opportunity, while an overbought situation indicates a potential sell.

Bollinger Bands

Bollinger bands can be used to track changes in the price of an asset. A standard deviation is often added to and subtracted from a 20-day simple moving average to determine the band. The market price is considered overbought whenever it crosses the upper Bollinger band and oversold when it crosses the lower band.

Pros and Cons of Day Trading Cryptocurrency

Each cryptocurrency investment carries a high level of risk and potential return. Since cryptocurrencies are a new type of digital asset, investors should always be aware that their holdings could disappear.

Pros of Crypto Day Trading

Everyone with a cryptocurrency exchange account can trade

Apart from verifying their identity and funding their exchange account, there are no further barriers for retail investors or day traders to access, investigate, and engage in the cryptocurrency markets. For instance, if you are interested in buying bitcoin but cannot afford to spend $26,000 on it, you can buy a fraction of the cryptocurrency.

Cryptocurrency markets are open every day of the year

Unlike the New York Stock Exchange and the Nasdaq which are open from 9:30 a.m. to 4:00 p.m. ET, cryptocurrency markets are open every day. This allows traders to buy and sell without limitations. One advantage of having unlimited access to the market is the convenience of being able to trade whenever you like.

No third party

Users may make payments without the use of an intermediary because of the decentralized nature of cryptocurrencies and the blockchain technology that powers them. Dealing with cryptocurrencies on a centralized exchange is extremely affordable for day traders due to the lack of government taxes and fees.

Cons of Crypto Day Trading

- Since the entry barrier to trading cryptocurrencies is low, inexperienced traders are at risk of losing a lot of money (just as they can make lots of money).

- If you trade cryptocurrencies, you can fall prey to pump-and-dump schemes or wash sales. This occurs when a group of individuals comes together to manipulate the price of a cryptocurrency to entice unsuspecting traders. After making a profit, the traders sell the cryptocurrency, thereby driving down the price.

- The market is still largely unregulated despite the fact FinCEN and other US watchdogs are steadily strengthening the know-your-client (KYC) and anti-money laundering (AML) laws for domestic cryptocurrency exchanges. Exchanges, institutions, and traders that are scammed or hacked are not protected because there is no government oversight. This means that users are unlikely to receive their money back if an exchange shuts down unless they have a private insurance fund.

- The cryptocurrency market has some drawbacks since it is open every day of the week. There are fewer patterns in the day when traders may make predictable (and successful) deals because bitcoin is always open. To discover the optimum time to execute a trade, cryptocurrency day traders can find themselves glued to the charts for longer periods than they would in traditional markets. A brief day trading session might easily transition into a night trading session as a result, making it more challenging to see trends.

Tax Implications of Cryptocurrency

As you prepare to start day trading cryptocurrency as a full-time job, it’s important to understand the tax implications of these assets. That will be taken care of in this section.

Cryptocurrency Tax Laws

It is important to be aware of the local tax regulations for cryptocurrencies since they differ from one country to another. The following details can give you more insight into cryptocurrency tax laws:

Taxable Events

Taxable events in cryptocurrency trading include selling, exchanging, or using cryptocurrency to pay for goods or services.

Capital Gains Tax

For taxation reasons, most countries view cryptocurrencies as properties. This indicates that when you sell or exchange cryptocurrencies for a profit, capital gains tax may be applied.

Holding Period

There may be a minimum holding period before you have to pay tax on your capital gains in your country. For instance, in the US, if you keep your cryptocurrency for at least a year, before selling it, your long-term capital gains tax rate can be lowered.

Reporting Requirements

Traders should keep detailed records of all their cryptocurrency transactions, including the date they bought the currency, the price they paid for it, the date they sold it, and the price they got for it. This will help them report their gains and losses correctly.

Traders can use IRS Form 8949 and Schedule D to declare their gains and losses on their tax returns. It is important to remember that penalties and interest charges may apply if cryptocurrency gains and losses are not reported.

Risks of Day Trading Cryptocurrency

Although day trading cryptocurrencies can be extremely rewarding, there are also substantial risks involved. The following are some risks of day trading cryptocurrencies:

Volatility

Due to their extreme volatility, cryptocurrencies' prices can change significantly in a short period. This volatility makes it hard to predict how the market will change, which can lead to big losses.

Inadequate Regulation

Since cryptocurrency trading is generally unregulated, traders are not adequately supervised or protected. Due to the lack of regulation, fraudsters may find it easy to operate, which might cost traders money.

Security Threats

Cyberattacks can happen on cryptocurrency exchanges and wallets, which could lead to the loss of money. Hackers can steal private keys, passwords, and other sensitive information that can be used to get to and move cryptocurrencies.

Liquidity Problems

Since cryptocurrencies are less liquid than traditional assets, it can be challenging to buy and sell significant amounts of these assets without having an impact on the market price. This can lead to slippage and lower profitability.

Emotional Biases

Cryptocurrency day traders may find it difficult to control their emotions, and they may be prone to acting quickly because of greed, fear, or other biases. Emotional biases can cause traders to make bad decisions that cost them money.

How to Manage Your Risk

While learning how to day trade cryptocurrency, managing your money is an important step and strategy that you should not ignore. This strategy entails doing everything you can to protect your investment capital.

To achieve this, you need to set clear limits on the amount of capital you can risk on a single deal. For instance, you can decide that each position should not risk more than 2% of your balance.

Hence, if you have a $15,000 balance, your maximum trade size is $300. Also, your maximum trade size will be $600 if, after a few months, your balance has increased to $30,000.

The idea behind this strategy is that you will never deplete your trade balance. After all, if you have a run of bad luck and your balance keeps dropping, so will the largest trade size you can enter.

For instance, the maximum amount you can risk on every trade at 2% would drop from $300 to $150 if your balance decreased from $15,000 to $7,500.

Conclusion

Cryptocurrency day trading can be a potentially lucrative venture, but it is not without its risks. To protect your trading capital, it is essential to use technical and fundamental analysis in combination with risk management techniques. It is also important to stay up-to-date with the latest news and market trends and to understand the tax implications of trading cryptocurrencies.

If you are considering cryptocurrency day trading, there are some important tips to keep in mind. It is recommended to start with a small investment and gradually increase it as you gain more experience and confidence. Always have a solid strategy in place and avoid making emotional decisions that can lead to losses. In addition, keep up with industry trends and strategies and be prepared to make and lose money, as the crypto market is highly volatile.

For those looking to improve their day trading results, it may be beneficial to use trading tools and software like the 3Commas trading bot. However, it is important to remember that day trading cryptocurrency is not for everyone, and the risks should be thoroughly understood before beginning. With a well-informed strategy, risk management approaches, and ongoing learning, cryptocurrency day trading can be a lucrative and exciting way to enter the cryptocurrency market.

Cryptocurrency Day Trading in 2025: A Strategic Update

As we move through 2025, day trading cryptocurrency as a full-time profession continues to demand a calculated, informed approach. The trading environment has been shaped by fresh regulatory shifts, macroeconomic policies, and increasing technological sophistication — all of which have direct implications for professionals and asset managers.

Regulatory Shifts and Institutional Influence

The re-election of President Donald Trump has brought renewed attention to deregulation, with implications that favor digital asset adoption. The growing presence of spot Bitcoin ETFs and a loosening of oversight in some jurisdictions have contributed to higher liquidity and increased institutional trading volumes.

Macroeconomic Forces at Play

Recent tariffs and broader economic decisions are actively impacting crypto price behavior. Bitcoin’s price projections for 2025 reflect these variables, with bullish forecasts reaching $88,000 — and bearish scenarios suggesting a floor near $73,000. Traders must stay informed about policy changes that could directly affect market behavior.

AI-Powered Trading Intelligence

Artificial intelligence is no longer experimental in trading — it’s embedded in strategy. From pattern recognition to real-time anomaly detection, AI tools are now core components of modern crypto trading software. Traders leveraging this technology are able to act on micro-signals and market shifts with greater precision.

Beyond Bitcoin: Strategic Diversification in the Works

Ethereum, Solana, and other altcoins have gained renewed traction in 2025, each supported by maturing ecosystems and increasing developer activity. These assets offer strategic diversification opportunities beyond Bitcoin, helping traders reduce correlation risk in their portfolios.

Reinforcing Risk Controls

Despite market expansion, volatility remains a defining characteristic. Advanced risk management — including automation, capital allocation protocols, and consistent performance reviews — remains essential. For serious traders, stability in process often outweighs short-term gains.

FAQ

You can start day trading cryptocurrency with just a few dollars. For instance, most cryptocurrency exchanges have a $5 or $10 minimum trade requirement. The minimum on other cryptocurrency trading platforms might be considerably lower.

Day trading can be quite profitable. However, it's important to remember that it's also one of the riskiest ways to trade cryptocurrencies. If you want to achieve long-term gains, it's important to understand the basics of day trading cryptocurrencies.

Due to the volatile nature of crypto assets and the liquidity of the cryptocurrency markets, day trading cryptocurrencies is a high-risk endeavor. For consistent trading success, cryptocurrency day traders need a deep understanding of blockchain technology and cryptocurrencies.

Adedamola is a highly resourceful content writer with comprehensive experience in researching and creating simple content that engage and educate the audience. He is interested in improving the marketing results of blockchain and crypto brands through great content.